- Foreign exchange market. European session: the Swiss franc traded higher against the U.S. dollar after the better-than-expected Swiss producer and import prices data

Market news

Foreign exchange market. European session: the Swiss franc traded higher against the U.S. dollar after the better-than-expected Swiss producer and import prices data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation April 3.2% 3.4%

01:30 Australia New Motor Vehicle Sales (MoM) March 2.7% Revised From 2.9% 0.5%

01:30 Australia New Motor Vehicle Sales (YoY) March 4.1% 4.4%

01:30 Australia Changing the number of employed March 41.9 Revised From 15.6 15.1 37.7

01:30 Australia Unemployment rate March 6.2% Revised From 6.3% 6.3% 6.1%

06:00 G20 G20 Meetings

07:15 Switzerland Producer & Import Prices, m/m March -1.4% 0.1% 0.2%

07:15 Switzerland Producer & Import Prices, y/y March -3.6% -3.4%

The U.S. dollar traded lower against the most major currencies ahead of the U.S. economic data. Housing starts in the U.S. are expected to rise to 1.040 million units in March from 0.900 million units in February.

The number of building permits is expected to decline to 1.080 million units in March from 1.100 million units in February.

The number of initial jobless claims in the U.S. is expected to increase by 3,000 to 284,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to rise to 5.5 in April from 5.0 in March.

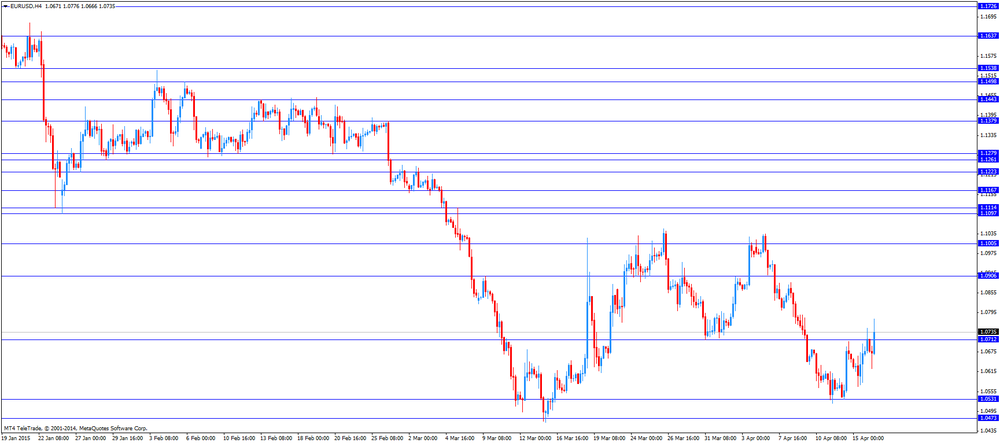

The euro traded higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Concerns over Greece's debt problems continue to weigh on the euro. Greece will run out of cash if the Greek government will not sign an agreement with its creditors to receive new tranche of loans. Greece is due to repay the IMF loan of 760 million euro on May 12. The Greek Finance Minister Yanis Varoufakis is to meet U.S. President Barack Obama in Washington later in the day.

The ratings agency Standard & Poor's (S&P) lower Greece's credit rating to 'CCC+' from 'B-'.

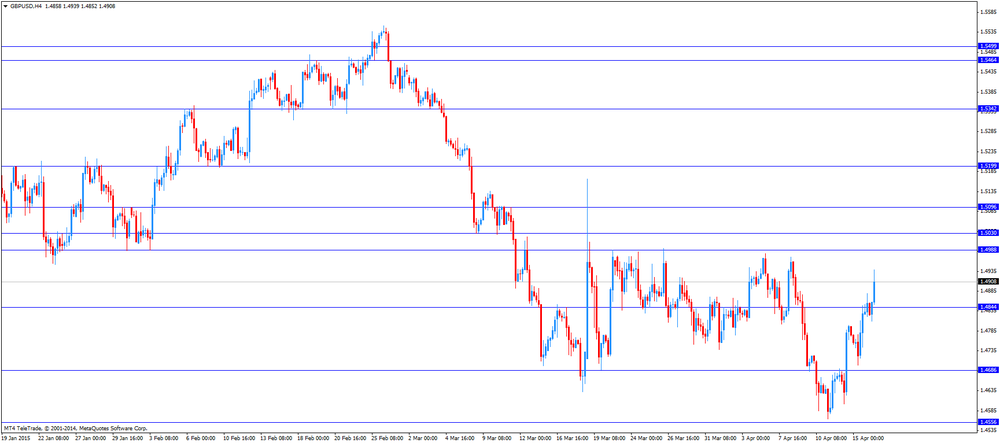

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected Swiss producer and import prices data. Switzerland's producer and import prices climbed 0.2% in March, exceeding expectations for a 0.1% increase, after a 1.4% drop in February. That was the first increase in ten months.

On a yearly basis, producer and import prices decreased 3.4% in March, after a 3.6% drop in February.

The increase was driven by higher prices for petroleum and petroleum products.

EUR/USD: the currency pair increased to $1.0746

GBP/USD: the currency pair rose to $1.4939

USD/JPY: the currency pair fell to Y118.91

The most important news that are expected (GMT0):

12:30 U.S. Building Permits, mln March 1.10 1.08

12:30 U.S. Housing Starts, mln March 0.90 1.04

12:30 U.S. Initial Jobless Claims April 281 284

14:00 U.S. Philadelphia Fed Manufacturing Survey April 5.0 5.5

17:00 U.S. FOMC Member Dennis Lockhart Speaks

19:00 U.S. FED Vice Chairman Stanley Fischer Speaks