Noticias del mercado

-

22:05

Major US stock indexes finished trading in the "green zone"

Major US stock indices closed in positive territory on the background of growth of business activity and strong quarterly results, stimulating investor confidence.

"Now everything is determined by the financial statements," - said Bill Northey, an expert U.S. Bank. He added that in the last session of the driver of the dynamics in the stock markets were the financial performance of companies rather than macro-economic events.

In addition, as shown by the October data, the US manufacturers have started confidently fourth quarter, with output and new orders rose significantly stronger than in September. The rebound in business conditions contributed to increased purchases among manufacturers and renewed pressure on capacity. At the same time, manufacturers have sought to increase their resource stocks, while the rate rose for the first time since November 2015. Manufacturers reported that supported domestic economic conditions are a key factor in the growth, helping to offset sluggish export sales in October. On a seasonally adjusted, pre-production managers' index in the US supply of Markit (PMI) jumped to 53.2 in October, with a three-month low of 51.5 in September.

The price of oil fell moderately against the background of a partial profit-taking, as well as indications that the assumption of OPEC to reduce oil production may encounter obstacles. Over the weekend, the head of Iraq's state-owned SOMO Falah al-Amri said that Iraq does not intend to reduce the current level of oil production. He also noted that the volume of oil production in the country is a matter of its sovereignty. In addition, Iraqi Oil Minister urged to resolve Iraq does not participate in the transaction on the level of oil production frozen. He said that Iraq must receive the same privileges as Libya and Nigeria.

Most DOW components of the index showed an increase (21 of 30). More rest up shares Microsoft Corporation (MSFT, + 2.10%). Outsider were shares of Chevron Corporation (CVX, -0.72%).

Most Sector S & P index closed in positive territory. The leader turned out to be the technology sector (+ 0.9%). the health sector fell the most (-0.2%).

At the close:

DOW + 0.42% 18,221.35 +75.64

Nasdaq + 1.00% 5,309.83 +52.43

S & P + 0.46% 2,151.08 +9.92

-

21:00

Dow +0.46% 18,228.68 +82.97 Nasdaq +0.88% 5,303.67 +46.27 S&P +0.46% 2,150.91 +9.75

-

18:32

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes increased as a flurry of deal activity and strong quarterly earnings boosted investor confidence. AT&T (T) was down ~2% after the telecommunications company said it would buy Time Warner Inc (TWX) for $85,4 billion. If approved by regulators, this would be the biggest deal in the world this year. Investors are also parsing quarterly earnings reports from companies. More than a third of the S&P 500 components are scheduled to report earnings this week, including heavyweights such as Apple (AAPL) and Boeing (BA).

Most of Dow stocks in positive area (24 of 30). Top gainer - The Boeing Company (BA, +1.64%). Top loser - Caterpillar Inc. (CAT, -0.73%).

Almost all S&P sectors also in positive area. Top gainer - Technology (+0.8%). Top loser - Basic Materials (-0.3%).

At the moment:

Dow 18146.00 +80.00 +0.44%

S&P 500 2143.75 +9.00 +0.42%

Nasdaq 100 4893.25 +50.00 +1.03%

Oil 49.84 -1.01 -1.99%

Gold 1262.80 -4.90 -0.39%

U.S. 10yr 1.77 +0.03

-

18:00

European stocks closed: FTSE 100 -34.07 6986.40 -0.49% DAX +50.44 10761.17 +0.47% CAC 40 +16.51 4552.58 +0.36%

-

17:42

WSE: Session Results

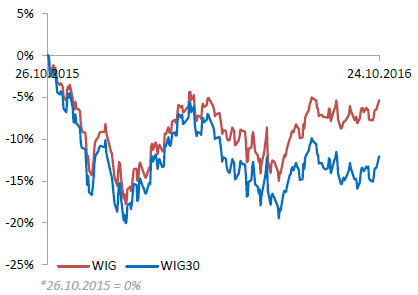

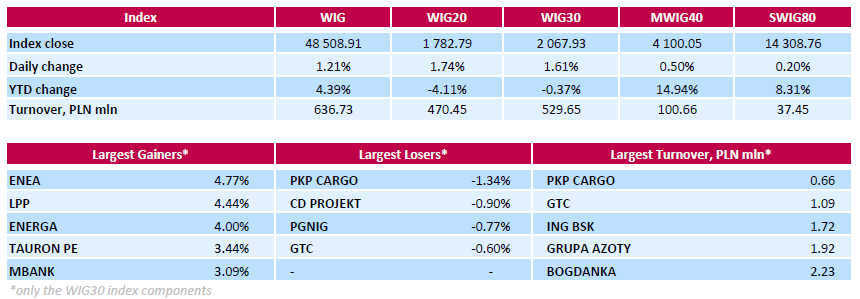

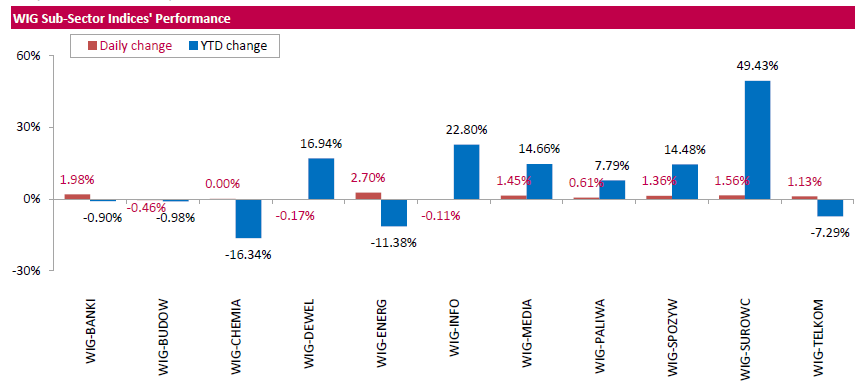

Polish equity market advanced on Monday. The broad market measure, the WIG Index, surged by 1.21%. The WIG sub-sector indices were mainly higher with utilities measure (+2.7%) outpacing.

The large-cap stocks' measure, the WIG30 Index, advanced 1.61%. A majority of the index components returned gains, with the way up led by genco ENEA (WSE: ENA) and clothing retailer LPP (WSE: LPP), climbing by 4.77% and 4.44% respectively. Other major advancers were two gencos ENERGA (WSE: ENG) and TAURON PE (WSE: TPE), banking sector name MBANK (WSE: MBK) and oil refiner LOTOS (WSE: LTS), adding between 3.08% and 4%. At the same time, the handful decliners included railway freight transport operator PKP CARGO (WSE: PKP), videogame developer CD PROJEKT (WSE: CDR), oil and gas producer PGNIG (WSE: PGN) and property developer GTC (WSE: GTC), losing between 0.6% and 1.34%.

-

15:32

U.S. Stocks open: Dow +0.64%, Nasdaq +0.63%, S&P +0.48%

-

15:24

Before the bell: S&P futures +0.48%, NASDAQ futures +0.65%

U.S. stock-index futures rose to begin one of the earnings reporting season's busiest weeks, as a flurry of deal activity spurred optimism in equity markets.

Global Stocks:

Nikkei 17,234.42 +49.83 +0.29%

Hang Seng 23,604.08 +229.68 +0.98%

Shanghai 3,128.41 +37.47 +1.21%

FTSE 7,016.28 -4.19 -0.06%

CAC 4,573.24 +37.17 +0.82%

DAX 10,807.12 +96.39 +0.90%

Crude $50.16 (-1.36%)

Gold $1265.50 (-0.17%)

-

14:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

172

2.50(1.4749%)

768

ALCOA INC.

AA

27

0.12(0.4464%)

5685

Amazon.com Inc., NASDAQ

AMZN

823.65

4.66(0.569%)

19783

American Express Co

AXP

67.85

0.49(0.7274%)

1500

Apple Inc.

AAPL

117.12

0.52(0.446%)

126263

AT&T Inc

T

36.5

-0.99(-2.6407%)

3359825

Barrick Gold Corporation, NYSE

ABX

17.02

0.10(0.591%)

28177

Caterpillar Inc

CAT

85.76

-0.57(-0.6603%)

833

Chevron Corp

CVX

101.33

0.03(0.0296%)

320

Cisco Systems Inc

CSCO

30.4

0.25(0.8292%)

2683

Citigroup Inc., NYSE

C

49.89

0.32(0.6456%)

3710

Exxon Mobil Corp

XOM

86.5

-0.12(-0.1385%)

175

Facebook, Inc.

FB

132.75

0.68(0.5149%)

185577

Ford Motor Co.

F

12.05

0.03(0.2496%)

28967

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.1

0.06(0.5976%)

22825

General Electric Co

GE

29.06

0.08(0.2761%)

11783

General Motors Company, NYSE

GM

32.22

0.18(0.5618%)

1760

Goldman Sachs

GS

175.18

0.51(0.292%)

2110

Google Inc.

GOOG

803.5

4.13(0.5167%)

3638

Home Depot Inc

HD

126.8

0.20(0.158%)

2040

HONEYWELL INTERNATIONAL INC.

HON

108.97

0.01(0.0092%)

1100

Intel Corp

INTC

35.25

0.10(0.2845%)

8140

International Business Machines Co...

IBM

149.88

0.25(0.1671%)

2339

International Paper Company

IP

47.4

0.40(0.8511%)

8200

Johnson & Johnson

JNJ

113.85

0.41(0.3614%)

1957

JPMorgan Chase and Co

JPM

68.79

0.30(0.438%)

5531

McDonald's Corp

MCD

114.05

0.12(0.1053%)

2251

Microsoft Corp

MSFT

59.75

0.09(0.1509%)

57964

Nike

NKE

51.94

0.17(0.3284%)

9634

Pfizer Inc

PFE

32.3

0.12(0.3729%)

4364

Procter & Gamble Co

PG

84.5

0.17(0.2016%)

5104

Starbucks Corporation, NASDAQ

SBUX

53.8

0.17(0.317%)

2559

Tesla Motors, Inc., NASDAQ

TSLA

201.52

1.43(0.7147%)

12172

The Coca-Cola Co

KO

42.4

0.27(0.6409%)

31415

Travelers Companies Inc

TRV

108.08

-0.27(-0.2492%)

300

Twitter, Inc., NYSE

TWTR

17.83

-0.26(-1.4373%)

248031

Verizon Communications Inc

VZ

48.69

0.49(1.0166%)

29641

Visa

V

83.18

0.83(1.0079%)

22918

Walt Disney Co

DIS

93.4

0.37(0.3977%)

5623

Yahoo! Inc., NASDAQ

YHOO

42.39

0.22(0.5217%)

1113

Yandex N.V., NASDAQ

YNDX

19.97

0.47(2.4103%)

2950

-

14:41

Upgrades and downgrades before the market open

Upgrades:

3M (MMM) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

AT&T (T) downgraded to Market Perform from Outperform at Cowen

AT&T (T) downgraded to Hold from Buy at Drexel Hamilton

Other:

-

13:12

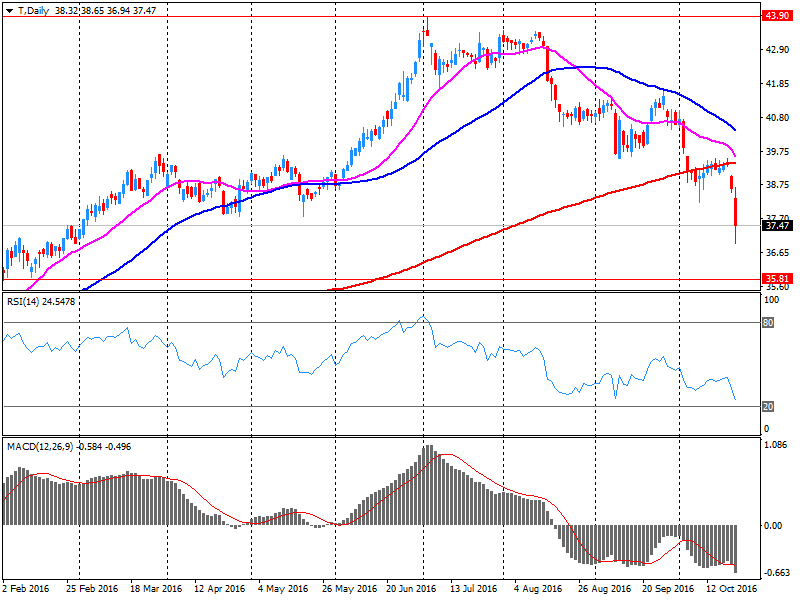

Company News: AT&T (T) posts Q3 EPS in line with analysts' estimate

AT&T reported Q3 FY 2016 earnings of $0.74 per share (versus $0.74 in Q3 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $40.890 bln (+4.6% y/y), slightly missing analysts' consensus estimate of $41.148 bln.

AT&T also announced that its board of directors has approved a 2.1% increase in the company's quarterly dividend. AT&T's quarterly dividend will increase from $0.48 to $0.49 per share.

T fell to $36.75 (-1.97%) in pre-market trading.

-

12:43

Major stock indices in Europe show a positive trend

European stocks started trading on an upward trend due to the news that Spain withdrew from the political impasse and strong statistical data for the euro area economy.

The Spanish IBEX 35 jumped 1.4% on the information that the leader of the opposition Socialist Party will no longer intend to block the return of Mariano Rajoy, representing the People's Party, to the post of prime minister.

Thus, M.Rahoy can be re-elected to the post of prime minister, and the country will avoid the repeated parliamentary elections, reports BBC.

Statistical data released today, reported an increase in business activity in the euro area.

The composite PMI index of euro-zone countries rose from 52.6 points to 53.7 points - the highest since December 2015, according to preliminary data by Markit Economics.

The indicator of activity in the euro zone's services sector rose from 52.2 to 53.5, manufacturing jumped from 52.6 to 53.3 points - the highest level since April 2014.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,5% - to 346.16 points.

Shares of Philips NV rose 4,5%. The company has increased its net profit in the third quarter of 2016 by 18.2% thanks to the strong performance in medical technology. In addition to this guide Philips announced plans to sell the unit for the production of LEDs and automotive lamps until the end of 2016.

The cost of securities of Swiss chemical company Syngenta dropped by 8.3%.

Shares of the French supplier of components for the aerospace industry Zodiac Aerospace rose by 2.7% onM & A actions.

At the moment:

FTSE 7022.62 2.15 0.03%

DAX 10799.82 89.09 0.83%

CAC 4572.25 36.18 0.80%

-

12:01

Earnings Season in U.S.: Major Reports of the Week

October 24

Before the Open:

AT&T (T). Consensus EPS $0.74, Consensus Revenue $41148.26 mln.

After the Close:

Visa (V). Consensus EPS $0.73, Consensus Revenue $4241.50 mln.

October 25

Before the Open:

3M (MMM). Consensus EPS $2.14, Consensus Revenue $7719.82 mln.

Caterpillar (CAT). Consensus EPS $0.76, Consensus Revenue $9884.63 mln.

DuPont (DD). Consensus EPS $0.21, Consensus Revenue $4845.32 mln.

Freeport-McMoRan (FCX). Consensus EPS $0.20, Consensus Revenue $3956.57 mln.

General Motors (GM). Consensus EPS $1.45, Consensus Revenue $37665.94 mln.

Merck (MRK). Consensus EPS $0.99, Consensus Revenue $10180.00 mln.

Procter & Gamble (PG). Consensus EPS $0.98, Consensus Revenue $16484.77 mln.

United Tech (UTX). Consensus EPS $1.67, Consensus Revenue $14286.18 mln.

After the Close:

Apple (AAPL). Consensus EPS $1.65, Consensus Revenue $46934.05 mln.

October 26

Before the Open:

Boeing (BA). Consensus EPS $2.62, Consensus Revenue $23600.13 mln.

Coca-Cola (KO). Consensus EPS $0.48, Consensus Revenue $10534.38 mln.

After the Close:

Barrick Gold (ABX). Consensus EPS $0.21, Consensus Revenue $2229.35 mln.

Tesla Motors (TSLA). Consensus EPS $0.06, Consensus Revenue $2338.10 mln.

October 27

Before the Open:

Altria (MO). Consensus EPS $0.81, Consensus Revenue $5110.94 mln.

Ford Motor (F). Consensus EPS $0.21, Consensus Revenue $33210.96 mln.

Intl Paper (IP). Consensus EPS $0.93, Consensus Revenue $5376.48 mln.

Yandex N.V. (YNDX). Consensus EPS RUB 10.74, Consensus Revenue RUB 18707.51 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $8.62, Consensus Revenue $21878.94 mln.

Amazon (AMZN). Consensus EPS $0.81, Consensus Revenue $32653.99 mln.

Twitter (TWTR). Consensus EPS $0.09, Consensus Revenue $605.50 mln.

October 28

Before the Open:

Chevron (CVX). Consensus EPS $0.40, Consensus Revenue $31339.15 mln.

Exxon Mobil (XOM). Consensus EPS $0.57, Consensus Revenue $63851.56 mln.

MasterCard (MA). Consensus EPS $0.98, Consensus Revenue $2743.57 mln.

-

11:16

UBS raises EasyJet stock rating to "buy" from "neutral"

-

08:57

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.1%, FTSE + 0.2%

-

06:57

Global Stocks

European stocks finished flat Friday, with some indexes easing from multimonth highs as investors waded through corporate reports while they considered European Central Bank President Mario Draghi's hint toward the possibility of more monetary stimulus.

The Dow and S&P 500 on Friday finished near break-even, but ended well off their lows of the session, while the Nasdaq rallied and all three indexes ended a string of back-to-back weekly declines. The mixed results from the Dow components further muddied the question of whether the pace of economic activity was justifying equity valuations, especially ahead of the coming U.S. election and an expected interest-rate hike from the Federal Reserve.

Asia's main equity markets were lower early Monday, with disappointing trade data from Japan and a slightly stronger yen putting a cap on local shares. Data released Monday by Japan's Ministry of Finance showed exports falling 6.9% in September from a year earlier, in the 12th consecutive month of declines as the stronger yen continued to hurt manufacturers.

-

00:31

Stocks. Daily history for Oct 21’2016:

(index / closing price / change items /% change)

Nikkei 225 17,184.59 -50.91 -0.30%

Shanghai Composite 3,091.29 +7.41 +0.24%

S&P/ASX 200 5,430.32 -11.83 -0.22%

FTSE 100 7,020.47 -6.43 -0.09%

CAC 40 4,536.07 -4.05 -0.09%

Xetra DAX 10,710.73 +9.34 +0.09%

S&P 500 2,141.16 -0.18 -0.01%

Dow Jones 18,145.71 -16.64 -0.09%

-