Noticias del mercado

-

21:05

S&P 500 2,097.31 -4.75 -0.23 %, NASDAQ 4,998.36 +2.39 +0.05 %, Dow 18,010 -47.65 -0.26 %

-

20:00

U.S.: Federal budget , March $-53B (forecast -43.2)

-

18:10

Bank of Japan’s March monetary policy meeting minutes: the economy will continue to recover moderately

The Bank of Japan (BoJ) released its March monetary policy meeting minutes. The central bank said that the economy will continue to recover moderately. The consumer inflation is expected to be about zero percent "for the time being".

Many board members believes that the BoJ's monetary policy have a positive effect on the economy.

-

18:00

European stocks closed: FTSE 100 7,063.62 -26.15 -0.37 %, CAC 40 5,256.32 +15.86 +0.30 %, DAX 12,345.78 -28.95 -0.23 %

-

18:00

European stocks close: stocks closed mixed

Stock indices closed mixed. Mining shares declined due to the weaker-than-expected Chinese trade data. China's trade surplus fell to $3.10 billion in March from $60.60 billion in February, missing expectations for a decline to a surplus of $43.40 billion.

Exports dropped 14.6% in March, while imports slid 12.3%.

Concerns over Greece's debt problems continue to weigh on markets, despite the fact that Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros last week.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,064.3 -25.47 -0.36 %

DAX 12,338.73 -36.00 -0.29 %

CAC 40 5,254.12 +13.66 +0.26 %

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed lower against the most major currencies

The U.S. dollar traded mixed lower against the most major currencies. The greenback remained supported by the speculation the Fed could start to hike its interest rate in June.

There will released no major economic reports in the U.S.

The euro traded higher against the U.S. dollar in the absence of any major reports from the Eurozone.

Concerns over Greece's debt problems continue to weigh on the euro, despite the fact that Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros last week.

The British pound traded higher against the U.S. dollar in the absence of any major reports from the U.K.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi declined against the greenback in the absence of any economic reports from New Zealand.

The weak Chinese trade data weighed on the kiwi. China's trade surplus fell to $3.10 billion in March from $60.60 billion in February, missing expectations for a decline to a surplus of $43.40 billion.

Exports dropped 14.6% in March, while imports slid 12.3%.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback in the absence of any economic reports from Australia.

The weak Chinese trade data weighed on the Aussie.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback despite the better-than-expected core machinery orders from Japan. Japan's core machinery orders declined 0.4% in February, beating expectations for a 2.8% drop, after a 1.7% fall in January.

On a yearly basis, Japan's core machinery orders climbed 5.9% in February, exceeding expectations for a 3.7% gain, after a 1.9% rise in January.

The Bank of Japan (BoJ) released its March monetary policy meeting minutes. The central bank said that the economy will continue to recover moderately. The consumer inflation is expected to be about zero percent "for the time being".

-

16:50

European Central Bank purchased 9.159 billion euros of government bonds last week

The European Central Bank (ECB) purchased 9.159 billion euros of government bonds last week.

The ECB said on Monday that purchases of sovereign bonds totalled 61.681 billion euros as of April 10, up from 52.522 billion the previous week.

The ECB settled 2.48 billion euros of covered bond purchases and 371 million euros in total purchases of asset-backed securities (ABS) last week.

-

16:18

China’s trade surplus declines to $3.10 billion in March

The Chinese Customs Office released its trade data on Monday. China's trade surplus fell to $3.10 billion in March from $60.60 billion in February, missing expectations for a decline to a surplus of $43.40 billion.

Exports dropped 14.6% in March, while imports slid 12.3%.

Exports climbed 4.9% in the first quarter, while imports dropped 17.3%.

-

15:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0450(E521mn), $1.0550 (E593mn), $1.0630(E592mn), $1.0670-75(E825mn), $1.0750(E1.1bn)

USD/JPY: Y120.00($498mn), Y121.00($482mn), Y121.80($800mn), Y122.00(372mn)*Y121.00 $2bn

GBP/USD: $1.5000(Gbp256mn)

AUD/USD: $0.7600(A$1.7bn)

NZD/USD: $0.7325(NZ$771mn), $0.7400(NZ$337mn), $0.7525(NZ$400mn), $0.7710(NZ$806mn), $0.7750(NZ$552mn)

USD/CAD: C$1.1.2580($375mn)

-

15:34

U.S. Stocks open: Dow +0.02%, Nasdaq +0.24%, S&P +0.09%

-

15:27

Before the bell: S&P futures -0.17%, NASDAQ futures +0.01%

U.S. stock-index are mixed as investors awaited this week's corporate earnings reports.

Global markets:

Nikkei 19,905.46 -2.17 -0.01%

Hang Seng 28,016.34 +743.95 +2.73%

Shanghai Composite 4,121.27 +86.96 +2.16%

FTSE 7,056.52 -33.25 -0.47%

CAC 5,244.94 +4.48 +0.09%

DAX 12,352.28 -22.45 -0.18%

Crude oil $52.60 (+1.86%)

Gold $1203.20 (-0.10%)

-

15:17

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

International Business Machines Co...

IBM

162.90

+0.02%

0.3K

General Motors Company, NYSE

GM

36.58

+0.03%

4.7K

American Express Co

AXP

79.64

+0.06%

2.6K

JPMorgan Chase and Co

JPM

61.74

+0.06%

2.9K

Amazon.com Inc., NASDAQ

AMZN

383.01

+0.09%

1.6K

Visa

V

66.45

+0.17%

1.4K

Citigroup Inc., NYSE

C

52.52

+0.17%

11.2K

Chevron Corp

CVX

107.11

+0.19%

1.1K

The Coca-Cola Co

KO

40.96

+0.20%

2.7K

International Paper Company

IP

56.39

+0.20%

0.1K

Apple Inc.

AAPL

127.84

+0.58%

471.1K

FedEx Corporation, NYSE

FDX

175.38

+0.58%

0.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.45

+1.10%

100.6K

UnitedHealth Group Inc

UNH

121.00

+1.68%

14.0K

Yandex N.V., NASDAQ

YNDX

18.17

+1.85%

9.8K

AT&T Inc

T

32.77

0.00%

4.4K

E. I. du Pont de Nemours and Co

DD

72.23

0.00%

0.6K

Exxon Mobil Corp

XOM

85.56

0.00%

4.0K

Intel Corp

INTC

31.82

0.00%

4.9K

Johnson & Johnson

JNJ

102.06

0.00%

3.6K

Microsoft Corp

MSFT

41.72

0.00%

1.7K

Walt Disney Co

DIS

106.95

0.00%

0.4K

Deere & Company, NYSE

DE

89.07

0.00%

0.1K

ALTRIA GROUP INC.

MO

52.51

0.00%

0.1K

Verizon Communications Inc

VZ

49.20

-0.04%

1.0K

Yahoo! Inc., NASDAQ

YHOO

45.16

-0.04%

2.6K

Procter & Gamble Co

PG

83.30

-0.06%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

56.55

-0.07%

0.1K

Twitter, Inc., NYSE

TWTR

51.89

-0.10%

29.5K

Caterpillar Inc

CAT

82.50

-0.12%

1.6K

Hewlett-Packard Co.

HPQ

32.06

-0.16%

15.4K

McDonald's Corp

MCD

97.61

-0.19%

2.2K

Facebook, Inc.

FB

81.88

-0.20%

75.8K

Boeing Co

BA

154.00

-0.25%

1.1K

Pfizer Inc

PFE

35.35

-0.25%

3.8K

Ford Motor Co.

F

15.99

-0.25%

2.1K

Starbucks Corporation, NASDAQ

SBUX

48.05

-0.25%

1.0K

Home Depot Inc

HD

114.88

-0.31%

0.7K

Goldman Sachs

GS

195.00

-0.33%

1.3K

Nike

NKE

99.64

-0.33%

0.1K

Cisco Systems Inc

CSCO

27.94

-0.36%

7.1K

United Technologies Corp

UTX

118.02

-0.37%

0.6K

Google Inc.

GOOG

537.60

-0.45%

1.6K

Tesla Motors, Inc., NASDAQ

TSLA

209.94

-0.46%

20.1K

Barrick Gold Corporation, NYSE

ABX

12.60

-0.63%

13.3K

ALCOA INC.

AA

13.06

-0.68%

29.8K

General Electric Co

GE

28.25

-0.91%

733.0K

-

15:09

Upgrades and downgrades before the market open

Upgrades:

UnitedHealth (UNH) upgraded to Buy from Hold at Jefferies, target $141

Freeport-McMoRan (FCX) upgraded to Buy from Neutral at Citigroup

Downgrades:

Freeport-McMoRan (FCX) downgraded to Underperform from Neutral at BofA/Merrill

Other:

General Electric (GE) reiterated at Outperform at Credit Suisse, target raised from $29 to $31

Walt Disney (DIS) reiterated at Buy at Nomura, target raised from $110 to $120

-

14:52

Italian industrial output climbs 0.6% in February

Italy's statistics institute Istat released its industrial production figures on Monday. Italian industrial output rose 0.6% in February, after a 0.7% decline in January.

The increase was driven by gains in energy and investment products. Energy products climbed by 3.6% in February, while investment products increased 1.1%.

On a yearly basis, industrial output in Italy decreased at an adjusted rate of 0.2%, after a 2.2% fall in January.

The Italian government forecasts that the economy will grow at 0.7% this year.

-

14:20

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota: the Fed should wait until the second half of 2015 before starting to hike its interest rate

The Federal Reserve Bank of Minneapolis President Narayana Kocherlakota noted on Friday that the Fed should wait until the second half of 2015 before starting to hike its interest rate.

"Under my current outlook, I continue to believe that it would be a mistake to raise the target range for the fed funds rate in 2015," Mr. Kocherlakota said.

-

14:02

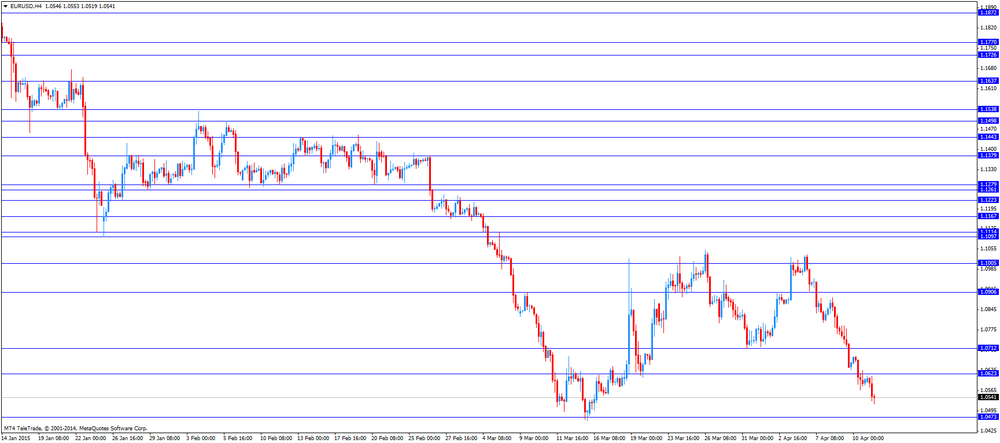

Foreign exchange market. European session: the euro declined toward 1-month low against the U.S. dollar in the absence of any major reports from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Trade Balance, bln March 60.6 43.4 3.1

The U.S. dollar traded higher against the most major currencies, supported by the speculation the Fed could start to hike its interest rate in June.

There will released no major economic reports in the U.S.

The euro declined toward 1-month low against the U.S. dollar in the absence of any major reports from the Eurozone.

Concerns over Greece's debt problems continue to weigh on the euro, despite the fact that Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros last week.

The British pound traded higher against the U.S. dollar in the absence of any major reports from the U.K.

EUR/USD: the currency pair fell to $1.0519

GBP/USD: the currency pair increased to $1.4630

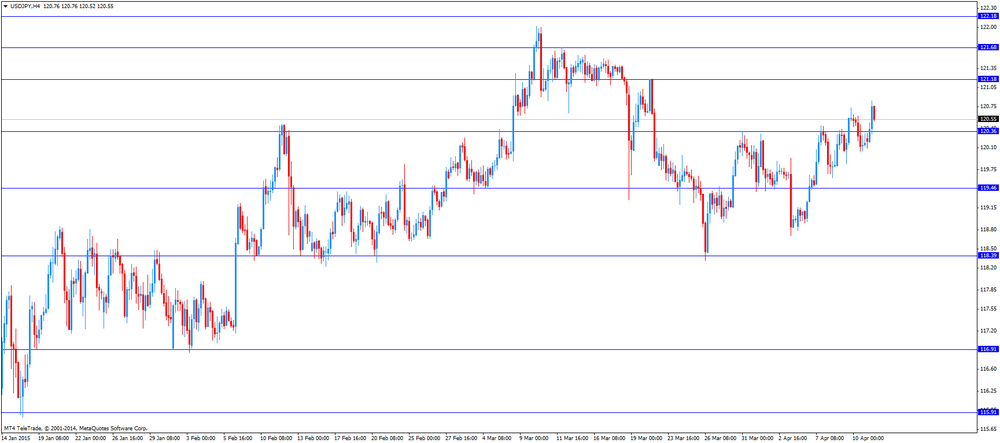

USD/JPY: the currency pair rose to Y120.84

The most important news that are expected (GMT0):

22:00 New Zealand NZIER Business Confidence Quarter I 23

-

14:00

Orders

EUR/USD

Offers 1.0750 1.0720/30 1.0700 1.0650

Bids 1.0500 1.0460/50 1.0400

GBP/USD

Offers 1.4800 1.4750 1.4725 1.4700 1.4660/70

Bids 1.4565/55 1.4510/05 1.4500

EUR/JPY

Offers 129.20 129.00 128.50 128.00/20 127.80

Bids 126.50 126.00

USD/JPY

Offers 122.00 121.50 121.00

Bids 120.10/00 119.50 119.00

EUR/GBP

Offers 0.7315 0.7290/00 0.7275

Bids 0.7200 0.7150 0.7080/75

AUD/USD

Offers 0.7850 0.7780/00 0.7750 0.7700 0.7635

Bids 0.7530 0.7500

-

13:00

European stock markets mid-session: DAX30 and CAC40 back in positive territory after weak start

European stocks mostly turn positive after opening lower at the start of the new week, now moderately extending last week's rally. Stocks were under pressure after weaker-than-expected Chinese data, fuelling concerns over the economic outlook of the world's second largest economy. This week all eyes are on the upcoming ECB's monetary policy meetings scheduled for Wednesday.

The commodity heavy FTSE 100 index is currently trading -0,43% quoted at 7,059.40 points weighed by losses in the mining sector. Germany's DAX 30 is trading at 12,380.92 points +0.05%. France's CAC 40 is currently trading at 5,242.33 points, +0.04%.

-

12:20

Oil: prices continue Friday’s climb on hopes for Chinese stimulus and on lower rig-count in the U.S.

Oil is trading higher today continuing Friday's bullish momentum on weaker Chinese data that could lead to further stimulus measures taken by the Peoples Bank of China - China is the world's second largest consumer of oil - and decreasing numbers of active drilling rigs in the U.S. Baker Hughes reported on Friday that rig-numbers declined the most in a month and the 18th consecutive month. Still, U.S. stockpiles are at a record and Saudi Arabia, the OPEC's largest producer is pumping at record levels. Brent Crude added +1.47% currently trading at USD58.72 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate rose by +1.51% currently quoted at USD52.42.

-

12:00

Gold: focus on key U.S. data later in the week – prices below USD1,200 again

Gold fell under the important USD 1,200 level again at the start of the week after Friday's pullback from a 4-day decline. The minutes of the last FOMC policy meeting showed that the board is divided on whether to hike interest rates in June or not. Even though the weaker-than-expected GDP growth and disappointing labour market data could delay a potential interest rate hike a lot of market participants speculate that the FED is on track for a mid-year hike, weighing down the precious metal. According to FED Governor Powell the FED could hike interest rates as early as June if labor markets data remains strong and points to a recovery. Markets focus on key U.S. data including inflation, consumer sentiment as well as industrial production and housing starts due later this weak

A stronger US dollar is putting pressure on gold, as it reduces the metal's appeal as an alternative asset and makes dollar-denominated commodities more expensive for holders of other currencies.

Gold is currently quoted at USD1,198.10 -0,80% a troy ounce, falling under the USD1,200 mark again. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday the 17th of march gold traded as low as USD1,142.50, a three-month low.

-

11:17

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0450(E521mn), $1.0550 (E593mn), $1.0630(E592mn), $1.0670-75(E825mn), $1.0750(E1.1bn)

USD/JPY: Y120.00($498mn), Y121.00($482mn), Y121.80($800mn), Y122.00(372mn)*Y121.00 $2bn

GBP/USD: $1.5000(Gbp256mn)

AUD/USD: $0.7600(A$1.7bn)

NZD/USD: $0.7325(NZ$771mn), $0.7400(NZ$337mn), $0.7525(NZ$400mn), $0.7710(NZ$806mn), $0.7750(NZ$552mn)

USD/CAD: C$1.1.2580($375mn)

-

10:20

Press Review: Oil Bulls Boost Wagers by Most Since 2010 as Output Seen Peaking

BLOOMBERG

The Curious Case of Japan's Hidden InflationIf the Bank of Japan's core price gauge is anything to go by, inflation has all but disappeared. Try telling that to anyone who pays the bills.

The general public thinks the cost of living is rising more than twice as fast as the official inflation rate, a survey of consumers by the Bank of Japan shows.

So why the gap? Naohito Abe, a professor at Hitotsubashi University, has one possible answer in an index that captures changes in prices of new products that account for almost half of goods sold at an average retail shop, and often don't show up in official data.

Together with Intage Inc. and the New Supermarket Association of Japan, he's come up with a measure that also captures the sneaky ways businesses milk consumers -- by reducing the size of a product while charging the same price.

Source: http://www.bloomberg.com/news/articles/2015-04-13/the-curious-case-of-japan-s-hidden-inflation

REUTERS

World Bank cuts East Asia growth forecast, warns of risks to outlook

(Reuters) - The World Bank cut its 2015 growth forecasts for developing East Asia and China, and warned of "significant" risks from global uncertainties including the potential impact from a strengthening dollar and higher U.S. interest rates.

The Washington-based lender expects the developing East Asia and Pacific (EAP) region, which includes China, to grow 6.7 percent in each of 2015 and 2016, down from 6.9 percent growth in 2014.

That's down from its previous forecast in October of 6.9 percent growth this year and 6.8 percent in 2016.

China's growth is likely to slow due to policies aimed at putting its economy on a more sustainable footing and tackling financial vulnerabilities, the World Bank said in its latest East Asia and Pacific Economic Update report on Monday.

Source: http://www.reuters.com/article/2015/04/13/us-worldbank-asia-idUSKBN0N404O20150413

BLOOMBERG

Oil Bulls Boost Wagers by Most Since 2010 as Output Seen Peaking

Speculators increased bullish oil bets by the most in more than four years, wagering that the U.S. production boom is slowing.

Hedge funds boosted net-long positions on West Texas Intermediate crude by 30 percent in the seven days ended April 7, the biggest jump since October 2010, U.S. Commodity Futures Trading Commission data show. Long bets rose to a nine-month high, while shorts tumbled 21 percent.

U.S. crude output and inventories may peak this month amid a record drop in rigs exploring for oil, Goldman Sachs Group said. Refiners returning from seasonal maintenance will add about 500,000 barrels a day of demand by July, the Energy Information Administration forecast, helping ease the biggest glut in 85 years.

-

10:00

European stock markets First hour: Indices open lower on weak Chinese data

European stocks open lower at the start of the new week on a light data day and could not follow the bullish momentum in the U.S. on Friday and in Asia on Monday. Stocks are under pressure after weaker-than-expected Chinese data, fuelling concerns over the economic outlook of the world's second largest economy. This week all eyes are on the upcoming ECB's monetary policy meetings scheduled for Wednesday.

The commodity heavy FTSE 100 index is currently trading -0,33% quoted at 7,066.64 points. Germany's DAX 30 is trading at 12,341.07 points -0.27%. France's CAC 40 is currently trading at 5,224.95 points, -0.30%.

-

09:00

Global Stocks: Wall Street up, Nikkei flat, Chinese stocks rally on stimulus hopes

U.S. stocks traded higher on Friday with the focus on corporate earnings this week. The S&P 500 closed +0.52% with a final quote of 2,102.06 points. The DOW JONES index added +0.55%, closing at 18,057.65 points - above the psychologically important 18,000 points level again with the industrial sector leading shares higher. General Electric Company skyrocketed 11% after announcing a restructuring. Both indices are back in positive territory for the year.

Chinese stocks are rallying on hopes on further stimulus measures by the Chinese government after an unexpected drop in exports. Hong Kong's Hang Seng is trading +1.80% at 27,762.44 points. China's Shanghai Composite is currently trading at 4,108.27 points +1.83%. Last week was the fifth straight week of gains with the index up more than 70% in 6 months. The Chinese Trade Balance declined in March with exports slumping. The Balance fell to a surplus of 3.1 billion from 60.6 billion last month. Analysts expected a reading of 43.4 billion. Data on the Chinese GDP is scheduled for Wednesday.

The Nikkei closed almost flat on Monday after setting a new 15-year high on Friday and trading above the 20,000 points mark. The index declined on profit taking in choppy trade -0.01% and closed at 19,905.46 points.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly higher against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Trade Balance, bln March 60.6 40.3 3.1

The U.S. dollar is trading broadly higher against its major peers as speculations about the timing of a future rate hike go on. Comments of some of the FOMC members about a rate hike this summer boosted the greenback.

The Australian dollar slumped against the U.S. dollar after the weaker-than-expected Chinese data. China is Australia's biggest trade partner due to Australia's raw material exports to the world's second largest economy.

The Chinese Trade Balance declined in March with exports slumping. The Balance fell to a surplus of 3.1 billion from 60.6 billion last month. Analysts expected a reading of 43.4 billion. Data on the Chinese GDP is scheduled for Wednesday.

New Zealand's dollar slumped against the greenback during the Asian in the absence of any major economic news.

The Japanese yen traded lower against the greenback in Asian trade. Yesterday at 23:50 GMT data on Core Machinery orders was reported. Orders for February declined -0.4%, less than the expected decline of -2.8%. The January reading was -1.7%. Year on year Order rose +5.9%, above the forecast of +3.7%. According to the minutes of the BoJ's March policy meetings board members said that the BoJ must pay closer attention to the effects of the aggressive monetary policy on Japanese government bonds.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling continued to decline against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

18:00 U.S. Federal Budget

22:00 New Zealand NZIER Business Confidence Quarter I 23

23:01 United Kingdom BRC Retail Sales Monitor y/y March 0.2%

-

08:06

Options levels on monday, April 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0796 (1058)

$1.0745 (1463)

$1.0706 (226)

Price at time of writing this review: $1.0594

Support levels (open interest**, contracts):

$1.0552 (2586)

$1.0517 (4441)

$1.0468 (4553)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 49352 contracts, with the maximum number of contracts with strike price $1,1200 (5917);

- Overall open interest on the PUT options with the expiration date May, 8 is 62983 contracts, with the maximum number of contracts with strike price $1,0000 (7311);

- The ratio of PUT/CALL was 1.28 versus 1.29 from the previous trading day according to data from April, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.4909 (677)

$1.4813 (1011)

$1.4717 (283)

Price at time of writing this review: $1.4587

Support levels (open interest**, contracts):

$1.4486 (1394)

$1.4389 (1599)

$1.4292 (1001)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 20561 contracts, with the maximum number of contracts with strike price $1,5000 (2273);

- Overall open interest on the PUT options with the expiration date May, 8 is 27826 contracts, with the maximum number of contracts with strike price $1,4700 (2791);

- The ratio of PUT/CALL was 1.35 versus 1.38 from the previous trading day according to data from April, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:22

China: Trade Balance, bln, March 3.1 (forecast 40.3)

-

04:02

Nikkei 225 19,861.42 -46.21 -0.23 %, Hang Seng 27,431.17 +158.78 +0.58 %, Shanghai Composite 4,082.13 +47.82 +1.19 %

-

01:52

Japan: Core Machinery Orders, y/y, February 5.9%

-

01:51

Japan: Core Machinery Orders, February -0.4%

-

00:34

Commodities. Daily history for Apr 10’2015:

(raw materials / closing price /% change)

Oil 51.64 +1.67%

Gold 1,207.80 +0.27%

-

00:33

Currencies. Daily history for Apr 10’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0603 -0,55%

GBP/USD $1,4629 -0,53%

USD/CHF Chf0,9791 +0,19%

USD/JPY Y120,17 -0,33%

EUR/JPY Y127,45 -0,86%

GBP/JPY Y175,82 -0,84%

AUD/USD $0,7678 -0,21%

NZD/USD $0,7531 -0,39%

USD/CAD C$1,2560 -0,18%

-

00:33

Stocks. Daily history for Apr 10’2015:

(index / closing price / change items /% change)

Nikkei 225 19,907.63 -30.09 -0.15 %

Hang Seng 27,272.39 +328.00 +1.22 %

Shanghai Composite 4,034.9 +77.37 +1.95 %

FTSE 100 7,089.77 +74.41 +1.06 %

CAC 40 5,240.46 31.51 +0.60 %

Xetra DAX 12,374.73 +208.29 +1.71 %

S&P 500 2,102.06 +10.88 +0.52 %

NASDAQ Composite 4,995.98 +21.41 +0.43 %

Dow Jones18,057.65 +98.92 +0.55 %

-