Noticias del mercado

-

22:09

Major US stock indexes closed in positive zone

Major US stock indexes closed in positive zone against the background of the fact that Greece will prevent default and due to both strong domestic macroeconomic data showing the US economic recovery. International creditors of Greece signaled its readiness to compromise to avoid a default.

In addition, the US trade deficit narrowed in April, easing one of the biggest obstacles to economic growth during the first months of the year. As reported by the Ministry of Commerce on Wednesday, the trade deficit decreased by 19.2% to a seasonally adjusted amounted to $ 40.88 billion. In April. It was the sharpest drop in more than six years, continuing the pattern of significant changes caused by the strikes in the ports of the West Coast. Economists had forecast a deficit of $ 44 billion.

However, in May, the index of business activity in the US service sector, calculated by the Institute for Supply Management (ISM), worsened, reaching 55.7 at the same level compared to the April reading at the level of 57.8. According to experts, the value of this index was down to 57.0.

Oil prices fell today as investors adjusted positions ahead of the OPEC meeting to be held this Friday. Earlier today, the head of OPEC's Abdullah al-Badri at the Sixth International Seminar OPEC have on the adequacy of supply and demand in the world oil market at the moment. At the same time, the UAE Minister of Energy Mohammed Suhail Al Mazruey expressed the opinion that the correction of balance of supply and demand on the oil market is not yet complete. Also on the dynamics of trade have affected the data on stocks of petroleum products in the United States. US Department of Energy reported that in the week of May 23-29, oil stocks fell by 1.9 million barrels to 477.4 million barrels, while the average forecast anticipated a decrease of 2.0 million barrels per day.

Most components of the index DOW closed in positive territory (20 of 30). Outsider shares were Intel Corporation (INTC, -1.97%). More rest up shares The Home Depot, Inc. (HD, + 1.63%).

Sector S & P index finished trading mostly in positive territory. Most of the services sector grew (+ 0.7%). Outsiders were utilities sector (-1.6%).

At the close:

Dow + 0.34% 18,073.90 +61.96

Nasdaq + 0.40% 5,097.05 +20.52

S & P + 0.19% 2,113.69 +4.09

-

21:00

Dow +0.46% 18,093.95 +82.01 Nasdaq +0.48% 5,101.00 +24.47 S&P +0.27% 2,115.39 +5.79

-

18:36

WSE: Session Results

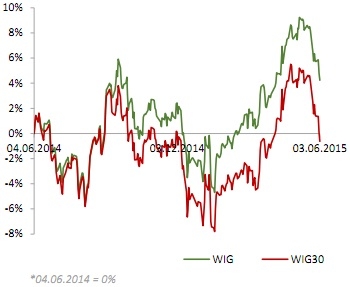

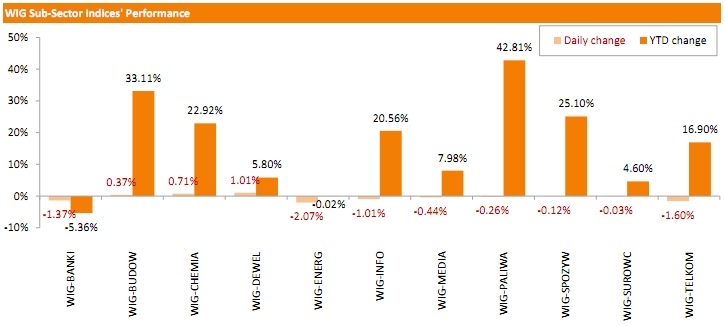

Polish equity market continued to decline on Wednesday. The broad market measure - the WIG index fell by 0.54%. The WIG sub-sector indices moved in different directions. The developers benchmark - the WIG-DEWEL index (+1.01%) outpaced, while the utilities measure - the WIG-ENERG index (-2.07%) lagged.

The large-cap stocks' measure - the WIG30 index declined by 0.69%. Within the WIG30 index components, coal producers JSW (WSE: JSW) and BOGDANKA (WSE: LWB) posted the largest declines, tumbling a respective 5.47% and 3.07%. They were followed by BZ WBK (WSE: BZW), ORANGE POLSKA (WSE: OPL), PGE (WSE: PGE) and ALIOR (WSE: ALR), losing between 2.52% and 2.98%. At the same time, GTC (WSE: GTC), LPP (WSE: LPP), EUROCASH (WSE: EUR) and CCC (WSE: CCC) were among growth leaders, providing returns of 5.48%, 3.83%, 2.37% and 2.27% respectively.

Thursday, June 4, 2015, is the Corpus Christi Day in Poland. The Warsaw Stock Exchange will be closed for trading.

-

18:29

Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Wednesday on growing hopes that Greece would avert a default and as strong domestic data suggested the U.S. economic recovery was on track. Greece's international creditors signaled they were ready to compromise to avert a debt default, with the country's prime minister expected to hear the terms of the plan later on Wednesday. The market also got a boost from data that showed U.S. trade deficit narrowed in April after surging in March, while companies picked up their hiring in May after a pullback the previous month.

Most of Dow stocks in positive area (23 of 30). Top looser - Intel Corporation (INTC, -1.89%). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.31%).

Most of S&P index sectors also in positive area. Top gainer - Services (+0,6%). Top looser - Utilities (-1.5%).

At the moment:

Dow 18077.00 +76.00 +0.42%

S&P 500 2112.00 +5.25 +0.25%

Nasdaq 100 4521.00 +18.00 +0.40%

10-year yield 2.35% +0.09

Oil 60.10 -1.16 -1.89%

Gold 1189.50 -4.90 -0.41%

-

18:11

European Central Bank raised the amount the Greek central bank can lend its banks to €80.7 billion

The European Central Bank (ECB) on Tuesday raised the amount the Greek central bank can lend its banks by €500 million to €80.7 billion from €80.2 billion.

-

18:04

European stocks close: stocks closed higher on comments by the ECB President Mario Draghi

Stock indices closed higher on comments by the European Central Bank (ECB) President Mario Draghi. He presented new inflation and growth forecasts at a press conference on Wednesday. The ECB forecasts an annual inflation at 0.3% in the Eurozone in 2015, up from the previous estimate of 0.0%, 1.5% in 2016 and 1.8% in 2017.

The central bank expects the annual real GDP to expand at 1.5% in 2015, at 1.9% in 2016 and at 2.0% in 2017, down from the previous estimate of 2.1%.

Draghi noted that the central will continue its asset buying programme until September 2016 or as long as needed.

The Greek debt crisis remained in focus. Draghi said at a press conference on Wednesday that he wants Greece to stay in the Eurozone, "but it has to be a strong agreement".

Draghi declined to comment on the debt talks between Greece and its creditors.

The European Commission President Jean-Claude Juncker meets Greek Prime Minister Alexis Tsipras in Brussels on Wednesday. Juncker is expected to provide details of a proposal designed to avert a Greek default.

Meanwhile, the economic data from the Eurozone was better than expected. Eurozone's unemployment rate fell to 11.1% in April from 11.2% in March. It was the lowest level since February 2012.

March's figure was revised down from 11.3%.

Analysts had expected the unemployment rate to remain unchanged at 11.2%.

Retail sales in the Eurozone rose 0.7% in April, in line with expectations, after a 0.6% fall in March. March's figure was revised up from a 0.8% drop.

The increase was driven by higher food, drinks and tobacco sales, which rose 1.3% in April.

Gasoline sales were up 0.6% in April, while non-food sales increased 0.3%.

On a yearly basis, retail sales in the Eurozone rose 2.2% in April, beating forecasts of a 2.0% gain, after a 1.7% increase in March. March's figure was revised up from a 1.6% rise.

The annual rise was driven by non-food sales, which gained 3.3%, and by gasoline sales, which increased 3.2%.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 56.5 in May from 59.5 in April, missing expectations for a fall to 59.2. It was the lowest level since December 2014.

A reading above 50 indicates expansion in the sector.

The decline was driven by a lower increase in new business.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,950.46 +22.19 +0.32%

DAX 11,419.62 +90.82 +0.80%

CAC 40 5,034.17 +29.71 +0.59%

-

18:01

European stocks closed: FTSE 100 6,960.31 +32.04 +0.46% CAC 40 5,039.19 +34.73 +0.69% DAX 11,437.71 +108.91 +0.96%

-

17:07

OECD downgrades its global growth outlook

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Wednesday. The OECD downgraded its global growth outlook.

"The global economy is projected to strengthen, but the pace of recovery remains weak and investment has yet to take off," the OECD Secretary-General Angel Gurria.

The OECD expect the U.S. will grow at 2.0% in 2015, down from the previous estimate of 3.1%, and at 2.8% in 2016, down from the previous estimate of 3.0%. The stronger dollar and adverse weather weighed on the U.S. economic growth, according to OECD.

Japan's economy is expected to grow at 0.7% in 2015 and at 1.4% in 2016, down from November estimate of 0.8% for 2015 and up 1.0% for 2016.

Eurozone's forecasts were upgraded to 1.4% in 2015 from the previous estimate of 1.1% and to 2.1% in 2016 from the previous estimate of 1.7%.

China is expected to expand at 6.8% in 2015, down from 7.1% estimate in November. Growth forecast for 2016 was downgraded to 6.7% from the previous estimate of 6.9%.

Global GDP is estimated to grow 3.1% in 2015 and 3.8% in 2016, down from 3.6% and from 3.9%.

-

16:52

ISM non-manufacturing purchasing managers’ index falls to 56.2 in May

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index fell to 56.2 in May from 57.4 in April, missing expectations for a decrease to 56.4. It was the lowest level since April 2014

A reading above 50 indicates a growth in the service sector.

The decline was partly driven by a drop in the business activity/production index, which declined to 59.5 in May from 61.6 in April.

The ISM's new orders index decreased to 57.9 in May from 59.2 in April.

The ISM's employment index declined to 55.3 in May from 56.7 in April.

The ISM's price index rose to 55.9 in May from 50.1 in April.

-

16:32

Makit’s final U.S. services PMI is down to 56.2 in May

Markit Economics released its final services purchasing managers' index (PMI) for the U.S. on Wednesday. The final U.S. services PMI declined to 56.2 in May from 57.4 in April, down from the preliminary reading of 56.4.

A reading over 50 indicates expansion in the sector.

The downward revision was driven by weaker than previously estimated new business index, which decreased to 55.7 in May from 57.7 in April, down from the preliminary reading of 55.8.

"Slowing service sector growth adds to signs that the U.S. economy has lost some momentum after an initial bounce-back from weather-related weakness at the start of the year," Markit Economics Chief Economist Chris Williamson noted.

-

16:05

ECB upgrades inflation forecast for the Eurozone to 0.3% in 2015

The European Central Bank (ECB) President Mario Draghi presented new inflation and growth forecasts at a press conference on Wednesday. The ECB forecasts an annual inflation at 0.3% in the Eurozone in 2015, up from the previous estimate of 0.0%, 1.5% in 2016 and 1.8% in 2017.

The central bank expects the annual real GDP to expand at 1.5% in 2015, at 1.9% in 2016 and at 2.0% in 2017, down from the previous estimate of 2.1%.

-

15:57

European Central Bank President Mario Draghi: the central will continue its asset buying programme until September 2016 or as long as needed

The European Central Bank (ECB) President Mario Draghi said at a press conference on Wednesday that the central will continue its asset buying programme until September 2016 or as long as needed.

"We have to look through the medium term, until the objectives has been reached in a sustained fashion," Draghi noted.

"The full implementation of all our monetary policy measures will provide the necessary support to the economic recovery in the euro area and lead to a sustained return of inflation rates towards levels below, but close to, 2 percent in the medium term," he added.

The ECB president pointed out that the economy should recover and domestic demand should be supported by quantitative easing, adding that recovery is on track according to the central bank's projections.

Draghi noted that the economic growth in the Eurozone could remain low due to "the sluggish pace of implementation of structural reforms".

"The risks surrounding the economic outlook for the euro area have become more balanced on account of our monetary policy decisions and oil price and exchange rate developments. Inflation bottomed out at the beginning of the year," Draghi said.

He also said that he wants Greece to stay in the Eurozone, "but it has to be a strong agreement".

Draghi declined to comment on the debt talks between Greece and its creditors.

The central bank kept its interest rate unchanged at 0.05%.

-

15:36

U.S. Stocks open: Dow +0.30%, Nasdaq +0.23%, S&P +0.04%

-

15:33

U.K. Nationwide house price index rises 0.3% in May

The Nationwide Building Society released its house price index for the U.K. on Wednesday. The U.K. Nationwide house price index increased 0.3% in May, in line with expectations, after a 1.0% rise in April.

On a yearly basis, the U.K. Nationwide house price inflation was up to 4.6% in May from 5.2% in April. It was the slowest rise since August 2013.

Analysts had expected the index to drop to 4.7%.

"However, much will depend on supply side developments. In recent years the rate of building activity has remained well below that required to keep up with population growth," Nationwide's chief economist Robert Gardner noted.

He added that the house price increase is expected "to converge with earnings growth, which has typically been around 4 percent per annum".

-

15:29

Before the bell: S&P futures +0.33%, NASDAQ futures +0.63%

U.S. stock-index futures signaled a rebound for equities as investors weighed Greek debt talks and data showed private payroll growth was in line with forecasts.

Global markets:

Nikkei 20,473.51 -69.68 -0.34%

Hang Seng 27,657.47 +190.75 +0.69%

Shanghai Composite 4,909.98 -0.55 -0.01%

FTSE 6,965.58 +37.31 +0.54%

CAC 5,070.25 +65.79 +1.31%

DAX 11,475.44 +146.64 +1.29%

Crude oil $60.19 (-1.19%)

Gold $1188.80 (-0.47%)

-

15:11

Canada's trade deficit narrows to C$2.97 billion in April

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$2.97 billion in April from a deficit of C$3.85 billion in March.

March's figure was revised down from a deficit of C$3.02 billion.

Analysts had expected a trade deficit of C$2.1 billion.

The declined in deficit was driven by lower imports. Imports fell 2.5% in April.

Imports of motor vehicles and parts climbed by 2.7%, imports of metal and non-metallic mineral products plunged 11.3%, imports of energy products increased 7.4%, while imports of consumer goods dropped 6.2%.

Exports decreased 0.7% in April. Exports of energy products climbed by 5.9%, exports of consumer goods dropped 6.0%, while exports of forestry products and building and packaging materials fell 5.0%.

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

12.63

+0.08%

16.5K

Exxon Mobil Corp

XOM

85.23

+0.11%

11.4K

Google Inc.

GOOG

540.05

+0.16%

1.9K

Verizon Communications Inc

VZ

49.25

+0.22%

34.2K

Tesla Motors, Inc., NASDAQ

TSLA

248.95

+0.24%

13.6K

AMERICAN INTERNATIONAL GROUP

AIG

59.83

+0.25%

0.3K

Ford Motor Co.

F

15.30

+0.26%

0.4K

Intel Corp

INTC

33.36

+0.27%

26.1K

JPMorgan Chase and Co

JPM

66.21

+0.29%

40.6K

American Express Co

AXP

80.24

+0.31%

0.2K

Pfizer Inc

PFE

34.60

+0.32%

2.1K

Procter & Gamble Co

PG

78.81

+0.34%

0.9K

General Electric Co

GE

27.43

+0.37%

12.9K

McDonald's Corp

MCD

96.66

+0.38%

0.7K

Home Depot Inc

HD

112.03

+0.39%

6.3K

The Coca-Cola Co

KO

41.15

+0.39%

2.0K

Wal-Mart Stores Inc

WMT

74.82

+0.39%

3.9K

Johnson & Johnson

JNJ

100.38

+0.40%

10.4K

International Business Machines Co...

IBM

170.34

+0.41%

1.9K

E. I. du Pont de Nemours and Co

DD

71.60

+0.46%

5.9K

Yahoo! Inc., NASDAQ

YHOO

43.35

+0.46%

23.4K

Citigroup Inc., NYSE

C

54.99

+0.49%

2.7K

General Motors Company, NYSE

GM

36.40

+0.50%

2.4K

Boeing Co

BA

144.00

+0.52%

4.6K

Apple Inc.

AAPL

130.66

+0.54%

208.2K

Travelers Companies Inc

TRV

100.88

+0.55%

1K

Visa

V

69.43

+0.56%

0.7K

Cisco Systems Inc

CSCO

29.25

+0.58%

4.5K

Microsoft Corp

MSFT

47.20

+0.60%

12.8K

Caterpillar Inc

CAT

86.71

+0.63%

3.3K

UnitedHealth Group Inc

UNH

118.50

+0.64%

1.2K

Starbucks Corporation, NASDAQ

SBUX

52.07

+0.66%

2.0K

AT&T Inc

T

34.60

+0.70%

5.7K

Twitter, Inc., NYSE

TWTR

36.66

+0.71%

14.8K

Walt Disney Co

DIS

111.55

+0.72%

4.2K

ALTRIA GROUP INC.

MO

51.00

+0.73%

2.0K

Merck & Co Inc

MRK

60.72

+0.80%

1.0K

Hewlett-Packard Co.

HPQ

34.15

+0.80%

8.6K

Facebook, Inc.

FB

81.12

+0.84%

190.2K

Amazon.com Inc., NASDAQ

AMZN

434.90

+0.91%

14.8K

Chevron Corp

CVX

102.42

-0.16%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.35

-0.54%

2.8K

Barrick Gold Corporation, NYSE

ABX

11.81

-1.42%

0.8K

Yandex N.V., NASDAQ

YNDX

18.60

-1.72%

7.2K

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Caterpillar (CAT) initiated with a Buy at Societe Generale, target $110

Amazon (AMZN) initiated with a Outperform at Credit Suisse

Walt Disney (DIS) Credit Suisse initiated with a Outperform at Credit Suisse, target $130

Amazon (AMZN) reiterated at Overweight at Piper Jaffray, target raised from $475 to $520

-

14:57

U.S. trade deficit narrows to $40.88 billion in April

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit narrowed to $40.88 billion in April from a deficit of $50.57 billion in March.

March's figure was revised up from a deficit of $51.37 billion.

Analysts had expected a trade deficit of $40.3 billion.

The decline of a deficit was driven by lower imports. Imports fell by 3.3% in April, while exports increased by 1.0%.

A stronger U.S. dollar weighs on exports as it makes U.S. goods and services less affordable abroad.

Exports to China declined 5.8%.

-

14:38

ADP report: private sector adds 201,000 jobs in May

Private sector in the U.S. added 201,000 jobs in May, according the ADP report on Wednesday.

April's figure was revised down to 165,000 jobs from a previous reading of 169,000 jobs.

Analysts expected the private sector to add 200,000 jobs.

The increase was driven by a job creation in the services sector.

"If we just maintain this rate of growth, by almost every estimate we will be back to full employment by this time next year" the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.4% in May. The U.S. economy is expected to add 227,000 jobs in May, after adding 223,000 jobs in April.

-

12:03

European stock markets mid session: stocks traded higher ahead of the ECB’s interest rate decision

Stock indices traded higher ahead of the European Central Bank's (ECB) interest rate decision. Analysts expect the central to keep its interest rate unchanged at 0.05%.

The Greek debt crisis remained in focus. The European Commission President Jean-Claude Juncker meets Greek Prime Minister Alexis Tsipras in Brussels on Wednesday. Juncker is expected to provide details of a proposal designed to avert a Greek default.

Meanwhile, the economic data from the Eurozone was better than expected. Eurozone's unemployment rate fell to 11.1% in April from 11.2% in March. It was the lowest level since February 2012.

March's figure was revised down from 11.3%.

Analysts had expected the unemployment rate to remain unchanged at 11.2%.

Retail sales in the Eurozone rose 0.7% in April, in line with expectations, after a 0.6% fall in March. March's figure was revised up from a 0.8% drop.

The increase was driven by higher food, drinks and tobacco sales, which rose 1.3% in April.

Gasoline sales were up 0.6% in April, while non-food sales increased 0.3%.

On a yearly basis, retail sales in the Eurozone rose 2.2% in April, beating forecasts of a 2.0% gain, after a 1.7% increase in March. March's figure was revised up from a 1.6% rise.

The annual rise was driven by non-food sales, which gained 3.3%, and by gasoline sales, which increased 3.2%.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 56.5 in May from 59.5 in April, missing expectations for a fall to 59.2. It was the lowest level since December 2014.

A reading above 50 indicates expansion in the sector.

The decline was driven by a lower increase in new business.

Current figures:

Name Price Change Change %

FTSE 100 6,928.98 +0.71 +0.01 %

DAX 11,379.19 +50.39 +0.44 %

CAC 40 5,015.73 +11.27 +0.23 %

-

11:49

Eurozone's unemployment rate decreases to 11.1% in April from 11.2% in March, the lowest level since February 2012

Eurostat released its unemployment data for the Eurozone on Wednesday. Eurozone's unemployment rate fell to 11.1% in April from 11.2% in March. It was the lowest level since February 2012.

March's figure was revised down from 11.3%.

Analysts had expected the unemployment rate to remain unchanged at 11.2%.

There were 17.846 million unemployed in the Eurozone in April, down 130,000 from March.

The lowest unemployment rate in the Eurozone in April was recorded in Germany (4.7%), and the highest in Greece (25.4% in February 2015) and Spain (22.7%).

The youth unemployment rate declined to 22.3% in the Eurozone in April from 22.6% in March.

-

11:38

Eurozone’s retail sales rise 0.7% in April

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone rose 0.7% in April, in line with expectations, after a 0.6% fall in March. March's figure was revised up from a 0.8% drop.

The increase was driven by higher food, drinks and tobacco sales, which rose 1.3% in April.

Gasoline sales were up 0.6% in April, while non-food sales increased 0.3%.

On a yearly basis, retail sales in the Eurozone rose 2.2% in April, beating forecasts of a 2.0% gain, after a 1.7% increase in March. March's figure was revised up from a 1.6% rise.

The annual rise was driven by non-food sales, which gained 3.3%, and by gasoline sales, which increased 3.2%.

Food, drinks and tobacco sales rose 1.1%.

-

11:27

UK’s services PMI declines to 56.5 in May

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 56.5 in May from 59.5 in April, missing expectations for a fall to 59.2. It was the lowest level since December 2014.

A reading above 50 indicates expansion in the sector.

The decline was driven by a lower increase in new business.

"Rate hikes later this year should not be ruled out: there are signs that the disappointing rate of expansion is only temporary, linked to uncertainty surrounding the general election, and the surveys point to rising inflationary pressures as well as a further tightening of the labour market," the Chief Economist at Markit Chris Williamson said.

-

11:15

Eurozone's final services PMI declines to 53.8 in May

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) fell to 53.8 in May from 54.1 in April, down from a preliminary reading of 53.3.

The upward revision was driven by stronger than previously estimated services PMI from France.

Germany's final services PMI decreased to 53.0 in May from 54.0 in April, up from a preliminary reading of 52.9.

France's final manufacturing PMI rose to 52.8 in May from 51.4 in April, up a preliminary reading of 51.6.

-

11:07

Australia's GDP climbs 0.9% in the first quarter

The Australian Bureau of Statistics released its gross domestic product (GDP) data on Wednesday. Australia's GDP climbed 0.9% in the first quarter, exceeding expectations for a 0.7% gain, after a 0.5% rise in the fourth quarter.

On a yearly basis, Australia's GDP rose 2.3% in the first quarter, beating expectations for a 2.1% increase, after a 2.4% gain in the fourth quarter. The fourth quarter's figure was revised down from 2.5% rise.

Final consumption spending was up 0.5% quarter-on-quarter and 2.4% year-on-year.

Terms of trade dropped 2.9% quarter-on-quarter and 11.4% year-on-year, while real net national disposable income increased 0.2% quarter-on-quarter and fell 0.2% year-on-year.

On seasonally adjusted basis, mining rose 0.3%, financial and insurance services climbed 0.2%, while construction declined 0.1%.

-

10:48

Services PMI for Australia is down to 49.6 in May

The Australian Industry Group released its services purchasing managers' index (PMI) for Australia on late Tuesday. Australia's PMI fell to 49.6 in May from 49.7 in April.

A reading below 50 indicates a contraction of the sector.

The sales, new orders, supplier deliveries and stock levels subindex contracted, while employment subindex expanded.

The three-month moving average for the services PMI fell 0.7 points to 49.8.

-

10:39

Auto sales in the U.S. increase in May

Auto sales in the U.S. increased in May due to easy-to-get loans and cheap gasoline. U.S. auto sales reached 17.79 million in May on a seasonally adjusted annualized basis, the highest since summer 2005.

The increase was driven by sales of pickup trucks and SUVs.

GM sales climbed 3% in May, Fiat Chrysler Automobiles' sales increased 4%, Ford Motor Co sales decreased 1%, Toyota Motor Corp and Nissan Motor Co both declined less than 1%, while Honda Motor Co sales jumped 10.6%.

-

10:31

OECD: consumer price inflation in the OECD area declines to an annual rate of 0.4% in April

OECD released its consumer price inflation (CPI) data. Consumer price inflation in the OECD area declined to an annual rate of 0.4% in April from 0.6% in March.

The decline was driven by lower energy prices, which dropped 11.5%. Food prices decreased to 1.7% in April from 1.9% in March.

CPI excluding food and energy in the OECD area fell to an annual rate to 1.6% in April from 1.7% in March.

April's CPI was 0.1% in the U.K., 0.8% in Canada, 0.5% in Germany and 0.6% in Japan. The consumer price inflation in Russia reached 16.4% in April.

-

04:03

Nikkei 225 20,454.91 -88.28 -0.43 %, Hang Seng 27,642.42 +175.70 +0.64 %, Shanghai Composite 4,903.19 -7.33 -0.15 %

-

00:34

Stocks. Daily history for Jun 2’2015:

(index / closing price / change items /% change)

Nikkei 225 20,543.19 -26.68 -0.13 %

Hang Seng 27,466.72 -130.44 -0.47 %

S&P/ASX 200 5,636 -99.39 -1.73 %

Shanghai Composite 4,911.57 +82.84 +1.72 %

FTSE 100 6,928.27 -25.31 -0.36 %

CAC 40 5,004.46 -20.84 -0.41 %

Xetra DAX 11,328.8 -107.25 -0.94 %

S&P 500 2,109.6 -2.13 -0.10 %

NASDAQ Composite 5,076.52 -6.40 -0.13 %

Dow Jones 18,011.94 -28.43 -0.16 %

-