Noticias del mercado

-

22:17

U.S. stocks closed

U.S. stocks erased earlier losses as investors shook off concerns over the downing of a Russian warplane by Turkish forces, and energy shares rallied for their first back-to-back gains in three weeks.

Commodity companies led a rebound, with raw-materials joining energy to rise the most among S&P 500's main groups. Airlines slumped along with travel-related shares after a government warning to American travelers abroad coupled with a jump in crude prices.

The Standard & Poor's 500 Index rose 0.1 percent to 2,08.54 at 4 p.m. in New York, after earlier falling as much as 0.8 percent. The gauge has gone without two straight winning sessions since Nov. 3.

Turkey shot down the Russian warplane near the border with northwestern Syria, drawing an angry rebuke from President Vladimir Putin and marking the first direct clash between foreign powers embroiled in the civil war. He said Russia "won't tolerate such crimes" but stopped short of threatening any military response against Turkey, which is a member of the North Atlantic Treaty Organization, warning only of "serious consequences" for bilateral ties.

While global financial markets were jolted by concerns that the situation could escalate, political analysts in Russia and Europe said that seemed unlikely given the risks associated with any conflict between Russia and a NATO member. The incident comes with Brussels on the highest-level terror alert and after the U.S. State Department issued a global alert for Americans.

The geopolitical tensions overshadowed data today that showed the economy expanded at a faster pace in the third quarter than previously reported, bolstering the Federal Reserve's case for raising borrowing costs for the first time since 2006. Traders are now pricing in a 74 percent probability that the Fed will increase interest rates next month.

A separate report showed home prices climbed more than estimated in September compared to a year earlier, signaling residential real estate is sustaining momentum. Another gauge showed consumer confidence unexpectedly fell in November to the lowest since September 2014.

Stocks struggled to add to an advance following the S&P 500's strongest weekly gain this year, with the gauge little changed from its Friday close. The benchmark is 2 percent away from its May record after rallying 12 percent from a summer swoon and its first correction in four years.

The earnings season is drawing to a close, with almost all members of the gauge having reported. Of those, 74 percent beat profit estimates, while only 44 percent exceeded sales forecasts. Analysts project profits for index members fell 3.8 percent in the third quarter, compared with expectations for a 7.2 percent drop at the start of the season.

-

21:00

DJIA 17833.69 41.01 0.23%, NASDAQ 5103.90 1.42 0.03%, S&P 500 2091.41 4.82 0.23%

-

20:20

American focus: the US dollar declined moderately

Dollar holds decline against other major currencies, but traded near an eight-month peak in the previous session after data that showed the US economy grew in the third quarter more than originally anticipated.

The US economy has shown in the 3rd quarter of faster growth than originally anticipated, helped review the amount of reserves. Last Change suggested that the economy may end the current year with a modest, but not spectacular expansion.

The revised report from the Commerce Department showed that the gross domestic product, the broadest measure of goods and services produced in the economy increased by 2.1% (seasonally adjusted) compared with the initial estimate at + 1.5%. Experts expect that the economy will expand by 2.0%. But in spite of such a revision, the pace of growth was significantly less than in the second quarter (when GDP grew by 3.9% 0.

Compared with last year, the economy in the third quarter increased by 2.2%, recording the slowest pace since the first quarter of 2014. In general, over the past few years, economic growth oscillates around 2%.

In addition, the report submitted by the Conference Board, showed that US consumer confidence index fell in November to a level of 90.4 points against 99.1 points in October (revised from 97.6 points). Economists had expected the index was 99.5 points. The expectations index fell to 78.6 from 88.7 in October, while the current situation index fell to 108.1 points from 114.6 points.

The share of consumers who believe that business conditions are "good" decreased to 24.4 percent from 26.8 percent, while the number reporting to the contrary decreased to 16.9 percent from 18.3 percent. As regards the situation in the labor market, the percentage of respondents who reported a sufficient number of jobs fell from 22.7 percent to 19.9 percent, while those who argue the opposite, increased to 26.2 percent from 24.6 percent.

It also became known that the share of consumers who expect to improve the conditions for doing business in the next six months, fell to 14.8 percent from 18.1 percent. Meanwhile, the number of pending worsening business conditions rose to 11.0 percent from 10.4 percent. The proportion of consumers expecting their incomes rise, decreased from 18.1 percent to 17.2 percent, while the number is expected to decline, rose to 11.8 percent from 10.5 percent.

Support for the euro has had a previous positive statistics in Germany. Recall, the level of business confidence improved unexpectedly in November, reaching more than one-year maximum. Last Modified indicates that the economy remains quite strong despite the weak outlook for exports, a slowdown of the world economy and the scandal around Volkswagen. The results of a monthly survey Ifo showed business climate index rose to 109.0 points compared to 108.2 points in October. The last reading was the highest since June 2014. On average, the experts had expected the index to remain unchanged. The survey was conducted during the first three weeks of November, and the majority of responses were received before the terrorist attacks in Paris. "Prospects for the German economy looks good," - said Andreas Rees, economist at UniCredit. - We expect a return to moderate growth in the end of the year. "Earlier it was reported that German GDP growth in the 3rd quarter slowed to 0.3% from 0.4%. In annual terms, the economy expanded by 1.8% versus 1 6% in the second quarter.

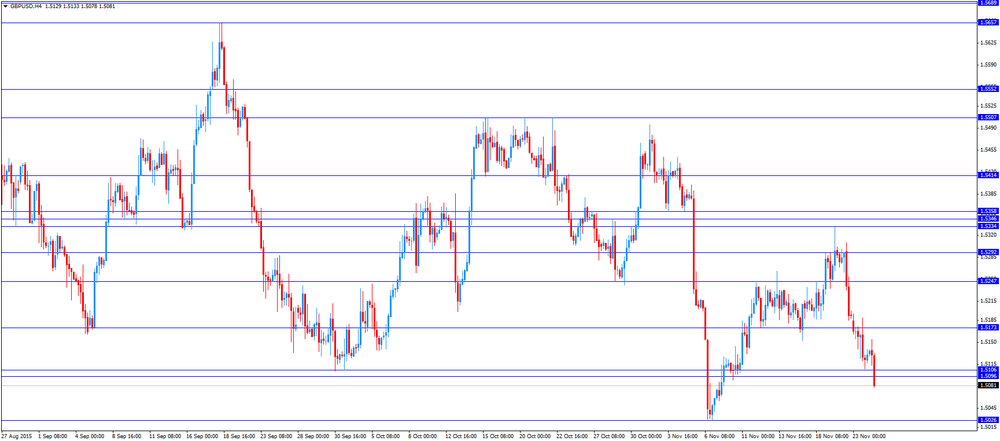

The pound fell against the US dollar, falling below $ 1.5100. Pressure on the pound had political commentaries Central Bank of England. Speaking to British lawmakers Bank of England Carney said that for some time, interest rates will remain at low levels. He added that there is no need for negative interest rates. Meanwhile, the representative of the Bank of England's Haldane said that the balance of risks to the UK economy and inflation is biased towards the downside risks, so that the Central Bank should be ready to lower interest rates in the case of deterioration of the economic outlook. "Given the balance of risks, I stick to a neutral position on the future direction of monetary policy", - he said. In addition, one representative of the Central Bank Kristin Forbes noted that the growth of wages in the country is not yet large enough to annual inflation back to the target level of 2%. Forbes added that did not vote for a rate hike, as there has not yet seen signs of such price pressures, which could bring inflation back to the target level. In general, the statements of politicians indicate that the leadership is in no hurry to increase rates.

A slight effect on the pound has also provided statistics for the UK. Research results Confederation of British Industry (CBI) showed that sales growth in the retail sector slowed again in November, while orders fell for the first time since April. However, the pace of recruitment companies, the retail sector grew at the fastest pace in 17 years, which may indicate a recovery of sales in the next month. According to the index of retail sales in November fell to 7% compared with 19% in October. Experts expect that figure to increase to 25%.

-

18:33

WSE: Session Results

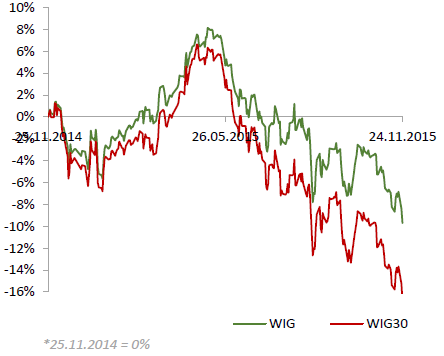

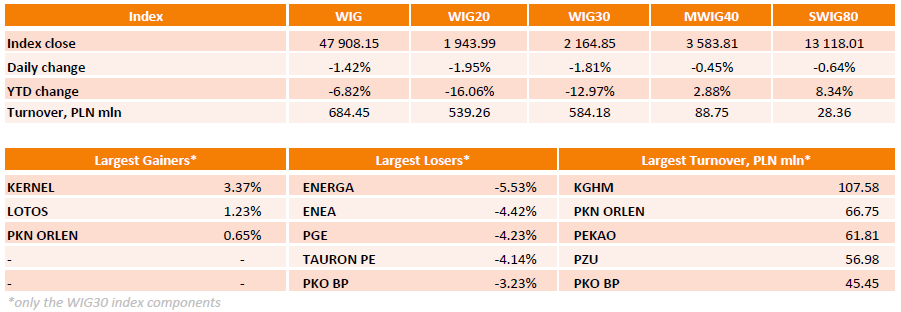

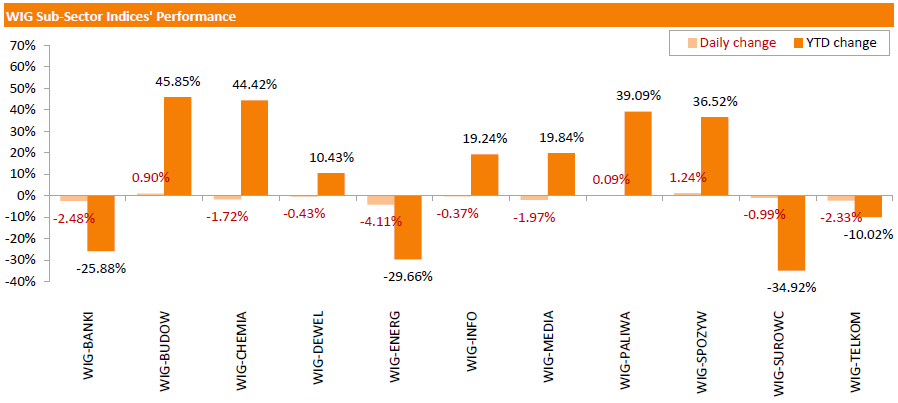

Polish equity market continued to slump on Tuesday. The broad market measure, the WIG Index, fell by 1.42%. Only two sectors in the WIG Index rose and nine fell. Food sector stocks (+1.24%) and oil and gas sector names (+0.09%) returned gains. At the same time, utilities stocks (-4.11%) and banking sector names (-2.48%) fared the worst.

In the large-cap stock universe, most of the names posted losses, pushing the group measure, the WIG30 Index, down 1.81%. Utilities names ENERGA (WSE: ENG), ENEA (WSE: ENA), PGE (WSE: PGE) and TAURON PE (WSE: TPE) recorded the biggest declines, slumping 4.14%-5.53%. They were followed by banks PKO BP (WSE: PKO) and MBANK (WSE: MBK), tumbling by 3.23% and 2.94% respectively. On the contrary, agricultural producer KERNEL (WSE: KER) performed best, advancing by 3.37%. Oil and gas names LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN) did well too, gaining 1.23% and 0.65% respectively.

-

18:03

European stocks close: stocks closed lower on concerns over the situation in the Middle East

Stock indices closed lower on concerns over the situation in the Middle East. Turkey reported today that it shot down the Russian jet near the Syria's border. The jet should have violated Turkish airspace.

Russia's defence ministry said the jet did not violate Turkish airspace. Russian President Vladimir Putin said that Turkey's action was a "stab in the back by the terrorists' accomplices" and that this action would have serious consequences.

Meanwhile, the economic data from the Eurozone was positive. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rises to 109.0 in November from 108.2 in October. Analysts had expected to remain unchanged at 108.2.

"The German economy remains unaffected by growing uncertainty worldwide. Not even the Paris attacks had a negative impact on survey data," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 113.4 from 112.7. October's figure was revised up from 112.6. Analysts had expected the index to fell to 112.4.

The Ifo expectations index rose to 104.7 from 103.9. October's figure was revised up from 103.8. Analysts had expected the index to decrease to 104.0.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the third quarter, in line with the preliminary reading, after a 0.4% increase in the second quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.6% in the third quarter, while government spending increased by 1.3%.

Exports of goods and services were up 0.2% in third quarter, while imports climbed 1.1%.

On a yearly basis, Germany's final GDP rose to 1.8% in the third quarter from 1.6% in the second quarter, in line with the preliminary reading.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,277.23 -28.26 -0.45 %

DAX 10,933.99 -158.32 -1.43 %

CAC 40 4,820.28 -68.84 -1.41 %

-

18:00

European stocks closed: FTSE 6277.23 -28.26 -0.45%, DAX 10933.99 -158.32 -1.43%, CAC 40 4820.28 -68.84 -1.41%

-

17:44

Oil prices climb on concerns over the situation in the Middle East

Oil prices rose on concerns over the situation in the Middle East. Turkey reported today that it shot down the Russian jet near the Syria's border. The jet should have violated Turkish airspace.

Russia's defence ministry said the jet did not violate Turkish airspace. Russian President Vladimir Putin said that Turkey's action was a "stab in the back by the terrorists' accomplices" and that this action would have serious consequences.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for January delivery climbed to $43.46 a barrel on the New York Mercantile Exchange.

Brent crude oil for January rose to $46.12 a barrel on ICE Futures Europe.

-

17:30

Gold price rises due to increasing demand for safe-haven assets

Gold price climbed due to increasing demand for safe-haven assets, driven by concerns over the situation in the Middle East. Turkey reported that it shot down the Russian jet near the Syria's border. The jet should have violated Turkish airspace.

Market participants eyed the U.S. economic data. The U.S. Commerce Department released gross domestic product (GDP) figures on Tuesday. The U.S. revised GDP climbed 2.1% in the third quarter, exceeding expectations for a 2.0% increase, up from the preliminary estimate of a 1.5% rise.

The upward revision was partly driven by an upward revision to business spending on equipment and investment in home building.

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 90.4 in November from 99.1 in October, missing expectations for a rise to 99.5. October's figure was revised up from 97.6.

The decline was mainly driven by a less favourable assessment of the job market.

December futures for gold on the COMEX today rose to 1080.70 dollars per ounce.

-

17:24

Bank of England’s Monetary Policy Committee member Gertjan Vlieghe: the U.K. economy is expected to continue to improve

The Bank of England's (BoE) Monetary Policy Committee member Gertjan Vlieghe said before the Treasury Committee on Tuesday that the U.K. economy is expected to continue to improve.

"We have recently seen an improvement in productivity growth. By and large we expect that improvement to be maintained and we might even over the next few years see some upside risk," he said.

-

17:15

Bank of England’s Monetary Policy Committee member Kirstin Forbes: the next central bank’s move should be an interest rate hike

The Bank of England's (BoE) Monetary Policy Committee member Kirstin Forbes said before the Treasury Committee on Tuesday that the next central bank's move should be an interest rate hike.

"Given the state of the UK economy, a solid recovery, I still believe certainly the next move in interest rates will be up, we will not require loosening," she said.

"So this is something we are very much watching closely, movement is in the direction of a tightening labour market, building inflationary pressure, supporting the case at which we would need to be raising interest rates sooner rather than later," Forbes added.

-

17:13

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Tuesday as investors turned to less-risky assets after Turkey shot down a Russian warplane, even as GDP data indicated healthier economic growth. Crude oil prices were up about 2% on the prospect of more turmoil in the Middle East. Gold also rose.

The U.S. Commerce Department revised third-quarter GDP growth to an annual rate of 2.1%, in line with market expectations but up from 1.5% estimated previously. The data could give the Federal Reserve confidence to raise interest rates at its December meeting.

Most of Dow stocks in negative area (24 of 30). Top looser - Merck & Co. Inc. (MRK, -1.61%). Top gainer - Chevron Corporation (CVX. +0.89%).

Almost all of S&P index sectors also in negative area. Top looser - Services (-1.2%). Top gainer - Conglomerates (+1,2%).

At the moment:

Dow 17660.00 -102.00 -0.57%

S&P 500 2068.75 -15.50 -0.74%

Nasdaq 100 4626.75 -49.00 -1.05%

Oil 42.59 +0.84 +2.01%

Gold 1074.20 +7.40 +0.69%

U.S. 10yr 2.23 -0.02

-

17:05

Bank of England Chief Economist Andy Haldane: downside risks to growth and inflation outlook increased

The Bank of England (BoE) Chief Economist Andy Haldane said before the Treasury Committee on Tuesday that downside risks to growth and inflation outlook increased.

"I see the balance of risks around UK GDP growth and inflation as skewed materially to the downside, more so than embodied in the November 2015 Inflation Report. There are of course also risks to the upside, but I consider these to be both more modest in scale and somewhat easier to cope with should they occur," he said.

-

16:59

Richmond Fed Manufacturing Index falls to -3 in November

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing declined to -3 in November from -1 in October.

The decrease was partly driven by a drop in new orders. New orders sub-index was down to -6 from 0.

Shipments sub-index rose to -2 in November from -4 in October.

"Shipments remained sluggish and new orders declined. Hiring in the sector changed little compared to the previous month, while the average workweek shortened and wages rose mildly. Raw materials prices rose at a somewhat faster pace, while prices of finished goods increased modestly in November," the survey said.

-

16:29

U.S. consumer confidence index slides to 90.4 in November

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 90.4 in November from 99.1 in October, missing expectations for a rise to 99.5. October's figure was revised up from 97.6.

The decline was mainly driven by a less favourable assessment of the job market. The percentage of consumers expecting more jobs in the coming months was down to 19.9% in November from 22.7% in October.

The present conditions index fell to 108.1 in November from 112.1 in October.

The Conference Board's consumer expectations index for the next six months decreased to 78.6 in November from 88.0 in October.

"The decline was mainly due to a less favourable view of the job market. Consumers' appraisal of current business conditions, on the other hand, was mixed. Fewer consumers said conditions had improved, while the proportion saying conditions had deteriorated also declined. Heading into 2016, consumers are cautious about the labour market and expect little change in business conditions," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:16

NBB business climate for Belgium rises to -3.9 in November

The National Bank of Belgium (NBB) released its business survey on Tuesday. The business climate rise to -3.9 in November from-4.0 in October. Analysts had expected the index to remain unchanged at -4.0.

2 of 4 indicators increased in November.

The business climate index for the manufacturing sector fell to -6.3 in November from -5.6 in October due to less favourable assessments of total order books.

The business climate index for the services sector was up to 11.0 in November from 7.2 in October due to a more positive outlook for firms' activity and an upward revision of general market demand forecasts.

The business climate index for the building sector increased to -7.3 in November from -8.5 in October due to more favourable assessments of total order books.

The business climate index for the trade sector dropped to -8.0 in November from -4.3 in October due to a drop in all three components of the indicator.

-

16:00

U.S.: Consumer confidence , November 90.4 (forecast 99.5)

-

16:00

U.S.: Richmond Fed Manufacturing Index, November -3

-

15:57

S&P/Case-Shiller home price index rises 5.5% in September

The S&P/Case-Shiller home price index increased 5.5% in September, exceeding expectations for a 5.2% rise, after a 5.1% gain in August.

San Francisco, Denver and Portland were the largest contributors to the rise, where prices climbed by 11.2%, 10.9% and 10.1%, respectively.

"Home prices and housing continue to show strength with home prices rising at more than double the rate of inflation. The general economy appeared to slow slightly earlier in the fall, but is now showing renewed strength," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index rose by a seasonally adjusted 0.6% rate in September.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:34

U.S. Stocks open: Dow -0.44%, Nasdaq -0.48%, S&P -0.44%

-

15:26

Before the bell: S&P futures -0.72%, NASDAQ futures -0.78%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 19,924.89 +45.08 +0.23%

Hang Seng 22,587.63 -78.27 -0.35%

Shanghai Composite 3,615.82 +5.50 +0.15%

FTSE 6,229.51 -75.98 -1.20%

CAC 4,784.16 -104.96 -2.15%

DAX 10,887.27 -205.04 -1.85%

Crude oil $42.62 (+2.08%)

Gold $1077.40 (+0.99%)

-

15:22

Bank of England Governor Mark Carney: the interest rate in the U.K. is likely to remain at low level "for some time"

The Bank of England (BoE) Governor Mark Carney testified before the Treasury Committee on Tuesday. He said that that the interest rate in the U.K. is likely to remain at low level "for some time".

"One of the concerns in a low prolonged interest rate environment, in which we are clearly are, and are likely to remain for some time, even with limited and gradual rate increases it still will be a relatively low interest rate environment," he said.

Carney noted that he does not know when to start raising interest rates.

"The question in my mind is when is the appropriate time for interest rates to increase, and that is strongly consistent with the strength of the domestic economy," the BoE governor said.

-

15:00

Belgium: Business Climate, November -3.9 (forecast -4)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, September 5.5% (forecast 5.2%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.19

0.98%

293.3K

Pfizer Inc

PFE

31.56

0.73%

9.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.04

0.50%

28.4K

Exxon Mobil Corp

XOM

80.48

0.25%

15.4K

Chevron Corp

CVX

89.95

-0.07%

1K

Procter & Gamble Co

PG

75.80

-0.22%

3.7K

United Technologies Corp

UTX

97.80

-0.30%

0.2K

AT&T Inc

T

33.35

-0.33%

74.5K

International Business Machines Co...

IBM

138.00

-0.33%

0.2K

Apple Inc.

AAPL

117.33

-0.36%

166.9K

HONEYWELL INTERNATIONAL INC.

HON

104.18

-0.39%

0.4K

McDonald's Corp

MCD

114.01

-0.40%

0.1K

Ford Motor Co.

F

14.48

-0.48%

4.3K

ALTRIA GROUP INC.

MO

57.33

-0.50%

0.1K

Verizon Communications Inc

VZ

44.76

-0.51%

3.7K

Wal-Mart Stores Inc

WMT

59.94

-0.53%

2.5K

Google Inc.

GOOG

752.00

-0.53%

0.3K

ALCOA INC.

AA

9.02

-0.55%

7.6K

General Electric Co

GE

30.42

-0.56%

21.0K

Home Depot Inc

HD

131.70

-0.60%

3.8K

Starbucks Corporation, NASDAQ

SBUX

62.24

-0.64%

1.8K

Boeing Co

BA

147.36

-0.66%

0.1K

Intel Corp

INTC

34.25

-0.67%

0.4K

Microsoft Corp

MSFT

53.82

-0.68%

10.7K

E. I. du Pont de Nemours and Co

DD

66.06

-0.69%

1.2K

Facebook, Inc.

FB

106.15

-0.75%

41.4K

Twitter, Inc., NYSE

TWTR

25.00

-0.79%

17.9K

UnitedHealth Group Inc

UNH

111.25

-0.81%

0.6K

Deere & Company, NYSE

DE

74.00

-0.82%

0.9K

Visa

V

79.44

-0.84%

0.4K

Nike

NKE

131.34

-0.85%

1.6K

Walt Disney Co

DIS

118.40

-0.85%

2.6K

Citigroup Inc., NYSE

C

53.82

-0.85%

2.1K

Goldman Sachs

GS

187.57

-0.86%

0.4K

JPMorgan Chase and Co

JPM

66.30

-0.87%

20.3K

AMERICAN INTERNATIONAL GROUP

AIG

62.20

-0.89%

0.1K

Amazon.com Inc., NASDAQ

AMZN

672.91

-0.90%

22.6K

Hewlett-Packard Co.

HPQ

14.10

-0.91%

0.8K

The Coca-Cola Co

KO

42.56

-0.93%

11.3K

Merck & Co Inc

MRK

53.48

-0.98%

1.8K

American Express Co

AXP

71.51

-1.01%

6.0K

Cisco Systems Inc

CSCO

27.15

-1.02%

0.2K

General Motors Company, NYSE

GM

35.70

-1.05%

3.5K

Tesla Motors, Inc., NASDAQ

TSLA

215.30

-1.13%

1.9K

Yandex N.V., NASDAQ

YNDX

16.45

-3.52%

33.6K

-

14:50

U.S. revised GDP rises 2.1% in the third quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Tuesday. The U.S. revised GDP climbed 2.1% in the third quarter, exceeding expectations for a 2.0% increase, up from the preliminary estimate of a 1.5% rise.

The upward revision was partly driven by an upward revision to business spending on equipment and investment in home building.

Consumer spending was revised down.

Consumer spending rose by 3.0% in the third quarter, down from the previous estimate of a 3.2% increase.

Exports climbed 0.9% in the third quarter, while imports were up 2.1%.

The PCE price index excluding food and energy costs increased 1.3% in the third quarter, in line with expectations, after a 1.9% rise in the second quarter.

The PCE price index is the Fed's preferred gauge for inflation.

These figures could mean that the Fed may start raising its interest rate next month.

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 123.15-25 (USD 445m)

EURUSD 1.0600 (EUR 503m) 1.0650 (337m)

USDCAD 1.3660-75 (USD 300m)

AUDUSD 0.7100 (AUD 376m) 0.7420 (230m)

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Merck (MRK) initiated with a Hold at Berenberg

-

14:30

U.S.: GDP, q/q, Quarter III 2.1% (forecast 2.0%)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter III 1.3% (forecast 1.3%)

-

14:25

CBI retail sales balance slides to +7% in November

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance plunged to +7% in November from +19% in October, missing expectations for a rise to +25%.

Sales expectations for next month were up to +31% in November from +24% in October.

"After a stronger showing earlier in the year, retailers will naturally be disappointed by the unexpected slowing in sales growth in November, which may be related to the mild start to the autumn. Nevertheless, it's encouraging that retailers have been boosting employment and we expect that trend to continue," CBI Director of Economics, Rain Newton-Smith, said.

-

14:01

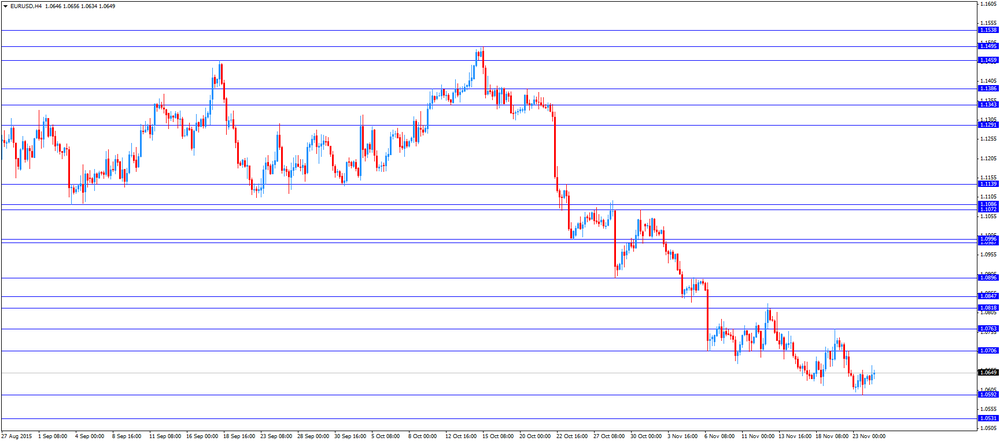

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on the better-than-expected Ifo index from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) November 52.4 52.1 52.8

07:00 Germany GDP (QoQ) (Finally) Quarter III 0.4% 0.3% 0.3%

07:00 Germany GDP (YoY) (Finally) Quarter III 1.6% 1.8% 1.8%

09:00 Germany IFO - Business Climate November 108.2 108.2 109

09:00 Germany IFO - Expectations November 103.9 Revised From 103.8 104 104.7

09:00 Germany IFO - Current Assessment November 112.7 Revised From 112.6 112.4 113.4

09:05 Australia RBA's Governor Glenn Stevens Speech

11:00 United Kingdom CBI retail sales volume balance November 19 25 7

The U.S. dollar traded mixed against the most major currencies ahead of the release of the economic data from the U.S. The U.S. revised GDP is expected to rise 2.0% in third quarter, up from the previous estimate of a 1.5% gain.

The S&P/Case-Shiller home price index is expected to rise by 5.1% in September, after a 5.1% gain in August.

The U.S. consumer confidence is expected to increase to 99.5 in October from 97.6 from September.

The euro traded higher against the U.S. dollar on the better-than-expected Ifo index from Germany. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rises to 109.0 in November from 108.2 in October. Analysts had expected to remain unchanged at 108.2.

"The German economy remains unaffected by growing uncertainty worldwide. Not even the Paris attacks had a negative impact on survey data," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 113.4 from 112.7. October's figure was revised up from 112.6. Analysts had expected the index to fell to 112.4.

The Ifo expectations index rose to 104.7 from 103.9. October's figure was revised up from 103.8. Analysts had expected the index to decrease to 104.0.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the third quarter, in line with the preliminary reading, after a 0.4% increase in the second quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.6% in the third quarter, while government spending increased by 1.3%.

Exports of goods and services were up 0.2% in third quarter, while imports climbed 1.1%.

On a yearly basis, Germany's final GDP rose to 1.8% in the third quarter from 1.6% in the second quarter, in line with the preliminary reading.

The British pound traded lower against the U.S. dollar on comments by the Bank of England Governor Mark Carney. He said on Tuesday that the interest rate in the U.K. is likely to remain at low level "for some time".

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance plunged to +7% in November from +19% in October, missing expectations for a rise to +25%.

EUR/USD: the currency pair rose to $1.0669

GBP/USD: the currency pair fell to $1.5078

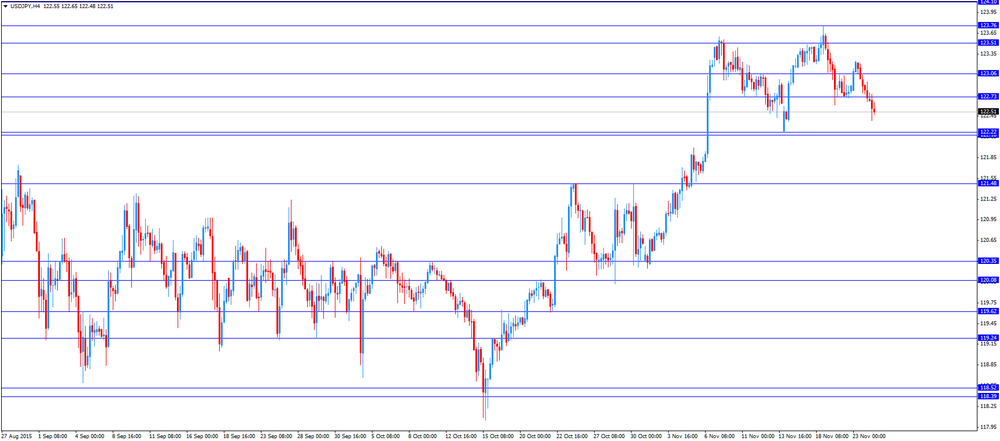

USD/JPY: the currency pair decreased to Y122.39

The most important news that are expected (GMT0):

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter III 1.9% 1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III 3.9% 2.0%

14:00 Belgium Business Climate November -4 -4

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September 5.1% 5.2%

15:00 U.S. Richmond Fed Manufacturing Index November -1 0

15:00 U.S. Consumer confidence November 97.6 99.5

23:50 Japan Monetary Policy Meeting Minutes

-

13:59

Orders

EUR/USD

Offers 1.0650-55 1.0680-85 1.0700* 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0615-20 1.0600 1.0580-85 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5150-55 1.5170 1.5180-85 1.5200 1.5300 1.5325-30 1.5350 1.5380 1.5400 1.5420 1.5435 1.5450 1.54880-85 1.5500

Bids 1.5120-25 1.5100 1.5085 1.5065 1.5050 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7050 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7015 0.7000 0.6980-85 0.6965 0.6950 0.6930 0.6900

EUR/JPY

Offers 130.80 131.00 131.20 131.50 131.85 132.00 132.50 132.75 133.00

Bids 130.25-30 130.00 129.85 129.50 129.35 129.00

USD/JPY

Offers 122.85 123.00 123.20-25 123.35 123.50 123.65.70 123.85 124.00

Bids 122.50 122.25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7220 0.7235 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7185 0.7165 0.7150 0.7130 0.7100-05 0.7085 0.7065 0.7050

-

12:00

European stock markets mid session: stocks traded lower on concerns over the situation in the Middle East

Stock indices traded lower on concerns over the situation in the Middle East. Turkey reported that it shot down the Russian jet near the Syria's border. The jet should have violated Turkish airspace.

Meanwhile, the economic data from the Eurozone was positive. German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rises to 109.0 in November from 108.2 in October. Analysts had expected to remain unchanged at 108.2.

"The German economy remains unaffected by growing uncertainty worldwide. Not even the Paris attacks had a negative impact on survey data," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 113.4 from 112.7. October's figure was revised up from 112.6. Analysts had expected the index to fell to 112.4.

The Ifo expectations index rose to 104.7 from 103.9. October's figure was revised up from 103.8. Analysts had expected the index to decrease to 104.0.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the third quarter, in line with the preliminary reading, after a 0.4% increase in the second quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.6% in the third quarter, while government spending increased by 1.3%.

Exports of goods and services were up 0.2% in third quarter, while imports climbed 1.1%.

On a yearly basis, Germany's final GDP rose to 1.8% in the third quarter from 1.6% in the second quarter, in line with the preliminary reading.

Current figures:

Name Price Change Change %

FTSE 100 6,248.65 -56.84 -0.90 %

DAX 10,980.44 -111.87 -1.01 %

CAC 40 4,812.63 -76.49 -1.56 %

-

12:00

United Kingdom: CBI retail sales volume balance, November 7 (forecast 25)

-

11:15

French manufacturing confidence index declines to 102 in November

The French statistical office Insee released its manufacturing confidence index for France on Tuesday. The French manufacturing confidence index decreased to 102 in November from 103 in October.

Past change in production index was up to 10 in November from 8 in October.

Personal production expectations index fell to 4 in November from 12 in October, while general production outlook index rose to 10 from 2.

The Insee noted that the most responses were registered before the terrorist attacks of 13 November.

-

11:07

German final GDP increases 0.3% in the third quarter

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.3% in the third quarter, in line with the preliminary reading, after a 0.4% increase in the second quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.6% in the third quarter, while government spending increased by 1.3%.

Exports of goods and services were up 0.2% in third quarter, while imports climbed 1.1%.

On a yearly basis, Germany's final GDP rose to 1.8% in the third quarter from 1.6% in the second quarter, in line with the preliminary reading.

-

10:47

German Ifo business confidence index rises to 109.0 in November

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rises to 109.0 in November from 108.2 in October. Analysts had expected to remain unchanged at 108.2.

"The German economy remains unaffected by growing uncertainty worldwide. Not even the Paris attacks had a negative impact on survey data," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index increased to 113.4 from 112.7. October's figure was revised up from 112.6. Analysts had expected the index to fell to 112.4.

The Ifo expectations index rose to 104.7 from 103.9. October's figure was revised up from 103.8. Analysts had expected the index to decrease to 104.0.

-

10:33

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan climbs to 52.8 in November, the highest level since March 2014

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan climbed to 52.8 in November from 52.4 in October, beating expectations for a decline to 52.1. It was the highest level since March 2014.

A reading below 50 indicates contraction of activity.

The index was partly driven by a rise in new orders.

"Latest survey data pointed to a substantial improvement in operating conditions at Japanese manufacturers. Growth in production accelerated to the sharpest since March 2014, while new orders increased at a marked rate," economist at Markit, Amy Brownbill, said.

-

10:22

Fed Chairwoman Janet Yellen: the Fed starts raising its interest rate if the labour market will continue to strengthen and the inflation will toward the Fed’s 2% target

The Fed Chairwoman Janet Yellen wrote in a letter to consumer advocate Ralph Nader on late Monday evening that the Fed starts raising its interest rate if the labour market will continue to strengthen and the inflation will toward the Fed's 2% target.

"We all hope and expect that the economy will continue to expand, that the jobs market will continue to make progress, and that inflation will move toward our two percent price stability objective," she wrote.

Yellen added that interest rate hikes will be gradual.

The Fed chairwoman defended low interest rates, saying that it helped to stimulate the economy.

Nader posted online an open letter to Yellen on October 30. He asked why the Fed was keeping interest rates at low levels.

-

10:11

German IW Institute: Germany’s economy is expected to expand 1.5% in 2016

According to German IW Institute, Germany's economy is expected to expand 1.5% in 2016, compared to a 1.75% growth forecasted in 2015.

Private consumption is expected to rise 1.5% in 2016, compared to a 2.0% gain forecasted in 2015.

The institute expects the unemployment rate to be 6.5% in 2015 and 2016.

-

10:00

Germany: IFO - Business Climate, November 109 (forecast 108.2)

-

10:00

Germany: IFO - Expectations , November 104.7 (forecast 104)

-

09:03

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.15-25 (USD 445m)

EUR/USD 1.0600 (EUR 503m) 1.0650 (337m)

USD/CAD 1.3660-75 (USD 300m)

AUD/USD 0.7100 (AUD 376m) 0.7420 (230m)

-

08:28

Options levels on tuesday, November 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0846 (5203)

$1.0778 (2576)

$1.0724 (1242)

Price at time of writing this review: $1.0640

Support levels (open interest**, contracts):

$1.0581 (5201)

$1.0549 (7506)

$1.0528 (3480)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 93877 contracts, with the maximum number of contracts with strike price $1,1100 (5899);

- Overall open interest on the PUT options with the expiration date December, 4 is 119246 contracts, with the maximum number of contracts with strike price $1,0500 (9852);

- The ratio of PUT/CALL was 1.27 versus 1.28 from the previous trading day according to data from November, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5401 (1879)

$1.5302 (2712)

$1.5204 (995)

Price at time of writing this review: $1.5152

Support levels (open interest**, contracts):

$1.5093 (2523)

$1.4997 (2657)

$1.4898 (2405)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28365 contracts, with the maximum number of contracts with strike price $1,5600 (3578);

- Overall open interest on the PUT options with the expiration date December, 4 is 332170 contracts, with the maximum number of contracts with strike price $1,5050 (5082);

- The ratio of PUT/CALL was 1.13 versus 1.14 from the previous trading day according to data from November, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:12

Oil prices climbed

West Texas Intermediate futures for January delivery climbed to $42.04 (+0.69%), while Brent crude climbed to $45.05 (+0.49%) after Saudi Arabia said on Monday it was ready to cooperate with OPEC and non-OPEC producers to stabilize prices. The news came days before the organization is set to hold a meeting in Vienna on December 4. However gains were limited by a stronger greenback, which makes the dollar-denominated commodity more expensive for buyers using other currencies. Some analysts also doubt that there will be a significant change in OPEC's policy.

Meanwhile investors are preparing to see a modest increase in U.S. crude stockpiles when the U.S. Energy Information Administration releases its report on Wednesday.

-

08:00

Germany: GDP (QoQ), Quarter III 0.3% (forecast 0.3%)

-

08:00

Germany: GDP (YoY), Quarter III 1.8% (forecast 1.8%)

-

07:52

Foreign exchange market. Asian session: the U.S. dollar advanced against the euro

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) November 52.4 52.1 52.8

The U.S. dollar climbed slightly against the euro and the pound amid expectations for a Federal Reserve's interest rate hike. The probability of a liftoff in rates keeps growing. That's why market participants are paying much attention to what Fed officials say and to data on the U.S. economy. Yesterday Federal Reserve Chair Janet Yellen wrote to consumer advocate Ralf Nader that she expects further improvements in the labor market and inflation. This makes many economists sure the Fed will raise rates next month. Today market participants are waiting for revised U.S. GDP data.

The yen rose against the greenback amid profit taking ahead of Thanksgiving Day. Today's preliminary PMI data supported the yen as well. November Manufacturing PMI came in at 52.8 versus 52.1 expected and 52.4 reported previously marking the twentieth month of growth.

IFO data on German economy are due later today. The business climate index is expected to stay at 108.2 this month. A reading above 100 indicates growing optimism among business owners.

EUR/USD: the pair fluctuated within $1.0620-45 in Asian trade

USD/JPY: the pair fell to Y122.65

GBP/USD: the pair rose to $1.5140

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany GDP (QoQ) (Finally) Quarter III 0.4% 0.3%

07:00 Germany GDP (YoY) (Finally) Quarter III 1.6% 1.8%

09:00 Germany IFO - Business Climate November 108.2 108.2

09:00 Germany IFO - Expectations November 103.8 104

09:00 Germany IFO - Current Assessment November 112.6 112.4

09:05 Australia RBA's Governor Glenn Stevens Speech

11:00 United Kingdom CBI retail sales volume balance November 19 25

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter III 1.9% 1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III 3.9% 2.0%

14:00 Belgium Business Climate November -4 -4

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September 5.1% 5.2%

15:00 U.S. Richmond Fed Manufacturing Index November -1 0

15:00 U.S. Consumer confidence November 97.6 99.5

23:50 Japan Monetary Policy Meeting Minutes

-

07:24

Gold near a six-year low

Gold climbed to $1,070.50 (+0.35%), but stayed near a six-year low amid expectations for an imminent interest rate hike by the Federal Reserve. Several Federal Reserve's officials signaled recently that they see sufficient improvements in the economy and they are ready for a liftoff soon.

Higher rates would harm demand for the non-interest-bearing precious metal.

Physical demand in top consumers China and India supports prices, however it cannot withstand falling investor demand. SPDR Gold Trust, the world's biggest gold-backed exchange-traded fund, said its holdings fell to 655.69 tonnes on Monday, the lowest since September 2008.

-

07:22

Global Stocks: U.S. stock indices edged down

U.S. stock indices closed little changed on Monday as investors were cautious ahead of Thanksgiving Day on Thursday.

The Dow Jones Industrial Average fell 31.13 points, or 0.2%, to 17,792.68. The S&P 500 lost 2.58 points, or 0.1%, to 2,086.59 (six out of its 10 sectors declined). The Nasdaq Composite edged down 2.44 points, or less than 0.1%, to 5,102.48.

Pfizer (PFE) and Allergan (AGN) confirmed they will merge and become the largest pharmaceutical company in the world. The company would be worth around $160 billion. Pfizer stocks fell 2.9% and Allergan stocks lost 3.3% after the news.

This morning in Asia Hong Kong Hang Seng declined 0.84%, or 189.73, to 22,476.17. China Shanghai Composite Index lost 0.57%, or 20.63, to 3.589.68. The Nikkei gained 0.24%, or 47.06, to 19,926.87.

Asian indices traded mixed. Stocks outside Japan fell following declines in the U.S.

Favorable preliminary data helped Japanese stocks gain. The country's manufacturing PMI rose to 52.8 in November from 52.4 reported previously. Economists had expected a reading of 52.1.

Chinese stocks continued falling amid declines in copper prices.

-

02:35

Japan: Manufacturing PMI, November 52.8 (forecast 52.1)

-

00:44

Commodities. Daily history for Nov 23’2015:

(raw materials / closing price /% change)

Oil 41.99 +0.57%

Gold 1,068.20 +0.13%

-

00:43

Stocks. Daily history for Sep Nov 23’2015:

(index / closing price / change items /% change)

Hang Seng 22,665.9 -88.82 -0.39 %

Shanghai Composite 3,610.89 -19.61 -0.54 %

FTSE 100 6,305.49 -29.14 -0.46 %

CAC 40 4,889.12 -21.85 -0.44 %

Xetra DAX 11,092.31 -27.52 -0.25 %

S&P 500 2,086.59 -2.58 -0.12 %

NASDAQ Composite 5,102.48 -2.44 -0.05 %

Dow Jones 17,792.68 -31.13 -0.17 %

-

00:42

Currencies. Daily history for Nov 23’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0635 -0,08%

GBP/USD $1,5123 -0,46%

USD/CHF Chf1,018 -0,04%

USD/JPY Y122,83 -0,05%

EUR/JPY Y130,64 -0,13%

GBP/JPY Y185,73 -0,52%

AUD/USD $0,7190 -0,61%

NZD/USD $0,6519 -0,71%

USD/CAD C$1,3363 +0,16%

-