Noticias del mercado

-

16:50

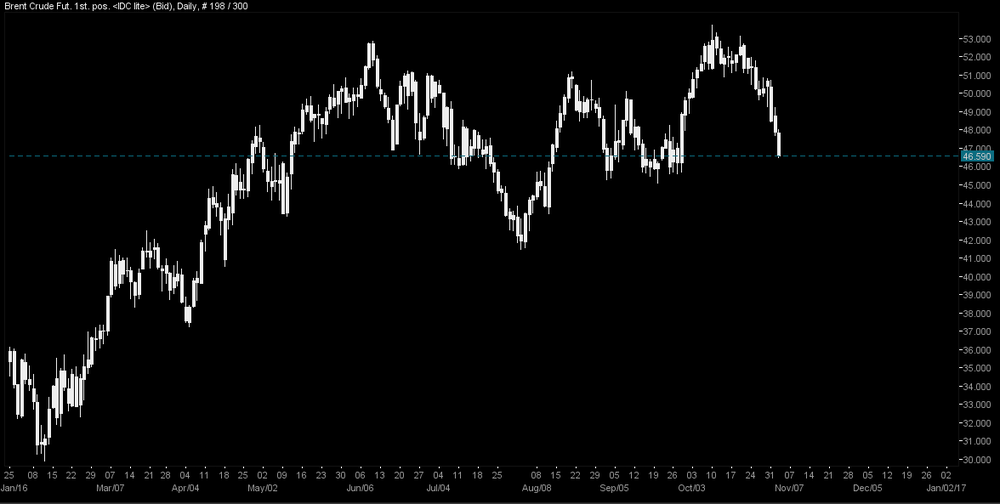

Oil continue to fall after disappointing US stocks data

Crude oil futures fell further Wednesday after industry data revealed a surprise build in U.S. oil inventories.

WTI light sweet oil was down 72 cents at $45.94 a barrel, the lowest in weeks.

The American Petroleum Institute said on Tuesday that crude oil inventories last week surged 9.3 million barrels.

However, official figures from the Energy Information Administration have defied some recent API reports.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 14.4 million barrels from the previous week. At 482.6 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Distillate fuel inventories decreased by 1.8 million barrels last week but are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.3 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 9.0 million barrels last week.

-

16:07

Bullish gold ahead of an expected FOMC decision

Gold prices continued to rise today, climbing above $1,300 an ounce for the first time in almost a month as the U.S. dollar fell the race for the U.S. presidency tightened.

Gold for December delivery rose $17.20 an ounce, or 1.34% to $1,305 in recent market action.

Less than one week ahead of the U.S. election, analysts said the appetite for gold was mounting on the possibility of a victory for Republican candidate Donald Trump, with the metal providing a safe haven. HSBC analyst James Steel says the price of the precious metal could rise to $1,500 by the end of 2016 and climb to $1,575 next year following a Trump Victory.

Gold prices also depend on the U.S. dollar, as well as Federal Reserve interest rates.

A stronger dollar will pressure gold, which is priced in the U.S. currency and becomes more expensive for foreign buyers when the dollar rises. The metal, which does not pay dividends or generate interest income, struggles when rates rise.

U.S. Federal Reserve will release its latest monetary policy statement, even as a rate increase isn't expected until December.

-

12:37

Gold Prices Rise to One-Month High

Gold prices rose to a nearly one-month high on Wednesday morning in London, as safe haven buying mounted ahead of next week's U.S. presidential elections, and investors awaited a Federal Reserve meeting later in the day.

Spot gold was trading 0.53% higher at $1,296.01 per troy ounce in midmorning European trade, nearly crossing the technically important 50-day moving average, and trading at the highest level since Oct. 3.

-

11:10

Oil is trading lower

This morning, the New York futures for Brent have fallen 0.75% to $ 46.33 and WTI -0.48% to $ 47.90 per barrel. Thus, the black gold is trading in the red zone on the background of standby US crude stocks after industry data showed an unexpected increase in inventories, highlighting the steady global oversupply of oil. The American Petroleum Institute said that the volume of oil reserves rose by 9.3 million barrels for the week ended October 28, which is more than nine times the amount expected by analysts.

-

00:29

Commodities. Daily history for Nov 01’2016:

(raw materials / closing price /% change)

Oil 46.39 -0.60%

Gold 1,290.20 +0.17%

-