Noticias del mercado

-

22:10

Major US stock indexes finished trading above zero

Major indexes fodovye Wall Street rose slightly on Tuesday, helped boost shares of energy and technology sectors.

As it became known today, retail sales in the US fell in June, suggesting that consumer spending may weaken after recovering from a sluggish winter season sales. Sales in the retail and restaurants decreased by 0.3% compared to the previous month to a seasonally adjusted reached 442 billion. USD. In June, the Ministry of Commerce said on Tuesday. Economists had expected growth in June to 0.3%.

In addition, the prices of imported goods fell in June, recalling that a strong dollar and a weak foreign growth is constrained by the US economy. Import prices fell by a seasonally adjusted 0.1% in June compared to the previous month, the Labor Department said Tuesday. Economists had expected import prices to rise 0.1% in June from May. Over the past year, import prices fell by 10%.

At the same time, inventories rose 0.3 percent after increasing 0.4 percent in April. The increase was in line with expectations.

It is also worth noting that confidence among small business owners US worsened the end of June, while reaching lowest level in more than a year, due to expectations of lower profits and a decline in the labor market. This was reported by the National Federation of Independent Business (NFIB). According to the data, small business confidence index fell in June by 4.2 points - to 94.1 points (the lowest level since March 2014). It is worth emphasizing, we participated in the survey of 620 small businesses.

Oil prices rose moderately, after recovering from a 2 percent drop, which was caused by the news on Iran. As reported earlier, Iran reached an historic agreement with the US and five other world powers agreement on its nuclear program, said Tuesday morning the diplomats of Western countries. The successful completion of negotiations on Iran was long-standing goal of administration of US President Barack Obama, and now the White House to be many months of political struggle with opponents in Congress and in the allied countries of the Middle East.

Most components of the index DOW closed in positive territory (22 of 30). Outsider were shares Johnson & Johnson (JNJ, -0.56%). Most remaining shares rose UnitedHealth Group Incorporated (UNH, + 2.20%).

All sectors of the index S & P closed in the positive zone. Leaders of growth were the health sector (+ 1.2%).

At the close:

Dow + 0.42% 18,053.58 +75.90

Nasdaq + 0.66% 5,104.89 +33.38

S & P + 0.44% 2,108.94 +9.34

-

21:00

Dow +0.47% 18,061.33 +83.65 Nasdaq +0.81% 5,112.49 +40.98 S&P +0.51% 2,110.31 +10.71

-

18:42

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday as energy stocks rallied and Micron Technologies (MU.O) led tech stocks higher on reports of buyout interest. Twitter (TWTR) jumped as much as 8.5% to $38.82 after a report, purportedly from Bloomberg, that the company was made a $31 billion offer. The stock quickly gave up most of its gains after Bloomberg said the report was fake. Micron jumped as much as 12.4% and was the biggest gainer on the S&P 500. China's state-backed Tsinghua Unigroup Ltd is preparing a $23 billion bid for the U.S. memory chip maker, Reuters reported, in what would be the biggest Chinese takeover of a U.S. company. Oil prices steadied after Iran and six global powers reached a landmark nuclear deal that left sanctions on the country in place for now, continuing to limit its crude exports. Oil prices had tumbled earlier on fears that the deal would ease sanctions, allowing more oil into the markets.

Almost all of Dow stocks in positive area (22 of 30). Top looser - Johnson & Johnson (JNJ, -0.76%). Top gainer - The Coca-Cola Company (KO, +1.41).

Almost all of S&P index sectors also in positive area. Top looser - Utilities (-0.1%). Top gainer - Healthcare (+0.9%).

At the moment:

Dow 17948.00 +48.00 +0.27%

S&P 500 2100.75 +6.25 +0.30%

Nasdaq 100 4518.25 +30.25 +0.67%

10-year yield 2.41% -0.02

Oil 53.00 +0.80 +1.53%

Gold 1154.90 -0.50 -0.04%

-

18:01

European stocks close: stocks closed slightly higher as investors are cautious if the Greek government will be able to pass a series of reforms in the Greek parliament

Stock indices closed slightly higher as investors are cautious if the Greek government will be able to pass a series of reforms in the Greek parliament, while Greek banks remain closed until July 15.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods.

Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

The Bank of England (BoE) Governor Mark Carney said the Treasury Select Committee on Tuesday that the time for interest rate hike is nearing. He added that interest rates would not move back to the pre-crisis levels.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The BoE Governor Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,753.75 +15.80 +0.23 %

DAX 11,516.9 +32.52 +0.28 %

CAC 40 5,032.47 +34.37 +0.69 %

-

18:00

European stocks closed: FTSE 100 6,753.75 +15.80 +0.23% CAC 40 5,032.47 +34.37 +0.69% DAX 11,516.9 +32.52 +0.28%

-

17:57

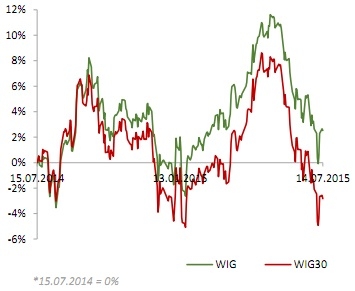

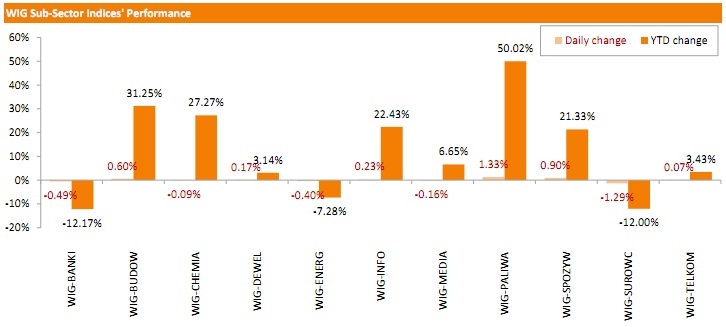

WSE: Session Results

The Polish equity market finished lower Tuesday, with the broad-market measure, the WIG Index, sliding 0.14%. Sector performance in the WIG Index was mixed. Materials stocks (-1.29%) fared the worst, while oil and gas sector names (+1.33%) recorded the biggest gains.

The large-cap stocks' measure, the WIG30 Index, lost 0.28%. Within the index components, TAURON PE (WSE: TPE) fell the most, down 2.37%. It was followed by PZU (WSE: PZU) and KGHM (WSE: KGH), which corrected down 1.74% and 1.46% respectively. On the other side of the ledger, the biggest advancers were LPP (WSE: LPP), PGNIG (WSE: PGN), EUROCASH (WSE: EUR) and LOTOS (WSE: LTS), climbing 1.29%-2.77%.

-

17:12

Bank of England Governor Mark Carney: implementing a third Greek bailout programme would require a "Herculean effort" from all sides

The Bank of England Governor Mark Carney said on Tuesday that implementing a third Greek bailout programme would require a "Herculean effort" from all sides.

"The statement by the Eurogroup leaders on Monday morning is an attempt to craft a programme that will allow ... a return to sustainable growth. I would observe that what's embedded in that statement requires Herculean efforts of all sides," he said.

"It will be tested, the scale of structural reforms, the scale of fiscal adjustment that is required. The scale of fiscal adjustment and privatisations are significant," he added.

-

16:40

U.S. business inventories rise 0.3% in May

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.3% in May, in line with expectations, after a 0.4% gain in April.

The increase was driven by a rise in wholesale inventories. Wholesale inventories climbed 0.8% in May.

Business sales climbed 0.4% in May, while retail sales rose 1.1%.

The business inventories/sales ratio remained unchanged at 1.36 months in May. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:45

U.S. import price index declines 0.1% in June

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index declined by 0.1% in June, missing expectations for a 0.1% increase, after a 1.2% rise in May. May's figure was revised down from a 1.3% increase.

The decline was driven by lower no-fuel import prices, which fell 0.2% in June.

Fuel import prices rose 0.7% in June.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.2% in June, after a 0.6% gain in May.

-

15:32

U.S. Stocks open: Dow -0.04%, Nasdaq +0.08%, S&P -0.03%

-

15:28

Bank of England Governor Mark Carney: the time for interest rate hike is nearing

The Bank of England (BoE) Governor Mark Carney said the Treasury Select Committee on Tuesday that the time for interest rate hike is nearing.

"The point at which interest rates may begin to rise is moving closer with the performance of the economy, consistent growth above trend, a firming in domestic costs, counter-balanced somewhat by disinflation imported from abroad. Once rates begin to adjust, we expect for those adjustments to be at a gradual pace and to a limited extent," he said.

Carney added that interest rates would not move back to the pre-crisis levels.

"I do think there are a variety of factors that mean that the new normal, certainly over the policy horizon over the next three years, is substantially lower than it was previously. I see no scenario in which they would move towards historic levels," the BoE governor said.

-

15:28

Before the bell: S&P futures -0.17%, NASDAQ futures +0.06%

U.S. stock-index futures were little changed while data showed sales at U.S. retailers unexpectedly dropped in June.

Nikkei 20,385.33 +295.56 +1.47%

Hang Seng 25,120.91 -103.10 -0.41%

Shanghai Composite 3,926.03 -44.36 -1.12%

FTSE 6,725.8 -12.15 -0.18%

CAC 4,989.13 -8.97 -0.18%

DAX 11,417.46 -66.92 -0.58%

Crude oil $52.13 (-0.13%)

Gold $1156.50 (+0.10%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Cisco Systems Inc

CSCO

27.80

+0.04%

0.5K

Google Inc.

GOOG

546.79

+0.04%

1.1K

Ford Motor Co.

F

14.65

+0.07%

14.6K

Wal-Mart Stores Inc

WMT

73.95

+0.09%

1.3K

ALCOA INC.

AA

10.83

+0.09%

3.4K

Starbucks Corporation, NASDAQ

SBUX

55.75

+0.09%

24.5K

Boeing Co

BA

146.85

+0.16%

0.7K

Visa

V

69.64

+0.17%

1.9K

Twitter, Inc., NYSE

TWTR

35.84

+0.17%

34.5K

Walt Disney Co

DIS

118.31

+0.22%

1.1K

Facebook, Inc.

FB

90.30

+0.22%

173.1K

ALTRIA GROUP INC.

MO

51.45

+0.23%

1.1K

Exxon Mobil Corp

XOM

82.65

+0.28%

3.5K

Procter & Gamble Co

PG

82.26

+0.43%

1.4K

Yandex N.V., NASDAQ

YNDX

15.40

+0.46%

2.4K

E. I. du Pont de Nemours and Co

DD

59.80

+0.49%

1.7K

The Coca-Cola Co

KO

40.89

+0.57%

15.4K

Barrick Gold Corporation, NYSE

ABX

10.03

+0.60%

12.5K

Amazon.com Inc., NASDAQ

AMZN

461.05

+1.20%

33.1K

American Express Co

AXP

78.53

0.00%

0.2K

Chevron Corp

CVX

94.60

0.00%

5.1K

International Business Machines Co...

IBM

169.38

0.00%

0.2K

Apple Inc.

AAPL

125.66

0.00%

122.3K

United Technologies Corp

UTX

111.50

-0.07%

0.3K

General Electric Co

GE

26.43

-0.15%

9.5K

Microsoft Corp

MSFT

45.47

-0.15%

4.1K

Tesla Motors, Inc., NASDAQ

TSLA

261.64

-0.20%

10.4K

Pfizer Inc

PFE

34.73

-0.26%

0.8K

JPMorgan Chase and Co

JPM

67.86

-0.34%

540.4K

Goldman Sachs

GS

209.25

-0.41%

3.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.85

-0.41%

2.5K

Yahoo! Inc., NASDAQ

YHOO

38.59

-0.44%

0.1K

AT&T Inc

T

34.72

-0.46%

13.3K

Home Depot Inc

HD

114.30

-0.52%

8.4K

Johnson & Johnson

JNJ

99.75

-0.52%

63.7K

Citigroup Inc., NYSE

C

55.25

-0.52%

67.6K

Intel Corp

INTC

29.51

-0.74%

181.6K

-

15:14

U.S. retail sales decline 0.3% in June

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales unexpectedly fell 0.3% in June, missing expectations for a 0.3% increase, after a 1.0% gain in May. May's figure was revised down from a 1.2% rise.

The decline was partly driven by lower automobiles and clothing stores purchases. Automobiles sales fell 1.1% in June, while sales at clothing retailers slid 1.5%, the largest fall since September 2014.

Retail sales excluding automobiles decreased 0.1% in June, missing forecasts for a 0.5% rise, after a 0.8% gain in May. May's figure was revised down from a 1.0% increase.

Sales at building material and garden equipment stores were down 1.3% in June and sales at furniture stores decreased 1.6%.

Sales at electronics and appliance outlets were up 0.1% in June, whiles sales at service stations gained 0.8%.

These figures indicate that U.S. economy slowed down.

-

15:09

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgraded from Mkt Perform to Underperform at Bernstein

Other:

Hewlett-Packard (HPQ) initiated at Hold at Maxim Group, target $34

Boeing (BA) initiated at Overweight at JP Morgan

Visa (V) reiterated at Outperform at Bernstein, target raised from $77 to $81

-

14:44

Final Italian consumer prices climb 0.2% in June

The Italian statistical office Istat released its final consumer price inflation data on Tuesday. Final Italian consumer prices rose 0.2% in June, beating the preliminary reading of a 0.1% gain, after 0.1% rise in May.

On a yearly basis, final Italian consumer prices climbed 0.2% in June, exceeding the preliminary reading of a 0.1% gain, after a 0.1% increase in May.

-

14:36

Company News: Johnson & Johnson's revenue fell 8.8%

Company reported Q2 profit of $1.71 per share versus $1.69 consensus. Revenues fell 8.8% year/year to $17.79 bln versus $17.78 bln consensus.

Domestic sales decreased 2.4%. International sales decreased 14.3%.

Company issued in-line guidance for FY15, raises EPS to $6.10-6.20 from $6.04-6.19 versus $6.15 consensus.

JNJ rose to $100.80 (+0.53%). on the premarket.

-

14:33

Final consumer price inflation in Spain increases 0.3% in June

The Spanish statistical office INE released its final consumer price inflation data on Tuesday. Final consumer price inflation in Spain was up 0.3% in June, in line with preliminary estimate, after a 0.5% gain in May.

On a yearly basis, final consumer prices climbed by 0.1% in June from a year ago, in line with preliminary estimate, after a 0.2% decline in May. It was the first rise since last June.

-

14:22

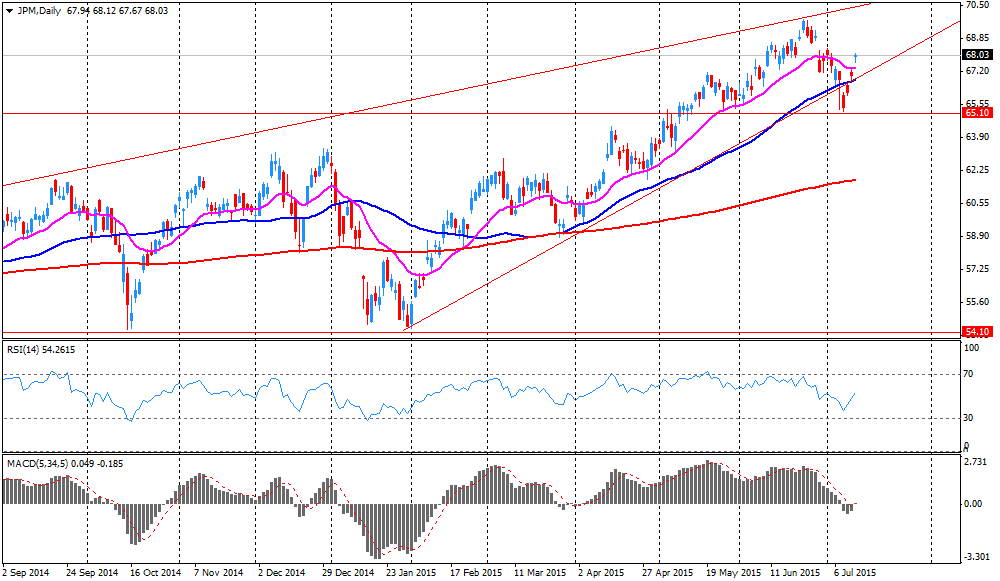

Company News: JPMorgan's earnings rose but revenue fell

Company reported Q2 profit of $1.54 per share versus $1.44 consensus. Revenues fell 3.5% year/year to $23.81 bln versus $24.31 bln consensus.

Net revenue on a U.S. GAAP basis totaled $23.8 billion for the second quarter of 2015 versus $24.1 billion for first quarter of 2015 and $24.7 billion for second quarter of 2014. Net revenue Non-GAAP was $24.5 billion, down 3%.

JPM rose to $68.30 (+0.31%). on the premarket.

-

12:02

European stock markets mid session: stocks traded lower on concerns if the Greek government will be able to pass a series of reforms in the Greek parliament

Stock indices traded lower on concerns if the Greek government will be able to pass a series of reforms in the Greek parliament, while Greek banks remain closed until July 15.

The deal also needs to be approved by national parliaments before talks about a bailout programme can start.

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

Meanwhile, the economic data from the Eurozone was mostly weaker-than-expected. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods.

Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,732.5 -5.45 -0.08 %

DAX 11,426.87 -57.51 -0.50 %

CAC 40 4,987.11 -10.99 -0.22 %

-

11:45

Switzerland's producer and import prices fall 0.1% in June

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.1% in June, after a 0.8% drop in May.

The Import Price Index decreased by 0.2% in June due to lower prices of products made from aluminium and copper.

On a yearly basis, producer and import prices plunged 6.1% in June, after a 6.0% drop in May.

The decline was driven by lower prices for chemical and pharmaceutical products. Prices for petroleum and petroleum products increased in May.

The Import Price Index fell by 10% year-on year in June.

-

11:37

Eurozone’s industrial production drops in May

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone dropped 0.4% in May, missing expectations for a 0.2% gain, after a 0.1% rise in April.

The decrease was driven by a drop in energy output and non-durable consumer goods output. Non-durable consumer goods were down 1.4% in May, while energy output slid by 3.2%.

Intermediate goods rose by 0.1%, consumer goods climbed by 0.4%, while capital goods output increased by 1.0%.

On a yearly basis, Eurozone's industrial production gained 1.6% in May, missing expectations for a 1.9% rise, after a 0.9% increase in April. April's figure was revised up from a 0.8 gain.

The increase was driven by a rise in durable consumer goods, capital goods and intermediate goods. Durable consumer goods climbed by 4.8% in May from a year ago, capital goods rose by 4.1%, while intermediate goods output gained by 2.2%.

Non-durable consumer goods declined by 0.5%, while energy output dropped 4.2%.

-

11:25

Germany's ZEW economic sentiment index declines to 29.7 in July

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 29.7 in July from 31.5 in June, missing expectations for a decline to 30.0.

"Neither the difficulties in dealing with the Greek sovereign debt crisis nor the turmoil on Chinese financial markets seem to impress the financial market experts strongly. Despite the slight decline of the indicator, the overall economic outlook for Germany remains positive," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index dropped to 42.7 in July from 53.7 in June.

-

11:15

UK consumer price inflation falls to 0.0% in June

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.0% in June from 0.1% in May, in line with expectations.

The decrease was driven by lower food and summer clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices was flat in June, missing expectations for a 0.1% gain, after a 0.2% rise in May.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 0.8% in June from 0.9% the month before.

The Retail Prices Index remained unchanged at 1.0% in June, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

-

11:03

German final consumer price inflation declines 0.1% in June

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index declined 0.1% in June, in line with the preliminary estimate, after a 0.1% rise in May.

On a yearly basis, German final consumer price index decreased to 0.3% in June from 0.3% in May, in line with the preliminary estimate. It was the highest level since October 2014.

The decline was driven by falling energy prices which dropped 5.9% year-on-year in June.

Food prices climbed 1.0% year-on-year in June, while recreation and culture prices fell 0.6%.

-

10:51

Head of the Eurogroup Jeroen Dijsselbloem: detailed development of new bailout programme could take about four weeks

The head of the Eurogroup Jeroen Dijsselbloem said that detailed development of the new bailout programme could take about four weeks. Greece will need short-term funding. Dijsselbloem said that Eurozone finance ministers had not been able to find a solution yet.

"This is very complex, we looked at a number of possibilities. We have not yet found the 'golden key' to solve this issue," he noted.

-

10:43

Greek banks remain closed until July 15

Greek banks remain closed until July 15.

"The aim is to reopen branches on Thursday," a Greek banker said.

The Greek government imposed capital controls to avert the collapse of its financial system. Daily cash withdrawals has been limited to 60 euros and payments and transfers abroad has been banned.

-

10:39

Greece has not repaid €456 million IMF loan on Monday

Greece has not repaid €456 million IMF loan on Monday. On June 30, Greece failed to make €1.5 billion repayment of IMF loans.

-

10:34

Britain’s Prime Minister David Cameron welcomes the deal between Greece and its creditors

Britain's Prime Minister David Cameron welcomed the deal between Greece and its creditors.

"What's in Britain's interest is that there is stability in the Eurozone and there isn't the threats of uncertainty and instability and I think this deal gives that sort of stability a chance. But obviously there is long way to go to put into place all the things that have been agreed," he said.

-

10:17

Chinese financial institutions issue about 1.27 trillion yuan of new loans in June

According to The Wall Street Journal, Chinese financial institutions issued about 1.27 trillion yuan of new loans in June, up from 901 billion yuan in May.

The People's Bank of China said on Tuesday that Chinese lenders extended 6.56 trillion yuan of new loans in the first half of the year.

China's M2 money supply rose 11.8% year-on-year in June, up from a 10.8% increase in May.

-

10:12

U.S. budget surplus is $51.8 billion in June

The U.S. Treasury Department released its federal budget data on Monday. The budget deficit turned into a surplus of $51.8 billion in June from a deficit of $82.4 billion in May.

Analysts had expect a surplus of $51 billion.

Receipts in June totalled $342.9 billion, while outlays were $291.2 billion.

-

09:43

DAX 11,474.56 +158.93 +1.40%, CAC 40 4,992.45 +89.38 +1.82%, EUROFIRST 300 1,561.58 +49.94 +3.30%, FTSE 100 6,735.24 +153.61 +2.33%

-

08:57

Global Stocks: U.S. stocks rose on news from Europe

U.S. stocks advanced after sources reported that Greece and its lenders reached a conditional deal to receive a possible $95 billion over three years, in exchange for strict reforms including pension overhauls and sales-tax increases. This agreement eased fears of an imminent Greece's exit from the euro zone.

The Dow Jones Industrial Average gained 217.27, or 1.2%, to 17977.68 (29 components out of 30 traded higher). The S&P 500 added 22.98, or 1.1%, to 2099.60. The Nasdaq Composite Index rose 73.82, or 1.5%, to 5071.51.

In Asia this morning Hong Kong Hang Seng slid 0.58%, or 145.09 points, to 25,078.92 in a volatile session. China Shanghai Composite Index declined by 0.32%, or 12.55 points, to 3,957.84. Meanwhile the Nikkei rose 1.64%, or 328.93 points, to 20,418.70 on Greece's deal with nonferrous metals, mining and steel products leading the gains.

Euro zone officials announced a deal between Greece and its creditors. In the first 15 minutes of trading, the Nikkei advanced by 298.65 points, or 1.49%. Chinese stocks were mixed. Analysts explained that markets had rebounded for three sessions and now investors need to take a breath.

-

04:03

Nikkei 225 20,405.86 +316.09 +1.57 %, Hang Seng 25,184.06 -39.95 -0.16 %, Shanghai Composite 3,970.15 -0.24 -0.01 %

-

00:30

Stocks. Daily history for Jul 13’2015:

(index / closing price / change items /% change)

HANG SENG 25,109.29 +208.01 +0.84%

S&P/ASX 200 5,473.2 -18.84 -0.34%

TOPIX 1,613.51 +29.96 +1.89%

SHANGHAI COMP 3,973.64 +95.83 +2.47%

FTSE 100 6,737.95 +64.57 +0.97 %

CAC 40 4,998.1 +95.03 +1.94 %

Xetra DAX 11,484.38 +168.75 +1.49 %

S&P 500 2,099.6 +22.98 +1.11 %

NASDAQ Composite 5,071.51 +73.82 +1.48 %

Dow Jones 17,977.68 +217.27 +1.22 %

-