- European session review: the pound continue to be volatile

Market news

European session review: the pound continue to be volatile

The following data was published:

(Time / country / index / period / previous value / forecast)

9:00 Eurozone Industrial Production m / m in August -0.7% Revised to -1.1% 1.5% 1.6%

9:00 Eurozone Industrial Production y / y in August -0.5% 1.1% 1.8%

9:00 Switzerland investor expectations index according to ZEW and Credit Suisse in October 2.7 5.2

12:00 US Speech by the Federal Open Market Committee member William Dudley

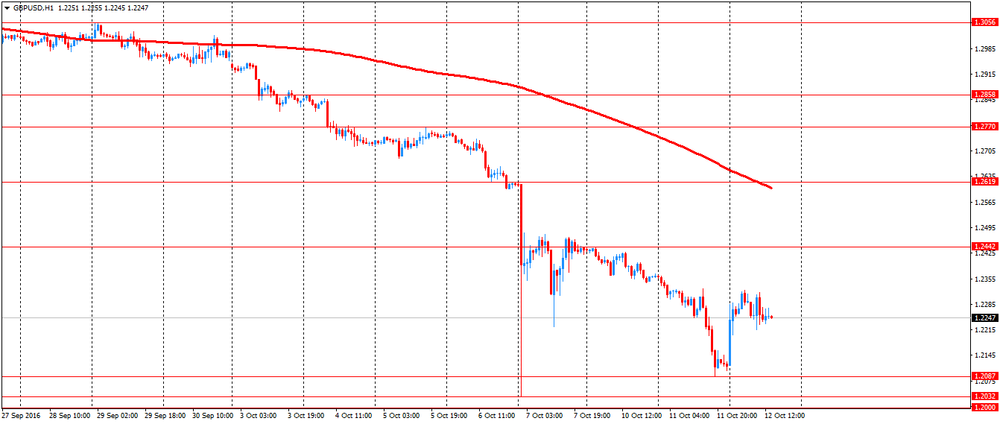

The pound rose sharply against the US dollar, recovering almost all the ground lost the day before. The cause of this trend was the closing of short positions on the message of the possible softer Brexit. Bloomberg agency said that British Prime Minister Theresa May has agreed to hold a vote in parliament about its plans, which may limit its ability to enforce "rigid script", in which Britain would lose free access to the common European market in exchange for limiting migration.

According to experts, if the hard Brexit is selected, Britain's GDP could fall by 9.5%.

However, despite the recent rally, the pound remains under pressure. Recently, French President Francois Hollande joined the negative sentiment of EU representatives, encouraging tough negotiations with the United Kingdom. Later, the French Prime Minister said that Hollande was right, calling for a tougher approach to Brexit.

The view from France is important because the EU position is determined mainly by Germany and France.

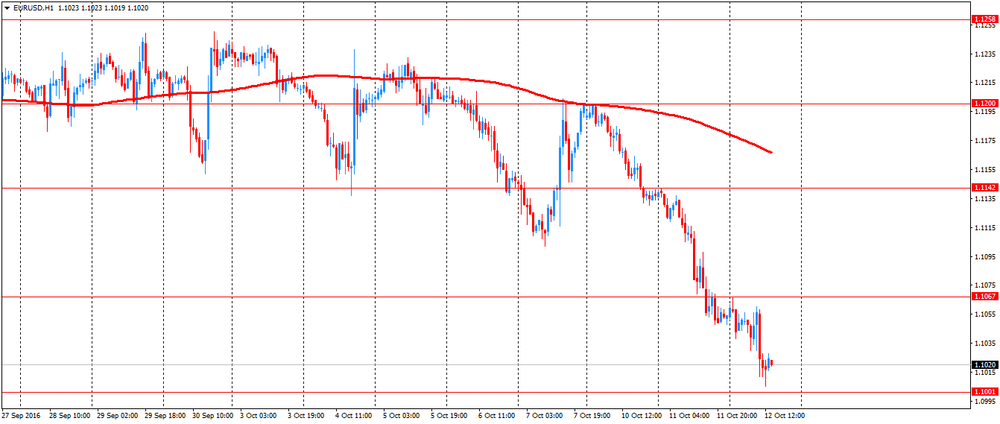

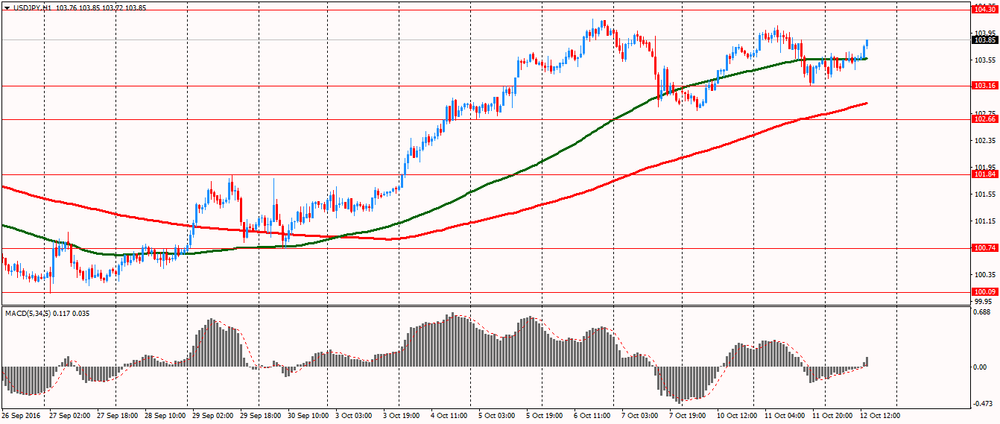

The US dollar rose against major currencies. Experts point out that the US dollar strengthened amid growing expectations of interest rate increases by the Federal Reserve at the end of this year. Higher US bond yields and low European yelds, also support the dollar against the EUR.

Later today, investors will examine statements by the Fed and the minutes of the September meeting in search for signals about the pace of rate hikes.

Protocols are likely to confirm that the rate hike in December seems likely, but also to show that rates are likely to remain low in the future. Such a scenario is ambiguous for the dollar,.

According to the futures market, a hike in December has 69.5% probability.

Industrial output in the euro zone rebounded in August, as most of the sub-sectors grew in July - Eurostat data.

Industrial production expanded by 1.6 percent in August from July, when it fell a revised 0.7 percent. It was forecasts an increase of 1.5 percent.

Among the components, the production of energy and capital goods increased by 3.3 percent and 3.5 percent respectively, while the production of consumer durables advanced 4.3 percent, production of consumer non-durable goods fell by 0.6 percent. Production of intermediate goods increased by 1.4 percent.

In annual terms, industrial output grew by 1.8 percent, in contrast to the fall of 0.5 percent in July. The annual rate is also faster than the expected increase of 1.1 percent.

EUR / USD: during the European session, the pair fell to $ 1.1005

GBP / USD: during the European session, the pair rose to $ 1.2317

USD / JPY: during the European session, the pair rose to Y103.85