Noticias del mercado

-

22:09

Major US stock indices grew moderately

The major stock indexes of the United States finished trading with a rise, as weak economic data reduced the chances of an increase in rates this year. Meanwhile, the moderate forecasts of JPMorgan and Wells Fargo limited profit.

As it became known, the prices that Americans pay for goods and services remained unchanged in June, which reflects more low prices for gasoline, and also shows that the recent surge in inflation was temporary. The consumer price index, or the cost of living, did not change last month, the government said on Friday. Economists predicted an increase in the CPI by 0.1%.

In addition, retailers spending in the US declined in June for the second consecutive month. Retail sales - an indicator of consumer spending in stores, restaurants and websites - fell by 0.2% in seasonally adjusted terms in June compared to the previous month, the Ministry of Commerce said. Economists had expected growth of 0.1%. In May, retail sales decreased by 0.1%. This was the first decline in sales from July to August 2016.

Industrial production in the US increased in June stronger than analysts' forecasts, as the demand for natural resources, cars and equipment recovered, according to the Federal Reserve. Industrial production grew 0.2% after falling 0.4%, overall industrial production, which also includes mining and utilities, increased by 0.4% after rising 0.1%, and capacity utilization rose to 76.6% from 76.4%.

It is also worth noting that the preliminary results of the studies presented by Thomson-Reuters and the Michigan Institute showed that the mood sensor among US consumers fell in June more than predicted by average experts' forecasts. According to the data, in July the consumer sentiment index fell to 93.1 points compared to the final reading for June at the level of 95.1 points. According to average estimates, the index had to drop to the level of 95 points.

Almost all components of the DOW index recorded a rise (27 out of 30). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.95%). Outsider were the shares of JPMorgan Chase & Co. (JPM, -0.69%).

All sectors of S & P completed the auction in positive territory. The sector of basic materials grew most (+ 0.9%).

At closing:

Dow + 0.40% 21.639.59 +86.50

Nasdaq + 0.61% 6,312.47 +38.03

S & P + 0.45% 2,458.96 +11.13

-

21:00

DJIA +0.36% 21,631.33 +78.24 Nasdaq +0.59% 6,311.65 +37.21 S&P +0.46% 2,459.18 +11.35

-

18:03

European stocks closed: FTSE 100 -35.05 7378.39 -0.47% DAX -9.61 12631.72 -0.08% CAC 40 -0.09 5235.31 0.00%

-

15:32

U.S. Stocks open: Dow +0.03%, Nasdaq +0.26%, S&P +0.02%

-

15:22

Before the bell: S&P futures +0.04%, NASDAQ futures +0.35%

Before the bell: S&P futures +0.04%, NASDAQ futures +0.35%

U.S. stock-index futures were slightly higher as investors analyzed a slew of important U.S. economic data and Q2 earnings reports from several big U.S. banks.

Global Stocks:

Nikkei 20,118.86 +19.05 +0.09%

Hang Seng 26,389.23 +43.06 +0.16%

Shanghai 3,222.31 +4.15 +0.13%

S&P/ASX 5,765.10 +28.33 +0.49%

FTSE 7,396.72 -16.72 -0.23%

CAC 5,238.79 +3.39 +0.06%

DAX 12,646.70 +5.37 +0.04%

Crude $46.64 (+1.22%)

Gold $1,227.60 (+0.85%)

-

14:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.1

0.09(0.25%)

11292

Amazon.com Inc., NASDAQ

AMZN

1,002.88

2.25(0.22%)

11301

American Express Co

AXP

85.1

-0.27(-0.32%)

2200

AMERICAN INTERNATIONAL GROUP

AIG

63.15

-0.98(-1.53%)

272

Apple Inc.

AAPL

147.72

-0.05(-0.03%)

155479

AT&T Inc

T

36.29

0.08(0.22%)

6912

Barrick Gold Corporation, NYSE

ABX

15.94

0.23(1.46%)

118237

Boeing Co

BA

208.2

1.97(0.96%)

12056

Caterpillar Inc

CAT

108.5

0.03(0.03%)

1501

Chevron Corp

CVX

104.5

0.37(0.36%)

2000

Cisco Systems Inc

CSCO

31.34

0.07(0.22%)

202

Citigroup Inc., NYSE

C

66.5

-0.52(-0.78%)

392238

Exxon Mobil Corp

XOM

81.05

0.08(0.10%)

974

Facebook, Inc.

FB

159.55

0.29(0.18%)

29958

Ford Motor Co.

F

11.64

0.04(0.34%)

5753

General Electric Co

GE

26.83

0.04(0.15%)

12522

General Motors Company, NYSE

GM

36.1

0.24(0.67%)

2100

Goldman Sachs

GS

227.83

-2.57(-1.12%)

23073

Google Inc.

GOOG

950.43

3.27(0.35%)

893

Intel Corp

INTC

34.3

0.06(0.18%)

1685

Johnson & Johnson

JNJ

132.5

0.64(0.49%)

634

JPMorgan Chase and Co

JPM

91.5

-1.60(-1.72%)

878704

McDonald's Corp

MCD

155.11

0.07(0.05%)

539

Merck & Co Inc

MRK

63.05

0.16(0.25%)

200

Microsoft Corp

MSFT

71.97

0.20(0.28%)

1482

Procter & Gamble Co

PG

86.73

0.03(0.03%)

764

Tesla Motors, Inc., NASDAQ

TSLA

323.73

0.32(0.10%)

23283

Verizon Communications Inc

VZ

43.55

0.06(0.14%)

3379

Visa

V

96

0.06(0.06%)

2373

Wal-Mart Stores Inc

WMT

76.2

1.15(1.53%)

60622

Walt Disney Co

DIS

104.56

0.27(0.26%)

838

Yandex N.V., NASDAQ

YNDX

31.6

-0.08(-0.25%)

19749

-

14:42

Analyst coverage resumption before the market open

Hewlett Packard Enterprise (HPE) reinstated with a Hold at Maxim Group; target $18

-

14:41

Upgrades before the market open

Wal-Mart (WMT) upgraded and added to Conviction Buy List at Goldman

Boeing (BA) upgraded to Overweight from Neutral at JP Morgan; target raised to $240

-

14:10

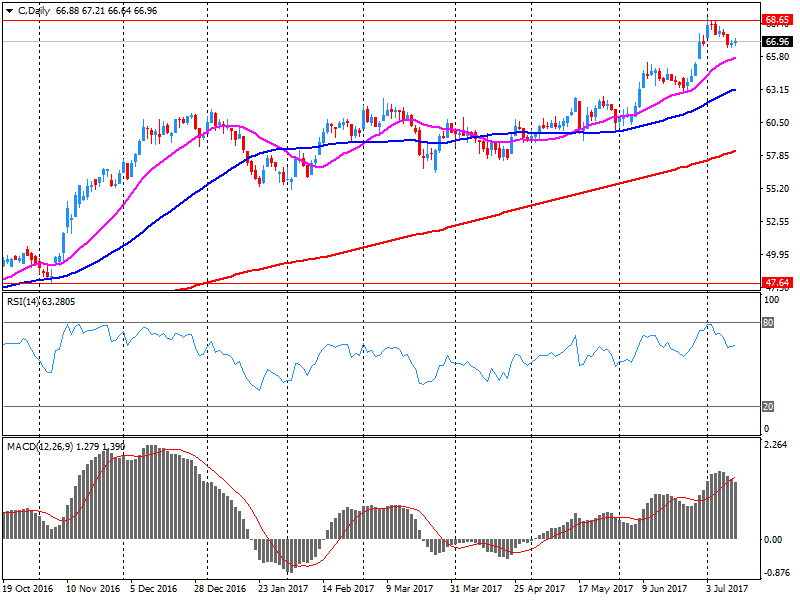

Company News: Citigroup (C) Q2 results beats analysts’ sorecast

Citigroup (C) reported Q2 FY 2017 earnings of $1.28 per share (versus $1.24 in Q2 FY 2016), beating analysts' consensus estimate of $1.21.

The company's quarterly revenues amounted to $17.901 bln (+2% y/y), beating analysts' consensus estimate of $ 17.379 bln.

C rose to $67.25 (+0.34%) in pre-market trading.

-

13:59

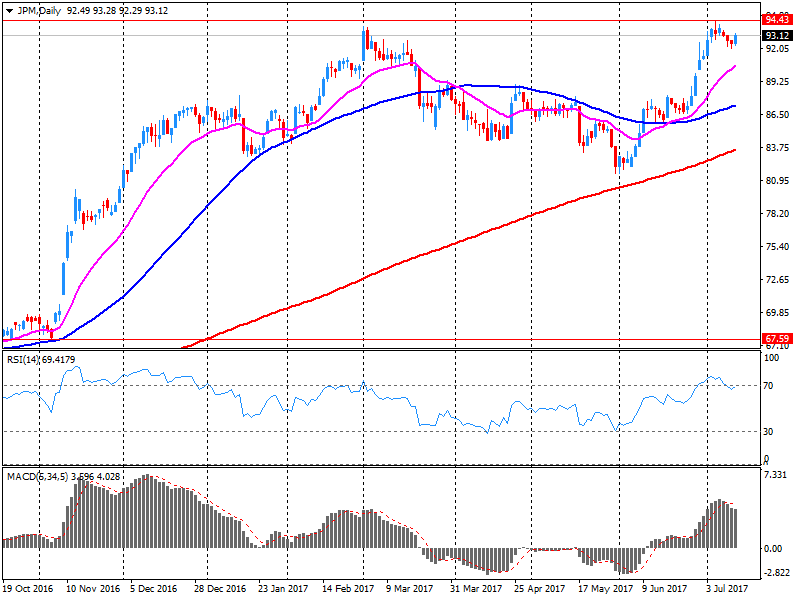

Company News: JPMorgan Chase (JPM) Q2 results beat analysts’ expectations

JPMorgan Chase (JPM) reported Q2 FY 2017 earnings of $1.82 per share (versus $1.55 in Q2 FY 2016), beating analysts' consensus estimate of $1.59.

The company's quarterly revenues amounted to $25.500 bln (+4.6% y/y), beating analysts' consensus estimate of $24.360 bln.

The company also cut FY 2017 net interest income guidance slightly. Now it expects 2017 net interest income to be up $4 bln y/y (down from $4.5 bln).

JPM fell to $92.30 (-0.86%) in pre-market trading.

-

09:34

Major stock exchanges in Europe trading in the red zone: FTSE 7407.19 -6.25 -0.08%, DAX 12625.56 -15.77 -0.12%, CAC 5232.31 -3.09 -0.06%

-

07:33

Global Stocks

European stocks largely stepped higher Thursday, building on the prior day's sizable jump that was sparked by dovish comments from U.S. Federal Reserve chief Janet Yellen. The Stoxx Europe 600 SXXP, +0.32% rose 0.3% to close at 386.14, after the index on Wednesday notched its biggest one-day percentage advance since April 24, tacking on 1.5%. Global equity benchmarks have been given a midweek shot in the arm by Yellen saying interest rates don't have to rise all that much further.

The Dow on Thursday closed at a record for the 24th time in 2017, as gains in the financial sector helped the broader market book modest gains ahead of a roster of corporate results from the U.S.'s biggest banks.

Global stocks continued to move higher Friday, with most Asia-Pacific markets poised to end the week on a high note as investors maintained their risk for appetite. "Asia has done well in the past couple of days," despite commentary from Federal Reserve chief Janet Yellen and the latest worries regarding U.S. President Donald Trump, said Tai Hui, chief market strategist in Asia at J.P. Morgan Funds.

-

00:57

Stocks. Daily history for Jul 13’2017:

(index / closing price / change items /% change)

Nikkei +1.43 20099.81 +0.01%

TOPIX -0.23 1619.11 -0.01%

Hang Seng +302.53 26346.17 +1.16%

CSI 300 +28.10 3686.92 +0.77%

Euro Stoxx 50 +12.60 3527.83 +0.36%

FTSE 100 -3.49 7413.44 -0.05%

DAX +14.75 12641.33 +0.12%

CAC 40 +13.27 5235.40 +0.25%

DJIA +20.95 21553.09 +0.10%

S&P 500 +4.58 2447.83 +0.19%

NASDAQ +13.27 6274.44 +0.21%

S&P/TSX -8.99 15135.00 -0.06%

-