Noticias del mercado

-

22:08

he main US stock indexes finished the session above the zero mark

The main US stock indexes rose, but only slightly, as investors are concerned about the possibility of President Donald Trump to implement his policy, and on the eve of a potentially tense meeting with Chinese President Xi Jinping, scheduled for April 6-7 in Florida.

The market moved away from session lows after Trump stated that infrastructure costs in the US could exceed $ 1 trillion and that his administration was working on major changes in Dodd-Frank banking regulation, reviving some of his campaign promises.

In addition, according to a report from the Department of Commerce, the US trade deficit in February fell more than expected, as exports increased to a two-year high, and a slowdown in domestic demand was due to imports. According to the report, the trade deficit decreased by 9.6% to $ 43.6 billion. Economists predicted a reduction in the trade deficit to $ 44.9 billion in February.

At the same time, production orders rose in February for the seventh time in eight months, which was a sign of a recovery in the manufacturing industry. Production orders rose by 1%, the Commerce Ministry said, which corresponds to a consensus forecast. The release in January was raised to 1.5%.

The components of the DOW index have mostly grown (19 out of 30). More shares fell NIKE, Inc. shares. (NKE, -0.97%). Caterpillar Inc. (CAT, + 2.12%) was the growth leader.

The sectors of the S & P index showed multidirectional dynamics. The conglomerate sector fell most of all (-0.5%). The leader of growth was the sector of basic materials (+ 0.7%).

At closing:

DJIA + 0.19% 20.689.18 +38.97

Nasdaq + 0.07% 5,898.61 +3.93

S & P + 0.05% 2,360.11 +1.27

-

21:00

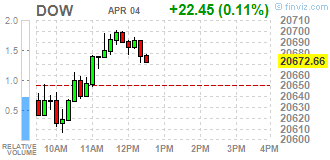

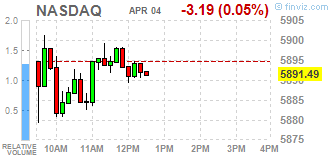

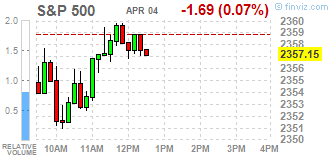

DJIA +0.12% 20,675.67 +25.46 Nasdaq -0.02% 5,893.28 -1.40 S&P -0.02% 2,358.39 -0.45

-

18:34

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday, trading in a tight range, as investors fretted over the ability of President Donald Trump to deliver on his policy plans, and ahead of his potentially tense meeting with Chinese President Xi Jinping. However, the market moved off session lows after Trump said the U.S. infrastructure bill may top $1 trillion and that his administration was working on a major "haircut" on the Dodd-Frank banking regulation, rekindling some of his campaign promises.

Most of Dow stocks in positive area (18 of 30). Top loser - Cisco Systems, Inc. (CSCO, -0.77%). Top gainer - Caterpillar Inc. (CAT, +2.29%).

S&P sectors mixed. Top loser - Conglomerates (-0.3%). Top gainer - Basic Materials (+0.5%).

At the moment:

Dow 20620.00 +30.00 +0.15%

S&P 500 2354.00 -2.00 -0.08%

Nasdaq 100 5431.50 -3.00 -0.06%

Oil 51.09 +0.85 +1.69%

Gold 1258.00 +4.00 +0.32%

U.S. 10yr 2.36 +0.01

-

18:00

European stocks closed: FTSE 100 +39.13 7321.82 +0.54% DAX +25.14 12282.34 +0.21% CAC 40 +15.22 5101.13 +0.30%

-

15:34

U.S. Stocks open: Dow -0.06%, Nasdaq -0.17%, S&P -0.16%

-

15:29

Before the bell: S&P futures -0.40%, NASDAQ futures -0.47%

U.S. stock-index futures as investors fretted over the ability of President Donald Trump to deliver on his policy plans, and the outcome of his potentially tense meeting with the President of the People's Republic of China Xi Jinping later this week.

Stocks:

Nikkei 18,810.25 -172.98 -0.91%

FTSE 7,312.94 +30.25 +0.42%

CAC 5,081.54 -4.37 -0.09%

DAX 12,245.28 -11.92 -0.10%

Crude $50.55 (+0.62%)

Gold $1,260.90 (+0.55%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

34.21

-0.01(-0.03%)

2256

ALTRIA GROUP INC.

MO

71.5

-0.12(-0.17%)

354

Amazon.com Inc., NASDAQ

AMZN

889.75

-1.76(-0.20%)

14899

AMERICAN INTERNATIONAL GROUP

AIG

61.51

-0.28(-0.45%)

315

Apple Inc.

AAPL

143.35

-0.35(-0.24%)

55122

Barrick Gold Corporation, NYSE

ABX

19.53

0.22(1.14%)

56367

Caterpillar Inc

CAT

93.89

1.62(1.76%)

22148

Chevron Corp

CVX

107.4

-0.40(-0.37%)

420

Citigroup Inc., NYSE

C

59.1

-0.58(-0.97%)

9130

Facebook, Inc.

FB

141.73

-0.55(-0.39%)

47100

Ford Motor Co.

F

11.37

-0.07(-0.61%)

64419

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.6

0.36(2.72%)

179329

General Electric Co

GE

29.8

-0.08(-0.27%)

3786

General Motors Company, NYSE

GM

33.93

-0.24(-0.70%)

21625

Goldman Sachs

GS

227

-1.96(-0.86%)

5073

Google Inc.

GOOG

830.5

-8.05(-0.96%)

3536

Hewlett-Packard Co.

HPQ

17.54

-0.05(-0.28%)

679

Intel Corp

INTC

36.1

-0.06(-0.17%)

5722

International Business Machines Co...

IBM

173.59

-0.91(-0.52%)

1880

JPMorgan Chase and Co

JPM

86.5

-0.52(-0.60%)

21554

Nike

NKE

55.25

-0.31(-0.56%)

4520

Pfizer Inc

PFE

34.06

-0.18(-0.53%)

971

Tesla Motors, Inc., NASDAQ

TSLA

297.5

-1.02(-0.34%)

80161

Twitter, Inc., NYSE

TWTR

14.79

-0.05(-0.34%)

17496

United Technologies Corp

UTX

112.08

0.15(0.13%)

2012

Verizon Communications Inc

VZ

49.08

-0.10(-0.20%)

2673

Wal-Mart Stores Inc

WMT

71.73

-0.10(-0.14%)

922

Walt Disney Co

DIS

112.95

-0.25(-0.22%)

1564

Yandex N.V., NASDAQ

YNDX

22.12

-0.01(-0.05%)

1100

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Hold from Buy at Argus

Bank of America (BAC) downgraded to Neutral from Buy at Citigroup

Alphabet A (GOOGL) downgraded to Market Perform from Outperform at BMO Capital

Other:

Caterpillar (CAT) added to Conviction Buy List at Goldman

United Tech (UTX) added to US 1 List at BofA/Merrill; maintain Buy, target $130

IBM (IBM) initiated with a Sell at Berenberg; target $140

Cisco Systems (CSCO) initiated with a Hold at Berenberg

Hewlett Packard Enterprise (HPE) initiated with a Hold at Berenberg

-

09:49

Major stock exchanges in Europe trading in the green zone: FTSE 7313.61 +30.92 + 0.42%, DAX 12250.99 -6.21 -0.05%, CAC 5091.19 +5.28 + 0.10%

-

07:28

Global Stocks

Stocks across Europe closed with losses Monday, as they start a new quarter with a heavy week of data, including from the European Central Bank. While German equities finished lower, they initially got help from the final March manufacturing PMI for Europe's largest economy being confirmed at a 71-month high at 58.3. The overall eurozone final March manufacturing PMI was also confirmed at a 71-month high, at 56.2.

U.S. stocks closed lower Monday, but off session lows, to kick off the second quarter as disappointing vehicle sales and lackluster economic data amplified concerns that lofty equity valuations won't be buttressed by commensurately strong corporate quarterly results in coming weeks.

Asian equities pulled back Tuesday as investors turned risk averse again amid growing investor uncertainty about U.S.-China trade and monetary policy in Japan and Europe. The yen rose against the dollar through the U.S. session, and has continued to strengthen in Asian trade.

-

00:30

Stocks. Daily history for Apr 03’2017:

(index / closing price / change items /% change)

Nikkei +73.97 18983.23 +0.39%

TOPIX +4.43 1517.03 +0.29%

Hang Seng +149.89 24261.48 +0.62%

CSI 300 +19.29 3456.05 +0.56%

Euro Stoxx 50 -27.99 3472.94 -0.80%

FTSE 100 -40.23 7282.69 -0.55%

DAX -55.67 12257.20 -0.45%

CAC 40 -36.60 5085.91 -0.71%

DJIA -13.01 20650.21 -0.06%

S&P 500 -3.88 2358.84 -0.16%

NASDAQ -17.05 5894.68 -0.29%

S&P/TSX +36.65 15584.40 +0.24%

-