Noticias del mercado

-

22:05

Major US stock indexes rose slightly on Thursday

Major US stock indexes rose slightly on Thursday. Weak economic data from the US, Europe and China, along with disappointing earnings forecasts US corporations were offset by growth in the energy sector.

As reported by the Commerce Department, new home sales fell sharply in March, which was another sign of fluctuating demand for housing, despite the persistently low mortgage rates and steady job growth. New home sales fell by 11.4% in February and to a seasonally adjusted annual rate reached 481 000. Thus ended three months of strong growth, and noted the sharpest decline since July 2013. Economists had expected sales will fall in March to a level of 514,000.

In addition, according to the report of the company Markit, growth in the US manufacturing sector slowed more than expected in April, noting the slowest pace since January. Markit said that its preliminary index of purchasing managers in the US manufacturing fell to 54.2 in April from March, the final reading of 55.7. Economists predicted that the figure will reach 55.6 in April. A reading above 50 indicates growth in the sector.

Oil has increased significantly today, approaching to $ 65 (Brent) and $ 58 (WTI), which is associated with exacerbation of tensions in the Middle East. In addition, support has quotes depreciation of the US dollar.

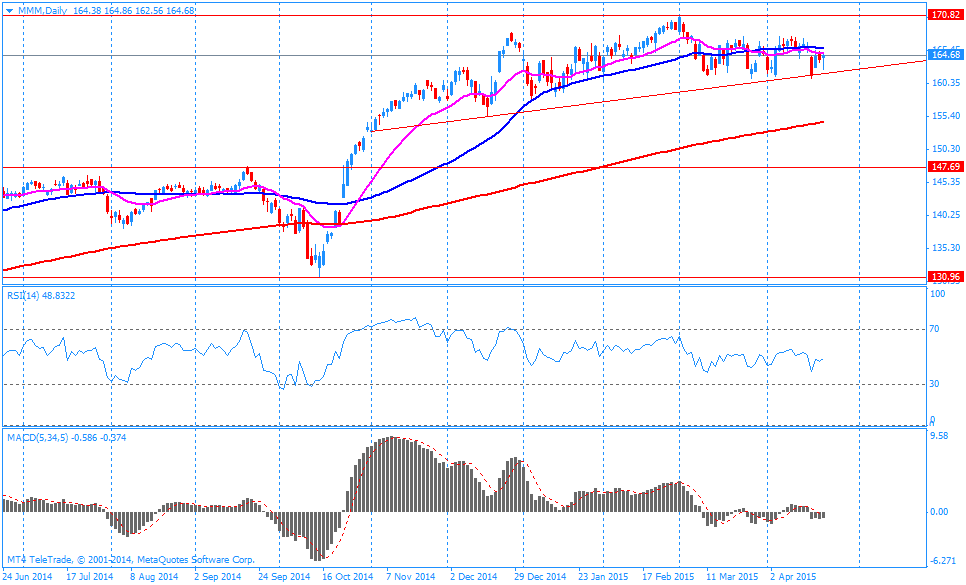

Most components of the index DOW closed in positive territory (19 of 30). Outsider shares were 3M Company (MMM, -2.95%). Shares rose more than the rest International Business Machines Corporation (IBM, + 3.33%).

All sectors of the S & P finished trading above the zero mark. Increased the most basic materials sector (+ 1.1%).

At the time of closing:

Dow + 0.11% 18,058.89 +20.62

Nasdaq + 0.41% 5,056.06 +20.89

S & P + 0.24% 2,112.93 +4.97

-

21:00

Dow +0.37% 18,104.21 +65.94 Nasdaq +0.59% 5,064.87 +29.70 S&P +0.43% 2,117.11 +9.15

-

18:45

Wall Street. Major U.S. stock-indexes ticked up

Major U.S. indexes rose on Thursday afternoon with the Nasdaq Composite briefly trading above its all-time closing high, helped by gains in energy stocks as oil prices jumped.

-

Most of the Dow stocks are trading in positive area (17 of 30). Top looser - 3M Company (MMM, -2.11%). Top gainer - International Business Machines Corporation (IBM, +3.40%).

All S&P index sectors are moving up. Top gainer - Basic Materials (+1,1%).

At the moment:

Dow 18007.00 +62.00 +0.35%

S&P 500 2107.25 +7.00 +0.33%

Nasdaq 100 4464.75 +19.50 +0.44%

10-year yield 1.97% +0.00

Oil 57.94 +1.78 +3.17%

Gold 1191.00 +4.10 +0.35%

-

18:05

European stocks close: stocks closed mixed as weaker-than-expected PMIs from the Eurozone weighed on markets

Stock indices closed mixed as weaker-than-expected PMIs from the Eurozone weighed on markets. Eurozone's preliminary manufacturing PMI decreased to 51.9 in April from 52.2 in March, missing expectations for a rise to 52.6.

Eurozone's preliminary services PMI declined to 53.7 in April from 54.2 in March. Analysts had expected the index to climb to 54.5.

Germany's preliminary manufacturing PMI fell to 51.9 in April from 52.8 in March, missing forecasts of an increase to 53.1.

Germany's preliminary services PMI decreased to 54.4 in April from 55.4 in March, missing expectations for a gain to 55.6.

The decline was driven by lower new orders and by a rise in prices.

France's preliminary manufacturing PMI was down to 48.4 in April from 48.8 in March, missing forecasts of a rise to 49.4.

France's preliminary services PMI dropped to 50.8 in April from 52.4 in March, missing expectations for a gain to 52.5.

The Greek debt crisis remains in focus. Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras met German Chancellor Angela Merkel ahead of the EU summit in Brussels today. The exact extent or nature of the conversation was not immediately known.

Retail sales in the U.K. decreased 0.5% in March, missing expectations for a 0.4% rise, after a 0.6% gain in February. February's figure was revised down from a 0.7% increase.

It was the first decline in six months.

The decrease was driven by a drop in fuel sales. Fuel sales plunged 6.2%, the biggest drop since April 2012.

On a yearly basis, retail sales in the U.K. climbed 4.2% in March, missing forecasts of 5.4% increase, after a 5.4% rise in February. February's figure was revised down from a 5.7% gain.

The public sector net borrowing in the U.K. rose to £6.74 billion in March from £4.8 billion in February, missing expectations for a rise to £6.6 billion. February's figure was revised down from £6.2 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,053.67 +25.43 +0.36 %

DAX 11,723.58 -143.79 -1.21 %

CAC 40 5,178.91 -32.18 -0.62 %

-

18:00

European stocks closed: FTSE 100 7,053.67 +25.43 +0.36% CAC 40 5,178.91 -32.18 -0.62% DAX 11,723.58 -143.79 -1.21%

-

16:57

New home sales plunge 11.4% in March, the steepest fall since July 2013

The U.S. Commerce Department released new home sales data on Thursday. New home sales dropped 11.4% to a seasonally adjusted annual rate of 481,000 units in March from 543,000 units in February. It was the steepest fall since July 2013.

February's figure was revised up from 539,000 units.

Analysts had expected new home sales to reach 514,000 units.

The drop was driven by lower sales in the Northeast in the South. New home sales in the Northeast plunged 33.3% in March, while new home sales in the South slid 15.8%.

The median sales price of new houses sold was $277,400 in March, down from $281,600 in February.

-

16:28

U.S. preliminary manufacturing purchasing managers' index (PMI) declines to 54.2 in April

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Thursday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 54.2 in April from 55.7 in March, missing expectations for a decline to 55.6.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that "key to the slowdown was a weakening of export orders, in turn a symptom of the loss of competitiveness arising from the dollar's strength".

He added that domestic demand remained robust.

The preliminary new orders index slid to 55.4 in April from 57.2 in March.

-

16:10

European Central Bank Chief Economist Peter Praet: quantitative easing by the ECB is “now gaining traction”

The European Central Bank (ECB) Chief Economist Peter Praet said on Thursday that quantitative easing by the ECB is "now gaining traction".

"The recovery is firming, and inflation expectations seem to be moving towards values more consistent with our aim," Praet said.

The ECB chief economist pointed out that there is the beginnings of a cyclical recovery, "but it is not yet a structural one".

-

15:48

Swiss trade surplus rises to CHF2.52 billion in March

The Swiss trade surplus climbed to CHF2.52 billion in March from CHF2.32 billion in the previous month. Analysts had expected the surplus to decline to CHF2.16 billion.

Exports increased 4.2% in March, while imports were up 6.8%.

The trade surplus declined to CHF8.2 billion in the first quarter from CHF8.4 billion in the previous quarter.

Exports dropped 1.7% in the first quarter, while imports climbed 0.8%.

-

15:35

U.S. Stocks open: Dow -0.32%, Nasdaq -0.26%, S&P -0.19%

-

15:24

Before the bell: S&P futures -0.27%, NASDAQ futures -0.25%

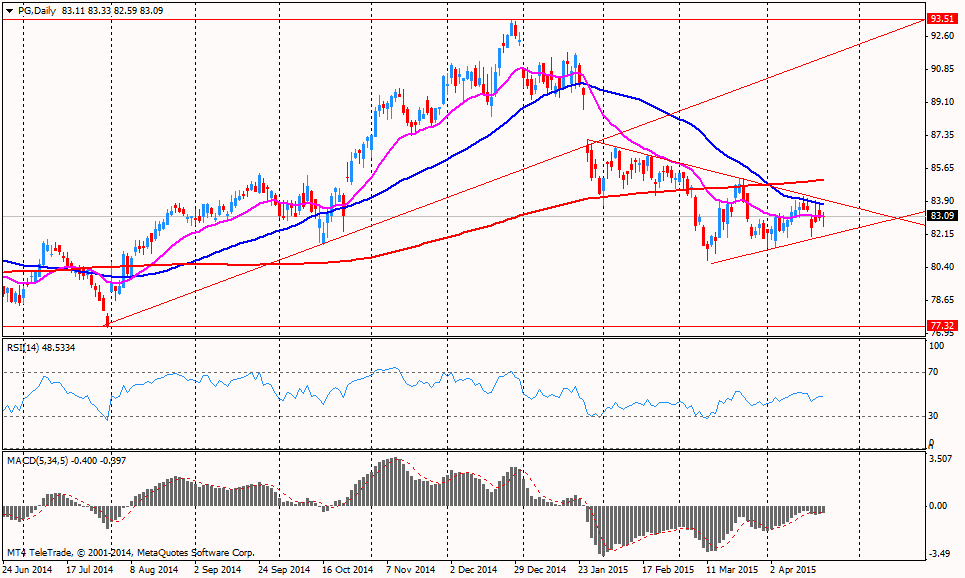

U.S. index futures declined, signaling equities will retreat after nearing records, as a stronger dollar took a toll on sales at companies including Procter & Gamble Co. and Facebook Inc.

Global markets:

Nikkei 20,187.65 +53.75 +0.27%

Hang Seng 27,827.7 -106.15 -0.38%

Shanghai Composite 4,414.88 +16.39 +0.37%

FTSE 7,029.55 +1.31 +0.02%

CAC 5,163.04 -48.05 -0.92%

DAX 11,721.23 -146.14 -1.23%

Crude oil $56.41 (+0.46%)

Gold $1188.40 (+0.12%)

-

15:19

European Central Bank Executive Board Member Benoit Coeure: there are signs of the economic recovery in the Eurozone

The European Central Bank (ECB) Executive Board Member Benoit Coeure said in an interview on Thursday that there are signs of the economic recovery in the Eurozone. He added that business and household confidence indicators increased.

He pointed out that Eurozone's recovery is still "insufficient and somewhat unequally spread from country to country".

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Caterpillar Inc

CAT

88,00

3,69%

320.4K

AT&T Inc

T

33,35

1,49%

338.4K

Starbucks Corporation, NASDAQ

SBUX

48,74

0,84%

15.5K

Deere & Company, NYSE

DE

88,58

0,54%

5.7K

Barrick Gold Corporation, NYSE

ABX

12,41

0,32%

2.8K

Google Inc.

GOOG

540,50

0,21%

3.9K

Amazon.com Inc., NASDAQ

AMZN

390,50

0,18%

0.7K

Visa

V

68,10

0,13%

8.8K

Verizon Communications Inc

VZ

49,63

0,12%

2.8K

Twitter, Inc., NYSE

TWTR

51,78

0,10%

44.7K

Exxon Mobil Corp

XOM

87,50

0,05%

0.1K

Hewlett-Packard Co.

HPQ

33,50

-0,03%

0.3K

Yandex N.V., NASDAQ

YNDX

20,69

-0,05%

0.4K

Goldman Sachs

GS

198,20

-0,06%

0.5K

Yahoo! Inc., NASDAQ

YHOO

43,95

-0,06%

5.5K

The Coca-Cola Co

KO

41,26

-0,12%

4.9K

Apple Inc.

AAPL

128,45

-0,13%

157.5K

Boeing Co

BA

150,98

-0,14%

90.5K

Wal-Mart Stores Inc

WMT

78,30

-0,17%

0.2K

General Electric Co

GE

26,86

-0,19%

13.1K

Johnson & Johnson

JNJ

100,23

-0,20%

1.4K

Pfizer Inc

PFE

34,85

-0,23%

0.6K

Walt Disney Co

DIS

107,61

-0,31%

0.4K

Citigroup Inc., NYSE

C

52,90

-0,38%

7.6K

International Business Machines Co...

IBM

164,72

-0,39%

0.9K

E. I. du Pont de Nemours and Co

DD

71,15

-0,41%

0.6K

Facebook, Inc.

FB

84,28

-0,41%

890.6K

JPMorgan Chase and Co

JPM

62,65

-0,46%

3.2K

ALTRIA GROUP INC.

MO

51,87

-0,48%

1.2K

Microsoft Corp

MSFT

42,76

-0,52%

5.2K

McDonald's Corp

MCD

97,25

-0,60%

0.9K

Tesla Motors, Inc., NASDAQ

TSLA

218,00

-0,66%

8.8K

UnitedHealth Group Inc

UNH

117,00

-0,69%

0.6K

Ford Motor Co.

F

15,80

-0,69%

23.1K

Cisco Systems Inc

CSCO

28,40

-0,77%

7.9K

Intel Corp

INTC

32,20

-1,53%

22.1K

Procter & Gamble Co

PG

81,50

-1,91%

31.9K

ALCOA INC.

AA

13,30

-1,99%

217.3K

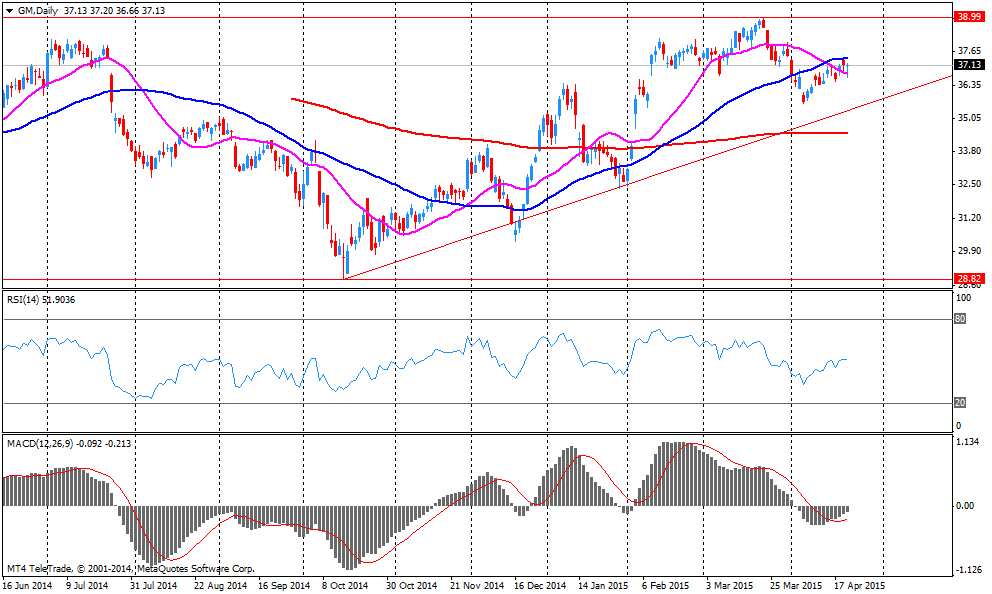

General Motors Company, NYSE

GM

36,24

-2,48%

627.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20,05

-2,53%

10.7K

3M Co

MMM

160,25

-2,68%

11.2K

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $100 from $96 at Brean Capital, to $94 from $84 at FBR Capital, to $105 from $88 at RBC Capital Mkts

-

14:50

Reserve Bank of New Zealand Assistant Governor John McDermott: the interest rate hike is possible if demand weakens and inflation in New Zealand declines

The Reserve Bank of New Zealand (RBNZ) Assistant Governor John McDermott ruled out the interest rate hike, and noted that the interest rate hike is possible if demand weakens and inflation in New Zealand declines.

"Evidence of weakening demand and domestic inflationary pressures would prompt us to consider lowering interest rates," McDermott said on Thursday.

The RBNZ assistant governor pointed out that "monetary policy should remain stimulatory for a prolonged period".

He also said that the labour market should improve and inflation should rise before hiking interest rate.

McDermott noted that the central bank will continue to monitor wages and price-setting outcomes.

-

14:49

-

14:39

Company News: Caterpillar (CAT) released better than expected report and raised guidance on EPS

Company reports Q1 earnings of $1.72 per share versus $1.36 consensus. Revenues fell 4.1% year/year to $12.70 bln versus $12.49 bln consensus.

Company raised guidance for FY15: EPS expected of $5.00 (up from $4.75) versus $4.75 consensus. Revenue reaffirmed on $50 bln versus $49.63 bln consensus.

CAT rose to $88.15 (+3.86%) on the premarket.

-

14:29

-

14:23

-

14:14

Company News: Facebook (FB) report was mixed but user growth crushes estimates

Company reports Q1 earnings of $0.42 per share versus $0.40 consensus. Revenues rose 41.6% year/year to $3.54 bln versus $3.56 bln consensus.

Daily active users (DAUs) for the social media platform came in at 936 million on average for March 2015, an increase of 17% YoY and consensus estimate of 920.2 million.

FB fell to $83.47 (-1.37%) on the premarket.

-

14:02

Chinese HSBC manufacturing Purchasing Managers' Index (PMI) falls to 49.2 in April

The Chinese HSBC manufacturing Purchasing Managers' Index (PMI) declined to 49.2 in April from 49.6 in March, missing expectations for a decrease to 49.4.

A reading below 50 indicates contraction of activity.

The decrease was driven by declines in new orders and prices.

-

14:02

Company News: AT&T (T) missed expectation

Company reports Q1 earnings of $0.63 per share versus $0.66 consensus. Revenues rose 0.3% year/year to $32.52 bln versus $33.16 bln consensus.

T rose to $33.21 (+1.07%) on the premarket.

-

12:01

European stock markets mid session: stocks traded mixed after the weaker-than-expected PMIs from the Eurozone

Stock indices traded mixed after the weaker-than-expected PMIs from the Eurozone. Eurozone's preliminary manufacturing PMI decreased to 51.9 in April from 52.2 in March, missing expectations for a rise to 52.6.

Eurozone's preliminary services PMI declined to 53.7 in April from 54.2 in March. Analysts had expected the index to climb to 54.5.

Germany's preliminary manufacturing PMI fell to 51.9 in April from 52.8 in March, missing forecasts of an increase to 53.1.

Germany's preliminary services PMI decreased to 54.4 in April from 55.4 in March, missing expectations for a gain to 55.6.

The decline was driven by lower new orders and by a rise in prices.

France's preliminary manufacturing PMI was down to 48.4 in April from 48.8 in March, missing forecasts of a rise to 49.4.

France's preliminary services PMI dropped to 50.8 in April from 52.4 in March, missing expectations for a gain to 52.5.

The Greek debt crisis remains in focus. Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

Retail sales in the U.K. decreased 0.5% in March, missing expectations for a 0.4% rise, after a 0.6% gain in February. February's figure was revised down from a 0.7% increase.

It was the first decline in six months.

The decrease was driven by a drop in fuel sales. Fuel sales plunged 6.2%, the biggest drop since April 2012.

On a yearly basis, retail sales in the U.K. climbed 4.2% in March, missing forecasts of 5.4% increase, after a 5.4% rise in February. February's figure was revised down from a 5.7% gain.

The public sector net borrowing in the U.K. rose to £6.74 billion in March from £4.8 billion in February, missing expectations for a rise to £6.6 billion. February's figure was revised down from £6.2 billion.

Current figures:

Name Price Change Change %

FTSE 100 7,049.21 +20.97 +0.30 %

DAX 11,804.23 -63.14 -0.53 %

CAC 40 5,187.95 -23.14 -0.44 %

-

11:35

Public sector net borrowing in the U.K. climbs to £6.74 billion in March

The Office for National Statistics released public sector net borrowing for the U.K. on Thursday. The public sector net borrowing in the U.K. rose to £6.74 billion in March from £4.8 billion in February, missing expectations for a rise to £6.6 billion. February's figure was revised down from £6.2 billion.

-

11:14

UK retail sales declines 0.5% in March, the first fall in six months

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. decreased 0.5% in March, missing expectations for a 0.4% rise, after a 0.6% gain in February. February's figure was revised down from a 0.7% increase.

It was the first decline in six months.

The decrease was driven by a drop in fuel sales. Fuel sales plunged 6.2%, the biggest drop since April 2012.

Sales at department stores declined, while sales at clothing and household-goods stores rose.

Food sales gained 0.4% in March.

On a yearly basis, retail sales in the U.K. climbed 4.2% in March, missing forecasts of 5.4% increase, after a 5.4% rise in February. February's figure was revised down from a 5.7% gain.

-

10:59

Asia Pasific Stocks Closed:

HANG SENG 27,945.09 +11.24 +0.04%

S&P CNX NIFTY 8,405.2 -24.50 -0.29%

S&P/ASX 200 5,844.8 +7.31 +0.13%

TOPIX 1,624.87 +3.08 +0.19%

SHANGHAI COMP 4,390.48 -8.01 -0.18% -

10:51

European Central Bank Executive Board Member Benoit Coeure: the Greek exit from the Eurozone was “out of the question”

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Wednesday that the Greek exit from the Eurozone was "out of the question".

"The euro area needs Greece just as Greece needs the euro," he said. Coeure noted that "quick and decisive action by the Greek authorities" is needed.

He pointed out that the ECB will continue to fund Greek banks as long as they remain solvent and have adequate collateral.

-

10:24

Bank of Japan Governor Haruhiko Kuroda: the BoJ is unlikely to expand its quantitative easing programme

The Bank of Japan Governor Haruhiko Kuroda said on Thursday the central bank is unlikely to expand its quantitative easing programme. He noted that Japan's economy continued to recover moderately.

Kuroda pointed out that the BOJ's 2% inflation target is likely to be reached between next March and the end of the first half of the fiscal year starting next April.

-

00:31

Stocks. Daily history for Apr 22’2015:

(index / closing price / change items /% change)

Nikkei 225 20,133.9 +224.81 +1.1 %

Hang Seng 27,933.85 +83.36 +0.3 %

Shanghai Composite 4,399.88 +106.26 +2.5 %

FTSE 100 7,028.24 -34.69 -0.5 %

CAC 40 5,211.09 +18.45 +0.4 %

Xetra DAX 11,867.37 -72.21 -0.6 %

S&P 500 2,107.96 +10.67 +0.5 %

NASDAQ Composite 5,035.17 +21.07 +0.4 %

Dow Jones 18,038.27 +88.68 +0.5 %

-