Noticias del mercado

-

17:41

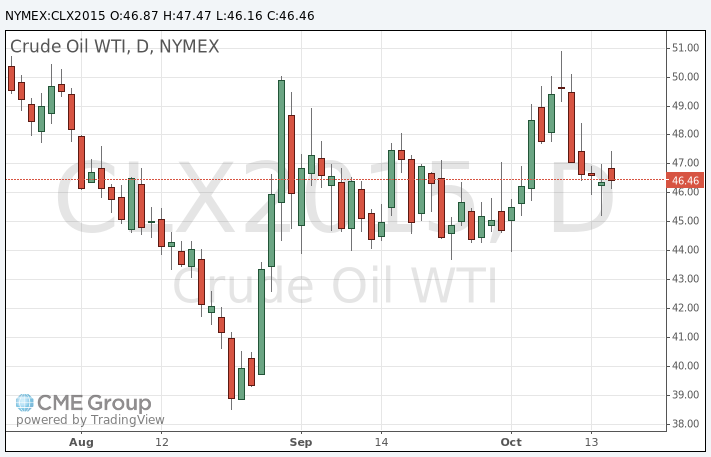

WTI crude oil declines for a fifth day

Oil prices traded mixed on news that Russia will meet OPEC countries in Vienna on Wednesday. Russia and OPEC countries could discuss price floors and production cuts as Russian Energy Minister Alexander Novak said on Thursday that Russia is ready to these discussions.

Meanwhile, market participants continued to eye the U.S. crude oil inventories data. According to the U.S. Energy Information Administration's (EIA), U.S. crude inventories increased by 7.56 million barrels to 468.6 million in the week to October 09. It was the third consecutive increase.

WTI crude oil for November delivery declined to $46.16 a barrel on the New York Mercantile Exchange.

Brent crude oil for November increased to $49.90 a barrel on ICE Futures Europe.

-

17:26

Gold price increases on a weaker U.S. dollar

Gold price rose on a weaker U.S. dollar. The greenback declined against other currencies after the release of the U.S. industrial production data. The Federal Reserve released its industrial production report on Friday. The U.S. industrial production fell 0.2% in September, in line with expectations, after a 0.1% decline in August. August's figure was revised up from a 0.4% drop.

The drop was mainly driven by a fall in the mining output, which plunged by 2.0% in September.

Manufacturing output was down 0.1% in September, while utilities production increased 1.3%.

Capacity utilisation rate decreased to 77.5% in September from 77.8% in August, beating expectations for a decline to 77.4%. August's figure was revised up from 77.6%.

December futures for gold on the COMEX today rose to 1184.80 dollars per ounce.

-

16:23

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 92.1 in October

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 92.1 in October from a final reading of 87.2 in September, missing expectations for an increase to 89.0.

"The rebound in confidence signifies that consumers have concluded that the fears expressed on Wall Street did not extend to Main Street. Importantly, the renewed confidence did not simply represent a relief rally, but instead reflected renewed optimism," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

He added that the consumption is expected to climb 2.9% during 2016.

The rise in the index was driven by increases in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions increased to 106.7 in October from 101.2 in September, while the index of consumer expectations rose to 82.7 from 78.2.

The one-year inflation expectations fell to 2.7% in October from 2.8% in September.

-

16:14

Job openings drops to 5.370 million in August

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Friday. Job openings dropped to 5.370 million in August from 5.668 million in July. July's figure was revised down from 5.753 million.

The number of job openings declined for total private (4.878 million) and for government (493,000) in August.

The hires rate was 3.6% in August.

Total separations rose to 4.846 million in August from 4.796 million in July.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:51

U.S. industrial production declines 0.2% in September

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production fell 0.2% in September, in line with expectations, after a 0.1% decline in August. August's figure was revised up from a 0.4% drop.

The drop was mainly driven by a fall in the mining output, which plunged by 2.0% in September.

Manufacturing output was down 0.1% in September, while utilities production increased 1.3%.

Capacity utilisation rate decreased to 77.5% in September from 77.8% in August, beating expectations for a decline to 77.4%. August's figure was revised up from 77.6%.

-

00:32

Commodities. Daily history for Sep Oct 15’2015:

(raw materials / closing price /% change)

Oil 46.86 +1.03%

Gold 1,183.00 -0.38%

-