Noticias del mercado

-

22:16

U.S. stocks closed

U.S. stocks closed mildly higher Monday in low volume trade as investors readied for the first major earnings reports due Tuesday.

The Nasdaq composite closed above its 50-day moving average for the first time since Aug. 17. The Dow Jones industrial average and S&P 500 closed above their 50-day moving averages last week and have remained above.

The major U.S. averages struggled to hold higher during the trading session, with the three indexes dipping in and out of negative territory in early trade.

Utilities closed up 0.9 percent as the greatest advancer in the S&P, while energy fell 1.08 percent and materials closed down 0.88 percent as the only decliners. Both sectors rallied last week as the best performers in the S&P during that time.

Oil settled down $2.53, or 5.10 percent, at $47.10 a barrel, giving back more than half of last week's rally of nearly 9 percent. Monday's decline was the worst daily decline since Sept. 1. Brent also declined to hold just above $50 a barrel.

Chevron and IBM were the greatest weights on the Dow Jones industrial average.

-

21:01

DJIA 17116.79 32.30 0.19%, NASDAQ 4835.47 5.00 0.10%, S&P 500 2015.44 0.55 0.03%

-

18:32

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes were little changed on Monday as investors paused before a busy week of quarterly results from U.S. banks and several Dow companies. JPMorgan (JPM) reports on Tuesday, with Goldman Sachs (GS), Bank of America (BAC), Wells Fargo (WFC) and Citigroup (C) posting results through the week.

Dow stocks mixed (16 in negative area, 14 in positive). Top looser - Chevron Corporation (CVX, -1.47%). Top gainer - UnitedHealth Group Incorporated (UNH, +2.50%).

Most of S&P index sectors in positive area. Top looser - Basic Materials (-1.4%). Top gainer - Utilities (+0,8%).

At the moment:

Dow 17034.00 +43.00 +0.25%

S&P 500 2009.00 +1.50 +0.07%

Nasdaq 100 4376.75 +17.25 +0.40%

10 Year yield 2,09% -0,01

Oil 48.05 -1.58 -3.18%

Gold 1162.90 +7.00 +0.61%

-

18:10

WSE: Session Results

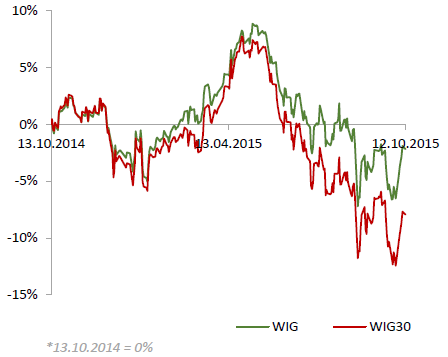

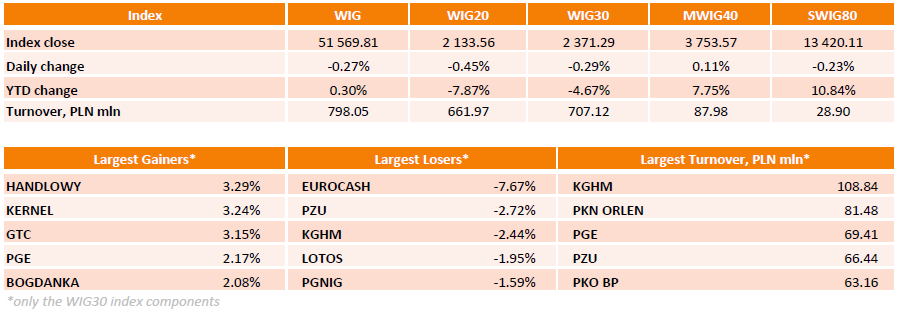

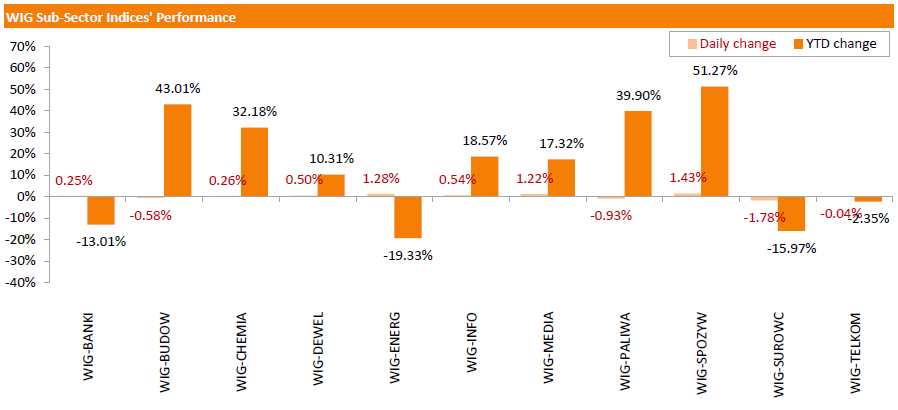

Polish equity market closed lower on Monday. The broad market benchmark, the WIG Index, lost 0.27%. Sector-wise, materials (-1.78%) fared the worst, while food sector (+1.43%) and utilities (+1.28%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 0.29%. Within the WIG30 Index components, EUROCASH (WSE: EUR) was hit the hardest, tumbling by 7.67% on announcement that Poland's main opposition party Law and Justice, which opinion polls show will win a general election on Oct. 25, plans to impose a 2% tax on retail sales for large outlets. It was followed by PZU (WSE: PZU) and KGHM (WSE: KGH), declining by 2.72% and 2.44% respectively. On the other side of the ledger, HANDLOWY (WSE: BHW), KERNEL (WSE: KER) and GTC (WSE: GTC) recorded the strongest daily performance, each gaining more than 3%.

-

18:00

European stocks close: stocks closed mixed as market participants were cautious on the uncertainty over the Fed's interest rate hike weighed on markets

Stock indices closed mixed as market participants were cautious on the uncertainty over the Fed's interest rate hike weighed on markets.

European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview with CNBC on Monday that it is too early to decide if to expand the asset-buying programme or not.

"If anything were needed, we would need to be ready. But it is too early to pass that kind of judgement," he said.

Coeure noted that the economy was recovering but there are risks from the slowdown in the emerging economies.

The ECB President Mario Draghi said in an interview with the Greek newspaper Kathimerini published on Saturday that the central bank's asset-buying programme is working better than expected but reaching the 2% inflation may take more time due to lower oil prices.

The Bank of France released its current account data on Monday. France's current account surplus was €0.2 billion in August, up from a deficit of €0.4 billion in July.

The trade goods deficit widened to €1.1 billion in August from €0.9 billion in July.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,371.18 -44.98 -0.70 %

DAX 10,119.83 +23.23 +0.23 %

CAC 40 4,688.7 -12.69 -0.27 %

-

18:00

European stocks closed: FTSE 6371.93 -44.23 -0.69%, DAX 10135.24 38.64 0.38%, CAC 40 4694.07 -7.32 -0.16%

-

17:20

Chicago Fed President Charles Evans: the interest rate hike should be very gradual when the Fed will start raising its interest rates

Chicago Fed President Charles Evans said on Monday that the interest rate hike should be very gradual when the Fed will start raising its interest rates.

"After lift-off, I think it would be appropriate to raise the target interest rate very gradually. This would give us sufficient time to assess how the economy is adjusting to higher rates and the progress we are making toward our policy goals," he said.

"And right now, regardless of the exact date for lift-off, I think it could well be appropriate for the funds rate to still be under 1 percent at the end of 2016," Evans added.

Chicago Fed president noted that he is not confident if the inflation target in the U.S. will be reached "within a reasonable time frame".

-

17:05

European Commission: Spain should adjust its budget plan

The European Commission said in its statement on Monday that Spain will not meet its deficit targets. According to the Spanish Draft Budgetary Plan (DBP), Spain expects the general government deficit to fall to 4.2% of GDP this year and 2.8% in 2016. But the European Commission forecasted that the government deficit to decline to 4.5% this year and to 3.5% of GDP in 2016.

The European Commission said that Spain should "ensure that the 2016 budget will be compliant with the Stability and Growth Pact".

-

16:35

Standard & Poor's Ratings Services lowers Volkswagen AG’s long-term rating by a notch to 'A-'

Standard & Poor's Ratings Services downgraded Volkswagen AG's long-term rating by a notch to 'A-' from 'A'. The agency noted that CreditWatch was negative.

"The downgrade reflects our assessment that VW has demonstrated material deficiencies in its management and governance and general risk management framework. We believe VW's internal controls have been shown to be inadequate in preventing or identifying alleged illegal behaviour in the U.S. and misconduct in other regions," the agency said in its statement.

-

16:22

European Central Bank purchases €12.46 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.46 billion of government and agency bonds under its quantitative-easing program last week.

The ECB said in its minutes of September meeting last week that it will raise the pace of its asset purchases from September to November 2015 "to prepare for the expected decline in market liquidity in December".

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.82 billion of covered bonds, and €244 million of asset-backed securities.

-

16:14

The European Central Bank (ECB) Governing Council Member Vitas Vasiliauskas: there is no need for further stimulus measures in the Eurozone

The European Central Bank (ECB) Governing Council Member Vitas Vasiliauskas said in an interview with The Wall Street Journal on Saturday that there is no need for further stimulus measures in the Eurozone.

"I feel in your questions and market sentiments, everybody is asking, what you will do additionally. My message is very clear: There is no need for any additional measures," he said.

Vasiliauskas added that the asset-buying programme was working.

He pointed out that low inflation in the Eurozone's is driven by a decline in energy prices.

-

15:55

U.S. Stocks open: Dow +0.05%, Nasdaq +0.04%, S&P -0.06%

-

15:32

Before the bell: S&P futures -0.06%, NASDAQ futures +0.17%

U.S. stock-index futures were little changed as investors awaited further indications on the strength of the world's biggest economy from corporate earnings reports.

Global Stocks:

Hang Seng 22,730.93 +272.13 +1.21%

Shanghai Composite 3,287.81 +104.66 +3.29%

FTSE 6,372.61 -43.55 -0.68%

CAC 4,679.94 -21.45 -0.46%

DAX 10,112.8 +16.20 +0.16%

Crude oil $49.61 (-0.04%)

Gold $1165.39 (+0.87%)

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

181.00

1.01%

3.6K

American Express Co

AXP

77.97

0.83%

0.1K

AT&T Inc

T

33.24

0.30%

1.2K

Boeing Co

BA

140.00

0.21%

3.9K

Caterpillar Inc

CAT

70.85

-0.63%

0.4K

Chevron Corp

CVX

89.75

0.20%

0.4K

Cisco Systems Inc

CSCO

27.89

-0.07%

0.7K

Exxon Mobil Corp

XOM

79.63

0.47%

7.3K

General Electric Co

GE

28.05

-0.07%

13.7K

Nike

NKE

124.06

-0.70%

0.2K

Intel Corp

INTC

32.05

-0.28%

3.7K

International Business Machines Co...

IBM

152.67

0.18%

0.8K

Johnson & Johnson

JNJ

95.01

-0.38%

2.6K

JPMorgan Chase and Co

JPM

62.10

0.27%

2.8K

Merck & Co Inc

MRK

49.15

-3.53%

27.1K

Microsoft Corp

MSFT

46.80

-0.66%

4.1K

Pfizer Inc

PFE

33.15

-0.27%

0.2K

United Technologies Corp

UTX

95.20

-0.18%

0.1K

Verizon Communications Inc

VZ

44.19

0.07%

5.4K

Walt Disney Co

DIS

105.66

0.09%

3.7K

ALCOA INC.

AA

10.32

0.58%

21.0K

Apple Inc.

AAPL

112.75

0.56%

352.4K

Barrick Gold Corporation, NYSE

ABX

7.86

3.29%

48.1K

Amazon.com Inc., NASDAQ

AMZN

539.19

-0.11%

7.2K

Citigroup Inc., NYSE

C

51.48

0.19%

0.2k

Ford Motor Co.

F

15.00

0.20%

4.7K

Facebook, Inc.

FB

93.40

0.17%

5.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.55

0.44%

42.2K

General Motors Company, NYSE

GM

33.00

0.15%

0.5k

Google Inc.

GOOG

647.30

0.57%

4.4K

HONEYWELL INTERNATIONAL INC.

HON

101.89

0.72%

0.1K

Hewlett-Packard Co.

HPQ

29.10

-0.68%

3.4K

Starbucks Corporation, NASDAQ

SBUX

60.10

0.05%

7.1K

Tesla Motors, Inc., NASDAQ

TSLA

222.50

0.82%

10.5K

Twitter, Inc., NYSE

TWTR

30.26

-1.91%

71.1K

Yahoo! Inc., NASDAQ

YHOO

32.74

0.68%

5.8K

Yandex N.V., NASDAQ

YNDX

12.58

1.70%

4.9K

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Exxon Mobil (XOM) upgraded to Equal Weight from Underweight at Barclays

Goldman Sachs (GS) upgraded to Buy from Neutral at Citigroup

Downgrades:

Other:

Apple (AAPL) target raised to $162 from $155 at Morgan Stanley

-

14:48

Atlanta Fed President Dennis Lockhart: the interest rate hike by the Fed this year is still possible

Atlanta Fed President Dennis Lockhart repeated on Monday that the interest rate hike by the Fed this year is still possible.

He repeated his Friday's remarks.

-

14:23

Earnings Season in U.S.: Major Reports of the Week

October 13

Before the Open:

Johnson & Johnson (JNJ). Consensus EPS $1.45, Consensus Revenue $17473.64 mln.

After the Close:

Intel (INTC). Consensus EPS $0.59, Consensus Revenue $14212.53 mln.

JPMorgan Chase (JPM). Consensus EPS $1.37, Consensus Revenue $23439.39 mln.

October 14

Before the Open:

Bank of America (BAC). Consensus EPS $0.33, Consensus Revenue $20841.58 mln.

October 15

Before the Open:

Citigroup (C). Consensus EPS $1.28, Consensus Revenue $18856.08 mln.

Goldman Sachs (GS). Consensus EPS $3.02, Consensus Revenue $6966.43 mln.

UnitedHealth (UNH). Consensus EPS $1.64, Consensus Revenue $40262.12 mln.

October 16

Before the Open:

General Electric (GE). Consensus EPS $0.26, Consensus Revenue $28487.55 mln.

Honeywell (HON). Consensus EPS $1.55, Consensus Revenue $9849.80 mln.

-

12:00

European stock markets mid session: stocks traded lower despite the rise in stock markets in Asia

Stock indices traded lower despite the rise in stock markets in Asia. Chinese stock markets increased on speculation the government will add further stimulus measures.

The uncertainty over the Fed's interest rate hike weighs on markets.

European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview with CNBC on Monday that it is too early to decide if to expand the asset-buying programme or not.

"If anything were needed, we would need to be ready. But it is too early to pass that kind of judgement," he said.

Coeure noted that the economy was recovering but there are risks from the slowdown in the emerging economies.

The ECB President Mario Draghi said in an interview with the Greek newspaper Kathimerini published on Saturday that the central bank's asset-buying programme is working better than expected but reaching the 2% inflation may take more time due to lower oil prices.

The Bank of France released its current account data on Monday. France's current account surplus was €0.2 billion in August, up from a deficit of €0.4 billion in July.

The trade goods deficit widened to €1.1 billion in August from €0.9 billion in July.

Current figures:

Name Price Change Change %

FTSE 100 6,377.94 -38.22 -0.60 %

DAX 10,085.37 -11.23 -0.11 %

CAC 40 4,665.54 -35.85 -0.76 %

-

11:20

European Central Bank (ECB) Executive Board Member Benoit Coeure: it is too early to decide if to expand the asset-buying programme or not

European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview with CNBC on Monday that it is too early to decide if to expand the asset-buying programme or not.

"If anything were needed, we would need to be ready. But it is too early to pass that kind of judgement," he said.

Coeure noted that the economy was recovering but there are risks from the slowdown in the emerging economies.

-

11:12

France’s current account surplus is €0.2 billion in August

The Bank of France released its current account data on Monday. France's current account surplus was €0.2 billion in August, up from a deficit of €0.4 billion in July.

The trade goods deficit widened to €1.1 billion in August from €0.9 billion in July, while the surplus on services rose to €0.9 billion from €0.1 billion.

The deficit on financial account increased to €10.4 billion in August from €9.7 billion in July.

-

10:52

Federal Reserve Vice Chairman Stanley Fischer: the Fed wants to start raising its interest rates this year

Federal Reserve Vice Chairman Stanley Fischer said on Sunday that the Fed wants to start raising its interest rates this year, adding that it is "an expectation, not a commitment", which depends on the developments in the global economy.

"Both the timing of the first rate increase and any subsequent adjustments to the federal funds rate target will depend critically on future developments in the economy," he said.

Fischer pointed out that the slowdown in the global economy already had an effect on the U.S as the Fed delayed its interest rate hike.

-

10:39

European Central Bank (ECB) President Mario Draghi: the central bank’s asset-buying programme is working better than expected

The European Central Bank (ECB) President Mario Draghi said in an interview with the Greek newspaper Kathimerini published on Saturday that the central bank's asset-buying programme is working better than expected but reaching the 2% inflation may take more time due to lower oil prices.

"We are satisfied with QE, as it has met and even surpassed our initial expectations," he said.

Draghi pointed out that the ECB is ready to expand its asset-buying programme if needed.

-

10:33

European Commission's Vice President Valdis Dombrovskis: the European Union’s (EU) economy benefits from lower oil prices and a weaker euro

The European Commission's Vice President Valdis Dombrovskis said on Friday that the European Union's (EU) economy benefits from lower oil prices and a weaker euro. But he added that there are risks to the EU's economy from the slowdown in the emerging economies.

Dombrovskis noted that the economy in the EU is still expected to expand 1.8% this year and 2.1% next year.

He pointed out that the central bank's asset-buying programme "cannot solve structural problems in the economy".

-

04:20

Hang Seng 22,689.51 +230.71 +1.03 %, Shanghai Composite 3,210.22 +27.07 +0.85 %

-

01:44

Stocks. Daily history for Sep Oct 9’2015:

(index / closing price / change items /% change)

Nikkei 225 18,438.67 +297.50 +1.64 %

Hang Seng 22,458.8 +103.89 +0.46 %

S&P/ASX 200 5,279.69 +69.29 +1.33 %

Shanghai Composite 3,183.52 +40.16 +1.28 %

FTSE 100 6,416.16 +41.34 +0.65 %

CAC 40 4,701.39 +25.48 +0.54 %

Xetra DAX 10,096.6 +103.53 +1.04 %

S&P 500 2,014.89 +1.46 +0.07 %

NASDAQ Composite 4,830.47 +19.68 +0.41 %

Dow Jones 17,084.49 +33.74 +0.20 %

-