Noticias del mercado

-

23:59

Schedule for today, Wednesday, Mar 25’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Financial Stability Review

07:00 Switzerland UBS Consumption Indicator February 1.24

09:00 Germany IFO - Business Climate March 106.8 107.4

09:00 Germany IFO - Current Assessment March 111.3

09:00 Germany IFO - Expectations March 102.5

09:30 United Kingdom BBA Mortgage Approvals February 36.4 36.9

10:30 U.S. FOMC Member Charles Evans Speaks

12:30 U.S. Durable Goods Orders February +2.8% +0.2%

12:30 U.S. Durable Goods Orders ex Transportation February 0.0% Revised From +0.3% +0.4% 14:00 Switzerland SNB Quarterly Bulletin Quarter I

14:30 U.S. Crude Oil Inventories March +9.6

19:45 Canada Gov Council Member Lane Speaks

-

20:00

Dow -0.46% 18,033.52 -82.52 Nasdaq -0.14% 5,003.99 -6.98 S&P -0.42% 2,095.65 -8.77

-

18:05

European stocks close: most stocks closed higher on mostly better-than-expected PMIs from the Eurozone

Most stock indices closed higher on mostly better-than-expected PMIs from the Eurozone. Eurozone's preliminary manufacturing PMI increased to 51.9 in March from 51.0 in February, exceeding expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 54.3 in March from 53.7 in February. Analysts had expected the index to climb to 53.9.

Germany's preliminary manufacturing PMI climbed to 52.4 in March from 51.1 in February, beating forecasts of an increase to 51.5.

Germany's preliminary services PMI increased to 55.3 in March from 54.7 in February, beating expectations for a gain to 55.0.

France's preliminary manufacturing PMI was up to 48.2 in March from 47.6 in February, missing forecasts of a rise to 48.9.

France's preliminary services PMI fell to 52.8 in March from 53.4 in February, missing expectations for a decline to 53.1.

The U.K. consumer price index declined to zero in February from 0.3% in January, missing expectations for a fall to 0.1%. That was the lowest level since 1989.

The drop was driven by lower prices for food and computer goods.

U.K. consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.2% in February from 1.4% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,019.68 -17.99 -0.26 %

DAX 12,005.69 +109.85 +0.92 %

CAC 40 5,088.28 +33.76 +0.67 %

-

18:00

European stocks closed: FTSE 100 7,019.68 -17.99 -0.26% CAC 40 5,088.28 +33.76 +0.67% DAX 12,005.69 +109.85 +0.92%

-

17:40

Oil: а review of the market situation

Prices for Brent crude oil fell slightly, due to the strengthening of the US dollar as well as concerns about the global oversupply. Meanwhile, the decline in the price of WTI crude oil is constrained by strong economic data in the USA.

Falling prices also associated with poor statistics on China. As it became known, in March manufacturing activity in China fell to 11-month low, as new orders declined. This suggests a weakening of the second largest economy in the world, which is likely to require easing to support growth. PMI PMI for the manufacturing of China from HSBC fell to 49.2 in March, which is below the mark of 50 points separating the increase in activity from the recession. Economists had forecast that the figure will be 50.5, that is, will be slightly weaker than in February, when the final PMI index was 50.7.

In addition, the pressure on the oil market continues to provide the words oil minister of Saudi Arabia, Ali al-Naimi that the country will produce 10 million barrels per day.

Market participants are also waiting for the publication of a report on energy reserves in the US last week. According to experts, the volume of oil reserves increased at the end of the 11th week in a row - to 4.75 million barrels. US crude stocks the previous week reached 458.5 million barrels - the maximum since the beginning of tracking this data by the Ministry of Energy in August 1982. "The market is starting to focus on data about the availability of facilities for the storage of oil, - analyst CMC Markets Michael McCarthy. - It is believed that the reduction in storage capacity over time takes its toll on production volumes."

"It is not yet started the summer driving season in the United States, the demand for fuel is reduced, and reserves in the country are growing," - said a senior analyst at Price Futures Group Phil Flynn.

May futures for US light crude oil WTI (Light Sweet Crude Oil) dropped to 47.35 dollars per barrel on the New York Mercantile Exchange.

May futures price for North Sea Brent crude oil mix fell 41 cents to 55.31 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:35

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data. New home sales climbed 7.8% to a seasonally adjusted annual rate of 539,000 units in February from 500,000 units in January. It was the highest level since February 2008. January's figure was revised up from 481,000 units. Analysts had expected new home sales to reach 472,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast rose 152.9% in February, after a 45.2% decline in January.

The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 55.3 in March from 55.1 in February, beating expectations for a decline to 54.9. It was the highest level since October 2014.

The U.S. consumer price inflation rose 0.2% in February, in line with expectations, after a 0.7% decline in January.

The increase was driven by higher gasoline prices. Gasoline prices rose for the first time since June 2014.

On a yearly basis, the U.S. consumer price index climbed to zero in February from -0.1% in January. Analysts had expected the index to remain unchanged at -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in February, exceeding expectations for a 0.1% increase, after a 0.2% rise in January.

On a yearly basis, the U.S. consumer price index excluding food and energy climbed to 1.7% in February from 1.6% in January. Analysts had expected the index to remain unchanged at 1.6%.

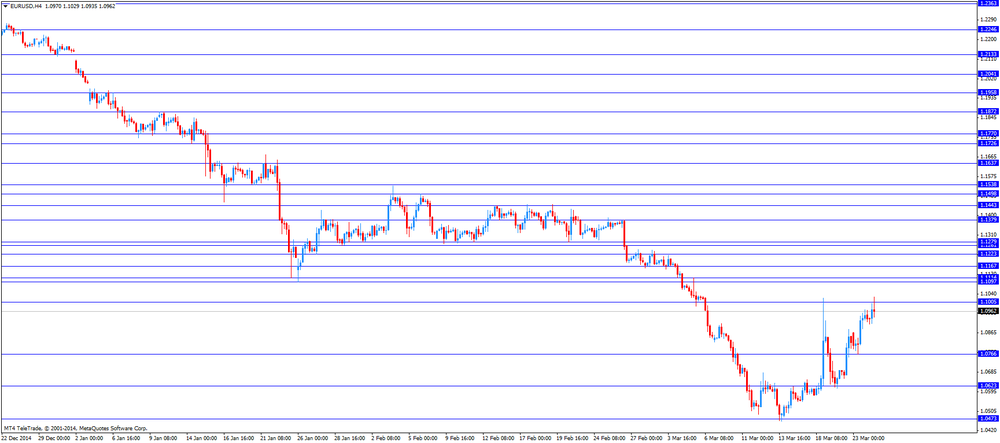

The euro declined against the U.S. dollar. Eurozone's preliminary manufacturing PMI increased to 51.9 in March from 51.0 in February, exceeding expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 54.3 in March from 53.7 in February. Analysts had expected the index to climb to 53.9.

Germany's preliminary manufacturing PMI climbed to 52.4 in March from 51.1 in February, beating forecasts of an increase to 51.5.

Germany's preliminary services PMI increased to 55.3 in March from 54.7 in February, beating expectations for a gain to 55.0.

France's preliminary manufacturing PMI was up to 48.2 in March from 47.6 in February, missing forecasts of a rise to 48.9.

France's preliminary services PMI fell to 52.8 in March from 53.4 in February, missing expectations for a decline to 53.1.

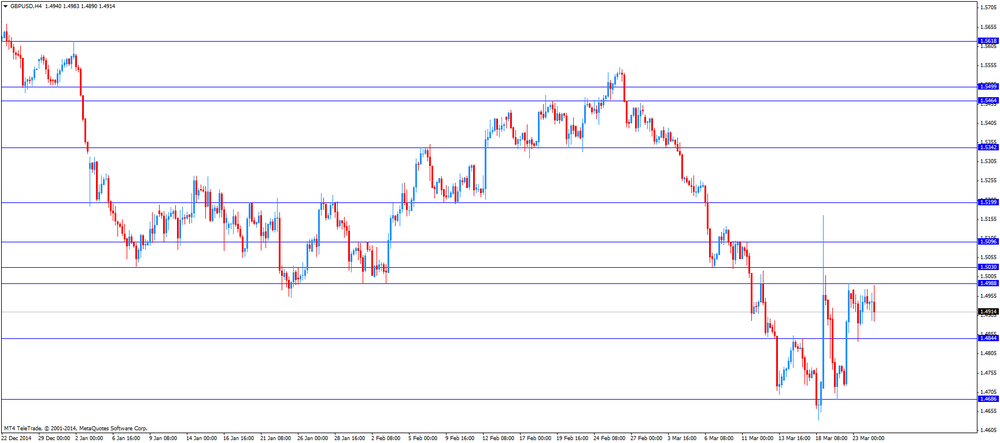

The British pound fell against the U.S. dollar. The U.K. consumer price index declined to zero in February from 0.3% in January, missing expectations for a fall to 0.1%. That was the lowest level since 1989.

The drop was driven by lower prices for food and computer goods.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.2% in February from 1.4% the month before.

The Retail Prices Index declined to 1.0% in February from 1.1% in January, beating forecasts of a decrease to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback in the absence of any major economic reports from New Zealand.

The weaker-than-expected preliminary Chinese HSBC Purchasing Managers' Index (PMI) weighed on the kiwi. The index declined to 49.2 in March from a final reading of 50.7 in February. It was the lowest level since April 2014. The decline was driven by lower new orders.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The weaker-than-expected preliminary Chinese HSBC Purchasing Managers' Index (PMI) weighed on the Aussie.

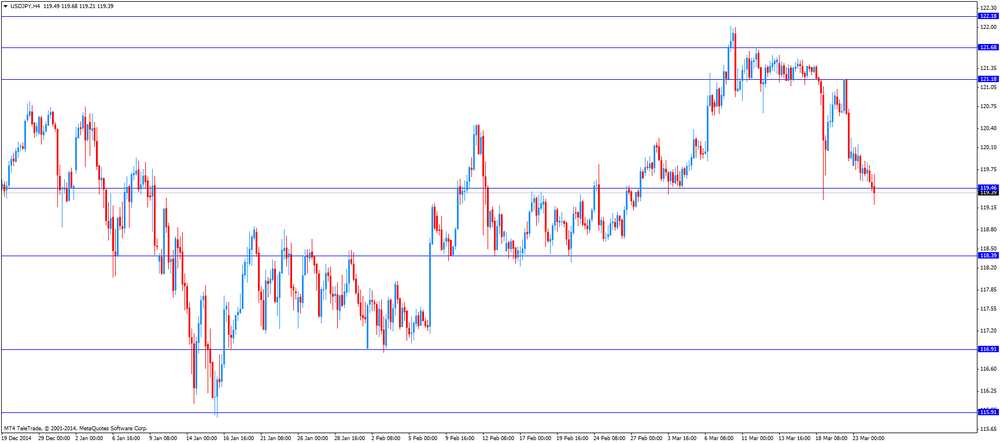

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after comments by the Bank of Japan (BoJ) Governor Haruhiko Kuroda. He said on Tuesday that he held talks with Prime Minister Shinzo Abe on Monday. Kuroda told Abe that the country's economy continues to recover moderately, and that inflation will increase.

Kuroda said to Abe that inflation is slowing due to falling oil prices but there is no change in the long-term rising trend.

The BoJ governor also said on Tuesday that tapering asset purchases is one option to end quantitative easing.

-

17:22

Gold: а review of the market situation

Gold prices retreated from a session high, and returned to the levels of the opening, which is associated with the strengthening of the dollar in response to strong US statistics.

The US currency showed mixed trends against the euro and the yen. As a result, gold briefly reached its highest level since March 6, 2015 - $ 1,194.5. "The dollar remains the main factor that affects the price of gold. Traders will closely follow the comments by the Fed to get hints about the timing of rate increases," - said the expert Naeem Aslam AvaTrade.

Today the head of the Federal Reserve Bank of St. Louis James Bullard said that zero interest rates are no longer suited the US economy, given the decline in the unemployment rate and the prospect of enhanced economic growth. Bullard said he expects the economic recovery in the 2nd quarter after a weak start to the year, as lower gasoline prices have supported consumer spending. He added that an early rate hike will help ensure that future Fed does not collide with the need to improve their faster to limit inflation. "If we do not begin to normalize policy now, two years later, we are very far behind," - he said.

At the same time on Monday, Deputy Chairman of the US Federal Reserve, Stanley Fischer, said that the rate may be increased in case of further improvement in the labor market, as well as sufficient confidence in the Fed that inflation will approach the target of 2%.

As for today's statistics, the Labor Department said that consumer prices in the US have resumed a modest rise last month after declining most of the winter, but core inflation remains weak against the backdrop of sluggish economic growth. The consumer price index, which reflects the fact that Americans pay for everything from food to medical care, increased a seasonally adjusted 0.2% in February compared with a month earlier. It was the first increase since October and the largest increase since June. With the exception of volatile food prices and energy prices, core prices also rose by 0.2%. Economists had expected growth of 0.2% of the total price and the increase in core prices by 0.1%.

Meanwhile, another report showed that new home sales rose to the highest level in the last seven years in February, becoming a sign of high demand, which can help improve the broader housing market in the United States. Sales of newly built, single-family homes rose by 7.8% compared to the previous month and reached a seasonally adjusted annual rate of 539,000, the Commerce Department said. This is the highest level since February 2008. Economists had expected sales to fall to 472 000. The figures for the previous month was revised up to 500,000 from the level of the initial value of 481 000. The sales are not recorded above $ 500,000, since the spring of 2008.

May futures for gold on the COMEX today rose by $ 1.3 - up to 1189.30 dollars per ounce.

-

17:07

St. Louis Federal Reserve Bank President James Bullard: zero percent interest rate in the U.S. is no longer appropriate

The St. Louis Federal Reserve Bank President James Bullard said in London on Tuesday that zero percent interest rate in the U.S. is no longer appropriate. He added that the U.S. economy will remain "extremely accommodative" even if the Fed will start to raise slowly its interest rate in the summer.

The St. Louis Federal Reserve Bank president expects that the U.S. economy will recover in the second quarter.

Bullard isn't currently a voting member of the Federal Open Market Committee.

-

16:54

Bank of Japan Governor Haruhiko Kuroda said to Prime Minister Shinzo Abe that Japan’s inflation is slowing due to falling oil prices but there is no change in the long-term rising trend

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Tuesday that he held talks with Prime Minister Shinzo Abe on Monday. He told Abe that the country's economy continues to recover moderately, and that inflation will increase.

Kuroda said to Abe that inflation is slowing due to falling oil prices but there is no change in the long-term rising trend.

The BoJ governor also said on Tuesday that tapering asset purchases is one option to end quantitative easing.

-

16:07

U.S. preliminary manufacturing purchasing managers' index (PMI) rises to 55.3 in March

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 55.3 in March from 55.1 in February, beating expectations for a decline to 54.9. It was the highest level since October 2014.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that "manufacturing regained further momentum from the slowdown".

The preliminary output index increased to 58.2 in March from 57.3 in February.

The preliminary new orders index rose to 56.4 in March from 55.8 in February.

-

15:57

New home sales rises 7.8% in February, the highest level since February 2008

The U.S. Commerce Department released new home sales data on Tuesday. New home sales climbed 7.8% to a seasonally adjusted annual rate of 539,000 units in February from 500,000 units in January. It was the highest level since February 2008.

January's figure was revised up from 481,000 units.

Analysts had expected new home sales to reach 472,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast rose 152.9% in February, after a 45.2% decline in January.

The median sales price of new houses sold was $275,500 in February, down from $289,400 in January.

-

15:28

Japan’s Cabinet Office upgraded its assessment of the economy for the first time in eight months

The Japanese Cabinet Office upgraded its assessment of the economy on Monday as business climate improved. It was the first time in eight months.

The government said that Japan's economy recovers moderately. The economy is expected to recover, supported by falling oil prices and stimulus measures, while "employment and income situation show a trend toward improvement", the Cabinet Office said.

Japan's government noted that a slowdown in overseas economies is a downside risk of the Japanese economy.

-

15:03

European Central Bank Governing Council member Christian Noyer: the ECB can provide more liquidity assistance to Greek banks if they will not use it to finance the country’s government

The European Central Bank (ECB) Governing Council member Christian Noyer said on Monday that the central bank can provide more liquidity assistance to Greek banks if they will not use it to finance the country's government. He warned that Greece must turn to capital controls only as a "last resort". Noyer added that the Greek government should restore confidence among the corporates and the households.

-

15:00

Belgium: Business Climate, March -6.3 (forecast -7.5)

-

15:00

U.S.: Richmond Fed Manufacturing Index, March -8 (forecast 2)

-

15:00

U.S.: New Home Sales, February 539 (forecast 472)

-

14:57

Preliminary HSBC Purchasing Managers' Index declined to 49.2 in March, the lowest level since April 2014

China's factory activity dropped in March. The preliminary HSBC Purchasing Managers' Index (PMI) declined to 49.2 in March from a final reading of 50.7 in February. It was the lowest level since April 2014. The decline was driven by lower new orders.

Analysts had expected the index to decline to 50.5.

A reading below 50 indicates a contraction of the activity.

These figures could mean that the government might implement further stimulus measures.

-

14:45

U.S.: Manufacturing PMI, March 55.3 (forecast 54.9)

-

14:33

U.S. consumer price inflation rises 0.2% in February

The U.S. Labor Department released consumer price inflation data on Tuesday. The U.S. consumer price inflation rose 0.2% in February, in line with expectations, after a 0.7% decline in January.

The increase was driven by higher gasoline prices. Gasoline prices rose 2.4% in February, for the first time since June 2014. It was the largest rise since December 2013.

Food prices climbed 0.2% in February, shelter expenses rose 0.2%, while apparel prices increased 0.3%.

On a yearly basis, the U.S. consumer price index climbed to zero in February from -0.1% in January. Analysts had expected the index to remain unchanged at -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in February, exceeding expectations for a 0.1% increase, after a 0.2% rise in January.

On a yearly basis, the U.S. consumer price index excluding food and energy climbed to 1.7% in February from 1.6% in January. Analysts had expected the index to remain unchanged at 1.6%.

The Fed noted last week that it would hike interest rate when it is "reasonably confident" that low inflation is on track to return to its 2% target and as long as the labour market keeps strengthening.

-

14:33

U.S. Stocks open: Dow -0.08%, Nasdaq +0.06%, S&P -0.04%

-

14:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0850 (E946M), 1.0900 (E1BLN), 1.0950 (E1.6BLN)

USD/CHF: 0.9810 ($210M), 0.9900 ($150M)

EUR/CHF: 1.0800 (E100M)

EUR/GBP: 0.7225 (E1.2BLN)

USD/CAD: C$1.2610-15 ($700M)

USD/JPY: Y119.00 ($300M), Y120.00 ($369M), Y120.15-20 ($380M), Y121.00-10 ($1.5BLN), Y121.50 ($1.65BLN)

-

14:28

Before the bell: S&P futures +0.10%, NASDAQ futures +0.11%

U.S. stock-index futures fluctuated as investors weighed stronger-than-forecast gains in consumer prices for clues on when the Federal Reserve will raise interest rates.

Global markets:

Nikkei 19,713.45 -40.91 -0.21%

Hang Seng 24,399.6 -94.91 -0.39%

Shanghai Composite 3,691.95 +4.22 +0.11%

FTSE 7,046.37 +8.70 +0.12%

CAC 5,066.25 +11.73 +0.23%

DAX 11,898.95 +3.11 +0.03%

Crude oil $48.23 (+1.64%)

Gold $1191.70 (+0.33%)

-

14:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

General Motors Company, NYSE

GM

38.60

+0.03%

3.2K

AT&T Inc

T

33.30

+0.06%

10.7K

Cisco Systems Inc

CSCO

28.43

+0.09%

15.3K

McDonald's Corp

MCD

98.72

+0.10%

0.2K

Yahoo! Inc., NASDAQ

YHOO

44.76

+0.10%

0.5K

Wal-Mart Stores Inc

WMT

83.40

+0.11%

0.6K

Microsoft Corp

MSFT

42.91

+0.13%

0.4K

Pfizer Inc

PFE

35.10

+0.14%

2.2K

Citigroup Inc., NYSE

C

52.56

+0.15%

3.9K

Procter & Gamble Co

PG

85.00

+0.16%

0.2K

The Coca-Cola Co

KO

40.69

+0.17%

0.4K

Apple Inc.

AAPL

127.42

+0.17%

131.7K

Walt Disney Co

DIS

108.41

+0.18%

2.2K

Ford Motor Co.

F

16.60

+0.18%

13.5K

Visa

V

67.22

+0.21%

72.7K

Google Inc.

GOOG

560.00

+0.21%

0.2K

JPMorgan Chase and Co

JPM

61.28

+0.23%

2.4K

Intel Corp

INTC

31.28

+0.26%

0.9K

Johnson & Johnson

JNJ

103.25

+0.26%

2.1K

Home Depot Inc

HD

116.40

+0.28%

0.1K

Boeing Co

BA

153.25

+0.29%

1K

Chevron Corp

CVX

106.25

+0.31%

3.5K

American Express Co

AXP

82.49

+0.35%

6.8K

Facebook, Inc.

FB

84.73

+0.36%

147.1K

Exxon Mobil Corp

XOM

85.79

+0.42%

5.4K

Tesla Motors, Inc., NASDAQ

TSLA

201.00

+0.69%

22.4K

Twitter, Inc., NYSE

TWTR

48.85

+0.80%

40.1K

Barrick Gold Corporation, NYSE

ABX

11.50

+0.88%

21.2K

Merck & Co Inc

MRK

59.68

+1.62%

0.6K

Yandex N.V., NASDAQ

YNDX

15.09

+2.37%

24.3K

Amazon.com Inc., NASDAQ

AMZN

375.10

-0.00%

2.3K

Verizon Communications Inc

VZ

49.61

-0.06%

1.3K

General Electric Co

GE

25.45

-0.08%

4.5K

Caterpillar Inc

CAT

81.00

-0.11%

3.2K

Nike

NKE

101.35

-0.11%

3.0K

E. I. du Pont de Nemours and Co

DD

74.02

-0.54%

0.4K

ALCOA INC.

AA

12.93

-0.54%

39.8K

-

14:08

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the mostly better-than-expected PMIs from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:15 U.S. FOMC Member Williams Speaks

01:35 Japan Manufacturing PMI (Preliminary) March 51.6 52.1 50.4

01:45 China HSBC Manufacturing PMI (Preliminary) March 50.7 50.5 49.2

04:50 Australia RBA Assist Gov Edey Speaks

08:00 France Manufacturing PMI (Preliminary) March 47.6 48.9 48.2

08:00 France Services PMI (Preliminary) March 53.4 53.1 52.8

08:30 Germany Manufacturing PMI (Preliminary) March 51.1 51.5 52.4

08:30 Germany Services PMI (Preliminary) March 54.7 55.0 55.3

09:00 Eurozone Manufacturing PMI (Preliminary) March 51.0 51.6 51.9

09:00 Eurozone Services PMI (Preliminary) March 53.7 53.9 54.3

09:30 United Kingdom Producer Price Index - Input (MoM) February -3.6% Revised From -3.7% +1.6% +0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) February -14.1% Revised From -14.2% -13.5%

09:30 United Kingdom Producer Price Index - Output (MoM) February -0.4% Revised From -0.5% -0.1% +0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) February +0.5% -1.8%

09:30 United Kingdom Retail Price Index, m/m February -0.8% +0.5%

09:30 United Kingdom Retail prices, Y/Y February +1.1% +0.9% +1.0%

09:30 United Kingdom RPI-X, Y/Y February +1.2% +1.0%

09:30 United Kingdom HICP, m/m February -0.9% +0.3%

09:30 United Kingdom HICP, Y/Y February +0.3% +0.1% 0.0%

09:30 United Kingdom HICP ex EFAT, Y/Y February +1.4% +1.3% +1.2%

12:30 U.S. CPI, m/m February -0.7% +0.2% +0.2%

12:30 U.S. CPI, Y/Y February -0.1% -0.1% 0.0%

12:30 U.S. CPI excluding food and energy, m/m February +0.2% +0.1% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y February +1.6% +1.6% +1.7%

13:00 U.S. Housing Price Index, m/m January +0.7% Revised From +0.8% +0.3%

13:00 U.S. Housing Price Index, y/y January +5.4% +5.1%

The U.S. dollar traded mixed to lower against the most major currencies after the mixed U.S. consumer inflation data and ahead of the preliminary U.S. manufacturing PMI and new home sales data. The U.S. consumer price inflation rose 0.2% in February, in line with expectations, after a 0.7% decline in January.

The increase was driven by higher gasoline prices. Gasoline prices rose for the first time since June 2014.

On a yearly basis, the U.S. consumer price index climbed to zero in February from -0.1% in January. Analysts had expected the index to remain unchanged at -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in February, exceeding expectations for a 0.1% increase, after a 0.2% rise in January.

On a yearly basis, the U.S. consumer price index excluding food and energy climbed to 1.7% in February from 1.6% in January. Analysts had expected the index to remain unchanged at 1.6%.

The U.S. preliminary manufacturing PMI is expected to decrease to 54.9 in March from 55.1 in February.

New home sales in the U.S. are expected to decline to 472,000 units in February from 481,000 units in January.

The euro traded higher against the U.S. dollar after the mostly better-than-expected PMIs from the Eurozone. Eurozone's preliminary manufacturing PMI increased to 51.9 in March from 51.0 in February, exceeding expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 54.3 in March from 53.7 in February. Analysts had expected the index to climb to 53.9.

Germany's preliminary manufacturing PMI climbed to 52.4 in March from 51.1 in February, beating forecasts of an increase to 51.5.

Germany's preliminary services PMI increased to 55.3 in March from 54.7 in February, beating expectations for a gain to 55.0.

France's preliminary manufacturing PMI was up to 48.2 in March from 47.6 in February, missing forecasts of a rise to 48.9.

France's preliminary services PMI fell to 52.8 in March from 53.4 in February, missing expectations for a decline to 53.1.

The British pound traded mixed against the U.S. dollar despite the weaker-than-expected consumer price inflation data from the U.K. The U.K. consumer price index declined to zero in February from 0.3% in January, missing expectations for a fall to 0.1%. That was the lowest level since 1989.

The drop was driven by lower prices for food and computer goods.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.2% in February from 1.4% the month before.

The Retail Prices Index declined to 1.0% in February from 1.1% in January, beating forecasts of a decrease to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

EUR/USD: the currency pair rose to $1.1029

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair fell to Y119.21

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Preliminary) March 55.1 54.9

14:00 U.S. New Home Sales February 481 472

21:45 New Zealand Trade Balance, mln February 56 355

-

14:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

NIKE (NKE) reiterated at Buy at Argus, target raised from $110 to $116

Boeing (BA) reiterated at Buy Jefferies, target raised from $165 to $185

-

14:02

U.S.: Housing Price Index, y/y, January +5.1%

-

14:01

U.S.: Housing Price Index, m/m, January +0.3%

-

13:45

Orders

EUR/USD

Offers 1.1000-10 1.1030 1.1050 1.1065 1.1080 1.1100

Bids 1.0960 1.0940 1.0925 1.0900 1.0880 1.0860 1.0825.30 1.0800

GBP/USD

Offers 1.4975 1.5000 1.5020-25 1.5040 1.5065 1.5080 1.5100

Bids 1.4920-25 1.4900 1.4885 1.4860 1.4840 1.4825 1.4800 1.4780 1.4760

EUR/JPY

Offers 131.50 131.80 132.00 132.30 132.50

Bids 130.80 130.50 130.00 129.80 129.40 129.00

USD/JPY

Offers 119.65 119.80 120.00 120.20-25 120.50 120.80 121.00

Bids 119.30 119.00 118.80 118.60 118.30 118.00

EUR/GBP

Offers 0.7350-60 0.7375 0.7400 0.7420 0.7440-45 0.7480

Bids 0.7320 0.7300 0.7285 0.7265 0.7250

AUD/USD

Offers 0.7900 0.7930-35 0.7950 0.7980 0.8000

Bids 0.7850 0.7825 0.7800 0.7780-85 0.7750 0.7725 0.7700

-

13:30

U.S.: CPI, m/m , February +0.2% (forecast +0.2%)

-

13:30

U.S.: CPI excluding food and energy, m/m, February +0.2% (forecast +0.1%)

-

13:30

U.S.: CPI, Y/Y, February 0.0% (forecast -0.1%)

-

13:30

U.S.: CPI excluding food and energy, Y/Y, February +1.7% (forecast +1.6%)

-

13:21

Federal Reserve Bank of San Francisco President John Williams: the Fed should start to discuss about hiking interest rate by mid-year

The Federal Reserve Bank of San Francisco President John Williams said in Sidney on Tuesday that the Fed should start to discuss about hiking interest rate by mid-year. He added that the Fed should raise its interest rate "gradually over the next couple of years to more normal levels". Williams expects full employment by the end of the year and the U.S. economic growth to reach 2.5%. He downgraded his GDP growth from a previous estimate of just below 3%.

-

13:00

European stock markets mid-session: Indices cannot hold onto early gains despite solid PMI data

Despite solid PMI data showing that the Eurozone is on track to recover European indices shed early gains in today's trading. The data suggests that low energy prices combined with a weaker euro and the quantitative easing started by the ECB this month already have a positive impact on the economic development. Greece's future in the Eurozone and reform plans as condition of a further bailout remain in the focus.

At 12:30 GMT U.S. data on inflation will be in investors focus as inflation was named as one of the factors considered by the FED on when to hike benchmark interest rates.

The French Manufacturing PMI for March rose from a previous reading of 47.6 to 48.2 but remained below estimates of an increase to 48.9 - and below the 50 mark that separates growth from contraction. The Services PMI declined from 53.4 to 52.8 not meeting expectations of a decrease to 53.1. The data not only shows a divergence between the service and manufacturing sector but also with Germany, Eurozone's powerhouse and largest economy.

German data came in better-than-expected with the Manufacturing PMI at 52.4, above estimates for an increase to 51.5 and a previous reading of 51.1. The Manufacturing activity rose to the highest level in eight months. The German Services PMI rose from 54.7 to 55.3 beating estimates of an increase to 55.0. German PMI data is a solid sign of the economic recovery.

Eurozone data came in better-than-expected with the Manufacturing PMI at 51.9, above estimates for an increase to 51.6 and a previous reading of 51.0. The Manufacturing activity rose to the highest level in ten months. The German Services PMI rose from 53.7 to 54.3 beating estimates of an increase to 53.9 - a new 46-month high.

Eurozone's recovery is gaining momentum.

The Producer Price index Input rose less-than-expected in February, according to the National statistics bureau. The Index rose +0.2%, a positive reading for the first time in nine months, but far below estimates of an increase of +1.6%. Last month's reading was revised up -3.6% from previous -3.7%.

The Producer Price index Output rose +0.2%, beating estimates of a decline by -0.1% after falling -0.4% in January.

Retail Prices rose +0.5% in February compared to a decline of -0.8% in January.

The HICP, that monitors retail price changes for goods and services included into the consumer goods basket, rose +0.3% month on month but declined year on year to 0.0% - according to constructed historical data the lowest since 1960, said the Office of National Statistics. Analysts expected a decline to +0.1%. Food, non-alcoholic drinks, furniture, computers and household equipment had the largest effect on the reading.

The HICP ex EFAT, excluding the volatile costs of food and energy, measuring core inflation rose +1.2% year on year compared to a previous reading of +1.4% and below the estimated +1.3%.

The FTSE 100 index is currently trading higher, quoted at 7,043.89 +0.09%. Germany's DAX 30 lost -0.05% trading at 11,890.46 points. France's CAC 40 is currently trading at 5,062.74 points, +0.16%.

-

12:20

Oil: prices reverse early losses after Chinese PMI on upbeat Eurozone PMI data

Oil is trading higher today, reversing early losses after better-than-expected PMI data from Germany and the whole Eurozone. The data showed first signs of the ECB's quantitative easing, it's massive bond-buying program worth 60 billion euro a month, is stimulating the economy and that the recovery is gathering momentum.

Early in the session prices were under pressure after the preliminary Chinese HSBC Manufacturing PMI for March came in at 49.2, an 11-month low, as new orders declined, fuelling fears of an economic slowdown of the world's second largest economy and the second largest consumer of oil.

Later in the day the American Petroleum Institute will report Crude Oil Inventories. As of last week U.S. stockpiles are at a record level - the highest since recording starte 80 years ago.

Brent Crude added +0.52% and trading above USD55 again, currently trading at USD56.21 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate gained +0.72% currently quoted at USD47.79.

Oil prices declined sharply in recent months as worldwide supply exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

12:00

Gold adds gains for the fifth session – trades above USD1,190

Gold is trading higher today adding gains for the fifth consecutive session - supported by a broadly weaker greenback. Last week bullion added the most in one week since the January 2015.Now all eyes are on U.S. inflation data due today at 12:30 GMT.

The somehow dovish FED statement still lends some support to the precious metal and ongoing uncertainty over the Greek bailout and its future in the Eurozone add to bullish investor's sentiment. Yesterday ECB president Mario Draghi said in a statement that there is an acceleration of economic growth in the eurozone amid falling oil prices, improvements in external demand, easing financial conditions in the current course of monetary policy, as well as the weakening of the euro.

Recently a strong U.S. dollar and the prospect for higher U.S. rates weighed on the precious metal - as gold is dollar-denominated and not yield-bearing. Now, after the FED removed the 'patient' wording but giving a more dovish outlook on inflation and growth and the greenback is trading lower, gold finds some support.

Gold is currently quoted at USD1,193.80, +0,40% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday last week gold traded as low as USD1,142.50, a three-month low.

-

11:30

U.K.: Inflation at record low of zero – lowest reading since 1989/1960

The Producer Price index Input rose less-than-expected in February, according to the National statistics bureau. The Index rose +0.2%, a positive reading for the first time in nine months, but far below estimates of an increase of +1.6%. Last month's reading was revised up -3.6% from previous -3.7%.

The Producer Price index Output rose +0.2%, beating estimates of a decline by -0.1% after falling -0.4% in January.

Retail Prices rose +0.5% in February compared to a decline of -0.8% in January.

The HICP, that monitors retail price changes for goods and services included into the consumer goods basket, rose +0.3% month on month but declined year on year to 0.0% - according to constructed historical data the lowest since 1960, said the Office of National Statistics. Analysts expected a decline to +0.1%. Food, non-alcoholic drinks, furniture, computers and household equipment had the largest effect on the reading.

The HICP ex EFAT, excluding the volatile costs of food and energy, measuring core inflation rose +1.2% year on year compared to a previous reading of +1.4% and below the estimated +1.3%.

-

11:10

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0850 (E946M), 1.0900 (E1BLN), 1.0950 (E1.6BLN)

USD/CHF: 0.9810 ($210M), 0.9900 ($150M)

EUR/CHF: 1.0800 (E100M)

EUR/GBP: 0.7225 (E1.2BLN)

USD/CAD: C$1.2610-15 ($700M)

USD/JPY: Y119.00 ($300M), Y120.00 ($369M), Y120.15-20 ($380M), Y121.00-10 ($1.5BLN), Y121.50 ($1.65BLN)

-

10:50

Eurozone: Manufacturing and Services PMI rose above estimates

After Germany and France PMI data was reported now data on the whole Eurozone came in.

Eurozone data came in better-than-expected with the Manufacturing PMI at 51.9, above estimates for an increase to 51.6 and a previous reading of 51.0. The Manufacturing activity rose to the highest level in ten months. The German Services PMI rose from 53.7 to 54.3 beating estimates of an increase to 53.9 - a new 46-month high.

Eurozone's recovery is gaining momentum. The data suggest that the quantitative easing program, the large-scale asset-purchase program worth 60 billion a month, by the ECB is stimulating the economy. The slump in oil prices and the single currencies decline start to have a positive effect on the economy.

-

10:32

United Kingdom: Retail Price Index, m/m, February +0.5%

-

10:32

United Kingdom: Retail prices, Y/Y, February +1.0% (forecast +0.9%)

-

10:31

United Kingdom: Producer Price Index - Input (MoM), February +0.2% (forecast +1.6%)

-

10:31

United Kingdom: Producer Price Index - Input (YoY) , February -13.5%

-

10:31

United Kingdom: Producer Price Index - Output (YoY) , February -1.8%

-

10:31

United Kingdom: Producer Price Index - Output (MoM), February +0.2% (forecast -0.1%)

-

10:30

United Kingdom: HICP, m/m, February +0.3%

-

10:30

United Kingdom: HICP, Y/Y, February 0.0% (forecast +0.1%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, February +1.2% (forecast +1.3%)

-

10:20

Press Review: Greece promises list of reforms by Monday to unlock cash

BLOOMBERG

Analyst Predicts Apple Will Hit a $1 Trillion Market Cap

As Apple gets ready to launch its first new product in five years, Cantor Fitzgerald is raising its price target to a level that would make Apple a $1 trillion company.

People first started talking seriously about the potential for Apple to become a trillion dollar company in February when shares reached new highs, surpassing the $700 billion market cap level. The current stock price of $127 a share gives the company a valuation of $744 billion. Cantor analyst Brian White currently has the highest price target on Wall Street.

REUTERS

Greece promises list of reforms by Monday to unlock cash(Reuters) - Greece said it will present a package of reforms to its euro zone partners by next Monday in hope of unlocking aid to help it deal with a cash crunch and avoid default.

"It will be done at the latest by Monday," government spokesman Gabriel Sakellaridis told Mega TV.

Greece's left-wing government and its euro zone creditors agreed last week that Athens would come up with a list of its own reforms, which must achieve a similar budget impact to measures agreed by the previous conservative-led administration.

Athens is rushing to get the list ready before state coffers run empty, which is expected to happen in a few weeks without more aid.

Source: http://www.reuters.com/article/2015/03/24/us-eurozone-greece-reforms-idUSKBN0MK0F420150324

BLOOMBERG

Iran Could Add Million More Barrels a Day to the Oil Glut

(Bloomberg) -- Iran says it could add a million barrels to daily oil production shortly after a deal to lift sanctions, reclaiming the position of OPEC's second-largest supplier. While such a boost would take months because sanctions may be rolled back slowly, industry observers agree the capacity is there.

Going further than that and adding a second million barrels -- as the government has said it plans to do -- will prove a much bigger challenge. It would take some five years and tens of billions of dollars of investment, according to two former oil-industry executives who worked in the country.

"The number one need is investment," said Mohsen Shoar, an analyst with Continental Energy DMCC in Dubai who helped ConocoPhillips negotiate oil contracts in Iran in the 1990s. "To get anywhere beyond 4 million barrels a day" will require foreign assistance, he said by phone.

-

10:00

Eurozone: Manufacturing PMI, March 51.9 (forecast 51.6)

-

10:00

Eurozone: Services PMI, March 54.3 (forecast 53.9)

-

10:00

European stock markets First hour: Indices book early gains – focus on Eurozone PMI

European stocks open higher on Tuesday amid hopes on a progress in the negotiations between the E.U and Greece and better-than expected PMI data from Germany.

Early in the day data on the preliminary Chinese HSBC Manufacturing PMI for March came in at 49.2, an 11-month low, as new orders declined. The February reading was 50.7 and analysts expected a decline to 50.5. The reading below 50 added to indications that the world's second largest economy is slowing and could lead to further stimulus measures by the PBoC.

The French Manufacturing PMI for March rose from a previous reading of 47.6 to 48.2 but remained below estimates of an increase to 48.9 - and below the 50 mark that separates growth from contraction. The Services PMI declined from 53.4 to 52.8 not meeting expectations of a decrease to 53.1. The data not only shows a divergence between the service and manufacturing sector but also with Germany, Eurozone's powerhouse and largest economy.

German data came in better-than-expected with the Manufacturing PMI at 52.4, above estimates for an increase to 51.5 and a previous reading of 51.1. The Manufacturing activity rose to the highest level in eight months. The German Services PMI rose from 54.7 to 55.3 beating estimates of an increase to 55.0. German PMI data is a solid sign of the economic recovery.

The FTSE 100 index is currently trading +0.20% quoted at 7,049.75 points ahead of a set of data including U.K.'s PPI, Retail Prices and the HICP. Germany's DAX 30 is trading higher at 11,928.38 points +0.30%. France's CAC 40 is currently trading at 5,064.75 points, +0.2%.

-

09:55

German Ifo business confidence index rises to 108.6 in April

German Ifo Institute released its business confidence index on Friday. German business confidence index climbed to 108.6 in April from 107.9 in March, exceeding expectations for a rise to 108.5. It was the sixth consecutive increase.

"The upswing in the German economy continues," Ifo President Hans-Werner Sinn said.

He added that manufacturers "expressed slightly less optimism about future business developments".

The Ifo current conditions index rose 113.9 in April from 112.1 in March, beating forecasts for an increase to 112.4.

The Ifo expectations index declined to 103.5 in April from 103.9 in March, missing expectations for a gain to 104.5.

-

09:45

Manufacturing and Services PMI: French data below – German above expectations

Today Markit Economics reported preliminary data on French and German Manufacturing and Services PMI.

The French Manufacturing PMI for March rose from a previous reading of 47.6 to 48.2 but remained below estimates of an increase to 48.9 - and below the 50 mark that separates growth from contraction. The Services PMI declined from 53.4 to 52.8 not meeting expectations of a decrease to 53.1. The data not only shows a divergence between the service and manufacturing sector but also with Germany, Eurozone's powerhouse and largest economy.

German data came in better-than-expected with the Manufacturing PMI at 52.4, above estimates for an increase to 51.5 and a previous reading of 51.1. The Manufacturing activity rose to the highest level in eight months. The German Services PMI rose from 54.7 to 55.3 beating estimates of an increase to 55.0. German PMI data is a solid sign of the economic recovery.

-

09:30

Germany: Manufacturing PMI, March 52.4 (forecast 51.5)

-

09:30

Germany: Services PMI, March 55.3 (forecast 55.0)

-

09:00

France: Manufacturing PMI, March 48.2 (forecast 48.9)

-

09:00

France: Services PMI, March 52.8 (forecast 53.1)

-

09:00

Global Stocks: Wall Street and Nikkei moderately decline

U.S. stocks declined on Monday trading between small losses and gains retreating from last week's gains. The S&P 500 closed lower -0.17% with a final quote of 2,104.42 points. The DOW JONES index moderately declined and closed at 18,116.04 points, -0.06%.

Chinese stocks were mixed on Tuesday. Hong Kong's Hang Seng is trading lower -0.37% at 24,403.92 points. China's Shanghai Composite closed at 3,691.95 points closing +0.11% - up for a ninth consecutive day and setting a new 3-year high at 3,715.87 points. The weaker-than-expected PMI data at 11-month lows indicating a contraction fuelled speculations on further economic stimulus.

The Nikkei declined on soft Chinese and Japanese PMI and a lower Wall Street but losses were limited and the index remains close to its newly set 15-year high reached on Monday. Data on Japanese the Japanese Production PMI came in at 50.4 for March, a decrease from a previous reading of 51.6 and below an expected increase to 52.1. The preliminary Chinese HSBC Manufacturing PMI for March came in at 49.2, an 11-month low, as new orders declined. The index closed -0.21% with a final quote of 19,713.45.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:15 U.S. FOMC Member Williams Speaks

01:35 Japan Manufacturing PMI (Preliminary) March 51.6 52.1 50.4

01:45 China HSBC Manufacturing PMI (Preliminary) March 50.7 50.5 49.2

04:50 Australia RBA Assist Gov Edey Speaks

The U.S. dollar is trading mixed against its major peers after the weaker-than-expected U.S. existing home sales figures. Sales of existing homes rose 1.2% to a seasonally adjusted annual rate of 4.88 million in February from 4.82 million in January. San Francisco Fed chief John Williams reiterated his belief that the Fed should consider raising rates in summer given the momentum of the improving economy. He said that a gradual increase is the 'safer option' rather having to react with dramatic hikes.

The euro is trading moderately lower against the greenback after yesterday's gains as Greece talks continue to find a common ground. Merkel said that Germany wants Greece economically strong and that the country belongs to Europe. Yesterday ECB president Mario Draghi noted that the Eurozone "is gaining momentum" due to falling oil prices, higher external demand, easy financing conditions and a weaker euro.

The Australian dollar booked gains against the U.S. dollar after touching an intraday low after the Chinese Manufacturing PMI. China is Australia's biggest trade partner. The Conference Board Australia Leading Index rose +0.4% for January. The previous reading was revised down from +0.4% to +0.3%. Reserve Bank of Australia assistant governor Malcolm Edey held a speech at the ASIC Annual Forum in Sydney.

The preliminary Chinese HSBC Manufacturing PMI for March came in at 49.2, a 11-month low, as new orders declined. The February reading was 50.7 and analysts expected a decline to 50.5. The 50-points level separates growth from contraction. The reading below 50 added to indications that the world's second largest economy is slowing and could lead to further stimulus measures by the PBoC.

New Zealand's dollar gained against the greenback during the Asian session in the absence of any major data from the region.

The Japanese yen traded higher against the greenback on Tuesday. Data on Japanese the Japanese Production PMI came in at 50.4 for March, a decrease from a previous reading of 51.6 and below an expected increase to 52.1.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 France Manufacturing PMI (Preliminary) March 47.6 48.9

08:00 France Services PMI (Preliminary) March 53.4 53.1

08:30 Germany Manufacturing PMI (Preliminary) March 51.1 51.5

08:30 Germany Services PMI (Preliminary) March 54.7 55.0

09:00 Eurozone Manufacturing PMI (Preliminary) March 51.0 51.6

09:00 Eurozone Services PMI (Preliminary) March 53.7 53.9

09:30 United Kingdom Producer Price Index - Input (MoM) February -3.7% +1.6%

09:30 United Kingdom Producer Price Index - Input (YoY) February -14.2%

09:30 United Kingdom Producer Price Index - Output (MoM) February -0.5% -0.1%

09:30 United Kingdom Producer Price Index - Output (YoY) February +0.5%

09:30 United Kingdom Retail Price Index, m/m February -0.8%

09:30 United Kingdom Retail prices, Y/Y February +1.1% +0.9%

09:30 United Kingdom RPI-X, Y/Y February +1.2%

09:30 United Kingdom HICP, m/m February -0.9%

09:30 United Kingdom HICP, Y/Y February +0.3% +0.1%

09:30 United Kingdom HICP ex EFAT, Y/Y February +1.4% +1.3%

12:30 U.S. Housing Price Index, y/y January +5.4%

12:30 U.S. CPI, m/m February -0.7% +0.2%

12:30 U.S. CPI, Y/Y February -0.1% -0.1%

12:30 U.S. CPI excluding food and energy, m/m February +0.2% +0.1%

12:30 U.S. CPI excluding food and energy, Y/Y February +1.6% +1.6%

13:00 U.S. Housing Price Index, m/m January +0.8%

13:45 U.S. Manufacturing PMI (Preliminary) March 55.1 54.9

14:00 Belgium Business Climate March -8.3 -7.5

14:00 U.S. Richmond Fed Manufacturing Index March 0 2

14:00 U.S. New Home Sales February 481 472

20:30 U.S. API Crude Oil Inventories March +10.5

21:45 New Zealand Trade Balance, mln February 56 355

-

08:22

Options levels on tuesday, March 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1151 (2103)

$1.1086 (3804)

$1.1019 (2321)

Price at time of writing this review: $1.0912

Support levels (open interest**, contracts):

$1.0844 (1067)

$1.0785 (2933)

$1.0713 (2259)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 65192 contracts, with the maximum number of contracts with strike price $1,1000 (3804);

- Overall open interest on the PUT options with the expiration date April, 2 is 73309 contracts, with the maximum number of contracts with strike price $1,0600 (6028);

- The ratio of PUT/CALL was 1.12 versus 1.10 from the previous trading day according to data from March, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5203 (1193)

$1.5106 (1654)

$1.5009 (1352)

Price at time of writing this review: $1.4918

Support levels (open interest**, contracts):

$1.4889 (1171)

$1.4793 (1389)

$1.4696 (1920)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 25835 contracts, with the maximum number of contracts with strike price $1,5100 (1654);

- Overall open interest on the PUT options with the expiration date April, 2 is 28562 contracts, with the maximum number of contracts with strike price $1,5050 (2327);

- The ratio of PUT/CALL was 1.11 versus 1.10 from the previous trading day according to data from March, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:00

Nikkei 225 19,667.68 -86.68 -0.44 %, Hang Seng 24,404.32 -90.19 -0.37 %, Shanghai Composite 3,666.27 -21.45 -0.58 %

-

02:47

China: HSBC Manufacturing PMI, March 49.2 (forecast 50.5)

-

02:35

Japan: Manufacturing PMI, March 50.4 (forecast 52.1)

-

00:32

Commodities. Daily history for Mar 23’2015:

(raw materials / closing price /% change)

Oil 47.45 +1.89%

Gold 1,189.00 +0.11%

-

00:32

Stocks. Daily history for Mar 23’2015:

(index / closing price / change items /% change)

Nikkei 225 19,754.36 +194.14 +0.99 %

Hang Seng 24,494.51 +119.27 +0.49 %

Shanghai Composite 3,687.81 +70.49 +1.95 %

FTSE 100 7,037.67 +15.16 +0.22 %

CAC 40 5,054.52 -32.97 -0.65 %

Xetra DAX 11,895.84 -143.53 -1.19 %

S&P 500 2,104.42 -3.68 -0.17 %

NASDAQ Composite 5,010.97 -15.44 -0.31 %

Dow Jones 18,116.04 -11.61 -0.06 %

-

00:31

Currencies. Daily history for Mar 23’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $ 1,0944 +1,13%

GBP/USD $1,4953 +0,03%

USD/CHF Chf0,9659 -0,94%

USD/JPY Y119,70 -0,27%

EUR/JPY Y131,01 +1,62%

GBP/JPY Y178,99 -0,29%

AUD/USD $0,7875 +1,30%

NZD/USD $0,7653 +1,16%

USD/CAD C$1,2516 -0,27%

-

00:00

Australia: Conference Board Australia Leading Index, January +0.4%

-