Noticias del mercado

-

20:00

DJIA 17956.60 -3.04 -0.02%, NASDAQ 5072.13 -33.43 -0.65%, S&P 500 2092.41 -5.53 -0.26%

-

18:45

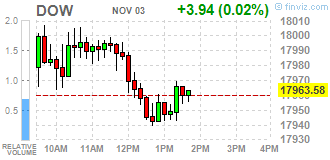

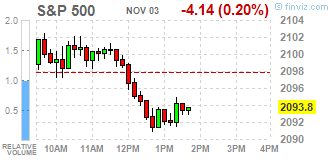

Wall Street. Major U.S. stock-indexes fell, Dow little changed

Major U.S. stock-indexes reversed course to trade lower on Thursday as concerns over the tightening race for the White House and a fall in Facebook's shares weighed on sentiment. Facebook (FB) fell as much as 5,9% to a more than three-month low of $119.61 after the social media giant warned that revenue growth would slow this quarter. The stock was the biggest drag on the S&P and the Nasdaq.

Most of Dow stocks in negative area (18 of 30). Top gainer - The Walt Disney Company (DIS, +1.72%). Top loser - Intel Corporation (INTC, -1.68%).

Almost all S&P sectors also in negative area. Top gainer - Utilities (+0.7%). Top loser - Conglomerates (-1.1%).

At the moment:

Dow 17878.00 -3.00 -0.02%

S&P 500 2088.25 -4.00 -0.19%

Nasdaq 100 4691.75 -25.00 -0.53%

Oil 44.51 -0.83 -1.83%

Gold 1303.40 -4.80 -0.37%

U.S. 10yr 1.82 +0.02

-

18:00

European stocks closed: FTSE 6790.51 -54.91 -0.80%, DAX 10325.88 -45.05 -0.43%, CAC 4411.68 -2.99 -0.07%

-

17:46

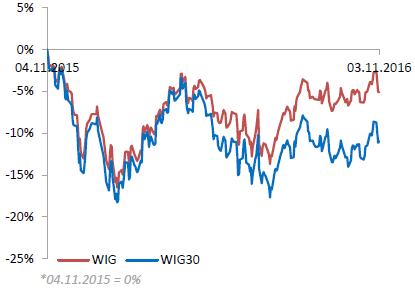

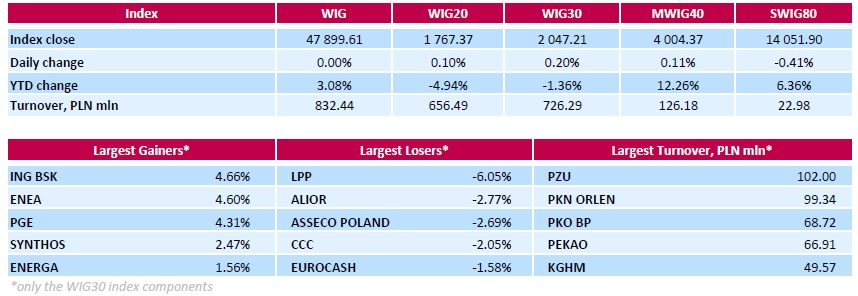

WSE: Session Results

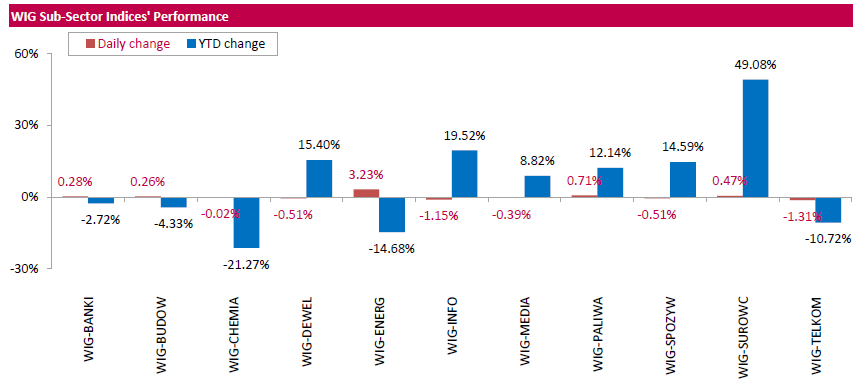

Polish equity market closed flat on Thursday, as measured by the WIG Index. Sector performance within the WIG Index was mixed. Telecoms (-1.31%) tumbled the most, while utilities (+3.23%) fared the best.

The large-cap companies' measure, the WIG30 Index, added 0.2%. In the index basket, bank ING BSK (WSE: ING) and genco ENEA (WSE: ENA) topped the list of advancers, jumping by 4.66% and 4.6% respectively, supported by stronger-than-expected Q3 financials. ING BSK reported net profit of PLN 0.332 bln versus analysts' consensus estimate of PLN 0.284 bln. ENEA posted net profit of PLN 0.249 bln versus analysts' consensus estimate of PLN 0.196 bln and net revenues of PLN 2.705 bln versus analysts' consensus estimate of PLN 2.603 bln. Other major gainers were chemical producer SYNTHOS (WSE: SNS) and three utilities names PGE (WSE: PGE), TAURON PE (WSE: TPE) and ENERGA (WSE: ENG), which rose by 1.16%-4.31%. At the same time, clothing retailer LPP (WSE: LPP) recorded the biggest drop, retreating by 6.05% after four consecutive sessions of growth. It was followed by bank ALIOR (WSE: ALR), IT-company ASSECO POLAND (WSE: ACP) and footwear retailer CCC (WSE: CCC), which fell by 2.05%-2.77%.

-

14:33

U.S. Stocks open: Dow +0.15%, Nasdaq +0.11%, S&P +0.10%

-

14:27

Before the bell: S&P futures +0.26%, NASDAQ futures +0.08%

U.S. stock-index futures advanced as as oil prices rebounded.

Global Stocks:

Nikkei Closed

Hang Seng 22,683.51 -126.99 -0.56%

Shanghai 3,128.67 +25.94 +0.84%

FTSE 6,820.57 -24.85 -0.36%

CAC 4,443.47 +28.80 +0.65%

DAX 10,389.06 +18.13 +0.17%

Crude $45.67 (+0.73%)

Gold $1,292.60 (-1.19%)

-

13:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

22.62

-0.29(-1.2658%)

511

Amazon.com Inc., NASDAQ

AMZN

767

1.44(0.1881%)

36694

Apple Inc.

AAPL

110.92

-0.10(-0.0901%)

71643

AT&T Inc

T

36.38

0.01(0.0275%)

7889

Boeing Co

BA

141.88

1.13(0.8028%)

555

Cisco Systems Inc

CSCO

30.42

0.03(0.0987%)

747

Citigroup Inc., NYSE

C

48.6

0.22(0.4547%)

10428

Facebook, Inc.

FB

121.57

-5.60(-4.4036%)

2911626

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.74

0.12(1.1299%)

55275

Goldman Sachs

GS

176.07

-0.51(-0.2888%)

730

Google Inc.

GOOG

767.07

-1.63(-0.212%)

10525

JPMorgan Chase and Co

JPM

68.97

0.29(0.4222%)

909

McDonald's Corp

MCD

112.16

-0.23(-0.2046%)

401

Microsoft Corp

MSFT

59.45

0.02(0.0337%)

14031

Nike

NKE

49.82

0.10(0.2011%)

1189

Pfizer Inc

PFE

30.71

0.08(0.2612%)

1013

Starbucks Corporation, NASDAQ

SBUX

53.05

0.07(0.1321%)

3753

Tesla Motors, Inc., NASDAQ

TSLA

188.23

0.21(0.1117%)

13258

Twitter, Inc., NYSE

TWTR

17.52

-0.09(-0.5111%)

53597

United Technologies Corp

UTX

101.5

-0.04(-0.0394%)

100

Verizon Communications Inc

VZ

47.12

0.18(0.3835%)

1382

Yahoo! Inc., NASDAQ

YHOO

40.43

-0.25(-0.6146%)

6475

Yandex N.V., NASDAQ

YNDX

19.01

0.32(1.7121%)

2814

-

13:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

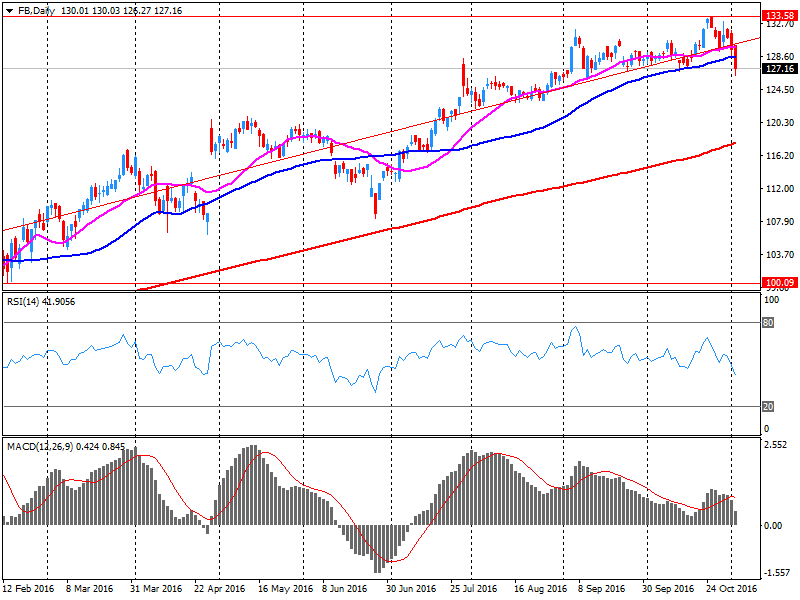

Facebook (FB) target lowered to $146 from $150 at Mizuho

Facebook (FB) target raised to $160 from $155 at Axiom Capital

-

13:23

Company News: Facebook (FB) Q3 results beat analysts’ expectations

Facebook reported Q3 FY 2016 earnings of $1.09 per share (versus $0.57 in Q3 FY 2015), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $7.011 bln (+55.8% y/y), beating analysts' consensus estimate of $6.920 bln.

FB fell to $121.45 (-4.50%). in pre-market trading.

-

13:17

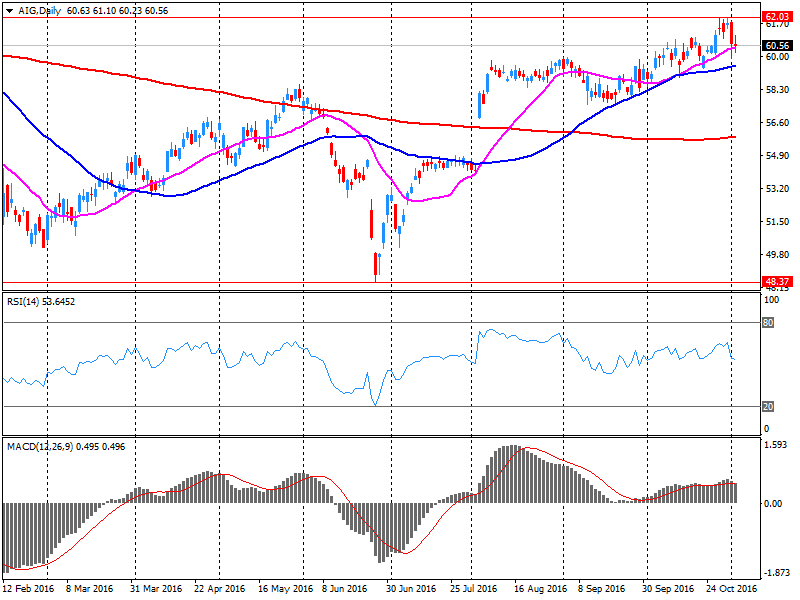

Company News: American Intl (AIG) Q3 EPS beat analysts’ estimate

American Intl reported Q3 FY 2016 earnings of $1.23 per share (versus $0.52 in Q3 FY 2015), beating analysts' consensus estimate of $1.20.

In addition, the company announced its Board of Directors authorized an additional increase to its previous repurchase authorization of AIG common stock of $3.0 bln, resulting in an aggregate remaining authorization on such date of approximately $4.4 bln. AIG's Board of Directors also declared a cash dividend on AIG Common Stock of $0.32 per share, payable on December 22, 2016 to shareholders of record on December 8, 2016.

AIG closed Wednesday's trading session at $60.55 (-0.21%).

-

12:26

Jefferies confirms Facebook stock rating to "buy", target price $ 170

-

09:50

Major stock markets trading in the red zone: FTSE 100 6,887.48 -29.66 -0.43%, Xetra DAX 10,433.47 -92.69 -0.88%

-

08:51

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.1%, CAC 40 -0.1, FTSE -0.2%

-

06:45

Global Stocks

European stocks ended sharply lower on Tuesday, as several major companies turned in disappointing financial results and as investors fretted over the U.S. presidential election. "An initial boost from positive Chinese economic data fizzled out on Tuesday as attention turned to the rising possibility of a Trump presidency," said Jasper Lawler, market analyst at CMC Markets, in a note.

U.S. stocks extended losses on Wednesday, with the S&P 500 recording its longest losing streak in five years after the Federal Reserve, as expected, kept interest rates unchanged.

Asian markets edged up Thursday as Chinese and Australian markets were lifted by positive economic news. However, uncertainty about the outcome about the U.S. presidential race continues to keep traders on edge in Asia. Activity in China's service sector expanded at a faster pace in October, a private gauge showed Thursday, adding to recent signs of firmness in China's economy. The Caixin China services purchasing managers index rose to 52.4 in October from 52.0 in September.

-

00:28

Stocks. Daily history for Nov 02’2016:

(index / closing price / change items /% change)

Nikkei 225 17,134.68 -307.72 -1.76%

Shanghai Composite 3,102.96 -19.48 -0.62%

S&P/ASX 200 5,228.99 0.00 0.00%

FTSE 100 6,845.42 -71.72 -1.04%

CAC 40 4,414.67 -55.61 -1.24%

Xetra DAX 10,370.93 -155.23 -1.47%

S&P 500 2,097.94 -13.78 -0.65%

Dow Jones Industrial Average 17,959.64 -77.46 -0.43%

S&P/TSX Composite 14,594.72 -183.60 -1.24%

-