Noticias del mercado

-

16:48

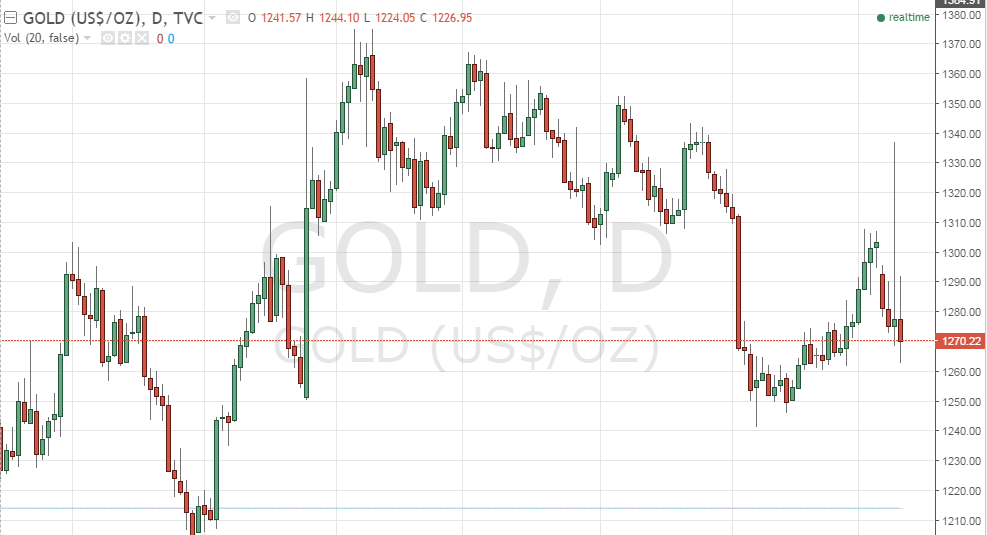

Gold continue to decline

Gold prices dropped on Thursday, reversing gains on a stronger U.S. dollar and concerns about an interest-rate increase in December, says Dow Jones.

Gold for December delivery was recently down 0.6% at $1,265.30 a troy ounce on the Comex division of the New York Mercantile Exchange, after trading as high as $1,280.60 earlier in the session.

The WSJ Dollar Index was recently up 0.7% at 89.53, putting pressure on gold prices. Gold is priced in the U.S. currency and becomes more expensive to foreign buyers when the dollar strengthens.

"Gold's retreat was in lockstep with the financial market and especially the equity market recovery," wrote James Steel, chief precious metals analyst at HSBC, on Wednesday.

"It looks like pricing for the December expected rate hike is on schedule ... so [the] gold rally is capped," George Gero, managing director at RBC Wealth Management, said in a Thursday note.

-

16:39

Oil is little changed

Crude oil futures fell as the dollar strengthened versus major rivals.

Oil is little changed since Donald Trump's upset victory over Hillary Clinton Tuesday night.

Traders are keeping a close eye on developments regarding OPEC and its plan to curb supplies along with Russia.

Rttnews says that Iran has balked at being part of the deal, as it seeks to boost market share in the aftermath of heavy sanctions.

WTI light sweet crude oil was down 44 cents at $44.83.

Yesterday, EIA data showed U.S. oil stockpiles rose sharply for second week.

-

11:00

Oil is trading higher

This morning, the New York futures for Brent increased 0.73% to $ 45.62 and WTI up 1.19% to $ 46.91 per barrel. Thus, the black gold is gaining due to the release of data on the growth in US oil inventories. The reserves of black gold in the US rose by 2.4 million barrels to 485 million barrels last week, despite the fact that refineries increased production, and the volume of imports fell, reported US Energy Information Administration. According to BMI Research, Trump's position aimed at supporting the oil and gas industry, may mean that the "oil and gas production could recover faster in 2017, as the industry will get more support."

-

00:30

Commodities. Daily history for Nov 09’2016:

(raw materials / closing price /% change)

Oil 45.34 +0.15%

Gold 1,278.20 +0.37%

-