Noticias del mercado

-

17:44

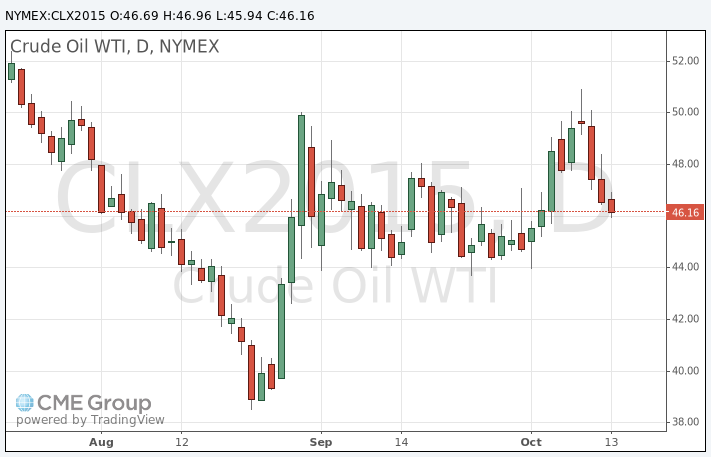

WTI crude oil declines for a third day

WTI crude oil fell on concerns over the global oil oversupply. The International Energy Agency's (IEA) agency said in its monthly report on Tuesday that global oil oversupply will remain next year as global demand is expected to slow. Global oil demand growth is expected to decline to 1.2 million barrels per day (mb/d) in 2016 from 1.8 mb/d in 2015, down 150,000 barrels per day from its September estimate.

Kuwait's oil minister Ali al-Omair said on Tuesday that OPEC will discuss Venezuela's proposal an oil price floor of $70-$100 per barrel at its next meeting this month.

Venezuelan Oil Minister Eulogio del Pino said on Tuesday that eight non-OPEC countries (Azerbaijan, Brazil, Colombia, Kazakhstan, Norway, Mexico, Oman and Russia) have been invited to ameeting on October 21.

Earlier, the weak inflation data from China weighed on oil prices. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in September, missing expectations for a 1.8% increase, after a 2.0% gain in August.

The Chinese producer price index (PPI) dropped 5.9% in September, in line with expectations, after a 5.9% decline in August. It was the biggest decline since 2009.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Thursday.

WTI crude oil for November delivery declined to $45.94 a barrel on the New York Mercantile Exchange.

Brent crude oil for November increased to $49.25 a barrel on ICE Futures Europe.

-

17:16

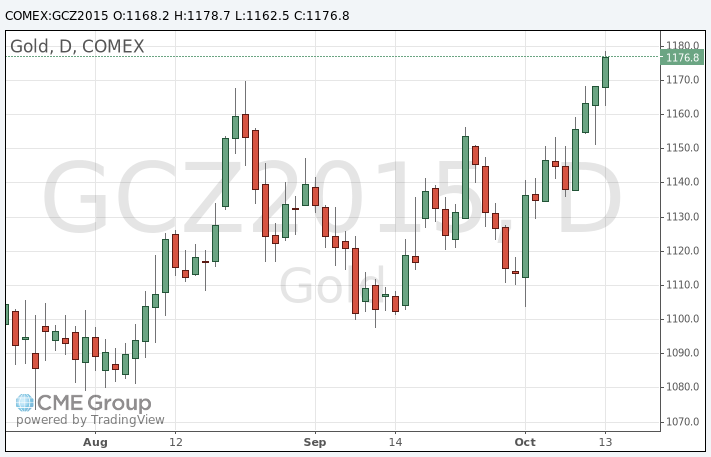

Gold price hits 3-months-high

Gold price increased on a weaker U.S. dollar. The greenback declined against other currencies after the release of the weaker-than-expected U.S. retail sales data. The U.S. Commerce Department released the retail sales data on Wednesday. The U.S. retail sales climbed 0.1% in September, missing expectations for a 0.2% decrease, after a flat reading in August.

The increase was mainly driven by higher automobiles purchases. Automobiles and car parts sales rose 1.7% in September.

Retail sales excluding automobiles decreased 0.3% in September, missing forecasts of a 0.1% decline, after a 0.1% fall in August.

These figures could mean that the Fed will not start raising its interest rate this year.

Earlier, the weak Chinese inflation data supported gold price. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in September, missing expectations for a 1.8% increase, after a 2.0% gain in August.

The Chinese producer price index (PPI) dropped 5.9% in September, in line with expectations, after a 5.9% decline in August. It was the biggest decline since 2009.

December futures for gold on the COMEX today climbed to 1178.70 dollars per ounce.

-

14:53

U.S. retail sales increase 0.1% in September

The U.S. Commerce Department released the retail sales data on Wednesday. The U.S. retail sales climbed 0.1% in September, missing expectations for a 0.2% decrease, after a flat reading in August. August's figure was revised up from a 0.2% rise.

The increase was mainly driven by higher automobiles purchases. Automobiles and car parts sales rose 1.7% in September.

Retail sales excluding automobiles decreased 0.3% in September, missing forecasts of a 0.1% decline, after a 0.1% fall in August. August's figure was revised down from a 0.3% increase.

Sales at building material and garden equipment stores declined 0.3% in September and sales at furniture stores increased 0.6%.

Sales at clothing retailers were up 0.9% in September, while sales at service stations dropped 3.2%.

These figures could mean that the Fed will not start raising its interest rate this year.

-

11:49

Kuwait's oil minister Ali al-Omair: OPEC will discuss Venezuela’s proposal an oil price floor of $70-$100 per barrel this month

Kuwait's oil minister Ali al-Omair said on Tuesday that OPEC will discuss Venezuela's proposal an oil price floor of $70-$100 per barrel at its next meeting this month.

Venezuelan Oil Minister Eulogio del Pino said on Tuesday that eight non-OPEC countries (Azerbaijan, Brazil, Colombia, Kazakhstan, Norway, Mexico, Oman and Russia) have been invited to ameeting on October 21.

"The confirmations are coming in gradually and I'm personally calling ministers to ensure that the delegation is of the adequate level of authority," del Pino said.

-

11:43

Fed Governor Daniel Tarullo: it would not be appropriate to raise interest rates this year

Fed Governor Daniel Tarullo said in an interview with CNBC on Tuesday that it would not be appropriate to raise interest rates this year.

"I wouldn't expect it would be appropriate to raise rates," he said.

Tarullo added that he would like to see any signs that the inflation accelerates before to start raising interest rates.

"There have been a series of factors which, for some period of time, have kept inflation down, and that's why my own perspective is that one should watch to see some tangible evidence that allows one to develop that reasonable confidence that inflation will return to target," Fed governor said.

-

10:27

Chinese consumer price index rises at annual rate of 1.6% in September

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in September, missing expectations for a 1.8% increase, after a 2.0% gain in August.

The inflation was driven by a rise in food prices. Food prices rose at an annual rate of 2.7% in September, while non-food prices increased 1.0%.

On a monthly basis, consumer price inflation increased 0.1% in September, after a 0.5% rise in August.

The Chinese producer price index (PPI) dropped 5.9% in September, in line with expectations, after a 5.9% decline in August. It was the biggest decline since 2009.

-

00:32

Commodities. Daily history for Sep Oct 13’2015:

(raw materials / closing price /% change)

Oil 46.57 -0.19%

Gold 1,168.50 +0.27%

-