Noticias del mercado

-

21:01

S&P 500 2,095.43 +3.00 +0.14%, NASDAQ 4,969.17 -19.08 -0.38%, Dow 18,028.93 +51.89 +0.29%

-

18:27

International Monetary Fund’s World Economic Outlook: the global economy will expand by 3.5% in 2015

The International Monetary Fund (IMF) released its World Economic Outlook on Tuesday. The IMF said that global growth will be driven in 2015 as advanced economies will benefit from lower oil prices. The lender added that macroeconomic risks have decreased, but financial and geopolitical risks have increased.

The global economy will expand by 3.5% in 2015, according to the IMF.

The global growth forecast for next year was upgraded to 3.8% from 3.7%.

The lender upgraded its growth forecast for the Eurozone for 2015 to 1.5% from 1.2%. The growth forecast for 2016 was also upgraded to 1.6% from 1.4%.

The IMF downgraded its growth forecast for the U.K. for 2016 to 2.3%.

The U.S. economic growth forecast for 2015 was cut to 3.1% from 3.6%, while the forecast for 2016 was also lowered to 3.1% from 3.3%.

The growth forecast for Japan was raised to 1% in 2015 and 1.2% in 2016.

China's economy is expected to expand 6.8% this year and 6.3% next year.

-

18:05

European stocks close: most stocks closed lower despite the better-than-industrial production from the Eurozone

Most stock indices closed lower despite the better-than-industrial production from the Eurozone. Industrial production in the Eurozone rose 1.1% in February, exceeding expectations for a 0.3% increase, after a 0.3% drop in January. January's figure was revised down from a 0.1% decline.

On a yearly basis, Eurozone's industrial production gained 1.6% in February, beating forecasts of a 0.5% rise, after a 0.4% increase in January. January's figure was revised down from a 1.2 gain.

Concerns over Greece's debt problems continue to weigh on markets. A report said that Greece was preparing for a debt default if the government did not reach a deal with its creditors by the end of the month. Greece denied the report.

The International Monetary Fund (IMF) upgraded its growth forecast for the Eurozone for 2015 to 1.5% from 1.2%. The growth forecast for 2016 was also upgraded to 1.6% from 1.4%.

The IMF downgraded its growth forecast for the U.K. for 2016 to 2.3%.

The U.K. consumer price index remained at zero in March, in line with expectations.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.0% in March from 1.2% the month before. Analysts had expected the index to remain unchanged at 1.2%.

The Retail Prices Index declined to 0.9% in March from 1.0% in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,075.26 +10.96 +0.16 %

DAX 12,227.6 -111.13 -0.90 %

CAC 40 5,218.06 -36.06 -0.69 %

-

18:00

European stocks closed: FTSE 100 7,074.55 +10.25 +0.15 %, CAC 40 5,214.07 -40.05 -0.76 %, DAX 12,223.05 -115.68 -0.94 %

-

17:07

Economic adviser to Prime Minister Shinzo Abe, Koichi Hamada, said a level around 105 would be appropriate for the yen

The economic adviser to Prime Minister Shinzo Abe, Koichi Hamada, said on Monday that a level around 105 would be appropriate for the yen, based on purchasing power parity.

"There's no need to force inflation to 2 percent," Hamada said.

-

16:58

NZIER’s business confidence for New Zealand was 23% in the first quarter

The New Zealand Institute of Economic Research (NZIER) released its Quarterly Survey of Business Opinion on Tuesday. The business confidence in New Zealand was 23% in the first quarter, down from 24% in the fourth quarter.

The fourth quarter's figure was revised up from 23%.

The senior economist at NZIER, Christina Leung, said that the companies "are still fairly optimistic".

She noted that the services sector has performed well.

"The manufacturing sector has also been surprisingly resilient in the face of a higher New Zealand dollar-Australian dollar," Leung added.

-

16:45

U.S. business inventories rise 0.3% in February

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.3% in February, missing expectations for a 0.2% increase, after a flat reading in January. December's figure was revised up from a 0.1% rise.

The increase was driven by a rise in retail inventories. Retail inventories climbed 0.4% in February.

Business sales remained unchanged in February.

The business inventories/sales ratio remained unchanged at 1.36 months in February. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:14

World Bank: developing East Asia will expand 6.7% in 2015 and 2016

The World Bank released its forecast for economic growth in developing countries in East Asia and Pacific on Monday. Developing East Asia will expand 6.7% in 2015 and 2016, down from 6.9% in 2014.

China is expected to grow 7.1% in 2015 and 7.0% in 2016.

The World Bank East Asia and Pacific Regional Vice President, Axel van Trotsenburg, said that "the region will still account for one-third of global growth, twice the combined contribution of all other developing regions".

-

15:58

U.S. producer price index is up 0.2% in March

The U.S. Commerce Department released the producer price index figures on Tuesday. The U.S. producer price index increased 0.2% in March, in line with expectations, after a 0.5% drop in February. It was the first increase since October 2014.

On a yearly basis, the producer price index decreased 0.8% in March, after a 0.6% fall in February. It was the first decline since 2009.

The rise was driven by higher energy prices which jumped 1.5% in March.

Food prices slid 0.8% in March due to a 5.1% decline in pork prices.

The producer price index excluding food and energy climbed 0.2% in March, exceeding forecasts of a 0.1% increase, after a 0.5% decrease in February.

The increase was driven by a 0.1% gain in final demand services.

On a yearly basis, the producer price index excluding food and energy climbed 0.9% in March, after a 1.0% rise in February.

-

15:43

U.S. Stocks open: Dow +0.28%, Nasdaq +0.11%, S&P +0.17%

-

15:30

U.S. retail sales climbs 0.9% in March

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales rose 0.9% in March, missing expectations for a 1.1% increase, after a 0.5% decline in February. It was the largest increase since March 2014.

February's figure was revised up from a 0.6% decrease.

The gain was driven by car purchases. Automobiles sales increased 2.7% in March.

Retail sales excluding automobiles increased 0.4% in March, missing forecasts for a 0.7% rise, after a flat reading in February. February's figure was revised up from a 0.1% decline.

Gasoline station sales decreased 0.6% due to falling oil prices.

Sales at clothing retailers climbed 1.2%. Sales at building material and garden equipment stores jumped 2.1% and sales at restaurants and bars increased 0.7%.

Sales at online stores, at electronics and appliance outlets dropped, whiles ales at sporting goods and hobby shops were up.

-

15:29

Before the bell: S&P futures -0.11%, NASDAQ futures -0.01%

U.S. stock-index futures fell as data showed sales at U.S. retailers rose less than forecast.

Global markets:

Nikkei 19,908.68 +3.22 +0.02%

Hang Seng 27,561.49 -454.85 -1.62%

Shanghai Composite 4,135.92 +14.20 +0.34%

FTSE 7,080.44 +16.14 +0.23%

CAC 5,220.28 -33.84 -0.64%

DAX 12,277.02 -61.71 -0.50%

Crude oil $52.42 (+0.98%)

Gold $1190.80 (-0.72%)

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

80.30

+0.01%

0.4K

Visa

V

65.63

+0.03%

5.3K

International Business Machines Co...

IBM

162.45

+0.04%

0.2K

Pfizer Inc

PFE

35.11

+0.06%

0.3K

Twitter, Inc., NYSE

TWTR

51.65

+0.06%

25.5K

Cisco Systems Inc

CSCO

28.00

+0.07%

3.5K

Yahoo! Inc., NASDAQ

YHOO

44.80

+0.07%

3.5K

Chevron Corp

CVX

106.60

+0.09%

4.8K

Home Depot Inc

HD

114.55

+0.10%

0.6K

UnitedHealth Group Inc

UNH

119.50

+0.11%

1.4K

Procter & Gamble Co

PG

83.57

+0.17%

0.6K

Ford Motor Co.

F

15.90

+0.19%

1.6K

Apple Inc.

AAPL

127.12

+0.21%

96.9K

Hewlett-Packard Co.

HPQ

32.77

+0.21%

0.2K

Verizon Communications Inc

VZ

49.15

+0.22%

15.7K

AT&T Inc

T

32.96

+0.24%

6.9K

Facebook, Inc.

FB

83.21

+0.24%

76.2K

Exxon Mobil Corp

XOM

85.55

+0.25%

4.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.31

+0.27%

1.1K

Caterpillar Inc

CAT

82.39

+0.30%

1.2K

American Express Co

AXP

79.57

+0.38%

2.0K

Walt Disney Co

DIS

106.91

+0.38%

1.0K

General Motors Company, NYSE

GM

36.54

+0.38%

0.5K

Goldman Sachs

GS

196.41

+0.42%

10.6K

Johnson & Johnson

JNJ

100.99

+0.44%

81.6K

Citigroup Inc., NYSE

C

52.90

+0.46%

67.6K

Amazon.com Inc., NASDAQ

AMZN

384.27

+0.50%

9.6K

Starbucks Corporation, NASDAQ

SBUX

48.80

+0.62%

9.4K

ALCOA INC.

AA

13.40

+0.83%

4.8K

JPMorgan Chase and Co

JPM

62.68

+0.98%

830.2K

Yandex N.V., NASDAQ

YNDX

18.01

+0.98%

19.7K

AMERICAN INTERNATIONAL GROUP

AIG

57.46

0.00%

0.1K

Deere & Company, NYSE

DE

88.00

0.00%

0.1K

United Technologies Corp

UTX

117.40

-0.01%

0.6K

Merck & Co Inc

MRK

56.71

-0.04%

1.1K

ALTRIA GROUP INC.

MO

51.75

-0.04%

0.6K

Intel Corp

INTC

31.71

-0.06%

2.5K

The Coca-Cola Co

KO

40.60

-0.25%

3.1K

Microsoft Corp

MSFT

41.63

-0.31%

0.3K

McDonald's Corp

MCD

97.08

-0.37%

3.2K

General Electric Co

GE

27.52

-0.40%

43.3K

Tesla Motors, Inc., NASDAQ

TSLA

208.65

-0.54%

7.6K

Google Inc.

GOOG

535.50

-0.68%

0.6K

Barrick Gold Corporation, NYSE

ABX

12.25

-0.89%

24.0K

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) reiterated at Buy at Argus, target raised to $135 from $145 at Argus

Amazon.com (AMZN) reiterated at Buy at Jefferies, target raised from $400 to $465

PepsiCo (PEP) initiated at Positive at Susquehanna, target $123

-

14:41

Company News: Wells Fargo (WFC) reported better than expected first quarter earnings, but revenue missed forecasts

Wells Fargo (WFC) earned $1.04 per share in the first quarter, beating analysts' estimate of $0.98. Revenue in the first quarter increased 3.3% year-over-year to $21.30 billion, but missing analysts' estimate of $21.37 billion.

Wells Fargo (WFC) shares decreased to $54.30 (-0.53%) prior to the opening bell.

-

14:39

UK consumer price inflation remains at zero in March

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained at zero in March, in line with expectations.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.0% in March from 1.2% the month before. Analysts had expected the index to remain unchanged at 1.2%.

The Retail Prices Index declined to 0.9% in March from 1.0% in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

Clothing prices declined for the first time in March.

Factory gate prices decreased by 1.7% in March.

House prices inflation in the U.K. fell to 7.2% in February from 8.4% in January.

-

14:37

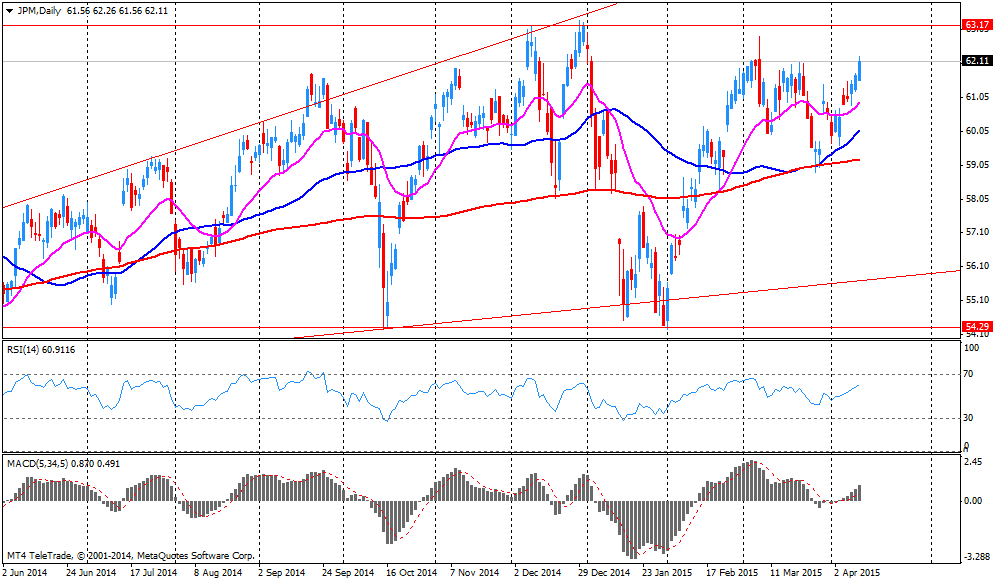

Company News: JPMorgan Chase (JPM) reported better than expected first quarter earnings, but revenue missed forecasts

JPMorgan Chase (JPM) earned $1.45 per share in the first quarter, beating analysts' estimate of $1.40. Revenue in the first quarter increased 4.8% year-over-year to $24.1 billion, but missing analysts' estimate of $24.4 billion.

JPMorgan Chase (JPM) shares increased to $62.71 (+1.03%) prior to the opening bell.

-

14:30

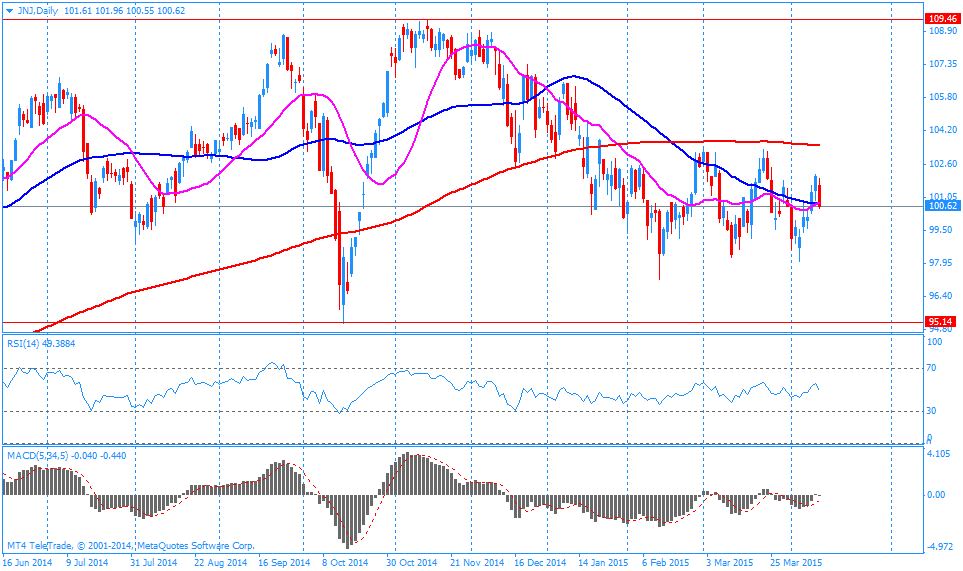

Company News: Johnson & Johnson (JNJ) reported better-than-expected earnings in the fisrt quarter

Johnson & Johnson (JNJ) earned $1.56 per share in the first quarter, beating analysts' estimate of $1.54. Revenue in the first quarter decreased by 4.1% year-over-year to $17.37 billion, but beating analysts' estimate of $17.33 billion.

The company reported that domestic sales increased 5.9%, while international sales fell 12.4%.

The company lowered its forecasts for 2015 to $6.04-$6.19 per share (analysts' estimate: $6.18 per share) from the previous estimate of $6.12-$6.27 per share.

Johnson & Johnson (JNJ) shares increased to $101.01 (+0.46%) prior to the opening bell.

-

14:21

Fitch Ratings affirmed its AAA rating for the U.S.

Fitch Ratings affirmed its AAA rating for the U.S. on Monday. The agency said the outlook is "stable."

"The U.S.' AAA rating is underpinned by the sovereign's unparalleled financing flexibility as the issuers of the world's pre-eminent reserve currency," Fitch said. Risks remain due to deficits and debt.

-

13:30

Unemployment rate in the developed countries declines to 7.0% in February

The Organization for Economic Cooperation and Development (OECD) released its unemployment rate figures on Monday. The unemployment rate in the developed countries decreased by 0.1% in February. "The OECD unemployment rate to 7.0 percent in February 2015, with a cumulative decline of 1.1 percentage points since the peak reached in January 2013," the OECD said.

The unemployment rate in Eurozone was 11.3% in February. The highest unemployment rate was recorded in Spain with 23%, while the U.S. unemployment rate was down to 5.5% in February, the lowest level since May 2008.

The youth unemployment fell to 14.3% in February, the lowest level since November 2008. The highest youth unemployment was in Spain with 50.7%, followed by Italy with 42.6% and Portugal with 35%.

-

10:54

U.S. budget deficit narrowed to $53 billion in March

The U.S. Treasury Department released its federal budget figure on Monday. The U.S. budget deficit narrowed to $53 billion in March from $192.0 billion in February, missing expectations for a decrease to $43.2 billion.

The U.S. budget deficit rose by 6% year-on year to $439.47 billion he first half of the fiscal year. The fiscal year begins on October 1.

-

04:02

Nikkei 225 19,901.21 -4.25 -0.02%, Hang Seng 27,837.31 -179.03 -0.64%, Shanghai Composite 4,108.47 -13.24 -0.32%

-

00:30

Stocks. Daily history for Apr 13’2015:

(index / closing price / change items /% change)

Nikkei 225 19,905.46 -2.17 -0.01%

Hang Seng 28,016.34 +743.95 +2.73%

S&P/ASX 200 5,960.27 -8.10 -0.14%

Shanghai Composite 4,121.27 +86.96 +2.16%

FTSE 100 7,064.3 -25.47 -0.36%

CAC 40 5,254.12 +13.66 +0.26%

Xetra DAX 12,338.73 -36.00 -0.29%

S&P 500 2,092.43 -9.63 -0.46%

NASDAQ Composite 4,988.25 -7.73 -0.15%

Dow Jones 17,977.04 -80.61 -0.45%

-