Market news

-

23:17

Japan’s Top FX Diplomat Kanda: Concerned about one-sided sharp FX moves

Japan's top currency diplomat Masato Kanda, who will instruct the BOJ to intervene, when he judges it necessary, commented on the weaker Japanese Yen (JPY) following the Bank of Japan (BoJ) policy decision on Tuesday.

Key quotes

“Concerned about one-sided, sharp FX moves.”

“Speculative moves seem to play the biggest factor.”

“Won't rule out any steps to respond to disorderly FX moves.”

“Did not intervene in FX market last month.”

“In close contact with authorities internationally on FX.”

“FX moves affect price stability target.”

Market reaction

At the time of writing, USD/JPY is trading at 151.28, losing 0.24% on the day.

-

23:15

NZD/USD wobbles on employment change miss, testing 0.5800

- New Zealand Employment Change misses expectations, looses jobs instead of meager gain.

- RBNZ Financial Stability Report reveals little new for investors to chew on.

- Broader market will shift attention to Wednesday's upcoming Fed rate call.

The NZD/USD saw mild declines on Tuesday as broad-market sentiment tips in favor of the US Dollar (USD), taking the Kiwi (NZD) down from opening bids near 0.5840 after hitting a new, albeit minor high for the week near 0.5860.

The Kiwi's downside pressure is set to continue through Wednesday as New Zealand saw an unexpected contraction in employment figures and the Reserve Bank of New Zealand's (RBNZ) Financial Stability Report (FSR) revealed little of note for investors to be concerned about.

New Zealand's Employment Change for the 3rd quarter unexpectedly contracted, printing at -0.2% against the previous quarter's 1% gain, missing the forecast 0.4% that NZD traders expected. Despite the miss, NZ's overall Employment Rate printed at expectations, coming in at the forecast 3.9% against the 2nd quarter's 3.6%, so overall market effect was restrained.

RBNZ Governor Adrian Orr delivered the NZ central bank's latest FSR, with the RBNZ head noting that significant risks remain on the horizon as New Zealand households and businesses continue to grapple with higher debt servicing costs. The NZ financial system is still adjusting to a higher-rate environment, and the RBNZ looks unlikely to raise rates any time soon as the central bank remains leery of potential declines or deterioration in asset quality.

Markets will now turn their eyes to Wednesday's Federal Reserve (Fed) rate call, where markets are expecting the US central bank to keep rates where they are, but investor bets of one last 25-basis-point rate hike to close out the year are on the rise in the face of firm US economic data and sticky inflation metrics that refuse to decline on-pace with market expectations.

NZD/USD Technical Outlook

The Kiwi continues to waffle into the low end of the charts, but there's only so far the NZD can fall, and the pair is struggling to extend further declines below 0.5800 despite broad-market US Dollar strength.

Bullish recovery still sees significant technical resistance, with the 50-day Simple Moving Average (SMA) descending into the 0.5900 handle region, and the NZD/USD continues to test the waters on the low end of 2023's prices.

NZD/USD Daily Chart

NZD/USD Technical Levels

-

23:03

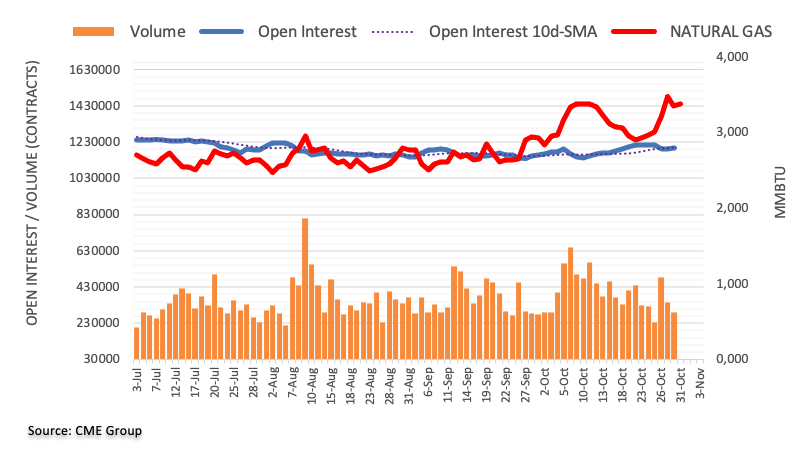

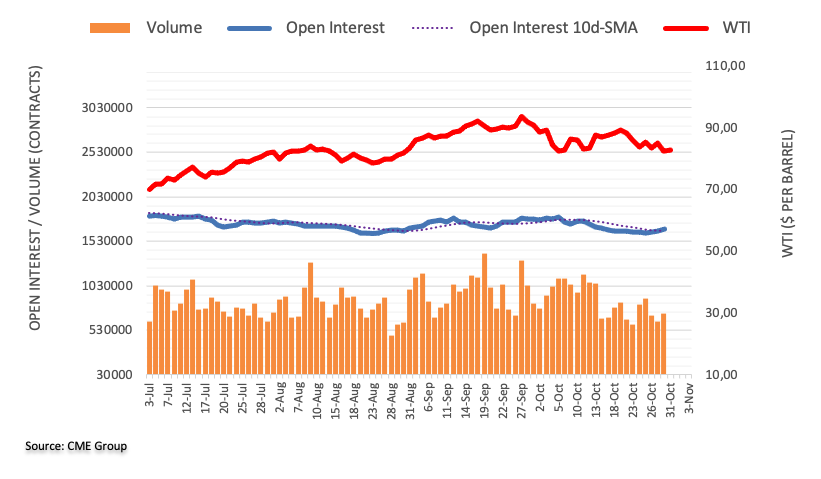

WTI Crude Oil drops amidst Greenback’s recovery, reduced supply concerns

- WTI dropped more than 1.40%, trading at $81.43 per barrel.

- A Reuters survey revealed that OPEC's crude output rose by 180K barrels per day in October.

- The US Energy Information Administration (EIA) reported a rise in US crude production to 13.05 million barrels daily.

West Texas Intermediate (WTI), the US crude oil benchmark, dropped more than 1.40% on Tuesday as the Greenback recovered while market players remain less worried about supply disruptions amid the Middle East conflict. At the time of writing, WTI is trading at $81.43 per barrel.

US Crude Oil benchmark faces a decline as the US Dollar rose, worries about supply disruptions in the Middle East

According to a Reuters survey sponsored by Nigeria and Angola, the Organization of Petroleum Exporting Countries (OPEC) revealed that crude output rose by 180K per day in October. Alongside that, the US revealed that is crude production rose at a 13.05 million barrel per day, revealed the US Energy Information Administration (EIA).

Crude Oil extended its losses as China revealed that manufacturing activity contracted, weighing on demand prospects in one of the largest oil importers.

Fears of global economic slowdown reignited as the Eurozone (EU) revealed its Gross Domestic Product (GDP) for the third quarter slipped to contractionary territory. Aside from this, woes of a possible escalation of the Israel-Hamas conflict loom, as Israel’s Prime Minister Benjamin Netanyahu disregarded the cease-fire in exchange for hostages.

WTI Technical Level

-

23:01

New Zealand Unemployment Rate comes in at 3.9% in Q3 versus 3.6% prior

The New Zealand Unemployment Rate in the third quarter (Q3) climbed to 3.9% from 3.6% in the second quarter, according to data published by Statistics New Zealand on Wednesday. The market consensus was a 3.9% print in the reported period.

Additionally, the Employment Change dropped to 0.2% in the third quarter from a 1% rise in the previous reading. This figure came in worse than the expectation of a 0.4% rise.Market reaction

Following the key New Zealand (NZ) Q3 employment report, the NZD/USD pair is trading lower on the day at 0.5809, as of writing.

-

22:49

AUD/USD sticks to the range-bound trade below the mid-0.6300s ahead of Fed rate decision

- AUD/USD faces some range-bound trade below the mid-0.6300s on Wednesday.

- The markets anticipate that the FOMC will leave interest rates unchanged at its November meeting.

- The Middle East geopolitical tensions and the downbeat Chinese data weighed on the Aussie.

- The FOMC interest rate decision and FOMC press conference will be in the spotlight.

The AUD/USD pair sticks to a range-bound trade during the early Asian session on Wednesday. Appetite for risk assets elsewhere was subdued ahead of the Federal Open Market Committee (FOMC) announcement, with no change in rates expected. The pair currently trades around 0.6334, losing 0.04% for the day.

The FOMC meeting on Wednesday will be a closely watched event. The markets anticipate that the central bank will leave interest rates unchanged at its November meeting. The FOMC has made it obvious that it will not raise interest rates at this meeting, thus, investors will keep an eye on the FOMC’s message after the meeting about how high the bar is to convince the FOMC to hike rates again.

The elevated geopolitical risks in the Middle East and the downbeat Chinese data weighed on the risk sentiment and lift the safe-haven US Dollar (USD) higher. The weaker-than-expected Chinese Manufacturing PMI data raised concerns about the economic recovery in the world’s second-largest economy.

Apart from this, the latest data on Wednesday revealed that the Australian AiG Industry Index for September came in at -9.9 versus -3.5 prior, while the AiG Manufacturing PMI arrived at -20.9 from -12.8 in the previous reading.

Looking ahead, market players will monitor the US ADP employment report, JOLTS, and the ISM Manufacturing PMI on Wednesday. The highlight events will be the FOMC decision and Powell's press conference. Traders will take cues from the events and find trading opportunities around the AUD/USD pair. -

22:32

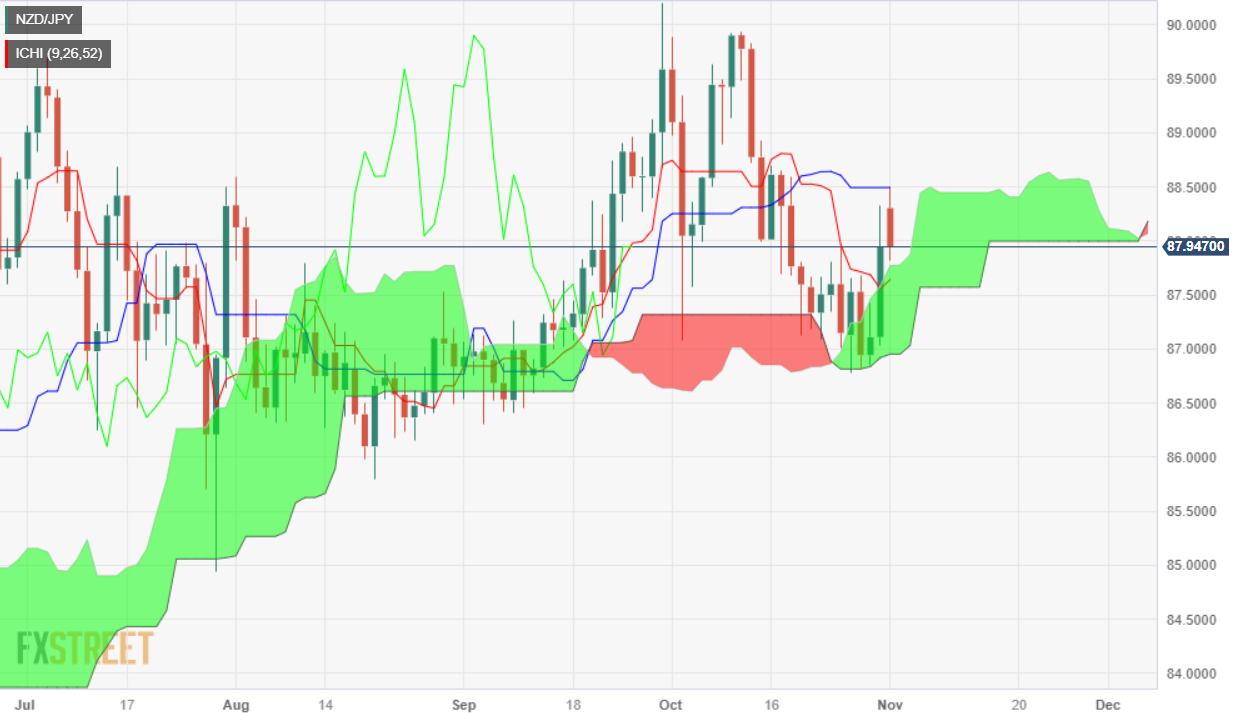

NZD/JPY Price Analysis: Rally capped at Kijun-Sen, at around 88.00

- NZD/JPY rose from daily lows of 87.03 to test 88.00, though the rally was halted by the Kijun-Sen at 88.49.

- On the upside, resistance levels are at 88.00, the Kijun-Sen at 88.49, and the October 11 high at 89.93.

- Key support levels include the top of the Kumo at 87.82, the bottom of the Kumo at 87.00, and the September 5 swing low at 86.30.

The NZD/JPY jumped from daily lows of 87.03, climbing past the 88.00 figure on Tuesday. However, the advancement was capped by the Kijun-Sen at 88.49, and a seven-month-old upslope support trendline turned resistance, which pushed prices toward the top of the Ichimoku Cloud (Kumo). The pair is trading at 87.89, down 0.48%.

The daily chart portrays the pair as neutral to downward biased, about to break inside the Kumo, which could pave the way for further downside. If NZD/JPY falls below the top of the Kumo at 87.82, that would drive the price towards the bottom of the Kumo at 87.00 before challenging the September 5 swing low of 86.30.

On the contrary, NZD/JPY buyers could remain hopeful if the pair climbs back above the 88.00 figure. A breach of the latter would expose the Kijun-Sen at 88.49, followed by 89.00. A decisive break would expose the October 11 high at 89.93.

NZD/JPY Price Action – Daily chart

NZD/JPY Technical Levels

-

22:24

AUD/NZD Price Forecast: Aussie sees early Wednesday break higher against Kiwi

- The AUD/NZD spent most of Tuesday drifting lower before a late-day break buoyed the pair.

- The Aussie is trading into familiar top end against the Kiwi heading into Wednesday's market session.

- The Kiwi stumbled on an employment data miss, hobbling the NZD's chances to turn bullish.

The AUD/NZD has bumped back over 1.0900 after the Kiwi (NZD) tripped and stumbled in early Wednesday market action, trading back down against the Aussie (AUD) and sending the AUD/NZD tipping back into a near-term high around 1.0930.

Aussie intraday declines sent the AUD/NZD back into the 200-hour Simple Moving Average (SMA) before the pair caught a rebound bid from the moving average.

The pair is trading back into the high end of recent action, but further upside remains limited for the AUD with long-term resistance piling up from the 1.0920 level.

On the down side, prices have been firmly cycling the 200-day SMA for most of the back half of 2023, and it won't take much to push the Aussie back into a bearish pattern in a return to the long-run average.

Technical indicators are also running dry on the high side, with the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) both tipping into overbought territory, though daily candlestick traders will want to wait for a slow-MA MACD crossover to confirm bearish momentum.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

-

22:19

Australia Judo Bank Manufacturing PMI came in at 48.2, above expectations (48) in October

-

21:57

EUR/JPY Price Analysis: Soars to new 15-year high, above 160.00

- EUR/JPY reached a new YTD high of 160.85, closing Tuesday's session with gains of over 1.32%.

- The uptrend remains intact, with the potential to test multi-year high of 169.97.

- Key resistance levels include the April 2008 high at 164.97 and the 2008 highs.

- On the downside, support levels are at 160.00, followed by the Tenkan-Sen at 159.27 and the 159.00 mark.

EUR/JPY rallies to a new year-to-date (YTD) high of 160.85, closing Tuesday’s session with gains of more than 1.32% or 200 pips post the Bank of Japan’s (BoJ) decision to keep its ultra-loose monetary policy. As Wednesday’s Asian session begins, the cross-currency pair trades at 160.35, almost unchanged.

With price action finally breaking the top of the range, the EUR/JPY uptrend remains intact, and it could be testing 13-year highs of 169.97, but buyers must face solid resistance levels ahead. The next resistance level would be the April 2008 high at 164.97 before rallying towards the 2008 highs.

Conversely, the EUR/JPY first support would be the 160.00 mark. Once cleared, the next support would be the Tenkan-Sen at 159.27, followed by the 159.00 mark. If sellers push prices lower, the next support would be the Senkou Span A at 158.43 before tripping towards 158.00.

EUR/JPY Price Action – Daily chart

EUR/JPY Technical Levels

-

21:47

New Zealand Unemployment Rate meets expectations (3.9%) in 3Q

-

21:46

New Zealand Labour Cost Index (YoY) below forecasts (4.2%) in 3Q: Actual (4.1%)

-

21:46

New Zealand Participation Rate came in at 72% below forecasts (72.5%) in 3Q

-

21:46

New Zealand Employment Change came in at -0.2% below forecasts (0.4%) in 3Q

-

21:46

New Zealand Labour Cost Index (QoQ) registered at 0.8%, below expectations (1%) in 3Q

-

21:29

GBP/USD fails to hold above the 20-day SMA, eyes on BoE and Fed

- The Cable slightly retreated and closed Tuesday with 0.15% losses at 1.2150.

- Markets aren’t discounting rate hikes for this week’s BoE and Fed meetings.

- Focus will be set on both bank's statements and their Chairman’s pressers.

- The BoE will release a fresh macro forecast.

In Tuesday’s session, the GBP/USD traded in the 1.2120 - 1.2200 range, closing with mild losses around 1.2150. On the USD side, it gained momentum with the DXY Index, advancing to 106.70, mainly driven by a cautious market mood. In that sense, as the economic calendar was empty with no relevant reports released by the US or the UK, the Greenback’s strength explained the pair’s trajectory.

On the Federal Reserve’s (Fed) side, investors await more clues on the bank’s stance, specifically on how they are assessing the recent robust economic reports and how they would impact their policy stance as they may give the officials reasoning to continue hiking. That being said, since the September meeting, inflation and job creation have decelerated, which would favour the case of the Fed finishing its tightening cycle with no hikes in the remainder of 2023. Markets have already discounted a pause for Wednesday's announcement, and the odds of a hike in December are still low but the bank's stance will likely impact the expectations for the last meeting of 2023.

On the Bank of England’s side, investors aren’t foreseeing a hike and will also look for clues for placing their bets for the next meetings on the bank’s statement and on Andrew Bailey’s words. Regarding the forecasts, there are growing expectations that as recent economic activity data came in weak, the bank will revise to the downside growth estimations while inflation projections are expected to be revised to the upside as prices remain stubbornly high.

GBP/USD Levels to watchAnalysing the daily chart, GBP/USD presents a bearish outlook for the short term. Both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain in negative territory, and the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), which highlights the continued dominance of bears on the broader scale.

Support levels: 1.2100, 1.2080, 1.2050.

Resistance levels: 1.2180 (20-day SMA), 1.2200, 1.2250.

GBP/USD Daily Chart

-638343844439788174.png)

-

21:25

USD/JPY pinned into the high end near 151.80 after dovish BoJ leaves Yen to flounder

- The USD/JPY climbed 1.75% on Tuesday after a dovish showing from the BoJ.

- The Yen has tumbled back into record lows, with the USD/JPY twenty pips away from a 30-year record.

- Fed Wednesday, US NFP Friday to dominate the back half of the trading week.

The USD/JPY is inches away from setting a new three-decade high as the pair trades into 151.70 heading into the end of Tuesday trading after the Bank of Japan (BoJ) left the Yen (JPY) in the dust with a dovish showing.

It's going to be a USD-forward showing for the latter half of the trading week, with the Federal Reserve's (Fed) latest rate call due on Wednesday, with another US Non-Farm Payroll (NFP) Friday set to close out the action.

BoJ: Another disappointment for JPY bulls – TDS

After announcing a slight tweak to the BoJ's yield curve control (YCC) scheme, BoJ Governor Kazuo Ueda struck a notably dovish tone, voicing concerns that inflation wouldn't achieve the BoJ's long-run targets "with certainty" and there's still too much room until positive price cyclicality is seen.

Despite that, the BoJ still upgraded their inflation forecasts, and the Japanese central bank now sees Japan's inflation at 2.8% for 2024 (previously 1.9%).

On the US side, the Fed is set to give their latest rate call on Wednesday, and though markets are broadly forecasting the Fed to stand pat on rates for this meeting, odds of one last rate hike for 2023 are rising, and investors will be keeping a close eye on FEd Chairman Jerome Powell's ensuing speech after the rate announcement.

Further out, US NFP is set to cap off another trading week, and markets are expecting a decline in the headline figure from 336K to 180K, and another beat in jobs data would be just the spark needed to send the US Dollar spiraling even higher.

USD/JPY Technical Outlook

The Yen's deflate on Tuesday has sent the USD/JPY surging, and the pair is resting some 20-odd pips from setting a fresh 30-year high beyond 151.94, a previous record ceiling set back in October of 2022.

With record bids crossing the pair, there's little in the way of technical resistance keeping the pair lashed down. The Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators have been pinned in overbought-to-neutral territory since August.

On the low side, the 50-day Simple Moving Average (SMA) is drifting upwards, acting as dynamic technical support from just north of the 148.00 handle.

USD/JPY Daily Chart

USD/JPY Technical Levels

-

20:39

Forex Today: Dollar rises as markets await the Fed and employment data

During the Asian session, New Zealand will release the employment report, and RBNZ Governor Orr will hold a press conference following the presentation of the Financial Stability Report. Australia's data includes the AiG Index and Building Permits. Later in the day, the ADP Employment report and the ISM Manufacturing PMI are due. The key event will be the FOMC decision and Powell's press conference.

Here is what you need to know on Wednesday, November 1:

The Federal Reserve (Fed) concludes its two-day meeting on Wednesday, with market expectations for the central bank to maintain its monetary policy stance. No surprises are expected, and if the Fed holds the same tone and message, it could be a non-event for markets. Analysts are looking for clues about how long the Fed will keep rates higher.

Before the FOMC statement, important economic data is due, including the ADP employment report, JOLTS, and the ISM Manufacturing PMI. More jobs data is due later in the week with the weekly Jobless Claims on Thursday and Nonfarm Payrolls on Friday.

Wall Street posted gains on Tuesday; however, the US Dollar strengthened amid higher Treasury yields. The Dow Jones gained 0.38%, and the Nasdaq climbed 0.48%. The 10-year Treasury yield rose to 4.90%. The US Dollar Index (DXY) rebounded and posted its highest close since October 4, above 106.60.

Data from the Eurozone showed that inflation slowed more than expected in October and that the economy contracted by 0.1% during the third quarter. These numbers will likely keep the European Central Bank (ECB) on hold. EUR/USD dropped from 1.068 to 1.0555. Despite the decline, the pair continues to make higher highs and higher lows, which is a positive sign for the Euro. However, it needs to break above 1.0700 to open the doors to more gains.

Analysts at Commerzbank on Euro area inflation:

Most members of the ECB's Governing Council are likely to be pleased with the data. The ECB is unlikely to raise interest rates further. This is all the more true as the economy contracted slightly in the third quarter.

GBP/USD reached 1.2200 and then turned downward, remaining below the 20-day Simple Moving Average (SMA). It closed around 1.2150, moving sideways near monthly lows. EUR/GBP reversed after hitting the highest level since May at 0.8757 and dropped towards 0.8700.

The Japanese Yen was the worst performer on Tuesday after the Bank of Japan (BoJ) meeting. USD/JPY continued to rise even during the American session and posted at 151.60, the highest daily close since 1990.

The Swiss Franc also tumbled across the board on Tuesday, with USD/CHF rising almost a hundred pips, and EUR/CHF climbing above 0.9600, reaching the highest level since October 5.

AUD/USD continued to trade in a range around 0.6350, offering no clear signals. The improvement in market sentiment did not offset Dollar strength and kept the pair far from 0.6400 and closer to 0.6300. Australian data due on Wednesday includes the AiG Construction, Manufacturing, and Industry indexes, as well as Building Permits.

USD/CAD hit fresh one-year highs at 1.3891 and then pulled back to 1.3870. The pair maintains a bullish tone, facing resistance at 1.3900.

Gold and Silver tumbled ahead of the FOMC meeting. XAU/USD failed to hold above $2,000 and dropped to $1,980. Silver lost 2%, falling to $22.75.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:32

United States API Weekly Crude Oil Stock rose from previous -2.668M to 1.347M in October 27

-

19:50

Silver Price Analysis: XAG/USD price retreats below $23.00 as double-top looms

- Silver is facing a potential double-top formation on the daily chart suggests further retracement is possible.

- Key support levels include the 50-day moving average (DMA) at $22.93 and the 20-day DMA at $22.45.

- On the upside, reclaiming $23.00 would bring the 200-DMA at $23.28 into focus, followed by the September 23 daily high at $23.77.

Silver price trips down and aims below the $23.00 mark, which was briefly visited by the grey metal and capped by a strong recovery from the Greenback. The XAG/USD is trading at $22.86, down 1.82%.

A double-top in the daily chart is forming, suggesting that XAG/USD could retrace further, past the latest cycle low of $22.45, the October 26 low. However, on its way to challenging the latter, Silver must break key technical support levels like the 50-day moving average (DMA) at 422.93, and the 20-day moving average (DMA) at $22.45. Once those levels are cleared, Silver could shift from a neutral to a downward bias.

Conversely, if XAG/USD stays above the 50-DMA and reclaims $23.00, the following resistance level would be the 200-DMA at $23.28, which needs to be cleared, along with the September 23 daily high at $23.77, the latest cycle high, to shift the grey-metal bias to upwards. In that outcome, the XAG/USD next resistance would be $24.00.

XAG/USD Price Action – Daily chart

XAG/USD Technical Levels

-

19:06

USD/COP retakes the 100-day SMA, bears still in command

- USD/COP is up by more than 1.50%, towards 4122.5.

- On Wednesday, the Fed announces its monetary policy decision, on Thursday, it’ll be the Colombian Bank’s turn.

- A negative market environment seems to be favouring the USD.

The USD/COP sharply rose on Tuesday, mainly driven by a cautious market mood ahead of the Federal Reserve (Fed) and the Colombian central bank decisions on Wednesday and Thursday.

On the US side, markets have already discounted a pause, but investors are looking for further clues on the Fed’s plan for the December meeting to take on their next positions. As for now, the CME FedWatch tool suggests that the odds of a hike in the last meeting of 2023 are low, but the policy statement and Chair Powell’s presser will likely impact those expectations.

Recent indicators reported that the US economy is doing better than expected, which will probably give the Fed officials reasons to leave the door open to hiking agains. Job creation has slightly decelerated, but the economic activity remains strong, which gave the Greenback traction in the last sessions.

On the COP’s side, markets are also discounting a pause in Thursday’s quarterly report from the Colombian Central Bank, holding rates at 13.25%. In the last meeting, the bank sounded hawkish and considered that its wasn’t prudent to consider cutting rates due to the recent economic data. In the meantime, swaps markets are discounting higher odds of the easing cycle to start next December.

USD/COP Levels to watch

According to the daily chart, the technical outlook for the USD/COP remains neutral to bearish, as despite the bulls gaining ground, the bears are in command. The Relative Strength Index (RSI) shows an upward trend below its midline, suggesting a potential resurgence of bullish strength, while the Moving Average Convergence (MACD) prints neutral red bars.

In the larger context, the pair is below the 20 and 200-day Simple Moving Averages (SMAs), and if the bulls hold above the 100-day average, the buyers may have some hope of stopping the recent bearish momentum.

Support levels: 4096.7 (100-day SMA), 4045.7,4027.3.

Resistance levels: 4147.8,4175.5, 4190.9.

USD/COP Daily Chart

-

19:04

Gold Price Forecast: XAU/USD reclaims $2,000 ahead of Fed rate call

- Spot Gold prices are on the high end as investors await the latest Fed statement.

- XAU/USD is hesitating near the $2,000 major level, but markets remain pinned in risk-off territory.

- Central banks may be a major underpin in Gold prices.

The XAU/USD is seeing some hesitation after pinning into the $2,000 major level as investors turn broadly risk-off ahead of the Federal Reserve's (Fed) upcoming interest rate call slated for tomorrow.

Spot Gold is set for it's best four-week performance in over seven months, with the XAU/USD reaching 11% from October's low bids near $1,810 and reaching a monthly high of $2,009.49.

Broad-market sentiment remains firmly beaten back on Tuesday, with Gold and the US Dollar climbing for the day as investors brace for the Fed rate call tomorrow. Markets anticipate the US central bank will hold rates steady for the upcoming meeting, but steady US economic data and still-firm inflation figures are increasing the chances of one last rate hike for 2023 at December's Fed meeting.

Central bank Gold purchases may have been an unexpected underpin in XAU/USD bids lately; according to reporting by the World Gold Council (WGC), central banks were a primary driver of Gold demand in the 3rd quarter.

Central banks socked away an additional 337 tons of physical Gold in the three months through September, compared to 175 tons the previous quarter, and 103 tons the quarter before that.

Central bank Gold purchases for 2023 now total over 800 tons, and central bank Gold demand is a key counterweight for XAU/USD bids that have become increasingly disconnected from US Treasury yields as of late.

XAU/USD Technical Outlook

Spot Gold's recent gains see the XAU/USD vaulting cleanly over the 200-day Simple Moving Average (SMA) currently rising into $1,940.

The 50-day SMA is set to complete a bullish rollover, rising into $1,940, and will confirm a bullish crossover of the 200-day SMA if XAU/USD sellers don't get bids pushed back towards $1,900.

2022's swing high of $2,079.76 sits as the key ceiling to break through for Gold bulls, while a bearish return to October's bottoms past $1,810 will see the XAU/USD trading into fresh lows for 2023.

XAU/USD Daily Candles

XAU/USD Technical Levels

-

19:03

EUR/USD dips below 1.0600 on mixed EU data, ahead of Fed’s decision

- EUR/USD retreats from a weekly high of 1.0675, currently trading below 1.0600.

- Mixed economic data from the Eurozone, with inflation dropping to 2.9% in October but GDP contracting by 0.1% in Q3.

- ECB officials keep the door open for additional tightening, with Joachim Nagel emphasizing the need for high rates for a prolonged period.

EUR/USD retreats from a weekly high at 1.0675 reached during the European session and dives below the 1.0600 figure courtesy of mixed economic data from the Eurozone (EU) and overall US Dollar (USD) strength. At the time of writing, is trading at 1.0580, down 0.31%.

Euro loses ground against the US Dollar amid mixed economic signals from the Eurozone

With Wall Street printing gains, risk appetite has improved throughout the North American session. Consumer Confidence deteriorated in the United States (US), as the Conference Board (CB) revealed. Figures came at 102.6, from 104.3 in September, above estimates of 100.5. At the same time, the US Department of Labor reported that employment costs are rising. Employment Cost Index rose 1.1%, above forecasts of 1%.

On Wednesday, the economic docket would feature the ADP Employment Change report and S&P Global and ISM PMIs ahead of the Federal Reserve’s monetary policy decision. The Fed is expected to keep rates unchanged, but it will most likely keep another rate hike increase on the table.

In October, Eurozone inflation dropped below the 3% threshold, coming in at 2.9%, which is lower than the expected 3.1% and a significant decrease from the 4.3% recorded in September. This data supports the European Central Bank's decision to keep rates on hold last week. As a result, money market futures are now estimating that the first-rate cut may occur in the first half of 2024.

Despite the positive inflation figures, the Eurozone's GDP for the third quarter was disappointing, coming in at -0.1%, which missed the forecast of 0% growth. Despite this, some European Central Bank (ECB) officials have kept the door open for additional tightening. Joachim Nagel from the Bundesbank stated, "Our tight monetary policy is working, but we must not let up too soon." He emphasized the need to maintain sufficiently high-interest rates for an extended period.

EUR/USD Technical Levels

-

18:21

Colombia Interest rate in line with expectations (13.25%)

-

18:14

GBP/JPY reclaims 184.00 on Tuesday as Yen gets yanked back down by dovish BoJ

- The GBP/JPY has rocketed back to 184.00 after the BoJ flubbed hawkish tone expectations.

- The Pound Sterling is set for its single best trading day against the Yen since July.

- The Guppy is back into its highest bids in over a month.

The GBP/JPY is climbing back over the 184.00 handle for Tuesday, with the Yen (JPY) getting punished after the Bank of Japan (BoJ) struck a far more dovish tone than markets were prepared for, even as Japanese inflation forecasts tick higher.

BoJ: Another disappointment for JPY bulls – TDS

BoJ Governor Kazuo Ueda hit newswires early Tuesday with dovish comments, stating that he doesn't see Japanese inflation reaching BoJ targets "with certainty", and the Japanese central bank will stand pat on interest rates for the foreseeable future, even as the BoJ's own inflation forecasts are revised higher.

The BoJ now expects 2024 inflation to come in at 2.8% (previous 1.9%), with 2025 seen at 1.7% (previous 1.6%).

It is now the Bank of England's (BoE) ballgame to lose with UK's central bank slated to bring another rate call on Thursday. The BoE is broadly expected to also hold steady on rates, and investors will be looking at the BoE's Monetary Policy Report and BoE Governor Andrew Bailey's press conference.

BoE Governor Bailey's press conference is scheduled for thirty minutes after the rate decision announcement is released.

GBP/JPY Technical Outlook

Tuesday's rally in the GBP/JPY sends the pair back over the 184.00 handle, taking the Guppy into its highest bids in six weeks.

The pair continues to cycle the 50-day Simple Moving Average (SMA), with the MA in play near 183.00.

Major top side resistance is baked in from August's swing high into 186.77, and a congestion range from here will see the formation of a head and shoulder pattern from July's peak near 184.00.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

-

17:30

USD/CHF to multi-week highs ahead of Fed decision

- USD/CHF tallies a sixth consecutive day of gains, rising to a high above 0.9100 and then settled at 0.9080.

- The market's mood is cautious ahead of the Fed decision on Wednesday which favours the USD.

On Tuesday, the USD/CHF extended its gains and rose to its highest level since mid-month, above 0.9100 and now trades above its primary 20,100 and 200-day Simple Moving Averages (SMAs). Daily market movers for the pair included mid-tier housing, consumer confidence and economic activity figures from the US but the Greenback is strengthening ahead of the Federal Reserve (Fed) decision on Wednesday.

On the data front, the House Price Index from August came in at 0.6% MoM, beating the expected 0.5% but declining from its previous reading of 0.8%. Furthermore, the S&P/Case-Shiller Home Price from August came in at 2.2% YoY, higher than the expected 1.6% and accelerated regarding its last reading of 0.2%. In addition, the CB Consumer Confidence Index from October also beat expectations, coming in at 102.6.

On the negative side, the Institute for Supply Management - Chicago reported that the Chicago PMI from October came in lower than expected at 44 vs the expected 45 and declined from its previous reading of 44.1.

Regarding the Fed’s decision, a pause is priced in, and investors will closely look at the policy statement and Chair Powell’s tone in his presser following the decision. In the last meeting, the bank hinted at a “cautious” stance, pointing out that the decisions will be decided carefully, and Powell left the door open for further tightening if the incoming data justifies it. In line with that, investors seem to be refraining from taking on big positions and instead seeking refuge in the USD, which is pushing the pair to the upside and lowering the demand for riskier assets.

USD/CHF Levels to watchThe technical analysis of USD/CHF highlights a short-term bullish trend. Nevertheless, traders should be mindful of overbought conditions, as these signals may foreshadow an incoming technical correction. The Relative Strength Index (RSI) displays a strong upward momentum in the overbought region, while the Moving Average Convergence (MACD) histogram presents larger green bars. Additionally, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating that the buyers command the broader perspective.

Resistance levels: 0.9090, 0.9100, 0.9150.

Support levels: 0.9050, 0.9015-0.9000 (20 and 200-day SMA convergence), 0.8970.

USD/CHF Daily Chart

-638343695129449338.png)

-

17:30

NZD/USD falls back towards 0.5800 as Greenback steps up

- The NZD/USD is falling back into near-term congestion as markets pick up the US Dollar.

- Kiwi traders keeping a look out for Tuesday's NZ labor figures.

- Broad markets are looking to Fed's Wednesday showing.

The NZD/USD is falling back towards 0.5800 as investors broadly turn back into the US Dollar (USD) ahead of the Federal Reserve's (Fed) upcoming rate call on Wednesday. Before that, late Tuesday sees the latest labor and unemployment figures for New Zealand, followed by a speech from Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr.

Broad-market sentiment has turned moderately risk-off, sending the USD higher across the board with the Dollar Index (DXY) gaining around a percent from Tuesday's early low, and the Kiwi is getting pushed back into the 0.5800 handle, keeping the NZD/USD pinned in familiar downside with the pair trading into eleven-month lows.

Markets have priced in a hold on Fed rates this Wednesday, but firm US growth figures and inflation that refuses to abate quick enough are pushing up odds of one more rate hike from the Fed in December to close out the year.

New Zealand: More robust than expected labour market to benefit the NZD – Commerzbank

New Zealand's Q3 Unemployment Rate is expected to tick up from 3.6% to 3.9%, with the 3rd quarter's Employment Change expected to climb 0.4%, compared to Q2's 1.0%.

With NZ labor market data expected to decline slightly, ongoing market concerns about China's wobbly economy, and still-high inflation plaguing the New Zealand domestic economy, the Kiwi isn't expected to find much to rally about.

However, a better-than-expected reading for economic activity figures could see the RBNZ given enough room to further tighten monetary policy, which could bolster the NZD.

NZD/USD Technical Outlook

With the Kiwi trading back into 0.8500, downside technical support is thinning quickly, and the levels to watch will be last week's downswing into 0.5772, and a break beyond this level will see the NZD/USD making a run for last October's trading territory, near 0.5700.

Technical resistance is piling up above current bids, with the 50-day Simple Moving AVerage (SMA) pushing down into the 0.5900 major level, a confluence resistance level. Further beyond that, October's swing high into 0.6050 represents the last major ceiling for any bullish recoveries for the NZD/USD.

NZD/USD Daily Chart

NZD/USD Technical Levels

-

17:23

EUR/GBP retreats from 5-month high as EU economy contracts

- EUR/GBP falls from a 5-month high of 0.8754, currently trading at 0.8705.

- Eurozone inflation drops to 2.9% in October, while GDP for Q3 misses forecasts, contracting by 0.1%.

- The Bank of England is expected to keep rates unchanged at 5.25% on November 2, as traders priced in rate cuts towards the end of 2024.

The EUR/GBP falls from a 5-month high reached earlier in the European session, at 0.8754, but has retreated after the Eurozone’s (EU) economy contracted while inflation cooled. Therefore, speculations are mounting that the European Central Bank (ECB) might finish raising rates. The cross exchanges hands at 0.8705.

Euro loses ground against the British Pound as economic data fuels speculation that the ECB might halt its rate hikes

During the European session, the EU revealed that inflation dipped below the 3% threshold in October, according to Eurostat, with prices rising to 2.9%, below the 3.1% expected and well beneath the September 4.3% jump. Given that data justifies the ECB’s pausing rates last week, money market futures estimate the first rate cut is expected in the first half of 2024.

Nevertheless, not everything is good news for the bloc, as the Gross Domestic Product (GDP) for Q3 missed forecasts of 0%, at -0.1%. despite that, some ECB officials continued to keep the door open for additional tightening, as Joachim Nagel from the Bundesbank noted, “Our tight monetary policy is working, but we must not let up too soon.” He stated that rates need to be at a sufficiently high level for a long time.

On the UK front, the Bank of England is expected to keep rates unchanged at a 15-year high of 5.25% on November 2. Although there are signs the economy is stagnating, inflation remains three times the BoE’s target of 2%. Money markets traders are betting the BoE is done raising rate increases, with rate cuts expected towards the end of 2024.

EUR/GBP Price Analysis: Technical outlook

From a daily chart perspective, the uptrend remains intact despite dipping toward the 0.8700 figure. However, if EUR/GBP sellers drive prices below the 200-day moving average (DMA) at 0.8691, that could pave the way towards a more significant correction, with first support seen at the October 24 low of 0.8682, followed by the August 11 high of 0.8669. On the other hand, if the pair stays above 0.8700, a re-test of 0.8754 is on the cards, followed by the 0.88 handle. Up next would be the May 3 high at 0.8834.

-

16:45

Canadian Dollar reverses course, falls to new twelve-month low as Fed decision looms

- Canadian Dollar falls back as broader markets turn into the US Dollar.

- Canada GDP flattens as economy lags, odds of future rate cuts beginning to rise.

- Fed’s Wednesday rate call has markets twisting, USD is Tuesday’s best performer.

The Canadian Dollar (CAD) has seen a quick end to its almost-rally on Monday, getting pushed back down and tipping into a fresh twelve-and-a-half-month low against the US Dollar (USD).

August’s Canada Gross Domestic Product (GDP) printed flat on Tuesday, missing the forecast of 0.1% and holding flat against July as Canadian economic growth stalls out.

Markets are turning broadly risk-off as investors jump back into the USD ahead of Wednesday’s Federal Reserve (Fed) rate call. While no rate moves are expected from the Fed this week, odds are increasing of one last rate hike in December before 2023 closes out.

Daily Digest Market Movers: Canadian Dollar flubs rally, market sentiment turns to the Greenback

- CAD bulls couldn’t extend Monday’s rebound into a second day as broad market risk appetite evaporates.

- USD is the largest market gainer for Tuesday, Dollar Index (DXY) climbs almost a full percent into 106.80 from Tuesday’s bottom of 105.90.

- Canadian GDP came in flat, missing expectations as Canadian manufacturing sectors chalk in a fifth straight month of growth declines, with notable losses in agriculture due to dry conditions in Western Canada.

- Odds of a rate cut in Q2 next year are rising as the Canadian economy shows deeper cracks.

- Fed’s rate call on Wednesday to be the major market focus mid-week, investors beginning to price in one more 25-basis-point rate hike from the FOMC in December.

- Bank of Canada (BoC) Governor Tiff Macklem will be squeaking in under the radar tomorrow, due to finish out day two of testifying before the Canadian government’s banking and finance oversight committee.

- BoC Governor Macklem day one highlights here.

USD/CAD Technical Analysis: Canadian Dollar can’t find strength to fight off US Dollar

The USD/CAD is heading back toward 1.3900 in Tuesday trading as the US Dollar sees a broad-market resurgence.

The USD/CAD kicked into an intraday low of 1.3813 Tuesday morning before the Greenback came roaring back, sending the USD/CAD into a fresh twelve-and-a-half month high above 1.3880.

The pair is vaulting off the 50-day Simple Moving Average (SMA) lifting into 1.3850, with the 200-day SMA building out a price floor from 1.3770.

Technical resistance to the topside is looking increasingly thin, with the only notable sticking point sitting at 1.3977, 2022’s annual high set back in October of last year.

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

16:24

ECB's Nagel: Rates must be sufficiently high for sufficiently long

European Central Bank (ECB) policymaker Joachim Nagel noted on Tuesday that inflation in the Euro area has fallen significantly but added that it was still too high, per Reuters.

Key quotes

"We must not let up too soon, rates must be sufficiently high for sufficiently long."

"It is not yet possible to say whether interest rates have already reached their peak."

"There are several upside risks to inflation; geopolitical tensions in the Middle East could drive up energy prices."

"Inflation has proven stubborn and has not yet been defeated."

Market reaction

EUR/USD stays under bearish pressure despite these hawkish comments and was last seen losing 0.45% on the day at 1.0565.

-

16:22

AUD/USD drops amid mixed sentiment, weak Chinese data

- AUD/USD drops more than 0.80%, trading at 0.6328 after hitting a daily high of 0.6376.

- US employment costs rise by 1.1%, above estimates, and Consumer Confidence deteriorates for a third straight month.

- The US Federal Reserve commences its two-day meeting, with expectations for rates to remain unchanged.

- The Reserve Bank of Australia faces pressure due to high inflation and strong consumer demand, with a 60% chance of a rate hike on November 7.

AUD/USD reversed its course during the North American session, dropping more than 0.80% due to a mixed market sentiment sponsored by weak economic data from China, alongside geopolitical risks attributed to the Middle East conflict. The pair is trading at 0.6328 after hitting a daily high of 0.6376.

Australian Dollar loses ground against the US Dollar as geopolitical risks and weak economic data from China weigh on the pair

Wall Street remains mixed, with the Dow Jones and the S&P 500 registering gains, except the Nasdaq Composite. The latest round of economic data from the United States (US) showed the employment costs are rising, according to the US Department of Labor. Employment Cost Index rose 1.1%, above estimates of 1%, while the Conference Board (CB) revealed Consumer Confidence is deteriorating for a third straight month.

Meanwhile, the US Federal Reserve (Fed) commenced its two-day meeting today, with officials expected to hold rates unchanged. After that, Fed Chair Jerome Powell would deliver its press conference, which would be interesting to see if he keeps the door open for another hike. Earlier in that day, the ADP Employment Change, along with PMIs, revealed by S&P Global and ISM, could stir the boat ahead of the Fed’s decision.

On Australia’s front, the Reserve Bank of Australia (RBA) remains under pressure due to high inflation and strong consumer demand. The swaps market implies around a 60% chance the RBA could hike rates from 4.1% by a quarter or percentage point on the November 7 meeting.

In the meantime, the Australian Dollar's (AUD) current leg down vs. the US Dollar (USD) was courtesy of China’s reporting October PMIs, which came weaker, with Services barely missing contractionary territory, while Manufacturing dropped below the 50 contraction/expansion level. Although it was an official statistic, traders will watch Caixin's release on Wednesday.

AUD/USD Technical Levels

-

16:19

Mexican Peso trades sideways despite Mexico’s upbeat data, ahead of Fed’s decision

- Mexican Peso remains unable to print a daily close below the 18.00 mark.

- Mexico's economy shows resilience as Gross Domestic Product expands for an eighth straight quarter.

- USD/MXN continues to exchange hands above the crucial 18.00 level, with geopolitical risks and month-end flows impacting the pair.

Mexican Peso (MXN) trades almost sideways against the US Dollar (USD) early morning during Tuesday’s North American session amid month-end flows and despite good economic data from Mexico. In addition, geopolitical risks remain as Israel disregards a cease-fire in Gaza, deteriorating investors' sentiment. Consequently, the USD/MXN continues to exchange hands above the 18.00 figure, seen as a crucial level for buyers and sellers, as they brace for the US Federal Reserve (Fed) monetary policy meeting.

Mexico’s National Statistics Agency (INEGI) revealed the country grew more than expected in the quarter and annually, extending its trend to eight consecutive quarters, posting solid growth and portraying a resilient economy. The annual growth rate slowed down compared to the previous quarter's reading. Jason Tuvey, deputy chief emerging markets economist at Capital Economics, said a “slowdown is on the cards,” adding that restrictive monetary policy takes a heavier toll, and weaker growth in the US weighs on Mexico’s external sector.

Meanwhile, the office of the finance minister in Mexico expressed that it’s too soon to assess the overall economic impact of Hurricane Otis.

In the meantime, Israel continues its ground offensive in Gaza. In addition to Middle East conflict, the Fed begins its two-day monetary policy meeting, in which officials are expected to keep rates unchanged at the 5.25% - 5.50% range, justifying that long-term bond yields remain higher. Besides that, traders would be looking for clues as Fed Chairman Jerome Powell would take the stand.

Daily digest movers: Mexican Peso hovers around 18.00, despite solid economic growth, awaits Fed's decision

- Mexico’s Gross Domestic Product grew by 0.9% QoQ in the third quarter on its preliminary reading, above the previous quarter and estimates of 0.8%.

- On a yearly basis, Mexico’s GDP for Q3 expanded 3.3%, above forecasts of 3.2%, but trailed the previous 3.6%.

- First estimates of Hurricane Otis damages stand at around $10 to 15 billion dollars, according to Enki Research, a firm specializing in natural disasters.

- Mexican authorities reported that around 270,000 houses in Acapulco were affected or destroyed, while 80% of hotels were severely damaged.

- The latest release of US economic data shows the economy remains resilient due to strong jobs market, as well as the preliminary release of Q3 GDP figures. USD/MXN traders should be aware of further economic data that could underpin or weigh on the Greenback.

- The US Dollar Index, which tracks the performance of the Greenback against six currencies, slides 0.40%, down at 106.15.

- Mexico’s economic docket will feature the release of , S&P Global Manufacturing PMIs, Foreign Exchange Reserves, and Gross Fixed Investment.

- The US agenda will feature the Fed’s decision, Fed Powell’s press conference, Nonfarm Payrolls employment data, and S&P Global and ISM Manufacturing PMIs.

- On October 24, Mexico's National Statistics Agency INEGI reported annual headline inflation hit 4.27%, down from 4.45% at the end of September, below forecasts of 4.38%.

- Mexico’s core inflation rate YoY was 5.54%, beneath forecasts of 5.60%.

- The Bank of Mexico (Banxico) held rates at 11.25% in September and revised its inflation projections from 3.50% to 3.87% for 2024, above the central bank’s 3.00% target (plus or minus 1%). Next decision will be announced on November 9.

Technical Analysis: Mexican Peso buyers target the 200-day Simple Moving Average

The USD/MXN uptrend remains intact despite Friday’s dip below the 18.00 figure, which puts the 20-day Simple Moving Average (SMA) at 18.10 at risk of being decisively broken to the downside. A daily close below the latter would keep sellers hopeful of driving price action towards the 200-day SMA at 17.72. A breach of the last and the subsequent support would be the 50-day SMA at 17.58. On the flip side, if the exotic pair remains above the 20-day SMA, the next resistance will emerge at the October 26 high at 18.42 before challenging last week’s high at 18.46, ahead of the 18.50 figure.

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

-

16:06

US Dollar gains momentum as Fed meeting gets underway

- US Dollar is gaining traction, DXY index surged to 106.70.

- The two-day Fed meeting ends on Wednesday with a monetary policy decision.

- Mid-tier economic figures from the US came in mixed.

- US Treasury yields retreat, which may limit the USD’s momentum.

The US Dollar (USD) is up on Tuesday, with the DXY index rising to 106.70 on the back of a cautious market mood ahead of the Federal Reserve (Fed) Interest Rate Decision on Wednesday. In addition, the US reported strong Housing and Confidence data, while Chicago’s PMI from October came in lower than expected.In defiance of the Federal Reserve’s (Fed) tightening measures, the United States economy showed remarkable resilience, which allowed the Greenback to gain traction. Despite this, the possibility of a 25-basis-point hike in December, as per the CME FedWatch Tool, continues to be low, limiting any upward movement of the USD. That being said, the policy statement and Fed Chair Jerome Powell’s words may provide further clues on forward guidance for investors to continue modeling their expectations for the next meeting.

Daily Digest Market Movers: US Dollar gained traction amid positive Housing and Confidence data, eyes on Fed- The US DXY Index jumped to 106.70, after bottoming below 106.00.

- The US Conference Board Consumer Confidence Index from October beat expectations, coming in at 102.6 vs the 100.5 expected.

- The S&P Dow Jones Indices reported that the S&P/Case-Shiller Home Price from August exceeded expectations. It came in at 2.2% YoY vs the expected 1.6% and increased in relation to its last reading of 0.2%.

- On the negative side, the Chicago PMI from October came in at 44, below the expected 45 consensus and declined from its previous reading of 44.1.

- Meanwhile, US government bond yields are mixed with the 2, 5 and 10-year yields standing at 5.07%,4.81% and 4.86%, respectively, which could limit the USD’s momentum.

- For Wednesday, according to the CME FedWatch Tool, a pause in November is nearly priced in, while the odds of a 25-basis-point hike in December are still low near 20%.

Technical Analysis: US Dollar Index jumps back above 20-day SMA, momentum still limited

According to the daily chart, the technical outlook for the DXY Index remains neutral to bearish as the bulls show signs of exhaustion. The Relative Strength Index (RSI) points toward a potential reversal, as its positive slope above the midline weakens, while the Moving Average Convergence Divergence (MACD) histogram presents red bars.

As long as the index remains above the 20, 100 and 200-day Simple Moving Averages (SMAs), the outlook on the broader scale will favour bulls, but buyers will probably have a hard time defending the 20-day SMA as momentum weakens.

Supports: 106.30 (20-day SMA), 106.00, 105.70.

Resistances: 106.80, 107.00, 107.30.US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

-

15:59

Fed Preview: Forecasts from 14 major banks, preserving the option of hiking once more

The US Federal Reserve will announce its Interest Rate Decision on Wednesday, November 1 at 18:00 GMT and as we get closer to the release time, here are the expectations as forecast by analysts and researchers of 14 major banks.

The Fed is set to leave rates unchanged for a second consecutive meeting but Fed Chair Jerome Powell is expected to keep door open to more hikes. Update macro forecasts and Dot Plots will not come until the December meeting.

Danske Bank

We expect the Fed to remain on hold in the November meeting, in line with consensus and market pricing. As financial conditions have tightened significantly, we doubt the Fed will opt for hikes at a later stage either. Rise in term premium suggests higher yields are driven by other factors than the Fed’s forward guidance, which could spark more cautious tone from Powell.

ANZ

We expect the FOMC to leave rates on hold and that its attention in coming months will evolve to focus on how long rates will need to stay at peak levels. We are of the view that recent developments in core inflation and the labour market support our analysis that rates have peaked. However, the risk that growth momentum remains strong in coming months is a wild card that needs to be acknowledged. We therefore remain focused on incoming economic data.

Commerzbank

The Fed is likely to leave the target range for the fed funds at 5.25%-5.50%. Only if the recent very high pace of growth does not weaken is a further rate hike to be expected – but not before December at the earliest.

Nordea

Fed meeting will likely be a rather uneventful event. The Fed will keep rates unchanged at 5.25% to 5.5%. With no new forecasts, Powell’s press conference will be most important for investors. We don’t think the Fed has been convinced that a new hike is needed still, even with strong macro data from the US over the last week. That does not mean that rate cuts are on the horizon either. The Fed will still put emphasis on upside risks for inflation and for the need for high rates for longer.

ING

We don’t expect any change to policy rates after the recent spike in Treasury yields prompted a tightening of financial conditions throughout the economy. The market seems to be doing the heavy lifting, so there isn't any need for the Fed to do much more – despite growth and the jobs market remaining hot and inflation still well above target. Fed Chair Jerome Powell has also acknowledged that long and variable lags between the implementation of rate hikes and the real-world impact point to the possibility that the full impact of policy tightening could still be yet to take full effect.

Deutsche Bank

We expect the Fed to stay on hold and see future hikes as a function of financial conditions and the path of the economy. While our baseline is for rates to stay at 5.3% through year-end, we see an increasing risk of a hike in December or Q1.

TDS

The FOMC is widely expected to extend a pause to rate increases again, keeping the Fed funds target range unchanged at 5.25%-5.50% for a second consecutive meeting. We expect the Fed to maintain its broadly hawkish policy tilt as it stays consistent with its signaling of an additional rate increase through the dot plot. However, the Fed will reiterate that it aims to ‘proceed carefully’ as it formulates the next policy steps.

Rabobank

We expect the FOMC to remain on hold, stress its data dependence and intention to proceed carefully. During the press conference, we expect Powell to keep the door open to a rate hike in December. However, for the remainder of the year, we expect the bond market to do the Fed’s work, making further policy rate hikes redundant. Meanwhile, the focus of the FOMC may be shifting from how high to raise the policy rate to how long to hold the policy rate at restrictive levels.

NBF

The FOMC is poised to leave the target range for the federal funds rate unchanged at 5.25% to 5.50%. Chair Powell has said that policymakers can proceed carefully ‘given the uncertainties and risks, and how far we have come’. Moreover, a number of FOMC participants have suggested the run-up in longer-term interest rates might substitute for additional policy rate increases.

RBC Economics

The Fed is widely expected to hold interest rates unchanged again in October after skipping a hike in September. US economic growth numbers have remained exceptionally resilient, but inflation pressures moderated over the summer and that is allowing the Fed room to be patient as they wait for already high interest rates to slow growth with a lag.

SocGen

Inflation has fallen back from its highs, but core inflation of just under 4% remains well above target. We see a need for the Fed to remain on hold. We see the prevailing FFR of 5.25-5.50% as appropriately restrictive given current inflation and growth, but the rate becomes increasingly restrictive if inflation subsides as expected. Fed officials have signalled they want additional information on how the economy has responded to yield increases before taking additional steps. We expect that by early next year, inflation pressures can subside and growth moderate to paces that allow the Fed to stay on hold. Rate cuts are our view of the next fed funds rate change, but employment weakness, which we expect near mid-2024, needs to be the trigger for such action.

BMO

We look for no change in Fed policy. A prolonged pause could be unfolding, but it’s still premature to rule out another rate hike on December 13 or at the end of January. We’re expecting the economic indicators to weaken meaningfully in the month or two ahead, sufficient to forestall further rate rises. Amid the lagged impact of policy rate hikes along with dwindling excess savings and tightening credit conditions, we reckon the headwinds from higher bond yields, the resumption of student loan payments and the autoworkers’ strike should do the trick. Then there are the risks posed by a potential government shutdown (after November 17) and a potential spike in oil prices owing to geopolitical developments. However, our expectation for the indicators could turn out to be incorrect; and if it is, so too will be our call for the current fed funds target range (5.25%-to-5.50%) marking the rate apex this tightening cycle.

Citi

We expect the Fed not to hike. However, given strong economic data and stronger September core CPI and PCE prints the Fed and Chair Powell will likely want to keep optionality in their language. It would also not be surprising were the Fed to add some language on determining how long to keep policy rates at restrictive levels. Chair Powell will once again try to walk a tightrope during the press conference emphasizing that at this juncture the FOMC ought to move cautiously in coming meetings. He will likely explicitly link caution in proceeding with rate hikes to the rapid rise of longer-term yields, as he did in a recent speech. He may also recognize that the resiliency of the economy so far and remaining upside risks to inflation likely imply that the policy rate needs to stay elevated for some time.

Wells Fargo

We expect the FOMC to leave the target range for the FFR unchanged at 5.25%-5.50%. While inflation is moving back toward the FOMC's 2% target, there is further progress to be made. We believe the FOMC will want to keep its options open for further tightening, and thus think the post-meeting statement will maintain the language that signals some additional policy tightening may be appropriate. We continue to anticipate the terminal rate of this cycle has been reached, though we acknowledge it is possible the FOMC will hike rates an additional 25 bps before the end of the year.

-

15:51

The bar is higher for the Fed to actually move the market – TDS

The focus this week turns to the Fed. Economists at TD Securities see the bar rising for the Fed to generate a hawkish market reaction.

Fed to deliver more of the same

We expect the Fed to maintain a tightening bias, likely aiming to show the market that policy could be tightened further if needed.

The market is trying to unpack the nuances between the Fed’s rhetoric, data trends and surprises, and the aggressive tightening of financial conditions. There is a bit of a tug and war between these indicators, especially as some of the recent sell-off in longer-dated USTs doesn’t jibe with the data, Fed repricing or macro setup. Instead, it likely reflects a mismatch of supply and demand. That’s not fundamentally supportive of the USD, especially if breaks the growth cycle.

While we expect the Fed to deliver more of the same, it’s unclear how much further gains the USD will achieve unless the Fed appears more willing to open the door to more hikes.

-

15:34

Gold Price Forecast: XAU/USD’s upswing may not continue – Commerzbank

Gold price exceeded the $2,000 mark again for the first time in five months and a half on Friday. Economists at Commerzbank analyze the yellow metal’s outlook.

Gold to lose momentum if the tailwind lent by buying by speculative investors abates

The increase in the Gold price is likely to lose momentum if the tailwind lent by buying by speculative investors abates. Furthermore, it is possible that the Fed might have to raise its key rate again after all, contrary to what the market currently expects.

The US economy saw third-quarter growth of nearly 5% in annualised terms – the strongest growth rate in seven quarters. At the press conference following the Fed meeting, Fed Chair Powell will probably leave the door open to another rate hike in December. What is more, it remains to be seen whether Friday’s data will indicate the cooling that is hoped for in the US labour market. If this fails to materialise yet again, a Fed rate hike in December could become more likely again.

It is true that interest rate expectations have had less of an influence on the Gold price of late, but that doesn’t necessarily mean that this will continue to apply in the coming weeks.

We would warn against assuming that the upswing in Gold that we have seen in recent weeks will simply continue, as it has been due to exceptional circumstances.

-

15:32

United States 52-Week Bill Auction declined to 5.135% from previous 5.185%

-

15:22

USD/JPY: A reversal of widening yield differentials with the US should support the Yen – Standard Chartered

The Bank of Japan (BoJ) tweaked its yield curve control policy (YCC). USD/JPY rallied after the BoJ’s policy announcement. Economists at Standard Chartered analyze Yen’s outlook.

Bout of JPY weakness between now and the next meeting in December should be fleeting

The likely bout of JPY weakness between now and the next meeting in December should be fleeting, especially if the authorities formalise the removal of YCC by then and start contemplating the end of NIRP in 2024. Said differently, a reversal of widening yield differentials with the US should support the JPY, although timing it remains tricky.

The BoJ’s forecasts paint a more nuanced picture for the economy. While it lifted growth and core-core inflation forecasts for FY23, it downgraded its FY24 growth forecast to 1% (July estimate: 1.2%) and raised the core-core forecast marginally to 1.9% (1.7%). That the core-core inflation forecast is just shy of 2% suggests that the BoJ needs a tad more convincing of progress on ending the multi-decade deflationary woes.

Going forward, we would watch for verbal messaging from the BoJ on growth and inflation prospects as a prelude to further policy normalisation down the line.

-

15:09

EUR/USD: Fundamental factors suggest that the Euro’s tenacity will be brief – Rabobank

EUR/USD has pushed higher this week. Economists at Rabobank analyze the pair’s outlook.

EUR/USD seen at 1.02 on a three-month view

Since fundamentals do not appear to justify the current buoyancy of the EUR, we expect that it is a function of position adjustment related to the strong sell-off in EUR/USD in recent months.

The current shake out in EUR/USD may be necessary but, in view of the softness of German economic numbers, we expect another move lower in the EUR on a three-month view.

We maintain a three-month forecast of EUR/USD 1.02.

-

15:05

Colombia National Jobless Rate in line with expectations (9.3%) in September

-

14:59

The earnings rebound may take time to revive the fortunes of the equity market – UBS

US earnings revival looks unlikely to lead to equity rebound yet, economists at UBS report.

Earnings are set to return to growth

The percentage of companies beating earnings estimates is in line with historical averages (around 73%), and earnings are beating forecasts, in aggregate, by nearly 8%. We continue to expect S&P 500 EPS growth of 3-4% in the third quarter.

Our 2023 and 2024 S&P 500 earnings per share estimates are $220 (0% year-over-year growth) and $240 (9% YoY growth), respectively.

The earnings rebound may take time to revive the fortunes of the equity market, especially against a backdrop of elevated valuations. Rising yields have caused a further deterioration in the equity risk premium – making stocks look less attractive relative to high quality fixed income.

We still expect the improving outlook for earnings to boost stocks over the coming year, with our base case for the S&P 500 to reach 4,700 by the end of 2024.

-

14:46

EUR/USD: The growth/inflation mix is a key headache for the Euro – HSBC

The Euro could face the double whammy of stagflation fears against a “safe-haven” USD over the near term, economists at HSBC report.

Not all fundamentals are against the EUR

The main headache for the EUR is the unpleasant growth/inflation mix, that the Eurozone economy faces.

The Eurozone activity data disappointments continue to mount, while US activity data still surprise on the upside. We think that stagflation fears in the Eurozone vs growth resilience in the US would probably point to lower EUR/USD over the near term.

If geopolitical tensions rise further in the Middle East, the EUR could also face downward pressure against a ‘safe-haven’ USD.

On a positive note, the EUR’s structural allure is supported by the improvement in the Eurozone’s current account, together with supportive financial flows, compared to the US’s sizeable twin deficits.

-

14:34

USD/CAD approaches 1.3900 as investors turn cautious ahead of Fed policy

- USD/CAD advances toward 1.3900 amid caution ahead of Fed policy.

- Fed policymakers believe that higher US Treasury yields are slowing overall spending and investment.

- BoC Macklem said that the central bank is prepared to raise rates if necessary.

The USD/CAD pair marches swiftly towards the round-level resistance of 1.3900 in the early New York session. The Loonie asset strengthens as investors have turned cautious ahead of the interest rate decision by the Federal Reserve (Fed), which will be announced on Wednesday.

The S&P500 opened with some losses amid anxiety among investors ahead of the Fed policy. The US Dollar Index (DXY) recovers strongly after discovering buying interest near 106.00 on expectations that the Fed will advocate for keeping interest rates higher for a longer period. An unchanged interest rate decision from the Fed is widely anticipated due to higher long-term bond yields.

Fed policymakers believe that higher US Treasury yields would perform the central bank’ job of slowing spending and investment effectively. The US Bureau of Economic Analysis (BEA) reported last week that business investment contracted for the first time in the Q3 of 2023 since Covid-era as firms postponed their expansion plans to avoid higher borrowing rates.

Apart from the Fed policy, investors will keenly watch private payrolls and the ISM Manufacturing PMI data for October. As per the estimates, 150K fresh private jobs were added against 89K added in September. The Manufacturing PMI is seen steady at 49.0, below the 50.0 threshold for the 12th month in a row.

On the Canadian Dollar front, Bank of Canada (BoC) Governor Tiff Macklem emphasized on protecting Canada’s good fiscal position in his speech on Monday. Macklem further added the central continues to assess whether monetary policy is sufficiently restrictive and is ready to do whatever is required to restore price stability.

-

14:33

New Zealand: More robust than expected labour market to benefit the NZD – Commerzbank

The New Zealand labour market report for the third quarter is due at 21:45 GMT. Economists at Commerzbank analyze Kiwi’s outlook ahead of employment data.

Will New Zealand's labour market remain robust?

If the labour market weakens more than expected, this should confirm the NZD sceptics. After all, the interest rate hikes are then slowly taking effect, but inflation remains (still) clearly too high. Add in concerns about the Chinese economy and things don't look so good for the New Zealand Dollar.