Noticias del mercado

-

22:07

Major US stock indexes completed today's mostly in the red

On Friday, the main stock indexes of Wall Street fell mainly amid falling Amazon (AMZN) capitalization after the publication of the quarterly report and the collapse of shares of tobacco companies in response to statements by the US Food and Drug Administration about the intention to reduce the level of tobacco in cigarettes to non-addictive .

In addition, investors drew attention to the US data. As the final results of the studies presented by Thomson-Reuters and the Michigan Institute showed, in July US consumers felt more pessimistic about the economy than last month. According to the data, in July the consumer sentiment index fell to 93.4 points compared to the final reading for June 95.1 points and the preliminary value for July 93.1 points. It was predicted that the index will be 93.1 points.

Oil prices rose more than 1% on Friday, reaching new two-month highs, and being on the way to its biggest weekly increase this year. Support for oil was provided by signs of a reduction in excess supply and the collapse of the US currency across the entire spectrum of the market.

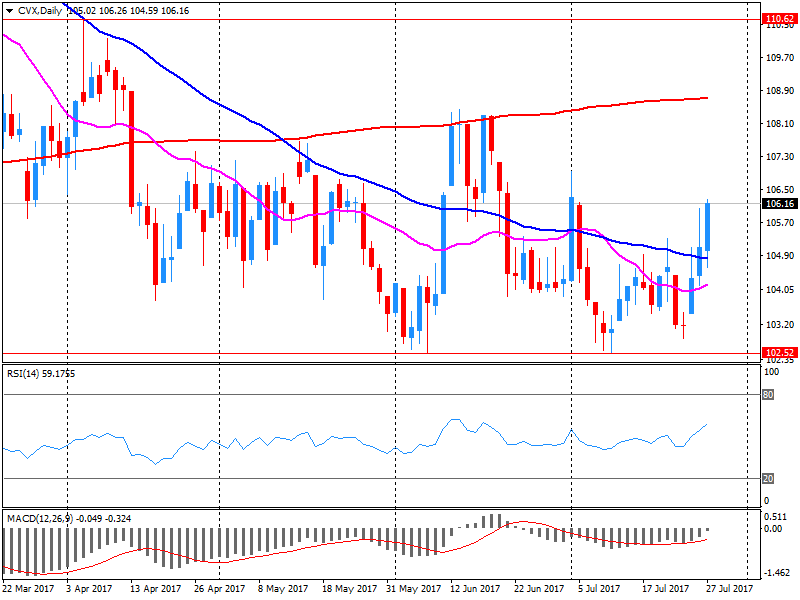

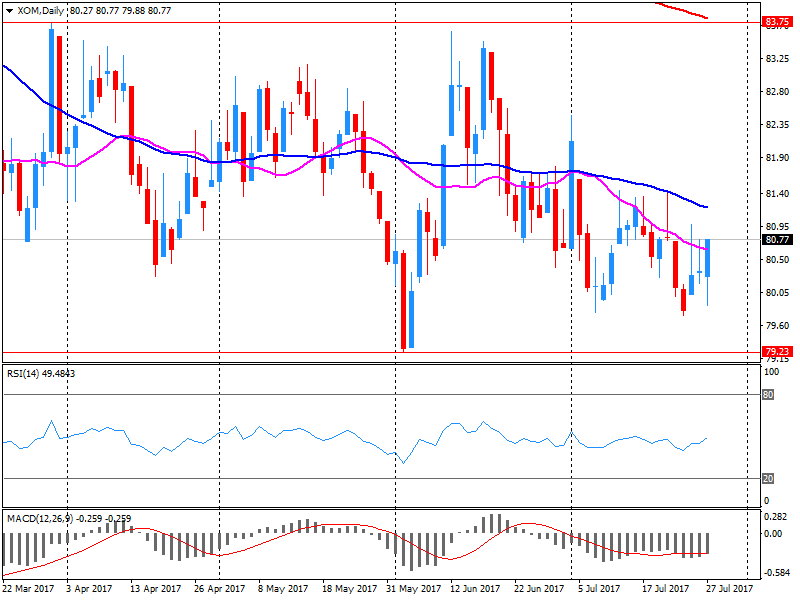

Components of the DOW index showed mixed dynamics (15 in positive territory, 15 in negative territory). The leader of growth was shares of Chevron Corporation (CVX, + 2.05%). Outsider were shares of Exxon Mobil Corporation (XOM, -1.56%).

Most S & P sectors recorded a decline. The healthcare sector grew most (+ 0.5%). The greatest decline was shown by the sector of conglomerates (-0.8%).

At this moment:

Dow + 0.15% 21.830.31 +33.76

Nasdaq -0.12% 6.374.68 -7.51

S & P -0.13% 2,472.10 -3.32

-

21:00

DJIA +0.09% 21,815.13 +18.58 Nasdaq -0.07% 6,377.87 -4.32 S&P -0.16% 2,471.41 -4.01

-

19:01

U.S.: Baker Hughes Oil Rig Count, July 766

-

18:00

European stocks closed: FTSE 100 -74.64 7368.37 -1.00% DAX -49.34 12162.70 -0.40% CAC 40 -55.56 5131.39 -1.07%

-

16:35

U.S. consumer sentiment index revised higher in July

The final reading for the July Reuters/Michigan index of consumer sentiment rose to 93.4 from a preliminary reading of 93.1 but fell from a final reading of 95.1 for June. That was the lowest reading since October of 2016. Economists had forecast the index to be unrevised.

According to the report, the index of the current economic conditions rose to 113.4 from the preliminary reading of 113.2 and June's final reading of 112.5. The gain was mainly due to improvements in consumers' personal finances.

Meanwhile, the index of consumer expectations increased to 80.5 from the preliminary reading of 80.2, but remained below June's final reading for June was 83.9. The report noted that expectations continued to be significantly influenced by political partisanship, and if the expectations index continues to decline by another 10 points in the second half of 2017, the loss would become more worrisome.

Despite small decline in July, the sentiment index still keeps higher in the first seven months of 2017 than in any other year since 2004, the report noted.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, July 93.4 (forecast 93.1)

-

15:46

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1525 (EUR 550m ) 1.1650-55 (405m) 1.1670 (550m) 1.1700 (1.3bln) 1.1725 (340m)

USDJPY: 110.80 (USD 1.3bln) 111.00 (1.5bln) 111.30 (540m) 112.00 (780m)

GBPUSD: 1.2950 ( GBP 625m) 1.3000 (550m)

AUDUSD: 0.7900 (AUD 350m) 0.7925-30 (380m) 0.8000 (400m)

USDCAD: 1.2550 (USD 470m) 1.2800 (425m)

EURJPY: 128.00 (EUR 615m)

-

15:33

U.S. Stocks open: Dow -0.06%, Nasdaq -0.67%, S&P -0.27%

-

15:28

Before the bell: S&P futures -0.26%, NASDAQ futures -0.63%

U.S. stock-index futures fell amid heightened concerns about corporate earnings.

Global Stocks:

Nikkei 19,959.84 -119.80 -0.60%

Hang Seng 26,979.39 -151.78 -0.56%

Shanghai 3,254.13 +4.34 +0.13%

S&P/ASX 5,702.82 -82.19 -1.42%

FTSE 7,388.72 -54.29 -0.73%

CAC 5,116.08 -70.87 -1.37%

DAX 12,142.36 -69.68 -0.57%

Crude $49.09 (+0.10%)

Gold $1,263.70 (+0.29%)

-

15:04

Company News: Chevron (CVX) Q2 EPS miss analysts’ estimate

Chevron (CVX) reported Q2 FY 2017 earnings of $0.77 per share (versus -$0.78 in Q2 FY 2016), missing analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $34.480 bln (+17.8% y/y), beating analysts' consensus estimate of $32.766 bln.

CVX fell to $106.00 (-0.1%) in pre-market trading.

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.25

-0.11(-0.30%)

1250

ALTRIA GROUP INC.

MO

73.5

-0.46(-0.62%)

4871

Amazon.com Inc., NASDAQ

AMZN

1,011.98

-34.02(-3.25%)

121277

American Express Co

AXP

83.6

-0.25(-0.30%)

150

Apple Inc.

AAPL

149.65

-0.91(-0.60%)

61925

AT&T Inc

T

39.15

-0.26(-0.66%)

16127

Barrick Gold Corporation, NYSE

ABX

16.7

0.17(1.03%)

87794

Boeing Co

BA

239.01

-1.99(-0.83%)

9081

Chevron Corp

CVX

106

-0.11(-0.10%)

44904

Cisco Systems Inc

CSCO

31.42

-0.15(-0.48%)

1441

Citigroup Inc., NYSE

C

67.34

-0.26(-0.38%)

5329

Exxon Mobil Corp

XOM

79.4

-1.43(-1.77%)

245212

Facebook, Inc.

FB

169.78

-0.66(-0.39%)

138380

Ford Motor Co.

F

11.13

-0.05(-0.45%)

7490

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.47

-0.03(-0.21%)

21189

General Electric Co

GE

25.77

-0.02(-0.08%)

24391

Goldman Sachs

GS

221.87

0.39(0.18%)

2225

Google Inc.

GOOG

930

-4.09(-0.44%)

7881

Home Depot Inc

HD

145.76

-1.97(-1.33%)

1436

Intel Corp

INTC

35.22

0.25(0.71%)

151867

Johnson & Johnson

JNJ

130.8

-0.03(-0.02%)

1197

JPMorgan Chase and Co

JPM

91.24

-0.31(-0.34%)

2884

Merck & Co Inc

MRK

63.62

-0.07(-0.11%)

18667

Microsoft Corp

MSFT

72.76

-0.40(-0.55%)

34379

Nike

NKE

58.49

0.34(0.58%)

796

Starbucks Corporation, NASDAQ

SBUX

55.23

-4.27(-7.18%)

757048

Tesla Motors, Inc., NASDAQ

TSLA

335.35

0.89(0.27%)

61252

The Coca-Cola Co

KO

45.92

-0.20(-0.43%)

789

Twitter, Inc., NYSE

TWTR

16.67

-0.17(-1.01%)

162407

UnitedHealth Group Inc

UNH

189.75

0.82(0.43%)

724

Verizon Communications Inc

VZ

47.52

-0.29(-0.61%)

11174

Visa

V

99.01

-0.56(-0.56%)

2836

Wal-Mart Stores Inc

WMT

79.15

-0.63(-0.79%)

763

Yandex N.V., NASDAQ

YNDX

29.8

-0.96(-3.12%)

124446

-

14:56

Downgrades before the market open

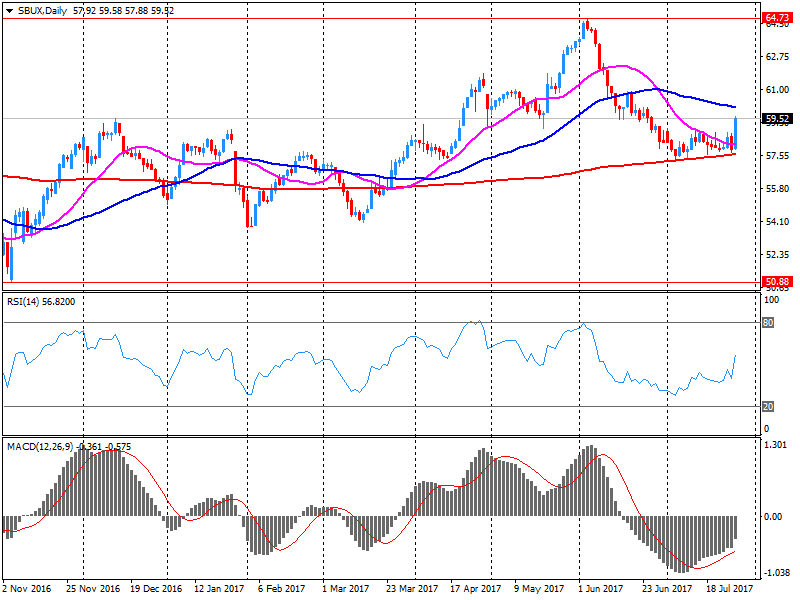

Starbucks (SBUX) downgraded to Hold from Buy at Stifel

Starbucks (SBUX) downgraded to Neutral from Buy at Guggenheim

-

14:56

Target price changes before the market open

Twitter (TWTR) target raised to $14 from $13 at RBC Capital Mkts

Twitter (TWTR) target raised to $13 from $12 at Aegis

-

14:55

Upgrades before the market open

Boeing (BA) upgraded to Neutral from Underperform at Buckingham Research

-

14:53

US Q2 GDP data matches estimates

The Commerce Department released its "advance" estimate for the U.S. gross domestic product (GDP) for the second quarter, which revealed the U.S. economic growth met expectations in the period. According to the estimate, the U.S. real GDP increased at an annual rate of 2.6 percent y-o-y last quarter, after rising by a downwardly revised 1.2 percent in the first quarter (originally 1.4 percent), and matching economists' forecast.

According to the report, the increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and federal government spending that were partly offset by negative contributions from private residential fixed investment, private inventory investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, also increased.

The PCE price index rose increased 0.3 percent q-o-q in the second quarter, compared with an increase of 2.2 percent in the previous quarter (revised from initially reported 2.4 percent). Excluding food and energy prices, the PCE price index increased 0.9 percent q-o-q, compared with an increase of 1.8 percent q-o-q (revised from initially reported 2 percent). Economists had expected PCE price index to increase 1.2 percent q-o-q in the second quarter.

-

14:33

Company News: Exxon Mobil (XOM) Q2 EPS miss analysts’ estimate

Exxon Mobil (XOM) reported Q2 FY 2017 earnings of $0.78 per share (versus $0.41 in Q2 FY 2016), missing analysts' consensus estimate of $0.86.

The company's quarterly revenues amounted to $62.876 bln (+9% y/y), beating analysts' consensus estimate of $61.349 bln.

XOM fell to $79.27 (-1.93%) in pre-market trading.

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter II 0.9% (forecast 0.8%)

-

14:30

U.S.: PCE price index, q/q, Quarter II 0.3% (forecast 1.2%)

-

14:30

Canada: GDP (m/m) , May 0.6% (forecast 0.2%)

-

14:30

U.S.: GDP, q/q, Quarter II 2.6% (forecast 2.6%)

-

14:25

German inflation accelerates in July

The Federal Statistical Office (Destatis) reported its preliminary estimates showed the inflation rate in Germany as measured by the consumer price index (CPI) rose to 1.7 percent y-o-y in July after gaining 1.6 percent in June. Economists had forecast the inflation would ease to 1.5 percent. That was the highest inflation rate since April, mainly boosted by rising energy prices, which demonstrated a 0.9 percent y-o-y surge in July after flat performance in June. Meanwhile, food inflation slowed marginally to 2.7 percent y-o-y this month from 2.8 percent y-o-y a month ago.

On a monthly basis, consumer prices rose 0.4 percent, also above economists' expectations of 0.2 percent.

The harmonized index of consumer prices (HICP) for Germany, which is calculated for European purposes, increased in July by 1.5 percent y-o-y and by 0.4 percent m-o-m.

The final results for July will be released on 11 August, the report said.

-

14:04

Germany: CPI, y/y , July 1.7% (forecast 1.5%)

-

14:04

Germany: CPI, m/m, July 0.4% (forecast 0.2%)

-

13:34

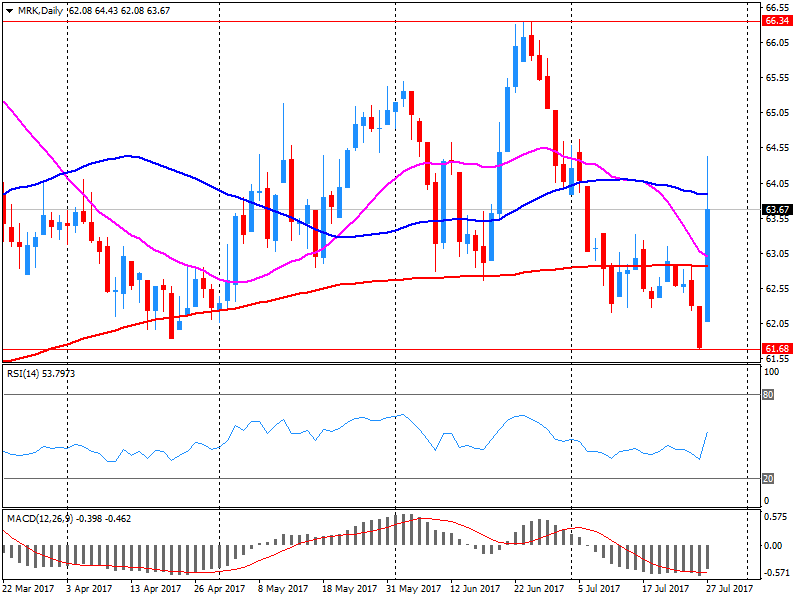

Company News: Merck (MRK) Q2 results beat analysts’ expectations

Merck (MRK) reported Q2 FY 2017 earnings of $1.01 per share (versus $0.93 in Q2 FY 2016), beating analysts' consensus estimate of $0.87.

The company's quarterly revenues amounted to $9.930 bln (+0.9% y/y), beating analysts' consensus estimate of $9.746 bln.

MRK rose to $64.48 (+1.24%) in pre-market trading.

-

12:44

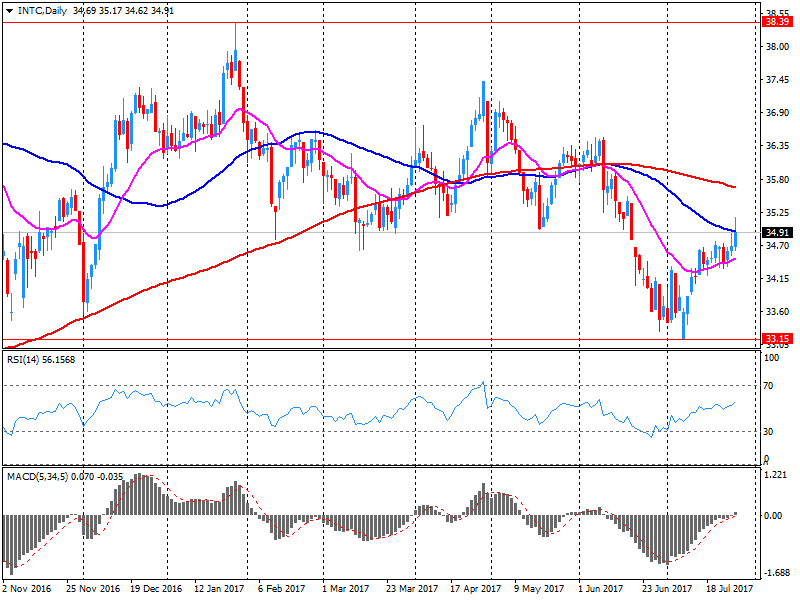

Company News: Intel (INTC) Q2 results beat analysts’ expectations

Intel (INTC) reported Q2 FY 2017 earnings of $0.72 per share (versus $0.59 in Q2 FY 2016), beating analysts' consensus estimate of $0.68.

The company's quarterly revenues amounted to $14.763 bln (+9.1% y/y), beating analysts' consensus estimate of $14.393 bln.

INTC rose to $35.09 (+0.34%) in pre-market trading.

-

12:42

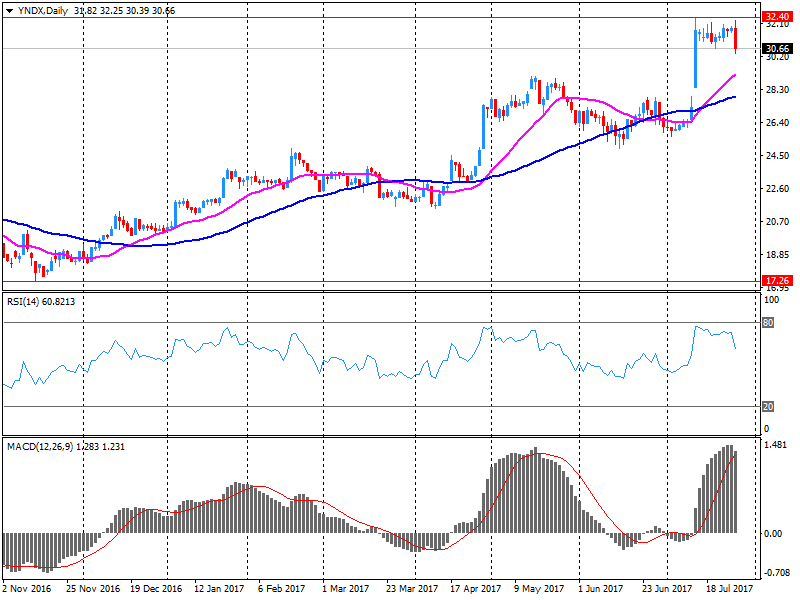

Company News: Yandex N.V. (YNDX) Q2 EPS miss analysts’ forecast

Yandex N.V. (YNDX) reported Q2 FY 2017 earnings of RUB 12.12 per share (versus RUB 12.05 in Q2 FY 2016), missing analysts' consensus estimate of RUB 12.50.

The company's quarterly revenues amounted to RUB 22.104 bln (+22.5% y/y), generally in-line with analysts' consensus estimate of RUB 22.220 bln.

The company also issued downside guidance for FY 2017, projecting FY 2017 revenues of RUB 89.6-91.9 bln versus analysts' consensus estimate of RUB 92.83 bln.

YNDX fell to $30.35 (-1.33%) in pre-market trading.

-

12:31

Company News: Starbucks (SBUX) posts quarterly earnings in line with analysts' estimates

Starbucks (SBUX) reported Q3 FY 2017 earnings of $0.55 per share (versus $0.49 in Q3 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.662 bln (+8.1% y/y), missing analysts' consensus estimate of $5.756 bln.

SBUX fell to $56.05 (-5.8%) in pre-market trading.

-

12:27

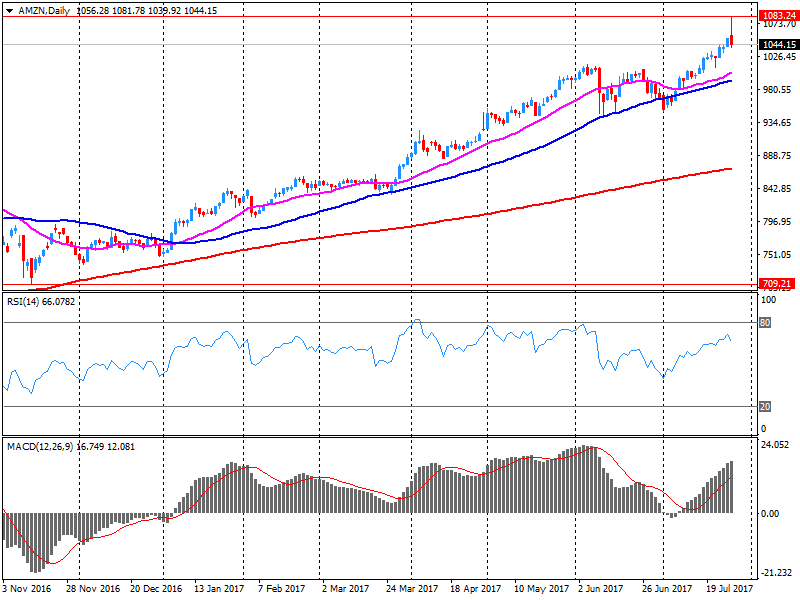

Company News: Amazon (AMZN) Q2 EPS miss analysts’ estimate

Amazon (AMZN) reported Q2 FY 2017 earnings of $0.40 per share (versus $1.78 in Q2 FY 2016), missing analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $37.955 bln (+24.8% y/y), beating analysts' consensus estimate of $37.177 bln.

The company also issued in-line guidance for Q3, projecting Q3 revenues of $39.25-41.75 bln versus analysts' consensus estimate of $39.92 bln.

AMZN fell to $1,014.70 (-2.99%) in pre-market trading.

-

12:15

Eurozone business confidence deteriorates in July

The European Commission reported the Business Climate Indicator (BCI) for the euro area fell to 1.05 in July from 1.16 in June. Economists had forecast the indicator would slide to 1.12.

"While managers' production expectations, as well as their appraisals of overall order books and the stocks of finished products remained broadly stable, their views on export order books and, in particular, past production deteriorated," the report said.

-

12:05

Eurozone economic sentiment strengthens in July

The final data from the European Commission showed economic confidence in the Eurozone strengthened in July. The Economic Sentiment Indicator (ESI) increased slightly to 111.2 in July from 111.1 in June, while economists forecast a fall to 110.8.

The ESI's July performance resulted from higher confidence in the construction (+1.8, to -1.7 points) and services (+0.8, to 14.1 points) sectors, which was outweighed by mildly weakening levels of retail trade (-0.4, to 4.0 points) and consumer (-0.4, to -1.7 points) confidence. Meanwhile, sentiment in industry remained flat (at 4.5 points).

Amongst the largest euro-area economies, the ESI rose only in Germany (+0.6) and, to a lesser extent, the Netherlands (+0.3), while it fell in Italy (-0.6), France (-0.7) and Spain (-1.0).

The survey also noted that employment plans saw upward revisions in all surveyed business sectors, mostly so in services and retail trade. Similarly, selling price expectations increased throughout all sectors, in particular construction and retail trade, while consumers' price expectations weakened.

-

11:00

Eurozone: Consumer Confidence, July -1.7 (forecast -1.7)

-

11:00

Eurozone: Industrial confidence, July 4.5 (forecast 4.3)

-

11:00

Eurozone: Business climate indicator , July 1.05 (forecast 1.12)

-

11:00

Eurozone: Economic sentiment index , July 111.2 (forecast 110.8)

-

10:22

Switzerland KOF leading indicator improves further

The KOF Swiss Economic Institute reported its leading indicator rose further in July, indicating that the outlook for the Swiss economy remains favourable.

According to the report, the KOF Economic Barometer increased to 106.8 this month from a revised reading of 105.8 in June (originally 105.5). Economists had forecast the index would increase to 106.

The strongest impulses contributing positively to the indicator's performance stem from indexes for the tourist industry as well as from the ones for the export development. The gauges for the construction activity also demonstrated an upward tendency. On the contrary, the data for the manufacturing industry dampen the development, the report said.

Overall, the KOF Economic Barometer remains above its long-term average.

-

09:01

France: CPI, m/m, July -0.3% (forecast -0.4%)

-

09:00

Switzerland: KOF Leading Indicator, July 106.8 (forecast 106)

-

08:47

France: CPI, y/y, July 0.7%

-

08:36

Options levels on friday, July 28, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1789 (1928)

$1.1762 (2478)

$1.1742 (1303)

Price at time of writing this review: $1.1693

Support levels (open interest**, contracts):

$1.1653 (1576)

$1.1623 (1968)

$1.1585 (4364)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 4 is 90833 contracts (according to data from July, 27) with the maximum number of contracts with strike price 1,1500 (4722);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3186 (1720)

$1.3156 (3059)

$1.3119 (2559)

Price at time of writing this review: $1.3082

Support levels (open interest**, contracts):

$1.3039 (510)

$1.3011 (440)

$1.2976 (780)

Comments:

- Overall open interest on the CALL options with the expiration date August, 4 is 30194 contracts, with the maximum number of contracts with strike price $1,3100 (3059);

- Overall open interest on the PUT options with the expiration date August, 4 is 28752 contracts, with the maximum number of contracts with strike price $1,2800 (3054);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:26

France’s economy expands 0.5 percent in the second quarter

France's economy grew by 0.5 percent q-o-q in the second quarter of 2017, according to a first official estimate from Insee. That matched the pace seen in the first quarter and economists' forecasts as well.

The French economy was helped by a rebound in exports, which surged 3.1 percent q-o-q in the second quarter, following a 0.7 percent q-o-q drop in the first quarter. Meanwhile, growth in imports eased to 0.2 percent q-o-q from 1.2 percent q-o-q.

Household consumption and government spending also contributed positively to the GDP. Household spending growth improved to 0.3 percent q-o-q from 0.1 percent q-o-q, while government spending jumped 0.4 percent q-o-q following a 0.3 percent q-o-q rise a quarter ago. However, business investment slowed to 0.5 percent q-o-q in the second quarter from 2.1 percent q-o-q in the first quarter.

On an annual basis, the French GDP grew by 1.8 percent in the second quarter, the highest level since 2011.

-

07:53

Japan jobless rate returns to its 23-year low

A report from the Ministry of Internal Affairs and Communications revealed the seasonally adjusted unemployment rate in Japan fell to 2.8 percent in June, while economists forecasted it to slid to 3 percent from 3.1 percent in May. That marked returning to the rate seen from February to April this year, which was also the lowest since June 1994. The job-to-applicant ratio rose to 1.51 in June from 1.49 in the previous month. The participation rate came in at 61, up from 60.8 a month earlier.

-

07:37

Japan household spending jumps most since August 2015

The Ministry of Internal Affairs and Communications reported that the Japanese household spending surged 2.3 percent y-o-y in June, exceeding economists' forecast for a 0.6 percent y-o-y gain. That was the first y-o-y rise in 16 months and the highest increase since August 2015. In previous months, retail sales posted a 0.1 percent y-o-y drop, which marked a sharp deceleration from -1.4 percent in April and the recent bottom of -3.8 percent in February. The surge in household spending was largely due to unusually dry weather during this year's rainy season, which provoked an increase in home renovation works compared to a year earlier. Another contributor to the growth was higher spending on automobiles.

-

07:35

Global Stocks

Asia-Pacific stock markets were hit by profit-taking Friday, after a strong week in the region and a selloff in U.S. tech stocks overnight. Australia and South Korea led losses in the region, with the Kospi poised for its third decline in four sessions. The index SEU, -1.34% fell 1.4% as a 3.4% pullback in Samsung 005930, -3.86% eighed. Until this week, the Kospi had been a star in setting record closing highs for eight straight trading days through Monday.

European stocks ended modestly lower Thursday as investors sent shares of German lender Deutsche Bank AG down and those for Anheuser-Busch InBev SA's and Diageo higher amid a barrage of corporate quarterly results. The Stoxx Europe 600 SXXP, -0.11% closed down 0.1% at 382.32, but spent the session searching for firm direction, as did major national indexes. Basic material, industrial and consumer services shares led the way lower, but telecom, tech and utility stocks advanced.

The Dow Jones Industrial Average closed at a record on Thursday driven by earnings-fueled gains in Verizon and Boeing, but the broader market finished in negative territory due to a firm slump in technology stocks. The Dow DJIA, +0.39% ended 85.54 points, or 0.4%, higher at 21,796.55, powered by a rally in shares of Boeing Co. and Verizon Communications Inc. VZ, +7.68%. Technology-weighted indexes, however took a beating.

-

07:30

France: GDP, q/q, Quarter II 0.5% (forecast 0.5%)

-

07:13

Japan consumer inflation unchanged at 0.4% in June

The Ministry of Internal Affairs and Communications reported Friday that country's consumer prices rose 0.4 percent y-o-y in June, the same increase as in the two previous months and in-line with economists' forecast. Individually, the cost of utilities rose the most (+3.5 percent y-o-y), followed by food (+0.8 percent y-o-y) and education (+0.4 percent y-o-y). On the contrary, prices for furniture and household utensils fell the most (-0.8 percent y-o-y). The nationwide core consumer price gauge, which excludes volatile fresh food prices, also rose 0.4 percent y-o-y in June, unchanged from the previous month and in-line with economists' expectations. The figure remained at its highest level since March of 2015.

Meanwhile, core consumer prices in Tokyo, available a month before the nationwide data, rose 0.2 y-o-y this month following the flat reading in June, while economists had forecast a 0.1 percent y-o-y increase. Overall, Tokyo consumer price index edged up 0.1 percent y-o-y after being flat in June. That was in line with economists' estimate. The increase was led by higher cost of utilities (+3.6 percent y-o-y), followed by furniture (+1.2 percent y-o-y) and food (+0.4 percent y-o-y). At the same time, clothing prices recorded the biggest decline (-0.6 percent y-o-y).

-

03:30

Australia: Producer price index, y/y, Quarter II 1.7%

-

03:30

Australia: Producer price index, q / q, Quarter II 0.5% (forecast 0.6%)

-

01:50

Japan: Retail sales, y/y, June 2.1% (forecast 2.3%)

-

01:31

Japan: Household spending Y/Y, June 2.3% (forecast 0.6%)

-

01:31

Japan: Tokyo Consumer Price Index, y/y, July 0.1% (forecast 0.1%)

-

01:30

Japan: Tokyo CPI ex Fresh Food, y/y, July 0.2% (forecast 0.1%)

-

01:30

Japan: National CPI Ex-Fresh Food, y/y, June 0.4% (forecast 0.4%)

-

01:30

Japan: National Consumer Price Index, y/y, June 0.4% (forecast 0.4%)

-

01:30

Japan: Unemployment Rate, June 2.8% (forecast 3%)

-

01:04

United Kingdom: Gfk Consumer Confidence, July -12 (forecast -11)

-

00:28

Commodities. Daily history for Jul 27’2017:

(raw materials / closing price /% change)

Oil 49.15 +0.22%

Gold 1,258.70 -0.10%

-

00:27

Stocks. Daily history for Jul 27’2017:

(index / closing price / change items /% change)

Nikkei +29.48 20079.64 +0.15%

TOPIX +5.96 1626.84 +0.37%

Hang Seng +190.15 27131.17 +0.71%

CSI 300 +6.80 3712.19 +0.18%

Euro Stoxx 50 +1.95 3493.14 +0.06%

FTSE 100 -9.31 7443.01 -0.12%

DAX -93.07 12212.04 -0.76%

CAC 40 -3.22 5186.95 -0.06%

DJIA +85.54 21796.55 +0.39%

S&P 500 -2.41 2475.42 -0.10%

NASDAQ -40.56 6382.19 -0.63%

S&P/TSX +19.97 15191.36 +0.13%

-

00:27

Currencies. Daily history for Jul 27’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1674 -0,61%

GBP/USD $1,3063 -0,42%

USD/CHF Chf0,96499 +1,55%

USD/JPY Y111,30 +0,17%

EUR/JPY Y129,95 -0,43%

GBP/JPY Y145,411 -0,24%

AUD/USD $0,7963 -0,60%

NZD/USD $0,7483 -0,49%

USD/CAD C$1,25577 +0,98%

-

00:03

Schedule for today, Friday, Jul 28’2017 (GMT0)

01:30 Australia Producer price index, y/y Quarter II 1.3%

01:30 Australia Producer price index, q / q Quarter II 0.5% 0.6%

05:30 France GDP, q/q (Preliminary) Quarter II 0.5% 0.5%

05:30 France GDP, Y/Y (Preliminary) Quarter II 1.1%

06:00 United Kingdom Nationwide house price index July 1.1% -0.2%

06:00 United Kingdom Nationwide house price index, y/y July 3.1% 2.7%

06:45 France CPI, m/m (Preliminary) July 0.0% -0.4%

06:45 France CPI, y/y (Preliminary) July 0.7%

07:00 Switzerland KOF Leading Indicator July 105.5 106

09:00 Eurozone Consumer Confidence (Finally) July -1.3 -1.7

09:00 Eurozone Business climate indicator July 1.15 1.12

09:00 Eurozone Industrial confidence July 4.5 4.3

09:00 Eurozone Economic sentiment index July 111.1 110.8

12:00 Germany CPI, m/m (Preliminary) July 0.2% 0.2%

12:00 Germany CPI, y/y (Preliminary) July 1.6% 1.5%

12:30 Canada GDP (m/m) May 0.2% 0.2%

12:30 U.S. PCE price index, q/q(Preliminary) Quarter II 2.4% 1.2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 2.0% 0.8%

12:30 U.S. GDP, q/q (Preliminary) Quarter II 1.4% 2.6%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) July 95.1 93.1

17:00 U.S. Baker Hughes Oil Rig Count July 764

17:20 U.S. FOMC Member Kashkari Speaks

-