Noticias del mercado

-

22:09

The main US stock indices grew moderately following the results of today's session

Major US stock indexes finished trading with a moderate increase, as the data surpassing the forecast on changes in the number of employed in non-agricultural sectors of the US economy increased expectations that the upward trend in the labor market could allow the Fed to go for the third increase in the interest rate this year, despite weak inflation .

The report of the Ministry of Labor showed that the number of jobs in the US increased more than expected in June and employers increased the number of working hours, which indicates the strength of the labor market. According to the report, the number of people employed in non-agricultural sectors jumped by 222,000 jobs last month, outpacing the expectations of growth economists by 179,000 jobs. Data for April and May were revised, and more was created for 47,000 new jobs than previously reported. At the same time, the unemployment rate rose to 4.4% from a 16-year low of 4.3%, which was caused by the fact that more people were looking for a job, which indicates a confidence in the labor market. The unemployment rate fell by four tenths of a percent this year and is close to the last median median forecast for 2017. The average work week increased to 34.5 hours from 34.4 hours in May. The average hourly earnings increased by four cents or 0.2% in June after rising 0.1% in May. This increased the annual wage growth to 2.5% from 2.4% in May.

Most components of the DOW index recorded a rise (24 out of 30). The leader of growth were shares of McDonald's Corp. (MCD, + 2.16%). Outsider were shares of The Goldman Sachs Group, Inc. (GS, -0.67%).

All sectors of S & P finished the session in positive territory. The technological sector grew most (+ 1.1%).

At closing:

Dow + 0.44% 21.412.97 +92.93

Nasdaq + 1.04% 6,153.08 +63.62

S & P + 0.64% 2.425.18 +15.43

-

21:00

DJIA +0.43% 21,412.43 +92.39 Nasdaq +1.08% 6,155.28 +65.82 S&P +0.64% 2,425.12 +15.37

-

18:00

European stocks closed: FTSE 100 +13.64 7350.92 +0.19% DAX +7.43 12388.68 +0.06% CAC 40 -7.24 5145.16 -0.14%

-

17:15

Wall Street. Major U.S. stock-indexes higher

Major U.S. stock-indexes rose on Friday as better-than-expected nonfarm payrolls data for June increased expectations that the labor market strength could make the case for a third interest rate hike by the Fed this year despite weakened inflation.

Most of Dow stocks in positive area (19 of 30). Top gainer - McDonald's Corp. (MCD, +1.50%). Top loser - Chevron Corp. (CVX, -0.72%).

A majority of S&P sectors in positive area. Top gainer - Technology (+0.75%). Sole loser - Basic Materials (-0.80%).

At the moment:

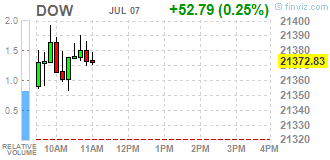

Dow 21329.00 +49.00 +0.23%

S&P 500 2415.75 +7.25 +0.30%

Nasdaq 100 5641.25 +44.50 +0.80%

Crude Oil 44.26 -1.26 -2.77%

Gold 1213.20 -10.10 -0.83%

U.S. 10yr 2.38 +0.01

-

15:32

U.S. Stocks open: Dow +0.27%, Nasdaq +0.40%, S&P +0.28%

-

15:24

Before the bell: S&P futures +0.22%, NASDAQ futures +0.46%

U.S. stock-index futures rose moderately amid better-than-expected nonfarm payrolls data and somewhat disappointing statistics on average hourly earnings for June.

Global Stocks:

Nikkei 19,929.09 64.97 -0.32%

Hang Seng 25,340.85 -124.37 -0.49%

Shanghai 3,217.61 +5.17 +0.16%

S&P/ASX 5,703.57 -55.20 -0.96%

FTSE 7,349.05 +11.77 +0.16%

CAC 5,142.11 -10.29 -0.20%

DAX 12,369.77 -11.48 -0.09%

Crude $44.54 (-2.15%)

Gold $1,221.40 (-0.16%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

208.51

0.49(0.24%)

198

Amazon.com Inc., NASDAQ

AMZN

970

4.86(0.50%)

17584

American Express Co

AXP

83.72

-0.02(-0.02%)

1086

Apple Inc.

AAPL

143.3

0.57(0.40%)

71235

Boeing Co

BA

202.79

1.31(0.65%)

2461

Caterpillar Inc

CAT

106.77

0.26(0.24%)

946

Chevron Corp

CVX

103.58

-0.24(-0.23%)

971

Cisco Systems Inc

CSCO

30.89

0.17(0.55%)

4027

Citigroup Inc., NYSE

C

67.86

0.23(0.34%)

17735

Exxon Mobil Corp

XOM

80

-0.12(-0.15%)

18503

Facebook, Inc.

FB

149.5

0.68(0.46%)

43348

Ford Motor Co.

F

11.22

0.04(0.36%)

22815

General Electric Co

GE

26.33

0.02(0.08%)

78721

Goldman Sachs

GS

227.7

1.01(0.45%)

11945

Intel Corp

INTC

33.85

0.22(0.65%)

5289

JPMorgan Chase and Co

JPM

93.76

0.38(0.41%)

23615

McDonald's Corp

MCD

153.6

0.51(0.33%)

779

Microsoft Corp

MSFT

68.83

0.26(0.38%)

17355

Pfizer Inc

PFE

33.34

0.12(0.36%)

538

Starbucks Corporation, NASDAQ

SBUX

57.9

0.30(0.52%)

1511

Tesla Motors, Inc., NASDAQ

TSLA

315.2

6.37(2.06%)

173074

The Coca-Cola Co

KO

44.5

0.10(0.23%)

453

Twitter, Inc., NYSE

TWTR

18.08

0.16(0.89%)

49817

Verizon Communications Inc

VZ

43.65

0.13(0.30%)

9132

Wal-Mart Stores Inc

WMT

75.5

0.03(0.04%)

1570

Walt Disney Co

DIS

104

0.65(0.63%)

1315

-

10:08

Major stock markets in Europe trading in the red zone: FTSE 7323.46 -13.82 -0.19%, DAX 12368.46 -12.79 -0.10%, CAC 5146.67 -5.73 -0.11%

-

08:40

Negative start of trading expected on the main European stock markets: DAX -0.1%, CAC 40 -0.1%, FTSE 100 -0.1%

-

07:31

Global Stocks

European stocks ended firmly lower on Thursday, with minutes from the European Central Bank and Federal Reserve fueling fears among traders that the era of ultraloose monetary policy is coming to an end. Among top performers on Thursday, Associated British Foods PLC ABF, +2.57% shares jumped 2.6% after the ingredient supplier and parent of fashion retailer Primark said its full-year outlook has improved.

U.S. stocks closed lower Thursday as investors continued to rotate out of battered technology names. A combination of geopolitical jitters and growing signs that global central banks are inching closer to unwinding policies that have helped to support both stocks and government bonds is also weighing on the broader market.

Equity markets across the Asia-Pacific region were lower Friday, tracking declines in the U.S. and Europe, as investors become more cautious about the prospects of global central bank tightening. Australia was leading the declines early in the session, as a slump in the country's bank stocks pressured the benchmark index. Mining stocks there also fell following a report that the Australian government is expecting iron ore to have an average price of $62.40 per metric ton this year, down from an earlier forecast of $65.20.

-

00:28

Stocks. Daily history for Jul 06’2017:

(index / closing price / change items /% change)

Nikkei -87.57 19994.06 -0.44%

TOPIX -3.10 1615.53 -0.19%

Hang Seng -56.75 25465.22 -0.22%

CSI 300 +0.42 3660.10 +0.01%

Euro Stoxx 50 -16.35 3462.06 -0.47%

FTSE 100 -30.32 7337.28 -0.41%

DAX -72.43 12381.25 -0.58%

CAC 40 -27.70 5152.40 -0.53%

DJIA -158.13 21320.04 -0.74%

S&P 500 -22.79 2409.75 -0.94%

NASDAQ -61.39 6089.47 -1.00%

S&P/TSX -75.12 15078.00 -0.50%

-