- Gold price decrease today

Market news

Gold price decrease today

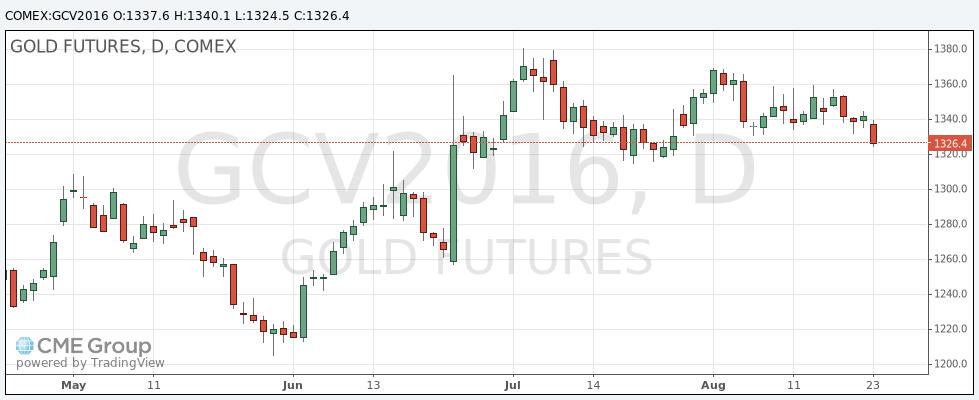

Gold prices fell to 4 weeks low as investors closed their positions on the background of the Jackson Hole meeting on friday.

Traders are waiting for the symposium during which will Fed Chairwoman Janet Yellen will deliver a speech. It is expected that signals about the possible timing of the Fed's interest rate increase can be served at the event. The market does not expect an immediate increase in interest rates, but any surprises in the speech may catch investors off guard and put pressure on the gold market.

A stronger dollar also makes gold prices which are set in US currency less attractive for holders of other currencies.

The dollar index, which tracks the US currency against a basket of other currencies, rose 0.1% to 85.79.

In preparation for the Fed symposium investors reduce the number of positions said Peter Hug from Kitco Metals.

"Traders may be too carried away with long positions now and not want to be caught off guard and thus closed some bets." - adds Hag.

Since the beginning of the year the price of gold rose more than 25%, as the comments from the central bank contributed to the reduction of expectations of rising interest rates, and investors preferred to invest money in safe-haven assets.

The cost of the October futures on COMEX rose to $ 1,324.50 an ounce.