Noticias del mercado

-

21:00

DJIA 17732.35 -140.87 -0.79%, NASDAQ 4926.79 -6.72 -0.14%, S&P 500 2089.76 -9.30 -0.44%

-

18:00

European stocks closed: FTSE 6230.79 -40.00 -0.64%, DAX 10262.74 -70.49 -0.68%, CAC 4505.62 -23.78 -0.53%

-

18:00

European stocks close: stocks closed lower despite the positive economic data from the Eurozone

Stock closed slightly lower despite the positive economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in May from -0.2 % in April, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.8% in May from 0.7% in April, in line with expectations.

Food, alcohol and tobacco prices were up 0.8% in May, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.1%.

Eurozone's unemployment rate remained unchanged at 10.2% in April, in line with expectations. It was the lowest reading since August 2011.

European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.6% in April from last year, missing expectations for a 5.0% gain, after a 5.0 % increase in March.

Loans to the private sector in the Eurozone climbed 1.5% in April from the last year, in line with expectations, after a 1.6% gain in March.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany slid by 11,000 in May, beating expectations for a 5,000 drop, after a 16,000 decrease in April.

The unemployment rate declined to 6.1% in May from 6.2% in April. Analysts expected the unemployment rate to remain unchanged at 6.2%.

Destatis released its retail sales for Germany on Tuesday. German adjusted retail sales slid 0.9% in April, missing forecasts of a 0.9% gain, after a 1.4% decrease in March. March's figure was revised down from a 1.1% drop.

On a yearly basis, German unadjusted retail sales increased 2.3% in April, exceeding expectations for a 1.9% gain, after a 0.6% rise in March. March's figure was revised down from a 0.7% increase.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,230.79 -40.00 -0.64 %

DAX 10,262.74 -70.49 -0.68 %

CAC 40 4,505.62 -23.78 -0.53 %

-

17:38

WSE: Session Results

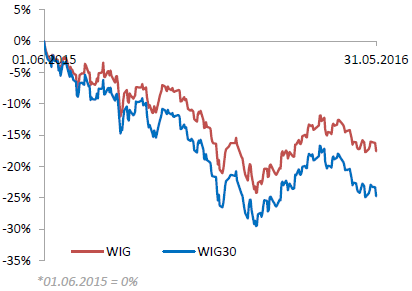

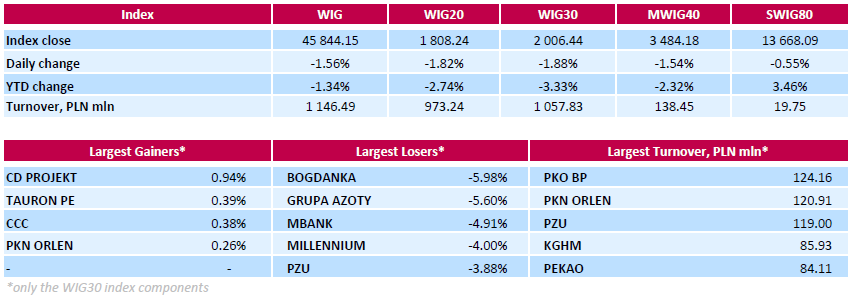

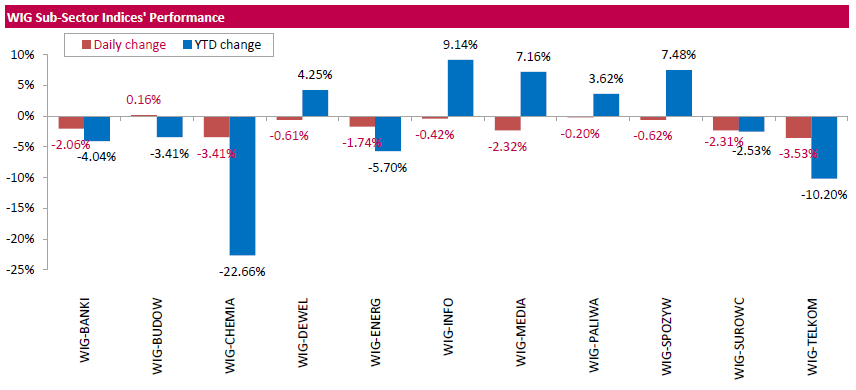

Polish equity market closed lower on Tuesday. The broad market benchmark, the WIG Index, dropped by 1.56%. Sector-wise, construction sector (+0.16%) was sole gainer within the WIG Index, while chemicals (-3.41%) and telecoms (-3.53%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.88%. A majority of the index components recorded losses. Thermal coal miner BOGDANKA (WSE: LWB) was hit the hardest, down 5.98%. It was followed by chemical producer GRUPA AZOTY (WSE: ATT), which tumbled by 5.6% as the company announced it analyzes the impact of restating 2015 results by its unit ZCH POLICE (WSE: PCE) on group consolidated earnings. On May 30, ZCH POLICE restated 2015 profit of PLN 164.8 mln as a loss of PLN 71.7 mln, due to revaluation of the African assets, and cancelled a proposed dividend. Other major laggards were four financials names MBANK (WSE: MBK), MILLENNIUM (WSE: MIL), PZU (WSE: PZU) and ALIOR (WSE: ALR), which lost between 3.2% and 4.91%. At the same time, the handful advancers included videogame developer CD PROJEKT (WSE: CDR), genco TAURON PE (WSE: TPE), footwear retailer CCC (WSE: CCC) and oil refiner PKN ORLEN (WSE: PKN), advancing 0.94%, 0.39%, 0.38% and 0.26% respectively.

-

17:38

The ANZ business confidence index for New Zealand climbs to 11.3% in April

ANZ Bank released its latest business sentiment survey for New Zealand on Tuesday. The ANZ business confidence index for New Zealand climbed to 11.3% in April from 6.2% in March. The index means that 11.3% of respondents expected the country's economy to improve over the coming year.

"Business confidence continues to recover lost ground," the ANZ Chief Economist Cameron Bagrie said.

-

17:22

Spanish current account deficit turns into a surplus of €0.84 billion in March

The Bank of Spain released its current account data on Tuesday. Spain's current account deficit turned into a surplus of €0.84 billion in March from a deficit of €1.46 billion in February.

The surplus on trade in goods and services totalled €1.82 billion in March, while the deficit on primary and second income totalled €0.99 billion.

-

17:17

French producer prices decrease 0.5% in April

French statistical office INSEE released its producer price index (PPI) data on Tuesday. French producer prices decreased 0.5% in April, after a 0.3% rise in March.

The decrease was mainly driven a drop in prices for mining and quarrying products, energy and water, which slid 2.7% in April.

On a yearly basis, French PPI fell 4.1% in April, after a 4.0% drop in March.

The annual drop was driven by a decline in prices for mining and quarrying products, energy and water, which slid 17.4 year-on-year in April.

Import prices were flat in April, after a 0.9% rise in March.

-

17:03

French preliminary consumer price inflation increases 0.4% in May

The French statistical office Insee released its preliminary consumer price inflation for France on Tuesday. The French consumer price inflation increased 0.4% in May, after a 0.2% rise in April.

The monthly increase was mainly driven by higher prices for food.

On a yearly basis, the consumer price rose to -0.1% in May from -0.2% in April.

The annual drop was mainly driven by a fall in energy and manufactured products prices.

Food prices rose 0.9% year-on-year in May, services prices climbed 0.9%, while energy prices dropped by 5.9%.

-

17:00

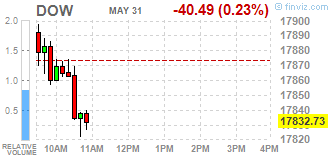

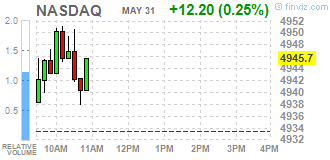

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexws little changed on Tuesday as strong consumer spending data gave the latest sign of improvement in economic growth and supported the Federal Reserve's stance to increase interest rates in the coming months. Hopes of a rate hike boosted financial companies, while a rise in oil prices pushed energy stocks higher. Data showed U.S. consumer spending surged 1% in April, its biggest increase in more than six years and beating economists' expectation of a 0,7% rise. The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, rose 0,2% last month.

Most of Dow stocks in negative area (18 of 30). Top looser - The Walt Disney Company (DIS, -1,46%). Top gainer - Caterpillar Inc. (CAT, +1,14%).

S&P sectors mixed. Top looser - Conglomerates (-0,6%). Top gainer - Utilities (+0,4%).

At the moment:

Dow 17819.00 -30.00 -0.17%

S&P 500 2097.00 -0.25 -0.01%

Nasdaq 100 4515.00 +5.00 +0.11%

Oil 49.93 +0.60 +1.22%

Gold 1217.30 +0.60 +0.05%

U.S. 10yr 1.86 +0.01

-

16:44

Greek retail sales increase 4.0% in March

The Greek statistical office Hellenic Statistical Authority released its retail sales data on Tuesdayy. Greek retail sales increased 4.0% in March.

On a yearly basis, Greek retail sales slid by 1.6% in March, after a 6.8% fall in February. January's figure was revised up from a 2.2% decrease.

Sales of food products increased by 1.8% year-on-year in March, sales of non-food products declined by 3.3%, while sales of automotive fuel dropped by 3.0%.

-

16:32

Italy’s unemployment rate climbs to 11.7% in April

The Italian statistical office Istat released its unemployment data on Tuesday. The seasonally adjusted unemployment rate increased to 11.7% in April from 11.5% in March. March's figure was revised up from 11.5%.

The number of unemployed people was 2.986 million in April, up 1.7% from the month before.

The youth unemployment rate increased to 36.9 in April from 36.7 in March.

The employment rate rose to 56.9 in April from 56.7% in March.

-

16:28

Preliminary consumer prices in Italy rise 0.3% in May

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Tuesday. Preliminary consumer prices in Italy rose 0.3% in May, after a 0.1% decline in April.

The monthly rise was mainly driven by higher prices for tobacco, of non-regulated energy products and unprocessed food.

On a yearly basis, consumer prices fell 0.3% in May, after a 0.5% decrease in April.

The increase was driven by higher prices for tobacco and unprocessed food.

Consumer price inflation excluding unprocessed food and energy prices increased to 0.6% year-on-year in May from 0.5% in April.

-

16:22

Italian final GDP rises 0.3% in the first quarter

The Italian statistical office Istat released its final gross domestic product (GDP) data for Italy on Tuesday. The Italian final GDP increased 0.3% in the first quarter, in line with the preliminary reading, after a 0.2% rise in the fourth quarter.

Final consumption expenditure climbed by 0.2% in the first quarter, gross fixed capital formation rose by 0.2%, imports decreased by 0.9%, while exports were down 1.5%.

On a yearly basis, Italian final GDP rose 1.0% in the first quarter, in line with the preliminary reading, after a 1.1% increase in the fourth quarter.

-

16:16

U.S. consumer confidence index falls to 92.6 in May

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index fell to 92.6 in May from 94.2 in April. Analysts had expected the index to rise to 96.0.

The present conditions index dropped to 112.9 in May from 117.1 in April.

The Conference Board's consumer expectations index for the next six months decreased to 79.0 in May from 79.7 in April.

The percentage of consumers expecting more jobs in the coming months remained unchanged at 12.8% in May.

"Consumer confidence declined slightly in May, primarily due to consumers rating current conditions less favourably than in April. Expectations declined further, as consumers remain cautious about the outlook for business and labour market conditions. Thus, they continue to expect little change in economic activity in the months ahead," the director of economic indicators at The Conference Board, Lynn Franco, said.

-

16:05

Chicago purchasing managers' index slides to 49.3 in May

The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The Chicago purchasing managers' index slid to 49.3 in May from 50.4 in April, missing expectations for a rise to 50.9.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decrease was mainly driven by drops in new orders and new orders. New orders were down to 48.8 in May from 51.0 in April, while the production index plunged to 47.4 from 54.0.

Order backlogs climbed to 47.7 in May from 38.7 in April, while the employment index rose to 48.3 from 47.5.

"While expectations are that growth in the US economy will bounce back in Q2, the evidence from the MNI Chicago Report shows activity weakening from an already low level," Chief Economist of MNI Indicators Philip Uglow said.

-

15:58

S&P/Case-Shiller home price index rises 5.4% in March

The S&P/Case-Shiller home price index increased 5.4% year-on-year in March, exceeding expectations for a 5.2% rise, after a 5.4% gain in February.

Portland, Seattle, and Denver were the largest contributors to the rise, where prices climbed by 12.3% year-on-year, 10.8% and 10.0%, respectively.

"Home prices are continuing to rise at a 5% annual rate, a pace that has held since the start of 2015," managing director chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

"The economy is supporting the price increases with improving labour markets, falling unemployment rates and extremely low mortgage rates. Another factor behind rising home prices is the limited supply of homes on the market," he added.

On a monthly basis, the S&P/Case-Shiller home price index rose 0.9% in March.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

15:33

U.S. Stocks open: Dow +0.10%, Nasdaq +0.13%, S&P +0.12%

-

15:26

Before the bell: S&P futures +0.13%, NASDAQ futures +0.18%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 17,234.98 +166.96 +0.98%

Hang Seng 20,815.09 +185.70 +0.90%

Shanghai Composite 2,916.15 +93.70 +3.32%

FTSE 6,262.09 -8.70 -0.14%

CAC 4,517.8 -11.60 -0.26%

DAX 10,312.85 -20.38 -0.20%

Crude $49.58 (+0.51%)

Gold $1209.60 (-0.35%)

-

15:06

U.S. personal spending rises 1.0% in April

The U.S. Commerce Department released personal spending and income figures on Tuesday. Personal spending rose 1.0% in April, exceeding expectations for a 0.7% gain, after a flat reading in March. It was the biggest rise since August 2009.

March's figure was revised down from a 0.1% increase.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 1.9% in the first quarter, the slowest pace since the first quarter of 2015, after a 2.4% increase in the fourth quarter.

The saving rate declined to 5.4% in April from 5.9% in March.

Personal income increased 0.4% in April, in line with expectations, after a 0.4% gain in March.

Wages and salaries were up 0.5% in April.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.2% in April, in line with forecasts, after a 0.1% gain in March.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.6% in April.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

This data added to speculation the Fed may raise its interest rate in June.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.38

0.03(0.3209%)

36675

Amazon.com Inc., NASDAQ

AMZN

714

1.76(0.2471%)

5830

AMERICAN INTERNATIONAL GROUP

AIG

58.39

0.07(0.12%)

301

Apple Inc.

AAPL

99.86

-0.49(-0.4883%)

227580

AT&T Inc

T

39

0.01(0.0256%)

7566

Barrick Gold Corporation, NYSE

ABX

16.62

0.00(0.00%)

65115

Boeing Co

BA

129.23

0.01(0.0077%)

1800

Chevron Corp

CVX

102.5

0.48(0.4705%)

717

Cisco Systems Inc

CSCO

29

0.08(0.2766%)

6862

Citigroup Inc., NYSE

C

46.78

0.20(0.4294%)

26925

Deere & Company, NYSE

DE

81.75

1.25(1.5528%)

5742

Facebook, Inc.

FB

119.7

0.32(0.268%)

37272

Ford Motor Co.

F

13.48

0.03(0.223%)

5714

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.12

-0.02(-0.1795%)

42476

General Electric Co

GE

30.13

0.01(0.0332%)

6241

General Motors Company, NYSE

GM

31.22

-0.17(-0.5416%)

1003

Google Inc.

GOOG

733.9

1.24(0.1692%)

1620

Hewlett-Packard Co.

HPQ

13.14

-0.03(-0.2278%)

3989

Home Depot Inc

HD

133.95

0.70(0.5253%)

618

Intel Corp

INTC

31.57

-0.00(-0.00%)

10904

International Business Machines Co...

IBM

152.5

-0.34(-0.2225%)

1018

JPMorgan Chase and Co

JPM

65.68

0.25(0.3821%)

5923

McDonald's Corp

MCD

123.4

0.15(0.1217%)

1066

Merck & Co Inc

MRK

56.58

0.10(0.1771%)

202

Microsoft Corp

MSFT

52.42

0.10(0.1911%)

3383

Starbucks Corporation, NASDAQ

SBUX

55.5

0.35(0.6346%)

9457

Tesla Motors, Inc., NASDAQ

TSLA

223.75

0.71(0.3183%)

2892

The Coca-Cola Co

KO

44.86

0.08(0.1787%)

705

Twitter, Inc., NYSE

TWTR

15.23

0.13(0.8609%)

122425

United Technologies Corp

UTX

100.83

0.07(0.0695%)

1401

Verizon Communications Inc

VZ

50.73

0.11(0.2173%)

2732

Visa

V

80

0.34(0.4268%)

3001

Wal-Mart Stores Inc

WMT

70.6

-0.15(-0.212%)

1147

Walt Disney Co

DIS

100.32

0.03(0.0299%)

3463

Yahoo! Inc., NASDAQ

YHOO

37.85

0.03(0.0793%)

27318

-

14:49

Canada's GDP climbs 0.6% in the first quarter

Statistics Canada released GDP (gross domestic product) growth data on Tuesday. Canada's GDP growth declined 0.2% in March, missing expectations for a 0.1% fall, after a 0.1% decrease in February.

On a quarterly basis, GDP rose 0.6% in the first quarter, after a 0.1% gain in the fourth quarter. The fourth quarter's figure was revised down from a 0.2% gain.

The quarterly rise was driven by exports. Exports of goods and services jumped 1.7% in the first quarter, while imports of goods and services rose 0.3%.

Final domestic demand increased 0.3% in the first quarter, after a 0.1% fall in the fourth quarter.

Household final consumption expenditure was up 0.6% in the first quarter as spending on goods rose 1.1% in the first quarter.

The household saving rate was 3.9% in the first quarter.

Business gross fixed capital formation declined 0.4% in the first quarter.

On a yearly basis, GDP climbed 2.4% in the first quarter, missing forecasts of a 2.9% increase, after 0.5% rise in the fourth quarter. The fourth quarter's figure was revised down from a 0.8% increase.

-

14:41

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Buy from Neutral at UBS

Downgrades:

Other: -

14:29

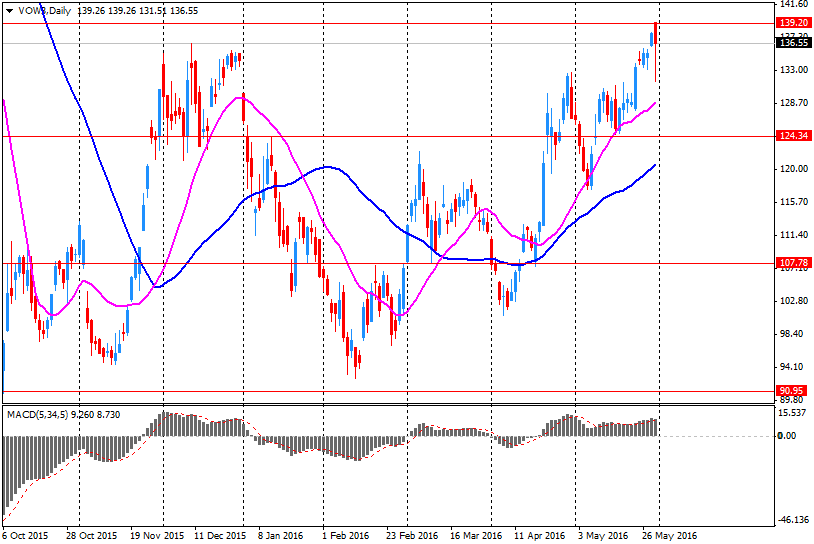

Company News: Volkswagen (VOW3) posts Q1 results

Volkswagen reported Q1 FY 2016 revenues of EUR 50.96 bln, down 3.4% y/y. The decline was primarily attributable to the fall in vehicle unit sales and negative exchange rate effects. The company's operating profit increased by 3.4% y/y to EUR 3.44 bln, with the reported figure equating to an operating return on sales of 6.8%. Volkswagen profit after tax amounted to EUR 2.37 bln, down 19.3 y/y.

Volkswagen reiterated that it expects FY 2016 sales to be down by up to 5% y/y and that it will achieve an operating return on sales of between 5% and 6%.

VOW3 fell to $135.60 (-1.70%).

-

12:10

European stock markets mid session: stocks traded lower despite the positive economic data from the Eurozone

Stock indices traded lower despite the positive economic data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in May from -0.2 % in April, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.8% in May from 0.7% in April, in line with expectations.

Food, alcohol and tobacco prices were up 0.8% in May, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.1%.

Eurozone's unemployment rate remained unchanged at 10.2% in April, in line with expectations. It was the lowest reading since August 2011.

European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.6% in April from last year, missing expectations for a 5.0% gain, after a 5.0 % increase in March.

Loans to the private sector in the Eurozone climbed 1.5% in April from the last year, in line with expectations, after a 1.6% gain in March.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany slid by 11,000 in May, beating expectations for a 5,000 drop, after a 16,000 decrease in April.

The unemployment rate declined to 6.1% in May from 6.2% in April. Analysts expected the unemployment rate to remain unchanged at 6.2%.

Destatis released its retail sales for Germany on Tuesday. German adjusted retail sales slid 0.9% in April, missing forecasts of a 0.9% gain, after a 1.4% decrease in March. March's figure was revised down from a 1.1% drop.

On a yearly basis, German unadjusted retail sales increased 2.3% in April, exceeding expectations for a 1.9% gain, after a 0.6% rise in March. March's figure was revised down from a 0.7% increase.

Current figures:

Name Price Change Change %

FTSE 100 6,263.48 -7.31 -0.12 %

DAX 10,318.71 -14.52 -0.14 %

CAC 40 4,520.28 -9.12 -0.20 %

-

12:04

M3 money supply in the Eurozone rises 4.6% in April from last year

The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.6% in April from last year, missing expectations for a 5.0% gain, after a 5.0 % increase in March.

Loans to the private sector in the Eurozone climbed 1.5% in April from the last year, in line with expectations, after a 1.6% gain in March.

Total credit to euro area residents increased to 3.3% year-on-year in April from 3.1% in March.

Loans to non-financial corporations rose to 1.2% year-on-year in April from 1.1% in March.

-

11:57

Number of unemployed people in Germany slides by 11,000 in May

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany slid by 11,000 in May, beating expectations for a 5,000 drop, after a 16,000 decrease in April.

The unemployment rate declined to 6.1% in May from 6.2% in April. Analysts expected the unemployment rate to remain unchanged at 6.2%.

The number of unemployed people was 1.78 million in April, down from 1.79 million in March, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.2% in April.

The employment rate increased to 65.6% in April from 65.3% in March, according to Destatis.

-

11:51

German adjusted retail sales fall 0.9% in April

Destatis released its retail sales for Germany on Tuesday. German adjusted retail sales slid 0.9% in April, missing forecasts of a 0.9% gain, after a 1.4% decrease in March. March's figure was revised down from a 1.1% drop.

On a yearly basis, German unadjusted retail sales increased 2.3% in April, exceeding expectations for a 1.9% gain, after a 0.6% rise in March. March's figure was revised down from a 0.7% increase.

Sales of non-food products rose at an annual rate of 2.8% in April, while sales of food, beverages and tobacco products rose by 1.4%.

-

11:44

Housing starts in Japan jump 9.0% year-on-year in April

Japan's Ministry of Land, Infrastructure, Transport and Tourism released its housing starts data on Tuesday. Housing starts in Japan rose 9.0% year-on-year in April, beating expectations for a 3.5% gain, after a 8.4% increase in March. It was the biggest rise since June 2015.

On a yearly basis, housing starts were up to 995,000 in April from 993,000 in March.

Construction orders plunged 16.9% year-on-year in April, after a 19.8% rise in March.

-

11:40

Private sector credit in Australia rises 0.5% in April

The Reserve Bank of Australia (RBA) released its private sector credit data on Tuesday. The total value of private sector credit in Australia rose 0.5% in April, exceeding expectations for a 0.4% gain, after a 0.4% increase in March.

Housing credit increased 0.4% in April, personal credit declined 0.1%, while business credit rose 0.8%.

On a yearly basis, the private sector credit in Australia jumped 6.7% in April, after a 6.4% rise in March.

-

11:34

Preliminary industrial production in Japan climbs 0.3% in April

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production data on late Monday evening. Preliminary industrial production in Japan climbed 0.3% in April, beating expectations for a 1.5% drop, after a 3.8% rise in March.

The increase was mainly driven by rises in chemicals (excluding drugs), electrical machinery, general-purpose, production and business oriented machinery.

According to a survey by the ministry, industrial production is expected to increase 2.2% in May and 0.3% in June.

On a yearly basis, Japan's industrial production was up 2.2% in April, after a 0.2% increase in March.

-

11:28

Building permits in New Zealand jump 6.6% in April

Statistics New Zealand released its building permits data on late Monday evening. Building permits in New Zealand jumped 6.6% in April, after a 9.7% drop in March. March's figure was revised up from a 9.8% fall.

Residential work rose 25% year-on-year in April, while non-residential work climbed 9.4%.

"The easing trend for new dwellings has been caused by a lull in apartment consents, especially in Auckland. However, apartment numbers tend to be quite volatile. For stand-alone houses, the trend is still increasing," Statistics New Zealand's business indicators senior manager Neil Kelly said.

-

11:22

Preliminary consumer price inflation in the Eurozone rises to -0.1% year-on-year in May

Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone rose to -0.1% year-on-year in May from -0.2 % in April, in line with expectations.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.8% in May from 0.7% in April, in line with expectations.

Food, alcohol and tobacco prices were up 0.8% in May, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.0%, while energy prices dropped 8.1%.

-

11:19

Eurozone's unemployment rate remains unchanged at 10.2% in April, the lowest reading since August 2011

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate remained unchanged at 10.2% in April, in line with expectations. It was the lowest reading since August 2011.

There were 16.420 million unemployed in the Eurozone in April, down by 63.000 from March.

The lowest unemployment rate in the Eurozone in March was recorded in Germany (4.2%) and the highest in Greece (24.2% in February 2016) and Spain (20.1%).

The youth unemployment rate was 21.1% in the Eurozone in April, compared to 22.5% in April a year ago.

-

11:03

Japan’s unemployment rate remains unchanged at 3.2% in April

Japan's Ministry of Internal Affairs and Communications released its unemployment rate on late Monday evening. Unemployment rate in Japan remained unchanged at 3.2% in April, in line with expectations.

The number of unemployed persons fell by 100,000 in April from a year ago to 2.24 million.

The number of employed persons rose by 540,000 in April from a year ago to 63.96 million.

-

10:50

Japanese Prime Minister Shinzo Abe plans to postpone the sales tax rise

Japanese Prime Minister Shinzo Abe plans to delay the sales tax rise. Natsuo Yamaguchi, head of the junior coalition Komeito Party, said on Monday that Abe noted he would like to postpone the sales tax rise by two-and-a-half years.

The Japanese government planned to increase the sales tax to 10% in April 2017 from the 8%.

-

10:37

Australia’s current account deficit narrows to A$20.8 billion in the first quarter

The Australian Bureau of Statistics released its current account data on Tuesday. Australia's current account deficit narrowed to A$20.8 billion in the first quarter from A$22.6 billion in the fourth quarter, missing expectations for a decline to a deficit of A$19.5 billion. The fourth quarter's figure was revised down from a deficit of A$21.1 billion.

The seasonally adjusted deficit on goods and services rose to A$12.6 billion in the first quarter from A$7.8 billion in the fourth quarter, which was 1.1% of gross domestic product.

Australia's net foreign debt climbed 1% in the first quarter.

-

10:20

Building permits in Australia climb 3.0% in April

The Australian Bureau of Statistics released its building permits data on Tuesday. Building permits in Australia climbed 3.0% in April, beating expectations for a 3.0% fall, after a 2.9% rise in March. March's figure was revised down from a 3.7% increase.

Building permits for private sector houses rose 0.2% in April, while building permits for private sector dwellings excluding houses plunged 2.3%.

The seasonally adjusted estimate of the value of total building approved was up 1.1% in April.

On a yearly basis, building permits increased 0.7% in April, after a 5.4% decrease in March.

-

10:07

Household spending in Japan falls 0.4% year-on-year in April

Japan's Ministry of Internal Affairs and Communications released its inflation data on late Monday evening. Household spending in Japan fell 0.4% year-on-year in April, beating expectations of a 1.4% decline, after a 5.3% drop in March.

The drop was mainly driven by decreases in spending on clothing and footwear, and housing.

Spending on clothing and footwear plunged 10.4% in real terms year-on-year in April, while spending on housing slid 11.5%.

-

08:01

WSE: Before opening

After a very quiet yesterday's session, today the market should begin to return to normal and to the trade will return both the British and the Americans. In the last day of the month some companies may lead to a desire a good closure. In Asia, the morning mood is good, with a particular behavior of Chinese market. In Shanghai increases reach almost 3%, which means that the last day of May brings the best session of the entire month. Also, the Japanese Nikkei gained noticeably by continuing the movement started yesterday. Contracts in the US quietly approach to the Asian optimism and are listed on neutral levels. All this means that the morning moods are slightly positive. It seems that the most important part of the day is the afternoon and the attitude of the Americans in the context of the emerging data from the US. We will know today data on spending and incomes of citizens and the index of consumer confidence Conference Board and the Chicago PMI.

On the Warsaw Stock Exchange we look forward to higher turnover and clearer behavior of either party. Yesterday's session with modest activity did not give reliable signals, which can begin to appear today.

-

07:01

Global Stocks

European stock markets inched higher on Monday, though the absence of U.S. and London markets, which are both closed for holidays, kept volumes thin. U.S. financial markets will be closed for the Memorial Day holiday on Monday, while London markets are closed for a bank holiday, which is expected to keep volumes low in Europe.

Financial markets in the U.S. will be closed on Monday for the observance of Memorial Day, in honor of men and women who died while serving in the U.S. military. The stock and bond market will remain closed, while trading in all Globex contracts will be halted from 1 to 6 p.m. Eastern.

Asian stocks rose, paring the worst monthly loss since February, as the dollar maintained strength against the yen amid expectations for higher U.S. interest rates.Prime Minister Shinzo Abe wants to put off a planned sales tax increase for 2 1/2 years, senior officials from his ruling party and its coalition partner said Monday, as Abe prepares to end the speculation that has swirled for months. With the weakness in private consumption, now isn't the time to raise the sales tax, Japanese Finance Minister Taro Aso said in Tokyo on Tuesday.

Based on MarketWatch materials

-

04:02

Nikkei 225 17,133.03 +65.01 +0.38 %, Hang Seng 20,762.1 +132.71 +0.64 %, Shanghai Composite 2,845.26 +22.81 +0.81 %

-

01:04

Stocks. Daily history for Sep Apr May 30’2016:

(index / closing price / change items /% change)

Nikkei 225 17,068.02 +233.18 +1.39 %

Hang Seng 20,629.39 +52.62 +0.26 %

S&P/ASX 200 5,408.02 +2.10 +0.04 %

Shanghai Composite 2,823.86 +2.82 +0.10 %

FTSE 100 6,270.79 +5.14 +0.08 %

CAC 40 4,529.4 +14.66 +0.32 %

Xetra DAX 10,333.23 +46.92 +0.46 %

-