Noticias del mercado

-

22:09

U.S. stocks closed

Weak import data from China rekindled concern that a slowdown there will spread, pulling emerging-market stocks down from a two-month high and weighing on industrial metals. U.S. stocks dropped from the highest level since August as Treasuries rallied.

The Standard & Poor's 500 Index fell after rising in nine of the past 10 sessions, while the Dow Jones Industrial Average couldn't extend its longest rally of the year. Miners led the MSCI All-Country World Index to its first drop in 10 days, with emerging-market equities tumbling 1.5 percent. The dollar advanced, while copper led metals lower and crude slipped.

U.S. stocks struggled to continue their two-week rebound from the first correction in four years, with investors awaiting corporate results to gauge the health of the economy. Data that showed the 11th straight monthly decline in Chinese imports rekindled concern that demand for metals from the world's second-largest economy will fall, sending equities in resource-rich nations lower.

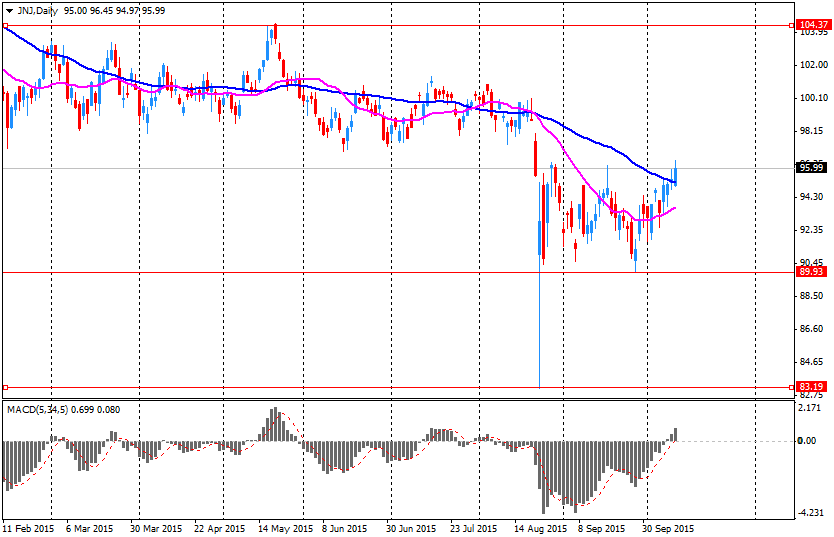

After the market closes, JPMorgan Chase & Co. kicks off a string of results from banks. Investors are bracing for bad news, with the ratio of puts to calls on the SPDR Financial Select Sector ETF at its highest level since March. Johnson & Johnson fell 0.5 percent after reporting its results.

-

21:00

DJIA 17131.17 -0.69 0%, NASDAQ 4821.02 -17.62 -0.36%, S&P 500 2011.30 -6.16 -0.31%

-

18:10

WSE: Session Results

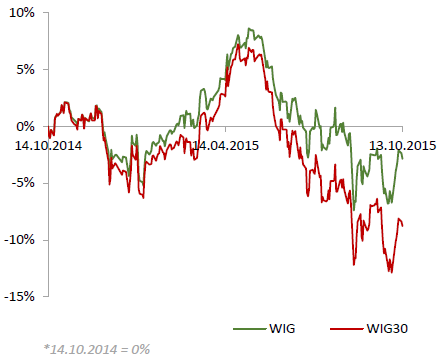

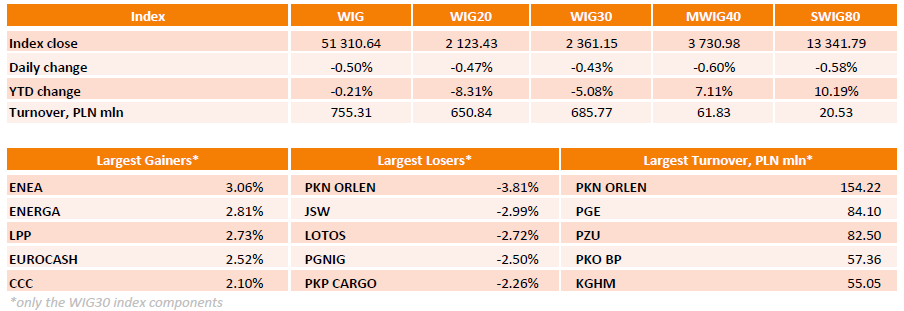

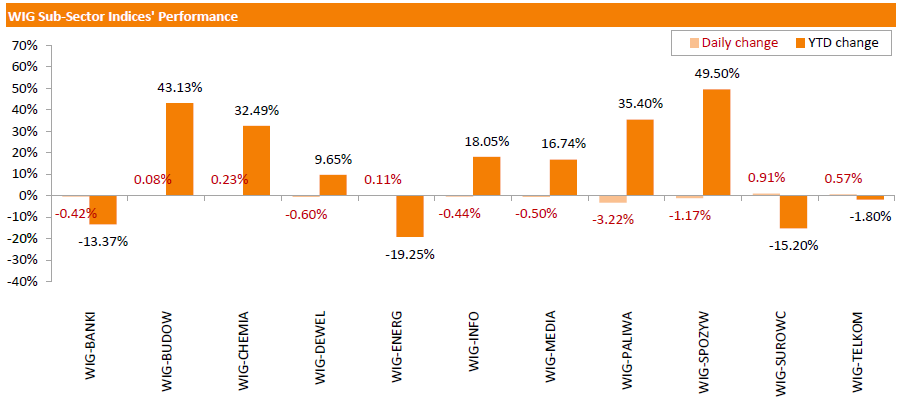

The Polish equity market finished lower Tuesday. The broad-market measure, the WIG Index, dropped by 0.50%. Sector performance in the WIG Index was mixed. Oil and gas sector (-3.22%) fared the worst, while materials (+0.91%) recorded the biggest gains.

The large-cap stocks' benchmark, the WIG30 Index, fell by 0.43%. Within the index components, PKN ORLEN (WSE: PKN) declined the most, down 3.81%, as the company's announcement about acquisition of two North American companies with significant oil reserves (Canada's Kicking Horse Energy and U.S. FX Energy) followed a decline in oil prices, which was triggered by OPEC's report. Other major laggards included JSW (WSE: JSW), LOTOS (WSE: LTS) and PGNIG (WSE: PGN), which slump by 2.5%-2.99%. On the other side of the ledger, ENEA (WSE: ENA) topped the list of outperformers with a 3.06% increase. It was followed by ENERGA (WSE: ENG), LPP (WSE: LPP) and EUROCASH (WSE: EUR), which gained 2.52%-2.81%.

-

18:00

European stocks close: stocks closed lower on Germany's ZEW economic sentiment index and the Chinese trade data

Stock indices closed lower on Germany's ZEW economic sentiment index and the Chinese trade data. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus declined to $59.43 billion in September from $60.24 billion in August, beating expectations for a decline to a surplus of $46.79 billion.

Exports fell at an annual rate of 3.7% in September, while Imports slid at an annual rate of 20.4%, the eleventh consecutive decline.

Meanwhile, the economic data from the Eurozone was negative. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index dropped to 1.9 in October from 12.1 in September, missing expectations for a fall to 6.0.

"The exhaust gas scandal of Volkswagen and the weak growth of emerging markets has dampened economic outlook for Germany. However, the performance of the domestic economy is still good and the Euro area economy continues to recover. This makes it rather unlikely that the German economy will slide into recession," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 30.1 in October from 33.3 in September.

Reuters reported on Tuesday that the German government will downgrade its 2015 growth forecasts to 1.7% from the previous estimate of a 1.8% rise, while 2016 growth forecast should remain unchanged at 1.8%, according to a senior government official.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in September from 0.0% in August, missing expectations for a flat reading.

The decline was driven by low petrol and clothing prices.

"The largest downward contribution came from petrol, with prices falling by 3.7 pence per litre between August and September this year compared with a fall of 0.8 pence per litre between the same 2 months a year ago. Diesel prices are now at their lowest level since December 2009, standing at 110.2 pence per litre," the ONS said.

On a monthly basis, U.K. consumer prices fell 0.1% in September, missing expectations for a flat reading, after a 0.2% rise in August.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.0% in September, missing forecasts of a rise to 1.1%.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.7% in August, faster than a 0.8% in July.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 5.2% in July, same as in July. It was the lowest rise since September 2013.

The lower house price inflation was mainly driven by a decline in prices in the East and the South East.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,342.28 -28.90 -0.45 %

DAX 10,032.82 -87.01 -0.86 %

CAC 40 4,643.38 -45.32 -0.97 %

-

18:00

European stocks closed: FTSE 6341.41 -29.77 -0.47%, DAX 10023.23 -96.60 -0.95%, CAC 40 4638.01 -50.69 -1.08%

-

17:22

Bank of England’s Monetary Policy Committee Member Ian McCafferty: the central bank should hike its interest rates to have room for interest rate cut in the event of a financial crisis

Bank of England's (BoE) Monetary Policy Committee (MPC) Member Ian McCafferty said on Tuesday that the central bank should hike its interest rates to have room for interest rate cut in the event of a financial crisis.

He said that low global inflation pressures could lead to the uncertainty for the economic outlook.

"Over the longer term, a number of more structural risks and uncertainties raise questions about the long term performance of the UK economy," McCafferty said.

McCafferty was only one member who voted to hike interest rate by 0.25% last week.

-

17:11

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Tuesday after weak China trade data added to worries about slowing global economic growth. Data showed Chinese imports fell 20 percent in September due to weak domestic demand, indicating that growth in the world's second-largest economy was sputtering.

Dow stocks mixed (15 in negative area, 15 in positive). Top looser - United Technologies Corporation (UTX, -2.10%). Top gainer - UnitedHealth Group Incorporated (UNH, +2.50%).

Most of S&P index sectors in negative area. Top looser - Financial (-0.5%). Top gainer - Healthcare (+0,2%).

At the moment:

Dow 17064.00 +24.00 +0.14%

S&P 500 2012.50 +1.50 +0.07%

Nasdaq 100 4386.75 +11.75 +0.27%

10 Year yield 2,07% -0,02

Oil 48.23 +1.13 +2.40%

Gold 1166.50 +2.00 +0.17%

-

16:41

National Federation of Independent Business’s small-business optimism index for the U.S. increases to 96.1 in September

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index increased to 96.1 in September from 95.9 in August.

7 of 10 subindexes rose last month, while three fell.

"Small business optimism continues to be stagnant, which is consistent with the expected economic growth of about 2.5 percent," NFIB Chief Economist Bill Dunkelberg said.

-

16:29

St. Louis Fed President James Bullard: the Fed should start raising its interest rates

St. Louis Fed President James Bullard said on Tuesday that the Fed should start raising its interest rates.

"Prudent monetary policy suggests gradually edging the policy settings closer to normal, since the goals have been met and policy would still remain very accommodative," he said.

Bullard pointed out that the U.S. economy remains supported even if the Fed will start raising its interest rates.

"Policy will remain exceptionally accommodative even as normalization proceeds, because policy settings are far from anything that could be called restrictive," St. Louis Fed president said.

He also said that he expects the unemployment rate in the U.S. to decline "into the 4% range", while inflation will rise.

-

15:33

U.S. Stocks open: Dow -0.47%, Nasdaq -0.57%, S&P -0.48%

-

15:27

Before the bell: S&P futures -0.56%, NASDAQ futures -0.65%

U.S. stock-index futures fell on weak China imports.

Global Stocks:

Nikkei 18,234.74 -203.93 -1.11%

Hang Seng 22,600.46 -130.47 -0.57

Shanghai Composite 3,293.64 +5.98 +0.18%

FTSE 6,314.52 -56.66 -0.89%

CAC 4,614.77 -73.93 -1.58%

DAX 9,958.57 -161.26 -1.59%

Crude oil $47.28 (+0.38%)

Gold $1160.30 (+0.37%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Twitter, Inc., NYSE

TWTR

29.64

3.10%

54.8K

Yandex N.V., NASDAQ

YNDX

12.44

2.05%

13.2K

ALTRIA GROUP INC.

MO

57.89

0.75%

3.8K

AMERICAN INTERNATIONAL GROUP

AIG

59.00

0.55%

0.1K

McDonald's Corp

MCD

103.24

0.00%

100.5K

General Electric Co

GE

28.07

-0.07%

67.1K

Goldman Sachs

GS

180.09

-0.08%

0.1K

Barrick Gold Corporation, NYSE

ABX

7.40

-0.13%

39.0K

JPMorgan Chase and Co

JPM

61.57

-0.24%

2.9K

AT&T Inc

T

33.20

-0.30%

0.1K

Nike

NKE

126.01

-0.33%

0.3K

Chevron Corp

CVX

88.44

-0.34%

0.5K

Home Depot Inc

HD

121.41

-0.40%

0.2K

Microsoft Corp

MSFT

46.81

-0.40%

0.6K

Boeing Co

BA

140.10

-0.41%

0.2K

Walt Disney Co

DIS

105.90

-0.42%

0.1K

Apple Inc.

AAPL

111.11

-0.44%

167.2K

Exxon Mobil Corp

XOM

78.94

-0.45%

3.7K

Ford Motor Co.

F

14.90

-0.53%

1.1K

Google Inc.

GOOG

643.15

-0.54%

1.1K

Cisco Systems Inc

CSCO

27.80

-0.57%

0.1K

Facebook, Inc.

FB

93.71

-0.58%

55.6K

Citigroup Inc., NYSE

C

50.96

-0.62%

7.2K

Starbucks Corporation, NASDAQ

SBUX

60.15

-0.64%

3.2K

Intel Corp

INTC

31.99

-0.68%

16.7K

Amazon.com Inc., NASDAQ

AMZN

546.41

-0.69%

4.3K

Caterpillar Inc

CAT

70.00

-0.71%

2.6K

UnitedHealth Group Inc

UNH

121.59

-0.75%

97.3K

Visa

V

74.42

-0.76%

2.3K

ALCOA INC.

AA

10.00

-0.79%

17.9K

General Motors Company, NYSE

GM

32.75

-0.82%

1.4K

Yahoo! Inc., NASDAQ

YHOO

32.50

-1.10%

17.5K

Tesla Motors, Inc., NASDAQ

TSLA

213.10

-1.15%

7.9K

Hewlett-Packard Co.

HPQ

28.92

-1.30%

0.5K

Johnson & Johnson

JNJ

94.36

-1.70%

19.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.63

-2.02%

37.5K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

General Electric (GE) upgraded to Outperform from Market Perform at William Blair

Downgrades:

Other:

-

14:46

Reuters reports the German government will downgrade its 2015 growth forecasts

Reuters reported on Tuesday that the German government will downgrade its 2015 growth forecasts to 1.7% from the previous estimate of a 1.8% rise, while 2016 growth forecast should remain unchanged at 1.8%, according to a senior government official.

Forecasts are expected to be announced on Wednesday.

-

14:24

Company News: Johnson & Johnson (JNJ) quarterly profit beats expectation

The company reported Q3 profit of $1.49 per share versus $1.45 consensus. Its revenues reduced by 7.4% y/y to $17.102 bln, missing consensus of $17.474 bln.

Johnson & Johnson revised upwards its EPS FY15 guidance to $6.15-6.20 from $6.10-6.20. The analysts' consensus forecast for the company's EPS FY15 stands at $6.18.

JNJ rose to $96.25 (+0.27%) in pre-market trading.

-

14:22

Japan’s consumer confidence index declines to 40.6 in September

Japan's Cabinet Office released its consumer confidence index on Tuesday. The consumer confidence index declined to 40.6 in September from 41.7 in August.

The decline was driven by falls in all sub-indexes. The overall livelihood sub-index fell to 38.8 in September from 40.1 in August, the income growth sub-index was down to 39.4 from 39.9, the employment sub-index dropped to 44.9 from 46.3, while the willingness to buy durable goods sub-index decreased to 39.1 from 40.3.

-

12:00

European stock markets mid session: stocks traded lower on the Chinese trade data

Stock indices traded lower on the Chinese trade data. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus declined to $59.43 billion in September from $60.24 billion in August, beating expectations for a decline to a surplus of $46.79 billion.

Exports fell at an annual rate of 3.7% in September, while Imports slid at an annual rate of 20.4%, the eleventh consecutive decline.

Meanwhile, the economic data from the Eurozone was negative. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index dropped to 1.9 in October from 12.1 in September, missing expectations for a fall to 6.0.

"The exhaust gas scandal of Volkswagen and the weak growth of emerging markets has dampened economic outlook for Germany. However, the performance of the domestic economy is still good and the Euro area economy continues to recover. This makes it rather unlikely that the German economy will slide into recession," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 30.1 in October from 33.3 in September.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in September from 0.0% in August, missing expectations for a flat reading.

The decline was driven by low petrol and clothing prices.

"The largest downward contribution came from petrol, with prices falling by 3.7 pence per litre between August and September this year compared with a fall of 0.8 pence per litre between the same 2 months a year ago. Diesel prices are now at their lowest level since December 2009, standing at 110.2 pence per litre," the ONS said.

On a monthly basis, U.K. consumer prices fell 0.1% in September, missing expectations for a flat reading, after a 0.2% rise in August.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.0% in September, missing forecasts of a rise to 1.1%.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.7% in August, faster than a 0.8% in July.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 5.2% in July, same as in July. It was the lowest rise since September 2013.

The lower house price inflation was mainly driven by a decline in prices in the East and the South East.

Current figures:

Name Price Change Change %

FTSE 100 6,318.84 -52.34 -0.82 %

DAX 9,999.97 -119.86 -1.18 %

CAC 40 4,611.38 -77.32 -1.65 %

-

11:52

UK house price inflation rises 0.7% in August

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.7% in August, faster than a 0.8% in July.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 5.2% in July, same as in July. It was the lowest rise since September 2013.

The lower house price inflation was mainly driven by a decline in prices in the East and the South East.

The average mix-adjusted house price was £284,000 in August, up from £282,000 in July.

-

11:39

Switzerland's producer and import prices fall 0.1% in September

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices fell 0.1% in September, after a 0.7% drop in August.

The decline was mainly driven by lower prices for crude petroleum and fuel products.

The Import Price Index decreased by 0.2% in September, while producer prices were flat.

On a yearly basis, producer and import prices plunged 6.8% in September, after a 6.8% drop in August. It was the biggest drop since April 1950.

The Import Price Index fell by 11.2% year-on year in September, while producer prices dropped 4.8%.

-

11:28

German wholesale prices fall 0.6% in September

The German statistical office Destatis released its wholesale prices for Germany on Tuesday. German wholesale prices fell 0.6% in September, after a 0.8% decrease in August.

On a yearly basis, wholesale prices in Germany dropped 1.8% in September, after a 1.1% decline in August. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 3.1% decline in the wholesale prices of solid fuels and related products.

-

11:23

German final consumer price inflation declines 0.2% in September

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index declined 0.2% in September, in line with the preliminary estimate, after a flat reading in August.

On a yearly basis, German final consumer price index fell to 0.0% in September from 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 9.3% year-on-year in September.

Food prices climbed 1.1% year-on-year in September.

-

11:18

Fed Governor Lael Brainard: the Fed should delay its interest rate hike until it is clear that developments abroad do not have a negative effect on the recovery of the U.S. economy

Fed Governor Lael Brainard said on Monday that the Fed should delay its interest rate hike until it is clear that developments abroad do not have a negative effect on the recovery of the U.S. economy.

"I view the risks to the economic outlook as tilted to the downside. The downside risks make a strong case for continuing to carefully nurture the U.S. recovery - and argue against prematurely taking away the support that has been so critical to its vitality," she said.

-

11:14

Germany's ZEW economic sentiment index drops to 1.9 in October

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index dropped to 1.9 in October from 12.1 in September, missing expectations for a fall to 6.0.

The assessment of the current situation in Germany fell by 12.3 points to 55.2 points in October.

"The exhaust gas scandal of Volkswagen and the weak growth of emerging markets has dampened economic outlook for Germany. However, the performance of the domestic economy is still good and the Euro area economy continues to recover. This makes it rather unlikely that the German economy will slide into recession," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 30.1 in October from 33.3 in September.

The assessment of the current situation in the Eurozone declined by 1.5 points to -11.2 points in October.

-

11:07

UK consumer price inflation is down to -0.1% in September

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to -0.1% in September from 0.0% in August, missing expectations for a flat reading.

The decline was driven by low petrol and clothing prices.

"The largest downward contribution came from petrol, with prices falling by 3.7 pence per litre between August and September this year compared with a fall of 0.8 pence per litre between the same 2 months a year ago. Diesel prices are now at their lowest level since December 2009, standing at 110.2 pence per litre," the ONS said.

On a monthly basis, U.K. consumer prices fell 0.1% in September, missing expectations for a flat reading, after a 0.2% rise in August.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.0% in September, missing forecasts of a rise to 1.1%.

The Retail Prices Index dropped to 0.8% in September from 1.1% in August, missing expectations for a decrease to 1.0%.

The consumer price inflation is below the Bank of England's 2% target.

-

10:55

National Australia Bank’s business confidence index climbs to 5 points in September

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index climbed to 5 points in September from 1 points in August. August's reading was lowest level since mid-2013.

The industry welcomed Malcolm Turnbull's replacement of Tony Abbott as Australian prime minister.

"It is not clear to what extent this reflects the change in leadership of the Liberal Party, as solid business conditions and some dissipation of financial market jitters may have also contributed to the result," the NAB said.

The main business conditions index remained unchanged at 9 points in September, while employment rose to 4 points in from -1 points.

-

10:48

China's trade surplus falls to 59.43 billion in September

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus declined to $59.43 billion in September from $60.24 billion in August, beating expectations for a decline to a surplus of $46.79 billion.

Exports fell at an annual rate of 3.7% in September, while Imports slid at an annual rate of 20.4%, the eleventh consecutive decline.

-

10:36

China's Finance Minister Lou Jiwei: now is not the right time to raise interest rates in the U.S.

China's Finance Minister Lou Jiwei said in an interview published in the China Business News on Monday that now is not the right time to raise interest rates in the U.S.

"The United States isn't at the point of raising interest rates yet and under its global responsibilities it can't raise rates," he said.

Jiwei added that the U.S. "should assume global responsibilities" because of the U.S. dollar's status as a global currency.

The finance minister pointed out the slowdown in the global economy was caused by "weak recovery of developed countries".

"Developed countries should now have faster recoveries to give developing countries some external demand," he added.

Jiwei noted that the slowdown in the Chinese economy is a healthy process.

-

10:22

Bank of Japan’s September monetary policy meeting minutes: exports and production are affected by the slowdown in emerging economies

The Bank of Japan (BoJ) released its September monetary policy meeting minutes on late Monday evening. According to minutes, the country's economy continued to recover moderately but exports and production were affected by the slowdown in emerging economies.

Many board members expect the inflation in Japan to rise.

"On the price front, the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) is about 0 percent. Inflation expectations appear to be rising on the whole from a somewhat longer-term perspective," the minutes said.

There are downside risks to the recovery in Japan from developments in emerging and commodity-driven economies as well as the debt problem and the momentum of economic activity and prices in Europe and the pace of recovery in the US. Economy, the minutes said.

Minutes showed that the central bank wants to continue its monetary policy until the 2% inflation target will be reached, and it will adjust its monetary policy if needed.

The BoJ decided to keep unchanged its monetary policy at its September meeting.

-

10:12

U.K. leading economic index rises 0.2% in August

The Conference Board (CB) released its leading economic index for the U.K. on Monday. The leading economic index increased 0.2% in August, after a 0.2% decline in July.

The coincident index was up 0.2% in August, after a 0.1% rise in July.

"The current behaviour of the composite indexes suggests that the economy is likely to continue to grow into early next year, but the pace is unlikely to pick up," the CB said.

-

04:29

Nikkei 225 18,293.45 -145.22 -0.79 %, Hang Seng 22,632.9 -98.03 -0.43 %, Shanghai Composite 3,267.99 -19.68 -0.60 %

-

00:31

Stocks. Daily history for Sep Oct 12’2015:

(index / closing price / change items /% change)

Hang Seng 22,730.93 +272.13 +1.21 %

S&P/ASX 200 5,232.87 -46.82 -0.89 %

Shanghai Composite 3,287.81 +104.66 +3.29 %

FTSE 100 6,371.18 -44.98 -0.70 %

CAC 40 4,688.7 -12.69 -0.27 %

Xetra DAX 10,119.83 +23.23 +0.23 %

S&P 500 2,017.46 +2.57 +0.13 %

NASDAQ Composite 4,838.64 +8.17 +0.17 %

Dow Jones 17,131.86 +47.37 +0.28 %

-