Noticias del mercado

-

22:06

Major US stock indexes closed mixed

Major US stock indexes closed mixed. Investors assessed corporate accountability, as well as news about a possible merger in the biotech industry. This week reports for the last quarter unveil more than 140 companies from the index Standard & Poor's 500. According to analysts, the total profit of the companies index decreased in January-March by 4.3% on an annualized basis, whereas on April 10 forecast anticipated drop in the index 5.6%. "Market participants have gone too far in their expectations reduce corporate profits in the US - said investment director Reyl & Cie. Francois Savary. - With the publication of the new reporting quotations may grow. However, I am still cautious attitude towards the prospects for GDP growth in the US coming quarters because of the weak global economy and a strong dollar. "

Meanwhile, Goldman Sachs and data Retail Economist LLC, showed that weekly sales index in retail stores during the week April 12-18 decreased by 0.1% compared to the previous week. The index is calculated based on seasonally adjusted and based on sales in those stores that operated in both periods being compared. Compared to the same period of the previous year, sales rose by 3.3%.

At the same time, the price of oil futures declined in today's trading, due to the upcoming expiration of the May contract, as well as the expectations of the publication of data on stocks of petroleum products in the United States. Meanwhile, there are rumors that the reserves at the terminal in Cushing could fall from a record high of 61.5 million barrels. Investors have recently expressed concerns that the storage terminal may soon be filled to capacity.

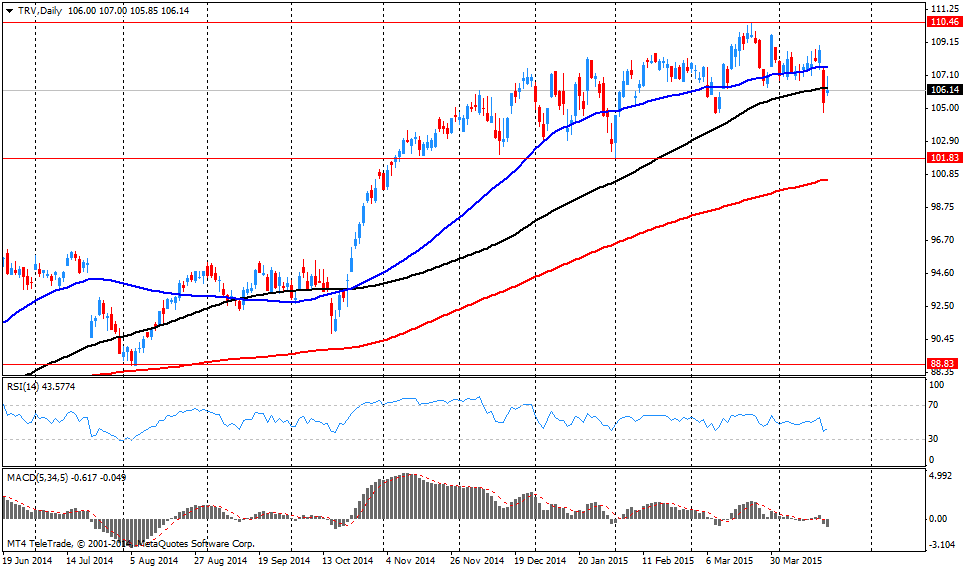

Most components of the index DOW closed in the red (18 of 30). Outsider were shares The Travelers Companies, Inc. (TRV, -4.12%). Shares rose more than the rest Visa Inc. (V, + 0.99%).

Sector S & P index ended the day mixed. Most of the health sector increased (+ 0.9%). Outsiders were the basic materials sector (-0.8%).

At the time of closing:

Dow -0.47% 17,950.85 -84.08

Nasdaq + 0.39% 5,014.10 +19.50

S & P -0.14% 2,097.45 -2.95

-

21:00

Dow -0.37% 17,967.87 -67.06 Nasdaq +0.49% 5,019.29 +24.69 S&P -0.06% 2,099.24 -1.16

-

18:38

Wall Street. Major U.S. stock-indexes mixed

Major U.S. indexes moving mixed on Tuesday, with the Dow industrials weighed by companies reporting earnings while the Nasdaq gained on the back of a proposed merger in the biotech sector.

Most of the Dow stocks are trading in negative area (20 of 30). Top looser - The Travelers Companies, Inc. (TRV, -2.88%). Top gainer - Visa Inc. (V, +1.41%).

S&P index sectors are moving mixed. Top looser - Basic Materials (-0.5%) - Top gainer - Healthcare (+0.9%).

At the moment:

Dow 17878.00 -65.00 -0.36%

S&P 500 2091.25 +0.25 +0.01%

Nasdaq 100 4427.50 +20.00 +0.45%

10-year yield 1.90% +0.01

Oil 57.52 -0.36 -0.62%

Gold 1199.70 +6.00 +0.50%

-

18:07

European stocks close: stocks closed higher despite the weaker-than-expected German ZEW economic sentiment index

Stock indices closed higher despite the weaker-than-expected German ZEW economic sentiment index. Germany's ZEW economic sentiment index decreased unexpectedly to 53.3 in April from 54.8 in March, missing expectations for a rise to 56.0.

It was the first decrease since October 2014.

The decline was driven by lower export prospects.

The ZEW President Clemens Fuest said that Germany's economy "is in good shape".

Eurozone's ZEW economic sentiment index rose to 64.8 in April from 62.4 in March, beating expectations for a gain to 63.7.

The Greek debt problem continue to weigh on markets. The country is still running out of cash, and it needs a new tranche of loans. The Greek government hopes to unblock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The head of the Eurogroup Jeroen Dijsselbloem said today that he expects that Greece and its creditors will sign an agreement in the coming weeks. He added that a Greek exit could lead to "very dangerous instability" in the Eurozone.

"It's in the interests of Greece and the euro zone as a whole to avoid that," Dijsselbloem said.

The European Central Bank (ECB) is studying measures on Greek banks in return for emergency liquidity. The ECB staff have proposed to increase the haircuts on Greek bank collateral when borrowing from the Bank of Greece, people with knowledge of the situation said.

The proposal hasn't been discussed by the ECB Governing Council.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,062.93 +10.80 +0.15 %

DAX 11,939.58 +47.67 +0.40 %

CAC 40 5,192.64 +5.05 +0.10 %

-

18:00

European stocks closed: FTSE 100 7,062.93 +10.80 +0.15% CAC 40 5,192.64 +5.05 +0.10% DAX 11,939.58 +47.67 +0.40%

-

16:57

Head of the Eurogroup Jeroen Dijsselbloem expects that Greece and its creditors will sign an agreement in the coming weeks

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that he expects that Greece and its creditors will sign an agreement in the coming weeks. He added that a Greek exit could lead to "very dangerous instability" in the Eurozone.

"It's in the interests of Greece and the euro zone as a whole to avoid that," Dijsselbloem said.

Dijsselbloem pointed out that Greece must meet its conditions and agreements if it wants to remain in the Eurozone.

Greece is still running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24.

-

16:17

European Central Bank is studying measures on Greek banks in return for emergency liquidity

The European Central Bank (ECB) is studying measures on Greek banks in return for emergency liquidity. The ECB staff have proposed to increase the haircuts on Greek bank collateral when borrowing from the Bank of Greece, people with knowledge of the situation said.

The proposal hasn't been discussed by the ECB Governing Council.

The Bank of Greece keeps a buffer of around 3 billion euros of Emergency Liquidity Assistance (ELA) allowance in reserve.

-

15:33

U.S. Stocks open: Dow +0.35%, Nasdaq +0.65%, S&P +0.43%

-

15:27

Before the bell: S&P futures +0.51%, NASDAQ futures +0.61%

U.S. stock-index futures rose amid mixed corporate earnings.

Global markets:

Nikkei 19,909.09 +274.60 +1.40%

Hang Seng 27,850.49 +755.56 +2.79%

Shanghai Composite 4,294.31 +77.23 +1.83%

FTSE 7,075.39 +23.26 +0.33%

CAC 5,214.88 +27.29 +0.53%

DAX 12,021.89 +129.98 +1.09%

Crude oil $56.43 (+0.09%)

Gold $1198.80 (+0.43%)

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

152.68

+0.01%

0.6K

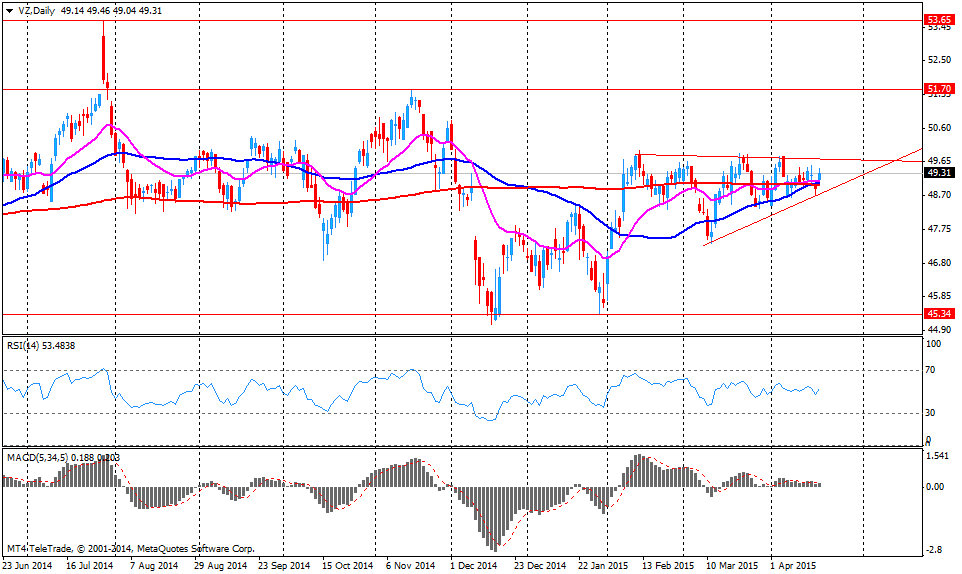

Verizon Communications Inc

VZ

49.39

+0.02%

122.5K

Home Depot Inc

HD

112.90

+0.04%

0.2K

Caterpillar Inc

CAT

84.65

+0.06%

0.2K

McDonald's Corp

MCD

96.25

+0.07%

0.8K

American Express Co

AXP

77.30

+0.09%

1.8K

AT&T Inc

T

32.86

+0.09%

9.4K

Microsoft Corp

MSFT

42.97

+0.15%

8.2K

The Coca-Cola Co

KO

40.72

+0.15%

16.5K

General Electric Co

GE

27.07

+0.19%

74.9K

Wal-Mart Stores Inc

WMT

78.32

+0.23%

7.6K

Cisco Systems Inc

CSCO

28.55

+0.25%

5.0K

Tesla Motors, Inc., NASDAQ

TSLA

205.80

+0.26%

4.6K

Citigroup Inc., NYSE

C

53.35

+0.28%

1.0K

3M Co

MMM

164.99

+0.29%

1.5K

Intel Corp

INTC

32.83

+0.31%

4.7K

Pfizer Inc

PFE

35.12

+0.31%

2.7K

AMERICAN INTERNATIONAL GROUP

AIG

57.69

+0.31%

0.2K

Exxon Mobil Corp

XOM

87.52

+0.32%

1.0K

Apple Inc.

AAPL

128.07

+0.37%

222.2K

Amazon.com Inc., NASDAQ

AMZN

391.10

+0.41%

11.6K

Google Inc.

GOOG

537.62

+0.42%

0.8K

Walt Disney Co

DIS

108.70

+0.44%

9.8K

Ford Motor Co.

F

15.98

+0.44%

8.0K

Johnson & Johnson

JNJ

100.68

+0.47%

0.2K

Starbucks Corporation, NASDAQ

SBUX

48.20

+0.48%

2.9K

Twitter, Inc., NYSE

TWTR

51.68

+0.54%

21.6K

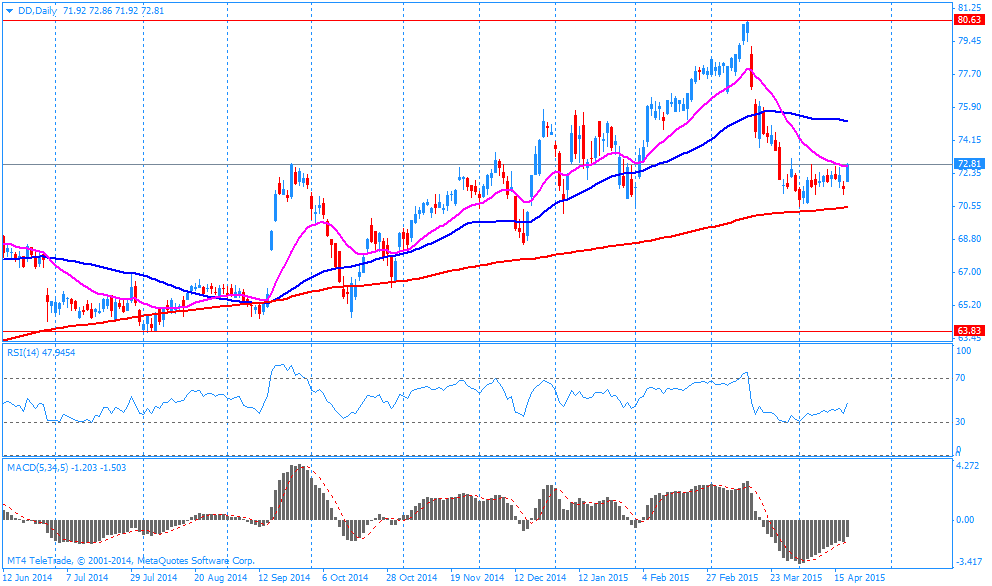

E. I. du Pont de Nemours and Co

DD

73.25

+0.56%

5.4K

Hewlett-Packard Co.

HPQ

33.60

+0.57%

7.2K

ALCOA INC.

AA

13.66

+0.59%

18.2K

Procter & Gamble Co

PG

83.38

+0.62%

1.2K

Barrick Gold Corporation, NYSE

ABX

12.83

+0.63%

0.7K

Facebook, Inc.

FB

83.76

+0.81%

194.6K

General Motors Company, NYSE

GM

37.48

+0.99%

19.9K

Yahoo! Inc., NASDAQ

YHOO

45.14

+1.09%

78.3K

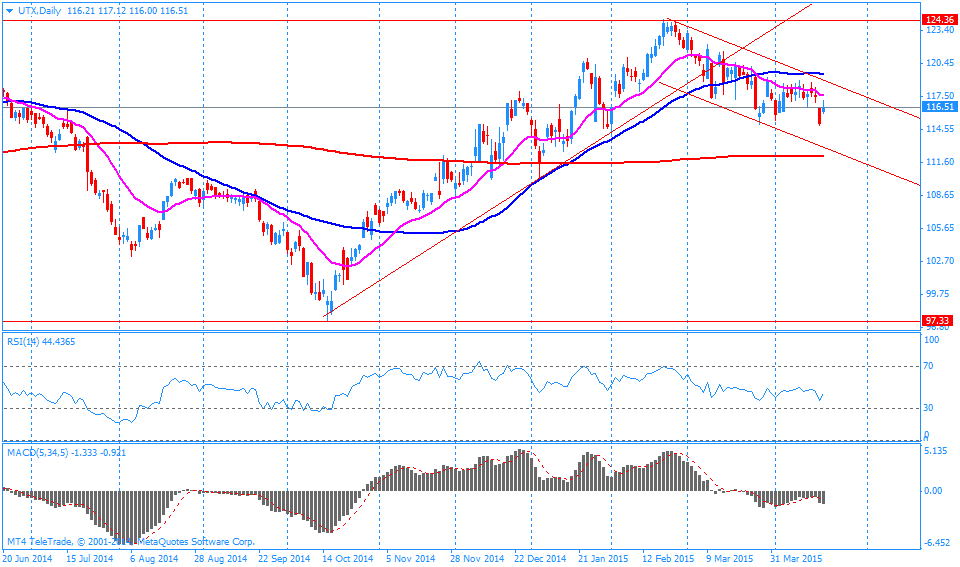

United Technologies Corp

UTX

118.01

+1.29%

2.3K

Merck & Co Inc

MRK

57.61

0.00%

0.1K

ALTRIA GROUP INC.

MO

52.60

-0.06%

0.1K

Nike

NKE

99.62

-0.37%

2.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.58

-0.39%

0.3K

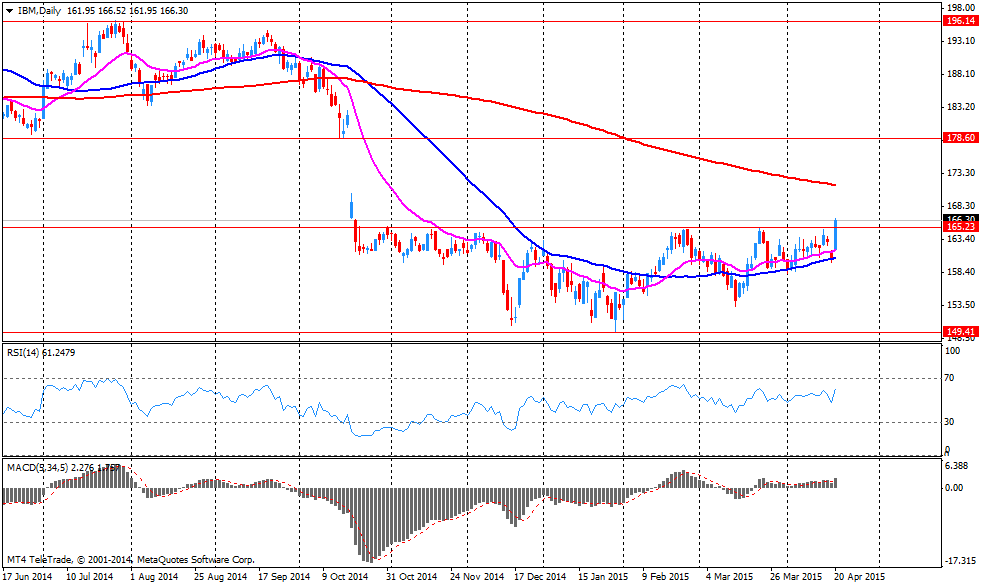

International Business Machines Co...

IBM

165.01

-0.69%

74.2K

Yandex N.V., NASDAQ

YNDX

20.39

-0.73%

11.0K

International Paper Company

IP

54.00

-1.19%

0.7K

Travelers Companies Inc

TRV

104.50

-1.55%

1.2K

-

15:02

-

15:01

Canada’s wholesale sales falls 0.4% in February

Statistics Canada released wholesale sales figures on Tuesday. Wholesale sales declined 0.4% in February, after a 2.9% drop in January.

January's figure was revised up from a 3.1% decline.

The decline was driven by lower sales in the building material and supplies subsector. Sales in the building material and supplies subsector slid 2.7%.

Sales decreased in three of the seven subsectors.

Sales of automobiles and parts dropped by 1.4% in February.

Inventories climbed by 0.6% in February. It was the 14th consecutive increase.

-

14:56

-

14:48

Company News: United Technologies Corp (UTX) reported better than expected EPS, but revenue was slightly less estimates

Company reports Q1 earnings of $1.51 per share versus $1.46 consensus. Revenues fell 1.4% year/year to $14.54 bln versus $14.87 bln consensus.

Company reaffired guidance for FY15: EPS expected at $6.85-7.05 versus $6.97 consensus, revenue expected at $65-$66 bln versus $65.38 bln consensus.

UTX rose to $118.25 (+1.49%) on the premarket.

-

14:40

-

14:32

-

14:13

The European Central Bank (ECB) Governing Council Member and Banque de France Governor Christian Noyer: quantitative easing by the ECB has been “very effective”

The European Central Bank (ECB) Governing Council Member and Banque de France Governor Christian Noyer said in New York on Monday that quantitative easing is "necessary but complex". Quantitative easing by the ECB has been "very effective", he noted.

-

12:00

European stock markets mid session: stocks traded mixed after the ZEW economic sentiment data from the Eurozone

Stock indices traded mixed after the ZEW economic sentiment data from the Eurozone. Germany's ZEW economic sentiment index decreased unexpectedly to 53.3 in April from 54.8 in March, missing expectations for a rise to 56.0.

It was the first decrease since October 2014.

The decline was driven by lower export prospects.

The ZEW President Clemens Fuest said that Germany's economy "is in good shape".

Eurozone's ZEW economic sentiment index rose to 64.8 in April from 62.4 in March, beating expectations for a gain to 63.7.

The Greek debt problem continue to weigh on markets. The country is still running out of cash, and it needs a new tranche of loans. The Greek government hopes to unblock a new tranche of loans at the Eurogroup meeting on April 24.

Current figures:

Name Price Change Change %

FTSE 100 7,048.48 -3.65 -0.05 %

DAX 11,943.19 +51.28 +0.43 %

CAC 40 5,181.61 -5.98 -0.12 %

-

11:42

Germany's ZEW economic sentiment index falls unexpectedly to 53.3 in April

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased unexpectedly to 53.3 in April from 54.8 in March, missing expectations for a rise to 56.0.

It was the first decrease since October 2014.

The decline was driven by lower export prospects.

The ZEW President Clemens Fuest said that Germany's economy "is in good shape".

"The current weakness of the world economy is dampening export prospects and reducing the scope for further improvements of the economic situation in Germany," Fuest added.

Eurozone's ZEW economic sentiment index rose to 64.8 in April from 62.4 in March, beating expectations for a gain to 63.7.

-

11:17

Greek current account deficit widened to €929 million in February

The Greek current account deficit widened to €929 million in February from €729 million a year ago.

The goods trade deficit narrowed to €1.15 billion in February from EUR 1.50 billion in February 2014.

The surplus on services trade declined to €501.6 million from €613.3 million a year ago.

-

10:57

Bank of Canada Governor Stephen Poloz: that interest rate hike by the Fed will have a positive impact on the Canadian economy

The Bank of Canada (BoC) Governor Stephen Poloz said at the Bloomberg Americas Monetary Summit in New York on Monday that the further interest rate cut by the BoC is not needed.

"That amount seems to be about right to restore our track for the Canadian economy for the next year or so and get the output gap to close late in 2016," Poloz noted.

The BoC governor described a shock January interest rate cut as "insurance". The BoC lowered its interest rate to 0.75% from 1.0% on January 21 due to falling oil prices.

Poloz also said that the U.S. economy will expand stronger than expected, and that interest rate hike by the Fed will have a positive impact on the Canadian economy.

The BoC governor hopes that Canada's interest rate would be "normalized" by 2016.

-

10:22

April’s Reserve Bank of Australia monetary policy meeting: further interest rate cut might be needed

The Reserve Bank of Australia (RBA) released its minutes from April monetary policy meeting on Tuesday. The RBA said that further interest rate cut might be needed "to foster sustainable growth in demand and inflation consistent with the target".

The RBA Board members want to wait for the new inflation data whether the Australian economy has responded to the interest rate cut in February.

The central bank noted that the Australian economy continue to expand below the trend in the December quarter and into the first quarter of 2015 despite the lower Australian dollar.

Household consumption had increased in the December quarter due to low interest rates and rising household wealth, according to the RBA.

The central bank said that "labour market conditions were likely to remain subdued".

The RBA kept its interest rate unchanged at 2.25% on April 07.

-

03:59

Nikkei 225 19,807.8 +173.31 +0.88%, Hang Seng 27,540.63 +445.70 +1.64%, Shanghai Composite 4,212.19 -4.89 -0.12%

-

00:36

Stocks. Daily history for Apr 20’2015:

(index / closing price / change items /% change)

Nikkei 225 19,634.49 -18.39 -0.09 %

Hang Seng 27,094.93 -558.19 -2.02 %

S&P/ASX 200 5,833.12 -44.75 -0.76 %

Shanghai Composite 4,218.12 -69.18 -1.61 %

FTSE 100 7,052.13 +57.50 +0.82 %

CAC 40 5,187.59 +44.33 +0.86 %

Xetra DAX 11,891.91 +203.21 +1.74 %

S&P 500 2,100.4 +19.22 +0.92 %

NASDAQ Composite 4,994.6 +62.79 +1.27 %

Dow Jones 18,034.93 +208.63 +1.17 %

-