Noticias del mercado

-

21:00

Dow -0.11% 17,196.60 -19.37 Nasdaq +0.15% 4,894.09 +7.40 S&P -0.21% 2,028.91 -4.20

-

18:26

WSE: Session Results

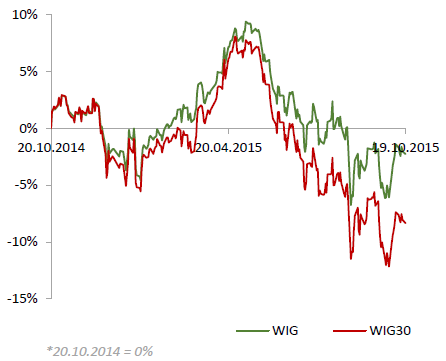

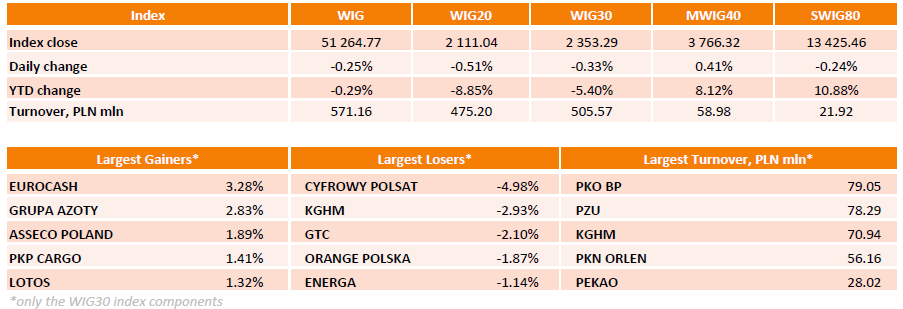

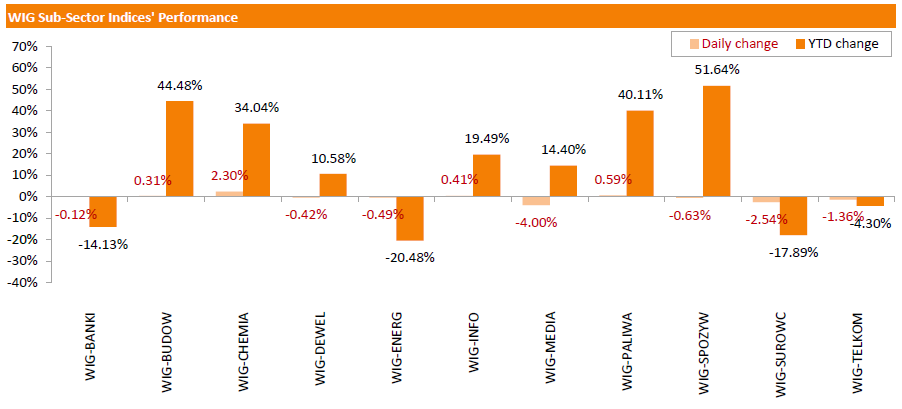

Polish equities declined on Monday. The broad market benchmark, the WIG Index, lost 0.25%. Sector-wise, media sector (-4%) fared the worst, while chemicals (+2.30%) outperformed.

The large-cap stocks plunged by 0.33%, as measured by the WIG30 Index. In the WIG30 index basket, CYFROWY POLSAT (WSE: CPS) and ORANGE POLSKA (WSE: OPL) suffered losses of 4.98% and 1.87% respectively on concerns that today's acquisitions of new broadband frequencies may impact the companies' financial situation. KGHM (WSE: KGH) dropped by 2.93% on tumbling copper prices. Elsewhere, GTC (WSE: GTC) slumped by 2.10%. On the other side of the ledger, EUROCASH (WSE: EUR) was the session's biggest advancer, jumping by 3.28%. It was followed by GRUPAAZOTY (WSE: ATT) and ASSECO POLAND (WSE: ACP), surging by 2.83% and 1.89% respectively.

-

18:00

European stocks closed: FTSE 100 6,352.33 -25.71 -0.40% CAC 40 4,704.07 +1.28 +0.03% DAX 10,164.31 +59.88 +0.59%

-

18:00

European stocks close: stocks closed mixed on the Chinese economic data

Stock indices closed mixed on the Chinese economic data. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

The growth missed the official target of 7%.

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview with the Polish newspaper Rzeczpospolita on Monday that additional measures, including structural reforms and fiscal policy changes, are needed to boost the economic growth in the Eurozone.

In an interview with Polish daily Puls Biznesu, Nowotny said on Monday that it is too early to talk about the adjustments of the central bank's asset-buying programme.

Meanwhile, the economic data from the Eurozone was negative. The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,352.33 -25.71 -0.40 %

DAX 10,164.31 +59.88 +0.59 %

CAC 40 4,704.07 +1.28 +0.03 %

-

17:44

Oil prices fall on concerns over the global oil oversupply and the slowdown in the Chinese economy

Oil prices traded lower on concerns over the global oil oversupply and the slowdown in the Chinese economy. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

China's industrial production increased 5.7% on year in September, missing expectations for a 6.0% rise, down from a 6.1% gain in August.

Comments by Iran's Oil Minister Bijan Zanganeh added to concerns over the global oil oversupply. He said on Monday that Iran would raise its oil production by 500,000 barrels a day after the nuclear deal is implemented.

Zanganeh also said that he does not expect the Organization of Petroleum Exporting Countries (OPEC) to cut its oil production at its next meeting on December 04. Iran's oil minister noted that the OPEC should lower its oil output to boost prices to a range of $70 to $80 a barrel.

Saudi Arabia's commercial crude oil inventories climbed to 326.6 million barrels in August from 320.2 million barrels in July, according to the Joint Organisations Data Initiative (JODI) data. It was the highest level since 2002.

According to the JODI data, Saudi Arabia' oil production fell to 10.27 million barrels a day in August from 10.36 million in July. Saudi Arabia said that its oil production totalled 10.23 million barrels a day in September.

Meanwhile, the number of the U.S. rigs declined again. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 595 last week. It was the seventh consecutive decrease and the lowest level since the week ending July 23, 2010.

WTI crude oil for November delivery declined to $46.65 a barrel on the New York Mercantile Exchange.

Brent crude oil for November decreased to $48.90 a barrel on ICE Futures Europe.

-

17:26

Gold price declines on a stronger U.S. dollar and on the uncertainty over the Fed’s interest rate hike

Gold price declined on a stronger U.S. dollar and on the uncertainty over the Fed's interest rate hike. The Italian newspaper CorrierEconomia reported on Monday that New York Fed President William Dudley said last Thursday that it is too early for an interest rate hike by the Fed as the global economic growth is weak.

"It's true we thought we could raise interest rates by the end of 2015, but turbulence on financial markets, modest global growth, energy prices and macro-prudential imbalances are slowing this process down," he said.

The Chinese economic data also weighed on gold price. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

China's industrial production increased 5.7% on year in September, missing expectations for a 6.0% rise, down from a 6.1% gain in August.

Fixed-asset investment in China climbed 10.3% year-on-year in the January-September period, after a 10.9% rise in the January-August period. Analysts had expected a 10.8% increase.

Retail sales in China increased 10.9% year-on-year in September, exceeding expectations for a 10.8% gain, after a 10.8% rise in August.

December futures for gold on the COMEX today fell to 1170.80 dollars per ounce.

-

17:21

The FOMC member Lacker has canceled his speech today

-

17:05

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes lower on Monday as Wall Street bank Morgan Stanley's weak quarterly results stoked investor concerns about U.S. corporate health. Wall Street bank Morgan Stanley (MS.N) reported a quarterly profit that fell far short of market expectations, capping a generally downbeat quarter for big U.S. banks after investors fled the bond, currency and commodity markets. Morgan Stanley's profit slumped for the second straight quarter, as uncertainty about the timing of a U.S. interest rate hike and concerns about China's cooling economy sent shudders through global markets.

Most of Dow stocks in negative area (19 of 30). Top looser - Chevron Corporation (CVX, -1.67%). Top gainer - NIKE, Inc. (NKE, +1.47%).

Most of S&P index sectors in positive area. Top looser - Basic Materials (-1.6%). Top gainer - Services (+0,2%).

At the moment:

Dow 17084.00 -31.00 -0.18%

S&P 500 2021.00 -4.50 -0.22%

Nasdaq 100 4434.50 -0.25 -0.01%

10 Year yield 2,04% +0,02

Oil 46.68 -1.04 -2.18%

Gold 1170.10 -13.00 -1.10%

-

16:54

European Central Bank purchases €12.04 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.04 billion of government and agency bonds under its quantitative-easing program last week.

The ECB said in its minutes of September meeting that it will raise the pace of its asset purchases from September to November 2015 "to prepare for the expected decline in market liquidity in December".

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.47 billion of covered bonds, and €1.07 billion of asset-backed securities.

-

16:27

New York Fed President William Dudley: it is too early for an interest rate hike by the Fed as the global economic growth is weak

The Italian newspaper CorrierEconomia reported on Monday that New York Fed President William Dudley said last Thursday that it is too early for an interest rate hike by the Fed as the global economic growth is weak.

"It's true we thought we could raise interest rates by the end of 2015, but turbulence on financial markets, modest global growth, energy prices and macro-prudential imbalances are slowing this process down," he said.

-

16:14

NAHB housing market index climbs to 64 on October

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index rose to 64 in October from 61 in September, exceeding expectations for an increase to 62. It was the highest level since 2005.

September's figure was revised down from 62.

A level above 50.0 is considered positive, below indicates a negative outlook.

The increase was driven by a rise in two of three components of the index. The buyer traffic subindex remained unchanged at 47 in October, the current sales conditions subindex rose to 70 from 67, while the subindex measuring sales expectations in the next six months climbed to 75 from 68.

"The fact that builder confidence has held in the 60s since June is proof that the single-family housing market is making lasting gains as more serious buyers come forward," the NAHB Chairman Tom Woods said.

"With firm job creation, economic growth and the release of pent-up demand, we expect housing to keep moving forward as we start to close out 2015," the NAHB Chief Economist David Crowe said.

-

16:00

U.S.: NAHB Housing Market Index, October 64 (forecast 62)

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.50 (USD 640m) 118.65-75 (560m) 120.00 (1.2bln)

EUR/USD 1.1300 (EUR 579m) 1.1400 (1bln) 1.1425 (543m) 1.1500 (1bln)

USD/CHF 0.9675 (USD 223m)

USD/CAD 1.2775 (USD 538m) 1.3000 (300m)

AUD/USD 0.7200 (AUD 437m) 0.7300 (301m) 0.7400 (683m)

NZD/USD 0.6850 (NZD 220m)

-

15:33

U.S. Stocks open: Dow -0.32%, Nasdaq -0.22%, S&P -0.35%

-

15:19

Before the bell: S&P futures -0.41%, NASDAQ futures -0.42%

U.S. stock-index futures fell, as Morgan Stanley's Q3 results disappointed investors.

Global Stocks:

Nikkei 18,131.23 -160.57 -0.88%

Hang Seng 23,075.61 +8.24 +0.04%

Shanghai Composite 3,387.46 -3.89 -0.11%

FTSE 6,343.68 -34.36 -0.54%

CAC 4,688.67 -14.12 -0.30%

DAX 10,128.51 +24.08 +0.24%

Crude oil $46.51 (-1.59%)

Gold $1175.20 (-0.67%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

131.62

0.88%

6.8K

Twitter, Inc., NYSE

TWTR

31.24

0.29%

154.1K

Boeing Co

BA

137.99

0.28%

290.4K

E. I. du Pont de Nemours and Co

DD

57.38

0.19%

0.3K

Amazon.com Inc., NASDAQ

AMZN

571.00

0.04%

8.1K

Johnson & Johnson

JNJ

98.26

0.02%

0.1K

Microsoft Corp

MSFT

47.51

0.00%

15.3K

Procter & Gamble Co

PG

74.90

0.00%

2.6K

United Technologies Corp

UTX

93.00

0.00%

4.2K

Home Depot Inc

HD

122.71

-0.02%

0.1K

Apple Inc.

AAPL

110.98

-0.05%

89.1K

Starbucks Corporation, NASDAQ

SBUX

59.90

-0.05%

0.1K

Pfizer Inc

PFE

34.39

-0.06%

2.2K

Caterpillar Inc

CAT

69.59

-0.13%

0.5K

AT&T Inc

T

33.78

-0.15%

1.3K

Cisco Systems Inc

CSCO

28.20

-0.18%

0.2K

ALTRIA GROUP INC.

MO

58.61

-0.19%

7.6K

McDonald's Corp

MCD

104.61

-0.20%

0.8K

American Express Co

AXP

77.05

-0.21%

0.2K

Walt Disney Co

DIS

108.00

-0.22%

9.4K

Yahoo! Inc., NASDAQ

YHOO

33.29

-0.24%

0.3K

International Business Machines Co...

IBM

150.00

-0.26%

0.8K

Visa

V

75.79

-0.28%

0.8K

AMERICAN INTERNATIONAL GROUP

AIG

59.80

-0.33%

0.4K

The Coca-Cola Co

KO

41.87

-0.36%

1.6M

Verizon Communications Inc

VZ

44.51

-0.43%

2.9K

General Motors Company, NYSE

GM

33.00

-0.45%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

225.99

-0.45%

8.2K

Citigroup Inc., NYSE

C

52.45

-0.46%

17.0K

General Electric Co

GE

28.84

-0.48%

69.5K

Wal-Mart Stores Inc

WMT

58.60

-0.49%

13.3K

Barrick Gold Corporation, NYSE

ABX

7.81

-0.51%

7.3K

Facebook, Inc.

FB

97.04

-0.51%

26.6K

JPMorgan Chase and Co

JPM

62.10

-0.53%

3.7K

Exxon Mobil Corp

XOM

82.03

-0.55%

5.2K

Intel Corp

INTC

32.85

-0.58%

12.9K

ALCOA INC.

AA

9.49

-0.63%

3.8K

Goldman Sachs

GS

183.68

-0.81%

0.6K

Ford Motor Co.

F

15.12

-1.05%

0.2K

Chevron Corp

CVX

90.21

-1.18%

835.4K

Yandex N.V., NASDAQ

YNDX

13.31

-2.13%

3.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.15

-2.33%

14.9K

-

14:50

Upgrades and downgrades before the market open

Upgrades:

NIKE (NKE) upgraded to Buy at BB&T Capital Mkts

Downgrades:

Other:

Yahoo! (YHOO) target raised to $45 at Axiom Capital

General Electric (GE) target raised to $32 at RBC Capital Mkts

General Electric (GE) target raised to $32 at Stifel

McDonald's (MCD) added to US and Global Focus List at Credit Suisse

-

14:49

Iran’s Oil Minister Bijan Zanganeh does not expect the OPEC to cut its oil production at its next meeting

Iran's Oil Minister Bijan Zanganeh said on Monday that he does not expect the Organization of Petroleum Exporting Countries (OPEC) to cut its oil production at its next meeting on December 04. He noted that the OPEC should lower its oil output to boost prices to a range of $70 to $80 a barrel.

Zanganeh pointed out that Iran would raise its oil production by 500,000 barrels a day after the nuclear deal is implemented.

-

14:41

Bundesbank board member Joachim Nagel: only a significant slowdown in the Chinese economy would a have a negative effect on the German economic growth

Bundesbank board member Joachim Nagel said on Monday that only a significant slowdown in the Chinese economy would a have a negative effect on the German economic growth, adding that such a slowdown "is not to be expected at present".

Nagel noted that the Chinese economy is undergoing a transformation.

-

14:20

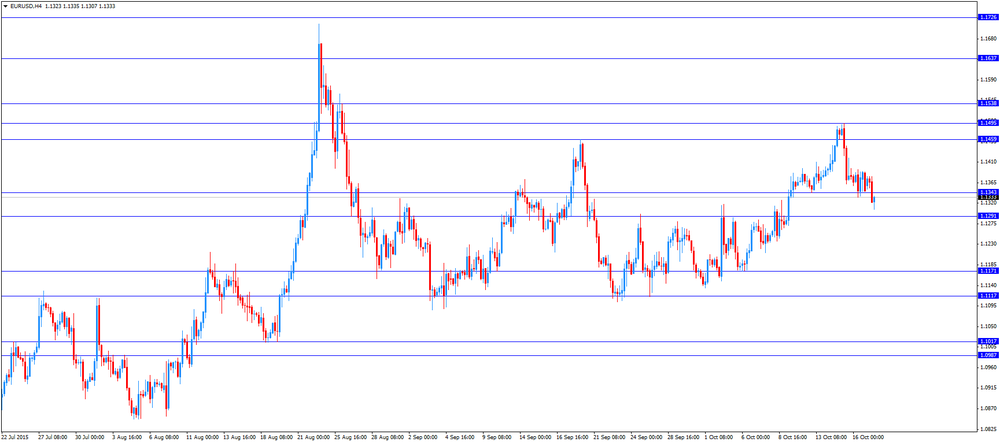

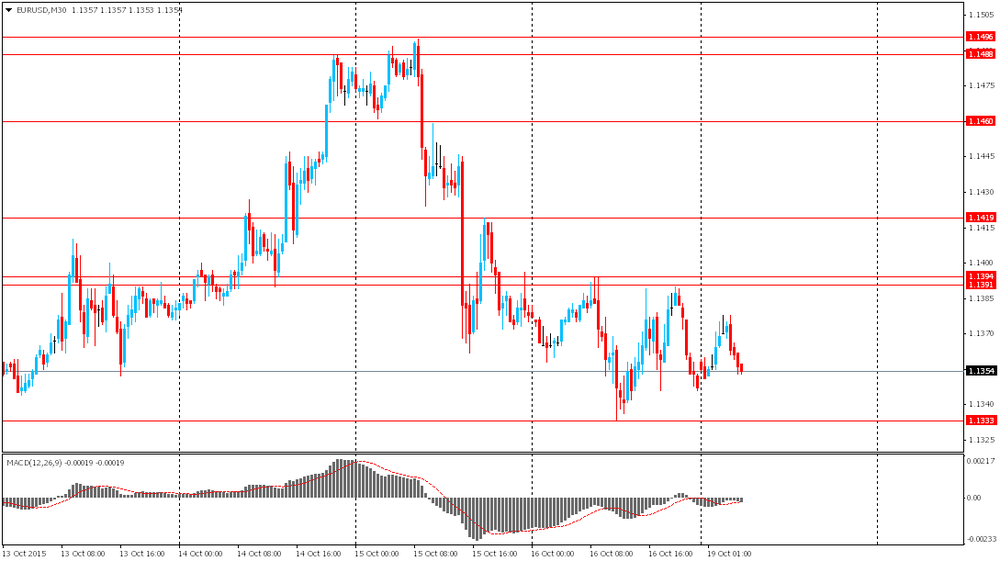

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Industrial Production y/y September 6.1% 6% 5.7%

02:00 China Retail Sales y/y September 10.8% 10.8% 10.9%

02:00 China Fixed Asset Investment August 10.9% 10.8% 10.3%

02:00 China GDP y/y Quarter III 7.0% 6.8% 6.9%

09:00 Eurozone Construction Output, y/y August -0.3% Revised From 1.8% -6.0%

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. NAHB housing market index data. The NAHB housing market index is expected to remain unchanged at 62 in October.

The FOMC member Lacker will speak at 16:00 GMT.

The euro traded lower against the U.S. dollar on the weak economic data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview with the Polish newspaper Rzeczpospolita on Monday that additional measures, including structural reforms and fiscal policy changes, are needed to boost the economic growth in the Eurozone.

In an interview with Polish daily Puls Biznesu, Nowotny said on Monday that it is too early to talk about the adjustments of the central bank's asset-buying programme.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair fell to $1.1307

GBP/USD: the currency pair increased to $1.5494

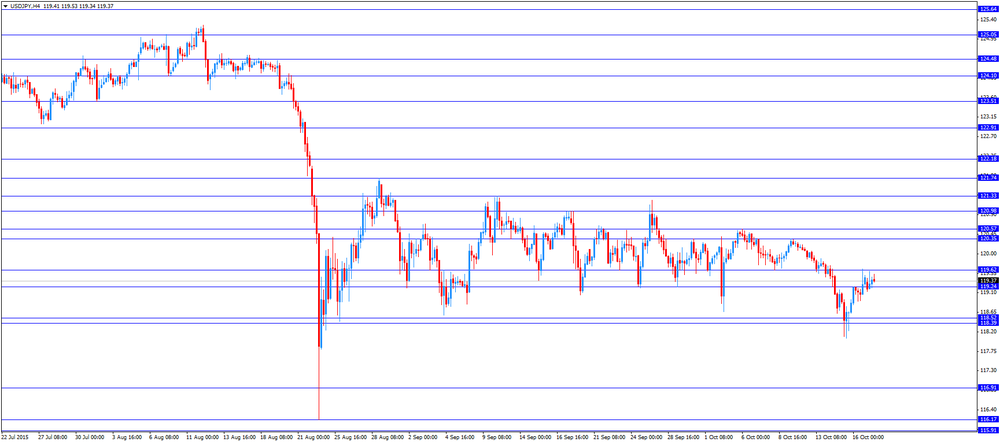

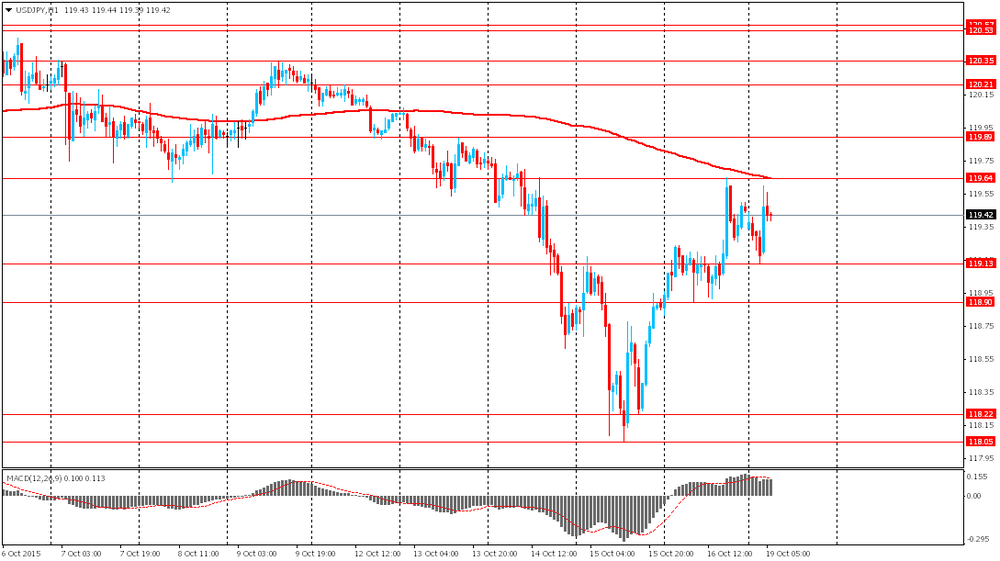

USD/JPY: the currency pair rose to Y119.53

The most important news that are expected (GMT0):

14:00 U.S. NAHB Housing Market Index October 62 62

16:00 U.S. FOMC Member Laсker Speaks

-

14:15

Earnings Season in U.S.: Major Reports of the Week

October 19

After the Close:

IBM (IBM). Consensus EPS $3.30, Consensus Revenue $19640.51 mln.

October 20

Before the Open:

Travelers (TRV). Consensus EPS $2.25, Consensus Revenue $6038.47 mln.

United Tech (UTX). Consensus EPS $1.56, Consensus Revenue $14587.26 mln.

Verizon (VZ). Consensus EPS $1.02, Consensus Revenue $32969.76 mln.

After the Close:

Yahoo! (YHOO). Consensus EPS $0.16, Consensus Revenue $1023.79 mln.

October 21

Before the Open:

Boeing (BA). Consensus EPS $2.20, Consensus Revenue $24781.01 mln.

Coca-Cola (KO). Consensus EPS $0.50, Consensus Revenue $11562.69 mln.

General Motors (GM). Consensus EPS $1.19, Consensus Revenue $37171.75 mln.

After the Close:

American Express (AXP). Consensus EPS $1.31, Consensus Revenue $8335.83 mln.

October 22

Before the Open:

3M (MMM). Consensus EPS $2.01, Consensus Revenue $7866.41 mln.

Caterpillar (CAT). Consensus EPS $0.79, Consensus Revenue $11257.47 mln.

Freeport-McMoRan (FCX). Consensus EPS $-0.10, Consensus Revenue $3973.48 mln.

McDonald's (MCD). Consensus EPS $1.28, Consensus Revenue $6410.20 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $7.21, Consensus Revenue $18308.76 mln.

Amazon (AMZN). Consensus EPS $-0.15, Consensus Revenue $24913.96 mln.

AT&T (T). Consensus EPS $0.69, Consensus Revenue $41020.88 mln.

Microsoft (MSFT). Consensus EPS $0.59, Consensus Revenue $21097.41 mln.

October 23

Before the Open:

Procter & Gamble (PG). Consensus EPS $0.95, Consensus Revenue $17391.44 mln.

-

13:50

Orders

EUR/USD

Offers 1.1375-80 1.1400 1.1425-30 1.1455-60 1.1485 1.1500

Bids 1.1330-35 1.1300 1.1285 1.1265 1.1250 1.1230 1.1200

GBP/USD

Offers 1.5460 1.5480 1.5500-10 1.5530 1.5550 1.5565 1.5585 1.5600

Bids 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300 1.5285 1,5265 1.5250

EUR/GBP

Offers 0.7375-80 0.7400 0.7425-30 0.7450 0.7475-80 0.7500

Bids 0.7330-35 0.7300 0.7285 0.7265 0.7250 0.7230 0.7200

EUR/JPY

Offers 135.75-80 136.00 136.50136.75 137.00 137.25 137.50

Bids 135.25-30 135.00 134.80 134.50 134.30 134.00 133.75 133.50

USD/JPY

Offers 119.50 119.65 119.80-85 120.00 120.20 120.35 120.50

Bids 119.20 119.00 118.85 118.65-70 118.50 118.30 118.00 117.85 117.50

AUD/USD

Offers 0.7300 0.7325 0.7335 0.7350 0.7375 0.7400 0.7425 0.7450

Bids 0.7270 0.7250 0.7235 0.7220 0.7200 0.7185 0.7150

-

12:00

European stock markets mid session: stocks traded mixed after the Chinese economic data

Stock indices traded mixed after the Chinese economic data. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

The growth missed the official target of 7%.

Meanwhile, the economic data from the Eurozone was negative. The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

Current figures:

Name Price Change Change %

FTSE 100 6,372.99 -5.05 -0.08 %

DAX 10,189.8 +85.37 +0.84 %

CAC 40 4,720.11 +17.32 +0.37 %

-

11:37

European Central Bank Governing Council Member Ewald Nowotny: additional measures are needed to boost the economic growth in the Eurozone

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview with the Polish newspaper Rzeczpospolita on Monday that additional measures, including structural reforms and fiscal policy changes, are needed to boost the economic growth in the Eurozone.

In an interview with Polish daily Puls Biznesu, Nowotny said on Monday that it is too early to talk about the adjustments of the central bank's asset-buying programme.

"In my view, we should keep calm and show that we're in control of the situation," he said.

-

11:27

Construction production in the Eurozone declines 0.2% in August

The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.50 (USD 640m) 118.65-75 (560m) 120.00 (1.2bln)

EUR/USD 1.1300 (EUR 579m) 1.1400 (1bln) 1.1425 (543m) 1.1500 (1bln)

USD/CHF 0.9675 (USD 223m)

USD/CAD 1.2775 (USD 538m) 1.3000 (300m)

AUD/USD 0.7200 (AUD 437m) 0.7300 (301m) 0.7400 (683m)

NZD/USD 0.6850 (NZD 220m)

-

11:19

China’s gold reserves rises by 14.9 tonnes in September

According to the People's Bank of China (PBoC) on Friday, China's gold reserves climbed by 14.9 tonnes to 1,708.5 tonnes in September, after a rise by 16.2 tonnes in August. China is the world's sixth largest gold holder.

Gold reserves in China make up only 1.7% of total reserves. The World Gold Council (WGC) said earlier this year that China should raise its gold holdings to around 5% of its total reserves.

-

11:11

Saudi Arabia's commercial crude oil inventories climb to 326.6 million barrels in August

Saudi Arabia's commercial crude oil inventories climbed to 326.6 million barrels in August from 320.2 million barrels in July, according to the Joint Organisations Data Initiative (JODI) data. It was the highest level since 2002.

Exports declined to 7 million barrels a day in August from 7.28 million in July.

According to the JODI data, Saudi Arabia' oil production fell to 10.27 million barrels a day in August from 10.36 million in July.

Saudi Arabia said that its oil production totalled 10.23 million barrels a day in September.

-

11:00

Eurozone: Construction Output, y/y, August -6.0%

-

10:59

Bank of England’s Monetary Policy Committee Member Kristin Forbes: the BoE will start raising its interest rates “sooner rather than later”

Bank of England's (BoE) Monetary Policy Committee Member Kristin Forbes said in a speech on Friday that the BoE will start raising its interest rates "sooner rather than later" despite high volatility in financial markets.

She pointed out the risks to the U.K. economy are manageable as the direct effect to the U.K. economy from the slowdown in emerging economies is limited.

Fobes concluded that the U.K. economy will continue to expand.

-

10:49

Greek parliament approves a package of economic overhauls and austerity measures

The Greek parliament approved a package of economic overhauls and austerity measures on Saturday morning. 154 to 140 members voted for new measures.

The next package of measures must be approved by the Greek parliament next month. The improvement will unlock €15bn-€25bn of bailout funds.

-

10:35

China’s economy expands 6.9% in the third quarter

The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

The growth missed the official target of 7%.

The tertiary industry climbed by 8.4% in the third quarter, while secondary industry increased by 6%.

"In order to restructure, the economy will face some downward pressure," a spokesman for the National Bureau of Statistics, Sheng Laiyun, said, adding that "all this indicates the restructuring and upgrading of the Chinese economy are going steadily".

-

10:20

The number of active U.S. rigs declines by 10 rigs to 595 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 595 last week. It was the seventh consecutive decrease and the lowest level since the week ending July 23, 2010.

Combined oil and gas rigs fell by 8 to 787. It was the lowest level since May 2002.

-

10:12

China’s industrial production increases 5.7% on year in September

The National Bureau of Statistics said on Monday that China's industrial production increased 5.7% on year in September, missing expectations for a 6.0% rise, down from a 6.1% gain in August.

Fixed-asset investment in China climbed 10.3% year-on-year in the January-September period, after a 10.9% rise in the January-August period. Analysts had expected a 10.8% increase.

Retail sales in China increased 10.9% year-on-year in September, exceeding expectations for a 10.8% gain, after a 10.8% rise in August.

-

09:06

Chinese data weighed on oil prices

West Texas Intermediate futures for November delivery fell to $47.45 (-0.57%), while Brent crude declined to $50.18 (-0.55%) amid China GDP data.

An official report showed on Monday that the economy of the world's second-biggest oil consumer expanded by 6.9% y/y in the third quarter. The reading was better than a 6.8% growth expected by economists, but it still missed the government's 7% growth target and intensified concerns over global oil demand.

-

08:53

Gold declined amid expectations for a Fed rate hike

Gold fell to $1,173.00 (-0.85%) as investors continued assessing upbeat U.S. inflation data released Thursday and preliminary consumer confidence data published on Friday. A report by University of Michigan showed improvements in consumer confidence strengthening expectations for a rate hike by the Federal Reserve. The Reuters/Michigan Consumer Sentiment Index rose to 92.1 in October beating expectations for an 89 points reading. However uncertainty over a potential rate hike persisted as recent data were mixed (U.S. industrial production fell by 0.2% m/m in September).

-

08:25

Global Stocks: U.S. indices advanced

U.S. stock indices rose on Friday as investors paid little attention to mixed economic data. Some analysts also say that equities gained amid speculation that the Federal Reserve will avoid raising rates in the near future considering signs of weakness in the economy.

The Dow Jones Industrial Average rose 74.09 points, or 0.4%, to 17,215.84 (+0.8% over the week). The S&P 500 advanced by 9.21, or 0.5%, to 2,033.07 (+0.9% over the week). The Nasdaq Composite Index climbed 16.59, or 0.3%, to 4,886.69 (+1.2% over the week).

Data showed on Friday that U.S. industrial production fell by 0.2% m/m and rose only by 0.4% y/y in September. Meanwhile preliminary Reuters/Michigan Consumer Sentiment Index rose to 92.1 in October from 87.2 reported previously.

This morning in Asia Hong Kong Hang Seng declined 0.41%, or 95.19, to 22,972.18. China Shanghai Composite Index added 0.08%, or 2.74, to 3.394.09. The Nikkei declined 0.95%, or 173.66, to 18,118.14.

Asian indices posted mixed results after initial gains amid China GDP data. Data showed on Monday morning that the pace of GDP growth of the world's second biggest economy slowed less than expected (6.9% y/y in the third quarter vs 6.8% expected and 7.0% previous).

National Bureau of Statistics of China noted that the economy still expanded about 7% and that there is a clear trend of transforming into a service-oriented economy. The bureau also said that the economic slowdown is partly caused by expectations of a rate hike in the U.S. and a weaker global economy.

-

08:21

Foreign exchange market. Asian session: the Australian dollar rose amid Chinese data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 China Industrial Production y/y September 6.1% 6% 5.7%

02:00 China Retail Sales y/y September 10.8% 10.8% 10.9%

02:00 China Fixed Asset Investment August 10.9% 10.8% 10.3%

02:00 China GDP y/y Quarter III 7.0% 6.8% 6.9%

The Australian dollar climbed on Chinese data. National Bureau of Statistics of China reported that the country's GDP rose by 6.9% y/y in the third quarter compared to expectations for a 6.8% rise. The bureau noted some downward pressure on China's economy, although the economy still functioned reasonably. Retail sales rose by 10.9% y/y in September compared to 10.8% reported previously.

The euro climbed against the U.S. dollar after a five-day decline, which was triggered by U.S. industrial production data and expectations for a rate hike. Data showed that the industrial production index fell by 0.2% in September. August reading was revised to -0.1% from -0.4%.

Diversion of monetary policies in the U.S., Japan and the euro zone support the greenback.

EUR/USD: the pair rose to $1.1380 in Asian trade

USD/JPY: the pair traded within Y119.15-60

GBP/USD: the pair traded within $1.5425-45

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Construction Output, y/y August 1.8%

10:00 Germany Bundesbank Monthly Report

14:00 U.S. NAHB Housing Market Index October 62 62

16:00 U.S. FOMC Member Laсker Speaks

-

07:10

Options levels on monday, October 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1500 (2294)

$1.1456 (1082)

$1.1427 (1049)

Price at time of writing this review: $1.1367

Support levels (open interest**, contracts):

$1.1286 (2038)

$1.1260 (2924)

$1.1230 (1900)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 36036 contracts, with the maximum number of contracts with strike price $1,1500 (3153);

- Overall open interest on the PUT options with the expiration date November, 6 is 46149 contracts, with the maximum number of contracts with strike price $1,1100 (4814);

- The ratio of PUT/CALL was 1.28 versus 1.27 from the previous trading day according to data from October, 16

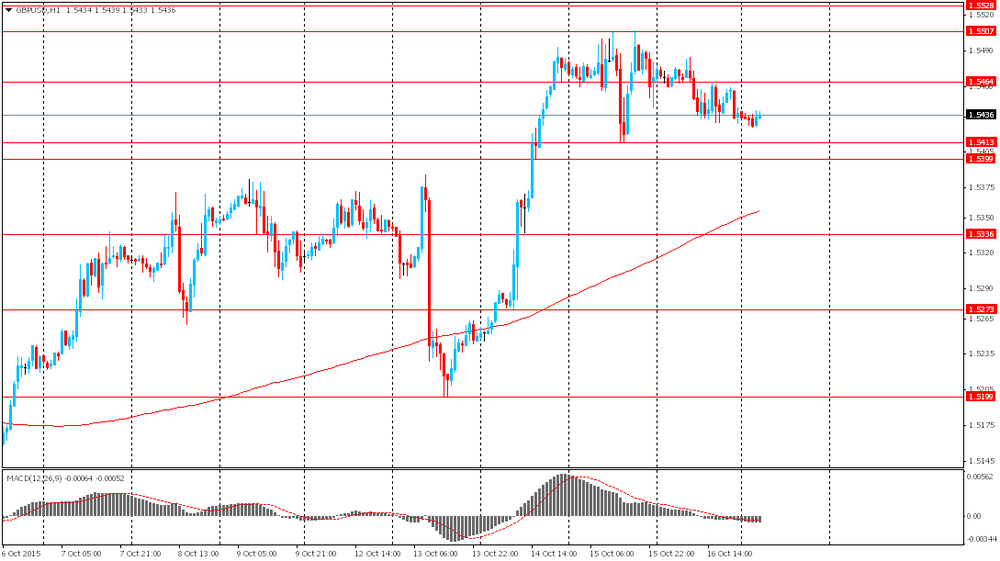

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (877)

$1.5605 (1080)

$1.5508 (1900)

Price at time of writing this review: $1.5442

Support levels (open interest**, contracts):

$1.5392 (568)

$1.5295 (2823)

$1.5197 (2525)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 19523 contracts, with the maximum number of contracts with strike price $1,5350 (2600);

- Overall open interest on the PUT options with the expiration date November, 6 is 20209 contracts, with the maximum number of contracts with strike price $1,5300 (2823);

- The ratio of PUT/CALL was 1.04 versus 0.99 from the previous trading day according to data from October, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:01

China: GDP y/y, Quarter III 6.9% (forecast 6.8%)

-

04:01

China: Industrial Production y/y, September 5.7% (forecast 6%)

-

04:01

China: Fixed Asset Investment, August 10.3% (forecast 10.8%)

-

04:00

China: Retail Sales y/y, September 10.9% (forecast 10.8%)

-

03:43

Nikkei 225 18,154.9 -136.90 -0.75 %, Hang Seng 23,007.01 -60.36 -0.26 %, Shanghai Composite 3,401.63 +10.28 +0.30 %

-

00:32

Commodities. Daily history for Sep Oct 15’2015:

(raw materials / closing price /% change)

Oil 47.260.00%

Gold 1,177.30-0.49%

-

00:32

Stocks. Daily history for Sep Oct 16’2015:

(index / closing price / change items /% change)

Nikkei 225 18,291.8 +194.90 +1.08 %

Hang Seng 23,067.37 +179.20 +0.78 %

S&P/ASX 200 5,268.21 +38.16 +0.73 %

Shanghai Composite 3,391.99 +53.92 +1.62 %

FTSE 100 6,378.04 +39.37 +0.62 %

CAC 40 4,702.79 +27.50 +0.59 %

Xetra DAX 10,104.43 +39.63 +0.39 %

S&P 500 2,033.11 +9.25 +0.46 %

NASDAQ Composite 4,886.69 +16.59 +0.34 %

Dow Jones 17,215.97 +74.22 +0.43 %

-

00:31

Currencies. Daily history for Oct 16’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1347 -0,27%

GBP/USD $1,5438 -0,19%

USD/CHF Chf0,9543 +0,35%

USD/JPY Y119,45 +0,49%

EUR/JPY Y135,57 +0,24%

GBP/JPY Y184,4 +0,29%

AUD/USD $0,7265 -0,94%

NZD/USD $0,6805 -0,85%

USD/CAD C$1,2908 +0,36%

-

00:00

Schedule for today, Monday, Oct 19’2015:

(time / country / index / period / previous value / forecast)

02:00 China Industrial Production y/y September 6.1% 6%

02:00 China Retail Sales y/y September 10.8% 10.8%

02:00 China Fixed Asset Investment August 10.9% 10.8%

02:00 China GDP y/y Quarter III 7.0% 6.8%

09:00 Eurozone Construction Output, y/y August 1.8%

10:00 Germany Bundesbank Monthly Report

14:00 U.S. NAHB Housing Market Index October 62 62

16:00 U.S. FOMC Member Laсker Speaks

-