Noticias del mercado

-

17:41

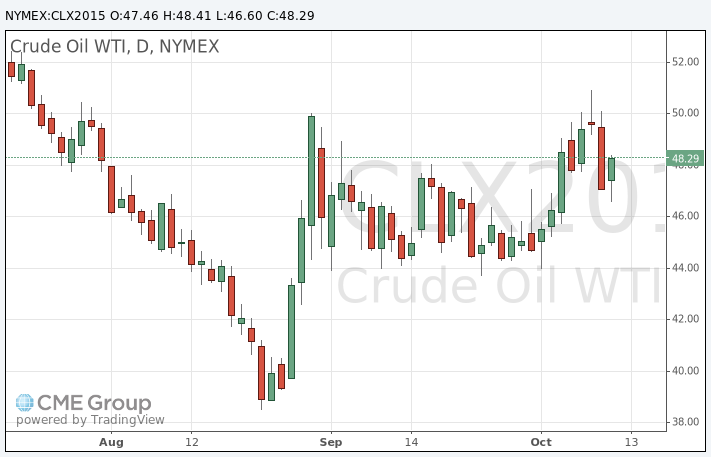

Oil prices rise but gains are limited by the IEA report

Oil prices traded higher but gains were limited by the release of the International Energy Agency's (IEA) monthly report. The agency said that global oil oversupply will remain next year as global demand is expected to slow. Global oil demand growth is expected to decline to 1.2 million barrels per day (mb/d) in 2016 from 1.8 mb/d in 2015, down 150,000 barrels per day from its September estimate.

"A projected marked slowdown in demand growth next year and the anticipated arrival of additional Iranian barrels - should international sanctions be eased - are likely to keep the market oversupplied through 2016," the IEA said in its report.

Global oil supply totalled about 96.6 million barrels a day in September. Lower non-OPEC oil output was offset by higher OPEC oil output.

WTI crude oil for November delivery rose to $48.43 a barrel on the New York Mercantile Exchange.

Brent crude oil for November increased to $50.24 a barrel on ICE Futures Europe.

-

17:26

Gold price rises on speculation that the Fed may not raise its interest rates this year

Gold price increased on speculation that the Fed may not raise its interest rates this year.

The weak Chinese trade data also supported gold price. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus declined to $59.43 billion in September from $60.24 billion in August, beating expectations for a decline to a surplus of $46.79 billion.

Exports fell at an annual rate of 3.7% in September, while Imports slid at an annual rate of 20.4%, the eleventh consecutive decline.

December futures for gold on the COMEX today rose to 1167.20 dollars per ounce.

-

16:15

International Energy Agency’s report: global oil oversupply remains next year

The International Energy Agency (IEA) released its monthly report on Tuesday. The agency said that global oil oversupply will remain next year as global demand is expected to slow. Global oil demand growth is expected to decline to 1.2 million barrels per day (mb/d) in 2016 from 1.8 mb/d in 2015, down 150,000 barrels per day from its September estimate.

"A projected marked slowdown in demand growth next year and the anticipated arrival of additional Iranian barrels - should international sanctions be eased - are likely to keep the market oversupplied through 2016," the IEA said in its report.

Global oil supply totalled about 96.6 million barrels a day in September. Lower non-OPEC oil output was offset by higher OPEC oil output.

-

10:48

China's trade surplus falls to 59.43 billion in September

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus declined to $59.43 billion in September from $60.24 billion in August, beating expectations for a decline to a surplus of $46.79 billion.

Exports fell at an annual rate of 3.7% in September, while Imports slid at an annual rate of 20.4%, the eleventh consecutive decline.

-

10:43

OPEC upgraded its 2015 global oil demand growth by 40,000 barrels a day

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Monday. It raised its forecast of 2015 global oil demand growth by 40,000 barrels a day to 1.5 million barrels. Total demand in 2015 is expected to be 92.86 million barrels a day, up from the previous estimate of 92.79 million.

The OPEC expects the non-OPEC oil output to decline to average 57.24 million barrels a day in 2015, down 160,000 barrels from the previous estimate.

-

10:36

China's Finance Minister Lou Jiwei: now is not the right time to raise interest rates in the U.S.

China's Finance Minister Lou Jiwei said in an interview published in the China Business News on Monday that now is not the right time to raise interest rates in the U.S.

"The United States isn't at the point of raising interest rates yet and under its global responsibilities it can't raise rates," he said.

Jiwei added that the U.S. "should assume global responsibilities" because of the U.S. dollar's status as a global currency.

The finance minister pointed out the slowdown in the global economy was caused by "weak recovery of developed countries".

"Developed countries should now have faster recoveries to give developing countries some external demand," he added.

Jiwei noted that the slowdown in the Chinese economy is a healthy process.

-

00:32

Commodities. Daily history for Sep Oct 12’2015:

(raw materials / closing price /% change)

Oil 47.44+0.72%

Gold 1,163.50+0.66%

-