- Crude Oil Futures: Further recovery not favoured

Market news

21 tháng 11 2023

Crude Oil Futures: Further recovery not favoured

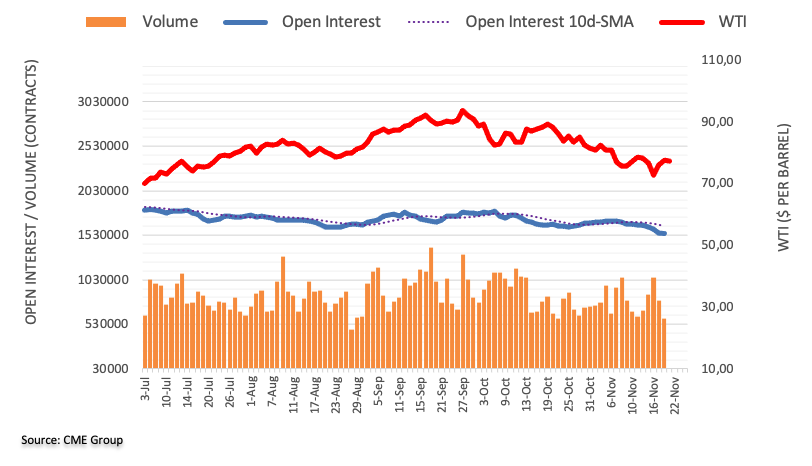

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions for yet another session on Monday, this time by around 10.7K contracts. In the same line, volume shrank for the second session in a row, now by around 210.5K contracts.

WTI: Another visit to $72.00 seems likely

Monday’s positive start of the week in prices of WTI was in tandem with shrinking open interest and volume, which dwindles the probability of further recovery in the very near term. Against that, the resumption of the selling pressure and a potential visit to recent lows near the $72.00 mark per barrel should not be ruled out.

Market Focus

Open Demo Account & Personal Page