- EUR/JPY Price Analysis: Tanks beneath 157.00 on an evening-star chart pattern

Market news

EUR/JPY Price Analysis: Tanks beneath 157.00 on an evening-star chart pattern

- EUR/JPY falls 0.78% to a three-day low of 156.64 after ECB raises rates by 25 bps but signals caution.

- Technical outlook turns bearish as Chikou Span crosses below price action and Tenkan-Sen dips below Kijun-Sen.

- Short-term battle ensues below the 157.00 mark; a daily close below could trigger a re-test of the weekly low at 156.58.

Late in the North American session, the EUR/JPY pair plunged sharply following a dovish rate hike by the European Central Bank (ECB), which raised rates by 25 bps for the tenth time since the central bank began its tightening cycle. Hence, the cross-currency pair extends its losses of 0.78%, falling to a new three-day low of 156.64 but shy of a new weekly low. The pair exchanges hands at 156.91.

EUR/JPY Price Analysis: Technical outlook

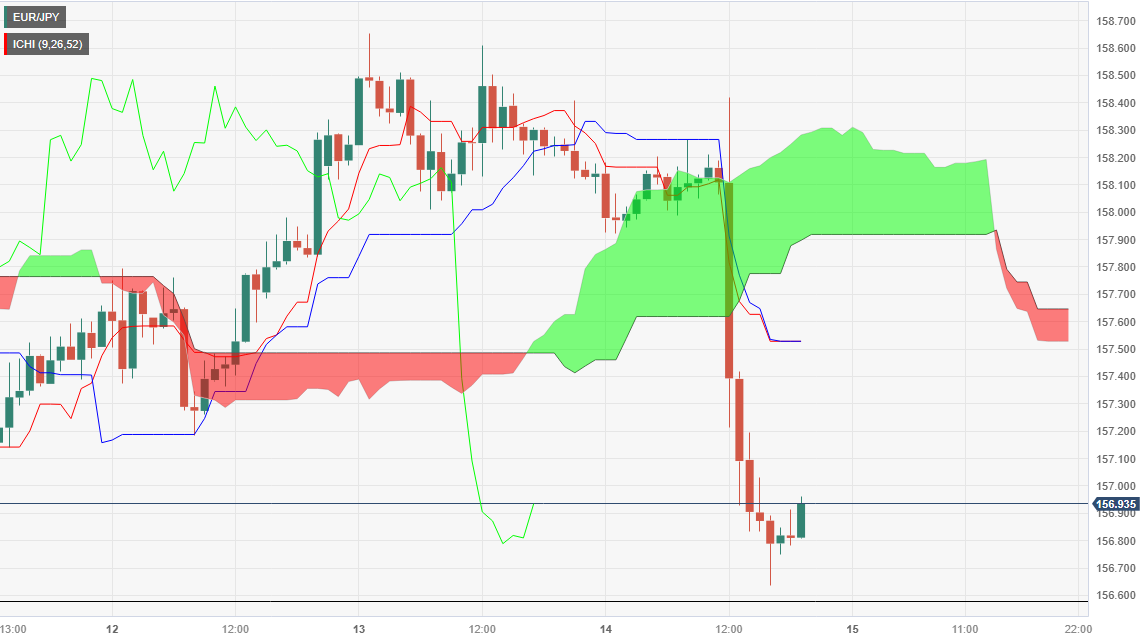

After achieving another lower low, the currency pair is neutrally biased yet remains above the Ichimoku Cloud (Kumo), seen as a bullish signal. Nonetheless, the Chikou Span crossing below the price action and the cross-over of the Tenkan-Sen below the Kijun-Sen gives two bearish signals that, summed to the market structure, portray the pair as slightly tilted to the downside.

In the short term, the EUR/JPY hourly chart depicts the pair diving to a three-day low, with bulls and bears fighting just below the 157.00 figure. If the pair achieves a daily close below that level, expect a re-test of the weekly low of 156.58 before the cross extends its losses toward the 156.00 figure. On the flip side, if the currency pair ends the day above 157.00, an upward correction is seen toward 157.52/64, a zone of confluence, where the Kijun-Sen, Tenkan-Sen, and the Senkou Span A and B lie before resuming its uptrend.

EUR/JPY Price Action – Hourly chart