- Crude Oil Futures: Further losses should not be ruled out

Market news

6 tháng 11 2023

Crude Oil Futures: Further losses should not be ruled out

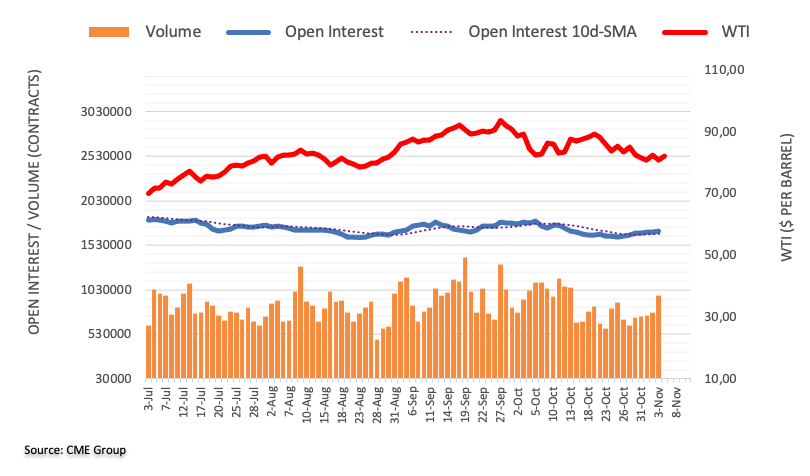

CME Group’s flash data for crude oil futures markets noted traders added around 18.2K contracts to their open interest positions last Friday, resuming the uptrend following the previous daily drop. In the same line, volume increased for the fifth straight session, now by around 186.7K contracts.

WTI: A drop below $80.00 could reignite the selling impulse

Friday’s decline in prices of WTI came amidst an increasing open interest and volume, leaving the door open to extra losses in the very near term. That said, a breach of the key contention area around $80.00 should spark a deeper pullback to initially, the interim support at the 200-day SMA at $78.16.

Market Focus

Open Demo Account & Personal Page