Noticias del mercado

-

23:30

Australia: AIG Manufacturing Index, November 54.2

-

21:01

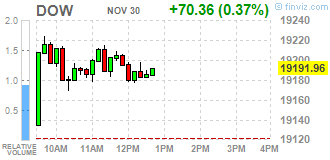

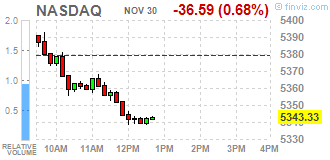

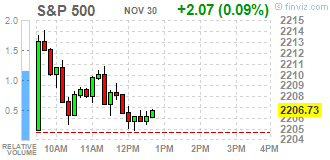

DJIA 19150.98 29.38 0.15%, NASDAQ 5330.50 -49.42 -0.92%, S&P 500 2201.90 -2.76 -0.13%

-

18:47

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. Gains in energy and bank stocks drove the Dow and the S&P 500 to record intraday highs on Wednesday, but losses in technology stocks dragged down the Nasdaq. OPEC agreed to cut production to 32,5 million barrels per day, Kuwait's oil minister said. The cuts include Iraq reducing output by 200,000 bpd to 4,351 million beginning in January. Oil was up 7,8% to a near five-week high. U.S. private employers stepped up hiring in November and consumer spending increased last month, the latest signs of economic strength that could further cement the case for an interest rate hike.

Most of Dow stocks in negative area (17 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +3.51%). Top loser - Visa Inc. (V, -1.69%).

Most S&P sectors also in negative area. Top gainer - Basic Materials (+3.9%). Top loser - Utilities (-2.0%).

At the moment:

Dow 19179.00 +64.00 +0.33%

S&P 500 2205.50 +1.75 +0.08%

Nasdaq 100 4828.25 -46.75 -0.96%

Oil 49.15 +3.92 +8.67%

Gold 1175.40 -15.40 -1.29%

U.S. 10yr 2.39 +0.09

-

18:00

European stocks closed: FTSE 6783.79 11.79 0.17%, DAX 10640.30 19.81 0.19%, CAC 4578.34 26.88 0.59%

-

17:30

WSE: Session Results

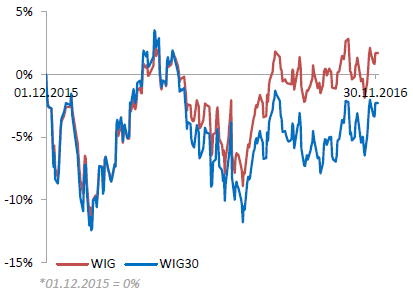

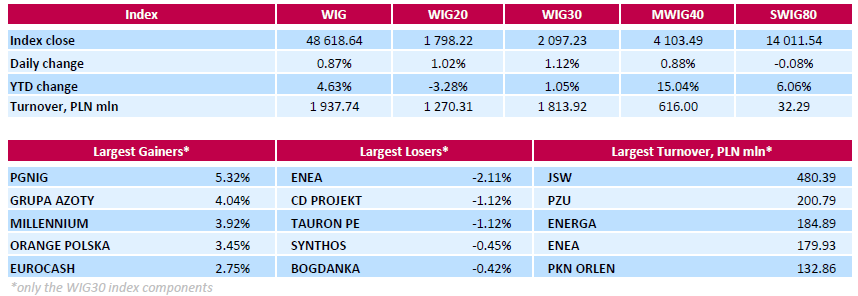

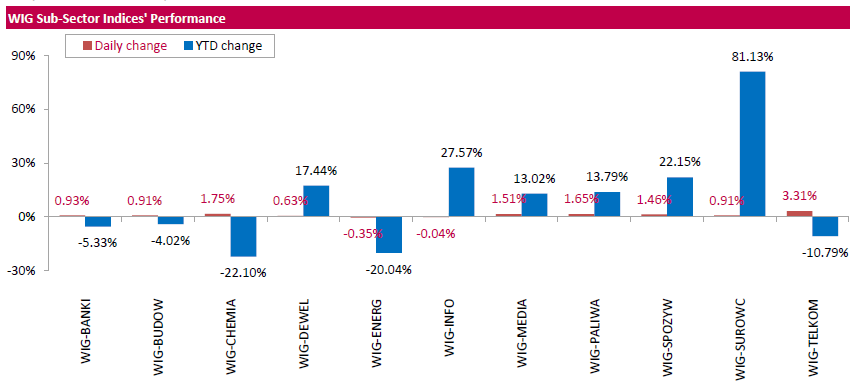

Polish equity market closed higher on Wednesday. The broad market measure, the WIG index, rose by 0.87%. Sector performance within the WIG was mainly positive as nine sectors recorded advances, with telecoms (+3.31%) outpacing.

The large-cap stocks grew by 1.12%, as measured by the WIG30 Index. A majority of the index components returned gains. The advancers pack was led by oil and gas producer PGNIG (WSE: PGN), with gains of 5.32%, followed by chemical producer GRUPA AZOTY (WSE: ATT), bank MILLENNIUM (WSE: MIL) and telecommunication services provider ORANGE POLSKA (WSE: OPL), which surged by 4.04%, 3.92% and 3.45% respectively. On the contrary, gencos ENEA (WSE: ENA) and TAURON PE (WSE: TPE), as well as videogame developer CD PROJEKT (WSE: CDR) were the weakest performers, retreating by 2.11%, 1.12% and 1.12% respectively. Other losers were chemical producer SYNTHOS (WSE: SNS) and thermal coal producer BOGDANKA (WSE: LWB), dropping by 0.45% and 0.42% respectively.

-

16:30

U.S.: Crude Oil Inventories, November -0.884 (forecast 0.636)

-

16:00

U.S.: Pending Home Sales (MoM) , October 0.1% (forecast 0.2%)

-

15:45

U.S.: Chicago Purchasing Managers' Index , November 57.6 (forecast 52)

-

15:32

U.S. Stocks open: Dow +0.41%, Nasdaq +0.21%, S&P +0.19%

-

15:25

Before the bell: S&P futures +0.29%, NASDAQ futures +0.02%

U.S. stock-index futures edged higher as sources informed OPEC members reached an agreement to cut oil production.

Global Stocks:

Nikkei 18,308.48 +1.44 +0.01%

Hang Seng 22,789.77 +52.70 +0.23%

Shanghai 3,250.59 -32.34 -0.98%

FTSE 6,827.29 +55.29 +0.82%

CAC 4,577.75 +26.29 +0.58%

DAX 10,640.02 +19.53 +0.18%

Crude $48.62 (+7.43%)

Gold $1,184.30 (-0.30%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

173

0.23(0.1331%)

1000

ALCOA INC.

AA

30.14

0.41(1.3791%)

4947

ALTRIA GROUP INC.

MO

65.33

0.15(0.2301%)

450

Amazon.com Inc., NASDAQ

AMZN

766.17

3.65(0.4787%)

46577

American Express Co

AXP

71.6

0.11(0.1539%)

685

Apple Inc.

AAPL

111.7

0.24(0.2153%)

25514

Barrick Gold Corporation, NYSE

ABX

15.34

-0.10(-0.6477%)

63728

Boeing Co

BA

152.19

0.55(0.3627%)

502

Caterpillar Inc

CAT

95.7

1.66(1.7652%)

13020

Chevron Corp

CVX

112.19

2.85(2.6066%)

74046

Cisco Systems Inc

CSCO

29.84

0.01(0.0335%)

2057

Citigroup Inc., NYSE

C

56.1

0.58(1.0447%)

13964

Deere & Company, NYSE

DE

100.98

0.63(0.6278%)

785

E. I. du Pont de Nemours and Co

DD

71.55

0.35(0.4916%)

728

Exxon Mobil Corp

XOM

88.22

2.32(2.7008%)

165584

Facebook, Inc.

FB

120.12

-0.75(-0.6205%)

165507

Ford Motor Co.

F

11.96

0.04(0.3356%)

11425

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.41

0.44(2.9392%)

428763

General Electric Co

GE

31.25

0.20(0.6441%)

21073

General Motors Company, NYSE

GM

34.75

0.18(0.5207%)

13349

Goldman Sachs

GS

214.54

2.79(1.3176%)

13364

Google Inc.

GOOG

772

1.16(0.1505%)

5153

Intel Corp

INTC

35.35

0.04(0.1133%)

1005

International Business Machines Co...

IBM

163.86

0.33(0.2018%)

157

International Paper Company

IP

49.2

0.36(0.7371%)

400

Johnson & Johnson

JNJ

112.75

0.27(0.24%)

2222

JPMorgan Chase and Co

JPM

79.64

0.72(0.9123%)

14986

Merck & Co Inc

MRK

62.36

0.17(0.2734%)

875

Microsoft Corp

MSFT

61.25

0.16(0.2619%)

2696

Nike

NKE

50.75

0.12(0.237%)

365

Pfizer Inc

PFE

32.33

0.41(1.2845%)

17207

Procter & Gamble Co

PG

82.9

0.01(0.0121%)

5438

Tesla Motors, Inc., NASDAQ

TSLA

191.45

1.88(0.9917%)

12954

The Coca-Cola Co

KO

41.2

0.05(0.1215%)

4636

Twitter, Inc., NYSE

TWTR

18.31

0.12(0.6597%)

15046

United Technologies Corp

UTX

109.5

0.66(0.6064%)

474

UnitedHealth Group Inc

UNH

158.14

1.175(0.7486%)

3953

Verizon Communications Inc

VZ

50.94

-0.02(-0.0392%)

3702

Visa

V

79.36

0.21(0.2653%)

1000

Wal-Mart Stores Inc

WMT

71.41

0.04(0.0561%)

2187

Yandex N.V., NASDAQ

YNDX

18.73

0.27(1.4626%)

9410

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Buy from Hold at Deutsche Bank

UnitedHealth (UNH) upgraded to Buy at Mizuho; target $178

Downgrades:

Freeport-McMoRan (FCX) downgraded to Sell from Hold at Berenberg

Other:

-

14:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0500 (EUR 690m) 1.0550-55 (1.04bln) 1.0600 (750m) 1.0620 (517m) 1.0650-60 (1.06bln) 1.0795-1.0800 (866m)

USDJPY 110.00 (USD 781m) 111.00 (737m) 112.00 (1.57bln) 113.00 (566m)

AUDUSD 0.7250 (AUD 811m)

USDCAD 1.3400 (USD 697m) 1.3550 (685m) 1.3700 (675m) 1.3800 (1.24bln)

-

14:30

Canada: GDP (m/m) , September 0.3% (forecast 0.1%)

-

14:30

U.S.: Personal spending , October 0.3 (forecast 0.5%)

-

14:30

U.S.: Personal Income, m/m, October 0.6% (forecast 0.4%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, October 1.7%

-

14:30

Canada: GDP QoQ, Quarter III 0.9%

-

14:30

U.S.: PCE price index ex food, energy, m/m, October 0.1% (forecast 0.1%)

-

14:30

Canada: Industrial Product Price Index, y/y, October 0.8%

-

14:30

Canada: GDP (YoY), Quarter III 3.5% (forecast 3.4%)

-

14:30

Canada: Industrial Product Price Index, m/m, October 0.7% (forecast 0.6%)

-

14:15

U.S.: ADP Employment Report, November 216 (forecast 165)

-

13:45

Orders

EUR/USD

Offers 1.0650-60 1.0685 1.0700 1.0730 1.0750 1.0780 1.0800

Ордера на покупку: 1.0620 1.0600 1.0580-85 1.0560 1.0530 1.0515 1.0500

GBP/USD

Offers 1.2500 1.2520 1.2530-351.2550-551.25701.2585 1.2600

Ордера на покупку: 1.2455-60 1.2430 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300

EUR/GBP

Offers 0.8535 0.8560 0.8575-80 0.8600 0.8630-35 0.8650

Ордера на покупку: 0.8500 0.8485 0.8470 0.8450 0.8420 0.8400

EUR/JPY

Offers 120.00-10 120.45-50 121.00 121.55-60 121.80 122.00

Ордера на покупку: 119.60 119.30 119.00 118.80 118.50 118.00

USD/JPY

Offers 112.85 113.00 113.25-30 113.60 113.80 114.00

Ордера на покупку: 112.40 112.20 112.00 111.80-85 111.50 111.30-35 111.00

AUD/USD

Offers 0.7485 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids 0.7460 0.7450 0.7435 0.7400 0.7370 0.7355-60 0.7325-30 0.7300

-

11:00

Eurozone: Harmonized CPI, Y/Y, November 0.6% (forecast 0.6%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, November 0.8% (forecast 0.8%)

-

10:01

Germany: Unemployment Change, November -5 (forecast -5)

-

10:01

Germany: Unemployment Rate s.a. , November 6% (forecast 6%)

-

09:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 690m) 1.0550-55 (1.04bln) 1.0600 (750m) 1.0620 (517m) 1.0650-60 (1.06bln) 1.0795-1.0800 (866m)

USD/JPY 110.00 (USD 781m) 111.00 (737m) 112.00 (1.57bln) 113.00 (566m)

AUD/USD 0.7250 (AUD 811m)

USD/CAD 1.3400 (USD 697m) 1.3550 (685m) 1.3700 (675m) 1.3800 (1.24bln)

-

09:02

Switzerland: KOF Leading Indicator, November 102.2 (forecast 104)

-

08:25

Options levels on wednesday, November 30, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0849 (5198)

$1.0786 (2633)

$1.0739 (1183)

Price at time of writing this review: $1.0625

Support levels (open interest**, contracts):

$1.0517 (4434)

$1.0450 (5254)

$1.0412 (4043)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 81154 contracts, with the maximum number of contracts with strike price $1,1400 (6390);

- Overall open interest on the PUT options with the expiration date December, 9 is 68883 contracts, with the maximum number of contracts with strike price $1,0500 (5254);

- The ratio of PUT/CALL was 0.85 versus 0.87 from the previous trading day according to data from November, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2044)

$1.2605 (1406)

$1.2509 (1808)

Price at time of writing this review: $1.2471

Support levels (open interest**, contracts):

$1.2395 (1457)

$1.2298 (2203)

$1.2199 (1062)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35286 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 34887 contracts, with the maximum number of contracts with strike price $1,2500 (2922);

- The ratio of PUT/CALL was 0.99 versus 1.04 from the previous trading day according to data from November, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Switzerland: UBS Consumption Indicator, October 1.49

-

08:00

Germany: Retail sales, real unadjusted, y/y, October -1.0% (forecast 1%)

-

08:00

Germany: Retail sales, real adjusted , October 2.4% (forecast 1%)

-

07:06

Global Stocks

European stock markets were struggling for direction on Tuesday, with investors staying on the sidelines ahead of the closely watched OPEC meeting and the Italian referendum later in the week. The sharp moves reflect uncertainty ahead of the country's referendum on proposed constitutional reforms on Sunday. Analysts fear a rejection could unleash political and economic uncertainty in a country that's already battling with a banking crisis.

U.S. stocks closed higher on Tuesday with the Nasdaq touching a record, but the market failed to make much headway as oil futures slumped ahead of a key meeting of major crude producers. The second reading of gross domestic product showed the economy grew at the fastest pace in over two years in the third quarter, while a measure of consumer confidence soared in November to prerecession levels.

Asian stocks tried to stabilize after a rocky November month drew to a close, but Wednesday's session brought new anxieties as Chinese equities and commodities tanked amid worries that Beijing's efforts to support its currency could squeeze liquidity. Analysts said moves by China's central bank in recent days to shore up a sliding yuan were sucking additional funds from the banking system, which is pushing up domestic borrowing costs.

-

06:16

Japan: Construction Orders, y/y, October 15.2%

-

06:02

Japan: Housing Starts, y/y, October 13.7% (forecast 11.2%)

-

01:32

Australia: Private Sector Credit, y/y, October 5.3%

-

01:30

Australia: Building Permits, m/m, October -12.6% (forecast 1.5%)

-

01:30

Australia: Private Sector Credit, m/m, October 0.5% (forecast 0.4%)

-

01:05

United Kingdom: Gfk Consumer Confidence, November -8 (forecast -4)

-

01:00

New Zealand: ANZ Business Confidence, November 20.5

-

00:50

Japan: Industrial Production (MoM) , October 0.1% (forecast -0.1%)

-

00:30

Commodities. Daily history for Nov 29’2016:

(raw materials / closing price /% change)

Oil 45.23 0.00%

Gold 1,187.10 -0.07%

-

00:29

Stocks. Daily history for Nov 29’2016:

(index / closing price / change items /% change)

Nikkei 225 18,307.04 -49.85 -0.27%

Shanghai Composite 3,283.36 +6.36 +0.19%

S&P/ASX 200 5,457.50 0.00 0.00%

FTSE 100 6,772.00 -27.47 -0.40%

CAC 40 4,551.46 +41.07 +0.91%

Xetra DAX 10,620.49 +37.82 +0.36%

S&P 500 2,204.66 +2.94 +0.13%

Dow Jones Industrial Average 19,121.60 +23.70 +0.12%

S&P/TSX Composite 14,999.81 -15.55 -0.10%

-

00:28

Currencies. Daily history for Nov 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0648 +0,34%

GBP/USD $1,2490 +0,60%

USD/CHF Chf1,0115 -0,14%

USD/JPY Y112,38 +0,40%

EUR/JPY Y119,65 +0,71%

GBP/JPY Y140,35 +0,98%

AUD/USD $0,7482 +0,03%

NZD/USD $0,7124 +0,73%

USD/CAD C$1,343 +0,15%

-

00:00

Schedule for today,Wednesday, Nov 30’2016

00:00 New Zealand ANZ Business Confidence November 24.5

00:05 United Kingdom Gfk Consumer Confidence November -3 -4

00:30 Australia Private Sector Credit, m/m October 0.4% 0.4%

00:30 Australia Private Sector Credit, y/y October 5.4%

00:30 Australia Building Permits, m/m October -8.7% 1.5%

05:00 Japan Construction Orders, y/y October 16.3%

05:00 Japan Housing Starts, y/y October 10% 11.2%

07:00 United Kingdom BOE Financial Stability Report

07:00 Germany Retail sales, real adjusted October -1.4% 1%

07:00 Germany Retail sales, real unadjusted, y/y October 0.4% 1%

07:00 Switzerland UBS Consumption Indicator October 1.59

08:00 Switzerland KOF Leading Indicator November 104.7 104

08:55 Germany Unemployment Change November -14 -5

08:55 Germany Unemployment Rate s.a. November 6% 6%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November 0.5% 0.6%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) November 0.8% 0.8%

12:30 Eurozone ECB President Mario Draghi Speaks

13:15 U.S. ADP Employment Report November 147 165

13:30 Canada Industrial Product Price Index, m/m October 0.4% 0.6%

13:30 Canada Industrial Product Price Index, y/y October -0.5%

13:30 Canada GDP (m/m) September 0.2% 0.1%

13:30 Canada GDP QoQ Quarter III -0.4%

13:30 Canada GDP (YoY) Quarter III -1.6% 3.4%

13:30 U.S. Personal spending October 0.5% 0.5%

13:30 U.S. Personal Income, m/m October 0.3% 0.4%

13:30 U.S. PCE price index ex food, energy, m/m October 0.1% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October 1.7%

14:45 U.S. Chicago Purchasing Managers' Index November 50.6 52

15:00 U.S. Pending Home Sales (MoM) October 1.5% 0.4%

15:30 U.S. Crude Oil Inventories November -1.255

16:45 U.S. FOMC Member Jerome Powell Speaks

19:00 U.S. Fed's Beige Book

22:30 Australia AIG Manufacturing Index November 50.9

23:50 Japan Capital Spending Quarter III 3.1%

-