Noticias del mercado

-

23:02

USD/CHF Price Forecast: Dips below 0.9100 on soft US Dollar

- USD/CHF continues downward, breaking below key SMAs, signaling potential for further consolidation.

- Persistent downtrend may test critical support at 0.9000 after breaching October trendline.

- Recovery above 50-day SMA at 0.9082 could push towards 20-day SMA at 0.9110 and 0.9150.

The USD/CHF reverses course and drops below 0.9100 for the fourth consecutive day. Broad US Dollar weakness keeps most G8 FX currencies in the green territory as US President Donald Trump begins his second term. The pair trades at 0.9068, down 0.87%.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has fallen below the 20 and 50-day Simple Moving Averages (SMAs) each at 0.9110 and 0.9082, respectively, an indication that some consolidation lies ahead. If sellers regain control, they could challenge a support trendline drawn from October lows, which if broken opens the door for testing 0.9000.

On the other hand, if USD/CHF edges above the 50-day SMA at 0.9082, buyers could target the 20-day SMA at 0.9110. If cleared, the next stop would be the 0.9150.

USD/CHF Price Chart - Daily

Swiss Franc FAQs

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

-

22:48

NZD/USD Price Analysis: Pair surges, strengthening bullish signals

- NZD/USD jumps 1.65% on Monday, reaching 0.5675 on fresh buying interest.

- RSI climbs to positive terrain, reflecting steady bullish momentum and room for further gains.

- MACD histogram shows rising green bars, indicating an accelerating upward trajectory.

NZD/USD rallied on Monday, notching a 1.65% advance to settle around the 0.5675 mark. This robust performance comes amid a notable shift in sentiment, with traders appearing more inclined to favor the Kiwi dollar after its recent stretch of subdued price action. The mood has turned convincingly bullish, supported by technical studies pointing to ongoing upside potential.

According to the Relative Strength Index (RSI), which has pushed up to 52 and crossed the 50 middle point, the pair still has room to extend its climb despite trending on the higher side of the scale. In the meantime, the Moving Average Convergence Divergence (MACD) histogram continues to print progressively taller green bars, confirming that buying pressure remains intact. Together, these indicators hint at a market biased toward additional gains in the near term.

On the immediate horizon, any pullback may initially target the 0.5650 region, with stronger support near 0.5620 if the pair faces stronger selling. To the upside, a break beyond 0.5700 could open the door toward 0.5730, further reinforcing the pair’s shift in favor of the bulls.

NZD/USD daily chart

-

22:45

New Zealand Electronic Card Retail Sales (MoM) climbed from previous 0% to 2% in December

-

22:45

New Zealand Electronic Card Retail Sales (YoY) climbed from previous -2.3% to -1% in December

-

22:35

New Zealand Business NZ PSI declined to 47.9 in December from previous 49.5

-

22:00

South Korea Producer Price Index Growth (MoM) climbed from previous 0.1% to 0.3% in December

-

22:00

South Korea Producer Price Index Growth (YoY) increased to 1.7% in December from previous 1.4%

-

21:59

Australian Dollar climbs as USD slides following Trump inauguration speech

- Aussie pair surges 1% to 0.6255 on Monday.

- Trump administration unveils a measured approach to tariffs.

- Softer USD underpins global equities, bolstering risk appetite.

The marked sell-off in the US Dollar on Monday paved the way for the AUD/USD to gain notable momentum, allowing it to reach multi-day peaks just below the 0.6300 threshold at the start of the week. The movement was part and parcel of markets digesting Donald Trump’s inauguration speech signals. This sharp rally came despite lingering questions over the Reserve Bank of Australia’s (RBA) policy path and mixed domestic fundamentals, highlighting the influence of a broadly weaker Greenback on high-beta currencies like the Aussie.

Daily digest market movers: Aussie recovers mainly due to a softer USD

- The Aussie is gaining traction as the US Dollar loses traders’ interest at the start of the week. The US Dollar Index revisited levels beneath 108.00 on Monday, reflecting a pronounced bout of risk-on sentiment.

- Following his inauguration, President Donald Trump directed federal agencies to examine persistent trade imbalances and consider corrective actions — particularly toward nations like China, Canada and Mexico, although a taskforce will first evaluate potential tariffs.

- Global stocks hold firm, buoyed by hopes that the new administration’s initially measured stance on trade may avert major upheavals.

- Market speculation concerning a Fed rate cut by mid-year grows with the CME FedWatch Tool assigning a 55% chance to a hold in May before a possible move by June.

- On the local front, the Aussie may suffer from a mixed economic outlook, or if the RBA eventually gives hints that it will start cutting rates in Q1 of 2025.

AUD/USD technical outlook: Bulls eye higher ground amid choppy swings

The AUD/USD pair jumped by 1% to 0.6255 on Monday, extending its recovery from previous setbacks. The Moving Average Convergence Divergence (MACD) histogram continues printing green bars, hinting at building bullish momentum.

Meanwhile, the Relative Strength Index (RSI) stands in the upper 50s near 59, having climbed sharply and reinforcing a positive tone. If the pair can consolidate above the mid-0.6200s, it could set its sights on the psychological 0.6300 barrier, although persistent policy and growth concerns may still temper any further upside.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

21:34

Gold prices edge higher as Trump assumes Presidency

- Gold rises as US Dollar dips to nine-day low during Trump's inauguration speech.

- Trump declares a national emergency on energy and immigration, aiming to reshape US policies.

- Upcoming US Jobless Claims and Flash PMIs expected to provide direction for the US economy.

Gold prices climbed moderately on Monday amid thin liquidity conditions after Donald Trump was sworn in as the 47th President of the United States (US). The Greenback weakened during his speech as he set aside his aggressive tariff policies, which could stoke inflation and prevent the Federal Reserve (Fed) from easing policy. At the time of writing, XAU/USD trades at $2,709, up 0.27%.

US President Donald Trump declared a national emergency on energy and at the southern border to overhaul energy and immigration policies. The former is aimed at filling up strategic reserves and exporting American oil, while the immigration policy proposes to return millions of “criminal aliens to the places from which they came.”

In the meantime, his speech eased his rhetoric on trade, but an article in The Wall Street Journal mentioned the issuance of a broad memorandum that directs federal agencies to study trade policies and evaluate US trading relationships with China, Canada and Mexico.

The US Dollar weakened to a nine-day low during the inauguration speech, according to the US Dollar Index (DXY), which measures the buck’s performance against a basket of peers. The DXY tumbled to 107.95 before matching those earlier losses and recovering above the 108.00 figure.

This week, the US economic docket will feature Initial Jobless Claims data, S&P Global Flash PMIs and housing data.

Daily digest market movers: Gold price ticks higher amid weaker US Dollar

- Gold fell as real yields edged lower one basis point on Friday. Measured by the 10-year Treasury Inflation-Protected Securities (TIPS) yield, it was virtually unchanged at 2.20%.

- The US 10-year Treasury bond yield was unchanged at 4.611%, which halted the advance in Gold.

- Geopolitical risks had eased amid a ceasefire in the Middle East, with Hamas releasing three female hostages in exchange for 90 Palestinians held in Israeli prisons, reported Reuters.

- Market participants are pricing in near-even odds that the Fed will cut rates twice by the end of 2025, with the first reduction occurring in June.

XAU/USD technical outlook: Gold price consolidates above $2,700

Gold price remains sideways trading, yet above the $2,700 mark but unable to crack the December 12 daily high of $2,725 which would clear the path for buyers to test the psychological $2,750 figure. If those levels are surpassed, Gold could aim towards the record high at $2,790 ahead of $2,800.

Conversely, if sellers drive XAU/USD below $2,700, the first support would be the January 13 swing low of $2,656, followed by the confluence of the 50 and 100-day Simple Moving Averages (SMAs) at $2,642 - $2,644.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

21:29

Crude Oil takes a knee for a third straight day, WTI taps $76

- Crude Oil markets eased for a third consecutive trading day.

- Monday sees further price declines in fossil fuel barrels.

- US production growth is expected to continue slowing.

West Texas Intermediate (WTI) Crude Oil prices eased for a third straight session on Monday, kicking off the new trading week with a fresh test of the $76/bbl handle. Despite newly-minted President Donald Trump’s insistence that he’s going to create a mandate that will push US Crude Oil producers to ramp up production, slowing growth in that exact space remains subdued as energy producers focus on returning profits to investors instead of going broke on behalf of the US government.

Despite lofty promises from the new US administration, major financial institutions are bracing for Crude Oil prices to continue easing moving forward. Median forecasts are predicting WTI barrel bids will sink to below $60 per barrel by the halfway point of President Donald Trump’s term. Global demand continues to undershoot lofty expectations that were set in 2023 and 2024, and investors are scrambling to walk back their expectations of global demand for energy that has thus far failed to materialize, specifically in mainland China despite the country perfectly nailing overall economic growth mandates established by the government, almost to a suspicious degree.

Crude Oil price forecast

After spending most of the fourth quarter battling it out in a rough technical range cycling the $69.00 handle, WTI prices surged to kick off the 2025 trading season, peaking a little over $79.00 per barrel. US Crude Oil bidding action has eased off the pedal, capping gains and chalking in a three-day losing streak as price action falls back toward the 200-day Exponential Moving Average (EMA) near $73.50.

Despite a near-term swing into a pattern of higher lows, a lack of a sustained pullback and ongoing bullish momentum means 2025’s early bull action could run out of runway and snap back into the low side. The 50-day EMA still remains physically below the 200-day EMA, and a lack of a meaningful crossover of the two key MAs could leave bears open for a chance to take another leg lower.

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

-

20:40

US President Donald Trump vows to “take back” Panama Canal in inauguration speech

In his first public appearance as the freshly-declared President of the United States, Donald Trump has reiterated several of his sweeping campaign claims and promises, including seizing control of the Panama Canal, as well as establish an "external revenue service" which will ostensibly be responsible for collecting profits from tariffs his administration intends to impose. Donald Trump also reiterated his promise to refill the US' Strategic Oil Reserve, a commodity stockpile that President Trump famously dipped into during his first term in a bid to shore up a massive funding shortfall in the US government budget caused by lopsided tax cuts which crimped federal funding revenues.

Key highlights

Trump directs US agencies to take emergency measures to reduce the cost of living.

Trump: I will sign a series of executive orders today.

Trump: I will direct the cabinet to defeat record inflation.

Trump: I will also declare a national energy emergency today.

Trump: I will fill strategic reserves again and export American energy all over the world.

Trump: I will revoke the EV mandate.

Trump: I will begin an overhaul of trade system.

Trump: I will tariff and tax foreign countries to enrich our citizens.

Trump: We will establish an external revenue service.

Trump: We will establish a department of government efficiency.

Trump will withdraw from the Paris climate accord

Trump: We will take back Panama canal.

-

20:00

Argentina Trade Balance (MoM) came in at $1666M, above forecasts ($900M) in December

-

19:42

US Dollar slips below key levels as market eyes Trump policy plans

- Many investors lock in profits as trade tensions linger and bond markets pause on the holiday.

- Early signals from the incoming US administration suggest a methodical approach to tariffs and fiscal expansion.

- Upcoming data-dependent Federal Reserve decisions remain in focus with May seen as pivotal for any policy shifts.

The US Dollar is in choppy trading after President-elect Donald Trump’s inauguration. Trading floors in the US will remain closed due to Martin Luther King, Jr. Day, but the US Dollar Index (DXY) plunged toward 108.30 with uncertainty ahead as markets await further details on Trump’s economic plans.

Daily digest market movers: USD sees red on delayed tariff signals

- Policy changes hinge on discussions in Washington: According to multiple sources, the new administration will establish a taskforce to investigate potential tariff impacts on Canada, Mexico and China before implementing any broad measures.

- In fact, during his inaugural speech Donald Trump flirted with the idea of a tariff plan on the mentioned countries but with no specific details.

- Holiday closure slows market action with the US bond market shut down. The 10-year yield holds near 4.60%. Traders will keep watch on Tuesday for fresh signals regarding inflation concerns and interest rate moves.

- CME FedWatch Tool indicates that a hold is priced in for this month’s Federal Reserve meeting, and there are high odds of another hold in May.

DXY technical outlook: 20-day SMA cracks, downside risk builds

The US Dollar Index lost key traction below 109.00 as profit-taking and tempered bond yields took their toll. The breach of the 20-day Simple Moving Average (SMA) near 108.50 underscores rising vulnerability for the Greenback.

Should buying interest fail to emerge, the DXY’s broader uptrend could face a more pronounced setback. Nonetheless, expectations of continued US economic outperformance may eventually attract fresh bids, keeping markets on alert for any policy-driven reversals.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

-

19:39

Forex Today: The UK jobs report takes centre stage

The US Dollar kicked off the new trading week sharply on the defensive as market participants closely followed President Trump’s Inauguration Day amid the inactivity in the US markets due to the MLK Jr. Day.

Here is what you need to know on Tuesday, January 21:

The US Dollar Index (DXY) accelerated its decline and receded to new two-week lows in the sub108.00 region on Monday. Absent relevant data releases on Tuesday, investors are expected to remain focused on announcements from the Trump administration.

EUR/USD climbed strongly and hit two-week peaks just beyond 1.0400 the figure in response to the generalised bid bias in the risk-associated universe. The Economic Sentiment tracked by the ZEW Institute in Germany and the broader Euroland are due, along with an ECOFIN meeting.

GBP/USD reclaimed the area above the key 1.2300 barrier in reponse to the intense sell-off in the Greenback on Monday. The main attraction in the FX world will be the publication of the UK labour market report.

Further repricing of rate hikes by the BoJ lent support to the Japanese yen and sparked a deeper retracement in USD/JPY, this time approaching the 155.00 mark. The Balance of Trade results will be the next salient event in Japan on January 23 seconded by weekly Foreign Bond Investment figures.

Surprisingly, AUD/USD traded on the defensive on Thursday, briefly breaking below the 0.6200 support despite the inconclusive Dollar and a solid jobs report in Oz. Next on tap Down Under will be the release of the Westpac Leading Index in December.

Prices of WTI sold off to multi-day lows and pierced the $76.00 mark per barrel as traders kept weighing potential developments from the Trump administration.

Prices of Gold resumed their move higher on Monday, maintaining the trade above the key $2,700 mark per ounce troy. Silver prices met support around the key 200-day SMA amid quite a positive start to the week.

-

18:55

Canadian Dollar lurches higher on easing market tensions

- The Canadian Dollar traded nearly 1.5% higher at its peak on Monday.

- Canada’s latest BoC outlook reveals nothing particularly noteworthy.

- The Loonie is benefiting from a broad-market easing in the Greenback.

The Canadian Dollar (CAD) caught a rare boost on Monday, dragging USD/CAD back below 1.4400 as investors across the globe find some risk appetite after incoming US President Donald Trump made a last-minute swerve to avoid day-one tariffs via executive order.

The Bank of Canada’s (BoC) latest Business Outlook Survey revealed few surprises, with overall economic sentiment remaining subdued. However, the BoC did note that the overall depth of bearish sentiment appears to be shallowing, with slightly fewer businesses and consumers expecting a recession in the next year.

Daily digest market movers: Canadian Dollar gets a bid as Greenback softens on upbeat market sentiment

- The Canadian Dollar bounced after tapping a fresh 5-year low against the US Dollar.

- Markets opened up the spigots after it was announced that newly-minted US President Donald Trump would not be imposing sweeping day-one tariffs of at least 20% on all of the US’ major trading partners at the same time.

- According to the BoC, only 46.5% of consumers in Q4 expect a recession in the next 12 months, down from Q3’s 49%. 15% of Canadian businesses also expect a recession in the next year, down slightly from 16%.

- Despite the overall easing in recession concerns, Canadian hiring expectations remain soft, and most firms expect someone else to pick up the tab for the forecast increases in consumer spending.

- Canadian firms remain uncertain about the economy’s future in the face of the incoming Trump administration, who have a track record littered with bizarre economic claims and equally-bizarre trade policies.

Canadian Dollar price forecast

The Canadian Dollar (CAD) found a much-needed bid on Monday, even if it was sparked entirely by outside sources. Markets flows reversed direction out of the US Dollar to kick off the new trading week, sending USD/CAD down back below the 1.4400 handle and inching price action back toward the 50-day Exponential Moving Average (EMA) near 1.4230.

The pair has been trading in a rough range between 1.4400 and 1.4300 since rising into a multi-year high back in December. Loonie traders are looking for reasons to buy after a long, one-sided grind that saw the CAD shed nearly 8% top-to-bottom over a four-month period. However, technical oscillators are beginning to ease out of overbought territory, and a notable lack of progress in building the Canadian Dollar back up against the Greenback could send USD/CAD spiraling into fresh highs.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

18:45

Mexican Peso rises amid delayed Trump tariffs

- Mexican Peso strengthens on news of a postponed tariff plan by the incoming Trump administration.

- The upcoming US-Mexico border emergency declaration could reintroduce tension, impacting Peso's trajectory.

- Banxico's Deputy Governor Heath suggests a dovish inflation stance, manageable without excessive tightening.

The Mexican Peso (MXN) rallied against the US Dollar (USD) on Monday ahead of United States (US) President Donald Trump's inauguration. An article in The Wall Street Journal suggested that tariffs would not be imposed immediately after Trump’s oath as the 47th President of the US. The USD/MXN trades at 20.53, down over 1.20% after reaching a daily peak of 20.89.

The market mood remains slightly positive as investors prepare for Trump's inauguration. The WSJ article mentioned that Trump directed federal agencies to “investigate and remedy persistent trade deficits and address unfair trade and currency policies by other nations.” Moreover, the presidential memo suggests that Trump’s administration would focus directly on China, Canada and Mexico.

In the meantime, once President Trump takes office, he is expected to declare a national emergency on the US-Mexico border, which could weigh on the Mexican Peso as tensions arise in both countries.

Aside from this, Banco de Mexico (Banxico) Deputy Governor Jonathan Heath was dovish, saying that headline and core inflation figures may hit 4% in January, adding that the Central Bank “does not need to exaggerate a restrictive posture.”

In a post in X, Heath noted that the December inflation report was “good news since it is the first time (inflation) comes below the 4.26% logged in October 2023.”

This week, Mexico’s economic docket will feature Retail Sales, mid-month Inflation and a proxy for November's Gross Domestic Product (GDP) Economic Activity.

Daily digest market movers: Mexican Peso climbs ahead of inflation data

- The Mexican Peso could take a breather if Trump does not impose tariffs immediately on Mexican imports.

- However, the Mexican currency is not out of the woods. The divergence between the Banco de Mexico (Banxico) and the Federal Reserve (Fed) hints that further upside in USD/MXN lies ahead.

- Mexico’s Retail Sales in November plunged to 0.3% MoM and 1.2% YoY.

- Mid-month inflation in January is foreseen to drop from 4.44% to 3.93%. Underlying inflation is expected to rise modestly from 3.62% to 3.69%.

- Economists polled by Reuters revealed that GDP will grow 1.2% in 2025, compared to 1.6% last year. Additionally, they foresee Banco de Mexico (Banxico) cutting interest rates by at least 150 basis points to 8.50% by the end of the year.

- In the Fed’s latest Summary of Economic Projections (SEP), officials estimate they will cut interest rates by 50 basis points.

- Money market futures had priced in 42.5 bps of Fed rate cuts in 2025, according to CME FedWatch Tool data.

USD/MXN technical outlook: Mexican Peso rises as USD/MXN dips below 20.80

The USD/MXN uptrend remains intact despite the ongoing pullback, which saw the exotic pair reach a daily low of 20.43 near the 50-day Simple Moving Average (SMA) at 20.38 before recovering some ground.

If USD/MXN climbs above the year-to-date (YTD) high of 20.94, it will clear the path to challenge the 21.00 psychological barrier. Once surpassed, the next resistance will be the March 8, 2022 peak at 21.46, followed by 21.50 and the 22.00 psychological level.

Conversely, if the pair tumbles below the 50-day SMA, the next support would be the 100-day SMA at 20.04, which is ahead of the 20.00 mark.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

16:49

EUR/GBP Price Analysis: Momentum extends as pair nears 0.8475

- EUR/GBP edges 0.23% higher on Monday, climbing to 0.8460 with an intraday high of 0.8475.

- RSI points to overbought conditions yet still allowing further upside.

- MACD histogram features rising green bars, confirming the pair’s sustained bullish momentum.

The EUR/GBP cross advanced further on Monday, reaching 0.8460 and briefly peaking at 0.8475. This steady push higher highlights ongoing buyer dominance, as the pair consolidates gains made in recent sessions. Overall sentiment remains tilted toward the upside, with no immediate sign of a pullback.

From a technical standpoint, the Relative Strength Index (RSI) has nudged up to 70, an indication of modestly overbought conditions that could still accommodate additional appreciation if buying persists. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram continues to show expanding green bars, reinforcing the view that bullish forces are gathering pace.

Looking ahead, the pair may find initial resistance around the 0.8480–0.8500 zone, where sellers might begin to test the ongoing rally. On the downside, a slip beneath 0.8430 could open the door to 0.8400, potentially signaling a pause in the current uptrend if sellers gain traction.

EUR/GBP daily chart

-

16:05

USD/JPY weakens on BoJ hike speculation ahead of Trump’s inauguration

- USD/JPY could face pressure as Trump's inauguration nears, with potential impacts from protectionist policies.

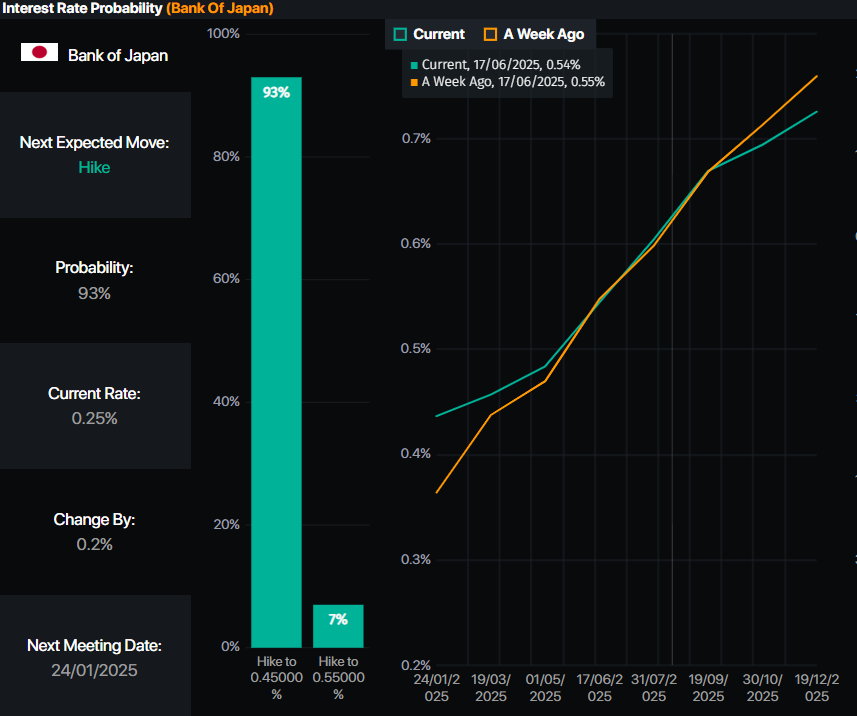

- Speculation rises on BoJ rate hike from 0.25% to 0.50%, first since July 2024, lifting yen.

- Hawkish comments from BoJ Governor Ueda and Deputy Governor Himino suggest monetary tightening.

The Japanese Yen gained some ground compared to the US Dollar in early trading on Monday, ahead of US President Donald Trump’s inauguration. Speculations that the Bank of Japan (BoJ) will hike rates kept the USD/JPY lower, trading near 155.60, down over 0.44%.

USD/JPY dips to 155.60; markets anticipate a rate hikefrom BoJ

Interest rates in Japan remain among the lowest in the G8. According to money markets futures, the BoJ would likely increase borrowing costs from 0.25% to 0.50% on Friday, the first since July 2024.

Last week, BoJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino delivered hawkish remarks, laying the ground for the January 23-24 meeting. The December meeting minutes showed that board members favored a rate increase.

Source: Prime Market Terminal

Therefore, further USD/JPY downside is seen as the interest rate differential between the US and Japan will diminish. However, US President Donald Trump’s taking office could keep traders on their toes due to his protectionist policies, which could be inflation-prone and prevent additional easing to the Federal Reserve.

US financial markets will remain closed on Monday due to Inauguration Day, alongside Martin Luther King Day. Therefore, liquidity conditions will likely remain thin as markets resume their activities on Tuesday.

USD/JPY Price Forecast: Technical outlook

The pair remains bullishly biased, though it has fallen below the Tenkan-sen and the 20-day Simple Moving Average (SMA), opening the door for a retracement to the Kijun-sen at 155.65. A breach of the latter will expose the 50-day SMA at 154.88, followed by a support trendline drawn from the September 2024 lows.

On the other hand, if USD/JPY climbs past 156.00, further upside is seen, with buyers eyeing the Tenkan-Sen at 156.92, followed by the 20-day SMA at 157.24.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

USD EUR GBP JPY CAD AUD NZD CHF USD -1.36% -1.11% -0.37% -1.21% -1.29% -1.36% -0.58% EUR 1.36% 0.19% 0.92% 0.05% 0.13% -0.11% 0.66% GBP 1.11% -0.19% 0.65% -0.15% -0.05% -0.31% 0.46% JPY 0.37% -0.92% -0.65% -0.83% -0.87% -1.09% -0.39% CAD 1.21% -0.05% 0.15% 0.83% -0.02% -0.16% 0.61% AUD 1.29% -0.13% 0.05% 0.87% 0.02% -0.34% 0.46% NZD 1.36% 0.11% 0.31% 1.09% 0.16% 0.34% 0.59% CHF 0.58% -0.66% -0.46% 0.39% -0.61% -0.46% -0.59% The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

-

16:04

US President Trump to stop short of imposing day-one tariffs – Reuters

US President-elect Donald Trump, who takes office on Monday, will reportedly refrain from announcing day-one tariffs at his inauguration address, per Reuters.

"The official, confirming a Wall Street Journal report, said Trump will direct agencies to investigate and remedy persistent trade deficits and address unfair trade and currency policies by other nations," Reuters further added.

Market reaction

The US Dollar (USD) came under selling pressure following this report. At the time of press, the USD Index was down 1.2% on the day at 108.10.

-

15:50

Starting Trump 2.0 with a firm USD – DBS

US President-elect Donald Trump’s inauguration on Monday should underpin the USD Index (DXY) this week, DBS' Senior FX Strategist Philip Wee notes.

Fed to become more cautious on rate cuts

"Trump had pledged to impose tariffs on his first day of office, particularly on goods entering the US from Canada, Mexico, and China. We expect the Fed to keep rates unchanged at 4.25-4.50% at the FOMC meeting on January 28-29."

"The Fed will likely become more cautious on rate cuts from Trump’s tariffs lifting US inflation expectations. Treasury Secretary Yellen warned that the reinstated statutory debt limit would be reached on January 21, with her agency taking extraordinary measures through March 14."

-

15:27

USD slips ahead of inauguration – Scotiabank

It’s inauguration day and Martin Luther King's Day — a federal holiday which means US markets are closed. The incoming president is reportedly set to sign 100 executive orders right out the gate and some of those are likely to address border security and tariffs. Will tariff action start off aggressively (25%?) and ease back as compliance emerges, Scotiabank's Chief FX Strategist Shaun Osborne notes.

US markets closed for MLK Day

“Or will tariffs start low and ramp up progressively to force the pace of negotiations. The positive price action in the USD since the outcome of the US presidential election suggests to me that markets have already factored in a — very roughly — 10-15% tariff regime being imposed on the US’ major trading partners, so somewhere in the middle of those two extremes which may mean profit-taking if its tariffs lite to start or more gains if it’s a sledgehammer approach.”

“The USD remains quite fully priced and long positioning is crowded which tilts risks towards some decent, corrective action in the USD in response to either a low or slow starting off point for tariffs—or if news on tariffs remains absent in the early days of Trump 2.0.”

“The USD has slipped a little in overnight trade and price action alone suggests the bull run may be tiring a bit; the DXY eased last week overall, for its first weekly loss since the start of December and the index is resting right on seven-week trend support at 108.95 this morning. A break below here may trigger a short-term correction at least in the USD’s recent gains.”

-

15:07

GBP/USD holds last week’s range in quiet trade – Scotiabank

The Pound Sterling (GBP) is up modestly on the day versus a generally softer USD, Scotiabank's Chief FX Strategist Shaun Osborne notes.

GBP/USD modestly firmer

"The UK, like everyone else, is waiting to see what emerges from the early days of the new Trump term on trade. The US is a key export market for the UK but trade flows are strongly services-oriented which may leave the UK a little less susceptible to tariff action."

"Cable is holding last week’s trading range. Intraday price action suggests good support on dips to the upper 1.21 area and broader price action last week suggested the GBP decline may have stalled. A positive week for the GBP this week will lift prospects for a push back towards 1.23/1.24."

-

15:05

USD/CNH: Breaking out of rising wedge – OCBC

USD/CNH fell amid supported risk sentiments. USD/CNH fell; last seen at 7.2853 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

Risks are skewed to the downside

"CSI300, HK equities printed 1% and 2%, respectively this morning. Trump said that that the phone call with President Xi on Fri was a very good one for both China and the US may have supported sentiments."

"Daily momentum is bearish bias while RSI fell. Risks are skewed to the downside. Next support at 7.2755 (23.6% fibo retracement of Sep low to Dec high). Resistance at 7.3340 (21 DMA), 7.36 levels."

"A brief respite for RMB is still likely, given that policymakers have taken efforts – both onshore (via the fix) and offshore to maintain the relative stability in RMB. That said, we still expect RMB to depreciate when tariffs ultimately hit."

-

15:01

EUR/USD: Firms but holds range – Scotiabank

The Euro (EUR) has firmed a little in quiet trade, Scotiabank's Chief FX Strategist Shaun Osborne notes.

ECB hawks push back on rate cut bets

"ECB policy hawks continue to push back against the idea that a January rate cut is a done deal—”not a foregone conclusion”, according to Governor Holzmann reiterated in an interview overnight. Note Holzmann and Vujcic speak again this morning. Swaps rather reflect a high degree of certainty that the central bank will ease rates on the 30th, with 25bps fully priced in, however."

"Spot has picked up a little overnight but trading is holding within the range that developed through the latter part of last week. EUR-bullish signals on the daily chart remain intact but spot needs to make some deeper headway—above 1.0350—to develop more upside momentum. Support is 1.0260."

-

15:00

Russia Foreign Trade dipped from previous $9.095B to $6.018B in November

-

14:46

AUD/USD rallies to near 0.6260 before Trump 2.O

- AUD/USD surges to near 0.6260 as the US Dollar plummets in a thin-trading volume day ahead of Trump’s inauguration.

- Donald Trump is expected to clear key policies such as immigration controls, tax cuts, and higher import tariffs soon after returning to the White House.

- The Australian Dollar gains despite the PBoC leaving its LPR unchanged.

The AUD/USD pair soars to near 0.6260 in Monday’s North American session. The Aussie pair rallies as the US Dollar (USD) plunges on a thin-trading volume day, with United States (US) markets remaining closed on account of Martin Luther King's Birthday.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, dives to near 108.30 as reports from the Wall Street Journal (WSJ) shows President-elect Donald Trump is planning to issue a broad memorandum that directs federal agencies to study trade policies and evaluate US trade relationships with China and America’s continental neighbors—but stops short of imposing new tariffs on the first day of his office.

The Greenback faces pressure as its safe-haven demand diminishes, given that market participants were anticipating that Trump would impose higher tariffs soon after returning to the White House.

Earlier, a report from Fox News Digital showed that Trump would sign over 200 orders in his first day of office that might include policies such as immigration controls, lower tax cuts, and higher tariffs. Market experts believe that Trump’s economic policies would be pro-growth and inflationary for the US.

Still, the event will force the Federal Reserve (Fed) to keep interest rates at their current levels for longer.

Currently, traders are pricing in more than one interest rate cut from the Fed this year, seeing the first in June, according to the CME FedWatch tool.

Meanwhile, the Australian Dollar (AUD) exhibits a mixed performance after the People’s Bank of China (PBoC) monetary policy decision. The PBoC kept its one-year Loan Prime Rate (LPR) unchanged at 3.10%, while the five-year LPR remains at 3.60%.

Since China and Australia are close trading partners, any shifts in China’s economy could have an impact on Australian markets.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

14:46

DXY: Await presidential inauguration – OCBC

US Dollar (USD) started the week on a slightly softer footing ahead of US holiday (Martin L. King Day) and Presidential inauguration today. Trump had promised to sign a host of executive orders on his 1st day as President. DXY was last at 108.48 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note.

Consolidation likely for now

"At a preinauguration rally hours ago, he told the crowd he “will act with historic speed and strength and fix every single crisis”. Trump promised executive orders that will ramp up artificial intelligence, form the Department of Government Efficiency (DOGE), etc. Media reports indicated Trump may issue more than 200 executive actions on Monday. There remains quite a fair bit of expectations that tariffs may soon be announced."

"But we believe tariff uncertainty remains in terms of timing, magnitude and scope of products. A longer delay for tariff announcement may provide a breather for risk proxies, and we do not rule out USD pullback (lower). That said, a swift order for tariff implementation is likely to undermine sentiments and provide a boost to the USD. Last Friday, President-elect Trump and President Xi had a phone call to discuss trade, TikTok and fentanyl."

"Trump said that that the call was a very good one for both China and the US. Separately over the weekend, Gaza ceasefire took effect. Daily momentum is mild bearish but decline in RSI moderated. Consolidation likely for now as we await event risk (signing of executive orders/ actions). Support at 107.43 (50DMA). Resistance at 110.10, 110.90 levels."

-

14:42

USD/CAD: Vols firm in nervous trade ahead of Trump 2.0 – Scotiabank

The Canadian Dollar (CAD) has failed to pick up any support amid a broadly softer USD this morning. It, along with the MXN and JPY, is a relative underperformer on the session after reaching a minor, new 5-year low overnight—just under 1.45. Minor new cycle highs for the USD overnight and spot holding near the recent USD peaks in what is a minor pullback from the overnight high leave the USD in a strong position, Scotiabank's Chief FX Strategist Shaun Osborne notes.

CAD hits new low

"CAD trading is clearly affected by concerns about trade policy under Trump 2.0. CAD vols continues to rise, with O/N vol nearing 20%, 1M implied near 9% and 3M implied vol trading at 7.6%. CAD options volume has been more active today, reports indicate, as traders position for immediate action on tariffs. That might mean a mini-CAD rebound if news on tariffs is limited in the next day or so."

"Crude prices are a little weaker following the president-elect's remark that he will invoke a national energy emergency to boost domestic energy production. The BoC releases the Q1 Business Outlook Survey at 10.30ET; focus here has been on jobs and prices recently but the survey will be a gauge of local business expectations ahead of the new Trump presidency."

"Price moves also scupper technical pointers that had suggested the USD could be peaking after failing to hold intraday gains through the mid-1.44s in recent weeks. Spot closed at a new high on the week (1.4477) on Friday. While the US trend looks stretched, there is no relenting in the bull move, it would seem. The next resistance is 1.47. Support is 1.4385/90 and 1.4300/05."

-

14:38

EUR/USD: 21 DMA holds key – OCBC

Euro (EUR) traded under pressure (sub1.03 levels), OCBC's FX analysts Frances Cheung and Christopher Wong note.

Risks modestly skewed to the upside

"ECB’s Schnabel said ECB has room to lower borrowing costs but also stressed that after the steep rate cuts over the last few months, ECB is getting closer to the point where policymakers have to take a closer look at whether and to what extent they can still reduce rates."

"Daily momentum turned mild bullish while RSI rose. Risks modestly skewed to the upside. EUR bulls to regain some momentum towards 1.0440 (50 DMA). Support at 1.0240, 1.02 (recent low)."

-

13:37

US Dollar focus on Donald Trump's inauguration

- The US Dollar is in choppy trading ahead of President-elect Donald Trump’s inauguration.

- Trading floors in the US will remain closed due to Martin Luther King’s Day.

- The US Dollar Index (DXY) stays afloat near 109.00 with uncertainty ahead.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades roughly flat and holds near 109.00 on Monday ahead of President-elect Donald Trump’s inauguration as the 47th President of the United States (US). Several asset classes in the US will remain closed, such as the Wall Street trading floor and US bond trading, in observance of Martin Luther King’s Day. This means erratic moves could occur in a market with thin liquidity.

All eyes will be on the aftermath of the inauguration, where President-elect Donald Trump has already confirmed in a rally on Sunday that a whole battery of new measures and executive orders will be issued. The main ones are, of course, more tariffs, mass deportation starting in Chicago, and issuing state of emergencies for energy and border security, Bloomberg reported. By issuing those last two, the upcoming President Trump can give the green light for massive drilling and mass deporting illegal immigrants without having to pass through Congress and the House of Representatives.

Daily digest market movers: All eyes on Trump’s first moves

- At 17:00 GMT, the Presidential Inauguration will take place, with Donald Trump being sworn in as the 47th President of the United States.

- Due to Martin Luther King’s Day, several trading floors in the US will remain closed throughout the day.

- Equities are off to a positive start on the day, with green numbers from Asia over Europe and US equity futures.

- The CME FedWatch tool projects a 55.6% chance that interest rates will remain unchanged at current levels in the May meeting, suggesting a rate cut in June. Expectations are that the Federal Reserve (Fed) will remain data-dependent with uncertainties that could influence inflation during President-elect Donald Trump’s term.

- The US 10-year yield is trading around 4.627% and will remain at that level this Monday, as bond trading in the US is closed due to the Martin Luther King’s bank holiday.

US Dollar Index Technical Analysis: No plan from here

The US Dollar Index (DXY) sees a split division between bears and bulls. The new Trump administration is set to unleash a large number of executive orders, making it hard for markets to assess the impact. With several topics being addressed and communicated in advance, it looks like markets have already priced in a fair bit of inflationary pressure from Trumponomics. The question now will be if the markets are correct and if the DXY index will ease further from current levels on the back of an overestimation of the actual impact of the measures being imposed.

On the upside, the 110.00 psychological level remains the key resistance to beat. Further up, the next big upside level to hit before advancing any further remains at 110.79 (September 7, 2022, high). Once beyond there, it is quite a stretch to 113.91, a double top from October 2022.

On the downside, the DXY is trading alongside the ascending trend line coming from December 2023, which currently comes in around 109.10 as nearby support. In case of more downside, the next support is 107.35 (October 3, 2023, high). Further down, the 55-day Simple Moving Average (SMA) at 107.29 should catch any falling knives.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

-

12:24

USD/CHF consolidates around 0.9150 with Trump 2.O taking center stage

- USD/CHF oscillates around 0.9150 as investors turn cautious ahead of Trump’s inauguration.

- Trump’s economic policies are expected to boost US inflation and growth.

- The SNB is expected to continue reducing interest rates this year.

The USD/CHF pair trades sideways inside Friday’s trading range around 0.9140 in Monday’s European session. The Swiss Franc pair consolidates as investors have sidelined ahead of United States (US) President-elect Donald Trump’s swearing ceremony.

Market participants expect an unprecedented global trading environment under Trump’s administration as he is expected to sign over 200 orders soon after returning to the White House. His initial orders might include immigration controls, higher tariffs, and lower individual taxes. Higher import tariffs are expected to lead to a global trader war, a scenario that will boost demand for US-produced goods and services. While, at the same time, it will make offerings from other economies as expensive.

Trump’s economic policies would be pro-growth and inflationary for the United States (US) economy and favorable for the US Dollar (USD). At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, is down to near 109.00 but is still 10% higher in slightly over three months.

Going forward, Trump’s policies are expected to force the Federal Reserve (Fed) to maintain interest rates elevated for a longer period. According to the CME FedWatch tool, traders are pricing in more than one 25-bps interest rate reduction this year, seeing the first coming in the June meeting.

Meanwhile, the Swiss Franc (CHF) remains broadly weak as investors expect the Swiss National Bank (SNB) could continue reducing interest rates. Swiss interest rates have already come down to 0.5% amid growing risks of inflation undershooting the central bank’s target.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

-

12:16

USD/CNH: Upward momentum has dissipated – UOB Group

Downward momentum is building, but this will likely lead to a lower trading range of 7.3200/7.3500 instead of a sustained decline. In the longer run, upward momentum has dissipated; US Dollar (USD) is likely to trade in a range between 7.3100 and 7.3650. UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

Downward momentum is building

24-HOUR VIEW: "USD traded in a quiet manner last Thursday. On Friday, we indicated that 'flat momentum indicators continue to suggest range trading, most likely between 7.3380 and 7.3550.' USD subsequently traded in a wider range of 7.3338/7.3578. It opened on a soft note in early Asian trade today. While downward momentum is building, this will likely lead to a lower trading range of 7.3200/7.3500 instead of a sustained decline."

1-3 WEEKS VIEW: We have held the view that 'there is room for USD to retest the 7.3700' since early last week. On Tuesday (14 Jan, spot at 7.3410), we noted that 'upward momentum is beginning to fade, and a breach of 7.3250 (‘strong support’ level) would suggest that 7.3700 is not coming into view.' USD traded in a quiet manner over the past few days, and upward momentum has dissipated. There has been a slight increase in downward momentum, but it is not sufficient to indicate a sustained decline. From here, we expect USD to trade in a range, most likely between 7.3100 and 7.3650."

-

12:11

Aluminum continues to rally on China growth – ING

LME aluminum ended last week on a strong footing, boosted by signs of economic recovery in China following a series of stimulus measures over the last couple of months. China’s economic data released last Friday showed China’s GDP in 2024 expanded 5%, meeting the government’s target. The final quarter of the year saw growth of 5.4%, which was the fastest pace in six quarters, ING's commodity analysts Warren Patterson and Ewa Manthey note.

LME aluminum ends last week on a strong footing

"The National Bureau of Statistics (NBS) numbers released last week showed monthly primary aluminum production in China rising 4.2% YoY to 3.8mt in December 2024 primarily due to the additions from new production capacity in the Northwestern region of Xinjiang. Cumulatively, production rose 4.6% YoY to around 44mt over Jan’24 – Dec’24. In other metals, monthly crude steel production rose 11.8% YoY to 76mt last month. However, cumulative output fell 1.7% YoY to 1,005.1mt in 2024, the lowest in five years as weakness in the property market continues to weigh on steel demand."

"Weekly data from the Shanghai Futures Exchange (ShFE) showed inventories for base metals remaining mixed over the last week. Aluminum weekly stocks fell by 3,694 tons for a twelfth consecutive week to 178,474 tons as of last Friday, the lowest since 23 February 2024. Zinc inventories decreased by 294 tons (-1.4% week-on-week) for a ninth straight week to 21,040 tons (the lowest since 30 December 2022), while lead inventories declined by 1,351 tons for a fifth consecutive week to 43,503 tons at the end of last week. Meanwhile, weekly inventories for copper and nickel rose by 12.9% WoW and 5.2% WoW, respectively."

-

12:06

USD/JPY: Unlikely to threaten 156.70 – UOB Group

Sharp bounce in US Dollar (USD) has room to extend; overbought conditions indicate that any advance is unlikely to threaten 156.70. In the longer run, USD remains weak; if it breaks below 154.90, the next objective will be at 154.40, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

USD remains weak

24-HOUR VIEW: "After USD fell sharply last Thursday, we highlighted on Friday that 'while the sharp drop appears to be excessive, the weakness has not stabilized just yet.' However, we held the view that “any further decline is likely part of a lower range of 154.90/156.15.” USD subsequently dipped to 154.96 before rebounding strongly, reaching a high of 156.37 in NY trade. The sharp bounce has room to extend, but given the overbought conditions, any advance is unlikely to threaten the strong resistance level at 156.70. On the downside, support levels are at 155.90 and 155.40."

1-3 WEEKS VIEW: "Last Friday (17 Jan), when USD was at 155.35, we indicated that USD 'remains weak.' We added, 'if it breaks below 154.90, the next objective will be at 154.40.' USD then dipped to 154.96 before rebounding strongly. Although downward momentum has eased somewhat with the rebound, only a breach of 157.60 (no change in ‘strong resistance’ from last Friday) would indicate that the weakness in USD that started last Thursday has stabilized. To look at it another way, there is still a chance for USD to break below 154.90."

-

11:49

Oil: Specs add to Brent long – ING

Despite the rally in crude oil prices running out of steam towards the end of last week, ICE Brent still managed to settle almost 1.3% higher on the week and remain above US$80/bbl, ING's commodity analysts Warren Patterson and Ewa Manthey note.

Oil markets are weighed on by uncertainty

"There is a fair amount of uncertainty across markets coming into this week given the inauguration of President Trump and the raft of executive orders he reportedly is planning to sign. This combined with it being a US holiday today, means that some market participants may have decided to take some risk off the table."

"The latest positioning data shows that speculators increased their net long in ICE Brent by 27,473 lots over the last reporting week to leave them with a net long of 254,332 lots as of last Tuesday. The move was driven by fresh longs entering the market and left speculators with their largest net long since May. The strong buying reflects supply concerns following the announcement of US sanctions against the Russian energy industry."

"Output data from China on Friday shows that refineries increased the amount of crude oil they processed by 1.3% year-on-year in December. However, for full-year 2024, refinery activity still fell by 3.6% YoY, reflecting weaker domestic demand. Output and trade numbers suggest that apparent oil demand in December came in at a little more than 13.9m b/d, down from 14m b/d the previous month, but up 0.6% YoY."

-

11:43

NZD/USD: Upward momentum has largely faded – UOB Group

New Zealand Dollar (NZD) is likely to trade sideways between 0.5560 and 0.5610. In the longer run, upward momentum has largely faded; NZD is expected to trade in a 0.5540/0.5650 range, UOB Group's FX analysts Quek Ser Leang and Peter Chia note.

NZD to trade in a 0.5540/0.5650 range

24-HOUR VIEW: "Our view for NZD to 'trade in a sideways range between 0.5580 and 0.5630' last Friday was incorrect, as it dropped to a low of 0.5564 before closing at 0.5585 (-0.41%). The decline did not result in a significant increase in momentum, and instead of continuing to decline, NZD is more likely to trade sideways between 0.5560 and 0.5610."

1-3 WEEKS VIEW: "While we noted 'a slight increase in momentum' last Thursday (15 Jan, spot at 0.5620), we pointed out that it 'must break and remain above 0.5650 before a move to 0.5695 is likely.' We added, 'the likelihood of NZD breaking clearly above 0.5650 will remain intact, provided that it remains above 0.5580 (‘strong support’ level).' Last Friday, NZD fell below 0.5580 (low has been 0.5564). Upward momentum has largely faded, and from here, we expect NZD to trade in a 0.5540/0.5650 range."

-

11:38

GBP: Staying offered – ING

EUR/GBP is staying bid near the recent high of 0.8450/60, ING's FX analyst Chris Turner notes.

Above 0.8450/60, EUR/GBP can see 0.8500

"While we (and the UK sovereign credit default swap market) do not think this is a Liz Truss-style moment for UK sovereign risk, we do think the solution to the current challenges is sterling negative. To resolve the risk of breaching the fiscal rule, either the government needs to cut spending, the Bank of England to cut rates (lowering Gilt yields) – or both."

"There is not a lot on the UK data calendar this week apart from the November jobs data tomorrow. We also wonder whether Wednesday's release of the December budget figures will draw greater attention than normal."

"But overall, we see little reason for sterling to recover. Above 0.8450/60, EUR/GBP can see 0.8500. GBP/JPY is very much in focus as well given the prospect of the Bank of Japan hiking 25bp this Friday. 185 looks very possible here."

-

11:25

AUD/USD: Set to trade in a 0.6165/0.6220 range – UOB Group