Noticias del mercado

-

17:46

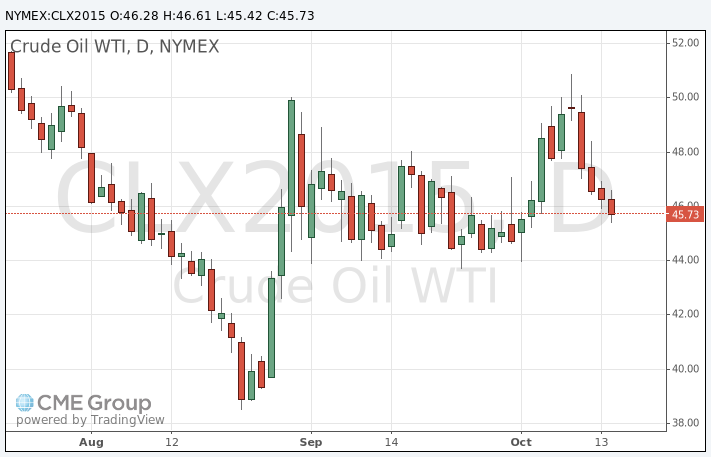

WTI crude oil declines for a fourth day

Oil prices decreased on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories increased by 7.56 million barrels to 468.6 million in the week to October 09. It was the third consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.5 million barrels.

Gasoline inventories decreased by 2.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.125 million barrels.

U.S. crude oil imports climbed by 247,000 barrels per day.

Refineries in the U.S. were running at 86.0% of capacity, down from 87.5% the previous week.

WTI crude oil for November delivery declined to $45.42 a barrel on the New York Mercantile Exchange.

Brent crude oil for November decreased to $49.23 a barrel on ICE Futures Europe.

-

17:41

Gold price declines on a stronger U.S. dollar

Gold price fell on a stronger U.S. dollar. The greenback rose against other currencies after the release of the U.S. consumer price inflation data. The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.2% in September, in line with expectations, after a 0.1% fall in August.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 9.0% in September. It was the biggest decline since January.

On a yearly basis, the U.S. consumer price index declined to 0.0% in September from 0.2% in August, beating expectations for a drop to -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.1% increase in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.9% in September from 1.8% in August. Analysts had expected the inflation to remain unchanged at 1.8%.

It is unclear if this mixed inflation data will be enough for the Fed's interest rate hike. Fed Governors Lael Brainard and Daniel Tarullo said this week that they would like to see clear signals that the inflation was accelerating toward the 2% target.

December futures for gold on the COMEX today declined to 1173.90 dollars per ounce.

-

17:37

U.S. crude inventories climb by 7.56 million barrels to 468.6 million in the week to October 09

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories increased by 7.56 million barrels to 468.6 million in the week to October 09. It was the third consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 2.5 million barrels.

Gasoline inventories decreased by 2.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 1.125 million barrels.

U.S. crude oil imports climbed by 247,000 barrels per day.

Refineries in the U.S. were running at 86.0% of capacity, down from 87.5% the previous week.

-

15:04

U.S. consumer price inflation falls 0.2% in September

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.2% in September, in line with expectations, after a 0.1% fall in August.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 9.0% in September. It was the biggest decline since January.

Food prices increased 0.4% in September. It was the largest rise since May 2014.

On a yearly basis, the U.S. consumer price index declined to 0.0% in September from 0.2% in August, beating expectations for a drop to -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.1% increase in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.9% in September from 1.8% in August. Analysts had expected the inflation to remain unchanged at 1.8%.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

It is unclear if this mixed inflation data will be enough for the Fed's interest rate hike. Fed Governors Lael Brainard and Daniel Tarullo said this week that they would like to see clear signals that the inflation was accelerating toward the 2% target.

-

14:41

Initial jobless claims decrease by 7,000 to 255,000 in the week ending October 10

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 10 in the U.S. declined by 7,000 to 255,000 from 262,000 in the previous week. The previous week's figure was revised down from 263,000.

Analysts had expected the initial jobless claims to increase to 270,000.

Jobless claims remained below 300,000 the 32th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 50,000 to 2,158,000 in the week ended October 03. It was the lowest level since November 2000.

-

14:19

People's Bank of China: bank lending in China rises to 1.05 trillion yuan in September

The People's Bank of China (PBoC) said on Thursday that bank lending in China rose to 1.05 trillion yuan ($165.5 billion) in September from CNY809.6 billion in August.

Total social financing climbed to 1.3 trillion yuan in September from 1.08 trillion yuan in August.

M2 money supply jumped 13.1% year-on-year in September, after a 13.3% gain in August.

-

10:35

Beige Book: the U.S. economic activity continued to grow modestly from mid-August through early October

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to grow modestly from mid-August through early October, but a strong U.S. dollar and the slowdown in the Chinese economy weighed on the manufacturing sector in the U.S.

The New York, Philadelphia, Cleveland, Atlanta, Chicago, and St. Louis Districts expanded modestly, the Minneapolis, Dallas, and San Francisco Districts grew moderately, Boston's and Richmond's activity rose, while Kansas City' activity declined.

The Fed noted that labour markets tightened in most districts, but wage growth was mostly subdued.

-

00:34

Commodities. Daily history for Sep Oct 14’2015:

(raw materials / closing price /% change)

Oil 46.29 -0.75%

Gold 1,183.90 +0.35%

-