Noticias del mercado

-

20:00

S&P 500 2,090.11 +15.83 +0.76 %, NASDAQ 4,979.62 +42.19 +0.85 %, Dow 18,032.94 +183.86 +1.03 %

-

18:03

European stocks close: stocks closed mixed ahead the Fed’s interest rate decision later in the day

Stock indices closed mixed ahead the Fed's interest rate decision later in the day. Market participants speculate that the Fed will drop the word "patient" from its outlook for monetary policy.

Eurozone's unadjusted trade surplus fell to €7.9 billion in December from €23.9 billion in November. November's figure was revised down from a surplus of €24.3 billion.

Eurostat said that seasonally adjusted numbers were not available due to technical problems.

The U.K. unemployment rate remained unchanged at 5.7% in the November to January quarter. Analysts had expected the unemployment rate to decline to 5.6%.

The claimant count in the U.K. decreased by 31,000 people in February, in line with expectations, after a decrease of 39,400 people in January. January's figure was revised from a decline of 38,600.

Average weekly earnings in the U.K., excluding bonuses, climbed by 1.6%.

Average weekly earnings in the U.K., including bonuses, rose by 1.8%.

The Bank of England (BoE) released its last meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

The U.K. Chancellor George Osborne announced the annual budget on Wednesday. He raised the economic growth forecasts for 2015 and next year. The growth forecast for 2015 was upgraded to 2.5% from the previous estimate 2.4%.

The economy in the U.K. is expected to expand 2.3% in 2016, up from 2.2%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,945.2 +107.59 +1.57 %

DAX 11,922.77 -58.08 -0.48 %

CAC 40 5,033.42 +4.49 +0.09 %

-

18:00

European stocks closed: FTSE 100 6,933.09 +95.48 +1.40 %, CAC 40 5,022.44 -6.49 -0.13 %, DAX 11,895.73 -85.12 -0.71 %

-

16:58

U.K. Chancellor George Osborne raised growth forecasts for 2015 and 2016

The U.K. Chancellor George Osborne announced the annual budget on Wednesday. He raised the economic growth forecasts for 2015 and next year. The growth forecast for 2015 was upgraded to 2.5% from the previous estimate 2.4%.

The economy in the U.K. is expected to expand 2.3% in 2016, up from 2.2%.

The unemployment rate is expected to decline to 5.3% this year, while the inflation forecast was revised down to 0.2%.

Mr Osborne noted that the inflation forecast for the following three years will be revised down due to falling global oil and food prices.

The budget deficit is expected to decline to 4% in 2015-16 and to 2% the following year.

The U.K. chancellor pointed out that the government expect a budget surplus of 0.2% in 2018-19 and a 0.3% surplus in 2019-20.

-

16:25

OECD left unchanged forecasts for economies that import oil, and downgraded forecasts for energy exporters

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Wednesday. "Overall, the near-term outlook remains for moderate, rather than rapid, world GDP growth; real investment remains sluggish, and labor is not yet fully engaged," the OECD said.

The OECD noted that "the outlook for the world economy has improved in the early months of 2015" due to lower oil prices and additional stimulus measures by several central banks.

The OECD left unchanged forecasts for economies that import oil, and downgraded forecasts for energy exporters such as Canada.

The OECD cut its Canadian growth forecasts to 2.2% for 2015 and to 2.1% in 2016, down from November estimate of 2.6% for 2015 and 2.4% for 2016.

It expect the U.S. will grow by 3.1% in 2015 and by 3% in 2016.

Japan's economy is expected to grow by 1% in 2015 and by 1.4% in 2016, up from November estimate of 0.8% for 2015 and 1.0% for 2016.

Eurozone's forecasts were upgraded to 1.4% in 2015 and to 2% in 2016.

China is expected to expand by about 7 percent in 2015, down from 7.1% estimate in November. Growth forecast for 2016 was left unchanged at 6.9%.

Global GDP is estimated to grow 4% in 2015 and 4.3% in 2016, up from 3.9% and from 4.1%.

-

15:51

Eurozone's trade surplus declines to €7.9 billion in December

Eurostat released trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus fell to €7.9 billion in December from €23.9 billion in November. November's figure was revised down from a surplus of €24.3 billion.

Unadjusted imports dropped 6% in January, while exports were flat.

The unadjusted traded balance was driven by a decline in the cost of energy imports.

The EU's trade deficit with Russia fell in January, while the trade deficit with China climbed.

For 2014 as whole, Eurozone's trade surplus rose to €192.9 billion from €151.9 billion in 2013. Exports increased 2%, while imports were unchanged.

Eurostat said that seasonally adjusted numbers were not available due to technical problems.

-

14:35

U.S. Stocks open: Dow -0.71%, Nasdaq -0.26%, S&P -0.33%

-

14:34

Canada’s wholesale sales drops 3.1% in January, the largest monthly decline since January 2009

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales dropped 3.1% in January, missing expectations for a 2.1% gain, after a 2.8% rise in December. It was the largest monthly decline since January 2009.

December's figure was revised up from a 2.5% increase.

Sales declined in four of seven subsectors, driven by a in the sale of motor vehicles and parts. Sales of motor vehicles and parts plunged 11.3% in January.

Sales excluding the motor vehicle sector decreased 1.3% in January.

-

14:21

Before the bell: S&P futures -0.38%, NASDAQ futures -0.35%

U.S. stock-index futures fell before the Federal Reserve's decision on monetary policy as oil prices slid for a seventh consecutive day.

Global markets:

Nikkei 19,544.48 +107.48 +0.55%

Hang Seng 24,120.08 +218.59 +0.91%

Shanghai Composite 3,577.04 +74.20 +2.12%

FTSE 6,905 +67.39 +0.99%

CAC 5,027.61 -1.32 -0.03%

DAX 11,900.8 -80.05 -0.67%

Crude oil $42.24 (-2.81%)

Gold $1146.50 (-0.15%)

-

14:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Apple Inc.

AAPL

127.05

+0.01%

210.0K

Tesla Motors, Inc., NASDAQ

TSLA

194.90

+0.09%

4.9K

Nike

NKE

97.00

+0.48%

4.1K

Yandex N.V., NASDAQ

YNDX

14.60

+0.76%

1.3K

Chevron Corp

CVX

103.17

0.00%

1.1K

UnitedHealth Group Inc

UNH

117.60

0.00%

0.6K

Google Inc.

GOOG

550.60

-0.04%

1.4K

Verizon Communications Inc

VZ

48.92

-0.06%

0.3K

Facebook, Inc.

FB

79.30

-0.08%

71.9K

Procter & Gamble Co

PG

82.73

-0.14%

0.2K

American Express Co

AXP

80.93

-0.16%

0.2K

Home Depot Inc

HD

115.40

-0.16%

0.1K

Johnson & Johnson

JNJ

99.72

-0.17%

0.3K

AT&T Inc

T

32.83

-0.21%

9.7K

JPMorgan Chase and Co

JPM

61.48

-0.21%

2.0K

Travelers Companies Inc

TRV

108.52

-0.21%

0.2K

Visa

V

263.90

-0.23%

3.7K

Intel Corp

INTC

30.52

-0.23%

3.5K

ALCOA INC.

AA

13.03

-0.23%

16.6K

E. I. du Pont de Nemours and Co

DD

74.50

-0.24%

0.1K

Deere & Company, NYSE

DE

88.40

-0.26%

0.2K

Twitter, Inc., NYSE

TWTR

46.81

-0.26%

5.9K

McDonald's Corp

MCD

95.90

-0.28%

3.2K

General Motors Company, NYSE

GM

38.16

-0.34%

1.6K

Amazon.com Inc., NASDAQ

AMZN

370.60

-0.35%

0.5K

Citigroup Inc., NYSE

C

53.64

-0.37%

4.1K

Walt Disney Co

DIS

106.53

-0.40%

89.4K

Barrick Gold Corporation, NYSE

ABX

10.29

-0.40%

6.7K

Starbucks Corporation, NASDAQ

SBUX

94.00

-0.41%

1.1K

Cisco Systems Inc

CSCO

28.03

-0.43%

0.9K

ALTRIA GROUP INC.

MO

51.40

-0.43%

0.2K

Pfizer Inc

PFE

34.02

-0.44%

5.6K

Exxon Mobil Corp

XOM

83.70

-0.45%

6.9K

Microsoft Corp

MSFT

41.49

-0.49%

8.7K

Ford Motor Co.

F

16.31

-0.49%

5.4K

Hewlett-Packard Co.

HPQ

32.27

-0.49%

0.1K

General Electric Co

GE

25.18

-0.51%

5.0K

The Coca-Cola Co

KO

40.30

-0.52%

0.9K

Caterpillar Inc

CAT

78.00

-0.57%

0.3K

Yahoo! Inc., NASDAQ

YHOO

43.40

-0.88%

1.0K

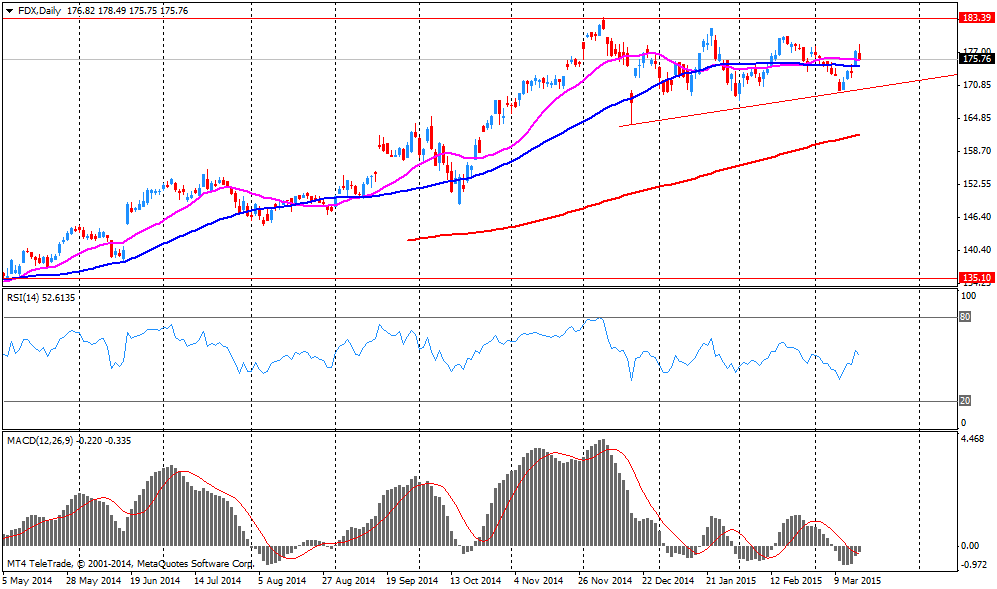

FedEx Corporation, NYSE

FDX

173.75

-1.12%

95.2K

Wal-Mart Stores Inc

WMT

81.30

-1.60%

7.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.10

-1.84%

7.9K

-

14:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised from $124 to $130 at Jefferies

-

13:47

Company News: FedEx (FDX) reported better than expected third fiscal quarter earnings, but revenue missed forecasts

FedEx (FDX) earned $2.01 per share in the third fiscal quarter, beating analysts' estimate of $1.88. Revenue in the third fiscal quarter increased 4.0% year-over-year to $11.7 billion, missing analysts' estimate of $11.8 billion.

The company downgraded its forecasts for the fiscal year 2015. EPS is expected to be $8.80-$8.95 (analysts' estimate: $8.97), down from a previous estimate of $8.50-$9.00.

FedEx (FDX) shares decreased to $173.89 (-1.04%) prior to the opening bell.

FedEx (FDX) is often called a "barometer of business activity in the world", as it is engaged in the transportation of the various products, and it responds to changes in supply and demand as one of the first companies.

-

13:32

Japan’s exports rise 2.4% in February

Japanese exports grew in February, driven by a weaker yen and strength in the U.S. economy, though the pace of gains was smaller than in previous months. It was the sixth consecutive increase. Exports increased 2.4% in February from the previous year, while imports declined 3.6%. Exports to China dropped 17.3% due to lower shipments of cars and car parts. Exports to the U.S. climbed 14.3% due to higher shipments of cars, car parts and construction equipment. Japan's trade deficit narrowed to ¥424.6 billion.

Japan's adjusted trade deficit widened to ¥638.8 billion in February from a deficit of ¥412.3 billion in January. Analysts had expected a deficit of ¥1,210.00 billion.

-

12:35

European stock markets mid-session: Indices mixed – FTSE up, DAX and CAC down

European indices are trading mixed, with the German DAX and the French CAC in negative territory, ahead of the FED's rate statement scheduled for 18:00 GMT, after the close of European stock markets. The wording will be closely watched to see if the pledge to be "patient" will be removed and a rate hike in June will become more likely.

Minutes from the last policy meeting of the Bank of England showed that all members of the committee voted unanimously to keep rates at the record-low level of 0.5% and its QE program unchanged. The strong economy could further strengthen the British pound and lead to inflation-rates below the targeted 2% - a level not seen for more than a year. A rate hike over the course of the next three years is seen more likely than not - although there was a "range of views" in the committee.

U.K.'s Unemployment Rate for February remained at 5.7%, a six-year low, analyst expected a decline to 5.6%. The Claimant Count fell seasonally adjusted 31,000 in February, compared to expectations for a decline of 30,000 people. Average earnings increased less-than-expected in the 3 months to January. Average earnings rose 1.8% compared to a previous reading of +2.1%, below the forecasted increase of +2.2%. Average earnings excluding boni rose +1.6%.

The FTSE 100 index is currently trading higher, quoted at 6,879.65. Germany's DAX 30 slumped -1.13% trading at 11,845.57 points. France's CAC 40 is currently trading at 5,005 points, -0.46%.

-

10:00

European stock markets First hour: Indices higher ahead of FED

European stocks open moderately higher on Wednesday ahead of the Federal Reserve's policy statement, due after European trading hours at 18:00 GMT. The wording of the statement will be closely watched to see if the pledge to be "patient" will be removed and if there is any further indication on when the FED is going to hike rates.

At 09:30 a set of U.K. data including the Bank of England Minutes will be in the focus. At 10:00 GMT Eurozone's Trade Balance will be reported. At 12:30 U.K.'s Annual Budget Release will be released.

Yesterday's data showed that Eurozone's Consumer Price Inflation fell -0.3% last month, in line with expectations and unchanged from a preliminary estimate.

The FTSE 100 index is currently trading +0.38% quoted at 6,863.83 points. Germany's DAX 30 is trading higher slightly below 12,000 points at 11,988.36 points +0.06%. France's CAC 40 is currently trading at 5,029.56 points, +0.01%.

-

09:00

Global Stocks: Wall Street nervous before FED, Nikkei at fresh 15-year high

U.S. stocks declined in nervous trading ahead of the FED's rate statement scheduled for today at 18:00 GMT to get an indication on the timing of an interest rate hike. The wording will be closely watched to see if the pledge to be "patient" will be removed. The S&P 500 closed -0.33% with a final quote of 2,074.28 points. The DOW JONES index lost -0.71% closing at 17,849.08 points.

Chinese stocks continued to add gains on Wednesday on speculations that the Chinese government will take further steps to stimulate economic growth. On Sunday Premier Li Keqiang announced to further stimulate the economy if necessary. Hong Kong's Hang Seng is trading higher adding +0.90% at 24,117.40 points. China's Shanghai Composite closed at 3,577.04 points closing +2.10% - up for a sixth consecutive day reaching the highest level since June 2008. In the last 12 months the index rose by almost 77%.

The Nikkei extended its 15-year closing high on Wednesday again as sentiment remains bullish and investors bet on an economic recovery. The index closed +0.60% with a final quote of 19,544.48 points. Nintendo was the biggest winner after announcing to enter the smart-phone market.

-

03:01

Nikkei 225 19,416.17 -20.83 -0.11 %, Hang Seng 24,106.02 +204.53 +0.86 %, Shanghai Composite 3,509.93 +7.08 +0.20 %

-

01:02

Stocks. Daily history for Mar 17’2015:

(index / closing price / change items /% change)

Nikkei 225 19,437 +190.94 +0.99 %

Hang Seng 23,901.49 -48.06 -0.20 %

Shanghai Composite 3,503.72 +54.42 +1.58 %

FTSE 100 6,837.61 +33.53 +0.49 %

CAC 40 5,028.93 -32.23 -0.64 %

Xetra DAX 11,980.85 -186.87 -1.54 %

S&P 500 2,074.28 -6.91 -0.33 %

NASDAQ Composite 4,937.44 +7.93 +0.16 %

Dow Jones 17,849.08 -128.34 -0.71 %

-