Noticias del mercado

-

21:00

Dow -0.38% 18,145.40 -69.02 Nasdaq -0.46% 4,964.94 -22.95 S&P -0.23% 2,105.78 -4.96

-

18:00

European stocks closed: FTSE 100 6,952.80 +3.07 +0.04% CAC 40 4,951.48 +40.86 +0.83% DAX 11,401.66 +74.47 +0.66%

-

18:00

European stocks close: most stocks closed higher on the better-than-expected economic data from the Eurozone

Most stock indices closed higher on the better-than-expected economic data from the Eurozone. German preliminary consumer price index rose 0.9% in February, exceeding expectations for a 0.6% increase, after a 1.1% drop in January.

On a yearly basis, German preliminary consumer price index increased to 0.1% in February from -0.4% in January.

The increase was driven by lower decline in energy and food prices.

French consumer spending increased 0.6% in January from a year earlier, after a 1.6% rise. December's figure was revised up from a 1.5% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,946.66 -3.07 -0.04 %

DAX 11,401.66 +74.47 +0.66 %

CAC 40 4,951.48 +40.86 +0.83 %

-

17:41

Oil: A review of the market situation

The price of oil rose today, breaking the level of $ 61 (Brent) and $ 49 (WTI), which is associated with the expectations of the publication of data on the number of drilling rigs operating in the US. It is worth emphasizing, since early February Brent has risen by almost 16% - is the maximum rise for May 2009, when she jumped in price by 29%. The cost of this month WTI rose by only 1.8%. We also add that the difference in cost between Brent and WTI in the last days is at a maximum in January 2014, including due to significant fuel reserves in the United States. "Increasing the price gap in part reflects the fact that oil production in the US continues to grow steadily, despite the much lower prices in recent years, said an expert on the commodity market Fawad Razagzada - This has helped push crude oil inventories to new all-time highs, which more or less confirms that the market is still saturated. " Recall, US Energy Information Administration on Wednesday reported the oil reserves in the country last week rose by 8.43 million barrels and amounted to 434.1 million barrels.

Traders await the report Baker Hughes Inc. by the number of drilling rigs operating in the US, which will be presented in the 18:00 GMT. Recall, for the last week, their number decreased by 3.5% - to 1.31 thousand. In annual terms, the number of installations has decreased by 26%, or 461 unit. Analysts predict that the rate will decrease again. However, some experts say that the reduction plants will not have an instant impact on oil production in the United States.

Rising oil prices also helps the weakening dollar against foreign currencies and data on consumer confidence in the United States. As shown by the final results of the studies submitted by Thomson-Reuters and the Institute of Michigan, in February, US consumers are more pessimistic about the economy than last month. According to published data, in February, the final index of consumer sentiment fell to 95.4 points compared with the final reading for January at around 98.1 points. It should be noted, according to the average estimates, the index was down to 94.2.

Meanwhile, a poll conducted by Reuters, showed that the price of oil is likely to have found the bottom and may start to grow in the second half of 2015, since the fall in 2014 caused a decline in production. In the short term the price can be reduced by concerns about oversupply. However, oil prices will recover, and Brent reached a high of $ 59 in 2015 and $ 71.80 in 2016. According to experts, the price will be supported by a slowdown of growth in production by OPEC. Problems in the Middle East and North Africa, especially in Iraq, may also have oil support.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 49.02 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea petroleum mix of Brent increased by $ 1.09 to $ 61.62 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data. The U.S. revised GDP grew 2.2% in the fourth quarter, lower than the previous estimated growth of 2.6%. Analysts had expected U.S. GDP to rise 2.1%.

The Chicago purchasing managers' index declined to 45.8 in February from 59.4 in January, missing expectations for a fall to 58.4. That was the lowest level since July 2009.

A reading below the 50 mark indicates contraction.

The decline was driven by drops in production, new orders, order backlogs and employment.

Pending home sales in the U.S. rose 1.7% in January, missing expectations for a 2.5% increase, after a 1.5% decline in December. December's figure was revised up from a 3.7% drop.

The final University of Michigan's consumer sentiment index was 95.4 in February, beating expectations for a decline to 94.2, down from the preliminary estimate of 98.2.

The euro traded lower against the U.S. dollar despite the positive economic data from the Eurozone. German preliminary consumer price index rose 0.9% in February, exceeding expectations for a 0.6% increase, after a 1.1% drop in January.

On a yearly basis, German preliminary consumer price index increased to 0.1% in February from -0.4% in January.

The increase was driven by lower decline in energy and food prices.

French consumer spending increased 0.6% in January from a year earlier, after a 1.6% rise. December's figure was revised up from a 1.5% gain.

The British pound traded higher against the U.S. dollar in the absence any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. The KOF leading indicator decreased to 90.1 in February from 96.1 in January, beating expectations for a decrease to 89.1. January's figure was revised down from 97.0.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the mixed economic data from New Zealand. The ANZ business confidence index for New Zealand climbed to 34.4 in January from 30.4 in December.

Building permits in New Zealand fell 3.8% in January, after a 2.1% decline in December.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback. Private sector credit in Australia climbed 0.6% in January, after a 0.5% increase in December.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded declined against the greenback after the mostly weaker-than-expected economic data from Japan. Japan's national consumer price index (CPI) remained unchanged at an annual rate of 2.4% in Japan.

Japan's national CPI excluding fresh food declined to an annual rate of 2.2% in January from 2.5% in December, missing expectations for a 2.4% gain.

Tokyo's CPI remained unchanged at an annual rate of 2.3% in February.

Tokyo's CPI excluding fresh food remained unchanged at an annual rate of 2.2% in February, in line with expectations.

Household spending in Japan dropped at annual rate of 5.1% in January, missing forecasts of a 4.0% decrease, after a 3.4% fall in December.

Japan's unemployment rate increased to 3.6% in January from 3.4% in December. Analysts had expected the unemployment rate to remain unchanged.

Preliminary industrial production in Japan climbed 4.0% in January, exceeding expectations for a 3.1% increase, after a 0.8% rise in December.

-

17:20

Gold: а review of the market situation

Gold futures rose significantly, while approaching to yesterday's high, which was associated with the release of the revised US GDP data.

As it became known, the gross domestic product, the broadest measure of goods and services produced in the economy expanded by 2.2% year on year in the fourth quarter. It was less than the original estimate of 2.6%, which was reported last month. Economists had expected in the fourth quarter GDP will grow by 2.1%. Recent figures show that the breakthrough by 5% in the third quarter and 4.6% in the second quarter were unstable. For 2014 as a whole, GDP increased by 2.4%, slightly better than the average growth for 2010-2013 at 2.2%. For comparison, the economy grew by an average of 3.4% per year during the 1990s. The overall picture in the last quarter was mixed, while consumer spending rose at the fastest pace in four years, but business investment has slowed, and exports also slowed down government spending.

Also continues to provide support to prices statistics on China showed that the total volume of exports and imports of goods from Hong Kong to China in January rose by 2.8% and 7.9%, respectively. In December were observed an increase of 0.6% and 1.9% respectively. "The risk of reducing the price of gold is rather limited due to consumer interest in emerging markets such as China," - said an analyst at Jinrui Futures Chen Ming.

As for the situation in the physical market, the margins on the Shanghai Gold Exchange declined slightly from Wednesday, when the stock exchange resumed work, up to $ 4 per ounce to the price in London.

It is worth emphasizing the precious metal closes the week in positive territory after four weeks of the fall. However, the February gold finish with a maximum drop since September last year, amid expectations that the Fed will raise rates, and an agreement on Greece will reduce demand for safe-haven assets.

Recall expectations rise in interest rates had a negative impact on the dynamics of the price of gold, because it can not compete with earning assets at high rates.

April futures price of gold on the COMEX today rose to 1216.70 dollars per ounce.

-

17:00

U.S. pending home sales rises 1.7% in January

The National Association of Realtors (NAR) released its pending home sales figures for the U.S. on Friday. Pending home sales in the U.S. rose 1.7% in January, missing expectations for a 2.5% increase, after a 1.5% decline in December. December's figure was revised up from a 3.7% drop.

The NAR's chief economist Lawrence Yun said that contract activity is increasing.

-

16:17

Chicago purchasing managers' index plunges to 45.8 in February

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The index declined to 45.8 in February from 59.4 in January, missing expectations for a fall to 58.4. That was the lowest level since July 2009.

A reading below the 50 mark indicates contraction.

The decline was driven by drops in production, new orders, order backlogs and employment.

-

16:00

U.S.: Pending Home Sales (MoM) , January +1.7% (forecast +2.5%)

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, February 95.4 (forecast 94.2)

-

15:45

U.S.: Chicago Purchasing Managers' Index , February 45.8 (forecast 58.4)

-

15:42

U.S. revised GDP grew 2.2% in the fourth quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Friday. The U.S. revised GDP grew 2.2% in the fourth quarter, lower than the previous estimated growth of 2.6%.

Analysts had expected U.S. GDP to rise 2.1%.

Consumer spending rose by 4.2% in the fourth quarter, the fastest pace since the first of 2006.

Business investment slowed in the fourth quarter and grew at 4.8% in fourth quarter.

Exports climbed 3.2% due to a stronger dollar and trouble in Asia and Europe.

-

15:36

U.S. Stocks open: Dow -0.12%, Nasdaq -0.02%, S&P -0.01%

-

15:25

Before the bell: S&P futures -0.11%, Nasdaq futures -0.11%

U.S. stock-index futures fell slightly as the economy expanded at a slower pace in the fourth quarter than previously reported.

Global markets:

Nikkei 18,797.94 +12.15 +0.06%

Hang Seng 24,823.29 -78.77 -0.32%

Shanghai Composite 3,310.72 +12.36 +0.37%

FTSE 6,941.63 -8.10 -0.12%

CAC 4,920.07 +9.45 +0.19%

DAX 11,323.38 -3.81 -0.03%

Crude oil $48.88 (+1.45%)

Gold $1209.60 (-0.04%)

-

15:17

Stocks before the bell

(company / ticker / price / change, % / volume)

Tesla Motors, Inc., NASDAQ

TSLA

207.25

+0.03%

9.3K

Exxon Mobil Corp

XOM

88.70

+0.06%

9.0K

International Business Machines Co...

IBM

161.00

+0.08%

0.8K

Barrick Gold Corporation, NYSE

ABX

12.77

+0.08%

2.6K

Visa

V

274.00

+0.09%

5.2K

American Express Co

AXP

83.40

+0.18%

3.1K

Twitter, Inc., NYSE

TWTR

49.50

+0.18%

18.9K

Starbucks Corporation, NASDAQ

SBUX

94.77

+0.23%

0.1K

Ford Motor Co.

F

16.42

+0.24%

0.3K

Chevron Corp

CVX

107.34

+0.26%

13.3K

JPMorgan Chase and Co

JPM

61.74

+0.26%

0.1K

Hewlett-Packard Co.

HPQ

34.10

+0.26%

4.4K

Facebook, Inc.

FB

80.71

+0.37%

45.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

21.22

+0.52%

0.2K

FedEx Corporation, NYSE

FDX

176.49

+1.08%

1.4K

Johnson & Johnson

JNJ

102.80

0.00%

0.2K

Procter & Gamble Co

PG

85.17

0.00%

0.3K

Yahoo! Inc., NASDAQ

YHOO

44.45

0.00%

5.8K

Yandex N.V., NASDAQ

YNDX

16.54

0.00%

0.5K

Intel Corp

INTC

33.64

-0.03%

78.9K

Cisco Systems Inc

CSCO

29.89

-0.07%

1.4K

Google Inc.

GOOG

555.00

-0.09%

1.8K

General Electric Co

GE

25.86

-0.12%

2.3K

Microsoft Corp

MSFT

44.00

-0.12%

2.9K

The Coca-Cola Co

KO

42.40

-0.14%

2.4K

General Motors Company, NYSE

GM

37.50

-0.16%

4.1K

ALCOA INC.

AA

15.07

-0.26%

1.0K

Apple Inc.

AAPL

130.07

-0.26%

203.5K

Amazon.com Inc., NASDAQ

AMZN

383.76

-0.27%

0.8K

Verizon Communications Inc

VZ

49.20

-0.34%

3.5K

AT&T Inc

T

34.38

-0.35%

2.2K

Citigroup Inc., NYSE

C

52.20

-0.40%

0.3K

Pfizer Inc

PFE

34.43

-0.46%

0.5K

Boeing Co

BA

151.00

-0.48%

1.8K

Walt Disney Co

DIS

104.00

-0.54%

0.1K

Goldman Sachs

GS

191.02

-0.61%

0.2K

McDonald's Corp

MCD

98.90

-0.61%

22.9K

-

15:03

German preliminary consumer price index rises 0.9% in February

Destatis released its consumer price inflation data for Germany on Friday. German preliminary consumer price index rose 0.9% in February, exceeding expectations for a 0.6% increase, after a 1.1% drop in January.

On a yearly basis, German preliminary consumer price index increased to 0.1% in February from -0.4% in January.

The increase was driven by lower decline in energy and food prices. Energy prices plunged 7.3% in February, after a 9% drop in the previous month. Food prices decreased 0.4%, after a 1.3% fall in January.

-

14:47

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 648m) 118.50 (USD 804m) 118.90 (USD 400m) 119.00 (USD 483m) 119.50 (USD 717m) 120.00 (USD 473m) 120.50 (USD 981m) 120.75 (USD 806m)

EUR/USD 1.1250 (EUR 1.4bln) 1.1300 (EUR 1bln) 1.1325 (EUR 1.2bln) 1.1400 (EUR 1.8bln) 1.1500 (EUR 1.6bln)

GBP/USD 1.5200 (GBP 359m) 1.5500 (GBP 301m)

USD/CAD 1.2390 (USD 330m) 1.2440 (USD 540m) 1.2500 (USD 1bln) 1.2700 (USD 401m)

AUD/USD 0.7700 (AUD 1.4bln) 0.7775-80 (AUD 2bln) 0.7800 (AUD 704m) 0.7850 (AUD 1.7bln) 0.7900 (AUD 687m)

-

14:32

U.S.: PCE price index, q/q, Quarter IV -0.4%

-

14:31

U.S.: PCE price index ex food, energy, q/q, Quarter IV +1.1%

-

14:30

U.S.: GDP, q/q, Quarter IV +2.2% (forecast +2.1%)

-

14:02

Germany: CPI, y/y , February +0.1%

-

14:01

Germany: CPI, m/m, February +0.9% (forecast +0.6%)

-

14:00

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the positive economic data from France

Economic calendar (GMT0):

00:00 New Zealand ANZ Business Confidence February 30.4 40.9

00:05 United Kingdom Gfk Consumer Confidence February 1 3 1

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y January +5.9% +6.2%

05:00 Japan Housing Starts, y/y January -14.7% -11.1% -13.0%

07:45 France Consumer spending, y/y January +0.5% +0.6%

08:00 Switzerland KOF Leading Indicator February 96.1 Revised From 97.0 89.1 90.1

The U.S. dollar traded mixed to higher against the most major currencies ahead the U.S. economic data. The U.S. revised GDP is expected to rise 2.1% in fourth quarter.

The Chicago purchasing managers' index is expected to decline to 58.4 in February from 59.4 in January.

The final Reuters/Michigan Consumer Sentiment Index is expected to decline to 94.2 in February.

Pending home sales in the U.S. are expected to climb 2.5% in January, after a 3.7% decrease in December.

The euro traded higher against the U.S. dollar after the positive economic data from France. French consumer spending increased 0.6% in January from a year earlier, after a 1.6% rise. December's figure was revised up from a 1.5% gain.

The British pound traded mixed against the U.S. dollar in the absence any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected KOF leading indicator. The KOF leading indicator decreased to 90.1 in February from 96.1 in January, beating expectations for a decrease to 89.1. January's figure was revised down from 97.0.

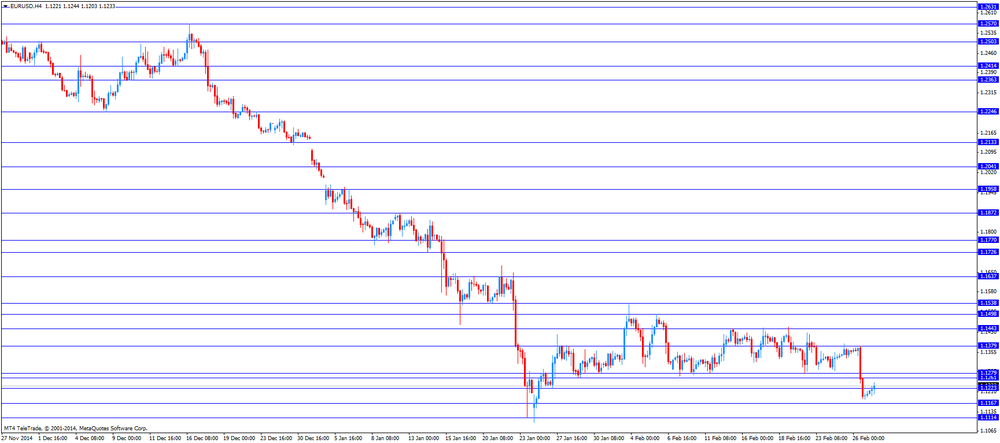

EUR/USD: the currency pair rose to $1.1244

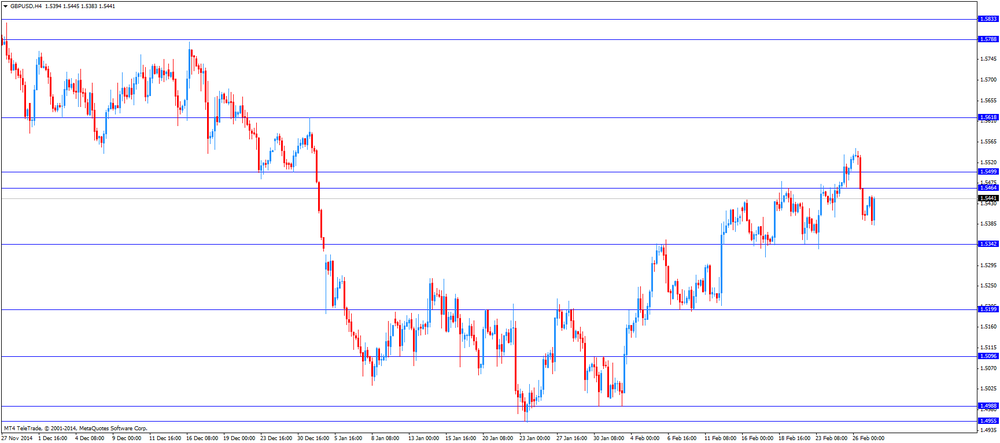

GBP/USD: the currency pair traded mixed

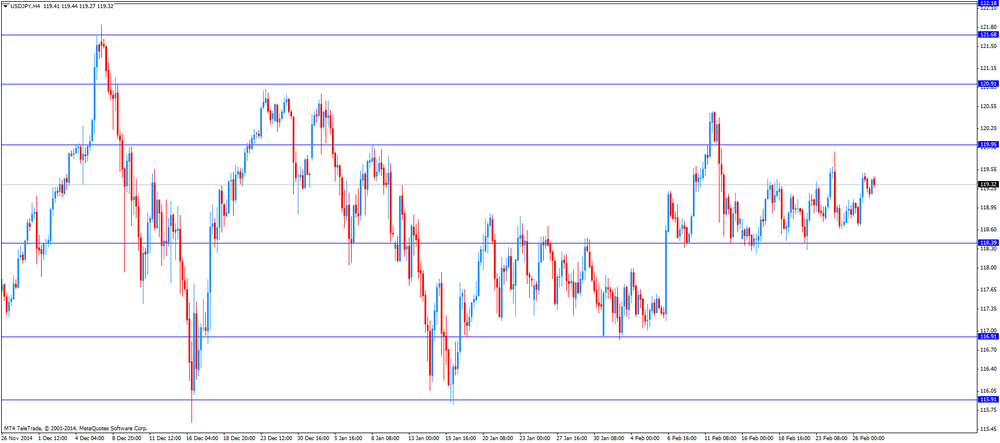

USD/JPY: the currency pair increased to Y119.44

The most important news that are expected (GMT0):

13:00 Germany CPI, m/m (Preliminary) February -1.1% +0.6%

13:00 Germany CPI, y/y (Finally) February -0.4%

13:30 U.S. PCE price index, q/q Quarter IV +4.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.1%

13:30 U.S. GDP, q/q (Revised) Quarter IV +2.6% +2.1%

14:45 U.S. Chicago Purchasing Managers' Index February 59.4 58.4

15:00 U.S. Pending Home Sales (MoM) January -3.7% +2.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 98.1 94.2

-

13:45

Orders

EUR/USD

Offers 1.1225 1.1260 1.1285 1.1300 1.1325 1.1350-60 1.1385 1.1400

Bids 1.1200-1.1190 1.1165 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5450-55 1.5475-80 1.5500 1.5530 1.5550-55 1.5580 1.5600

Bids 1.5400 1.5375-80 1.5360 1.5340 1.5325 1.53001.5285 1.5260

EUR/JPY

Offers 134.00 134.30 134.50 134.80 135.00 135.50

Bids 133.50 133.00 132.85 132.50

USD/JPY

Offers 119.50 119.80 120.00 120.25-30

Bids 119.00 118.85 118.60 118.40 118.20 118.00 117.85

EUR/GBP

Offers 0.7300 0.7320-25 0.7345-50 0.7385 0.7400

Bids 0.7250-55 0.7230 0.7200-10 0.7180-85 0.7160

AUD/USD

Offers 0.7825 0.7840 0.7880 0.7900-10 0.7930

Bids 0.7800-0.7790 0.7770-75 0.7750 0.7730 0.7700

-

12:50

European stock markets mid-session: shares pause rally

European stocks paused the recent rally on Friday. Markets remain cautious about the Greek debt deal. The IMF and the ECB warned that the reform plans are not detailed enough and Athens will have to take further steps to ensure further bailout releases.

French Consumer Spending declined -0.9% in January, more than the expected -0.3%. Year on year Consumer Spending rose +0.6% compared to +0.5%. Data on German CPI due at 13:00 GMT will be in the focus.

Today's focus will be on German CPI and later in the day U.S. GDP, Pending home Sales and the Chicago Purchasing Managers' Index as well as the Reuters/Michigan Consumer Sentiment Index.

The FTSE 100 index is currently trading -0.20% quoted at 6,938.83. Germany's DAX 30 lost -0.12% trading at 11,313.81, close to its new all-time high. France's CAC 40 is currently trading at 4,914.90 points, +0.09%.

-

12:20

Oil: Prices rebound on Japanese data

Oil prices rose on Friday after yesterday's sharp decline on U.S. stockpile data with a focus on good Japanese data on Industrial output, although other economic data from the major consumer of oil was mixed. Today data on U.S. GDP will be in the focus. Markets remain volatile.

Brent Crude added +1.98%, currently trading at USD61.24 a barrel. On January 13th Crude hit a low at USD45.19. West Texas Intermediate gained +2.01% currently quoted at USD49.14, still below USD50 a barrel.

Although prices stabilized recently worldwide supply still exceeds demand in a period of low global economic growth limiting the impact of positive macroeconomic news.

-

12:00

Gold trades lower after two days of gains - focus on U.S. GDP

Gold ended its rebound from 7-week lows in today's trading, now trading slightly above the USD1,200 threshold. After yesterday's mixed U.S. data lend some support now all eyes are on the U.S. GDP due at 13:30 GMT as well as the Chicago Purchasing Managers' Index and Pending Home Sales.

Markets remain cautious about the Greek debt deal bolstering demand for the haven asset. The IMF and the ECB warned that the reform plans are not detailed enough and Athens will have to take further steps to ensure further bailout releases.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as the precious metal is dollar-denominated and not yield-bearing.

The precious metal is currently quoted at USD1,206.00, -0,24% a troy ounce. Gold fell 2.3% last week, a fourth straight loss. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 118.00 (USD 648m) 118.50 (USD 804m) 118.90 (USD 400m) 119.00 (USD 483m) 119.50 (USD 717m) 120.00 (USD 473m) 120.50 (USD 981m) 120.75 (USD 806m)

EUR/USD 1.1250 (EUR 1.4bln) 1.1300 (EUR 1bln) 1.1325 (EUR 1.2bln) 1.1400 (EUR 1.8bln) 1.1500 (EUR 1.6bln)

GBP/USD 1.5200 (GBP 359m) 1.5500 (GBP 301m)

USD/CAD 1.2390 (USD 330m) 1.2440 (USD 540m) 1.2500 (USD 1bln) 1.2700 (USD 401m)

AUD/USD 0.7700 (AUD 1.4bln) 0.7775-80 (AUD 2bln) 0.7800 (AUD 704m) 0.7850 (AUD 1.7bln) 0.7900 (AUD 687m)

-

10:25

Press Review: Saudis’ Oil Price War Is Paying Off

BLOOMBERG

Saudis' Oil Price War Is Paying Off

(Bloomberg) -- Three months after Saudi Arabia made clear it was going to let oil prices keep tumbling, the strategy is showing signs of working.

U.S. drillers are idling rigs at a record pace, gutting investment plans and laying off thousands of workers.

Those steps highlight how the Saudi-led OPEC decision on Nov. 27 to maintain output levels and protect its market share is having the desired effect -- pushing prices down so far that they threaten to curb output in the U.S. and other non-OPEC countries. Saudi Arabia, the most powerful member of the Organization of Petroleum Exporting Countries, will maintain that tack when the group next meets in June, according to some of the world's biggest banks.

REUTERS

FOREX-Dollar on track for eighth month of gains on US data, Fed outlookLONDON, Feb 27 (Reuters) - The dollar index slipped on Friday, pegged back by month-end selling, but was still on track for its eighth straight month of gains on better data and comments from Federal Reserve officials that bolstered bets for a rate rise this year.

The index, which measures the dollar's performance against major currencies, was set to mark its longest streak of monthly gains since the greenback was floated as a fiat currency in 1971.

On the day however, the index was off 0.2 percent at 95.124, having hit a one-month high of 95.357 on Thursday. The index had rallied 1.1 percent on Thursday, bringing it close to the more than 11-year high of 95.481 struck on Jan. 23.

Data released on Thursday showed U.S. core consumer price index, which excludes food and energy costs, rose 0.2 percent in January, more than the 0.1 percent increase economists had expected.

Source: http://www.reuters.com/article/2015/02/27/markets-forex-idUSL5N0W11OD20150227

REUTERS

Apple faces second suit from victorious patent firm(Reuters) - Fresh off a $532.9 million jury win against Apple Inc, a Texas company is again suing the tech giant, this time over the same patents' use in devices introduced after the original case was underway.

Smartflash LLC aims to make Apple pay for using the patent licensing firm's technology without permission in devices not be included in the previous case, such as the iPhone 6 and 6 Plus and the iPad Air 2. The trial covered older Apple devices.

On Tuesday, a jury in federal court in Tyler, Texas found that Apple willfully violated three Smartflash patents with devices that use its iTunes software. The patents relate to accessing and storing downloaded songs, videos and games.

Source: http://www.reuters.com/article/2015/02/27/us-ip-apple-lawsuit-idUSKBN0LU27X20150227

-

10:10

European Stocks. First hour: Stocks almost little changed after opening pausing the recent rally

European stocks are little changed in early trading on Markets remain cautious about the Greek debt deal and take a breather after the recent rally. The IMF and the ECB warned that the reform plans are not detailed enough and Athens will have to take further steps to ensure further bailout releases.

French Consumer Spending declined -0.9% in January, more than the expected -0.3%. Year on year Consumer Spending rose +0.6% compared to +0.5%. Data on German CPI due at 13:00 GMT will be in the focus.

The FTSE 100 index is currently trading +0.01% quoted at 6,949.14 points. Germany's DAX 30 is trading +0.05 at 11,332.95 points. France's CAC 40 gained +0.12%, currently trading at 4,916.47 points.

-

09:50

Global Stocks: Wall Street declines on mixed data, Nikkei extends 15-year high

U.S. stocks closed lower on Thursday on mixed U.S. economic data and falling oil prices. U.S. consumer price inflation fell 0.7% in January, missing expectations for a 0.6% decrease, after a 0.4% decline in December. U.S. durable goods orders rose 2.8% in January, exceeding expectations for a 1.7% increase, after a 3.7% decline in December. The number of initial jobless claims in the week ending February 21 in the U.S. climbed by 31,000 to 313,000 from 282,000 in the previous week, missing expectations for a rise by 3,000. The S&P 500 closed -0.15% with a final quote of 2,110.74 points. The DOW JONES index declined by -0.06% closing at 18,214.42 points.

Chinese stocks were mixed. Yesterday markets rose on speculations on further stimulus measures taken by the PBoC. Premier Li stated that the economy needs more active fiscal policy. In a report the central bank said additional monetary easing is needed. Now all eyes are on the upcoming National People's Congress meeting next week. Hong Kong's Hang Seng is trading -0.32% at 24,823.29 points. China's Shanghai Composite closed at 3,310.72 points +0.37%.

The Nikkei continues extending its 15-year high. The Nikkei closed +0.06% with a final quote of 18,797.94 points, the highest closing since April 2000. Markets were supported by upbeat Industrial Production.

-

09:30

Foreign exchange market. Asian session: U.S. dollar traded lower against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand ANZ Business Confidence February 30.4 40.9

00:05 United Kingdom Gfk Consumer Confidence February 1 3 1

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5% +0.6%

00:30 Australia Private Sector Credit, y/y January +5.9% +6.2%

05:00 Japan Housing Starts, y/y January -14.7% -11.1% -13.0%

07:45 France Consumer spending January +1.5% -0.3% -0.9%

07:45 France Consumer spending, y/y January +0.5% +0.6%

08:00 Switzerland KOF Leading Indicator February 97.0 89.1 90.1

The U.S. dollar traded lower against its major peers after the mixed U.S. economic data yesterday. U.S. consumer price inflation fell 0.7% in January, missing expectations for a 0.6% decrease, after a 0.4% decline in December. That was largest decline since December 2008. On a yearly basis, the U.S. consumer price index fell to -0.1% in January from 0.8% in December. That was the lowest level since October 2009.

The U.S. durable goods orders rose 2.8% in January, exceeding expectations for a 1.7% increase, after a 3.7% decline in December. December's figure was revised down from a 3.3% decrease.

The number of initial jobless claims in the week ending February 21 in the U.S. climbed by 31,000 to 313,000 from 282,000 in the previous week, missing expectations for a rise by 3,000. The previous week's figure was revised up from 283,000.

The euro recovered moderately from yesterday's slump hitting a monthly-low yesterday.

The Australian dollar recovered from yesterday's slump and added gains versus the U.S. dollar. Private Sector Credit rose by +0.6% on a monthly basis in January, above estimates and a previous reading of +0.5%. Year on year Private Sector Credit rose +6.2% compared to +5.9%.

New Zealand's dollar rose against the greenback. The ANZ Business Confidence Index rose from 30.4 to 40.9 in February.

The Japanese yen traded higher against the greenback on Friday despite mostly disappointing Japanese economic reports as yesterday's U.S. data continued to weigh on the greenback. The Japanese Unemployment Rate for January rose to 3.6% from 3.4% in the previous month. Household spending decreases above estimates of -4.0% by -5.1%. The National Consumer Price index remained unchanged at +2.4%. Retail Sales declined by -2.0%, far more than the estimated -1.1%. Preliminary Industrial Production for January rose by +4.0% month on month, beating estimates of +3.1%. Year on year Industrial Production declined by -2.6%.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling traded almost flat against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

13:00 Germany CPI, m/m (Preliminary) February -1.1% +0.6%

13:00 Germany CPI, y/y (Finally) February -0.4%

13:30 U.S. PCE price index, q/q Quarter IV +4.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.1%

13:30 U.S. GDP, q/q (Revised) Quarter IV +2.6% +2.1%

14:45 U.S. Chicago Purchasing Managers' Index February 59.4 58.4

15:00 U.S. Pending Home Sales (MoM) January -3.7% +2.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 98.1 94.2

-

09:00

Switzerland: KOF Leading Indicator, February 90,1 (forecast 89.1)

-

08:45

France: Consumer spending , January -0.9% (forecast -0.3%)

-

08:45

France: Consumer spending, y/y, January +0.6%

-

08:21

Options levels on friday, February 27, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1333 (2300)

$1.1300 (847)

$1.1252 (310)

Price at time of writing this review: $1.1211

Support levels (open interest**, contracts):

$1.1178 (1918)

$1.1149 (2854)

$1.1097 (2906)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 108686 contracts, with the maximum number of contracts with strike price $1,1500 (6196);

- Overall open interest on the PUT options with the expiration date March, 6 is 110797 contracts, with the maximum number of contracts with strike price $1,1100 (6077);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from February, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (1136)

$1.5601 (2647)

$1.5503 (2890)

Price at time of writing this review: $1.5432

Support levels (open interest**, contracts):

$1.5394 (1684)

$1.5297 (2133)

$1.5199 (1936)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 30246 contracts, with the maximum number of contracts with strike price $1,5500 (2890);

- Overall open interest on the PUT options with the expiration date March, 6 is 35884 contracts, with the maximum number of contracts with strike price $1,5300 (2133);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from February, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:03

Japan: Housing Starts, y/y, January -13.0% (forecast -11.1%)

-

03:32

Nikkei 225 18,813.2 +27.41 +0.15%, Hang Seng 24,919.21 +17.15 +0.07%, Shanghai Composite 3,303.8 +5.44 +0.16%

-

01:31

Australia: Private Sector Credit, m/m, January +0.6% (forecast +0.5%)

-

01:31

Australia: Private Sector Credit, y/y, January +6.2%

-

01:20

Commodities. Daily history for Feb 26’2015:

(raw materials / closing price /% change)

Oil 48.17 -5.53%

Gold 1,210.100. 00%

-

01:20

Stocks. Daily history for Feb 26’2015:

(index / closing price / change items /% change)

Nikkei 225 18,785.79т+200.59 +1.08%

Hang Seng 24,902.06 +123.78 +0.50%

Shanghai Composite 3,298.36 +69.52 +2.15%

FTSE 100 6,949.73 +14.35 +0.21%

CAC 40 4,910.62 +28.40 +0.58%

Xetra DAX 11,327.19 +116.92 +1.04%

S&P 500 2,110.74 -3.12 -0.15%

NASDAQ Composite 4,987.89 +20.75 +0.42%

Dow Jones 18,214.42 -10.15 -0.06%

-

01:18

Currencies. Daily history for Feb 26’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1197 -1,46%

GBP/USD $1,5404 -0,80%

USD/CHF Chf0,9525 +0,45%

USD/JPY Y119,41 +0,47%

EUR/JPY Y133,70 -0,97%

GBP/JPY Y183,95 -0,32%

AUD/USD $0,7795 -1,17%

NZD/USD $0,7532 -0,29%

USD/CAD C$1,2513 +0,63%

-

01:05

United Kingdom: Gfk Consumer Confidence, February 1 (forecast 3)

-

01:00

New Zealand: ANZ Business Confidence, February 40.9

-

00:51

Japan: Industrial Production (YoY), January -2.6%

-

00:51

Japan: Industrial Production (MoM) , January +4.0% (forecast +3.1%)

-

00:50

Japan: Retail sales, y/y, January -2.0% (forecast -1.1%)

-

00:33

Japan: National CPI Ex-Fresh Food, y/y, January +2.2% (forecast +2.4%)

-

00:32

Japan: Household spending Y/Y, January -5.1% (forecast -4.0%)

-

00:32

Japan: Tokyo CPI ex Fresh Food, y/y, February +2.2% (forecast +2.2%)

-

00:31

Japan: Tokyo Consumer Price Index, y/y, February +2.3%

-

00:30

Japan: Unemployment Rate, January 3.6% (forecast 3.4%)

-

00:30

Japan: National Consumer Price Index, y/y, January +2.4%

-

00:00

Schedule for today, Friday, Feb 27’2015:

(time / country / index / period / previous value / forecast)

00:00 New Zealand ANZ Business Confidence February 30.4

00:05 United Kingdom Gfk Consumer Confidence February 1 3

00:30 Australia Private Sector Credit, m/m January +0.5% +0.5%

00:30 Australia Private Sector Credit, y/y January +5.9%

05:00 Japan Housing Starts, y/y January -14.7% -11.1%

07:00 United Kingdom Nationwide house price index February +0.3%

07:00 United Kingdom Nationwide house price index, y/y February +6.8%

07:45 France Consumer spending January +1.5% -0.3%

07:45 France Consumer spending, y/y January +0.5%

08:00 Switzerland KOF Leading Indicator February 97.0 89.1

13:00 Germany CPI, m/m (Preliminary) February -1.1% +0.6%

13:00 Germany CPI, y/y (Finally) February -0.4%

13:30 U.S. PCE price index, q/q Quarter IV +4.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.1%

13:30 U.S. GDP, q/q (Revised) Quarter IV +2.6% +2.1%

14:45 U.S. Chicago Purchasing Managers' Index February 59.4 58.4

15:00 U.S. Pending Home Sales (MoM) January -3.7% +2.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 98.1 94.2

-