Noticias del mercado

-

22:14

The main US stock indexes completed the session in negative territory

The major US stock indexes fell significantly, as the losses incurred by shares of technology companies as a result of resumed sales in the sector significantly exceeded the growth in the financial sector, caused by a report on the successful passage of the US Federal Reserve stress tests by 34 largest US banks.

Investors also evaluated a block of important data. The report submitted by the Ministry of Trade showed that in the first quarter the US economy slowed less sharply than initially expected due to unexpectedly higher consumer spending and a larger export jump. According to the report, GDP increased by 1.4% year-on-year, and not by 1.2%, as reported last month. It was the slowest growth rate since the second quarter of last year. Economists had expected that GDP growth would remain unchanged at 1.2%. The growth in the economy in the first quarter was supported by a revised increase in consumer spending, accounting for more than two thirds of US economic activity. Consumer spending grew by 1.1%, and not by previously announced 0.6%. It was the slowest pace since the second quarter of 2013.

At the same time, the report of the Ministry of Labor showed that the number of Americans applying for unemployment benefits increased last week, although their total number still corresponds to a steady increase in employment. According to the Ministry of Labor, the initial applications for state unemployment benefits increased by 2000 to 244,000, seasonally adjusted for the week to June 24. Economists predicted that initial applications for unemployment benefits fell to 240,000 over the last week. The claims for unemployment benefits for the previous week were revised to 242,000 from 241,000.

Almost all components of the DOW index recorded a decline (28 out of 30). Most fell shares of Cisco Systems, Inc. (CSCO, -2.09%). The growth leader JPMorgan Chase & Co. (JPM, + 1.69%).

Almost all sectors of S & P finished trading in the red. The technological sector fell most of all (-1.7%). The increase was shown only by the financial sector (+ 0.1%).

At closing:

DJIA -0.78% 21,287.03 -167.58

Nasdaq -1.44% 6,144.35 -90.06

S & P-0.86% 2.419.70 -20.99

-

21:00

DJIA -0.73% 21,297.14 -157.47 Nasdaq -1.77% 6,124.10 -110.31 S&P -0.87% 2,419.50 -21.19

-

18:00

European stocks closed: FTSE 100 -37.48 7350.32 -0.51% DAX -231.08 12416.19 -1.83% CAC 40 -98.55 5154.35 -1.88%

-

17:52

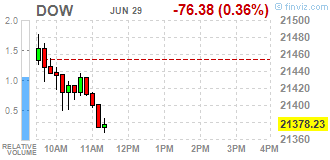

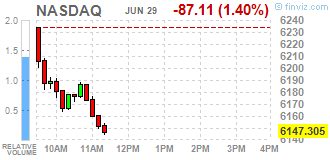

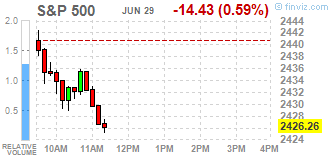

Wall Street. Major U.S. stock-indexes lower

Major U.S. stock-indexes fell, as a renewed selloff in technology stocks outweighed gains in the financial sector, buoyed by the announcement the Fed approved all 34 banks required to take its annual stress test.

Most of Dow stocks in negative area (21 of 30). Top losers - Visa Inc. (V, -1.84%). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.74%).

A majority of S&P sectors in negative area. Top loser - Technology (-1.6%). Top gainer Basic Materials (+0.6%).

At the moment:

Dow 21333.00 -69.00 -0.32%

S&P 500 2425.00 -13.50 -0.55%

Nasdaq 100 5661.25 -102.25 -1.77%

Crude Oil 45.39 +0.65 +1.45%

Gold 1243.70 -5.40 -0.43%

U.S. 10yr 2.28 +0.06

-

16:14

White House economic adviser Cohn says if Obamacare taxes cannot be cut, Trump administration still active in tax talks

-

Trump administration will get to tax reform in september

-

White House working non-stop with senate on health care bill

-

White House thinks an agreement can be reached that Trump can sign

-

-

16:06

Federal funds futures imply traders see 55 pct chance Fed raising interest rates to 1.25-1.50 pct by year-end, highest level in seven weeks - CME group's Fedwatch

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1300 (EUR 750m) 1.1320-30 (715m) 1.1340-50 (1bln) 1.1400-10 (1.9bln)

USDJPY: 111.00 (USD 810m) 111.50 (430m) 111.90-112.00 (555m) 112.40 (330m)113.00-05 (732m)

GBPUSD: 1.2940-50 (GBP 185m) 1.3000 (430m)

EURGBP: 0.8710-20 (EUR 595m) 0.8800 (300m)

AUDUSD: 0.7540-50 (AUD 240m) 0.7635 (635m) 0.7700 (765m) 0.7750 (650m)

USDCAD: 1.2980 (USD 290m)

-

15:32

U.S. Stocks open: Dow +0.10%, Nasdaq -0.35%, S&P +0.04%

-

15:21

Before the bell: S&P futures +0.03%, NASDAQ futures -0.61%

U.S. stock-index futures were mixed. The S&P 500 futures were edged up, a day after the S&P 500 index recorded its biggest one-day percentage surge in about two months. At the same time, stocks were declining once again, dragging the Nasdaq futures into negative territory.

Stocks:

Nikkei 20,220.30 +89.89 +0.45%

Hang Seng 25,965.42 +281.92 +1.10%

Shanghai 3,187.90 +14.70 +0.46%

S&P/ASX 5,818.10 +62.40 +1.08%

FTSE7,407.77 +19.97 +0.27%

CAC 5,206.76 -46.14 -0.88%

DAX 12,576.03 -71.24 -0.56%

Crude $45.25 (+1.14%)

Gold $1,244.80 (-0.36%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33.1

0.15(0.46%)

1125

Amazon.com Inc., NASDAQ

AMZN

986

-4.33(-0.44%)

23087

American Express Co

AXP

85.1

1.13(1.35%)

4390

AMERICAN INTERNATIONAL GROUP

AIG

64.49

0.65(1.02%)

12860

Apple Inc.

AAPL

144.94

-0.89(-0.61%)

136991

AT&T Inc

T

37.9

-0.04(-0.11%)

3788

Barrick Gold Corporation, NYSE

ABX

16.03

-0.10(-0.62%)

39668

Boeing Co

BA

199.15

-0.47(-0.24%)

279

Caterpillar Inc

CAT

106.7

0.25(0.23%)

2990

Chevron Corp

CVX

104.3

0.02(0.02%)

417

Cisco Systems Inc

CSCO

32

-0.08(-0.25%)

10438

Citigroup Inc., NYSE

C

67.17

1.99(3.05%)

311014

Exxon Mobil Corp

XOM

81.89

0.36(0.44%)

2166

Facebook, Inc.

FB

152.35

-0.89(-0.58%)

59099

Ford Motor Co.

F

11.1

0.01(0.09%)

4847

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.2

0.21(1.75%)

21429

General Electric Co

GE

27.18

0.10(0.37%)

37354

General Motors Company, NYSE

GM

34.6

0.02(0.06%)

1519

Goldman Sachs

GS

227

3.78(1.69%)

26151

Google Inc.

GOOG

936

-4.49(-0.48%)

1158

Hewlett-Packard Co.

HPQ

18

-0.03(-0.17%)

500

Johnson & Johnson

JNJ

133.99

0.17(0.13%)

692

JPMorgan Chase and Co

JPM

92.5

2.68(2.98%)

362259

McDonald's Corp

MCD

154.58

0.28(0.18%)

276

Merck & Co Inc

MRK

65.2

0.04(0.06%)

860

Microsoft Corp

MSFT

69.45

-0.35(-0.50%)

13392

Nike

NKE

53.34

-0.02(-0.04%)

1720

Pfizer Inc

PFE

33.72

-0.03(-0.09%)

600

Starbucks Corporation, NASDAQ

SBUX

59

-0.18(-0.30%)

1850

Tesla Motors, Inc., NASDAQ

TSLA

369.9

-1.34(-0.36%)

39902

The Coca-Cola Co

KO

45.28

-0.04(-0.09%)

3476

Twitter, Inc., NYSE

TWTR

17.91

-0.04(-0.22%)

33122

Visa

V

96.5

0.27(0.28%)

9026

-

14:53

US initial jobless claims in line with expectations

In the week ending June 24, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 241,000 to 242,000. The 4-week moving average was 242,250, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 244,750 to 245,000.

-

14:50

Important rise for German CPI in June

The inflation rate in Germany as measured by the consumer price index is expected to be 1.6% in June 2017. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.2% on May 2017.

-

14:49

US GDP rose more than expected in Q1

Real gross domestic product (GDP) increased at an annual rate of 1.4 percent in the first quarter of 2017, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2016, real GDP increased 2.1 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.2 percent.

With the third estimate for the first quarter, personal consumption expenditures (PCE) and exports increased more than previously estimated, but the general picture of economic growth remains the same.

-

14:45

Target price changes before the market open

McDonald's (MCD) target raised to $175 from $165 at BTIG Research

-

14:44

Upgrades before the market open

Barrick Gold (ABX) upgraded to Hold from Sell at Berenberg

General Electric (GE) upgraded to Hold from Sell at Standpoint Research; target $24

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter I 2.0% (forecast 2.1%)

-

14:30

U.S.: Continuing Jobless Claims, 1948 (forecast 1940)

-

14:30

U.S.: Initial Jobless Claims, 244 (forecast 240)

-

14:30

U.S.: GDP, q/q, Quarter I 1.4% (forecast 1.2%)

-

14:00

Germany: CPI, m/m, June 0.2% (forecast 0%)

-

14:00

Germany: CPI, y/y , June 1.6% (forecast 1.4%)

-

13:43

ECB's Weidmann says that is evident in the extent to which new principles on winding down of banks are adhered to, especially by countries demanding more mutual liability

-

Sufficient trust cannot be created without adhering to rules that would help further develop currency union

-

Doesn't see willingness to shift decision-making power to european level

-

-

12:46

ECB’s Weidmann: Expansive MonPol Is ‘Appropriate In Principle’, Can Disagree About ‘The Right Level Of Expansion’ - Reuters

-

11:22

Haldane Says BOE needs to Look Seriously at Raising Rates @zerohedge

-

11:01

Bank of Spain expects strengthening growth to have inflationary impact in future in developed economies

-

Sees Q2 Spain GDP rising 0.9 pct q/q

-

-

11:00

Eurozone: Consumer Confidence, June -1.3 (forecast -1.3)

-

11:00

Eurozone: Industrial confidence, June 4.5 (forecast 2.9)

-

11:00

Eurozone: Business climate indicator , June 1.15 (forecast 0.94)

-

11:00

Eurozone: Economic sentiment index , June 111.1 (forecast 109.5)

-

10:37

UK broad money increased by £8.1 billion in May

While the 12-month growth rate for broad money overall has been at around the current level since November 2016, the growth in households' money has continued to weaken and private non-financial corporations' (PNFCs') has strengthened. In May, households' money fell by £0.1 billion, this being the weakest flow since January 2015.

In contrast, M4 flows for PNFCs and non-intermediate other financial corporations (NIOFCs) were higher than their recent averages.

Sterling lending to the UK private sector excluding intermediate other financial corporations increased by £11.0 billion in May. Net lending flows to all sectors were higher than last month.

-

10:31

United Kingdom: Net Lending to Individuals, bln, May 5.3 (forecast 4)

-

10:30

United Kingdom: Consumer credit, mln, May 1732 (forecast 1400)

-

10:30

United Kingdom: Mortgage Approvals, May 65.2 (forecast 64.0)

-

10:06

German CPI Saxony (Y/Y) Jun: 1.70% (prev 1.60%) @LiveSquawk

-

09:37

Major European stock exchanges trading in the green zone: FTSE 7438.25 +50.45 + 0.68%, DAX 12722.87 +75.60 + 0.60%, CAC 5269.57 +16.67 + 0.32%

-

09:10

Spanish CPI in line with expectations in June

According to the flash estimate issued by the INE, the annual inflation of the CPI in June 2017 is 1.5%. This indicator provides a preview of the CPI that, if confirmed, would imply a decrease of four tenths in its annual rate, given that in May this change was 1.9%. It is worth nothing in this behaviour the decrease in the prices of fuels (diesel and gasoline/petrol), compared to the increase that they experienced last year. This evolution was also due to the increase in prices of electricity, lower than that of June 2016.

In turn, the annual variation of the flash estimate of the HICP in June stands at 1.6%. If confirmed, the annual change of the HICP would decrease four tenths as compared to the previous month.

-

09:09

BoJ’s Harada: BoJ Will Need To Tighten Policy At Some Point, But Not Sure When BoJ Will Withdraw Stimulus - Reuters

-

08:54

Positive start of trading expected on the main European stock markets: DAX + 0.6%, CAC 40 + 0.4%, FTSE 100 + 0.6%

-

08:23

Options levels on thursday, June 29, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1497 (2658)

$1.1472 (2181)

$1.1443 (3682)

Price at time of writing this review: $1.1409

Support levels (open interest**, contracts):

$1.1358 (643)

$1.1326 (1163)

$1.1287 (2065)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date July, 7 is 70074 contracts (according to data from June, 28) with the maximum number of contracts with strike price $1,1100 (4595);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3084 (2125)

$1.3052 (2150)

$1.3026 (2686)

Price at time of writing this review: $1.2961

Support levels (open interest**, contracts):

$1.2892 (769)

$1.2862 (1848)

$1.2825 (1443)

Comments:

- Overall open interest on the CALL options with the expiration date July, 7 is 33801 contracts, with the maximum number of contracts with strike price $1,2850 (2686);

- Overall open interest on the PUT options with the expiration date July, 7 is 31736 contracts, with the maximum number of contracts with strike price $1,2800 (3722);

- The ratio of PUT/CALL was 0.94 versus 0.89 from the previous trading day according to data from June, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:15

Russian foreign min Lavrov says we will react with dignity, proportionally to any U.S. pre-emptive intervention in Syria

-

08:14

Bank of Canada's Patterson: economic drag from lower oil prices largely behind us; rate cuts have helped facilitate economy's adjustment

-

Information gathered from markets is critical complement to bank's analytical work; helps shape bank policies

-

-

08:12

10-year U.S. treasury yield at 2.229 percent vs U.S. close of 2.223 percent on Wednesday

-

08:10

Kiwis can fly says ANZ in the latest Business Outlook

Business confidence lifted in June and broader survey sentiment also rose.

Firms are upbeat about their own prospects, and keen to hire and invest.

Our composite growth indicator is pointing to 4% GDP growth.

That's a stretch, but the economy is running faster than current real GDP

growth (2.5%) would suggest. Expect "official" growth to lift.

Inflation expectations are anchored at 2%.

The economy has good upwind speed. A net 25% of businesses are optimistic about the year ahead. That's up 10 points on the month prior and is the highest level since September 2016. Sentiment lifted across all sectors but most notably for agriculture. The service sector sits at the bow (+33).

-

08:08

The upswing in mood among German consumers continues in June - GfK

The upswing in mood among German consumers continues in June this year. Both economic and income expectations, as well as propensity to buy, are on the rise. GfK predicts an increase in consumer climate of 0.2 points to 10.6 points for July compared to the previous month.

German citizens view the domestic economy as being in excellent shape at the start of the summer. This is shown in the significant increase in economic expectations in June, taking them to a three year high. Income expectations are increasing moderately and have even climbed to their highest level since the German reunification. Propensity to consume is able to benefit from this with moderate growth.

From the point of view of the consumer, the German economic engine is still accelerating. Economic outlook climbs in June for the fourth time in a row. After gaining a significant 6.5 points, the indicator has now reached 41.3 points. This is the highest level for almost three years. The last time a higher value was measured, was 45.9 points in July 2014.

-

08:00

Germany: Gfk Consumer Confidence Survey, July 10.6 (forecast 10.4)

-

07:32

Global Stocks

European stocks on Wednesday closed a topsy-turvy session at a two-month low, with the euro pulled lower intraday while the pound leapt as investors reassessed policy stances at both the European Central Bank and the Bank of England. Major European benchmarks turned modestly higher as the euro declined, but many of them eventually settled slightly in the red.

A rally by financial and technology stocks on Wednesday helped lift U.S. equity indexes, with the S&P 500 posting its largest one-day gain in two months while Nasdaq Composite recorded its best day in eight months. The large-cap index has been somewhat "fickle" this month with three of this year's biggest gains and two of its worst losses having occurred in June, according to Frank Cappelleri, executive director of Instinet.

Equity markets in Asia were higher early Thursday, with finance stocks broadly leading gains after all major U.S. financial institutions received approval from the Federal Reserve to ramp up dividend payouts and share buybacks. The approvals - the first time since the annual tests began in 2011 that all firms got passing grades - reflect a turning point for big financial institutions that have been shackled by tighter regulation since the crisis.

-

03:00

Australia: HIA New Home Sales, m/m, May 1.1%

-

03:00

New Zealand: ANZ Business Confidence, June 24.8

-

01:50

Japan: Retail sales, y/y, May 2.0% (forecast 2.6%)

-

00:35

Commodities. Daily history for Jun 28’2017:

(raw materials / closing price /% change)

Oil 44.88 +0.31%

Gold 1,249.40 +0.02%

-

00:33

Stocks. Daily history for Jun 28’2017:

(index / closing price / change items /% change)

Nikkei -94.68 20130.41 -0.47%

TOPIX -4.65 1614.37 -0.29%

Hang Seng -156.49 25683.50 -0.61%

CSI 300 -28.55 3646.17 -0.78%

Euro Stoxx 50 -2.62 3535.70 -0.07%

FTSE 100 -46.56 7387.80 -0.63%

DAX -23.75 12647.27 -0.19%

CAC 40 -5.68 5252.90 -0.11%

DJIA +143.95 21454.61 +0.68%

S&P 500 +21.31 2440.69 +0.88%

NASDAQ +87.79 6234.41 +1.43%

S&P/TSX +74.36 15355.58 +0.49%

-

00:32

Currencies. Daily history for Jun 28’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1375 +0,35%

GBP/USD $1,2927 +0,89%

USD/CHF Chf0,9595 -0,05%

USD/JPY Y112,28 +0,01%

EUR/JPY Y127,72 +0,36%

GBP/JPY Y145,13 +0,90%

AUD/USD $0,7638 +0,77%

NZD/USD $0,7307 +0,62%

USD/CAD C$1,3033 -1,24%

-