- WSE: Session Results

Market news

WSE: Session Results

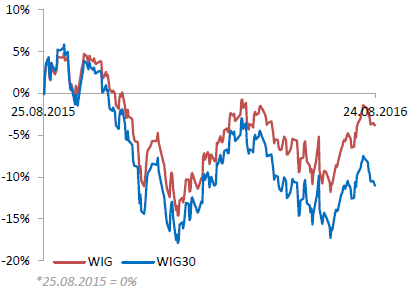

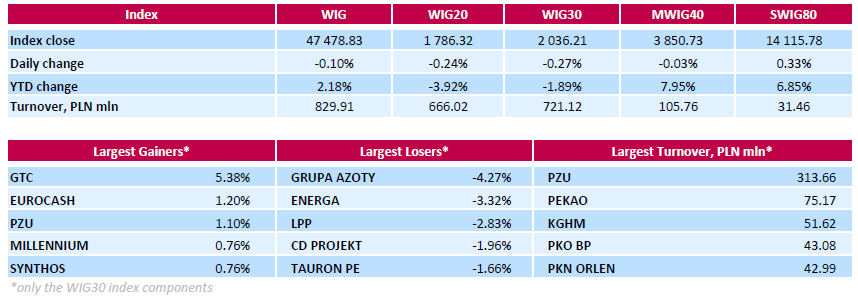

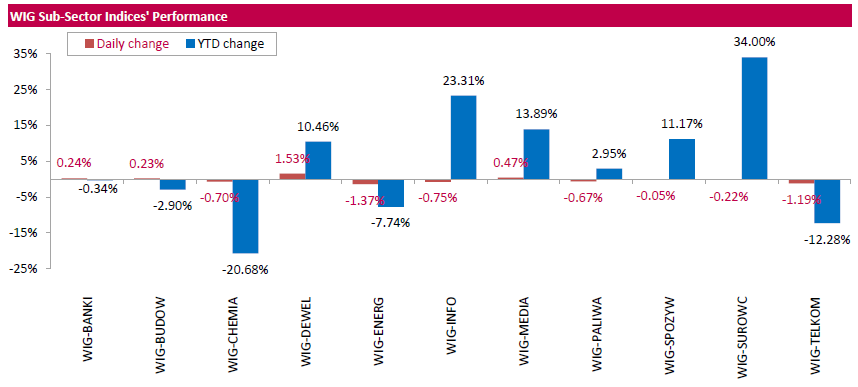

Polish equity market closed lower on Wednesday. The broad market benchmark, the WIG Index, fell by 0.1%. Sector performance in the WIG Index was mixed. Utilities (-1.37%) recorded the biggest decline, while developing sector (+1.53%) outpaced.

The large-cap stocks' measure, the WIG30 Index, lost 0.27%. In the index basket, chemical producer GRUPA AZOTY (WSE: ATT) tumbled the most, down 4.27%, as the company posted lower-than-expected Q2 earnings. Its net income amounted to PLN 44.4 mln in Q2, down 62.6% y/y and well below analysts' consensus estimate of PLN 118.8 mln. Meanwhile, the company's revenues fell by 5.2% y/y to PLN 2.16 bln in Q2, but beat analysts' consensus estimate of PLN 2.04 bln. Given weak Q2 earnings, GRUPA AZOTY cut its FY16 capital expenditure target by 20% to PLN 1.6 bln. Other major decliners were genco ENERGA (WSE: ENG), clothing retailer LPP (WSE: LPP) and videogame developer CD PROJEKT (WSE: CDR), plunging by 3.32%, 2.83% and 1.96% respectively. On the other side of the ledger, property developer GTC (WSE: GTC) led the gainers, climbing by 5.38%, as the company's quarterly financial report revealed it returned to profit in the Q2, helped by lower financial costs and revaluation of assets and real estate development projects. GTC posted net income for Q2 of EUR 18.8 mln, a turnaround from a loss of EUR 1.9 mln for the same three-month period last year. The bottom-line result was generally in-line with analysts' consensus estimate of EUR 18.3 mln.