Market news

-

23:28

Currencies. Daily history for Jan 05’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0606 +1,11%

GBP/USD $1,2417 +0,77%

USD/CHF Chf1,0096 -1,09%

USD/JPY Y115,34 -1,65%

EUR/JPY Y122,34 -0,51%

GBP/JPY Y143,24 -0,84%

AUD/USD $0,7336 +0,75%

NZD/USD $0,7022 +0,80%

USD/CAD C$1,3222 -0,58%

-

23:00

Schedule for today, Friday, Jan 06’2017 (GMT0)

00:00 Japan Labor Cash Earnings, YoY November 0.1% 0.2%

00:30 Australia Trade Balance November -1.54 -0.3

07:00 Germany Factory Orders s.a. (MoM) November 4.9% -2.3%

07:00 Germany Retail sales, real adjusted November 2.4% -0.6%

07:00 Germany Retail sales, real unadjusted, y/y November -1% 1.2%

07:45 France Trade Balance, bln November -5.2 -4.8

10:00 Eurozone Industrial confidence December -1.1 -1

10:00 Eurozone Economic sentiment index December 106.5 106.8

10:00 Eurozone Consumer Confidence (Finally) December -6.1 -5

10:00 Eurozone Business climate indicator December 0.42 0.4

10:00 Eurozone Retail Sales (MoM) November 1.1% -0.4%

10:00 Eurozone Retail Sales (YoY) November 2.4%

13:30 Canada Trade balance, billions November -1.13 -1.6

13:30 Canada Unemployment rate December 6.8% 6.9%

13:30 Canada Employment December 10.7 -5

13:30 U.S. Average workweek December 34.4 34.4

13:30 U.S. International Trade, bln November -42.6 -42.5

13:30 U.S. Average hourly earnings December -0.1% 0.3%

13:30 U.S. Nonfarm Payrolls December 178 178

13:30 U.S. Unemployment Rate December 4.6% 4.7%

15:00 Canada Ivey Purchasing Managers Index December 56.8

15:00 U.S. Factory Orders November 2.7% -2.2%

16:15 U.S. FOMC Member Charles Evans Speaks

-

16:00

U.S.: Crude Oil Inventories, December -7.051 (forecast -2.152)

-

15:17

Slowest upturn in US service sector activity for three months - Markit

At 53.9 in December, the seasonally adjusted Markit final U.S. Services Business Activity Index dropped from 54.6 in November to signal the slowest upturn in service sector activity for three months. Nonetheless, the latest reading was well above the neutral 50.0 threshold and pointed to a solid pace of expansion. Moreover, the average reading during the final quarter of 2016 (54.4) was the strongest since Q4 2015.

-

15:07

US ISM Non-Manufacturing Business Activity matching the November figure

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management (ISM) Non-Manufacturing Business Survey Committee. "The NMI registered 57.2 percent in December, matching the November figure. This represents continued growth in the non-manufacturing sector at the same rate.

The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.3 percentage point lower than the November reading of 61.7 percent, reflecting growth for the 89th consecutive month, at a slightly slower rate in December. The New Orders Index registered 61.6 percent, 4.6 percentage points higher than the reading of 57 percent in November.

The Employment Index decreased 4.4 percentage points in December to 53.8 percent from the November reading of 58.2 percent. The Prices Index increased 0.7 percentage point from the November reading of 56.3 percent to 57 percent, indicating prices increased in December for the ninth consecutive month at a slightly faster rate. According to the NMI, 12 non-manufacturing industries reported growth in December. The non-manufacturing sector closed out the year strong maintaining its rate of growth month-over-month. Respondents' comments are mostly positive about business conditions and the overall economy."

-

15:00

U.S.: ISM Non-Manufacturing, December 57.2 (forecast 56.6)

-

14:45

U.S.: Services PMI, December 53.9 (forecast 53.4)

-

14:28

BOE's Haldane: Neutral Stance on Policy Right for Now

-

14:08

Canadian Industrial Product Price Index rose 0.3% in November

Canadian Industrial Product Price Index rose 0.3% in November, following a 0.7% increase in October. Of the 21 major commodity groups, 14 were up, 2 were down and 5 were unchanged.

The rise in the IPPI in November was mainly attributable to higher prices for motorized and recreational vehicles (+1.1%) and primary non-ferrous metal products (+2.3%).

Within motorized and recreational vehicles, price gains were reported for passenger cars and light trucks (+1.0%), motor vehicle engines and motor vehicle parts (+0.7%) as well as aircraft (+1.5%). Higher prices for motorized and recreational vehicles were closely linked to the depreciation of the Canadian dollar relative to the US dollar.

-

14:05

US initial jobless claims much lower than expected

In the week ending December 31, the advance figure for seasonally adjusted initial claims was 235,000, a decrease of 28,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 265,000 to 263,000. The 4-week moving average was 256,750, a decrease of 5,750 from the previous week's revised average. The previous week's average was revised down by 500 from 263,000 to 262,500. There were no special factors impacting this week's initial claims. This marks 96 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

-

13:31

U.S.: Continuing Jobless Claims, 2112 (forecast 2051)

-

13:30

Canada: Industrial Product Price Index, y/y, November 1.4%

-

13:30

Canada: Industrial Product Price Index, m/m, November 0.3% (forecast 0.2%)

-

13:30

U.S.: Initial Jobless Claims, 235 (forecast 260)

-

13:21

US private sector employment increased by 153,000 jobs from November to December, below estimates

Private sector employment increased by 153,000 jobs from November to December according to the December ADP National Employment Report.

"As we exit 2016, it's interesting to note that the private sector generated an average of 174,000 jobs per month, down from 209,000 in 2015," said Ahu Yildirmaz, vice president and head of the ADP Research Institute. "And while job gains in December were slightly below our monthly average, the U.S. labor market has experienced unprecedented seven years of growth that has brought us to near full employment. As we enter 2017, the tightening labor market will likely slow the growth."

-

13:15

U.S.: ADP Employment Report, December 153 (forecast 170)

-

12:46

Orders

EUR/USD

Offers: 1.0580-85 1.0600 1.0620 1.0650 1.0680 1.0700 1.0730 1.0750

Bids: 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400 1.0380-85 1.0365 1.0345-50

GBP/USD

Offers: 1.2330 1.2350-55 1.2380-85 1.2400 1.2460 1.2500

Bids: 1.2280 1.2265 1.2250 1.2220 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8580-85 0.8600 0.8620 0.8650 0.8685 0.8700

Bids: 0.8545-50 0.8525-30 0.8500 0.8485 0.8450

EUR/JPY

Offers: 122.50 122.80 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.00 121.75 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers: 116.30 116.50-60 116.80 117.00 117.20-30 117.50 117.80 118.00

Bids: 115.50-55 115.20 115.00 114.80 114.50 114.30 114.00

AUD/USD

Offers: 0.7330 0.7350 0.7375-80 0.7400

Bids: 0.7280 0.7250 0.7230 0.7200

-

12:33

Short EUR/HUF if below 307.65, Equilor says

-

10:54

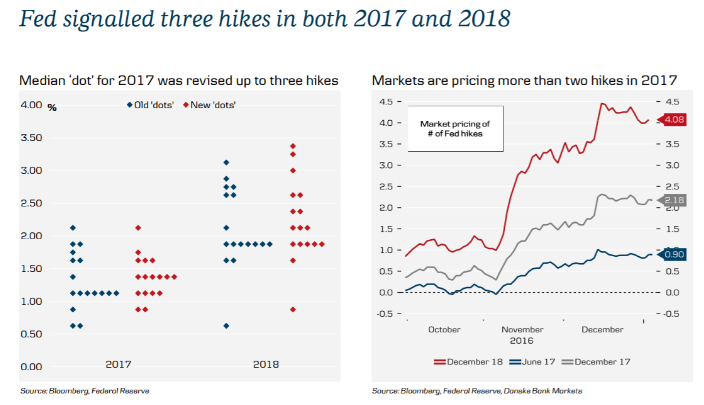

'Uncertain' mentioned 15 times in December FOMC minutes vs 5 times In Nov - Danske. Trumponomics in focus

"The FOMC members think the economic outlook is very 'uncertain' until we get more information about 'Trumponomics'. The word 'uncertain' is mentioned 15 times versus five times in the minutes from the November meeting.

The FOMC members think 'growth might turn out to be faster or slower than they currently anticipated' depending on the policy mix (tougher immigration rules and more protectionism slow growth while infrastructure spending and tax cuts increase growth). 'Almost all' FOMC members think there are upside risks to their growth forecasts due to the likely fiscal boost, which they have not fully taken into account.

Given the Fed's focus on 'Trumponomics', any comments or tweets from Donald Trump on economic policy will be followed closely.

We stick to our view that the Fed will hike twice this year (June and December) but believe the risk is skewed towards three hikes. One of the reasons is that the Fed has turned more dovish this year due to shifting voting rights, which mean that we (for now) weight dovish comments more relative to hawkish comments. This year we learned that it does not take much for the (dovish) FOMC members to postpone a hike.

That said, we believe the Fed is likely to increase its hiking pace in 2018 (late 2017 at the earliest), as we think Trump's fiscal policy is likely to have the biggest growth impact in 2018 due to policy lags (see also Five Macro Themes for 2017, 1 December 2016), although much can obviously still happen before 2018".

Copyright © 2017 Danske, eFXnews™

-

10:02

Industrial producer prices rose by 0.3% in euro area

In November 2016, compared with October 2016, industrial producer prices rose by 0.3% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In October 2016 prices increased by 0.8% in the euro area and by 1.0% in the EU28. In November 2016, compared with November 2015, industrial producer prices rose by 0.1% in the euro area and by 0.7% in the EU28.

-

10:00

Eurozone: Producer Price Index, MoM , November 0.3% (forecast 0.1%)

-

10:00

Eurozone: Producer Price Index (YoY), November 0.1% (forecast -0.1%)

-

09:34

UK service sector expanded sharply in December - Markit

The final batch of UK PMI survey data for 2016 from IHS Markit and CIPS signalled that the dominant UK service sector expanded sharply in December, rounding off the strongest quarter of the year. The rate of expansion of activity accelerated for the third month running to the sharpest since July 2015, fuelled by stronger growth in new work. Employment rose at a pace unchanged from November's seven-month high, and sentiment towards the 12-month outlook strengthened despite ongoing uncertainty regarding Brexit and European elections. The survey data also signalled that inflationary pressures in the sector remained substantial, with prices charged rising at the strongest rate since April 2011.

The Index remained above 50.0 for the fifth consecutive month in December, indicating a continued recovery in growth following a contraction in July linked to the EU referendum. Moreover, the Index rose for the third consecutive month to 56.2, from 55.2, signalling the fastest expansion since July 2015. The rate of growth was also sharper than the 20-year long-run survey average.

-

09:30

United Kingdom: Purchasing Manager Index Services, December 56.2 (forecast 54.7)

-

09:14

Latest Eurozone Retail PMI survey data showed a lift in sales in the final month of 2016 - Markit

Latest Eurozone Retail PMI survey data showed a lift in sales in the final month of 2016, reflecting growth across both Germany and France. However, Italian retailers endured another month of falling sales, with the pace of decline slightly faster than in November. Adjusted for the impact of usual seasonal factors, the seasonally adjusted headline Markit Eurozone Retail PMI - which tracks month-on-month changes in likefor-like retail sales in the bloc's biggest three economies combined - registered 50.4 in December, up from November's 48.6. That signalled a rise in sales for the first time in four months, albeit marginal.

-

08:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

Информационно-аналитический отдел TeleTrade

-

08:23

The Swiss Consumer Price Index fell by 0.1% in December 2016

The Swiss Consumer Price Index (CPI) fell by 0.1% in December 2016 compared with the previous month, reaching 100.0 points (December 2015=100). Inflation was 0.0% in comparison with the same month in the previous year. The average annualised inflation rate in 2016 was -0.4%. These are the findings from the Federal Statistical Office (FSO).

-

08:15

Switzerland: Consumer Price Index (YoY), December 0.0% (forecast 0.0%)

-

08:15

Switzerland: Consumer Price Index (MoM) , December -0.1% (forecast -0.1%)

-

08:03

Today’s events

-

At 09:30 GMT Spain will hold an auction to sell 10-year bonds

-

At 10:00 GMT France will hold an auction to sell 10-year bonds

-

At 13:00 GMT Member of the Commission of the Bank of England, Andy Haldane will make a speech

-

-

07:39

Standard & Poor's, Moritz Kraemer: the probability of a hard Brexit scenario increasing

-

07:30

Options levels on thursday, January 5, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0718 (2024)

$1.0663 (2295)

$1.0619 (341)

Price at time of writing this review: $1.0547

Support levels (open interest**, contracts):

$1.0460 (2056)

$1.0416 (1067)

$1.0381 (2232)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 48982 contracts, with the maximum number of contracts with strike price $1,1500 (3227);

- Overall open interest on the PUT options with the expiration date March, 13 is 57268 contracts, with the maximum number of contracts with strike price $1,0000 (5244);

- The ratio of PUT/CALL was 1.17 versus 1.23 from the previous trading day according to data from January, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.2609 (1168)

$1.2513 (567)

$1.2417 (252)

Price at time of writing this review: $1.2345

Support levels (open interest**, contracts):

$1.2281 (609)

$1.2185 (793)

$1.2088 (457)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14634 contracts, with the maximum number of contracts with strike price $1,2800 (3003);

- Overall open interest on the PUT options with the expiration date March, 13 is 17228 contracts, with the maximum number of contracts with strike price $1,1500 (2980);

- The ratio of PUT/CALL was 1.18 versus 1.20 from the previous trading day according to data from January, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:57

The New Zealand dollar was trading at its highest levels in around three weeks

-

06:55

Former UK representative Ivan Rogers dissatisfied with the Brexit approach

Recently Ivan Rogers, announced his resignation. The report of the representative of the British staff in Brussels showed weak preparation in conducting the important negotiations between UK and EU. In addition, Rogers noted the inexperience of the new cabinet and the lack of a clear plan for Brexit. "Once again, the authorities in London have received demands for a more detailed plan."

-

06:51

A number of risks" might call for "different path" than present course of gradual rate hikes - FOMC minutes

The pace of further interest rate hikes may speed up if the jobs market continues to improve, according to the minutes of the December meeting of the Federal Open Market Committee, cited by rttnews.

At the December 13-14 meeting, the FOMC raised interest rates for only the second time in a decade by a quarter-percentage point to 0.50%-0.75%, with policy makers also predicting two or three additional rate hikes in 2017

However, "A number of risks" might call for "different path" than present course of gradual rate hikes, the minutes revealed Wednesday.

The unemployment rate dropped to 4.6% in December. It is feared that a moved below 4.5% could spur inflation to rise faster than the Fed currently projects.

"Many" FOMC members noted the risk "sizable undershooting" of the jobless rate "had increased somewhat and that the Federal Open Market Committee might need to raise the federal funds rate more quickly than currently anticipated to limit the degree of undershooting and stem a potential buildup of inflationary pressures," according to the minutes.

-

01:46

China: Markit/Caixin Services PMI, December 53.4 (forecast 53.3)

-