- Company News: American Express (AXP) plans to increase its quarterly dividend by 10% and buy back for up to $ 3.3 billion.

Market news

Company News: American Express (AXP) plans to increase its quarterly dividend by 10% and buy back for up to $ 3.3 billion.

The American Express (AXP) reported that the Federal Reserve does not object to the plan for the capital of the company as set out in the program of comprehensive inspection and analysis of capital adequacy (CCAR). This plan includes the following items: 1) an increase in the quarterly dividend of up to $ 0.32 per share from the third quarter of 2016; 2) an increase in repurchase ordinary shares up to $ 3.3 billion in the period from the third quarter of 2016 to the second quarter of 2017. Thus, the entire company will be able to buy back shares worth about $ 4.4 bn, including the redemption of approximately $ 1.7 billion.

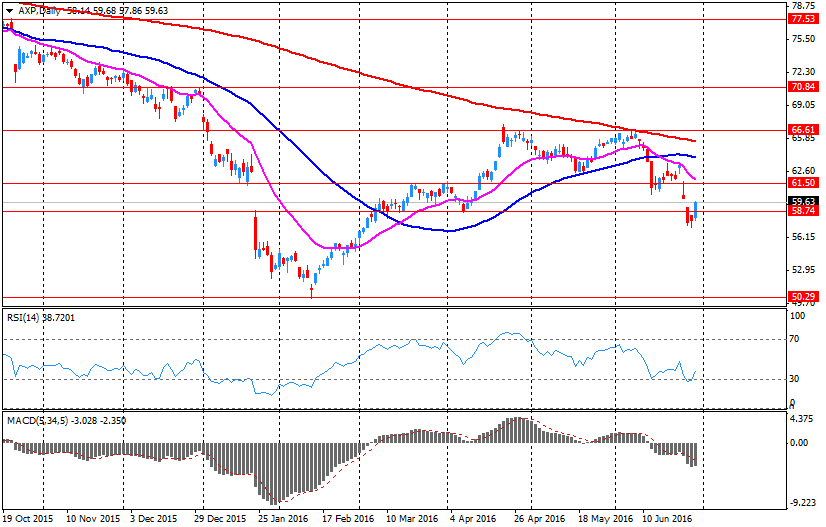

AXP shares fell in premarket trading to $ 59.20 (-0.72%).