Noticias del mercado

-

21:00

U.S.: Total Net TIC Flows, January 88.3

-

21:00

U.S.: Net Long-term TIC Flows , January -27.2 (forecast 27.2)

-

20:01

S&P 500 2,077.28 +23.88 +1.16 %, NASDAQ 4,925.8 +54.04 +1.11 %, Dow 17,974.8 +225.49 +1.27 %

-

18:00

European stocks closed: FTSE 100 6,803.28 +62.70 +0.93 %, CAC 40 5,064.1 +53.64 +1.07 %, DAX 12,162.94 +261.33 +2.20 %

-

18:00

European stocks close: stocks closed higher, supported by the European Central Bank’s quantitative easing

Stock indices closed higher, supported by the European Central Bank's quantitative easing. The European Central Bank has started to buy government bonds last Monday.

The European Central Bank President Mario Draghi is scheduled to speak at 18:45 GMT0.

Market participants are awaiting the Fed's monetary policy decision on Wednesday.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,804.08 +63.50 +0.94 %

DAX 12,167.72 +266.11 +2.24 %

CAC 40 5,061.16 +50.70 +1.01 %

-

17:31

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected U.S. economic data

The U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected U.S. economic data. The NAHB housing market index declined to 53 in March from 55 in February. It was the third consecutive decline. Analysts had expected the index to rise at 57.

The NAHB Chairman, Tom Woods, said that the NAHB expects the index to improve in the spring buying season.

The U.S. industrial production increased 0.1% in February, missing expectations for a 0.3% rise, after a 0.3% drop in January. January's figure was revised down from a 0.2% increase.

The increase was driven by higher output of utilities.

The NY Fed Empire State manufacturing index declined to 6.90 in March from 7.78 in February, missing expectations for a rise to 8.1. The decline was driven by a drop in new orders. The new orders index plunged to -2.39 in March from 1.22 in February. It was the lowest level since November 2013.

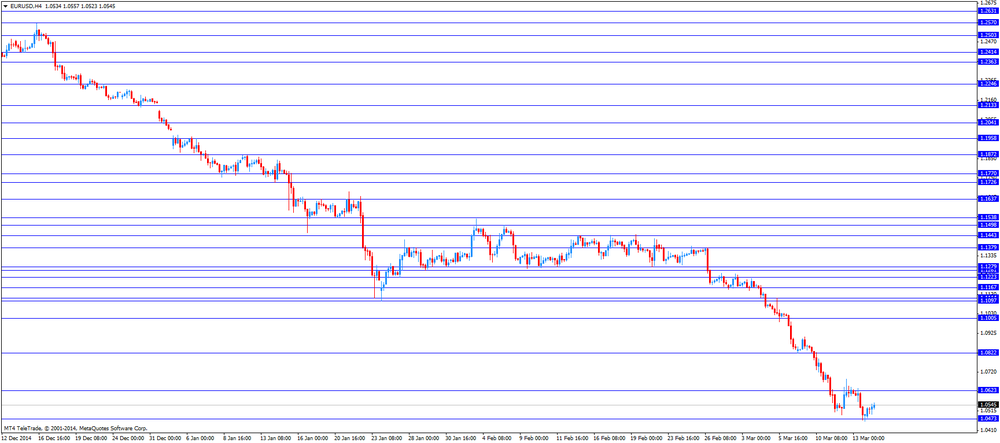

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro.

The European Central Bank President Mario Draghi is scheduled to speak at 18:45 GMT0.

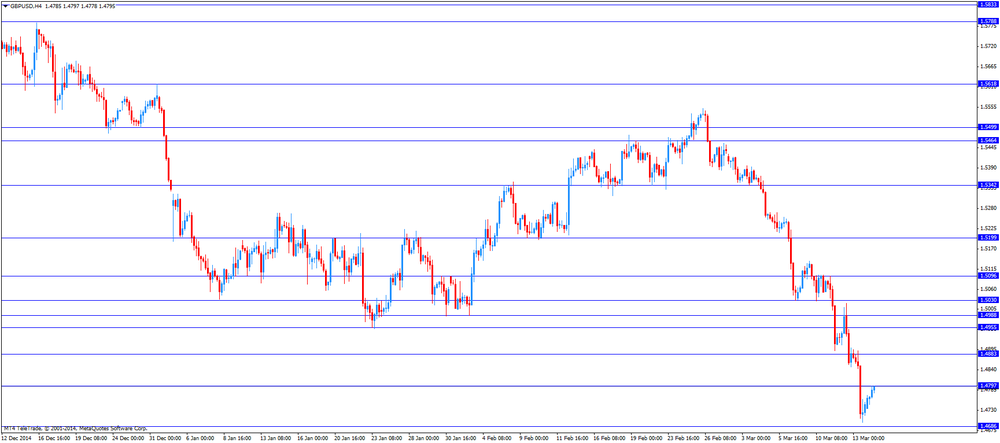

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Foreign securities purchases in Canada rose by C$5.73 billion in January, exceeding expectations for a gain by C$3.74 billion, after a drop by C$13.54 billion in December. December's figure was revised up from a decline by C$13.55 billion.

Canada's international transactions were driven by lower oil prices, stock prices and a lower Canadian dollar.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer and import prices declined 1.4% in February, missing expectations for a 0.4% increase, after a 0.6% fall in January. That was the biggest decline since November 2008.

On a yearly basis, producer and import prices decreased 3.6% in February, after a 2.7% drop in January. That was the lowest level since October 2009.

The decline was driven by lower oil prices and a stronger Swiss franc.

Retail sales in Switzerland decreased at an annual rate of 0.3% in January, missing expectations for a 2.6% rise, after a 1.9% rise in December. December's figure was revised down from a 2.2% increase.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback due to a weaker U.S. currency. There were released no major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after new motor vehicle sales data for Australia. Australia's new motor vehicle sales increased 2.9% in February, after a 1.9% drop in January. January's figure was revised down from a 1.5% decrease.

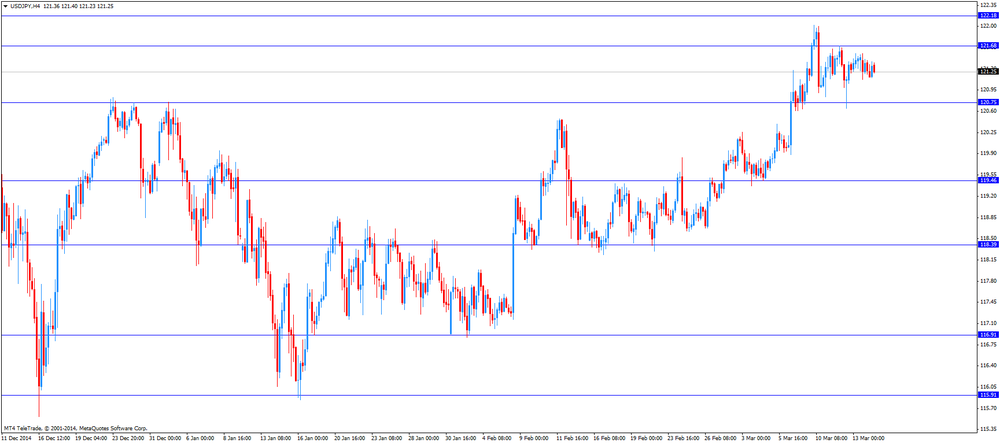

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any major economic reports from Japan.

-

17:03

Reserve Bank of Australia (RBA) assistant governor Guy Debelle: the Fed won’t delay its interest rate hike

The Reserve Bank of Australia (RBA) assistant governor Guy Debelle said that the inflation in the U.S. is low due to falling oil prices, and it is temporary. He added that the Fed won't delay its interest rate hike.

Mr Debelle also said that foreign investors are buying most Australian government bonds because of Australia's AAA credit rating.

-

15:57

NAHB housing market index declines to 53 in March

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index declined to 53 in March from 55 in February. It was the third consecutive decline.

Analysts had expected the index to rise at 57.

A level above 50.0 is considered positive, below indicates a negative outlook.

The NAHB Chairman, Tom Woods, said that the NAHB expects the index to improve in the spring buying season.

The NAHB Chief Economist, David Crowe noted that "the drop in builder confidence is largely attributable to supply chain issues, such as lot and labor shortages as well as tight underwriting standards".

-

15:17

U.S. industrial production rises 0.1% in February

The Federal Reserve released its industrial production report on Monday. The U.S. industrial production increased 0.1% in February, missing expectations for a 0.3% rise, after a 0.3% drop in January. January's figure was revised down from a 0.2% increase.

The increase was driven by higher output of utilities. Utility output climbed by 7.3% in February.

Mining output dropped by 2.5% in February.

The U.S. manufacturing production decreased 0.2% in February, after a revised 0.3% fall in January.

Capacity utilisation rate fell to 78.9% in February from 79.1% in January. Analysts had expected a capacity utilisation rate of 79.5%.

The Fed tend to use capacity utilisation as a signal of how much "slack" remains in the economy.

These figures are pointing to a slower economic growth in the U.S. in the first quarter.

-

15:00

U.S.: NAHB Housing Market Index, March 53 (forecast 57)

-

14:53

Foreign securities purchases in Canada climb by C$5.73 billion in January

Statistics Canada released foreign investment figures on Monday. Foreign securities purchases in Canada rose by C$5.73 billion in January, exceeding expectations for a gain by C$3.74 billion, after a drop by C$13.54 billion in December.

December's figure was revised up from a decline by C$13.55 billion.

Canadian investors sold C$10.8 billion of foreign securities in January, after buying C$13.89 billion in December.

Canada's international transactions were driven by lower oil prices, stock prices and a lower Canadian dollar.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.50 (USD 936m) 121.50 (USD 485m)

EUR/USD 1.0500 (EUR 890m) 1.0575 (EUR 370m) 1.0600 (EUR 1.2bln) 1.0650 (EUR 462m)

USD/CHF 1.0000 (USD 1bln)

USD/CAD 1.2800 (USD 215m) 1.2850 (USD 220m)

NZD/USD 0.7410 (NZD 323m) 0.7480 (NZD 389m)

AUD/JPY 93.00 (AUD 246m)

-

14:35

U.S. Stocks open: Dow +0.44%, Nasdaq +0.37%, S&P +0.39%

-

14:28

Before the bell: S&P futures +0.55%, NASDAQ futures +0.49%

U.S. stock-index futures rose. Investor aweited Federal Reserve meeting.

Global markets:

Nikkei 19,246.06 -8.19 -0.04%

Hang Seng 23,949.55 +126.34 +0.53%

Shanghai Composite 3,448.49 +75.58 +2.24%

FTSE 6,767.29 +26.71 +0.40%

CAC 5,042.98 +32.52 +0.65%

DAX 12,070.16 +168.55 +1.42%

Crude oil $44.15 (-1.54%)

Gold $1153.30 (+0.09%)

-

14:27

NY Fed Empire State manufacturing index declines to 6.90 in March

The New York Federal Reserve released its survey on Monday. The NY Fed Empire State manufacturing index declined to 6.90 in March from 7.78 in February, missing expectations for a rise to 8.1.

The decline was driven by a drop in new orders. The new orders index plunged to -2.39 in March from 1.22 in February. It was the lowest level since November 2013.

"Business activity continued to expand at a modest pace for New York manufacturers," the report said.

The price-paid index declined to 12.37 in March from 14.61 in February.

The index for the number of employees rose to 18.56 in March from 10.11 last month. It was the highest level since May 2014.

The general business conditions expectations index for the next six months climbed to 30.72 in March from 25.58 in February.

-

14:15

U.S.: Industrial Production (MoM), February +0.1% (forecast +0.3%)

-

14:01

Foreign exchange market. European session: the Canadian dollar traded lower against the U.S. dollar despite the better-than-expected foreign securities purchases from Canada

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) March +2.1% +1.0%

00:01 United Kingdom Rightmove House Price Index (YoY) March +6.6% +5,4%

00:30 Australia New Motor Vehicle Sales (MoM) February -1.9% Revised From -1.5% +2.9%

00:30 Australia New Motor Vehicle Sales (YoY) February +0.2% +4.1%

08:15 Switzerland Producer & Import Prices, m/m February -0.6% +0.4% -1.4%

08:15 Switzerland Producer & Import Prices, y/y February -2.7% -3.6%

08:15 Switzerland Retail Sales (MoM) January +1.0% -2.1%

08:15 Switzerland Retail Sales Y/Y January +1.9% +2.6% -0.3%

11:00 Germany Bundesbank Monthly Report

12:30 Canada Foreign Securities Purchases January -13.54 Revised From -13.55 3.74 5.73

12:30 U.S. NY Fed Empire State manufacturing index March 7.8 8.1 6.9

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. industrial production is expected to rise 0.3% in February, after a 0.2% gain in January.

The NAHB housing market index is expected to climb to 57 in March from 55 in February.

The NY Fed Empire State manufacturing index declined to 6.90 in March from 7.78 in February, missing expectations for a rise to 8.1.

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro.

The European Central Bank President Mario Draghi is scheduled to speak at 18:45 GMT0.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar despite the better-than-expected foreign securities purchases from Canada. Foreign securities purchases in Canada rose by C$5.73 billion in January, exceeding expectations for a gain by C$3.74 billion, after a drop by C$13.54 billion in December. December's figure was revised up from a decline by C$13.55 billion.

The Swiss franc traded mixed against the U.S. dollar after the weaker-than-expected data from Switzerland. Switzerland's producer and import prices declined 1.4% in February, missing expectations for a 0.4% increase, after a 0.6% fall in January. That was the biggest decline since November 2008.

On a yearly basis, producer and import prices decreased 3.6% in February, after a 2.7% drop in January. That was the lowest level since October 2009.

The decline was driven by lower oil prices and a stronger Swiss franc.

Retail sales in Switzerland decreased at an annual rate of 0.3% in January, missing expectations for a 2.6% rise, after a 1.9% rise in December. December's figure was revised down from a 2.2% increase.

EUR/USD: the currency pair rose to $1.0557

GBP/USD: the currency pair increased to $1.4797

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:15 U.S. Industrial Production (MoM) February +0.2% +0.3%

13:15 U.S. Industrial Production YoY February +4.8%

14:00 U.S. NAHB Housing Market Index March 55 57

18:45 Eurozone ECB President Mario Draghi Speaks

20:00 U.S. Net Long-term TIC Flows January 35.4 27.2

-

14:00

Orders

EUR/USD

Offers 1.0625 1.0640 1.0665 1.0680 1.0700 1.0720 1.0735 1.0750

Bids 1.0460 1.0400 1.0300

GBP/USD

Offers 1.4900 1.4925 1.4940-50 1.4985 1.5000 1.5030-35 1.5060 1.5080 1.5100

Bids 1.4695 1.4645 1.4600 1.4500

EUR/JPY

Offers 129.05 129.60 129.80 130.00 130.20

Bids 126.85 126.55 126.00 124.95

USD/JPY

Offers 121.60 121.80 122.00-10 122.35 122.50 122.80 123.00

Bids 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7170 0.7185 0.7200 0.7220-25 0.7245-50

Bids 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7700-10 0.7725 0.7740 0.7760

Bids 0.7610 0.7600 0.7585 0.7565 0.7550

-

13:37

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Walt Disney (DIS) downgraded to Neutral from Buy at BTIG Research

DuPont (DD) downgraded to Underperform from Buy at BofA/Merrill

Other:

-

13:30

U.S.: NY Fed Empire State manufacturing index , March 6.9 (forecast 8.1)

-

13:30

Canada: Foreign Securities Purchases, January 5.73 (forecast 3.74)

-

13:29

Switzerland's producer and import prices drops 1.4% in February, the biggest decline since November 2008

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices declined 1.4% in February, missing expectations for a 0.4% increase, after a 0.6% fall in January. That was the biggest decline since November 2008.

On a yearly basis, producer and import prices decreased 3.6% in February, after a 2.7% drop in January. That was the lowest level since October 2009.

The decline was driven by lower oil prices and a stronger Swiss franc.

-

13:00

European stock markets mid-session: DAX extends all-time high - above 12,000 points

European stocks trade higher on Monday despite Friday's losses on Wall Street with the German DAX trading again at new all-time highs - breaching the 12,000 points mark. The weaker euro, slightly rebounding from new 12-year lows set on Friday, is supporting export-heavy sectors and investors speculate on higher earnings. Worries over Greece continue to weigh but equities remain supported by the ECB's quantitative easing program started on Monday last week. The ECB is buying bonds worth 60 billion euros a month. Today's speech of ECB President Mario Draghi scheduled for 18:45 will be in the focus.

The commodity heavy FTSE 100 index is currently trading +0.52% quoted at 6,775.41, boosted by gains in the mining sector. Germany's DAX 30 added +1.12% trading at 12,034.34 setting a new all-time high at 12,054.30 points with Siemens being among the top performers on news of a deal in Egypt. France's CAC 40 is currently trading at 5,048.11 points, +0.75%.

-

12:20

Oil: WTI rebounds from freshly set 6-year low

Oil is trading lower. Brent Crude lost -0.97%, currently trading at USD54.14 a barrel - rebounding from an early selloff. West Texas Intermediate declined -0.76% currently quoted at USD44.50 after reaching a new 6-year low in today's trading on speculations that U.S. storage capacities might reach its maximum. Oil declined for a fourth consecutive week on Friday after government data showed U.S. output and stockpiles rose to the highest levels in more 30 years.

The IEA warned in its latest monthly oil report that the recovery in prices is fragile and that U.S. production might rebound despite a lower rig-count - further worsening the global supply glut. Today the OPEC will release its monthly report.

Oil prices declined by almost 60% between June 2014 and January 2015 and recovered by almost 35% in 2015 before declining again. Although prices rebounded after setting new lows, worldwide supply still exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

12:00

Gold trades lower ahead of U.S. rate decision

Gold is trading lower today after Friday's rebound from recent 3-month lows set on Wednesday last week. A broadly weaker greenback lends some support to bullion today. All eyes are now on the FED's upcoming two-day monetary policy meeting and the rate decision on Wednesday to see if the word "patient" will be dropped and if the U.S. economy has gained enough momentum. Investors hope that the minutes will provide further insight into when the Central Bank is going to hike rates that have been near zero since 2008. The U.S. Commodity Futures Trading Commission reported on Friday that bullish positions on bullion were reduced for the sixth straight week. Physical demand was higher due to low prices but not in sufficient numbers to support the price.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as gold is dollar-denominated and not yield-bearing.

Gold is currently quoted at USD1,156.60, -0,21% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Wednesday last week gold traded as low as USD1,147.30.

-

11:11

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.50 (USD 936m) 121.50 (USD 485m)

EUR/USD 1.0500 (EUR 890m) 1.0575 (EUR 370m) 1.0600 (EUR 1.2bln) 1.0650 (EUR 462m)

USD/CHF 1.0000 (USD 1bln)

USD/CAD 1.2800 (USD 215m) 1.2850 (USD 220m)

NZD/USD 0.7410 (NZD 323m) 0.7480 (NZD 389m)

AUD/JPY 93.00 (AUD 246m)

-

10:20

Press Review: Swiss Count Cost of Franc Tsunami Damage as Market Tide Recedes

BLOOMBERG

Swiss Count Cost of Franc Tsunami Damage as Market Tide Recedes

(Bloomberg) -- Thomas Jordan is about to reveal the damage from Switzerland's biggest single-day currency shock this century.

Two months after the Swiss National Bank abolished its cap on the franc, its officials are preparing their first economic forecasts to assess the impact of that move. President Jordan will give that outlook on March 19 at a policy assessment at which economists predict the central bank will keep its negative deposit rate at a record low.

"The strong appreciation of the franc after the cap was given up should significantly hit the Swiss economy," said Martin Gueth, economist at LBBW in Stuttgart, Germany. "We expect the SNB to remain in a wait-and-see mode, but should the franc appreciate, it will wage fresh currency interventions or even cut rates again."

The decision on Thursday gives the three-member SNB board an opportunity to jointly address the public after the denouement of the franc ceiling of 1.20 per euro on Jan. 15, a shock described as a "tsunami" by Swatch Group AG Chief Executive Officer Nicolas Hayek. SNB policy makers will hold a press conference in Zurich, breaking normal practice that would dictate waiting until June for the next such encounter.

BLOOMBERG

Oil Slumps to Six-Year Low as U.S. Production Seen Filling Tanks

(Bloomberg) -- Oil extended its collapse to the lowest intraday price since March 2009 on speculation that record U.S. supply may start to strain the country's storage capacity.

Crude tanks in the U.S. may fill up as drilling-rig cuts fail to slow production this year, the International Energy Agency predicted. Speculators have cut bullish bets on oil to the lowest level in more than two years while short wagers rise to a record, U.S. Commodity Futures Trading Commission data show. Futures lost as much as 2.8 percent to $43.57 a barrel in New York on Monday, falling a fifth day.

Oil slumped for a fourth week on Friday after government data showed U.S. output and stockpiles expanded to the highest levels in more than three decades, exacerbating a glut that drove prices almost 50 percent lower last year. The market hasn't bottomed yet because of the surplus, former Federal Reserve Chairman Alan Greenspan said on Bloomberg Television.

REUTERS

Greek PM Tsipras says there is no going back to austerity(Reuters) - Greece will not accept any return to austerity, leftist Prime Minister Alexis Tsipras said on Monday, adding that he was convinced he would strike a deal with international partners to keep finances afloat.

"The key for an honorable compromise (with the EU/IMF creditors) is to recognize that the previous policy of extreme austerity has failed, not only in Greece, but in the whole of Europe," Tsipras told daily Ethnos in an interview.

Greece's left-wing government won elections in January on a pledge to roll back budget rigor and renegotiate the terms of a 240 billion euro bailout. But it has faced resistance fromeuro zone partners who are unwilling to offer major compromises.

Source: http://www.reuters.com/article/2015/03/16/us-eurozone-greece-tsipras-idUSKBN0MC0MO20150316

-

10:00

European stock markets First hour: Indices continue rally on QE

European stocks open higher on Monday despite Friday's losses on Wall Street with the German DAX and the Fremch CAC40 extending its all-time highs. The weaker euro, slightly rebounding from new 12-year lows set on Friday, is supporting export-heavy sectors. Worries over Greece continue to weigh but equities remain supported by the ECB's quantitative easing program started on Monday last week. The ECB is buying bonds worth 60 billion euros a month. Today's speech of ECB President Mario Draghi scheduled for 18:45 will be in the focus.

The commodity heavy FTSE 100 index is currently trading +0.33% quoted at 6,763.02 as mining stocks add gains. Germany's DAX 30 gained +0.74% trading at 11,989.38 points, close to the next psychologically important mark 0f 12,000 points. France's CAC 40 is currently trading at 5,033.44 points, +0.46%.

-

09:15

Switzerland: Retail Sales Y/Y, January -0.3% (forecast +2.6%)

-

09:15

Switzerland: Producer & Import Prices, m/m, February -1.4% (forecast +0.4%)

-

09:15

Switzerland: Producer & Import Prices, y/y, February -3.6%

-

09:00

Global Stocks: Wall Street continues to decline, Chinese indexes boosted by comments on possible stimulus

U.S. stocks continued to decline on Friday on weaker-than-expected U.S. data and a broadly stronger U.S.dollar. The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped and U.S. producer prices fell 0.5% in February. All eyes will be on the FED's interest rate decision and the following statement this week on Wednesday. Investors hope that the minutes will provide further insight into when the Central Bank is going to hike rates. The S&P 500 closed -0.61% with a final quote of 2,053.40 points. The DOW JONES index lost -0.82% closing at 17,749.31 points.

Chinese stocks continued to add gains on Monday on comments of Prime Minister Li Keqiang who said that there is a broad scope of measures left to boost economy if needed as the country had avoided to use short term stimulus in recent years. Hong Kong's Hang Seng is trading higher +0.47% at 23,935.23 points. China's Shanghai Composite closed at 3,448.49 points skyrocketing +2.24%.

The Nikkei could not add gains at the closing on Monday and retreated slightly from its new 15-year high set intraday on profit taking after the recent rally. The index closed -0.04% with a final quote of 19,246.06 points.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly lower against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom Rightmove House Price Index (MoM) March +2.1% +1.0%

00:01 United Kingdom Rightmove House Price Index (YoY) March +6.6% +5.4%

00:30 Australia New Motor Vehicle Sales (MoM) February -1.5% +2.9%

00:30 Australia New Motor Vehicle Sales (YoY) February +0.2% +4.1%

The U.S. dollar traded higher against its major peers on Monday after the weaker-than expected economic data reported on Friday. The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped and U.S. producer prices fell 0.5% in February. All eyes will be on the FED's interest rate decision and the following statement this week on Wednesday.

The euro moderately rebounded from 12-year lows on Monday. Quantitative Easing and concerns over Greece continue to weigh on the single currency.

The Australian dollar traded higher against the greenback at the start of the week. On a monthly basis New Motor Vehicle Sales rose +2.9% in February after revised -1.9% in January. Year on year sales rose +4.1%, compared to +0.2% last year. On Sunday Reserve Bank of Australia Assistant Governor Guy Debelle said that government bond yields are unusually low. Inflation and economic growth were no explanation for negative yields in e.g. Germany or Japan although quantitative easing have contributed to the situation.

New Zealand's dollar added gains against the greenback on Monday in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the greenback on Monday currently trading at USD121.18, further gaining ground from 8-year lows at USD122.20 set on Tuesday last week. No major economic data for the region was reported.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling added gains against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Producer & Import Prices, m/m February -0.6% +0.4%

08:15 Switzerland Producer & Import Prices, y/y February -2.7%

08:15 Switzerland Retail Sales (MoM) January +1.0%

08:15 Switzerland Retail Sales Y/Y January +2.2% +2.6%

11:00 Germany Bundesbank Monthly Report

12:30 Canada Foreign Securities Purchases January -13.55 3.74

12:30 U.S. NY Fed Empire State manufacturing index February 7.8 8.1

13:15 U.S. Industrial Production (MoM) February +0.2% +0.3%

13:15 U.S. Industrial Production YoY February +4.8%

14:00 U.S. NAHB Housing Market Index March 55 57

18:45 Eurozone ECB President Mario Draghi Speaks

20:00 U.S. Total Net TIC Flows January -174.8

20:00 U.S. Net Long-term TIC Flows January 35.4 27.2

-

07:58

Options levels on monday, March 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0717 (1311)

$1.0654 (240)

$1.0604 (172)

Price at time of writing this review: $1.0531

Support levels (open interest**, contracts):

$1.0431 (2325)

$1.0400 (6267)

$1.0356 (4402)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 58438 contracts, with the maximum number of contracts with strike price $1,1200 (3465);

- Overall open interest on the PUT options with the expiration date April, 2 is 64015 contracts, with the maximum number of contracts with strike price $1,0600 (6267);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from March, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5005 (1266)

$1.4908 (1068)

$1.4811 (165)

Price at time of writing this review: $1.4773

Support levels (open interest**, contracts):

$1.4685 (1191)

$1.4589 (1489)

$1.4492 (422)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 23925 contracts, with the maximum number of contracts with strike price $1,5100 (1735);

- Overall open interest on the PUT options with the expiration date April, 2 is 26123 contracts, with the maximum number of contracts with strike price $1,5050 (2391);

- The ratio of PUT/CALL was 1.09 versus 1.13 from the previous trading day according to data from March, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:29

Nikkei 225 19,304.22 +49.97 +0.26 %, Hang Seng 23,853.65 +30.44 +0.13 %, Shanghai Composite 3,396.26 +23.35 +0.69 %

-

01:32

Australia: New Motor Vehicle Sales (YoY) , February +4.1%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , February +2.9%

-

01:03

United Kingdom: Rightmove House Price Index (YoY), March +5,4%

-

01:01

United Kingdom: Rightmove House Price Index (MoM), March +1.0%

-

00:31

Commodities. Daily history for Mar 13’2015:

(raw materials / closing price /% change)

Oil 44.84 -4.70%

Gold 1,156.10 +0.32%

-

00:31

Stocks. Daily history for Mar 13’2015:

(index / closing price / change items /% change)

Nikkei 225 19,254.25 +263.14 +1.39 %

Hang Seng 23,823.21 +25.25 +0.11 %

Shanghai Composite 3,373.79 +24.46 +0.73 %

FTSE 100 6,740.58 -20.49 -0.30 %

CAC 40 5,010.46 +23.13 +0.46 %

Xetra DAX 11,901.61 +102.22 +0.87 %

S&P 500 2,053.4 -12.55 -0.61 %

NASDAQ Composite 4,871.76 -21.53 -0.44 %

Dow Jones 17,749.31 -145.91 -0.82 %

-

00:30

Currencies. Daily history for Mar 13’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0461 -1,56%

GBP/USD $1,4742 -0,96%

USD/CHF Chf1,006 +0,32%

USD/JPY Y121,39 +0,08%

EUR/JPY Y127,42 -1,13%

GBP/JPY Y178,97 -0,87%

AUD/USD $0,7635 -0,86%

NZD/USD $0,7336 -0,67%

USD/CAD C$1,2783 +0,73%

-