Noticias del mercado

-

22:08

The main US stock indexes completed the session in a positive territory

Major US stock indices grew moderately on Thursday, closing the wave of recessions on major world stock markets caused by uncertainty on the agenda of US President Donald Trump.

The reports that Trump tried to intervene in the investigation of the alleged Russian interference in the presidential elections in the US last year and that his aides had numerous undisclosed contacts with Russian officials held tensions on the market the day after the S & P 500 published the biggest fall From september.

In addition, as shown by the report submitted by the Federal Reserve Bank of Philadelphia, the index of business activity in the manufacturing sector increased in May, reaching a level of 38.8 points compared to 22 points in April. Economists had expected the decline to 19.5 points.

However, new applications for unemployment benefits in the US unexpectedly fell last week, and the number of Americans who continue to receive unemployment benefits has reached a 28.5-year low, indicating a rapid reduction in the weakness of the labor market. Primary requests for unemployment benefits fell by 4,000 to 232,000, seasonally adjusted for the week to May 13. This returned the appeals closely to the levels that were last seen in 1973.

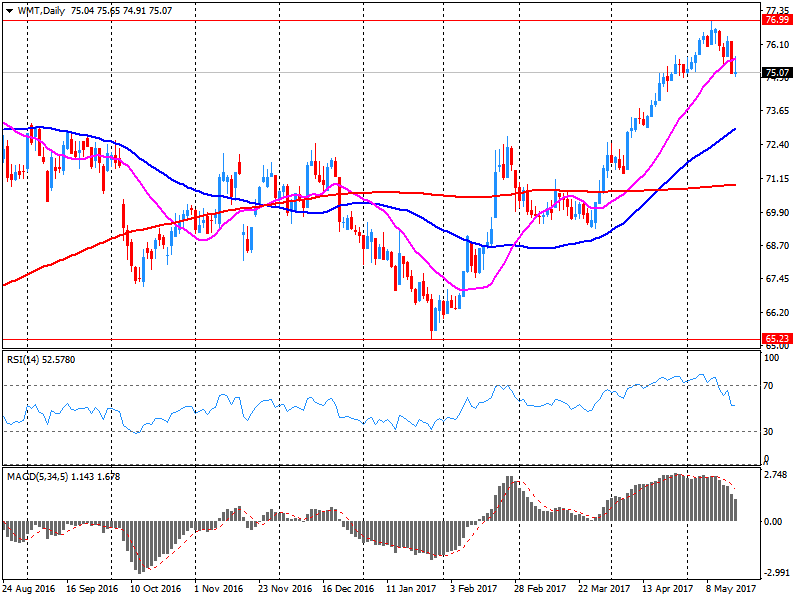

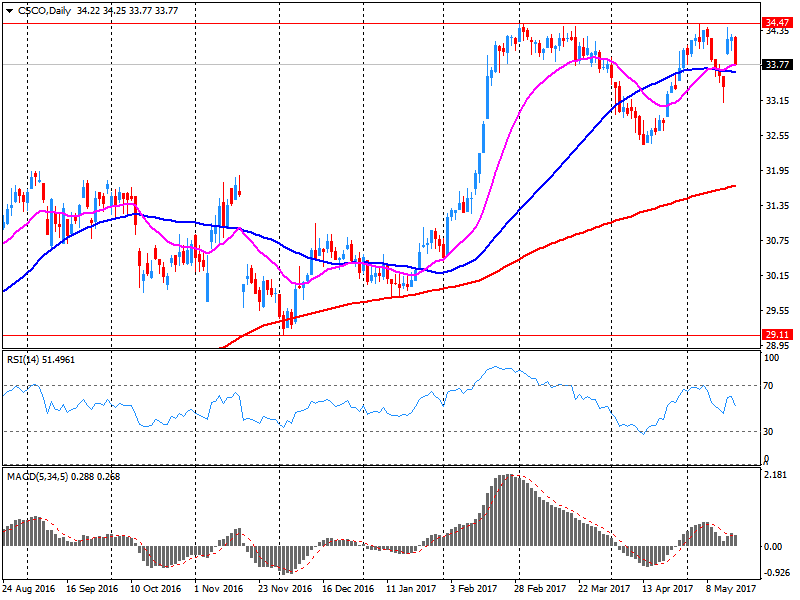

Most components of the DOW index finished trading in positive territory (21 out of 30). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 3.20%). More shares fell shares of Cisco Systems, Inc. (CSCO, -8.19%).

Most sectors of the S & P index recorded an increase. The growth leader was the conglomerate sector (+ 1.3%). The main materials sector fell most of all (-0.5%).

At closing:

DJIA + 0.27% 20.661.78 +54.85

Nasdaq + 0.73% 6,055.13 +43.89

S & P + 0.37% 2,365.73 +8.70

-

21:01

DJIA +0.51% 20,711.67 +104.74 Nasdaq +0.77% 6,057.80 +46.56 S&P +0.57% 2,370.37 +13.34

-

18:00

European stocks closed: FTSE 100 -67.05 7436.42 -0.89% DAX -41.55 12590.06 -0.33% CAC 40 -28.16 5289.73 -0.53%

-

15:32

U.S. Stocks open: Dow -0.22%, Nasdaq -0.22%, S&P -0.15%

-

15:26

Before the bell: S&P futures -0.33%, NASDAQ futures -0.08%

U.S. stock-index futures fell amid continuing uncertainties about President Donald Trump's political future and its impact on his pro-growth agenda.

Stocks:

Nikkei 19,553.86 -261.02 -1.32%

Hang Seng 25,136.52 -157.11 -0.62%

Shanghai 3,090.40 -14.04 -0.45%

S&P/ASX 5,738.31 -47.72 -0.82%

FTSE 7,413.39 -90.08 -1.20%

CAC 5,260.63 -57.26 -1.08%

DAX 12,532.10 -99.51 -0.79%

Crude $48.37 (-1.43%)

Gold $1,260.00 (+0.10%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

194.50

-0.34(-0.17%)

350

ALCOA INC.

AA

31.23

-0.40(-1.26%)

230

Amazon.com Inc., NASDAQ

AMZN

943.40

-1.36(-0.14%)

42661

Apple Inc.

AAPL

151.19

0.94(0.63%)

273744

AT&T Inc

T

37.53

0.07(0.19%)

12360

Barrick Gold Corporation, NYSE

ABX

17.02

-0.09(-0.53%)

59727

Boeing Co

BA

177.58

-1.20(-0.67%)

477

Caterpillar Inc

CAT

99.56

-0.58(-0.58%)

4331

Chevron Corp

CVX

104.30

-0.40(-0.38%)

2046

Cisco Systems Inc

CSCO

31.31

-2.51(-7.42%)

976709

Citigroup Inc., NYSE

C

59.27

-0.71(-1.18%)

158794

Deere & Company, NYSE

DE

113.00

-0.23(-0.20%)

1035

Exxon Mobil Corp

XOM

81.84

-0.15(-0.18%)

3079

Facebook, Inc.

FB

144.60

-0.25(-0.17%)

146373

Ford Motor Co.

F

10.74

-0.02(-0.19%)

23726

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.23

-0.20(-1.75%)

45943

General Electric Co

GE

27.35

-0.06(-0.22%)

61233

General Motors Company, NYSE

GM

32.23

-0.19(-0.59%)

4812

Goldman Sachs

GS

212.48

-1.24(-0.58%)

25554

Google Inc.

GOOG

918.00

-1.62(-0.18%)

7652

Home Depot Inc

HD

155.60

-0.49(-0.31%)

4155

Intel Corp

INTC

35.06

0.02(0.06%)

95520

International Business Machines Co...

IBM

151.00

0.07(0.05%)

37288

JPMorgan Chase and Co

JPM

83.69

-0.58(-0.69%)

66255

McDonald's Corp

MCD

146.00

-0.41(-0.28%)

1047

Merck & Co Inc

MRK

62.44

-0.56(-0.89%)

175

Microsoft Corp

MSFT

67.47

-0.01(-0.01%)

35645

Pfizer Inc

PFE

32.07

-0.16(-0.50%)

1599

Procter & Gamble Co

PG

86.16

-0.10(-0.12%)

3526

Starbucks Corporation, NASDAQ

SBUX

59.66

-0.07(-0.12%)

992

Tesla Motors, Inc., NASDAQ

TSLA

305.38

-0.73(-0.24%)

56292

The Coca-Cola Co

KO

43.84

-0.09(-0.20%)

8712

Twitter, Inc., NYSE

TWTR

18.20

-0.08(-0.44%)

127951

United Technologies Corp

UTX

119.00

-0.58(-0.49%)

628

UnitedHealth Group Inc

UNH

168.30

-0.56(-0.33%)

104

Verizon Communications Inc

VZ

44.50

0.02(0.05%)

7462

Visa

V

91.42

-0.34(-0.37%)

3908

Wal-Mart Stores Inc

WMT

76.40

1.28(1.70%)

251050

Walt Disney Co

DIS

105.33

-0.98(-0.92%)

1511

Yahoo! Inc., NASDAQ

YHOO

48.60

-1.05(-2.11%)

87485

Yandex N.V., NASDAQ

YNDX

27.30

-0.28(-1.02%)

34083

-

14:40

Target price changes before the market open

Johnson & Johnson (JNJ) target raised to $128 from $124 at Stifel

-

14:21

Company News: Walmart (WMT) Q1 EPS beat analysts’ forecast

Walmart (WMT) reported Q1 FY 2018 earnings of $1.00 per share (versus $0.98 in Q1 FY 2017), beating analysts' consensus of $0.96.

The company's quarterly revenues amounted to $116.526 bln (+1.3% y/y), generally in-line with analysts' consensus estimate of $117.013 bln.

The company also issued guidance for Q2, projecting EPS of $1.00-1.08 versus analysts' consensus estimate of $1.07.

WMT rose to $75.99 (+1.16%) in pre-market trading.

-

14:09

Company News: Cisco Systems (CSCO) Q3 EPS beat analysts’ estimates

Cisco Systems (CSCO) reported Q3 FY 2017 earnings of $0.60 per share (versus $0.57 in Q3 FY 2016), beating analysts' consensus of $0.58.

The company's quarterly revenues amounted to $11.940 bln (-0.5% y/y), generally in-line with analysts' consensus estimate of $11.900 bln.

The company also issued guidance for Q4, projecting EPS of $0.60-0.62 (versus analysts' consensus estimate of $0.62) and revenues of $11.88-12.13 bln, down 4-6% y/y (versus analysts' consensus estimate of $12.53 bln).

CSCO fell to $31.22 (-7.69%) in pre-market trading.

-

09:32

Major stock markets in Europe trading mixed: FTSE 7477.79 -25.68 -0.34%, DAX 12633.56 +1.95 + 0.02%, CAC 5319.60 +1.71 + 0.03%

-

08:52

Negative start of trading on the main stock markets of Europe is expected: DAX -0.4%, CAC40 -0.5%, FTSE -0.3%.

-

07:38

Global Stocks

European stocks moved sharply lower on Wednesday, with investors rattled by the latest political turmoil in the U.S. that is feared to put President Donald Trump's pro-growth agenda at risk.

The Nasdaq on Wednesday saw its worst one-day decline since the day after U.K.'s vote to exit from the European Union rattled markets, as turmoil in Washington cast doubt on President Donald Trump's pro-growth agenda that had helped to drive stocks to records.

Asian equity markets were broadly lower, extending a selloff in the U.S. overnight, as doubts increased that the Trump administration would be able to deliver on its policy goals due to mounting political problems.

-

00:30

Stocks. Daily history for May 17’2017:

(index / closing price / change items /% change)

Nikkei -104.94 19814.88 -0.53%

TOPIX -8.41 1575.82 -0.53%

Hang Seng -42.31 25293.63 -0.17%

CSI 300 -18.68 3409.97 -0.54%

Euro Stoxx 50 -57.06 3584.83 -1.57%

FTSE 100 -18.56 7503.47 -0.25%

DAX -172.92 12631.61 -1.35%

CAC 40 -88.21 5317.89 -1.63%

DJIA -372.82 20606.93 -1.78%

S&P 500 -43.64 2357.03 -1.82%

NASDAQ -158.64 6011.23 -2.57%

S&P/TSX -269.65 15273.68 -1.73%

-