Noticias del mercado

-

21:00

DJIA 17174.55 32.80 0.19%, NASDAQ 4873.83 3.73 0.08%, S&P 500 2028.51 4.65 0.23%

-

18:01

European stocks closed: FTSE 6378.04 39.37 0.62%, DAX 10104.43 39.63 0.39%, CAC 40 4702.79 27.50 0.59%

-

18:00

European stocks close: stocks closed higher on corporate earnings

Stock indices traded higher on corporate earnings.

Meanwhile, the economic data from the Eurozone was negative. Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index rose 0.2% in September, in line with the preliminary reading, after a flat reading in August.

On a yearly basis, Eurozone's final consumer price inflation fell to -0.1% in September from 0.1% in August, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in September, vegetables prices rose by 0.11%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.71%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.06%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in September, in line with the preliminary reading.

Eurozone's unadjusted trade surplus dropped to €11.12 billion in August from €31.4 billion in July.

Exports rose at an annual rate of 6.0% in August, while imports increased by 3.0%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,378.04 +39.37 +0.62 %

DAX 10,104.43 +39.63 +0.39 %

CAC 40 4,702.79 +27.50 +0.59 %

-

17:53

WSE: Session Results

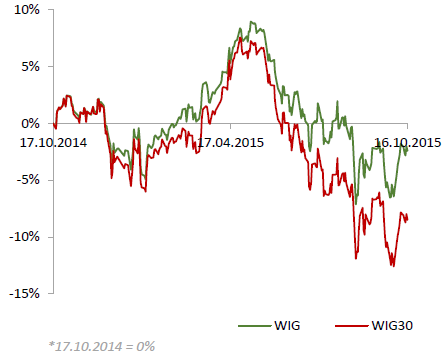

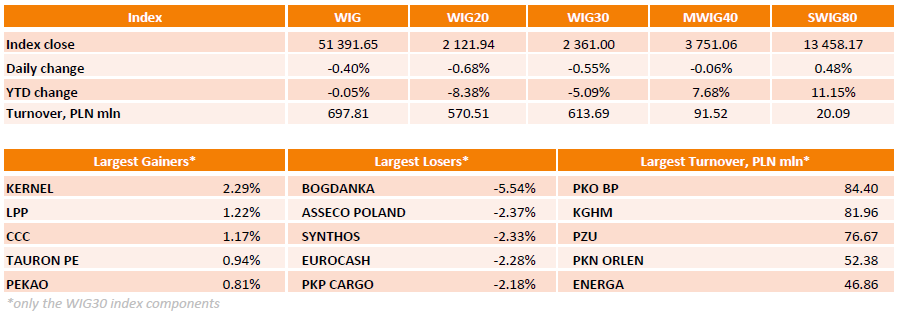

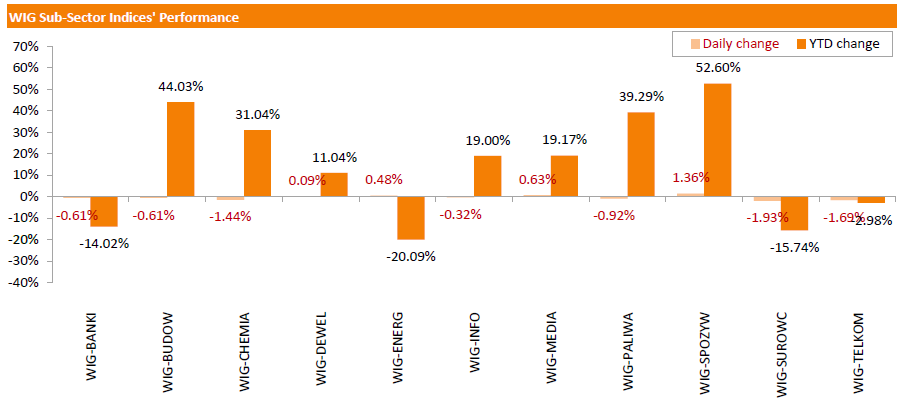

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, fell by 0.4%. Sector-wise, materials (-1.93%) fared the worst, while food sector (+1.36%) was the biggest advancer.

The large-cap stocks' measure, the WIG30 Index, lost 0.55%. Within the WIG30 Index components, BOGDANKA (WSE: LWB) led the decliners with a 5.54% drop, followed by ASSECO POLAND (WSE: ACP), SYNTHOS (WSE: SNS) and EUROCASH (WSE: EUR), slumping by 2.37%, 2.33% and 2.28% respectively. On the other side of the ledger, KERNEL (WSE: KER), LPP (WSE: LPP) and CCC (WSE: CCC) became the best performers, gaining 2.29%, 1.22% and 1.17% respectively. Elsewhere, TAURON PE (WSE: TPE) added 0.94% on news the company signed a preliminary deal to buy part of Brzeszcze coal mine assets from the state mine restructuring company for PLN 1.

-

17:16

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday as investors assessed mixed results from industrial heavyweights. U.S. industrial production in September shrank for the second month in a row, but was in line with expectations. The University of Michigan's preliminary index on consumer sentiment for October, which is forecast to rise to 89 from a final reading of 87.2 in September.

Most of Dow stocks in positive area (20 of 30). Top looser - Caterpillar Inc. (CAT, -1.91%). Top gainer - General Electric Company (GE, +1.93%).

Most of S&P index sectors in positive area. Top looser - Basic Materials (-0.9%). Top gainer - Healthcare (+0,8%).

At the moment:

Dow 17066.00 -3.00 -0.02%

S&P 500 2019.25 +0.25 +0.01%

Nasdaq 100 4418.00 +6.25 +0.14%

10 Year yield 2,02% +0,00

Oil 46.94 +0.07 +0.15%

Gold 1182.90 -4.60 -0.39%

-

17:04

Reserve Bank of Australia’s Financial Stability Review: risks to financial stability in Australia continue to revolve around some local property markets

The Reserve Bank of Australia (RBA) said in its Financial Stability Review that risks to financial stability in Australia continued to revolve around some local property markets.

Focus shifted from Greece to China and other emerging market economies, the central bank said. The RBA added that "global factors have not had a material impact on Australia's financial system".

-

16:39

European Central Bank Executive Board Member Benoit Coeure: the banking union in the Eurozone should be completed as fast as possible

European Central Bank (ECB) Executive Board Member Benoit Coeure said at a conference in Berlin on Friday that the banking union in the Eurozone should be completed as fast as possible for better reaction to the possible shocks.

"I would like to stress the urgency of completing the banking union," he said.

-

16:23

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 92.1 in October

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 92.1 in October from a final reading of 87.2 in September, missing expectations for an increase to 89.0.

"The rebound in confidence signifies that consumers have concluded that the fears expressed on Wall Street did not extend to Main Street. Importantly, the renewed confidence did not simply represent a relief rally, but instead reflected renewed optimism," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

He added that the consumption is expected to climb 2.9% during 2016.

The rise in the index was driven by increases in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions increased to 106.7 in October from 101.2 in September, while the index of consumer expectations rose to 82.7 from 78.2.

The one-year inflation expectations fell to 2.7% in October from 2.8% in September.

-

16:14

Job openings drops to 5.370 million in August

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Friday. Job openings dropped to 5.370 million in August from 5.668 million in July. July's figure was revised down from 5.753 million.

The number of job openings declined for total private (4.878 million) and for government (493,000) in August.

The hires rate was 3.6% in August.

Total separations rose to 4.846 million in August from 4.796 million in July.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:51

U.S. industrial production declines 0.2% in September

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production fell 0.2% in September, in line with expectations, after a 0.1% decline in August. August's figure was revised up from a 0.4% drop.

The drop was mainly driven by a fall in the mining output, which plunged by 2.0% in September.

Manufacturing output was down 0.1% in September, while utilities production increased 1.3%.

Capacity utilisation rate decreased to 77.5% in September from 77.8% in August, beating expectations for a decline to 77.4%. August's figure was revised up from 77.6%.

-

15:37

U.S. Stocks open: Dow +0.16%, Nasdaq +0.01%, S&P +0.21%

-

15:30

Before the bell: S&P futures -0.1%, NASDAQ futures -0.03%

U.S. stock-index futures were little changed as investors weighed corporate results while data showed factory output fell for a second month.

Global Stocks:

Nikkei 18,291.8 +194.90 +1.08%

Hang Seng 23,067.37 +179.20 +0.78%

Shanghai Composite 3,391.99 +53.92 +1.62%

FTSE 6,371.61 +32.94 +0.52%

CAC 4,699.11 +23.82 +0.51%

DAX 10,098.65 +33.85 +0.34%

Crude oil $46.84 (+0.94%)

Gold $1181.60 (-0.50%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

139.76

1.73%

29.6K

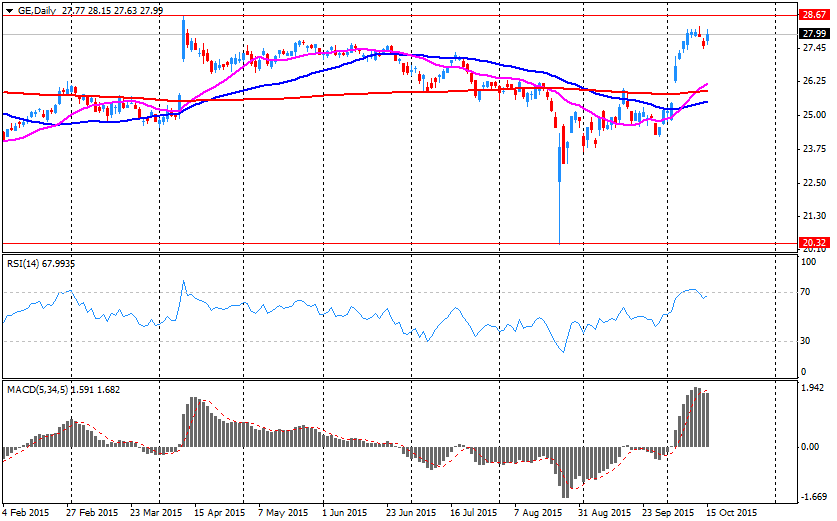

General Electric Co

GE

28.40

1.32%

752.3K

Yahoo! Inc., NASDAQ

YHOO

33.73

0.75%

8.9K

Tesla Motors, Inc., NASDAQ

TSLA

222.90

0.72%

6.9K

Twitter, Inc., NYSE

TWTR

29.89

0.61%

245.2K

McDonald's Corp

MCD

103.99

0.32%

1.0K

Amazon.com Inc., NASDAQ

AMZN

563.70

0.22%

5.1K

Cisco Systems Inc

CSCO

28.21

0.21%

2.7K

Pfizer Inc

PFE

34.15

0.21%

1K

ALCOA INC.

AA

9.72

0.21%

44.7K

Microsoft Corp

MSFT

47.10

0.19%

2.5K

Walt Disney Co

DIS

108.10

0.19%

3.5K

Nike

NKE

129.00

0.16%

1.7K

Facebook, Inc.

FB

96.10

0.15%

30.5K

Home Depot Inc

HD

121.98

0.14%

6.3K

Wal-Mart Stores Inc

WMT

59.39

0.10%

3.9K

Intel Corp

INTC

32.78

0.09%

0.6K

American Express Co

AXP

76.79

0.07%

4.6K

Google Inc.

GOOG

662.06

0.05%

0.8K

United Technologies Corp

UTX

93.20

0.02%

0.1K

Starbucks Corporation, NASDAQ

SBUX

59.70

0.02%

0.2K

Johnson & Johnson

JNJ

97.15

0.00%

6.0K

Verizon Communications Inc

VZ

44.66

-0.02%

2.8K

Chevron Corp

CVX

90.69

-0.03%

0.4K

JPMorgan Chase and Co

JPM

61.85

-0.06%

51.8K

Caterpillar Inc

CAT

70.77

-0.08%

11.5K

Goldman Sachs

GS

184.75

-0.11%

0.2K

Citigroup Inc., NYSE

C

52.88

-0.17%

5.2K

Exxon Mobil Corp

XOM

81.33

-0.18%

1.1K

Ford Motor Co.

F

15.18

-0.26%

2.5K

Apple Inc.

AAPL

111.40

-0.41%

90.2K

Barrick Gold Corporation, NYSE

ABX

8.11

-0.61%

53.5K

AT&T Inc

T

33.28

-0.63%

1.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.88

-0.92%

27.1K

UnitedHealth Group Inc

UNH

119.00

-0.97%

0.1K

Yandex N.V., NASDAQ

YNDX

13.38

-1.62%

2.3K

HONEYWELL INTERNATIONAL INC.

HON

96.75

-1.78%

1.8K

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Nike (NKE) initiated with a Buy at Brean Capital

IBM (IBM) initiated with a Hold at Cantor Fitzgerald

AT&T (T) initiated with a Buy at Nomura

Verizon Communications (VZ) initiated with a Neutral at Nomura

-

14:47

Foreign investors add C$3. 1 billion of Canadian securities in August

Statistics Canada released foreign investment figures on Friday. Foreign investors added C$3. 1 billion of Canadian securities in August, after a divestment of C$10.09 billion in July.

July's figure was revised down from a sale of C$10.12 billion.

Canadian investors purchased C$8.7 billion of foreign securities in August, mainly US securities.

-

14:42

Canadian manufacturing shipments are down 0.2% in August

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments fell 0.2% in August, beating forecasts of a 1.0% decrease, after a 1.7% gain in July.

The decline was driven by falls in the petroleum and coal product, motor vehicle parts, and aerospace product and parts industries.

Sales of petroleum and coal products dropped 5.2% in August, sales of motor vehicle parts fell 4.4%, output in the aerospace product and parts industries declined 3.5%, while sales in the motor vehicle assembly industry increased 6.7%.

Inventories rose 0.5% in August.

Sales decreased in 8 of 21 categories.

-

14:17

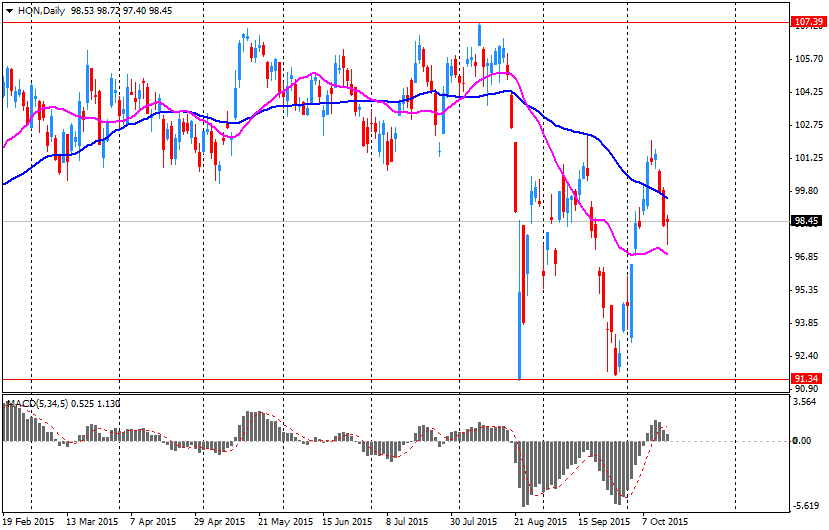

Company News: Honeywell (HON) Q3 profit beats expectations

Honeywell reported Q3 earnings of $1.57 per share (+6.8% y/y), beating analysts' consensus of $1.55.

The company's revenues amounted to $9.611 bln (-4.9% y/y), missing consensus estimate of $9.847 bln.

Honeywell expects FY15 EPS of $6.10 (in-line with consensus) and revenues of $38.7 bln (below consensus of $39.22 bln).

HON fell to $98.00 (-0.51%) in pre-market trading.

-

14:13

-

12:00

European stock markets mid session: stocks traded higher on speculation that the Fed will delay its interest rate hike

Stock indices traded higher on speculation that the Fed will delay its interest rate hike after the release of the mixed U.S. consumer price inflation data on Thursday.

Meanwhile, the economic data from the Eurozone was negative. Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index rose 0.2% in September, in line with the preliminary reading, after a flat reading in August.

On a yearly basis, Eurozone's final consumer price inflation fell to -0.1% in September from 0.1% in August, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in September, vegetables prices rose by 0.11%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.71%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.06%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in September, in line with the preliminary reading.

Eurozone's unadjusted trade surplus dropped to €11.12 billion in August from €31.4 billion in July.

Exports rose at an annual rate of 6.0% in August, while imports increased by 3.0%.

Current figures:

Name Price Change Change %

FTSE 100 6,389.61 +50.94 +0.80 %

DAX 10,151.09 +86.29 +0.86 %

CAC 40 4,711.95 +36.66 +0.78 %

-

11:53

Bank of Japan Governor Haruhiko Kuroda: the consumer price inflation trend is improving

Bank of Japan Governor Haruhiko Kuroda said on Friday that the consumer price inflation trend was improving, adding that the consumer price inflation excluding fresh food and energy increased more than 1%.

"The overall price trend is improving, and consumer prices are expected to accelerate toward our 2 percent inflation target," he said.

Kuroda noted that "domestic demand is on track to strengthen".

Bank of Japan governor also said that a slowdown in emerging economies weighed on exports and factory production.

In general, Kuroda's comments could mean that the central bank will not add further stimulus measures at its meeting on October 30.

-

11:43

Italy’ trade surplus declines to €1.85 billion in August

The Italian statistical office Istat released its trade data for Italy on Friday. Italy' trade surplus fell to €1.85 billion in August from €8.07 billion in July.

Exports increased 1.0% year-on-year in August, while imports climbed 2.1%.

The trade surplus with the EU was €467 million in August, while the trade surplus with non-EU countries was €1.38 billion.

-

11:28

Eurozone's final harmonized consumer price index rises 0.2% in September

Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index rose 0.2% in September, in line with the preliminary reading, after a flat reading in August.

On a yearly basis, Eurozone's final consumer price inflation fell to -0.1% in September from 0.1% in August, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in September, vegetables prices rose by 0.11%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.71%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.06%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in September, in line with the preliminary reading.

-

11:21

Eurozone's unadjusted trade surplus drops to €11.12 billion

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus dropped to €11.12 billion in August from €31.4 billion in July.

Exports rose at an annual rate of 6.0% in August, while imports increased by 3.0%.

-

11:12

Federal Reserve Bank of New York President William Dudley: the Fed should raise its interest rates this year if growth, employment and inflation will meet their targets

Federal Reserve Bank of New York President William Dudley said on Thursday that the Fed should raise its interest rates this year if growth, employment and inflation will meet their targets.

"If the economy performs in line with my forecast, I would favour lifting off later this year. But it's a forecast. It's not a commitment," he said.

Dudley added that the recent U.S. economic data pointed to the slower growth in the U.S. economy. But he noted that he sees that the U.S. economy expands above trend.

"When I put it all together, I still see an economy that's growing a bit above trend. And if that is the case, we should see greater pressure over time on resources. And if that is the case, then we should be able to begin to normalize monetary policy," Federal Reserve Bank of New York president said.

-

10:53

Cleveland Fed President Loretta Mester: the U.S. economy can handle interest rate hike

Cleveland Fed President Loretta Mester said on Thursday that the U.S. economy can handle interest rate hike.

"I believe the economy can handle an increase in the fed funds rate and that it is appropriate for monetary policy to take a step back from the emergency measure of zero interest rates," she said.

Mester added that the U.S. economy needs to add between 70,000 and 120,000 jobs per month to keep the unemployment rate steady at the current level of 5.1%.

-

10:45

U.S. Treasury Secretary Jacob Lew: the U.S. government will run out of cash if the federal borrowing limit will not be raised

U.S. Treasury Secretary Jacob Lew said on Thursday that the U.S. government will run out of cash if the federal borrowing limit will not be raised because emergency cash-management measures will be exhausted by November 03.

"We do not foresee any reasonable scenario in which it would last for an extended period of time," he said in a letter to U.S. Congress.

The emergency measures currently total $18.1 trillion.

-

10:32

U.S. budget deficit turns to a surplus of $91.0 billion in September

The U.S. Treasury Department released its federal budget data on Thursday. The budget deficit turned to a surplus of $91.0 billion in September, up from a deficit of $64.4 billion in August.

In the fiscal year 2015, which ends at September this year, the budget deficit totalled $439 billion, down $44 million from 2014. It was the lowest level since 2007.

The deficit totalled 2.5% of gross domestic product (GDP).

Spending rose 5% in the fiscal year 2015, while individual income-tax receipts jumped by 11%, and corporate tax revenues climbed by 7.2%.

-

10:22

Consumer prices in New Zealand rise 0.3% in the third quarter

The Reserve Bank of New Zealand (RBNZ) released its consumer price inflation data on late Thursday evening. Consumer prices in New Zealand rose 0.3% in the third quarter, beating expectations for a 0.2% gain, after a 0.4% increase in the second quarter.

The increase in consumer price inflation was driven by higher housing-related prices, and higher vegetable and package holiday prices.

On a yearly basis, consumer price inflation increased 0.4% in the third quarter, beating forecasts of the 0.3% rise, after a 0.4% gain in the second quarter.

The annual increase in consumer price inflation was driven by higher housing-related prices.

-

10:10

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 45.2 in in the week ended October 11

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 45.2 in in the week ended October 11 from 44.8 the prior week. The increase was driven by a better sentiment among part-time workers.

The measure of views of the economy rose to 35.6 from 35.4. It was the highest reading since early May.

The buying climate index fell to 39.5 from 39.6.

The personal finances index was up to 60.5 from 59.3.

-

04:03

Nikkei 225 18,370.61 +273.71 +1.51 %, Hang Seng 23,147.07 +258.90 +1.13 %, Shanghai Composite 3,358.3 +20.22 +0.61 %

-

00:31

Stocks. Daily history for Sep Oct 15’2015:

(index / closing price / change items /% change)

Nikkei 225 18,096.9 +205.90 +1.15 %

Hang Seng 22,888.17 +448.26 +2.00 %

S&P/ASX 200 5,230.05 +32.79 +0.63 %

Shanghai Composite 3,338.27 +75.83 +2.32 %

FTSE 100 6,338.67 +69.06 +1.10 %

CAC 40 4,675.29 +66.26 +1.44 %

Xetra DAX 10,064.8 +148.95 +1.50 %

S&P 500 2,023.86 +29.62 +1.49 %

NASDAQ Composite 4,870.1 +87.25 +1.82 %

Dow Jones 17,141.75 +217.00 +1.28 %

-