Noticias del mercado

-

22:10

Major US stock indexes finished trading mainly in the red

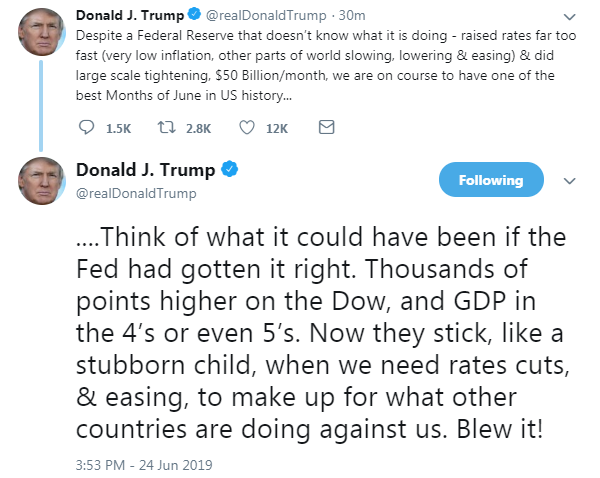

Major US stock indices predominantly declined amid a fall in the conglomerate sector and investors' expectations of a meeting between the leaders of the United States and China.

Presidents Donald Trump and Xi Jinping are expected to meet at the G20 summit on June 28-29 in Japan. However, according to Reuters, analysts do not expect the conclusion of a trade agreement following this meeting, but they hope for progress in the negotiations. On Monday, China’s vice minister of commerce announced that the negotiators were negotiating, and confirmed that both parties must compromise in order to conclude the deal.

Shares of the health sector came under pressure after reports that President Donald Trump would issue an increase in the transparency of health spending.

The increased tensions between the US and Iran also negatively affected the mood of market participants after Tehran hit a US drone last week. On Sunday, President Trump said he was not seeking war with Iran after a high-ranking Iranian military commander warned that any conflict in the Gulf region could spread uncontrollably and threaten the lives of American troops.

In addition, today, Trump signed a decree imposing additional sanctions against Iran, and noted that the sanctions were imposed in response to the crashed drone. “Sanctions will be directed against Iran’s supreme leader. The US wants Iran to stop sponsoring terrorism. But the US does not seek conflict with Iran,” Trump said, adding that the US will not allow Iran to have nuclear weapons.

Most of the components of DOW finished trading in positive territory (21 out of 30). The growth leader was Dow Inc. (DOW; + 2.40%). Outsiders were The Home Depot (HD; -1.80%).

Almost all sectors of the S & P recorded a decline. The largest drop was shown by the conglomerate sector (-0.7%). Only the consumer goods sector grew (+ 0.1%).

At the time of closing:

Dow 26,729.23 +10.10 +0.04%

S & P 500 2,945.35 -5.11 -0.17%

Nasdaq 100 8,005.70 -26.01 -0.32%

-

21:50

Schedule for tomorrow, Tuesday, June 25, 2019

Time Country Event Period Previous value Forecast 10:00 United Kingdom CBI retail sales volume balance June -27 12:30 Canada Wholesale Sales, m/m April 1.4% 0.4% 12:45 U.S. FOMC Member Williams Speaks 13:00 U.S. Housing Price Index, m/m April 0.1% 0.2% 13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 2.7% 2.5% 14:00 U.S. Richmond Fed Manufacturing Index June 5 5 14:00 U.S. New Home Sales May 0.673 0.686 14:00 U.S. Consumer confidence June 134.1 132.0 16:00 U.S. FOMC Member Bostic Speaks 17:00 U.S. Fed Chair Powell Speaks 17:15 Eurozone ECB's Benoit Coeure Speaks 22:30 U.S. FOMC Member James Bullard Speaks -

21:00

DJIA +0.10% 26,746.35 +27.22 Nasdaq -0.20% 8,015.27 -16.43 S&P -0.09% 2,947.93 -2.53

-

18:01

European stocks closed: FTSE 100 7,416.69 +9.19 +0.12% DAX 12,274.57 -65.35 -0.53% CAC 40 5,521.71 -6.62 -0.12%

-

16:54

Canada's monthly GDP growth to slow to 0.2% in April - TDS

Analysts at TD Securities are expecting Canada's monthly GDP growth to slow to 0.2% in April on the heels of a 0.5% increase the prior month.

- “A moderation in services will provide the main driver, as further gains to energy output and strong residential construction drive continued strength in goods-producing industries. This will offset a modest drag from manufacturing, owing to a one-off in auto production, while utilities output is also expected to edge lower.

- Services will benefit from a rebound in real estate although weaker retail activity will weigh on the sector. However, a 0.2% headline print should provide some comfort to policymakers concerned over global headwinds, and keep Q2 GDP tracking well above the Bank of Canada's 1.3% projection from April.”

-

16:37

Central banks sounding rather aggressive - ABN AMRO

Han de Jong, the chief economist at ABN AMRO, notes the ECB president Mario Draghi has signaled that the European regulator will provide more stimulus.

- “We had assumed that the ECB will restart purchasing assets. But we had also presumed they would leave the already negative deposit rate unchanged. Mr. Draghi said explicitly that cutting rates further is a policy option that is on the table.

- Mr. Draghi’s opposite number at the US Federal Reserve, Jay Powell, spoke at the press conference following the Fed’s policy meeting last Wednesday. He also signaled easing and we are confident that the Fed will cut rates at their next meeting on the last two days of July.

- What surprised us a little, or even more than a little, is that Powell appeared to keep open the option of cutting by 50 bp. The market has been pricing in some rate cuts for some time. Most people worry that the market has gotten a little ahead of itself. If the Fed cuts rates, but by less or fewer times than the market is pricing in, then there could be a negative market reaction. I would have thought that there was no need to be egging the market on in terms of their rate-cut expectations. Yet, that is effectively what Powell did. Markets responded positively. He’d better deliver.”

-

16:16

USD longs moved higher, EUR shorts dropped sharply - Rabobank

Rabobank's analyst note that IMM net speculators’ positioning as at June 18, 2019, reveales the level of net EUR short positions dropped back sharply last week.

- “Counter to the move in the previous two weeks, USD longs moved higher ahead of the June FOMC meeting, returning to levels maintained through April and May.

- Net short GBP positions increased by a strong margin as Johnson emerged as the favourite to win the Tory party election.

- The level of JPY shorts dropped sharply to their lowest levels for a year.

- CHF net shorts also dropped sharply. The CHF is traditionally considered to be a safe haven, so the move is consistent with an increase in broad levels of geopolitical tension.

- CAD net shorts increased. BoC policy, trade talks and oil prices are in view.

- AUD net shorts edged a little higher awaiting further developments on RBA policy and Chinese growth.”

-

15:43

Belgium Business confidence falls in June

The National Bank of Belgium (NBB) reported on Monday that business confidence in the country fell for the third consecutive month in June.

According to the report, Belgium business barometer edged down to -4.9 in June from -3.6 in the previous month. It was the worst reading since February 2016.

Economists had forecast improvement to -2.2.

Almost all branches of activity surveyed witnessed the loss of business confidence in June. The only exception was trade, which recorded a sharp recovery (to -0.7 in June from -8.1 in May).

-

15:33

U.S. Stocks open: Dow +0.21%, Nasdaq +0.16% S&P +0.09%

-

15:26

-

15:18

Brexit turns three, but back to square one – Standard Chartered

Christopher Graham, an economist at Standard Chartered, notes that it is almost three years to the day that the UK voted to leave the EU, but the UK Parliament has thus far failed to agree on a way forward.

- “A new prime minister (PM) is now expected within the month and will try to reset the process to get the UK out by 31 October, but like Theresa May, he will face the same stark realities of Brexit.”

-

15:16

Before the bell: S&P futures +0.24%, NASDAQ futures +0.32%

U.S. stock-index futures rose moderately on Monday, as investors were awaiting a highly-anticipated meeting between the U.S. Presidents Donald Trump and his Chinese counterpart Xi Jinping later this week on the sidelines of the G20 summit in Japan.

Global Stocks:

Index/commodity

Last

Today's Change, points

Today's Change, %

Nikkei

21,285.99

+27.35

+0.13%

Hang Seng

28,513.00

+39.29

+0.14%

Shanghai

3,008.15

+6.17

+0.21%

S&P/ASX

6,665.40

+14.60

+0.22%

FTSE

7,413.78

+6.28

+0.08%

CAC

5,524.01

-4.32

-0.08%

DAX

12,281.06

-58.86

-0.48%

Crude oil

$57.94

+0.89%

Gold

$1,410.10

+0.71%

-

15:00

Belgium: Business Climate, June -4.9 (forecast -2.2)

-

14:57

Investors scale back stretched long positions in USD - Danske Bank

Jens Nærvig Pedersen, the senior analyst at Danske Bank, notes that the USD continued to weaken on Friday on the back of weaker US PMIs and dovish comments by the Fed’s Kashkari, with EUR/USD climbing above the 1.1370 level.

- “IMM positioning data shows that investors have started to scale back their stretched long positions in USD and reduce their short positions in the CHF, EUR and JPY. As the market is assuming some probability of the Fed delivering a 50bp cut in July, weak US and global macro figures along with lack of progress in trade talks is needed to sustain current USD weakness.”

-

14:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

173.78

0.43(0.25%)

559

ALTRIA GROUP INC.

MO

48.2

0.20(0.42%)

13342

Amazon.com Inc., NASDAQ

AMZN

1,915.27

3.97(0.21%)

19556

American Express Co

AXP

125.25

0.52(0.42%)

1147

Apple Inc.

AAPL

199

0.22(0.11%)

103940

AT&T Inc

T

32.55

0.10(0.31%)

6524

Boeing Co

BA

372.6

0.76(0.20%)

4938

Chevron Corp

CVX

125.2

0.27(0.22%)

3177

Cisco Systems Inc

CSCO

57.32

0.29(0.51%)

9895

Citigroup Inc., NYSE

C

67.98

0.01(0.01%)

2531

Deere & Company, NYSE

DE

165.99

1.71(1.04%)

6216

Exxon Mobil Corp

XOM

77.73

0.04(0.05%)

6723

Facebook, Inc.

FB

192.85

1.71(0.89%)

99422

FedEx Corporation, NYSE

FDX

163

-2.35(-1.42%)

6005

Ford Motor Co.

F

9.98

-0.01(-0.10%)

11207

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.36

0.02(0.18%)

8660

General Electric Co

GE

10.54

0.06(0.57%)

88861

General Motors Company, NYSE

GM

36.95

0.03(0.08%)

53389

Goldman Sachs

GS

196

0.06(0.03%)

13106

Google Inc.

GOOG

1,119.90

-1.98(-0.18%)

2981

Home Depot Inc

HD

209.38

-0.01(-0.00%)

1379

Intel Corp

INTC

47.55

0.09(0.19%)

9037

International Business Machines Co...

IBM

139.08

-0.12(-0.09%)

416

International Paper Company

IP

43

-0.61(-1.40%)

2545

Johnson & Johnson

JNJ

142.52

0.43(0.30%)

1326

JPMorgan Chase and Co

JPM

109.3

-0.14(-0.13%)

17031

McDonald's Corp

MCD

204.8

0.54(0.26%)

471

Merck & Co Inc

MRK

84.8

0.23(0.27%)

2667

Microsoft Corp

MSFT

137.46

0.49(0.36%)

39176

Nike

NKE

86.19

0.44(0.51%)

3092

Pfizer Inc

PFE

43.75

0.08(0.18%)

2065

Procter & Gamble Co

PG

111.72

0.52(0.47%)

4966

Starbucks Corporation, NASDAQ

SBUX

84.77

0.95(1.13%)

668

Tesla Motors, Inc., NASDAQ

TSLA

223

1.14(0.51%)

37763

The Coca-Cola Co

KO

51.64

0.09(0.17%)

2058

Travelers Companies Inc

TRV

151

-0.48(-0.32%)

225

Twitter, Inc., NYSE

TWTR

35.04

0.02(0.06%)

17141

United Technologies Corp

UTX

130.2

1.45(1.13%)

20278

UnitedHealth Group Inc

UNH

252.4

0.12(0.05%)

242

Verizon Communications Inc

VZ

57.97

0.20(0.35%)

5605

Visa

V

174.12

0.68(0.39%)

4896

Wal-Mart Stores Inc

WMT

111.47

0.34(0.31%)

5933

Walt Disney Co

DIS

140.5

0.27(0.19%)

15979

Yandex N.V., NASDAQ

YNDX

39.42

0.40(1.03%)

4154

-

14:46

Target price changes before the market open

Alphabet (GOOG) target lowered to $1250 from $1290 at MoffettNathanson

-

14:46

Downgrades before the market open

Int'l Paper (IP) downgraded to Equal-Weight from Overweight at Stephens

-

14:45

Upgrades before the market open

Deere (DE) upgraded to Buy from Hold at Jefferies; target raised to $190

United Tech (UTX) upgraded to Outperform from Market Perform at Cowen; target raised to $150

-

14:44

Chicago Fed National Activity Index points to a pickup in economic growth in May

The Chicago Federal Reserve announced on Monday the Chicago Fed national activity index (CFNAI), a weighted average of 85 different economic indicators, came in at -0.05 in May, up from a revised -0.48 in April (originally -0.45), pointing to an improvement in economic growth in May.

Economists had forecast the index to come in at -0.37 in April.

At the same time, the index’s three-month moving average rose to -0.17 in May from -0.37 in April.

According to the report, three of the four broad categories of indicators that make up the index increased from April, but only one of the four categories made a positive contribution to the index in May

The contribution from production-related indicators to the CFNAI moved up to +0.07 in May from -0.44 in April. The contribution of the personal consumption and housing category to the CFNAI improved to -0.06 in May from -0.08 in April. Meanwhile, the sales, orders, and inventories category made a neutral contribution to the CFNAI in May, up slightly from -0.02 in April. Employment-related indicators contributed -0.06 to the CFNAI in May, down from +0.05 in April.

-

14:30

U.S.: Chicago Federal National Activity Index, May -0.05 (forecast -0.37)

-

14:24

Iran’s crude oil exports decline to 300,000 barrels per day or less so far in June due to U.S. sanctions – Reuters reports, citing industry sources

"It's a very low level of real crude exports," one of the sources told Reuters.

-

14:14

-

13:59

U.S. planning more sanctions against Iran – Danske Bank

Analysts at Danske Bank think that the U.S. is planning more sanctions against Iran in order to force the country back to the negotiating table and agree on a deal to ensure Iran never requires nuclear weapons.

- “US Secretary of State Michael Pompeo will visit Saudi Arabia and the UAE to discuss a global coalition against Iran. Iran has already seen a sharp drop in oil production following the first round of US sanctions, which has tightened world oil supply.

- New sanctions are therefore likely to be felt primarily in Iran and to a lesser extent in the rest of the world. Brent is trading above USD65/bbl. However, we reckon this is more a function of the recent recovery in risk sentiment and weakening of the USD with the outlook for upcoming rate cuts in the US.”

-

13:39

Canada: An important week ahead – RBC

Analysts at Royal Bank of Canada say the next week brings some key Canadian data that might determine whether the Bank of Canada (BoC) follows the Fed in adopting a more dovish stance.

- “The BoC’s Business Outlook Survey is an important input into BoC decision-making. The latest edition will garner even more attention than usual given a further escalation in global trade tensions since April’s survey.

- Just ahead of the BOS, April’s GDP report will give insight into whether a softer business sentiment is finding its way into activity indicators. March’s GDP figures showed plenty of resilience with nearly every sector growing in the month. April should be a bit more mixed with manufacturing output expected to be flat. That sector will be a focal point in the coming months given a slowdown in industrial production globally (including in the US) that could intensify with recent tariff hikes.

- Retail sale volumes edged down 0.2% in April, though other services industries should pick up some of the slack. On balance we look for GDP to edge up by 0.1% in April, which following March’s more robust gain, should leave Q2 growth tracking a solid 2% annualized rate.”

-

13:18

U.S. special representative to Iran Hook: Trump is very willing to sit down with Iran to talk

- U.S. sanctions are reducing Iranian military spending

- Iran can come to the negotiating table or continue to watch its economy crumble

- Iran is more diplomatically isolated now than before the U.S. left the nuclear deal

- There is no diplomatic backchannel with Iran

- U.S. is prepared to restore diplomatic ties with Iran and lift sanctions but only if Iran is willing to do a deal

-

13:08

German government source: Defence budget to reduce to 44 billion euros in 2023, or 1.24% of GDP - Reuters

-

13:02

China's economy sees a resumption of mild non-FDI outflows in May – Standard Chartered

Standard Chartered analysts say that their estimates revealed that modest non-FDI outflows of USD 16.4bn resumed in May for the Chinese economy, following moderate inflows of USD 10.4bn in April.

- “The mild outflows suggest broadly stable market expectations, despite sharp depreciation of the Chinese yuan (CNY) in the first half of May. Several financial officials made comments to stabilize the market, keeping USD-CNY firmly around the 6.90 level in the second half of the month.

- FX assets held by the People’s Bank of China (PBoC) fell by a modest USD 0.2bn in May, following a small USD 0.1bn decline in April; this suggests still-balanced overall cross-border flows. The merchandise trade surplus widened to USD 41.7bn in May from USD 13.8bn in April, partially offsetting the estimated services deficit of USD 25.0bn.

- Outflow pressure in May could have been much worse given the jump in USD-CNY above 6.90 amid renewed US-China trade concerns. We expect trade negotiations to resume after the meeting between Presidents Xi and Trump at the G20 summit, supporting our view that USD-CNY is unlikely to break above 7.0 in the short term.”

-

12:40

Weak German IFO data - TDS

Analysts at TD Securities note that the German IFO dropped half a point to 97.4 in June, with the Current Assessment rising a tick off a multi-year low, while the Expectations Index fell a point leaving it down near its February multi-year low.

- “It caps a mixed week for German survey data, with the ZEW Expectations Index showing a very sharp drop in June, while the PMI Manufacturing bounced off its recent lows.”

-

12:19

JPY net shorts receded to one-year lows - CFTC Positioning report

The Commodity Futures Trading Commission's (CFTC) positioning report for the week ended on June 18 revealed:

- Speculators trimmed their short positions to the lowest level since June 16 of 2018 on the Japanese safe haven on the back of escalating geopolitical jitters exclusively on rising US-Iran effervescence. In addition, the likeliness of rate cuts by the Fed has also spurred the preference for riskier assets, all in detriment of JPY.

- The speculative community pushed USD net longs to fresh multi-month tops ahead of the FOMC meeting. The subsequent dovish tilt by the FOMC should impact on the next report, as the event was after the cut-off date.

- EUR net shorts dropped to the lowest level since February 5 despite the fact the ECB showed a clear will to return to rate cuts or QE following its monetary policy meeting.

-

11:58

German wage increases lose speed as economy cools

German wages grew at a slower pace in the first quarter, the Federal Statistics Office said on Monday, reflecting a slowdown in Europe's biggest economy driven by a contraction in the export-dependent manufacturing sector.

Real wages rose by 1.2% on the year in the first quarter compared with 1.4% and 1.6% increases in the previous two quarters, data showed.

-

11:42

Chances of US-Iran tensions escalating are ‘very, very high - former advisor to Tehran

Chances of a U.S.-Iran conflict escalating into something bigger are “very, very high” — though a full-blown war is unlikely, said a former advisor to the Iranian government.

Washington and Tehran nearly came to blows last week after Iran claimed it downed an American drone that entered its territory. The U.S. said its aircraft was operating in international airspace.

“We have to remember Iran is a regional superpower. U.S. says ‘I’ll put you in a box, please die.’ They (Iran) are not going to stay in a box and just die,” said Fereidun Fesharaki, who was a former energy advisor to the government in Tehran in the 1970s.

“They will strike back one way or the other; I think chances of tensions becoming bigger is very, very high in the near future,” Fesharaki, who is now chairman of oil and gas consultancy Facts Global Energy, told.

-

11:19

Germany: Still stumbling - ING

Carsten Brzeski, chief Economist at ING Germany, offered his take on the latest disappointment from Germany’s most prominent leading indicator, the Ifo index, which dropped for the third month in a row to its lowest level in more than four years.

“The German economy currently is the best showcase model for a broader phenomenon: the stark discrepancy between external risks and uncertainty and solid domestic fundamentals. This discrepancy explains why, despite the sharp slowdown in confidence indicators, economic growth has actually been holding up well. The second quarter does not (yet) look recessionary. The big question for the months ahead is clearly whether this time could really be different. If the decoupling between manufacturing and services were part of a structural transition, then it could be. But if previous patterns were to prevail, the slump in the manufacturing sector could infect the rest of the economy. We maintain our optimism and favour the hypothesis that this time is indeed different.”

-

11:00

Brent firmer above $65 on USD weakness, US-Iran rift - Danske Bank

The Danske Bank analysts mainly attribute the latest strength in Brent oil to broad-based US dollar weakness induced by the dovish Fed. But the escalating US-Iran geopolitical tensions also continue to underpin.

“The US is planning more sanctions against Iran in order to force the country back to the negotiating table and agree on a deal to ensure Iran never requires nuclear weapons. Iran has already seen a sharp drop in oil production following the first round of US sanctions, which has tightened world oil supply. New sanctions are therefore likely to be felt primarily in Iran and to a lesser extent in the rest of the world.”

-

10:41

Ifo economist Wohlrabe: sticking to German GDP growth forecast, does not see a recession

Order books are well-filled in the construction sector but doesn't expect new ones

US-China trade dispute is the main cause of uncertainty

Brexit and Iran conflict are not playing a dominant role at the moment

Impact from Iran only if oil price rises significantly or tensions escalate considerably

-

10:19

Germany: ifo business climate index falls in June

According to the report from Ifo Institute for Economic Research, the headline German Business Climate Index came in at 97.4 in June, weaker than last month's 97.9. Economists had expected decrease to 97.3. Meanwhile, the Current Economic Assessment arrived at 100.8 points compared to last month's 100.6 and 100.0 anticipated. On the other hand, the IFO Expectations Index – indicating firms’ projections for the next six months, came in at 94.2 for June, down from previous month’s 95.3 reading and worse than market expectations of 94.5.

“The German economy is heading for the doldrums,” Ifo President Clemens Fuest said, adding that the business climate in both the manufacturing and services sectors had worsened.

-

10:00

Germany: IFO - Expectations , June 94.2 (forecast 94.5)

-

10:00

Germany: IFO - Current Assessment , June 100.8 (forecast 100.0)

-

10:00

Germany: IFO - Business Climate, June 97.4 (forecast 97.3)

-

09:40

USD/JPY could target 106.60 if 107.00 is breached – UOB

A break below the 107.00 handle should motivate USD/JPY to extend the drop to the 106.60 region, suggested FX Strategists at UOB Group.

“USD tried but failed to break the 107.00 level that was first highlighted last Thursday (20 Jun, spot at 107.70). The price action was not exactly surprising as deeply oversold shorter-term conditions suggest USD could consolidate and trade sideways for 1 to 2 days. As long as the ‘key resistance’ at 108.00 is intact (no change in level from last Friday), the current ‘negative phase’ that started 3 weeks ago (03 Jun, spot at 108.30) appears to have legs to extend lower. From here, a break of 107.00 would indicate that USD is ready to tackle the next support at 106.60”.

-

09:20

EUR/USD now targets 1.1416 and 1.1570 – Commerzbank

In light of the ongoing strong rebound, EUR/USD could now advance to 1.1416 ahead of 1.1570, noted Karen Jones, Head of FICC Technical Analysis at Commerzbank.

“EUR/USD last week tested and saw a strong rebound off support at 1.1176, the March low. The market has overcome on a closing basis both the 200 week ma and the 200 day ma at 1.1349. This should trigger an attempt on the 1.1416 55 week moving average and the 1.1570 2019 high. Beyond this we target 1.1815/54 (highs from June and September 2018). We regard recent lows at 1.1110/06 as an interim turning point and continue to view the market as based longer term and we target 1.1990 (measurement higher from the wedge). Initial support at 1.1175”.

-

09:00

The Fed is close to cutting rates – NAB

Tony Kelly, Senior Economist – International, Group Economics at National Australia Bank (NAB) believes that the US Federal Reserve (Fed) is preparing to cut the interest rates as soon as next month.

“Trade disputes continue to cast a shadow over the US economic outlook. While recent data suggest some upside risk to our Q2 GDP forecast, business surveys point to a slowing economy. The Fed is getting ready to cut rates; we expect two 25bp reductions in the federal funds rate, with July and September now the most likely dates. There is considerable event risk around these projections – including the upcoming meeting between the US and Chinese Presidents. Risks still appear slanted towards the Fed making more rather than fewer cuts."

-

08:40

China says both U.S., China should make compromises in trade talks

Both China and the United States should make compromises in trade talks, Chinese Vice Commerce Minister Wang Shouwen said, ahead of meeting between the Chinese and U.S. presidents at this week's G20 summit in Japan.

Speaking at a news briefing on the G20 summit, Wang, who is also part of the trade negotiating team with the United States, said talks between the two countries' trade teams were underway, though he gave no details.

China's principles are clear, he said - mutual respect, equality and mutual benefit and meeting each other halfway.

"Mutual respect means each side must respect the other's sovereignty," Wang said.

"Equality and mutual benefit means the consultations have to happen on an equal basis, the agreement to be reached has to be beneficial for both sides," he said.

Wang declined to answer a question about what specific compromises Xi may offer to win a trade deal with Trump.

-

08:19

EUR/USD seen tough resistance in the mid-1.1400s – UOB

FX Strategists at UOB Group expect EUR/USD to face significant resistance in the 1.1450 area in the near term.

“We woefully underestimated EUR strength as instead of “edging above 1.1320”, it blew past this level and rocketed to 1.1377. While overbought, the rally has scope to extend above 1.1400. For today, the next major resistance at 1.1450 is not expected to come into the picture. On the downside, 1.1320 is deemed as strong enough to hold any intraday pullback (minor support is at 1.1345)”.

Next 1-3 weeks: “While our expectation from last Friday that “EUR is likely to move into a ‘positive phase’ soon” was not wrong, the timeliness of the call could be ‘earlier’. EUR not only eclipsed several strong resistance levels with ease but also hit a 3-month high of 1.1377 before ending the week higher. The strong and impulsive rally suggests there is scope for the current ‘positive phase’ to extend further even though March’s peak near 1.1450 is expected to offer solid resistance. The ‘positive phase’ is deemed as intact until the 1.1275 ‘key support’ is taken out (level was a ‘strong support’ at 1.1220 last Friday)”.

-

08:00

UK consumer spending to expand at slowest pace in 6 years: EY

UK consumer spending is forecast to grow at the slowest pace in six years, the latest EY ITEM Club special report on consumer spending, said. Nonetheless, spending is seen continuing to outperform the economy as a whole.

The think tank forecast consumer spending to grow 1.6 percent in 2019, 1.7 percent in 2020. The economy is expected to log 1.3 percent growth and 1.5 percent expansion in 2019, 2020, respectively.

According to EY ITEM Club, households' real disposable income is set to grow at slower pace in the next two years after 2018 spike and is likely to be significantly below the post-war average.

"We forecast employment growth to slow from 1.2 percent in 2018 to 1.0 percent in 2019 and 0.6 percent in 2020," Howard Archer, chief economic advisor to the EY ITEM Club, said.

-

07:07

Japan: Coincident Index, April 102.1 (forecast 101.9)

-

07:06

Japan: Leading Economic Index , April 95.9 (forecast 95.5)

-

07:05

Options levels on monday, June 24, 2019

EUR/USD

Resistance levels (open interest**, contracts)

$1.1499 (3477)

$1.1476 (3949)

$1.1452 (4422)

Price at time of writing this review: $1.1377

Support levels (open interest**, contracts):

$1.1292 (2618)

$1.1246 (2766)

$1.1198 (3070)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 5 is 70675 contracts (according to data from June, 21) with the maximum number of contracts with strike price $1,1300 (4422);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2855 (1177)

$1.2831 (653)

$1.2813 (375)

Price at time of writing this review: $1.2750

Support levels (open interest**, contracts):

$1.2672 (846)

$1.2633 (1726)

$1.2590 (1496)

Comments:

- Overall open interest on the CALL options with the expiration date July, 5 is 17379 contracts, with the maximum number of contracts with strike price $1,3000 (2829);

- Overall open interest on the PUT options with the expiration date July, 5 is 15654 contracts, with the maximum number of contracts with strike price $1,2500 (2199);

- The ratio of PUT/CALL was 0.90 versus 0.88 from the previous trading day according to data from June, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:30

Commodities. Daily history for Friday, June 21, 2019

Raw materials Closed Change, % Brent 64.58 0.92 WTI 57.55 0.66 Silver 15.33 -0.58 Gold 1398.763 0.74 Palladium 1500.72 1.06 -

02:30

Stocks. Daily history for Friday, June 21, 2019

Index Change, points Closed Change, % NIKKEI 225 -204.22 21258.64 -0.95 Hang Seng -76.72 28473.71 -0.27 KOSPI -5.67 2125.62 -0.27 ASX 200 -36.6 6650.8 -0.55 FTSE 100 -16.94 7407.5 -0.23 DAX -15.47 12339.92 -0.13 CAC 40 -7.24 5528.33 -0.13 Dow Jones -34.04 26719.13 -0.13 S&P 500 -3.72 2950.46 -0.13 NASDAQ Composite -19.63 8031.71 -0.24 -

02:15

Currencies. Daily history for Friday, June 21, 2019

Pare Closed Change, % AUDUSD 0.69248 0.02 EURJPY 121.986 0.67 EURUSD 1.13693 0.68 GBPJPY 136.753 0.31 GBPUSD 1.27434 0.3 NZDUSD 0.65877 0.09 USDCAD 1.32197 0.22 USDCHF 0.97618 -0.49 USDJPY 107.311 0.01 -

00:30

Schedule for today, Monday, June 24, 2019

Time Country Event Period Previous value Forecast 05:00 Japan Coincident Index April 101.1 101.9 05:00 Japan Leading Economic Index April 95.7 95.5 08:00 Germany IFO - Current Assessment June 100.6 100.0 08:00 Germany IFO - Expectations June 95.3 94.5 08:00 Germany IFO - Business Climate June 97.9 97.3 12:30 U.S. Chicago Federal National Activity Index May -0.45 -0.37 13:00 Belgium Business Climate June -3.6 22:45 New Zealand Trade Balance, mln May 433 971 23:50 Japan Monetary Policy Meeting Minutes -