Noticias del mercado

-

21:00

Dow -0.30% 18,085.47 -54.97 Nasdaq -0.10% 4,950.82 -5.15 S&P -0.23% 2,105.35 -4.95

-

18:14

Bank of Japan minutes: three BoJ's board members expressed doubts the central bank will achieve its 2% inflation target

The Bank of Japan (BoJ) released its minutes from January meeting. Three BoJ's board members expressed doubts the central bank will achieve its 2% inflation goal in the targeted period.

The BoJ cut its consumer inflation forecast for fiscal 2015 starting in April to 1.0% from its previous estimate of 1.7%. For fiscal 2016, the central bank upgraded its inflation forecast to 2.2% from 2.1%.

The BoJ's board members remained satisfied with the pace of the Japan's economic recovery.

-

18:03

European stocks close: most stocks closed higher on Greek debt deal

Most stock indices closed higher on Greek debt deal. Greece and the European Union agreed on Friday to extend Greek bailout programme by four months.

German Ifo business climate index rose to 106.8 in February from 106.7 in January, missing expectations for a rise to 107.4.

The Confederation of British Industry released its monthly Distributive Trades survey on Monday. The CBI retail sales balance dropped to 1% in February from 39% in January, missing expectations for an increase to 42%. That was the lowest level since November 2013.

The drop was largely driven by lower supermarkets and department stores sales.

Sales expectations for March declined to 27% from 42% in February.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,912.16 -3.04 -0.04 %

DAX 11,130.92 +80.28 +0.73 %

CAC 40 4,862.3 +31.40 +0.65 %

-

18:00

European stocks closed: FTSE 100 6,918.24 +3.04 +0.04% CAC 40 4,862.3 +31.40 +0.65% DAX 11,130.92 +80.28 +0.73%

-

17:40

Oil: а review of the market situation

Oil prices fell today, dropping at the same time below $ 60 (Brent) and $ 50 (WTI), which was due to concerns about oversupply and continued growth of the dollar.

Pressure also had a government report that showed last week that US crude stocks rose to their highest level in at least 80 years, indicating that the low prices have not affected the production. Meanwhile, industry research group Baker Hughes reported that the number of drilling rigs for oil in the US fell by only 37 last week, showing the smallest weekly drop this year, compared with a decrease of 84 rigs in the previous week. The number of drilling rigs for oil in the US is 1019, which is the minimum in August 2011.

The focus was also news that Oman plans to increase oil production in the conditions of oversupply in the market. Earlier, Deputy Minister of Oil and Gas Industry of Oman Salim al 'Awfi said that this year the volume of oil production will be increased to 980 thousand. Barrels daily, which is 4% higher compared to 2013. But serious decline in supply of oil and rising prices in the near future should not be expected. Analysts say that as long as the world does not happen a significant reduction in oil production and increase economic activity in the United States and China, the market will remain highly volatile. US Energy Information Administration in 2015-2016 still expects growth of production and the expansion of oil reserves in the country, contrary to expectations that production will decline because of falling world prices.

It should also be emphasized that the oil came under pressure as the biggest strike since 1980 at US refineries extended for another 12 enterprises. Experts say that any breach of the supply from these plants can seriously affect the demand.

Meanwhile, investors remain cautious, because today Athens must submit a list of reforms to the country's creditors to provide bailout extension for another four months, which would gain time to reach new agreements with creditors.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) dropped to 49.38 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea Brent crude oil mix fell $ 0.31 to $ 59.72 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:35

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies ahead the U.S. existing home sales data

The U.S. dollar traded lower against the most major currencies ahead the U.S. existing home sales data. Sales of existing homes fell 4.9% to a seasonally adjusted annual rate of 4.82 million in January from 5.07 million in December. That was the lowest level since April 2014.

December's figure was revised up from 5.04 million units.

Analysts had expected a decline to 5.03 million units.

The euro traded higher against the U.S. dollar. Concerns over Greek bailout programme weighed on the euro despite Friday's new debt deal between Greece and the European Union. Greece and the European Union agreed on Friday to extend Greek bailout programme by four months.

German Ifo business climate index rose to 106.8 in February from 106.7 in January, missing expectations for a rise to 107.4.

The British pound traded higher against the U.S. dollar. The Confederation of British Industry released its monthly Distributive Trades survey on Monday. The CBI retail sales balance dropped to 1% in February from 39% in January, missing expectations for an increase to 42%. That was the lowest level since November 2013.

The drop was largely driven by lower supermarkets and department stores sales.

Sales expectations for March declined to 27% from 42% in February.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback. Credit card spending in New Zealand rose 6.2% in January, after a 4.5% gain in December.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the Bank of Japan (BoJ) meeting minutes. The BoJ released its January meeting minutes. Three members of the BoJ's policy board expressed doubts the central bank will achieve its inflation target.

-

17:20

Gold: A review of the market situation

Gold prices rose markedly, departing from the seven-week low, and a foothold above $ 1200. Support for precious metals were disappointing US data, as well as the fall of the American stock indexes.

National Association of Realtors (NAR) reported that sales of existing homes fell in January, highlighting the uneven recovery of the housing market, which appears almost six years after the end of the recession. According to the data, housing sales in the secondary market fell by 4.9% last month from December and reached a seasonally adjusted annual rate of 4.82 million, said on Monday is the slowest pace in nine months. Economists had expected in January sales were down to the level of 5.03 million. Sales for December were revised to 5.07 million. 5.04 million. Sales in January rose by 3.2% compared to 2014 year. Given the current sales pace, it would take 4.7 months to exhaust the supply of homes on the market. The median sales price of homes in the secondary market was up 6.2% compared with a year earlier, at $ 199,600 in January.

The course of trade is also affected by expectations of speech Chairman of the Board of Governors of the Federal Reserve Janet Yellen before the Senate Banking Committee. Her statement will be watched for any indication of when US interest rates will go up.

"Alluding to the fact that the Fed is in no hurry to raise interest rates is likely to trigger a rise in gold prices," said Bart Melek, an analyst at TD Securities. He expects that by the middle of March, the price of gold reached the level of 1229 dollars per troy ounce. "But we can expect volatility, as prices will depend on the economic data," - he said. Strong data provoke the fall in gold prices, while poor performance will have the opposite effect, he said.

Recall, gold is under pressure in recent weeks amid lingering expectations that this year the Fed will raise interest rates. Expectations rise in interest rates has a negative impact on the dynamics of the price of gold, because it can not compete with earning assets at high rates.

April futures price of gold on the COMEX today rose to 1203.50 dollars per ounce.

-

16:52

U.S. existing homes sales declines 4.9% in January

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes fell 4.9% to a seasonally adjusted annual rate of 4.82 million in January from 5.07 million in December. That was the lowest level since April 2014.

December's figure was revised up from 5.04 million units.

Analysts had expected a decline to 5.03 million units.

The NAR chief economist Lawrence Yun said that the labour market and economy support buyer demand.

Yun added that January data can be volatile.

-

16:00

U.S.: Existing Home Sales , January 4.82 (forecast 5.03)

-

15:35

U.S. Stocks open: Dow -0.04%, Nasdaq -0.11%, S&P -0.27%

-

15:24

Before the bell: S&P futures -0.20%, Nasdaq futures +0.01%

U.S. stock-index futures are mixed after equity benchmark indexes capped a third weekly rally to close at all-time highs.

Global markets:

Nikkei 18,466.92 +134.62 +0.73%

Hang Seng 24,836.76 +4.68 +0.02%

FTSE 6,895.89 -19.31 -0.28%

CAC 4,843.99 +13.09 +0.27%

DAX 11,100.99 +50.35 +0.46%

Crude oil $49.13 (-3.35%)

Gold $1200.60 (-0.36%)

-

15:08

Stocks before the bell

(company / ticker / price / change, % / volume)

Intel Corp

INTC

34.44

+0.09%

136.7K

Johnson & Johnson

JNJ

100.36

+0.10%

3.0K

General Motors Company, NYSE

GM

37.70

+0.13%

6.5K

Home Depot Inc

HD

112.40

+0.14%

0.1K

American Express Co

AXP

79.95

+0.15%

8.8K

Hewlett-Packard Co.

HPQ

38.46

+0.18%

2.3K

Twitter, Inc., NYSE

TWTR

49.20

+0.18%

25.0K

International Business Machines Co...

IBM

163.96

+0.19%

0.2K

Apple Inc.

AAPL

129.75

+0.20%

348.5K

UnitedHealth Group Inc

UNH

113.00

+0.34%

1.1K

Facebook, Inc.

FB

80.18

+0.36%

128.9K

Visa

V

273.00

0.00%

2.0K

Procter & Gamble Co

PG

84.87

0.00%

1.5K

Wal-Mart Stores Inc

WMT

84.30

0.00%

0.9K

Starbucks Corporation, NASDAQ

SBUX

93.50

-0.01%

0.4K

ALTRIA GROUP INC.

MO

55.60

-0.02%

1.0K

AT&T Inc

T

34.07

-0.03%

3.2K

AMERICAN INTERNATIONAL GROUP

AIG

55.19

-0.05%

1.0K

3M Co

MMM

168.01

-0.07%

0.2K

Amazon.com Inc., NASDAQ

AMZN

383.40

-0.07%

4.6K

General Electric Co

GE

25.18

-0.12%

2.9K

Cisco Systems Inc

CSCO

29.57

-0.14%

15.0K

Verizon Communications Inc

VZ

48.90

-0.14%

0.3K

Merck & Co Inc

MRK

58.25

-0.17%

3.2K

JPMorgan Chase and Co

JPM

59.64

-0.27%

13.5K

Microsoft Corp

MSFT

43.70

-0.35%

1.7K

Citigroup Inc., NYSE

C

51.60

-0.35%

3.3K

Deere & Company, NYSE

DE

92.09

-0.37%

1.5K

Ford Motor Co.

F

16.34

-0.37%

37.2K

McDonald's Corp

MCD

93.80

-0.41%

0.6K

Caterpillar Inc

CAT

84.00

-0.52%

2.9K

United Technologies Corp

UTX

123.46

-0.52%

0.8K

Walt Disney Co

DIS

104.01

-0.52%

1.1K

Barrick Gold Corporation, NYSE

ABX

12.82

-0.54%

11.5K

Yahoo! Inc., NASDAQ

YHOO

43.85

-0.59%

3.5K

The Coca-Cola Co

KO

41.70

-0.64%

0.1K

Pfizer Inc

PFE

34.33

-0.67%

5.5K

ALCOA INC.

AA

15.68

-0.70%

17.7K

Tesla Motors, Inc., NASDAQ

TSLA

215.40

-0.79%

10.2K

FedEx Corporation, NYSE

FDX

177.02

-0.83%

0.1K

Exxon Mobil Corp

XOM

88.97

-1.06%

35.9K

Chevron Corp

CVX

107.30

-1.20%

5.7K

Goldman Sachs

GS

189.00

-1.31%

0.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.95

-1.55%

16.4K

Boeing Co

BA

155.40

-1.84%

40.6K

Yandex N.V., NASDAQ

YNDX

16.51

-2.94%

0.8K

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Boeing (BA) downgraded from Neutral to Sell at Goldman

Other:

Boeing (BA) target raised to $175 from $160 at Stifel

Intel (INTC) initiated at Outperform at Exane BNP Paribas, target $42

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 116.65-75 (USD 1.4bln) 118.00 (USD 481m) 119.50 (USD 608m) 120.00 (USD 1.25bln)

EURUSD 1.1150 (EUR 400m) 1.1250 (EUR 1.4bln) 1.1300 (EUR 654m) 1.1320 (EUR 1bln) 1.1335 (EUR 629m) 1.1350 (EUR 488m) 1.1450 (EUR 636m)

USDCAD 1.2400 (EUR 290m)

NZDUSD 0.7445 (NZD 803m)

-

14:03

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

02:00 New Zealand Credit Card Spending January +4.5% +6.2%

09:00 Germany IFO - Business Climate February 106.7 107.4 106.8

09:00 Germany IFO - Expectations February 102.0 103.0 102.5

09:00 Germany IFO - Current Assessment February 111.7 112.7 111.3

11:00 United Kingdom CBI retail sales volume balance February 39 42 1

The U.S. dollar traded mixed against the most major currencies ahead the U.S. existing home sales data. The existing home sales in the U.S. are expected to decrease to 5.03 million units in January from 5.04 million units in December.

The euro dropped against the U.S. dollar despite new bailout deal between Greece and the European Union. Greece and the European Union agreed on Friday to extend Greek bailout programme by four months.

German Ifo business climate index rose to 106.8 in February from 106.7 in January, missing expectations for a rise to 107.4.

The British pound traded lower against the U.S. dollar after the weaker-than-expected data from the U.K. The Confederation of British Industry released its monthly Distributive Trades survey on Monday. The CBI retail sales balance dropped to 1% in February from 39% in January, missing expectations for an increase to 42%. That was the lowest level since November 2013.

The drop was largely driven by lower supermarkets and department stores sales.

Sales expectations for March declined to 27% from 42% in February.

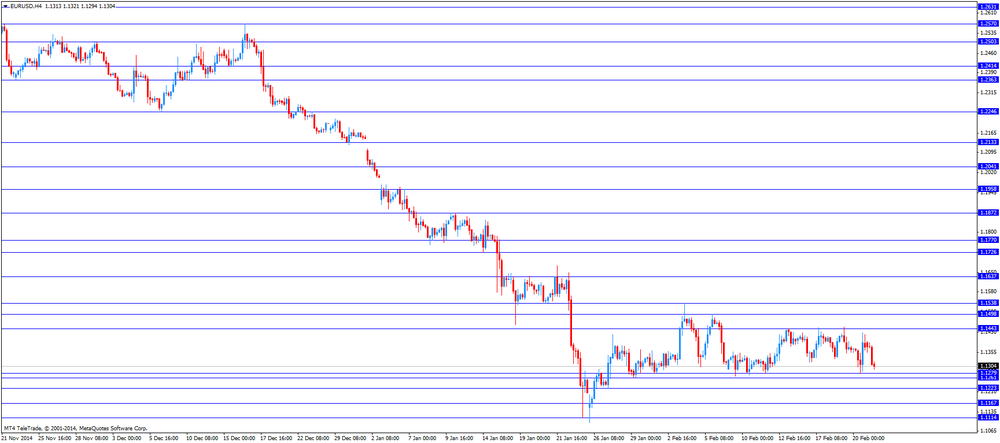

EUR/USD: the currency pair declined to 1.1294

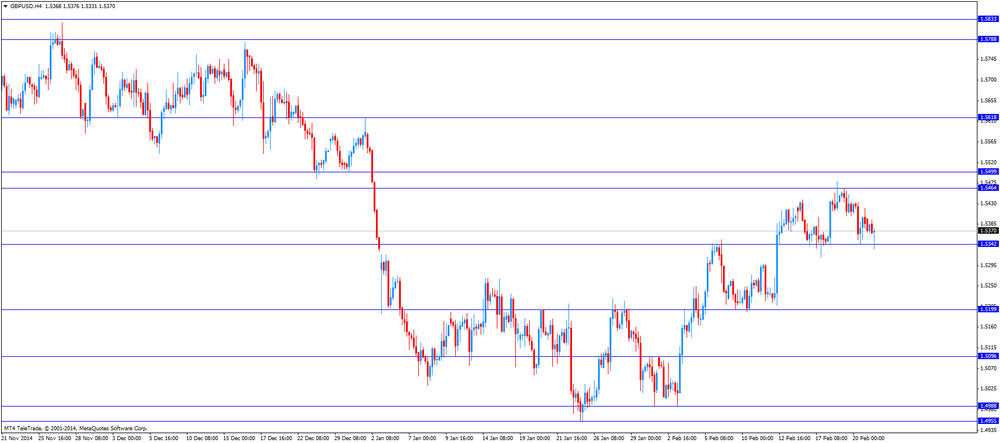

GBP/USD: the currency pair fell to $1.5331

USD/JPY: the currency pair rose to Y119.36

The most important news that are expected (GMT0):

15:00 U.S. Existing Home Sales January 5.04 5.03

-

13:10

U.K. Retail sales slump to an almost halt in growth

Today the Confederation of British Industry (CBI) published U.K's CBI Retail Sales Volume Balance with supermarkets and department stores reporting a massive slowdown in growth. The index slumped from a previous reading of 39 to 1 in February, missing expectations of a rise to 42. The reading far below estimates and the lowest reading since November 2013 is fuelling concerns over Britain's economy. The index value above zero implies sales growth, below means slowdown.

-

13:00

European stock markets mid-session: Indices mixed – FTSE down on Retail Sales, DAX and CAC40 up

European stocks shed some of its early gains on Friday's deal between Greece and the European Union after German business climate came in below estimates - but still better than in the previous month. Eurozone's finance ministers agreed on extending Greece's international bailout under the condition that Greece has to submit a list of policy measures four the four months to come on Monday. The measures planned will have to be approved by the E.U.

Today data on Germany's business climate came in at 10:00 GMT rising to a 7-month high easing concerns over the health of Eurozone's biggest economy. The IFO - Business Climate for February rose from 106.7 in the previous month to 106.8 points, below expectations of an increase to 107.4. The IFO-Expectations came I at 102.5 from previous 102 points. Analysts expected an increase to 103.0. The IFO Current Assessment came in at 111.3, declining from previous 111.7 points. Analyst expected a reading of 112.7 points.

U.K's CBI Retail Sales Volume Balance slumped from a previous reading of 39 to 1 in February, missing expectations of a rise to 42. A positive reading of the index indicates higher sales volume, a reading below represents lower sales.

The FTSE 100 index is currently trading -0.38% quoted at 6,888.97 points further declining on dissapointig CBI Retail Sales data. Germany's DAX 30 added +0.23% trading at 11,076.19 retreating from a new all-time high hit earlier in the session. France's CAC 40 is currently trading at 4,835.96 points, +0.10%.

-

12:20

Oil: Prices decline on concerns over U.S. stockpiles and oversupply

Oil prices declined in today's trading after rising earlier on worries about an U.S. oversupply and U.S. stockpiles at record highs leaving Crude trading back below USD60 and WTI slightly above USD50. Brent Crude lost -1.10%, currently trading at USD59.56 a barrel. On January 13th Crude hit a low at USD45.19 and began to rise on reports on declining rig numbers in the U.S. and capital expenditure cuts. West Texas Intermediate declined by -1.44% currently quoted at USD50.08.

Oil prices lost more than 50% between June and January before rebounding from lows. Worldwide supply still exceeds demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices. Smaller OPEC members want to cut production but the organisation, responsible for 40% of worldwide production focuses on its fight for market share. Rising U.S. stockpiles are contributing to a global glut that drove prices lower. The U.S., Brazil, Russia and the OPEC are producing at record levels.

-

12:00

United Kingdom: CBI retail sales volume balance, February 1 (forecast 42)

-

12:00

Gold prices back under USD1,200 threshold after Greek bailout extension

Gold declined today to 7-week lows, back below the USD1,200 threshold as Eurozone's finance ministers approved in a provisional deal the extension of Greece's bailout for four further months. Greece must submit a list with planned measures until today in order to secure the extension. Eurozone's finance ministers will then decide whether the proposed reforms are enough.

A stronger U.S. dollar and the prospect for higher U.S. rates weigh on the precious metal as the precious metal is dollar-denominated and not yield-bearing. On Tuesday all eyes will be on Federal Reserve Chair Janet Yellen who will speak in front of the Senate Banking Committee for further indication on when a possible interest rate may take place.

The precious metal is currently quoted at USD1,193.30, -0,72% a troy ounce. Gold fell 2.3% last week, a fourth straight loss. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:20

Option expiries for today's 10:00 ET NY cut

USDJPY 116.65-75 (USD 1.4bln) 118.00 (USD 481m) 119.50 (USD 608m) 120.00 (USD 1.25bln)

EURUSD 1.1150 (EUR 400m) 1.1250 (EUR 1.4bln) 1.1300 (EUR 654m) 1.1320 (EUR 1bln) 1.1335 (EUR 629m) 1.1350 (EUR 488m) 1.1450 (EUR 636m)

USDCAD 1.2400 (EUR 290m)

NZDUSD 0.7445 (NZD 803m)

-

10:50

German IFO business climate rose to 7-month high but below expectations

Today data on German business climate came in at 10:00 GMT. The index rose to a 7-month high easing concerns over the health of Eurozone's biggest economy although being below expectations for a stronger increase. The IFO-index is based on a survey conducted by a munich-based research institute polling 7,000 German firms in the manufacturing, construction, wholesale and retail sectors.

The IFO - Business Climate for February rose from 106.7 in the previous month to seasonally adjusted 106.8 points, below expectations of an increase to 107.4.

The IFO-Expectations, measuring business prospects came I at 102.5 from previous 102 points. Analysts expected an increase to 103.0.

The IFO Current Assessment came in at 111.3, declining from previous 111.7 points. Analyst expected a reading of 112.7 points.

-

10:20

Press Review: Greece readies reform promises

BLOOMBERG

Yellen Faces Congress Amid Direst Threat to Fed Since Dodd-Frank

(Bloomberg) -- Chair Janet Yellen testifies before Congress this week with the Federal Reserve facing its gravest political threat since the drafters of the Dodd-Frank act tried to strip it of its supervisory powers.

The Fed is being pressured from the left and the right. Senator Elizabeth Warren of Massachusetts and other Democrats have blasted the central bank for being too cozy with the banks it oversees. Republicans, including potential 2016 presidential contender Senator Rand Paul of Kentucky, have focused on its aggressive monetary policy.

Lawmakers from both parties are demanding greater transparency and accountability from an institution that has the power to impose capital requirements for banks and influence how much Americans pay for a mortgage or an auto loan.

REUTERS

Greece readies reform promises(Reuters) - Greece's government prepared reform measures on Sunday to secure a financial lifeline from the euro zone, but was attacked for selling "illusions" to voters after failing to keep a promise to extract the country from its international bailout.

Leftist Prime Minister Alexis Tsipras has insisted Greece achieved a negotiating success when euro zone finance ministers agreed to extend the bailout deal for four months, provided it came up with a list of reforms by Monday.

Greeks reacted with relief that Friday's deal averted a banking crisis which fellow euro zonemember Ireland said could have erupted in the coming week. This means Tsipras has stood by one promise at least: to keep the country in the euro zone.

Source: http://www.reuters.com/article/2015/02/22/us-eurozone-greece-idUSKBN0LO0O620150222

REUTERS

U.S. refinery strike affects one-fifth of national capacity

(Reuters) - The largest U.S. refinery strike in 35 years entered its fourth week on Sunday as workers at 12 refineries accounting for one-fifth of national production capacity were walking picket lines.

Sources familiar with the negotiations said talks may resume by mid-week to end the walkout by 6,550 members of the United Steelworkers union (USW) at 15 plants, including the 12 refineries.

Representatives of both sides said no date has been set to restart negotiations, however.

The strike comes as U.S. workers seek more pay in a strengthening economy. Wal-Mart Stores Inc has said its U.S. workers will get a raise to at least $9 an hour, while West Coast port workers have reached a tentative deal for a new contract after a months-long dispute.

Source: http://www.reuters.com/article/2015/02/23/us-refineries-labor-strike-idUSKBN0LP06420150223

-

10:05

European Stocks. First hour: Stocks add gains on Greek debt deal – DAX at new all-time high

European stocks added gains in early trading on Friday's deal between Greece and the European Union. Eurozone's finance ministers agreed on extending Greece's international bailout under the condition that Greece has to submit a list of policy measures four the four months to come on Monday. The measures planned will have to be approved by the E.U.

Today data on Germany's business climate came in at 10:00 GMT rising to a 7-month high easing concerns over the health of Eurozone's biggest economy. The IFO - Business Climate for February rose from 106.7 in the previous month to 106.8 points, below expectations of an increase to 107.4. The IFO-Expectations came I at 102.5 from previous 102 points. Analysts expected an increase to 103.0. The IFO Current Assessment came in at 111.3, declining from previous 111.7 points. Analyst expected a reading of 112.7 points.

The FTSE 100 index is currently trading -0.10% quoted at 6,908.63 points close to its all-time high at 6950.99. Markets await CBI Retail sales Volume Balance scheduled for 11:00 GMT. Germany's DAX 30 rose +0.77% trading at a new all-time high at 11,135.85. France's CAC 40 added +0.67%, currently trading at 4,863.25 points.

-

10:02

Germany: IFO - Current Assessment , February 111.3 (forecast 112.7)

-

10:02

Germany: IFO - Expectations , February 102.5 (forecast 103.0)

-

10:00

Germany: IFO - Business Climate, February 106.8 (forecast 107.4)

-

09:00

Global Stocks: Wall Street at all-time closing highs, Nikkei extending 15-year high on Greek deal

U.S. markets hit all-time highs reversing early losses on Greek bailout hopes as on late Friday Eurozone finance ministers and Greece agreed on a draft extending the countries international bailout for additional four months. Today Greece must submit a list with planned measures and the EU will judged whether the list is sufficient or not.

The DOW JONES index added +0.86% closing above the psychologically important threshold of 18,000 points at 18,140.44 points. The S&P 500 closed +0.61% with a final quote of 2,110.30 extending a record high hit Wednesday last week.

Chinese markets are closed today for a public holiday as the Lunar New year celebrations take place.

Japanese markets rose for a third day and closed at a fresh 15-year high in today's trading on the Greek debt deal to extend its bailout for further four months. Financials were amongst the losers as investors took profits after recent gains. The index rose despite some members of the BoJ questioned the massive pace of the quantitative easing program and said that the program might have to stop before reaching the 2% inflation target. The Nikkei added 134 points, closing +0.73% with a final quote of 18,466.92 points - the highest level since 2000.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded stronger against most major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Bank holiday

02:00 New Zealand Credit Card Spending January +4.5% +6.2%

The U.S. dollar traded higher against its major peers with exception of the Japanese yen. On Friday d better-than-expected data on the U.S. preliminary manufacturing purchasing managers' index supported the greenback. The index rose to 54.3 in February from 53.9 in January, beating expectations for a decline to 53.7.

On Friday a deal between Eurozone's finance ministers and Greece was reached to extend aid for Greece for four months under conditions. Today Greece must submit a list with planned measures and the EU will judged whether the list is sufficient or not.

On Tuesday all eyes will be on Federal Reserve Chair Janet Yellen who will speak in front of the Senate Banking Committee for an indication on when a possible interest rate may take place.

The Australian dollar lost against the dollar on Monday with no important data in the region published. Worries about low commodity prices weigh on the currency.

New Zealand's dollar declined against the greenback. Credit Card Spending for January came in at +6.2% compared to an increase of +4.5% in the previous month.

The Japanese yen traded slightly higher against the greenback on Monday after minutes of the January policy meeting of the Bank of Japans showed that some members of the board questioned the extension of the massive quantitative easing program started in October this year and that the QE may need to stop before reaching the 2% inflation target, although it was technically feasible to continue.

Chinese markets remained closed for a public holiday.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar traded moderately lower against the yen

GPB/USD: Sterling traded lower against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Germany IFO - Business Climate February 106.7 107.4

09:00 Germany IFO - Current Assessment February 102.0 103.0

09:00 Germany IFO - Expectations February 111.7 112.7

11:00 United Kingdom CBI retail sales volume balance February 39 42

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Existing Home Sales January 5.04 5.03

-

07:59

Options levels on monday, February 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1514 (3000)

$1.1476 (1945)

$1.1449 (699)

Price at time of writing this review: $1.1376

Support levels (open interest**, contracts):

$1.1331 (3577)

$1.1285 (5152)

$1.1223 (4741)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 106523 contracts, with the maximum number of contracts with strike price $1,1500 (6051);

- Overall open interest on the PUT options with the expiration date March, 6 is 116684 contracts, with the maximum number of contracts with strike price $1,1200 (5424);

- The ratio of PUT/CALL was 1.10 versus 1.05 from the previous trading day according to data from February, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (1160)

$1.5603 (2320)

$1.5505 (3064)

Price at time of writing this review: $1.5388

Support levels (open interest**, contracts):

$1.5294 (2088)

$1.5197 (2097)

$1.5098 (1644)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 30078 contracts, with the maximum number of contracts with strike price $1,5500 (3064);

- Overall open interest on the PUT options with the expiration date March, 6 is 34474 contracts, with the maximum number of contracts with strike price $1,5200 (2097);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from February, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:01

New Zealand: Credit Card Spending, January +6.2%

-

02:38

Nikkei 225 18,503.76 +171.46 +0.94 %, Topix 1,509.1 +8.77 +0.58 %

-

00:31

Commodities. Daily history for Feb 20’2015:

(raw materials / closing price /% change)

Oil 50.81 -1.97%

Gold 1,203.40 -0.12%

-

00:30

Stocks. Daily history for Feb 20’2015:

(index / closing price / change items /% change)

Nikkei 225 18,332.3 +67.51 +0.37 %

Topix 1,500.33 +5.40 +0.36 %

FTSE 100 6,915.2 +26.30 +0.38 %

CAC 40 4,830.9 -2.38 -0.05 %

Xetra DAX 11,050.64 +48.70 +0.44 %

S&P 500 2,110.3 +12.85 +0.61 %

NASDAQ Composite 4,955.97 +31.27 +0.63 %

Dow Jones 18,140.44 +154.67 +0.86 %

-

00:29

Currencies. Daily history for Feb 20’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1376 +0,18%

GBP/USD $1,5387 -0,17%

USD/CHF Chf0,9405 -0,94%

USD/JPY Y119,06 +0,10%

EUR/JPY Y135,44 +0,18%

GBP/JPY Y183,19 -0,06%

AUD/USD $0,7841 +0,65%

NZD/USD $0,7524 +0,12%

USD/CAD C$1,2543 +0,39%

-

00:00

Schedule for today, Monday, Feb 23’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

02:00 New Zealand Credit Card Spending January +4.5%

09:00 Germany IFO - Business Climate February 106.7 107.4

09:00 Germany IFO - Current Assessment February 102.0 103.0

09:00 Germany IFO - Expectations February 111.7 112.7

11:00 United Kingdom CBI retail sales volume balance February 39 42

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Existing Home Sales January 5.04 5.03

-