Noticias del mercado

-

22:10

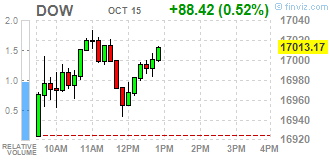

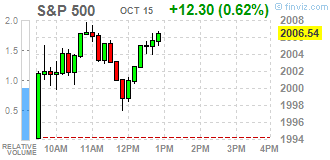

U.S. stocks closed

The October rebound in global equities resumed, with U.S. stocks rising to a eight-week high amid bank earnings and growing speculation the Federal Reserve will delay raising interest rates until 2016. Treasuries fell and gold erased its loss for the year.

The Standard & Poor's 500 Index jumped the most in 10 days with gains in the nation's largest financial firms leading equities higher after two days of declines. Economic data from Group of 10 nations are missing analysts' estimates by the most in four months, fueling bets the Fed will delay raising interest rates until next year.

The probability of a Fed interest rate increase by the December policy meeting has dropped to 30 percent, down from 70 percent at the start of August, according to futures data compiled by Bloomberg. The slide worsened even after a gauge of U.S. core consumer prices advanced more than projected in September, while hiring data provided evidence of labor-market resiliency

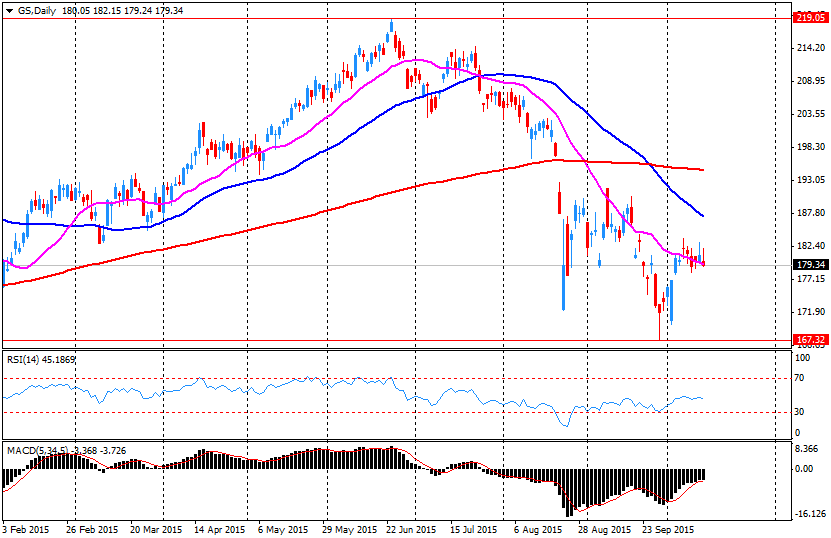

Financial shares paced gains with a 2.3 percent rally. Goldman Sachs Group Inc. added 3 percent even as third-quarter profit missed analysts' estimates as the global market turmoil took a bigger toll on its trading revenue than at rivals. Citigroup Inc. gained 4.4 percent as profit beat estimates.

The S&P 500 has jumped 8.4 percent from the depths of its August selloff, though it remains 5 percent below its all-time high set in May. The gauge has rallied as a weakening dollar bolsters the prospects for American companies that do business overseas, while speculation intensifies that rates will remain lower for longer.

-

21:00

DJIA 17104.60 179.85 1.06%, NASDAQ 4853.10 70.25 1.47%, S&P 500 2019.33 25.09 1.26%

-

19:01

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Thursday, after two days of losses, as investors assessed economic data and earnings reports from major banks. As the reporting season gathers steam, investors will be parsing quarterly results to gauge the impact of a slowing global economy on U.S. companies. Global stocks rebounded from two days of losses as investors bet the Federal Reserve will not raise interest rates until 2016. The Fed has said it will pull the trigger only if it sees signs of a sustainable economic recovery. Data released on Thursday painted contrasting pictures of the state of the U.S. economy. While consumer prices posted their biggest drop in eight months in September, unemployment benefit claims fell in the last week.

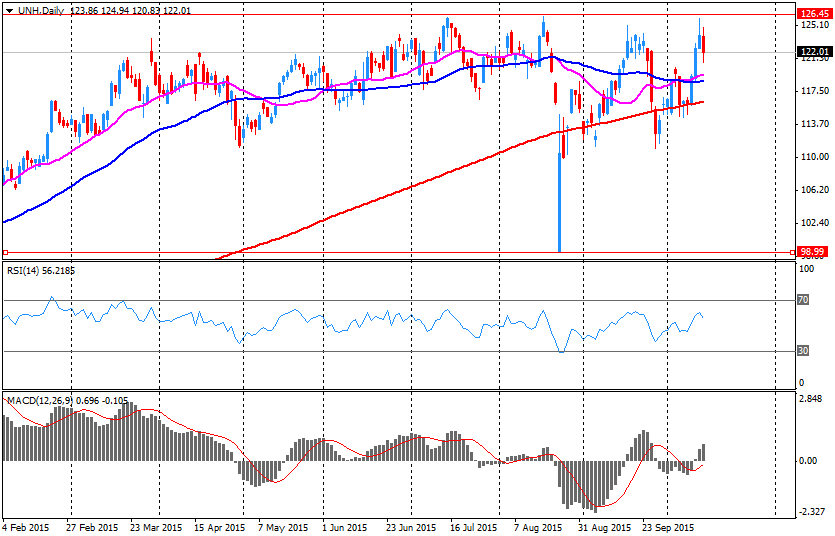

Most of Dow stocks in positive area (18 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -2.57%). Top gainer - NIKE, Inc. (NKE, +2.39%).

All S&P index sectors in positive area. Top gainer - Healthcare (+1,1%).

At the moment:

Dow 16909.00 +87.00 +0.52%

S&P 500 1998.50 +14.50 +0.73%

Nasdaq 100 4368.25 +41.75 +0.96%

10 Year yield 2,02% +0,04

Oil 46.08 -0.56 -1.20%

Gold 1187.90 +8.10 +0.69%

-

18:00

European stocks closed: FTSE 6338.67 69.06 1.10%, DAX 10064.80 148.95 1.50%, CAC 40 4675.29 66.26 1.44%

-

17:59

European stocks close: stocks closed higher on corporate earnings

Stock indices traded higher on corporate earnings.

Comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny also supported stock markets. He said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," Nowotny said.

He added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

Indexes on the close:

Name Price Change Change %

FTSE 100 6,338.67 +69.06 +1.10 %

DAX 10,064.8 +148.95 +1.50 %

CAC 40 4,675.29 +66.26 +1.44 %

-

17:53

WSE: Session Results

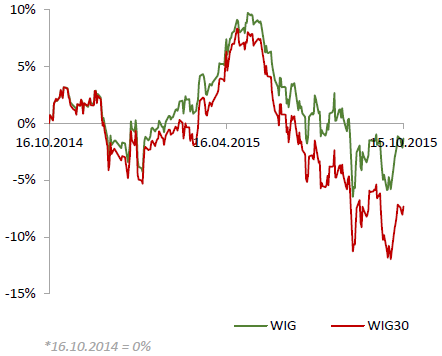

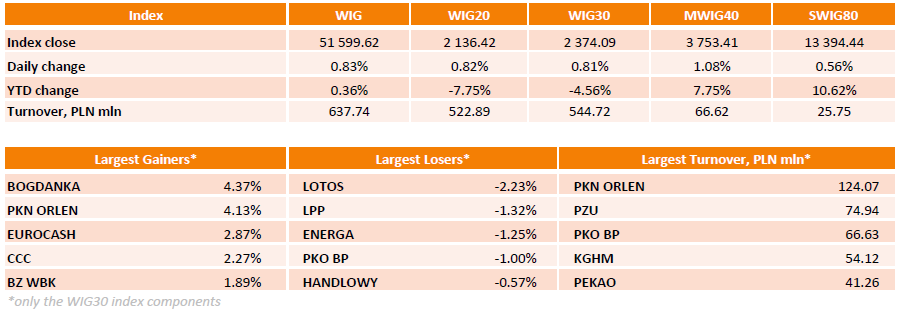

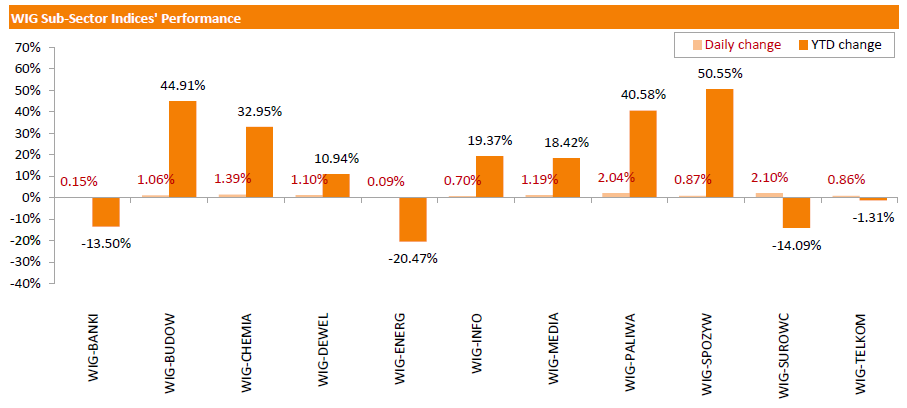

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, surged by 0.83%. All sectors in the WIG gained, with materials (+2.1%) and oil and gas sector (+2.04%) outperforming.

The large-cap stocks' measure, the WIG30 Index, added 0.81%. Within the index components, BOGDANKA (WSE: LWB) and PKN ORLEN (WSE: PKN) fared the best, advancing 4.37% and 4.13% respectively. EUROCASH (WSE: EUR) and CCC (WSE: CCC) were also noteworthy performers, gaining 2.87% and 2.27% respectively. On the other side of the ledger, LOTOS (WSE: LTS) was the weakest name, dropping 2.23% on worries that the local tax office's tax claims would affect the company's third-quarter profit. It was followed by LPP (WSE: LPP), ENERGA (WSE: ENG) and PKO BP (WSE: PKO), declining 1.23%, 1.25% and 1% respectively.

-

16:15

Philadelphia Federal Reserve Bank’s manufacturing index is up to -4.5 in October

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to -4.5 in October from -6.0 in September, missing expectations for a rise to -1.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"For the second consecutive month, regional manufacturers reported declines in overall activity. Indexes for new orders, shipments, employment, and average work hours all dipped into negative territory this month," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was down -6.1 in October from 14.8 in September.

The new orders index increased to 10.6 in October from 9.4 in September.

The prices paid index slid to -0.1 in October from 0.5 in September, while the prices received index increased to 1.3 from -5.0.

The number of employees index dropped to -1.7 in October from 10.2 last month.

According to the report, the future general activity index was down to 36.7 in October from 44.0 in September.

-

16:00

Fitch Ratings: New Zealand’s budget surplus “underscores the positive outlook on the sovereign's 'AA' rating”

Fitch Ratings said on Thursday that New Zealand's budget surplus "underscores the positive outlook on the sovereign's 'AA' rating".

The New Zealand government reached its budget surplus in the fiscal year ending June 30. It was the first budget surplus since 2008. The budget surplus was driven by stronger-than-expected tax revenue.

"Fitch believes that some of the improvement in revenue may be sustained into FY16. But the outlook for the dairy sector, and the implications for the wider economy, will be an important determinant of revenue growth," the agency said in its statement.

-

15:36

U.S. Stocks open: Dow +0.09%, Nasdaq +0.36%, S&P +0.28%

-

15:28

Before the bell: S&P futures +0.48%, NASDAQ futures +0.57%

U.S. stock-index futures climbed.

Global Stocks:

Nikkei 18,096.9 +205.90 +1.15%

Hang Seng 22,888.17 +448.26 +2.00%

Shanghai Composite 3,338.27 +75.83 +2.32%

FTSE 6,333.45 +63.84 +1.02%

CAC 4,662.81 +53.78 +1.17%

DAX 10,057.48 +141.63 +1.43 %

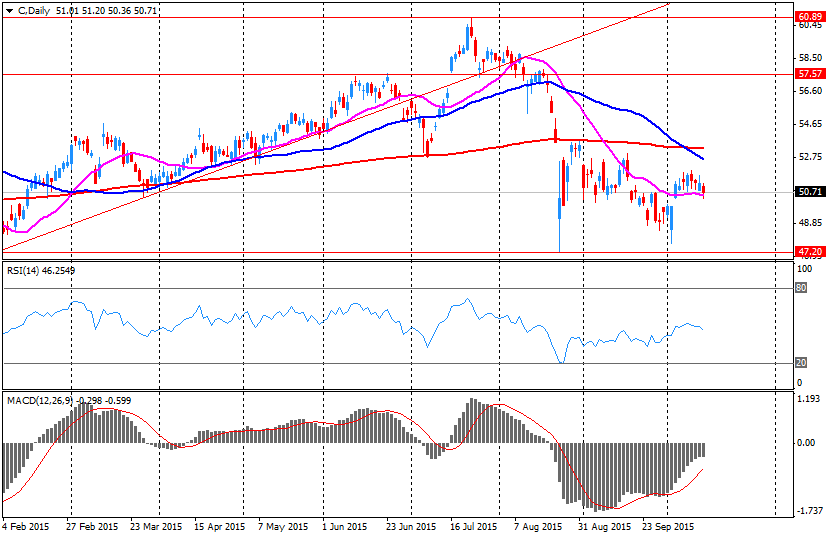

Crude oil $46.21 (-0.92%)

Gold $1185.50 (+0.48%)

-

15:15

NY Fed Empire State manufacturing index rises to -11.36 in October

The New York Federal Reserve released its survey on Thursday. The NY Fed Empire State manufacturing index rose to -11.36 in October from -14.67 in September, missing expectations for an increase to -8.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

The new orders index decreased to -18.91 in October from -12.90 in September, while the shipments index climbed to -13.61 from -7.9.

The general business conditions expectations index for the next six months increased to 23.6 in October from 23.2 in September.

The price-paid index decreased to 0.94 in October from 4.1 in September.

The index for the number of employees fell to -8.5 in October from -6.2 last month.

-

15:04

U.S. consumer price inflation falls 0.2% in September

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation fell 0.2% in September, in line with expectations, after a 0.1% fall in August.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 9.0% in September. It was the biggest decline since January.

Food prices increased 0.4% in September. It was the largest rise since May 2014.

On a yearly basis, the U.S. consumer price index declined to 0.0% in September from 0.2% in August, beating expectations for a drop to -0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in September, exceeding expectations for a 0.1% rise, after a 0.1% increase in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.9% in September from 1.8% in August. Analysts had expected the inflation to remain unchanged at 1.8%.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

It is unclear if this mixed inflation data will be enough for the Fed's interest rate hike. Fed Governors Lael Brainard and Daniel Tarullo said this week that they would like to see clear signals that the inflation was accelerating toward the 2% target.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Citigroup Inc., NYSE

C

52.34

3.19%

361.2K

Ford Motor Co.

F

15.26

1.67%

147.6K

American Express Co

AXP

76.99

1.08%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.20

1.07%

0.8K

Facebook, Inc.

FB

95.07

1.06%

83.6K

Nike

NKE

127.00

0.92%

0.5K

Deere & Company, NYSE

DE

76.95

0.88%

2.4K

ALTRIA GROUP INC.

MO

58.05

0.87%

4.0K

Yahoo! Inc., NASDAQ

YHOO

32.35

0.81%

1.8K

Cisco Systems Inc

CSCO

28.04

0.79%

3.3K

Travelers Companies Inc

TRV

103.58

0.79%

26.3K

Home Depot Inc

HD

121.20

0.77%

1.1K

Walt Disney Co

DIS

106.50

0.73%

5.4K

United Technologies Corp

UTX

92.83

0.72%

0.1K

E. I. du Pont de Nemours and Co

DD

56.80

0.71%

0.3K

Johnson & Johnson

JNJ

95.19

0.70%

2.7K

JPMorgan Chase and Co

JPM

60.40

0.68%

0.2K

Amazon.com Inc., NASDAQ

AMZN

548.50

0.67%

4.7K

General Motors Company, NYSE

GM

33.55

0.66%

156.5K

Visa

V

74.67

0.63%

04K

Boeing Co

BA

135.06

0.63%

7.1K

Twitter, Inc., NYSE

TWTR

29.56

0.61%

1.9K

Merck & Co Inc

MRK

49.83

0.59%

0.1K

The Coca-Cola Co

KO

41.92

0.58%

1.0K

Starbucks Corporation, NASDAQ

SBUX

59.15

0.56%

1.3K

3M Co

MMM

149.12

0.54%

27.9K

General Electric Co

GE

27.75

0.54%

17.6K

ALCOA INC.

AA

10.00

0.50%

12.5K

McDonald's Corp

MCD

103.30

0.47%

36.7K

Google Inc.

GOOG

654.23

0.47%

1.8K

Tesla Motors, Inc., NASDAQ

TSLA

217.89

0.47%

15.5K

International Business Machines Co...

IBM

150.62

0.41%

0.4K

Verizon Communications Inc

VZ

44.17

0.41%

1.3K

Apple Inc.

AAPL

110.65

0.40%

86.0K

Pfizer Inc

PFE

33.17

0.39%

13.5K

Procter & Gamble Co

PG

74.50

0.39%

3.7K

HONEYWELL INTERNATIONAL INC.

HON

98.58

0.33%

0.2K

Yandex N.V., NASDAQ

YNDX

13.37

0.30%

5.1K

Chevron Corp

CVX

90.00

0.27%

0.3K

Microsoft Corp

MSFT

46.80

0.26%

3.5K

Intel Corp

INTC

32.85

0.15%

38.5K

AT&T Inc

T

33.30

0.09%

2.6K

Exxon Mobil Corp

XOM

80.20

0.05%

2.3K

Caterpillar Inc

CAT

70.67

-0.06%

2.9K

Hewlett-Packard Co.

HPQ

29.35

-0.24%

0.1K

Barrick Gold Corporation, NYSE

ABX

8.15

-0.37%

47.2K

Wal-Mart Stores Inc

WMT

59.69

-0.57%

150.9K

UnitedHealth Group Inc

UNH

120.55

-1.25%

7.0K

Goldman Sachs

GS

177.00

-1.40%

94.2K

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Facebook (FB) upgraded to Buy from Hold at Argus

Downgrades:

Wal-Mart (WMT) downgraded to Neutral from Outperform at Credit Suisse; target lowered to $62 from $85

Other:

Hewlett-Packard (HPQ) initiated with an Underweight at Barclays

IBM (IBM) initiated with an Underweight at Barclays

Apple (AAPL) initiated with an Overweight at Barclays

Cisco Systems (CSCO) initiated with an Overweight at Barclays

NIKE (NKE) target raised to $126 from $120 at FBR Capital

Deere (DE) initiated with a Market Outperform at Avondale; target $90

-

14:41

Initial jobless claims decrease by 7,000 to 255,000 in the week ending October 10

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 10 in the U.S. declined by 7,000 to 255,000 from 262,000 in the previous week. The previous week's figure was revised down from 263,000.

Analysts had expected the initial jobless claims to increase to 270,000.

Jobless claims remained below 300,000 the 32th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 50,000 to 2,158,000 in the week ended October 03. It was the lowest level since November 2000.

-

14:24

-

14:19

People's Bank of China: bank lending in China rises to 1.05 trillion yuan in September

The People's Bank of China (PBoC) said on Thursday that bank lending in China rose to 1.05 trillion yuan ($165.5 billion) in September from CNY809.6 billion in August.

Total social financing climbed to 1.3 trillion yuan in September from 1.08 trillion yuan in August.

M2 money supply jumped 13.1% year-on-year in September, after a 13.3% gain in August.

-

14:08

-

13:33

Company News: UnitedHealth (UNH) reports Q3 results above expectations

UnitedHealth reported Q3 earnings of $1.65 per share (+1.2% y/y) versus analysts' consensus of $1.64.

Its revenues amounted to $41.500 bln (+26.5% y/y), beating consensus of $40.262 bln.

The company reaffirmed its FY 2015 guidance with earnings expected to be within the range of $6.25 to $ 6.35 per share. The analysts' consensus forecast for the company's EPS FY 2015 stands at $6.35.

UNH rose to $123.50 (+1.17%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded higher on speculation that the Fed will delay its interest rate hike due to the recent weak U.S. economic data

Stock indices traded higher on speculation that the Fed will delay its interest rate hike due to the recent weak U.S. economic data. According to the U.S. Commerce Department, the U.S. retail sales climbed 0.1% in September, missing expectations for a 0.2% decrease, after a flat reading in August. Retail sales excluding automobiles decreased 0.3% in September, missing forecasts of a 0.1% decline, after a 0.1% fall in August.

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

Current figures:

Name Price Change Change %

FTSE 100 6,325.36 +55.75 +0.89 %

DAX 10,042.42 +126.57 +1.28 %

CAC 40 4,659.59 +50.56 +1.10 %

-

11:49

Final industrial production in Japan declines 1.2% in August

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Thursday. Final industrial production in Japan declined 1.2% in August, down from the preliminary estimate of a 0.5% decrease, after a 0.8% drop in July.

On a yearly basis, Japan's industrial production was down 0.4% in August, down from the preliminary estimate of a 0.2% increase, after a flat reading in July.

The output at factories and mines was revised down to 96.3 from the preliminary reading of 97.0.

Industrial shipments were downgraded to a 0.7% fall from the preliminary 0.5% decline, while inventories were revised down to a 0.3% rise from the preliminary 0.4% increase.

-

11:26

Business NZ performance of manufacturing index for New Zealand rises to 55.4 in September

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand rose to 55.4 in September from 55.1 in August. It was the highest level since February.

August's figure was revised up from 55.0.

A reading above 50 indicates expansion in the manufacturing sector.

The increase was mainly driven by a rise in the production and new orders.

"Production was at its highest level since December last year, while new orders continued to improve. Overall, this should flow through into healthy results for the last quarter of the year," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

11:08

European Central Bank Vice President Vitor Constancio: the exit from the zero interest rate policy may have spillover on other countries in the short terms

The European Central Bank (ECB) Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

"Global challenges require both domestic and global responses to ensure that the global financial system becomes more resilient," he concluded.

-

10:55

European Central Bank Governing Council Member Ewald Nowotny: further stimulus measures are needed as the central bank’s inflation target will be missed

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

-

10:43

Richmond Federal Reserve President Jeffrey Lacker notes his outlook for the U.S. economy has not changed since September despite the recent weak economic data

Richmond Federal Reserve President Jeffrey Lacker said in an interview with Fox Business Network on Wednesday that his outlook for the U.S. economy has not changed since September despite the recent weak economic data.

"My views haven't changed much since September," he said.

But he did not said if he will vote for the interest rate hike at the Fed's monetary policy meeting in October. Lacker was only one FOMC official who voted for the interest rate hike in September.

Richmond Federal Reserve president pointed out that interest rates should higher than they are now.

"The higher sustained growth we've seen in real consumer spending strongly suggests that real interest rates need to be higher than they are now," he said.

-

10:35

Beige Book: the U.S. economic activity continued to grow modestly from mid-August through early October

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economic activity continued to grow modestly from mid-August through early October, but a strong U.S. dollar and the slowdown in the Chinese economy weighed on the manufacturing sector in the U.S.

The New York, Philadelphia, Cleveland, Atlanta, Chicago, and St. Louis Districts expanded modestly, the Minneapolis, Dallas, and San Francisco Districts grew moderately, Boston's and Richmond's activity rose, while Kansas City' activity declined.

The Fed noted that labour markets tightened in most districts, but wage growth was mostly subdued.

-

10:23

UBS Group AG expects central bank and sovereign wealth fund assets to decline by $1.2 trillion by the end of the year

UBS Group AG said on Tuesday that it expects central bank and sovereign wealth fund assets will decline by $1.2 trillion by the end of the year as China and oil-producing countries including Russia and Saudi Arabia use their foreign exchange reserves to boost the economic growth.

Massimiliano Castelli, head of global strategy at UBS Asset Management, said in a phone interview with Bloomberg on Tuesday that the decline in sovereign assets is likely to continue into next year.

UBS said that central banks and sovereign wealth funds totalled more than $18 trillion at the end of 2014.

-

10:10

Australia's unemployment rate remains unchanged at 6.2% in September

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 6.2% in September, beating expectations for a rise to 6.3%. The number of employed people in Australia declined by 5,100 in September, missing forecast of a rise by 5,000, after a gain by 18,000 in August. August's figure was revised up from a rise by 17,400.

Full-time employment fell by 13,900 in September, while part-time employment climbed by 8,900.

The participation rate declined to 64.9% in September from 65.0% in August.

-

04:04

Nikkei 225 18,042.49 +151.49 +0.85 %, Hang Seng 22,651.8 +211.89 +0.94 %, Shanghai Composite 3,260.91 -1.54 -0.05 %

-

00:33

Stocks. Daily history for Sep Oct 14’2015:

(index / closing price / change items /% change)

Nikkei 225 17,891 -343.74 -1.89 %

Hang Seng 22,439.91 -160.55 -0.71 %

S&P/ASX 200 5,197.25 -5.60 -0.11 %

Shanghai Composite 3,262.08 -31.15 -0.95 %

FTSE 100 6,269.61 -72.67 -1.15 %

CAC 40 4,609.03 -34.35 -0.74 %

Xetra DAX 9,915.85 -116.97 -1.17 %

S&P 500 1,994.24 -9.45 -0.47 %

NASDAQ Composite 4,782.85 -13.76 -0.29 %

Dow Jones 16,924.75 -157.14 -0.92 %

-