Noticias del mercado

-

21:00

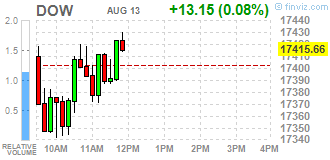

Dow +0.43% 17,477.04 +74.53 Nasdaq +0.43% 5,066.21 +21.82 S&P +0.30% 2,092.25 +6.20

-

18:43

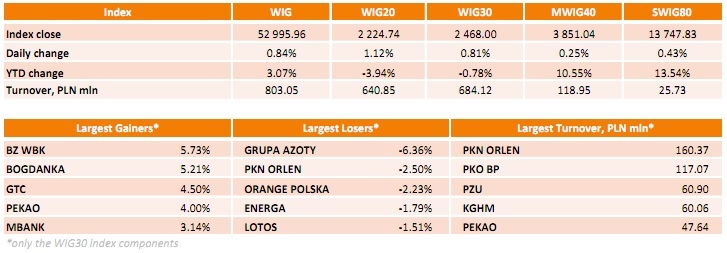

WSE: Session Results

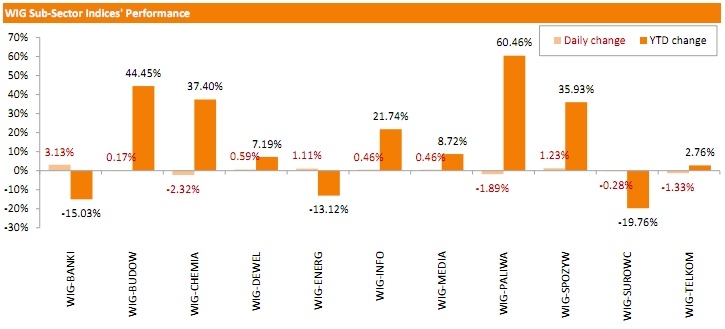

Polish equity market advanced on Thursday. The broad market measure, the WIG Index, added 0.84%. Sector-wise, banking names (+3.13%) fared the best on hopes the President will not sign into law the new version of a Sejm-approved bill on foreign currency mortgage conversion. On the contrary, chemicals (-2.32%) were the poorest performers.

The large-cap companies' measure, the WIG30 Index, grew by 0.81%. In the large-cap stock universe, the gainers were led by BZ WBK (WSE: BZW), BOGDANKA (WSE: LWB), GTC (WSE: GTC) and PEKAO (WSE: PEO), rising 4%-5.73%. At the same time, GRUPA AZOTY (WSE: ATT) topped the decliners' list, slumping 6.36%. It was followed by PKN ORLEN (WSE: PKN) and ORANGE POLSKA (WSE: OPL), which lost 2.50% and 2.23% respectively.

-

18:01

Wall Street. Major U.S. stock-indexes little changed

Mjor Wall Street indexes are little changed on Thursday as investors focus on the latest batch of strong U.S. economic data and digest China's reassurance that there was no basis for further depreciation of the yuan. U.S. retail sales rebounded in July, while the trend of weekly jobless pointed to a tightening job market, increasing the likelihood that the Federal Reserve would raise interest rates as early as September.

Most of Dow stocks in negative area (19 of 30). Top looser - Caterpillar Inc. (CAT, -1.34%). Top gainer - Cisco Systems, Inc. (CSCO, +3.33).

Most of all S&P index sectors also in negative area. Top looser - Services (-1.4%). Top gainer - Basic materials (+0,3%).

At the moment:

Dow 17366.00 -1.00 -0.01%

S&P 500 2083.00 -1.25 -0.06%

Nasdaq 100 4536.50 +3.00 +0.07%

10 Year yield 2,16% +0,03

Oil 42.25 -1.05 -2.42%

Gold 1115.30 -8.30 -0.74%

-

18:00

European stocks closed: FTSE 100 6,568.33 -2.86 -0.04% CAC 40 4,986.85 +61.42 +1.25% DAX 11,014.63 +90.02 +0.82%

-

18:00

European stocks close: stocks closed mixed as concerns over the yuan devaluation eased

Stock indices closed mixed as concerns over the yuan devaluation eased. The People's Bank of China (PBoC) has devaluated the yuan for the third day. But the central bank tried to reassure market participants on Thursday, saying there was no basis for further yuan devaluation.

The yuan depreciated 1.9% on Tuesday, 1.6% on Wednesday and 1.1% today. China's central bank set Thursday's daily fixing at 6.4010 per U.S. dollar, down from 6.3306 on Wednesday.

Meanwhile, the economic data from the Eurozone was weak. German final consumer price index rose 0.2% in July, in line with the preliminary estimate, after a 0.1% decline in June.

On a yearly basis, German final consumer price index decreased to 0.2% in July from 0.3% in June, in line with the preliminary estimate. It was the lowest level since February.

The decline was driven by falling energy prices, which dropped 6.2% year-on-year in July.

The French consumer price inflation dropped 0.4% in July, after a 0.1% decrease in June.

On a yearly basis, the consumer price index climbed 0.2% in July, after a 0.3% rise in June.

The European Central Bank's (ECB) its minutes of July meeting on Thursday. According to the minutes, financial developments in China could have a larger than expected adverse impact.

"In particular, financial developments in China could have a larger than expected adverse impact, given this country's prominent role in global trade. This risk could be compounded by negative knock-on effects from interest rate increases in the United States on growth in emerging market economies," the ECB said.

The central bank noted that the economic recovery in the Eurozone remained moderate and gradual.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,568.33 -2.86 -0.04 %

DAX 11,014.63 +90.02 +0.82 %

CAC 40 4,986.85 +61.42 +1.25 %

-

17:41

Oil prices fall on a stronger U.S. dollar and on concerns over the global oil glut

Oil prices declined on a stronger U.S. dollar and on concerns over the global oil glut. The U.S. dollar rose against other currencies after the release of the U.S. retail sales. The U.S. retail sales climbed 0.6% in July, exceeding expectations for a 0.5% increase, after a flat reading in June. June's figure was revised up from a 0.3% drop.

The increase was partly driven by higher automobiles purchases. Automobiles sales rose 1.4% in July.

Retail sales excluding automobiles increased 0.4% in July, in line with forecasts, after a 0.4% gain in June. June's figure was revised up from a 0.1% decrease.

These figures could add to speculation on that the Fed starts raising its interest rate next month.

BP's refinery in Whiting, Indiana faced problems, which could lead to higher U.S. crude oil inventories. The capacity of the refinery is 165,000 barrels per day.

News that Iraq plans to export near-record oil volumes in September also weighed on oil prices.

WTI crude oil for September delivery fell to $42.37 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $49.00 a barrel on ICE Futures Europe.

-

17:24

Gold declines as the U.S. dollar rose on the U.S. retail sales data and as concerns over the further yuan devaluation eased

Gold traded lower as the U.S. dollar rose on the U.S. retail sales data and as concerns over the further yuan devaluation eased. The People's Bank of China (PBoC) has devaluated the yuan for the third day. But the central bank tried to reassure market participants on Thursday, saying there was no basis for further yuan devaluation.

The yuan depreciated 1.9% on Tuesday, 1.6% on Wednesday and 1.1% today. China's central bank set Thursday's daily fixing at 6.4010 per U.S. dollar, down from 6.3306 on Wednesday.

The U.S. retail sales climbed 0.6% in July, exceeding expectations for a 0.5% increase, after a flat reading in June. June's figure was revised up from a 0.3% drop.

The increase was partly driven by higher automobiles purchases. Automobiles sales rose 1.4% in July.

Retail sales excluding automobiles increased 0.4% in July, in line with forecasts, after a 0.4% gain in June. June's figure was revised up from a 0.1% decrease.

These figures could add to speculation on that the Fed starts raising its interest rate next month.

Market participants eyed the report by the World Gold Council (WGC). Global demand for gold dropped 12% in the second quarter due to lower demand from Asia. Demand for gold totalled 914.9 tons in the second quarter, down from 1,038 tons during the same period in 2014.

October futures for gold on the COMEX today declined to 1115.20 dollars per ounce.

-

16:57

Greek budget revenues drop 40% below target in July

Greece's Finance Ministry released its revenues data on Thursday. The Greek budget revenues dropped 40% below target in July.

Greece's primary budget surplus was €3.53 billion in the first seven months of 2015, higher than a primary budget surplus target of €2.98 billion.

Tax revenues totalled €26.7 billion, below a target of €30.8 billion. Public spending totalled €27.7 billion, below a target of €32.1 billion.

-

16:27

ECB Monetary Policy Meeting Account: financial developments in China could have a larger than expected adverse impact

The European Central Bank's (ECB) its minutes of July meeting on Thursday. According to the minutes, financial developments in China could have a larger than expected adverse impact.

"In particular, financial developments in China could have a larger than expected adverse impact, given this country's prominent role in global trade. This risk could be compounded by negative knock-on effects from interest rate increases in the United States on growth in emerging market economies," the ECB said.

The central bank noted that the economic recovery in the Eurozone remained moderate and gradual.

The ECB pointed out that a deal on a Greek bailout programme will firm confidence in the Eurozone.

-

16:18

U.S. business inventories rise 0.8% in June

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories rose 0.8% in June, exceeding expectations for a 0.3% increase, after a 0.3% gain in May.

The increase was driven by a rise in in all categories. Wholesale inventories climbed 0.9% in June, retail inventories were up 0.9%, while manufacturing inventories rose 0.6%.

Business sales climbed 0.2% in June, while retail sales declined 0.1%.

The business inventories/sales ratio increased to 1.37 in June from 1.36 months in May. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:00

U.S.: Business inventories , June 0.8% (forecast 0.3%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E501mn), $1.1065(E626mn)

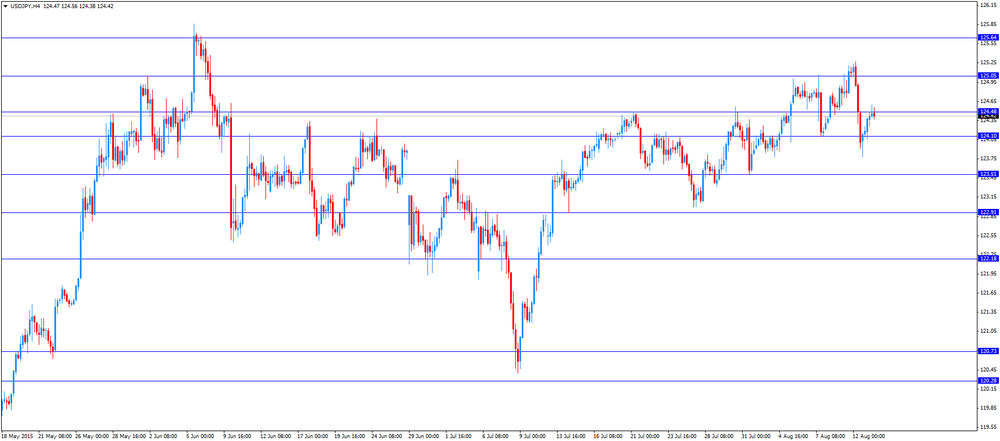

USD/JPY: Y124.00($1.41bn), Y124.50($1.11bn)

GBP/USD: $1.5500(Gbp307), $1.5625(Gbp102mn)

AUD/USD: $0.7300(A$101mn)

NZD/USD: $0.6625(NZ$329mn)

USD/CAD: C$1.3025($500mn)

-

15:31

U.S. Stocks open: Dow -0.11%, Nasdaq +0.12%, S&P -0.03%

-

15:27

Greek GDP rises 0.8% in the second quarter

The Hellenic Statistical Authority released its gross domestic product (GDP) data for Greece on Thursday. The Greek final GDP rose 0.8% in the second quarter, after a revised flat reading in the first quarter.

On a yearly basis, Greek final GDP rose 1.5% in the second quarter, after a 0.2% increase in the first quarter.

-

15:26

Before the bell: S&P futures -0.02%, NASDAQ futures +0.08%

U.S. stock-index futures were little changed as the Chinese central bank indicated it will support the yuan and sales at American retailers increased in July.

Global Stocks:

Nikkei 20,595.55 +202.78 +0.99%

Hang Seng 24,018.8 +102.78 +0.43%

Shanghai Composite 3,954.78 +68.46 +1.76%

FTSE 6,580.35 +9.16 +0.14%

CAC 4,995.58 +70.15 +1.42%

DAX 11,033.47 +108.86 +1.00%

Crude oil $42.89 (-0.97%)

Gold $1114.30 (-0.86%)

-

15:11

U.S. retail sales jumps 0.6% in July

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales climbed 0.6% in July, exceeding expectations for a 0.5% increase, after a flat reading in June. June's figure was revised up from a 0.3% drop.

The increase was partly driven by higher automobiles purchases. Automobiles sales rose 1.4% in July.

Retail sales excluding automobiles increased 0.4% in July, in line with forecasts, after a 0.4% gain in June. June's figure was revised up from a 0.1% decrease.

Sales at building material and garden equipment stores climbed 0.7% in July and sales at furniture stores increased 0.8%.

Sales at electronics and appliance outlets declined 1.2% in July, while sales at clothing retailers were up 0.4%.

These figures could add to speculation on that the Fed starts raising its interest rate next month.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Home Depot Inc

HD

117.81

+0.10%

2.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.26

+0.10%

20.2K

Ford Motor Co.

F

14.70

+0.14%

2.9K

Verizon Communications Inc

VZ

47.95

+0.21%

5.5K

Citigroup Inc., NYSE

C

57.03

+0.21%

3.6K

Intel Corp

INTC

29.53

+0.24%

8.7K

AT&T Inc

T

34.11

+0.26%

8.1K

General Electric Co

GE

25.93

+0.27%

8.2K

Wal-Mart Stores Inc

WMT

72.80

+0.30%

0.1K

JPMorgan Chase and Co

JPM

67.45

+0.31%

0.9K

United Technologies Corp

UTX

99.00

+0.31%

0.2K

ALCOA INC.

AA

09.54

+0.32%

18.6K

Visa

V

73.80

+0.35%

4.9K

Boeing Co

BA

143.00

+0.40%

1.6K

Apple Inc.

AAPL

115.70

+0.40%

311.9K

Procter & Gamble Co

PG

76.70

+0.41%

0.6K

Walt Disney Co

DIS

107.48

+0.46%

0.5K

Facebook, Inc.

FB

94.68

+0.52%

60.0K

Twitter, Inc., NYSE

TWTR

29.56

+0.58%

45.5K

Amazon.com Inc., NASDAQ

AMZN

529.10

+0.61%

1.6K

General Motors Company, NYSE

GM

31.07

+0.65%

0.8K

Starbucks Corporation, NASDAQ

SBUX

56.79

+0.73%

0.8K

Merck & Co Inc

MRK

58.75

+0.84%

0.8K

Microsoft Corp

MSFT

47.25

+1.09%

8.9K

Yahoo! Inc., NASDAQ

YHOO

35.00

+1.48%

58.4K

Tesla Motors, Inc., NASDAQ

TSLA

242.00

+1.48%

78.8K

Cisco Systems Inc

CSCO

28.92

+3.66%

109.4K

American Express Co

AXP

81.00

0.00%

0.6K

Caterpillar Inc

CAT

78.90

-0.03%

0.1K

McDonald's Corp

MCD

98.20

-0.08%

1.8K

ALTRIA GROUP INC.

MO

55.50

-0.43%

0.7K

Chevron Corp

CVX

86.40

-0.45%

9.8K

Yandex N.V., NASDAQ

YNDX

13.00

-0.46%

0.5K

Exxon Mobil Corp

XOM

78.32

-0.60%

3.1K

Hewlett-Packard Co.

HPQ

28.91

-0.65%

1K

Barrick Gold Corporation, NYSE

ABX

07.94

-2.34%

1.3K

-

14:53

Initial jobless claims rise by 5,000 to 274,000 in the week ending August 08

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 08 in the U.S. rose by 5,000 to 274,000 from 269,000 in the previous week. The previous week's figure was revised down from 270,000.

Analysts had expected the number of initial jobless claims to be 270,000.

Jobless claims remained below 300,000 the 23th straight week. This threshold is associated with the strengthening of the labour market.

The four-week moving average of initial jobless claims declined by 1,750 to 266,250 last week. It was the lowest level since April 2000.

Continuing jobless claims increased by 15,000 to 2,273,000 in the week ended August 01.

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Yahoo! (YHOO) upgraded to Outperform from Mkt Perform at Bernstein

Microsoft (MSFT) upgraded to Buy from Hold at Stifel, target $55

Downgrades:

Other:

-

14:37

Canada’s new housing price index climbs 0.3% in June

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.3% in June, exceeding expectations of a 0.1% gain, after a 0.2% rise in May. It was the biggest monthly rise since August 2014.

The increase was driven by gains in Toronto.

On a yearly basis, new housing price index in Canada climbed 1.3% in June, after a 1.2% gain in May.

-

14:30

Canada: New Housing Price Index, MoM, June 0.3% (forecast 0.1%)

-

14:30

U.S.: Initial Jobless Claims, August 274 (forecast 270)

-

14:30

U.S.: Retail sales excluding auto, August 0.4% (forecast 0.4%)

-

14:30

U.S.: Retail sales, July 0.6% (forecast 0.5%)

-

14:30

U.S.: Continuing Jobless Claims, August 2273 (forecast 2247)

-

14:20

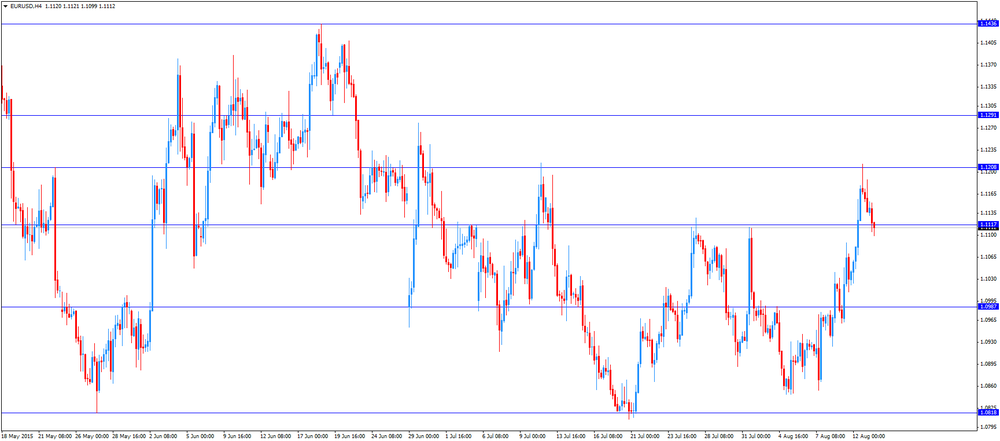

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany CPI, m/m (Finally) July -0.1% 0.2% 0.2%

06:00 Germany CPI, y/y (Finally) July 0.3% 0.2% 0.2%

06:45 France CPI, m/m July -0.1% -0.4%

06:45 France CPI, y/y July 0.3% 0.2%

07:15 Switzerland Producer & Import Prices, m/m July -0.1% -0.3%

07:15 Switzerland Producer & Import Prices, y/y July -6.1% -6.4%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. retail sales data. The U.S. retail sales are expected to rise 0.5% in July, after a 0.3% decline in June.

Retail sales excluding automobiles are expected to climb 0.4% in July, after a 0.1% decrease in June.

The number of initial jobless claims in the U.S. is expected to remain unchanged at 270,000.

The yuan devaluation weighed on the greenback. The People's Bank of China (PBoC) has devaluated the yuan for the third day. But the central bank tried to reassure market participants on Thursday, saying there was no basis for further yuan devaluation.

The yuan depreciated 1.9% on Tuesday, 1.6% on Wednesday and 1.1% today. China's central bank set Thursday's daily fixing at 6.4010 per U.S. dollar, down from 6.3306 on Wednesday.

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. German final consumer price index rose 0.2% in July, in line with the preliminary estimate, after a 0.1% decline in June.

On a yearly basis, German final consumer price index decreased to 0.2% in July from 0.3% in June, in line with the preliminary estimate. It was the lowest level since February.

The decline was driven by falling energy prices, which dropped 6.2% year-on-year in July.

The French consumer price inflation dropped 0.4% in July, after a 0.1% decrease in June.

On a yearly basis, the consumer price index climbed 0.2% in July, after a 0.3% rise in June.

The European Central Bank's (ECB) its minutes of July meeting on Thursday. According to the minutes, financial developments in China could have a larger than expected adverse impact.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian housing market data. Canada's new housing price index is expected to rise 0.1% in June, after a 0.2% gain in May.

The Swiss franc traded mixed against the U.S. dollar after the economic data from Switzerland. Switzerland's producer and import prices fell 0.3% in July, after a 0.1% drop in June.

The decline was driven by lower prices for petrol and petroleum products, watches and electronic components and circuit boards.

The Import Price Index decreased by 0.3% in July, while producer prices fell 0.2%.

On a yearly basis, producer and import prices plunged 6.4% in July, after a 6.1% drop in June.

The Import Price Index fell by 10.5% year-on year in July, while producer prices dropped 4.5%.

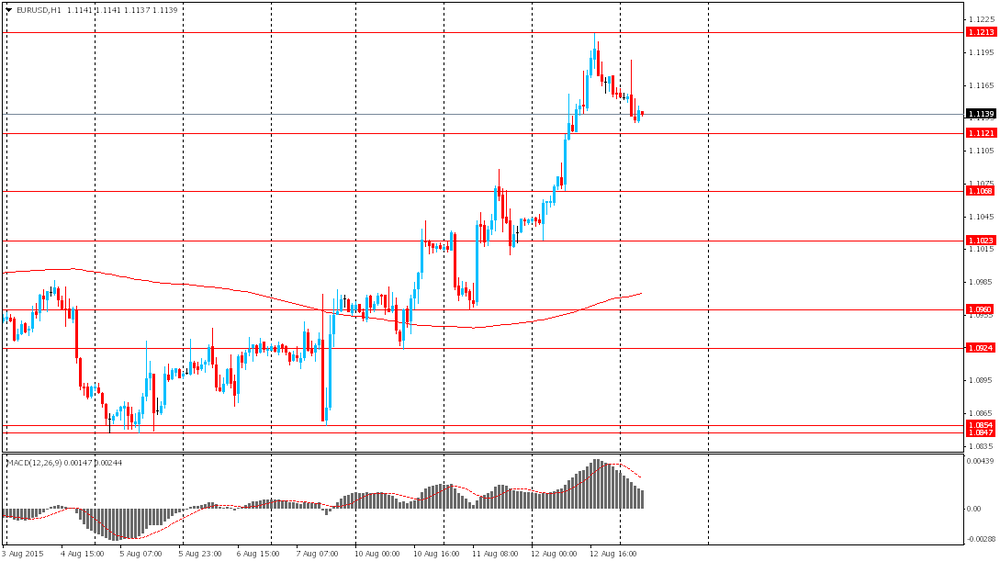

EUR/USD: the currency pair declined to $1.1099

GBP/USD: the currency pair increased to $1.5636

USD/JPY: the currency pair fell to Y124.38

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index, MoM June 0.2% 0.1%

12:30 U.S. Initial Jobless Claims August 270 270

12:30 U.S. Retail sales July -0.3% 0.5%

12:30 U.S. Retail sales excluding auto August -0.1% 0.4%

14:00 U.S. Business inventories June 0.3% 0.3%

22:45 New Zealand Retail Sales YoY Quarter II 7.4% 5.2%

22:45 New Zealand Retail Sales, q/q Quarter II 2.7% 0.5%

-

14:00

Orders

EUR/USD

Offers 1.1150 1.1180 1.1200 1.2220 1.1245

Bids 1.1100 1.1085 1.1050 1.1020 1.1000 1.0985 1.0965 1.0950 1.0900

GBP/USD

Offers 1.5650 1.5680 1.5700-10 1.5730 1.5750

Bids 1.5600 1.5580 1.5550 1.5525 -30 1.5500 1.5485 1.5465 1.5450

EUR/GBP

Offers 0.7130-35 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7110 0.7090 0.7075 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 138.80 139.00 139.30 139.50 139.75 140.00

Bids 138.30 138.00 137.80 137.60 137.45 137.25 137.00

USD/JPY

Offers 124.65 124.80 125.00 125.20-25 125.50 125.75 126.00

Bids 124.25 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7365 0.7380 0.7400-05 0.7425 0.7450

Bids 0.7335-40 0.7320 0.7300 0.7285 0.7260 0.7300 0.7280 0.7250

-

12:00

European stock markets mid session: stocks rebounded after the yesterday’s significant drop

Stock indices rebounded after the yesterday's significant drop. The People's Bank of China (PBoC) has devaluated the yuan for the third day. But the central bank tried to reassure market participants on Thursday, saying there was no basis for further yuan devaluation.

The yuan depreciated 1.9% on Tuesday, 1.6% on Wednesday and 1.1% today. China's central bank set Thursday's daily fixing at 6.4010 per U.S. dollar, down from 6.3306 on Wednesday.

Meanwhile, the economic data from the Eurozone was weak. German final consumer price index rose 0.2% in July, in line with the preliminary estimate, after a 0.1% decline in June.

On a yearly basis, German final consumer price index decreased to 0.2% in July from 0.3% in June, in line with the preliminary estimate. It was the lowest level since February.

The decline was driven by falling energy prices, which dropped 6.2% year-on-year in July.

The French consumer price inflation dropped 0.4% in July, after a 0.1% decrease in June.

On a yearly basis, the consumer price index climbed 0.2% in July, after a 0.3% rise in June.

Current figures:

Name Price Change Change %

FTSE 100 6,612.4 +41.21 +0.63 %

DAX 11,085.82 +161.21 +1.48 %

CAC 40 5,004.22 +78.79 +1.60 %

-

11:42

Final consumer price inflation in Spain plunges 0.9% in July

The Spanish statistical office INE released its final consumer price inflation data on Thursday. Final consumer price inflation in Spain was down 0.9% in July, up from the preliminary estimate of a 1.0% decline, after a 0.3% gain in June. It was the first drop in six months.

On a yearly basis, final consumer prices remained unchanged at 0.1% in July, up from the preliminary estimate of a flat reading.

-

11:24

Switzerland's producer and import prices fall 0.3% in July

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices fell 0.3% in July, after a 0.1% drop in June.

The decline was driven by lower prices for petrol and petroleum products, watches and electronic components and circuit boards.

The Import Price Index decreased by 0.3% in July, while producer prices fell 0.2%.

On a yearly basis, producer and import prices plunged 6.4% in July, after a 6.1% drop in June.

The Import Price Index fell by 10.5% year-on year in July, while producer prices dropped 4.5%.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E501mn), $1.1065(E626mn)

USD/JPY: Y124.00($1.41bn), Y124.50($1.11bn)

GBP/USD: $1.5500(Gbp307), $1.5625(Gbp102mn)

AUD/USD: $0.7300(A$101mn)

NZD/USD: $0.6625(NZ$329mn)

USD/CAD: C$1.3025($500mn)

-

11:10

French consumer price inflation falls 0.4% in July

The French statistical office Insee released its consumer price inflation for France on Thursday. The French consumer price inflation dropped 0.4% in July, after a 0.1% decrease in June.

On a yearly basis, the consumer price index climbed 0.2% in July, after a 0.3% rise in June.

Fresh food prices rose 4.6% year-on-year in July, while petroleum products prices dropped by 9.2%.

-

10:57

German final consumer price inflation rises 0.2% in July

Destatis released its final consumer price data for Germany on Thursday. German final consumer price index rose 0.2% in July, in line with the preliminary estimate, after a 0.1% decline in June.

On a yearly basis, German final consumer price index decreased to 0.2% in July from 0.3% in June, in line with the preliminary estimate. It was the lowest level since February.

The decline was driven by falling energy prices, which dropped 6.2% year-on-year in July.

Food prices climbed 0.4% year-on-year in July.

-

10:44

RICS house price balance increased to +44% in July

The Royal Institution of Chartered Surveyors' (RICS) released its house price data on late Wednesday evening. The monthly house price balance increased to +44% in July from +40% in June, exceeding expectations for a gain to +42%.

The increase was driven by a shortage of properties.

"More worrying still is the suspicion that the imbalance between supply and demand will lead to even stronger price gains over the next 12 months," RICS Chief Economist, Simon Rubinsohn, said.

-

10:35

U.S. budget deficit increases to $149.2 billion in July

The U.S. Treasury Department released its federal budget data on Wednesday. The budget deficit increased to $149.2 billion in July, down from a deficit of $94.6 billion in July 2014.

The budget deficit rose as the U.S. government paid out $42 billion in August benefits in July.

In the first 10 months of the fiscal year 2015, which ends at September this year, the budget deficit totalled $465.5 billion, 1.1% higher than a year ago.

-

10:17

Greek economy is expected to shrink 2.3% this year

EU officials said that the Greek economy is expected to shrink 2.3% this year and 1.3% next year. The country's economy is expected to expand 2.7% in 2017 and 3.1% in 2018.

Under a new reform program, the primary budget targets are a primary deficit of 0.25% of gross domestic product in 2015, a 0.5% surplus in 2016, a 1.75% surplus in 2017 and a 3.5% surplus in 2018.

-

10:11

The People's Bank of China devaluates the yuan for the third day

The People's Bank of China (PBoC) has devaluated the yuan for the third day. The PBoC has defended its decision to devaluate the yuan.

The yuan depreciated 1.9% on Tuesday, 1.6% on Wednesday and 1.1% today. China's central bank set Thursday's daily fixing at 6.4010 per U.S. dollar, down from 6.3306 on Wednesday.

The PBoC said on Tuesday that it was a "one-off depreciation".

The central bank tried to reassure market participants on Thursday, saying there was no basis for further yuan devaluation.

A weaker yuan could lead to capital outflows from China. The PBoC Governor Yi Gang said that the central bank will ensure "orderly" cross-border capital flows, adding that capital inflows and outflows were "basically balanced."

China wants to open the country's foreign-exchange markets to foreign institutions and to extend foreign-exchange trading hours. The yuan traded at a big discount in Hong Kong.

-

09:15

Switzerland: Producer & Import Prices, m/m, July -0.3%

-

09:15

Switzerland: Producer & Import Prices, y/y, July -6.4%

-

09:05

Oil prices climbed amid U.S. crude inventories data

West Texas Intermediate futures for September delivery climbed to $43.50 (+0.46%), while Brent crude advanced to $50.01 (+0.70%). The U.S. Energy Information Administration reported on Wednesday that the country's crude oil inventories fell 1.7 million barrels to 453.6 million barrels in the week ending August 7. The report also said U.S. oil production fell 70,000 barrels a day to about 9.4 million barrels.

The EIA expects global oil demand growth in 2015 to be the strongest in five years, although it added that global oversupply would last through 2016. However many analysts doubt such optimistic forecasts considering weakness of China's economy.

-

08:46

France: CPI, y/y, July 0.2%

-

08:45

France: CPI, m/m, July -0.3%

-

08:42

Gold declined slightly

Gold slid to $1,122.10 (-0.13%). The World Gold Council said in its Gold Demand Trends report for Q2 2015 that global demand for the precious metal fell 12% to 915 mt with investment demand declining 11% to 179 mt amid prospects of an imminent rate increase in the U.S. Demand for bars and coins dropped 15%. The WGC expects a better result in the second half of 2015, with the third quarter traditionally the busiest period for gold buying in top consumers India and China. The report also suggests that low prices in Asia and the Middle East should boost physical demand. "Lower prices in markets across Asia and the Middle East often trigger purchases and interest has already been reported across a number of these," the report said.

-

08:28

Options levels on thursday, August 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1229 (4521)

$1.1206 (1579)

$1.1192 (1601)

Price at time of writing this review: $1.1135

Support levels (open interest**, contracts):

$1.1107 (1601)

$1.1088 (1557)

$1.1066 (2283)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 83636 contracts, with the maximum number of contracts with strike price $1,1300 (6370);

- Overall open interest on the PUT options with the expiration date September, 4 is 116147 contracts, with the maximum number of contracts with strike price $1,0500 (7881);

- The ratio of PUT/CALL was 1.39 versus 1.39 from the previous trading day according to data from August, 12

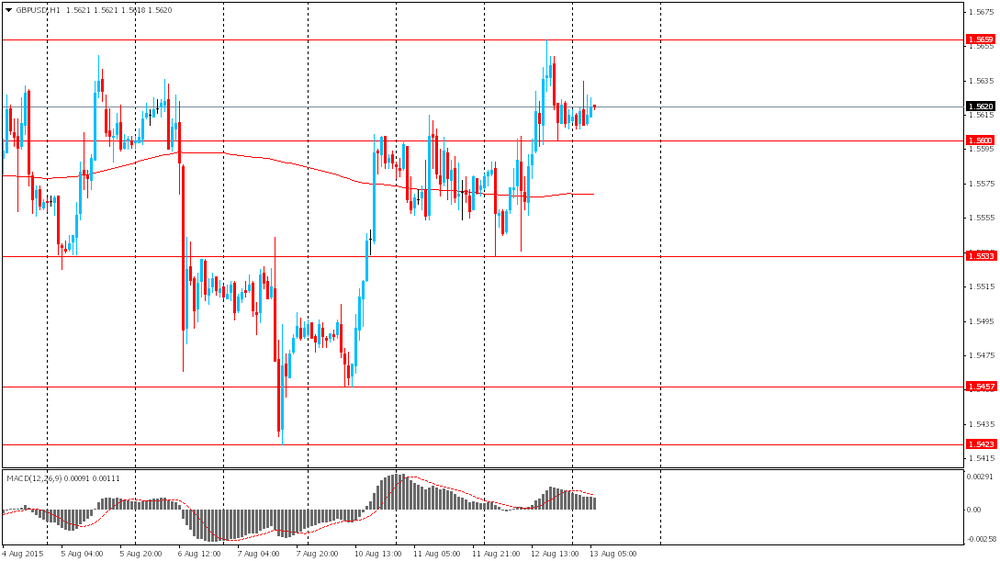

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (2038)

$1.5804 (1893)

$1.5707 (1917)

Price at time of writing this review: $1.5628

Support levels (open interest**, contracts):

$1.5590 (919)

$1.5494 (2130)

$1.5396 (1725)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 26877 contracts, with the maximum number of contracts with strike price $1,5600 (2812);

- Overall open interest on the PUT options with the expiration date September, 4 is 33190 contracts, with the maximum number of contracts with strike price $1,5450 (2369);

- The ratio of PUT/CALL was 1.23 versus 1.25 from the previous trading day according to data from August, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

Global Stocks: U.S. indices climbed slightly

Major U.S. stock indices rebounded from loses and managed to advance slightly on Wednesday. Markets were weighed by a weaker yuan, which intensified concerns over global economic growth. However the People's Bank of China said that the yuan was unlikely to keep on declining and expressed confidence that the exchange rate will stabilize as market participants get used to a new system of median points.

The Dow Jones Industrial Average declined 0.33 point to 17,402.51. The S&P 500 climbed 1.98 points, or 0.1%, to 2086.05.The Nasdaq Composite rose 7.6 points, or 0.2%, to 5044.39.

This morning in Asia Hong Kong Hang Seng rose 0.43%, or 103.36 points, to 24,019.38. China Shanghai Composite Index fell 0.47%, or 18.13 points, to 3,868.19. The Nikkei gained 0.98%, or 199.89 points, to 20,592.66.

Asian stocks outside China advanced. The People's Bank of China weakened the yuan 1.1% more after it had lowered it on Tuesday and Wednesday by 1.9% and 1.6% respectively. The PBOC said that it is able to maintain yuan's stability and pledged to open the country's currency markets for foreign investors.

Japanese stocks traded higher amid a weaker yen.

Stocks were also influenced by data from the Economic and Social Research Institute, which showed that Japan Core Machinery Orders fell by 7.9% m/m in June, while they were expected to decline only by 5.6%. This is the first decline in four months. It was generated by concerns over health of the global economy and falling commodity prices.

-

08:08

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Germany CPI, m/m (Finally) July -0.1% 0.2% 0.2%

06:00 Germany CPI, y/y (Finally) July 0.3% 0.2% 0.2%

The euro fluctuated only slightly against the U.S. dollar despite further 1.1% devaluation of the yuan. Markets calmed down and such actions are now considered a part of currency reforms in the country before Chinese president visits the U.S. in September. It's worth noting that the yuan trades with a significant discount in Hong Kong compared to mainland China reflecting investors' pessimism about China's economy.

The yen fell against the greenback amid core machinery orders data (-7.9% m/m in June vs -5.6% expected). A report on new orders reflects general volume of machinery orders placed in big Japanese companies. A negative reading suggests slower growth.

EUR/USD: the pair fluctuated around $1.1155 in Asian trade

USD/JPY: the pair rose to Y125.45

GBP/USD: the pair traded within $1.5605-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France CPI, m/m July -0.1%

06:45 France CPI, y/y July 0.3%

07:15 Switzerland Producer & Import Prices, m/m July -0.1%

07:15 Switzerland Producer & Import Prices, y/y July -6.1%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada New Housing Price Index, MoM June 0.2% 0.1%

12:30 U.S. Initial Jobless Claims August 270 270

12:30 U.S. Continuing Jobless Claims August 2255 2247

12:30 U.S. Retail sales July -0.3% 0.5%

12:30 U.S. Retail sales excluding auto August -0.1% 0.4%

14:00 U.S. Business inventories June 0.3% 0.3%

22:45 New Zealand Retail Sales YoY Quarter II 7.4% 5.2%

22:45 New Zealand Retail Sales, q/q Quarter II 2.7% 0.5%

-

08:00

Germany: CPI, m/m, July 0.2% (forecast 0.2%)

-

08:00

Germany: CPI, y/y , July 0.2% (forecast 0.2%)

-

04:03

Nikkei 225 20,436.39 +43.62 +0.21 %, Hang Seng 24,060.63 +144.61 +0.60 %, Shanghai Composite 3,869.91 -16.41 -0.42 %

-

01:53

Japan: Core Machinery Orders, y/y, June 16.6% (forecast 16.4%)

-

01:53

Japan: Core Machinery Orders, June -7.9% (forecast -5.6%)

-

01:02

Commodities. Daily history for Aug 12’2015:

(raw materials / closing price /% change)

Oil 43.31 +0.02%

Gold 1,125.00 +0.12%

-

01:01

Stocks. Daily history for Aug 12’2015:

(index / closing price / change items /% change)

Nikkei 225 20,392.77 -327.98 -1.58 %

Hang Seng 23,916.02 -582.19 -2.38 %

S&P/ASX 200 5,382.08 -91.15 -1.67 %

Shanghai Composite 3,887.3 -40.60 -1.03 %

FTSE 100 6,571.19 -93.35 -1.40 %

CAC 40 4,925.43 -173.60 -3.40 %

Xetra DAX 10,924.61 -369.04 -3.27 %

S&P 500 2,086.05 +1.98 +0.10 %

NASDAQ Composite 5,044.39 +7.60 +0.15 %

Dow Jones 17,402.51 -0.33 0.00%

-

00:58

Currencies. Daily history for Aug 12’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1157 +1,03%

GBP/USD $1,5615 +0,26%

USD/CHF Chf0,9751 -1,32%

USD/JPY Y124,19 -0,74%

EUR/JPY Y138,55 +0,30%

GBP/JPY Y193,91 -0,47%

AUD/USD $0,7381 +1,04%

NZD/USD $0,6615 +1,15%

USD/CAD C$1,2975 -1,06%

-

00:31

New Zealand: Business NZ PMI, July 53.5

-