Noticias del mercado

-

23:59

Schedule for today,Wednesday, Jul 26’2017 (GMT0)

01:30 Australia CPI, y/y Quarter II 2.1% 2.2%

01:30 Australia CPI, q/q Quarter II 0.5% 0.4%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.5% 0.5%

01:30 Australia Trimmed Mean CPI y/y Quarter II 1.9% 1.8%

03:05 Australia RBA's Governor Philip Lowe Speaks

06:00 Switzerland UBS Consumption Indicator June 1.39

06:45 France Consumer confidence July 108 108

08:30 United Kingdom BBA Mortgage Approvals June 40.35 39.9

08:30 United Kingdom GDP, y/y (Preliminary) Quarter II 2% 1.7%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.2% 0.3%

14:00 U.S. New Home Sales June 610 615

14:30 U.S. Crude Oil Inventories July -4.727

18:00 U.S. Fed Interest Rate Decision 1.25% 1.25%

18:00 U.S. FOMC Statement

-

22:08

The main US stock indexes completed trading on the positive territory

The major stock indexes of the US ended the session above zero, helped by a string of strong quarterly earnings from companies, including McDonald's and Caterpillar.

Additional support for the market also provided statistics on the United States. The Consumer Confidence Index from the Conference Board improved in July after slightly declining in June. The index is now 121.1 (1985 = 100), compared with 117.3 in June. The index of the current situation increased from 143.9 to 147.8, and the index of expectations increased from 99.6 to 103.3. "Consumer confidence increased in July after a slight decline in June," said Lynn Franco, director of economic performance at the Conference Board. - Consumers rated the current conditions at a 16-year high, and their expectations for short-term forecasts improved somewhat after cooling in June. In general, consumers predict that the current economic expansion will continue in the second half of the year. "

At the same time, the results of the survey of the Federal Reserve Bank of Richmond indicated that the mood of the producers of the fifth district improved in July. The composite index rose from 11 to 14 in July - the result of a slight increase in new orders and employment. The index of shipments remained at June level 13. A large proportion of firms reported higher wages and a longer workweek in July, as the wage index rose from 10 in June to 17 in July, and the average index of the working week rose from 1 to 9.

Oil prices rose by more than 3%, as the promises of Saudi Arabia and Nigeria sparked hopes that the pace of market rebalancing could accelerate.

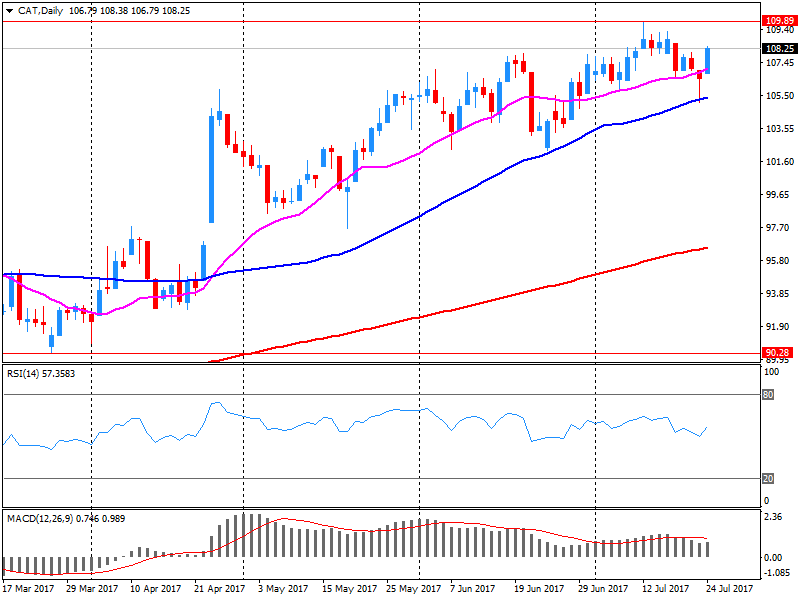

Most components of the DOW index recorded a rise (22 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 5.84%). Outsider were shares of 3M Company (MMM, -5.40%).

Most sectors of the S & P index showed growth. The sector of basic materials grew most (+ 1.4%). The health sector showed the greatest decline (-0.5%).

At closing:

DJIA + 0.46% 21.612.95 +99.78

Nasdaq + 0.02% 6,412.17 +1.36

S & P + 0.29% 2,477.18 +7.27

-

21:00

DJIA +0.54% 21,628.85 +115.68 Nasdaq +0.11% 6,418.05 +7.24 S&P +0.36% 2,478.83 +8.92

-

18:00

European stocks closed: FTSE 100 +57.09 7434.82 +0.77% DAX +55.36 12264.31 +0.45% CAC 40 +33.38 5161.08 +0.65%

-

16:01

Reports from manufacturers improved some in July, according to the latest survey by the Federal Reserve Bank of Richmond

Reports from Fifth District manufacturers improved some in July, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index rose from 11 in June to 14 in July - the result of a slight increase in the measures of new orders and employment. The index for shipments remained at its June reading of 13. A larger share of firms reported higher wages and longer workweeks in July, as the wages index rose from 10 in June to 17 in July and the average workweek index rose from 1 to 9.

Manufacturing executives remained generally optimistic about activity six months ahead. Among the indexes for expected activity, almost every measure was well into positive territory and each increased, with the exception of the index for vendor lead time, which held steady at its June level of 7.

-

16:00

U.S.: Consumer confidence , July 121.1 (forecast 116.6)

-

16:00

U.S.: Richmond Fed Manufacturing Index, July 14 (forecast 7)

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1400 (EUR 320m) 1.1500 (2.66bln) 1.1600 (370m) 1.1645-50 (1.25bln) 1.1700 (370m)

USDJPY: 110.50 (USD 470m) 111.00-10 (560m) 112.45 (270m)

EURGBP: 0.8880 (EUR 270m)

AUDUSD: 0.7750 (AUD 430m) 0.7925-30 (260m)

EURJPY: 129.60 (EUR 290m) 130.00 (760m)

USDCNY: 6.7290 (USD 1.1bln) 6.8060 (1bln) 6.82 1.2bln)

-

15:34

U.S. Stocks open: Dow +0.69%, Nasdaq -0.03%, S&P +0.38%

-

15:28

Before the bell: S&P futures +0.26%, NASDAQ futures +0.06%

U.S. stock-index futures were slightly higher with the earnings season gaining momentum and ahead of a two-day meeting of FOMC.

Global Stocks:

Nikkei 19,955.20 -20.47 -0.10%

Hang Seng 26,852.05 +5.22 +0.02%

Shanghai 3,243.77 -6.83 -0.21%

S&P/ASX 5,726.60 +38.53 +0.68%

FTSE 7,437.75 +60.02 +0.81%

CAC 5,183.75 +56.05 +1.09%

DAX 12,291.21 +82.26 +0.67%

Crude $47.06 (+1.55%)

Gold $1,250.70 (-0.29%)

-

15:09

U.S. house prices rose in May, up 0.4 percent from the previous month

U.S. house prices rose in May, up 0.4 percent from the previous month, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI). The previously reported 0.7 percent increase in April was revised downward to reflect a 0.6 percent increase.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From May 2016 to May 2017, house prices were up 6.9 percent.

For the nine census divisions, seasonally adjusted monthly price changes from April 2017 to May 2017 ranged from -0.5 percent in the Middle Atlantic division to +1.0 percent in the West South Central division. The 12-month changes were all positive, ranging from +4.0 percent in the Middle Atlantic division to +8.7 percent in the Pacific division.

-

15:01

U.S.: Housing Price Index, m/m, May 0.4% (forecast 0.6%)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, May 5.7% (forecast 5.8%)

-

14:59

Belgium: Business Climate, July -1.5 (forecast -1.9)

-

14:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

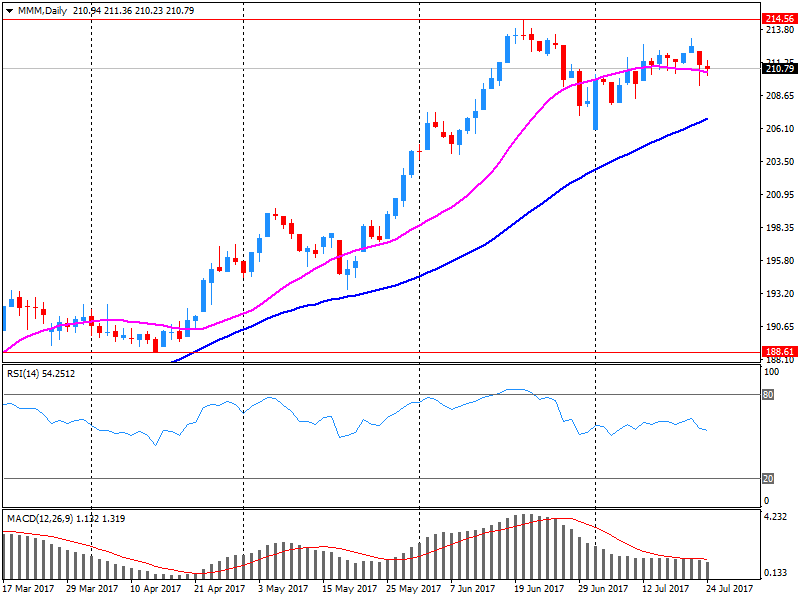

3M Co

MMM

205

-5.00(-2.38%)

14997

Amazon.com Inc., NASDAQ

AMZN

1,038.00

-0.95(-0.09%)

35813

American Express Co

AXP

85.5

0.50(0.59%)

605

Apple Inc.

AAPL

152.21

0.12(0.08%)

51348

AT&T Inc

T

36.28

0.05(0.14%)

4020

Barrick Gold Corporation, NYSE

ABX

15.41

-0.02(-0.13%)

40375

Boeing Co

BA

213.47

1.29(0.61%)

1810

Caterpillar Inc

CAT

113.29

5.11(4.72%)

403953

Cisco Systems Inc

CSCO

31.98

0.12(0.38%)

1449

Citigroup Inc., NYSE

C

67.56

1.46(2.21%)

331476

Deere & Company, NYSE

DE

128.25

1.70(1.34%)

1805

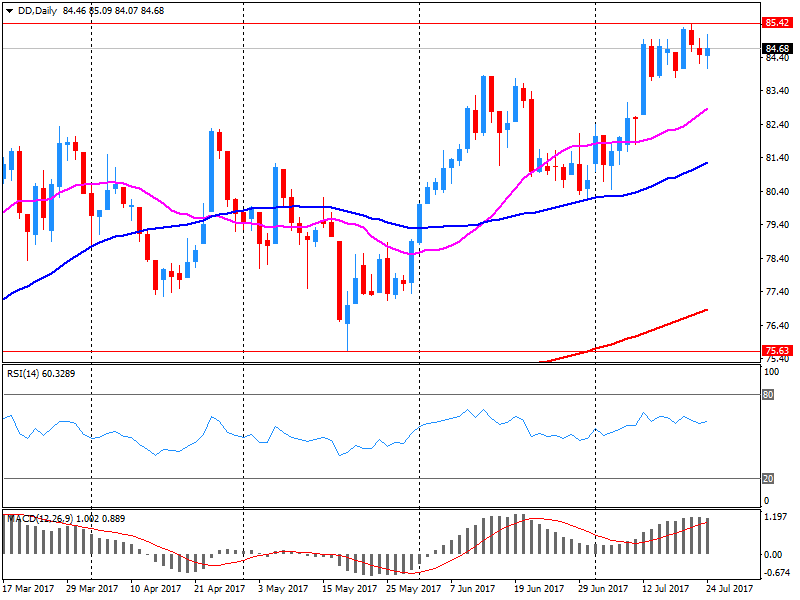

E. I. du Pont de Nemours and Co

DD

85.3

0.95(1.13%)

28677

Exxon Mobil Corp

XOM

80.36

0.49(0.61%)

15526

Facebook, Inc.

FB

165.45

-0.55(-0.33%)

96268

Ford Motor Co.

F

11.28

-0.01(-0.09%)

137218

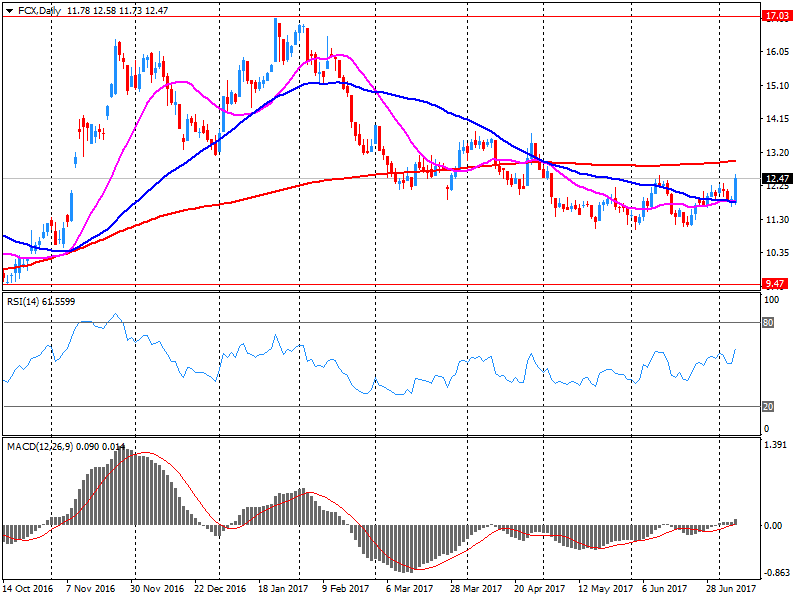

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.19

0.23(1.77%)

192585

General Electric Co

GE

25.49

0.06(0.24%)

32970

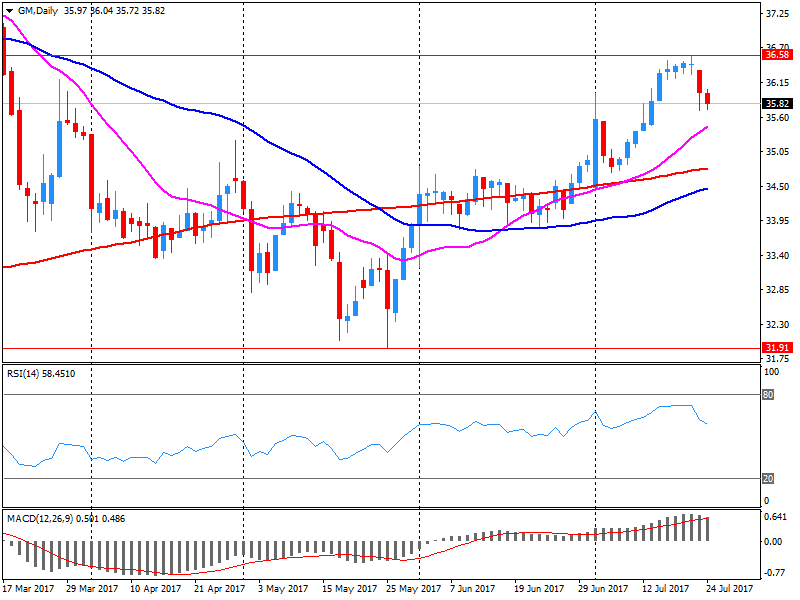

General Motors Company, NYSE

GM

35.7

-0.12(-0.34%)

212032

Goldman Sachs

GS

220.19

2.01(0.92%)

15429

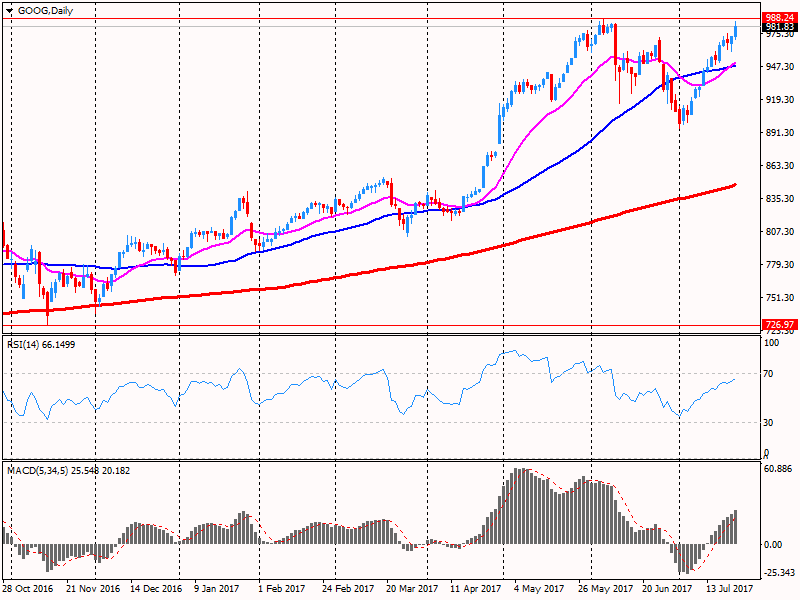

Google Inc.

GOOG

951.75

-28.59(-2.92%)

41740

Home Depot Inc

HD

145.37

0.79(0.55%)

1519

Intel Corp

INTC

34.63

0.13(0.38%)

4812

International Business Machines Co...

IBM

146.8

0.81(0.55%)

2502

Johnson & Johnson

JNJ

133.1

0.09(0.07%)

1226

JPMorgan Chase and Co

JPM

92.15

0.87(0.95%)

20384

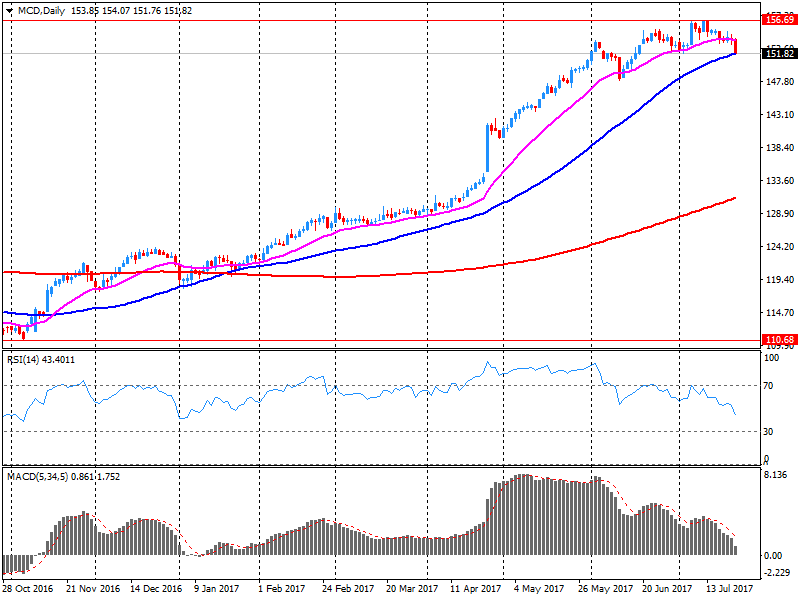

McDonald's Corp

MCD

155.74

3.89(2.56%)

147655

Microsoft Corp

MSFT

73.55

-0.05(-0.07%)

21559

Pfizer Inc

PFE

33.25

-0.07(-0.21%)

41186

Procter & Gamble Co

PG

88.6

0.42(0.48%)

768

Tesla Motors, Inc., NASDAQ

TSLA

345

2.48(0.72%)

73357

The Coca-Cola Co

KO

44.99

0.15(0.33%)

1487

Travelers Companies Inc

TRV

127.13

0.75(0.59%)

684

Twitter, Inc., NYSE

TWTR

20.04

0.04(0.20%)

29106

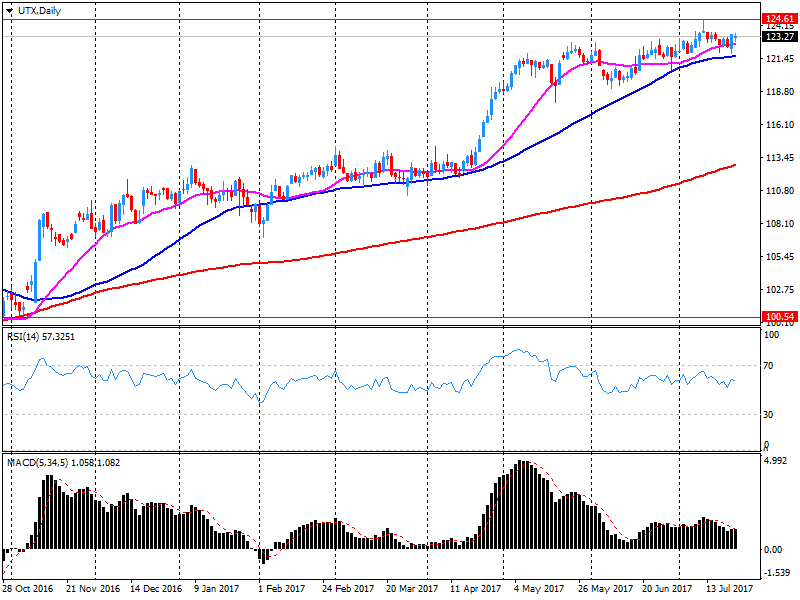

United Technologies Corp

UTX

123

-0.13(-0.11%)

2700

UnitedHealth Group Inc

UNH

192.61

1.72(0.90%)

733

Verizon Communications Inc

VZ

43.89

0.18(0.41%)

3016

Visa

V

100.75

0.38(0.38%)

2547

Wal-Mart Stores Inc

WMT

77.23

0.34(0.44%)

1080

Walt Disney Co

DIS

107.4

0.40(0.37%)

1313

Yandex N.V., NASDAQ

YNDX

31.95

0.11(0.35%)

2900

-

14:43

Analyst coverage initiations before the market open

Apple (AAPL) initiated with a Buy at Loop Capital; target $172

-

14:42

Target price changes before the market open

General Electric (GE) target lowered to $28 from $33 at Stifel

-

14:27

Company News: Freeport-McMoRan (FCX) Q2 EPS miss analysts’ forecast

Freeport-McMoRan (FCX) reported Q2 FY 2017 earnings of $0.17 per share (versus -$0.02 in Q2 FY 2016), missing analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $3.711 bln (+11.3% y/y), beating analysts' consensus estimate of $3.672 bln.

FCX rose to $13.22 (+2.01%) in pre-market trading.

-

14:18

Company News: McDonald's (MCD) quarterly results beat analysts’ expectations

McDonald's (MCD) reported Q2 FY 2017 earnings of $1.73 per share (versus $1.45 in Q2 FY 2016), beating analysts' consensus estimate of $1.62.

The company's quarterly revenues amounted to $6.050 bln (-3.4% y/y), beating analysts' consensus estimate of $5.964 bln.

MCD rose to $156.30 (+2.93%) in pre-market trading.

-

14:11

Company News: General Motors (GM) Q2 EPS beat analysts’ forecasts

General Motors (GM) reported Q2 FY 2017 earnings of $1.89 per share (versus $1.86 in Q2 FY 2016), beating analysts' consensus estimate of $1.72.

The company's quarterly revenues amounted to $36.984 bln (-1.1% y/y), missing analysts' consensus estimate of $37.673 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $6.00-6.50 versus analysts' consensus estimate of $6.08.

GM rose to $36.12 (+0.84%) in pre-market trading.

-

14:00

Company News: 3M (MMM) Q2 EPS miss analysts’ estimate

3M (MMM) reported Q2 FY 2017 earnings of $2.58 per share (versus $2.08 in Q2 FY 2016), missing analysts' consensus estimate of $2.59.

The company's quarterly revenues amounted to $7.810 bln (+1.9% y/y), generally in-line with analysts' consensus estimate of $7.858 bln.

The company also raised the low end of guidance for FY 2017 EPS to $8.80-9.05 from $8.70-9.05 (versus analysts' consensus estimate of $8.98).

MMM fell to $206.35 (-1.74%) in pre-market trading.

-

13:48

Company News: Caterpillar (CAT) quarterly results beat analysts’ forecasts

Caterpillar (CAT) reported Q2 FY 2017 earnings of $11.49 per share (versus $1.09 in Q2 FY 2016), beating analysts' consensus estimate of $1.26.

The company's quarterly revenues amounted to $11.331 bln (+9.6% y/y), beating analysts' consensus estimate of $10.961 bln.

The company also raised FY 2017 sales guidance to $42-44 bln from $38-41 bln (versus analysts' consensus estimate of $40.74 bln).

CAT rose to $113.25 (+4.69%) in pre-market trading.

-

13:25

Company News: United Tech (UTX) Q2 EPS beat analysts’ estimate

United Tech (UTX) reported Q2 FY 2017 earnings of $1.85 per share (versus $1.82 in Q2 FY 2016), beating analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $15.280 bln (+2.7% y/y), generally in-line with analysts' consensus estimate of $15.241 bln.

The company also raised its FY 2017 EPS projection to $6.45-6.60 from $6.30-6.60 (versus analysts' consensus estimate of $6.59), while FY 2017 revenues projection was improved to $58.5-59.5 bln from $57.5-59 bln (versus analysts' consensus estimate of $59.08 bln).

UTX fell to $122.50 (-0.51%) in pre-market trading.

-

13:10

Company News: DuPont (DD) quarterly results beat analysts’ estimates

DuPont (DD) reported Q2 FY 2017 earnings of $1.38 per share (versus $1.24 in Q2 FY 2016), beating analysts' consensus estimate of $1.28.

The company's quarterly revenues amounted to $7.424 bln (+5.1% y/y), beating analysts' consensus estimate of $7.277 bln.

DD closed Monday's trading session at $84.35 (-0.22%).

-

13:02

UK's manufacturing industry expanded strongly in July

The survey of 397 manufacturers also found that employee headcount increased at the fastest rate for three years and that hiring intentions for the coming quarter also improved. Optimism rose marginally in the three months to July, while export optimism for the year ahead rose at a slower, but still healthy pace.

Growth in total orders moderated in line with expectations, but remained robust. Domestic orders expanded at a strong pace, similar to the rate in the previous quarter, and growth in export orders also remained brisk, despite slowing somewhat.

-

13:01

Company News: Alphabet (GOOG) quarterly results beat analysts’ expectations

Alphabet (GOOG) reported Q2 FY 2017 earnings of $5.01 per share (versus $8.42 in Q2 FY 2016), beating analysts' consensus estimate of $4.43.

The company's quarterly revenues amounted to $26.010 bln (+21% y/y), beating analysts' consensus estimate of $25.614 bln.

GOOG fell to $954.92 (-2.59%) in pre-market trading.

-

12:00

United Kingdom: CBI industrial order books balance, July 10 (forecast 12)

-

11:38

Ifo economist says not worried about impact of Brexit on German economy

-

Sees no impact from Trump on German economy

-

Nothing appears to knock German economy off course at the moment

-

Business going well enough to offset euro fx rate

-

German companies are experienced in managing fx moves

-

Euro fx rate is no impediment to German economy

-

-

11:06

New BoJ board member Kataoka: if Japan lowers inflation target, that could cause deflationary pressure

-

Adoption of specific policy steps depends on economic conditions at the time

-

-

10:43

New BoJ board member Suzuki: 2 pct inflation target is global standard, though it seems a high goal

-

BoJ negative rate policy has a significantly large impact on banks' earnings

-

Don't see BoJ negative rate policy hurting financial system, intermediation

-

-

10:35

Sentiment among German businesses continues to improve says Ifo

The ifo Business Climate Index rose from 115.2 points (seasonally adjusted) last month to 116.0 points in July, hitting a new record high for the third month in succession. Companies' satisfaction with their current business situation reached its highest level since Germany's reunification. Their short-term business outlook also improved. Germany's economy is powering ahead.

In manufacturing the index hit a new record high. Assessments of the current business situation scaled unprecedented heights. Manufacturers once again expressed greater optimism about the short-term future. Capacity utilisation rose significantly by 0.7 percentage points to 86.7 percent.

In wholesaling the business climate improved again on the back of far more optimistic business expectations. Assessments of the current business situation, by contrast, edged downwards from last month's record highs. In retailing the index dropped. Retailers were far less satisfied with their current business situation. Their optimism about the short-term business outlook also waned. Both components, however, remain at a very high level.

-

10:25

Italian industrial turnover and orders rose more than expected in May

In May 2017 the seasonally adjusted turnover index increased by +1.5% compared to the previous month (+1.6% in domestic market and +1.2% in non-domestic market). The percentage change of the average of the last three months compared to the previous three months was +0.9% (+0.9% in domestic market and +0.7% in non-domestic market).

In May 2017 the seasonally adjusted industrial new orders index increased by +4.3% compared with April 2017 (+3.9% in domestic market and +4.9% in non-domestic market). The percentage change of the average of the last three months compared to the previous three months was -1.0% (-1.2% in domestic market and -0.8% in non-domestic market).

With respect to the same month of the previous year the calendar adjusted industrial turnover index increased by +7.6% (calendar working days in May 2017 being the same as in May 2016).

-

10:01

Germany: IFO - Expectations , July 107.3 (forecast 106.5)

-

10:00

Germany: IFO - Current Assessment , July 125.4 (forecast 123.8)

-

10:00

Germany: IFO - Business Climate, July 116 (forecast 114.9)

-

09:43

Major European stock exchanges trading in the green zone: FTSE 7414.67 +36.94 + 0.50%, DAX 12245.88 +36.93 + 0.30%, CAC 5153.60 +25.90 + 0.51%

-

08:42

Positive start of trading expected on the main European stock markets: DAX + 0.4%, CAC 40 + 0.3%, FTSE 100 + 0.5%

-

08:40

Options levels on tuesday, July 25, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1723 (1449)

$1.1705 (3745)

$1.1686 (5088)

Price at time of writing this review: $1.1661

Support levels (open interest**, contracts):

$1.1628 (770)

$1.1604 (596)

$1.1572 (1643)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 74134 contracts (according to data from July, 24) with the maximum number of contracts with strike price $1,1500 (5088);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3126 (2300)

$1.3105 (2483)

$1.3080 (1711)

Price at time of writing this review: $1.3038

Support levels (open interest**, contracts):

$1.2984 (335)

$1.2955 (639)

$1.2919 (1163)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 27787 contracts, with the maximum number of contracts with strike price $1,3100 (3044);

- Overall open interest on the PUT options with the expiration date August, 4 is 26746 contracts, with the maximum number of contracts with strike price $1,2800 (3054);

- The ratio of PUT/CALL was 0.96 versus 0.95 from the previous trading day according to data from July, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

BoJ minutes: several members said important to continue internal analysis on possible exit strategies and impact

-

Several members said providing information on exit could cause market turbulence

-

Several members said companies are taking steps to absorb upward presser on wages

-

A few members said important to explain how exit will impact BoJ's finances

-

Many members agreed need to keep policy easy because 2 pct inflation target still distant

-

One member said 2 pct inflation target is a global standard, can contribute to fx stability

-

-

08:25

The Amazon Washington Post fabricated the facts on my ending massive, dangerous, and wasteful payments to Syrian rebels fighting Assad..... @realDonaldTrump

-

08:23

German import prices down 1.1% in June

As reported by the Federal Statistical Office (Destatis), the index of import prices increased by 2.5% in June 2017 compared with the corresponding month of the preceding year. In May 2017 and in April 2017 the annual rates of change were +4.1% and +6.1%, respectively. From May 2017 to June 2017 the index fell by 1.1%.

The index of import prices, excluding crude oil and mineral oil products, increased by 2.6% compared with the level of a year earlier.

The index of export prices increased by 1.8% in June 2017 compared with the corresponding month of the preceding year. In May 2017 and in April 2017 the annual rates of change were +2.2% and +2.6%, respectively. From May 2017 to June 2017 the export price index fell by 0.2%.

-

08:20

So many stories about me in the @washingtonpost are Fake News. They are as bad as ratings challenged @CNN. Lobbyist for Amazon and taxes? @realDonaldTrump

-

07:38

Global Stocks

European stocks closed lower Monday, with shares of German auto makers and Dutch firm Gemalto NV among those pushing the market to its weakest finish in two weeks. The Stoxx Europe 600 SXXP, -0.24% was off 0.2% to end at 379.23, adding to its recent retreat and notching its lowest close since July 11. The index on Friday slid 1%, contributing to last week's loss of 1.9%.

The Dow and the S&P 500 on Monday finished modestly lower, as the market kicked off a busy week of earnings, but the Nasdaq logged another record as technology stocks shook off the broader market's weakness. The Nasdaq Composite Index COMP, +0.36% closed 0.4% at 6,410, boosted by a continued rally in the highflying technology sector XLK, +0.24% However, the Dow Jones Industrial Average DJIA, -0.31% ended the session 0.3% lower at 21,513, while the S&P 500 index SPX, -0.11% wrappeed up Monday trade off 0.1% at 2,469, as gains in the financials sector XLF, +0.44% and tech were more than offset by sharp slumps in telecommunications, utilities, and consumer-discretionary stocks.

Asian stock markets were mostly stronger in early trading Tuesday, with Australia leading the way higher after badly lagging regional peers a day earlier. Helping sentiment has been stabilization for now in the U.S. dollar. Its recent weakness had been pressuring down stocks in Australia and Japan in particular. The WSJ Dollar Index BUXX, -0.08% finished flat on Monday and was up 0.1% early Tuesday.

-

00:28

Commodities. Daily history for Jul 24’2017:

(raw materials / closing price /% change)

Oil 46.48 +0.30%

Gold 1,255.30 +0.08%

-

00:28

Stocks. Daily history for Jul 24’2017:

(index / closing price / change items /% change)

Nikkei -124.08 19975.67 -0.62%

TOPIX -8.42 1621.57 -0.52%

Hang Seng +140.74 26846.83 +0.53%

CSI 300 +14.87 3743.47 +0.40%

Euro Stoxx 50 +1.46 3453.17 +0.04%

FTSE 100 -75.18 7377.73 -1.01%

DAX -31.11 12208.95 -0.25%

CAC 40 +10.04 5127.70 +0.20%

DJIA -66.90 21513.17 -0.31%

S&P 500 -2.63 2469.91 -0.11%

NASDAQ +23.06 6410.81 +0.36%

S&P/TSX -54.44 15128.69 -0.36%

-

00:27

Currencies. Daily history for Jul 24’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1636 -0,22%

GBP/USD $1,3024 +0,24%

USD/CHF Chf0,94693 +0,13%

USD/JPY Y111,16 +0,05%

EUR/JPY Y129,35 -0,18%

GBP/JPY Y144,78 +0,28%

AUD/USD $0,7922 +0,12%

NZD/USD $0,7432 -0,26%

USD/CAD C$1,25077 -0,23%

-