Market news

-

23:30

Commodities. Daily history for Jan 05’2017:

(raw materials / closing price /% change)

Oil 53.78 +0.04%

Gold 1,181.10 -0.02%

-

23:29

Stocks. Daily history for Jan 05’2017:

(index / closing price / change items /% change)

Nikkei -73.47 19520.69 -0.37%

TOPIX +1.20 1555.68 +0.08%

Hang Seng +322.22 22456.69 +1.46%

CSI 300 -0.52 3367.79 -0.02%

Euro Stoxx 50 -1.05 3316.47 -0.03%

FTSE 100 +5.57 7195.31 +0.08%

DAX +0.63 11584.94 +0.01%

CAC 40 +1.24 4900.64 +0.03%

DJIA -42.87 19899.29 -0.21%

S&P 500 -1.75 2269.00 -0.08%

NASDAQ +10.93 5487.94 +0.20%

S&P/TSX +69.83 15586.58 +0.45%

-

23:28

Currencies. Daily history for Jan 05’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0606 +1,11%

GBP/USD $1,2417 +0,77%

USD/CHF Chf1,0096 -1,09%

USD/JPY Y115,34 -1,65%

EUR/JPY Y122,34 -0,51%

GBP/JPY Y143,24 -0,84%

AUD/USD $0,7336 +0,75%

NZD/USD $0,7022 +0,80%

USD/CAD C$1,3222 -0,58%

-

23:00

Schedule for today, Friday, Jan 06’2017 (GMT0)

00:00 Japan Labor Cash Earnings, YoY November 0.1% 0.2%

00:30 Australia Trade Balance November -1.54 -0.3

07:00 Germany Factory Orders s.a. (MoM) November 4.9% -2.3%

07:00 Germany Retail sales, real adjusted November 2.4% -0.6%

07:00 Germany Retail sales, real unadjusted, y/y November -1% 1.2%

07:45 France Trade Balance, bln November -5.2 -4.8

10:00 Eurozone Industrial confidence December -1.1 -1

10:00 Eurozone Economic sentiment index December 106.5 106.8

10:00 Eurozone Consumer Confidence (Finally) December -6.1 -5

10:00 Eurozone Business climate indicator December 0.42 0.4

10:00 Eurozone Retail Sales (MoM) November 1.1% -0.4%

10:00 Eurozone Retail Sales (YoY) November 2.4%

13:30 Canada Trade balance, billions November -1.13 -1.6

13:30 Canada Unemployment rate December 6.8% 6.9%

13:30 Canada Employment December 10.7 -5

13:30 U.S. Average workweek December 34.4 34.4

13:30 U.S. International Trade, bln November -42.6 -42.5

13:30 U.S. Average hourly earnings December -0.1% 0.3%

13:30 U.S. Nonfarm Payrolls December 178 178

13:30 U.S. Unemployment Rate December 4.6% 4.7%

15:00 Canada Ivey Purchasing Managers Index December 56.8

15:00 U.S. Factory Orders November 2.7% -2.2%

16:15 U.S. FOMC Member Charles Evans Speaks

-

21:08

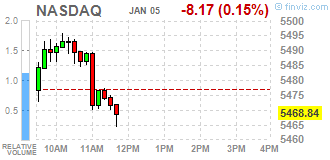

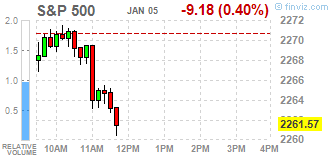

Major US stock indexes finished trading in different directions

Major US stock markets closed mixed, as the technology and healthcare growth could not compensate for the drop in shares of conglomerates sector. Investors were also evaluated a variety of economic data, including the ADP report on the number of jobs.

As it became known, the number of Americans who applied for unemployment benefits fell sharply last week to one of the lowest levels in the past four decades, reinforcing the view the Federal Reserve that the labor market is strengthening. The number of initial claims for unemployment benefits, a measure of how many workers were laid off, and fell by 28,000 to a seasonally adjusted reached 235,000 for the week ended December 31, reported Thursday the Ministry of Labour. It was the lowest level since mid-November, and the second lowest level since the end of 1973. Economists had expected 260,000 initial claims.

In addition, data for December showed a steady rise in business activity and new orders in the US services sector. Large workloads, and increased confidence in business prospects, in turn, contributed to a rapid increase in jobs since September 2015. The seasonally adjusted final index of business activity in the US services sector from Markit fell to 53.9 in December from 54.6 in November, and signaled the slowest growth in activity in the services sector for three months. Nevertheless, the last reading was significantly above the neutral level of 50.0, and pointed to solid growth.

However, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), remained unchanged at 57.2 in December. According to the forecast, the rate was expected to decline to 56.6. Recall, the indicator is the result of a survey of about 400 companies from 60 sectors across the United States.

DOW index closed mixed components (15 black, 15 red). Most remaining shares rose Visa Inc. (V, + 1.27%). Outsider were shares of The Travelers Companies, Inc. (TRV, -1.69%).

Sector S & P index closed trading mixed. The leader turned out to be the health sector (+ 0.7%). conglomerates (-1.7%) sectors fell most.

At the close:

Dow -0.22% 19,899.22 -42.94

Nasdaq + 0.20% 5,487.94 +10.93

S & P -0.08% 2,269.01 -1.74

-

20:00

DJIA -0.32% 19,879.09 -63.07 Nasdaq +0.11% 5,482.92 +5.91 S&P -0.19% 2,266.54 -4.21

-

17:00

European stocks closed: FTSE 100 +5.57 7195.31 +0.08% DAX +0.63 11584.94 +0.01% CAC 40 +1.24 4900.64 +0.03%

-

16:51

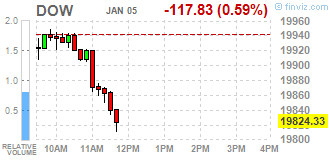

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fells on Thursday as a drop in banks and discretionary stocks weren't offset by gains in technology names. Investors are also assessing a host of economic data including the ADP payrolls report, which showed that 153 000 jobs were added in the private sector in December compared with economists' expectation of 170 000. The report sets a precedent to Friday's nonfarm payrolls data, which includes hiring in both private and public sectors.

Most of Dow stocks in negative area (16 of 30). Top gainer - Visa Inc. (V, +1.05%). Top loser - The Travelers Companies, Inc. (TRV, -2.15%).

S&P sectors mixed. Top gainer - Healthcare (+0.5%). Top loser - Conglomerates (-1.1%).

At the moment:

Dow 19764.00 -92.00 -0.46%

S&P 500 2256.50 -7.75 -0.34%

Nasdaq 100 4946.00 +12.50 +0.25%

Oil 52.96 -0.30 -0.56%

Gold 1184.30 +19.00 +1.63%

U.S. 10yr 2.38 -0.08

-

16:39

WSE: Session Results

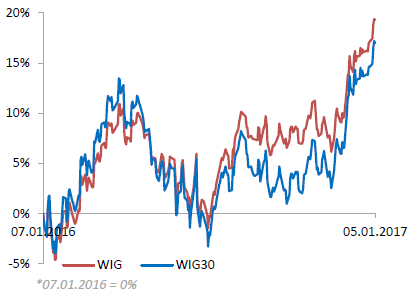

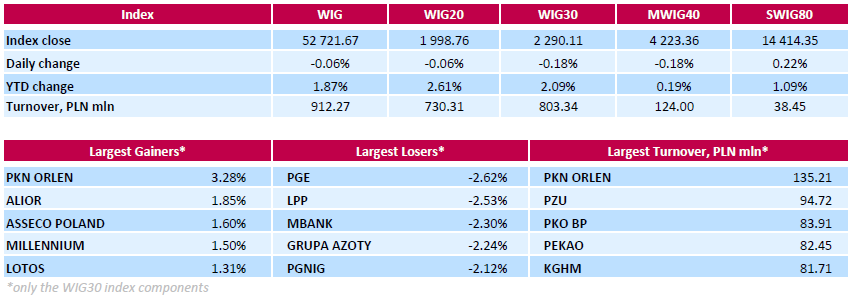

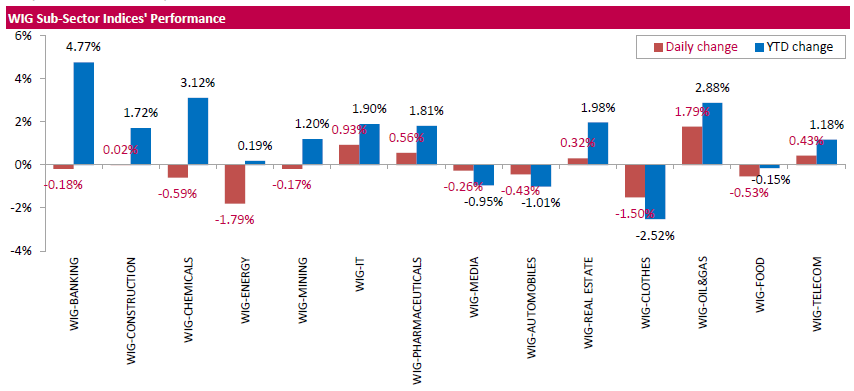

Polish equities closed flat on Thursday. The broad market benchmark, the WIG Index, edged down 0.06%. Sector-wise, oil and gas names (+1.79%) outperformed, while energy stocks (-1.79%) lagged behind.

The large-cap stocks fell by 0.18%, as measured by the WIG30 Index. Within the index components, genco PGE (WSE: PGE) and clothing retailer LPP (WSE: LPP) were the weakest performers, tumbling by 2.62% and 2.53% respectively. Other major losers were bank MBANK (WSE: MBK), chemical producer GRUPA AZOTY (WSE: ATT), oil and gas producer PGNIG (WSE: PGN) and genco TAURON PE (WSE: TPE), dropping by 2.04%-2.30%. On the other side of the ledger, oil refiner PKN ORLEN (WSE: PKN) led the gainers with a 3.28% advance, followed by bank ALIOR (WSE: ALR), IT-company ASSECO POLAND (WSE: ACP) and bank MILLENNIUM (WSE: MIL), jumping by 1.85%, 1.6% and 1.5% respectively.

The Warsaw Stock Exchange will be closed on Friday, January 6, due to celebration of Epiphany or Three Kings' Day (Swieto Trzech Kroli) in Poland.

-

16:00

U.S.: Crude Oil Inventories, December -7.051 (forecast -2.152)

-

15:41

Gold approached a one-month high

Gold prices approached a one-month high, as a weaker dollar helped the metal regain momentum following a swift selloff late last year, says Dow Jones.

Spot gold rose 0.24% to $1,171.39 per troy ounce in midmorning trade in Europe, the highest price since Dec 7.

Gold is up about 1.68% since trading began for the year on Tuesday, after a swift decline in the gold price following the U.S. election in November nearly wiped out 2016's gains.

The WSJ Dollar Index fell by 0.14% on Thursday. A weaker dollar typically helps gold prices rise, because it makes the metal more affordable for investors who hold other currencies.

-

15:17

Slowest upturn in US service sector activity for three months - Markit

At 53.9 in December, the seasonally adjusted Markit final U.S. Services Business Activity Index dropped from 54.6 in November to signal the slowest upturn in service sector activity for three months. Nonetheless, the latest reading was well above the neutral 50.0 threshold and pointed to a solid pace of expansion. Moreover, the average reading during the final quarter of 2016 (54.4) was the strongest since Q4 2015.

-

15:07

US ISM Non-Manufacturing Business Activity matching the November figure

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management (ISM) Non-Manufacturing Business Survey Committee. "The NMI registered 57.2 percent in December, matching the November figure. This represents continued growth in the non-manufacturing sector at the same rate.

The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.3 percentage point lower than the November reading of 61.7 percent, reflecting growth for the 89th consecutive month, at a slightly slower rate in December. The New Orders Index registered 61.6 percent, 4.6 percentage points higher than the reading of 57 percent in November.

The Employment Index decreased 4.4 percentage points in December to 53.8 percent from the November reading of 58.2 percent. The Prices Index increased 0.7 percentage point from the November reading of 56.3 percent to 57 percent, indicating prices increased in December for the ninth consecutive month at a slightly faster rate. According to the NMI, 12 non-manufacturing industries reported growth in December. The non-manufacturing sector closed out the year strong maintaining its rate of growth month-over-month. Respondents' comments are mostly positive about business conditions and the overall economy."

-

15:00

U.S.: ISM Non-Manufacturing, December 57.2 (forecast 56.6)

-

14:55

WSE: After start on Wall Street

The market in the US took off with a small decline of 0.1%, which is fully in line with previously presented small discount in the futures market. In Europe we may see today lack of appetite for growth and in the US growth weakens when approaching a resistance in the form of all time records. It seems that investors are waiting for tomorrow's release from the US labor market.

An hour before the end of trading the WIG20 index was at the level of 2,003 points (+0,15%).

-

14:45

U.S.: Services PMI, December 53.9 (forecast 53.4)

-

14:32

U.S. Stocks open: Dow -0.13%, Nasdaq -0.07%, S&P -0.15%

-

14:28

BOE's Haldane: Neutral Stance on Policy Right for Now

-

14:24

Before the bell: S&P futures -0.12%, NASDAQ futures -0.12%

U.S. stock-index futures fell as investors assessed the prospects of further growth of the stocks as a two-day rally sent valuations high, while the world's central banks are scaling down stimulus programs.

Global Stocks:

Nikkei 19,520.69 -73.47 -0.37%

Hang Seng 22,456.69 +322.22 +1.46%

Shanghai 3,165.55 +6.75 +0.21%

FTSE 7,200.84 +11.10 +0.15%

CAC 4,892.66 -6.74 -0.14%

DAX 11,569.51 -14.80 -0.13%

Crude $53.64 (+0.71%)

Gold $1,175.80 (+0.90%)

-

14:14

WSE will be closed on Friday, January 6, 2017

We would like to remind that there will be no trading session (the Exchange will be closed) on Friday, January 6, 2017.

-

14:08

Canadian Industrial Product Price Index rose 0.3% in November

Canadian Industrial Product Price Index rose 0.3% in November, following a 0.7% increase in October. Of the 21 major commodity groups, 14 were up, 2 were down and 5 were unchanged.

The rise in the IPPI in November was mainly attributable to higher prices for motorized and recreational vehicles (+1.1%) and primary non-ferrous metal products (+2.3%).

Within motorized and recreational vehicles, price gains were reported for passenger cars and light trucks (+1.0%), motor vehicle engines and motor vehicle parts (+0.7%) as well as aircraft (+1.5%). Higher prices for motorized and recreational vehicles were closely linked to the depreciation of the Canadian dollar relative to the US dollar.

-

14:05

US initial jobless claims much lower than expected

In the week ending December 31, the advance figure for seasonally adjusted initial claims was 235,000, a decrease of 28,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 265,000 to 263,000. The 4-week moving average was 256,750, a decrease of 5,750 from the previous week's revised average. The previous week's average was revised down by 500 from 263,000 to 262,500. There were no special factors impacting this week's initial claims. This marks 96 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.25

-0.01(-0.033%)

27605

ALTRIA GROUP INC.

MO

67.95

0.10(0.1474%)

1435

Amazon.com Inc., NASDAQ

AMZN

757.74

0.56(0.074%)

8082

American Express Co

AXP

76.37

0.11(0.1442%)

139

Apple Inc.

AAPL

116

-0.02(-0.0172%)

29132

AT&T Inc

T

42.89

0.12(0.2806%)

42075

Barrick Gold Corporation, NYSE

ABX

16.76

0.36(2.1951%)

76420

Boeing Co

BA

158.45

-0.17(-0.1072%)

550

Caterpillar Inc

CAT

93.43

-0.14(-0.1496%)

4118

Chevron Corp

CVX

118.4

0.58(0.4923%)

600

Cisco Systems Inc

CSCO

30.08

-0.02(-0.0664%)

17528

Citigroup Inc., NYSE

C

61.12

-0.29(-0.4722%)

30244

Deere & Company, NYSE

DE

106.15

0.33(0.3119%)

250

Exxon Mobil Corp

XOM

89.8

-0.09(-0.1001%)

202

Facebook, Inc.

FB

118.57

-0.12(-0.1011%)

36398

Ford Motor Co.

F

13.18

0.01(0.0759%)

36378

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.75

-0.08(-0.5394%)

100369

General Electric Co

GE

31.66

-0.04(-0.1262%)

4278

General Motors Company, NYSE

GM

37

-0.09(-0.2427%)

3041

Goldman Sachs

GS

242.7

-0.43(-0.1769%)

3413

Home Depot Inc

HD

135.26

-0.24(-0.1771%)

534

Intel Corp

INTC

36.45

0.04(0.1099%)

4398

Johnson & Johnson

JNJ

115.55

-0.10(-0.0865%)

7347

JPMorgan Chase and Co

JPM

86.5

-0.41(-0.4718%)

1716

Nike

NKE

52.8

-0.27(-0.5088%)

25994

Procter & Gamble Co

PG

84.11

-0.39(-0.4615%)

200

Starbucks Corporation, NASDAQ

SBUX

55.95

-0.04(-0.0714%)

18019

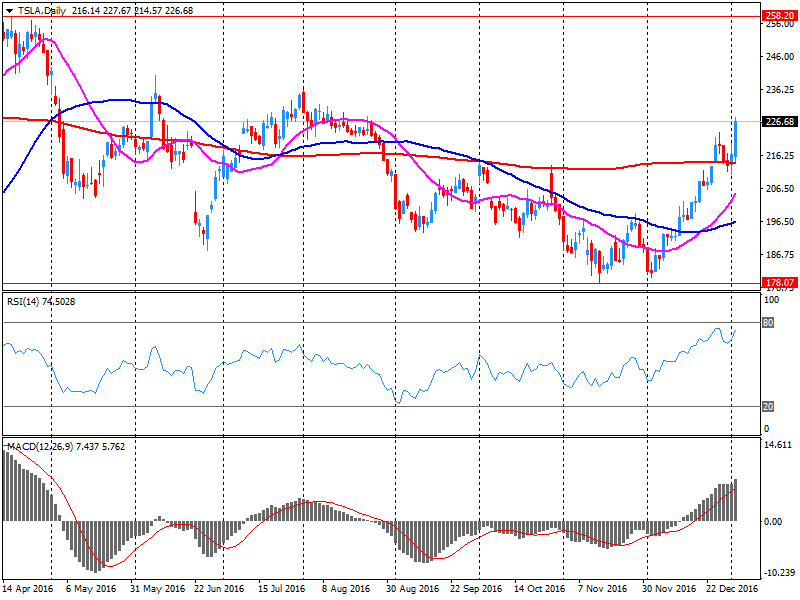

Tesla Motors, Inc., NASDAQ

TSLA

226.25

-0.74(-0.326%)

16087

Travelers Companies Inc

TRV

119.25

-1.00(-0.8316%)

1394

Twitter, Inc., NYSE

TWTR

16.92

0.06(0.3559%)

34924

United Technologies Corp

UTX

111

0.10(0.0902%)

685

Verizon Communications Inc

VZ

54.5

-0.02(-0.0367%)

2712

Wal-Mart Stores Inc

WMT

68.61

-0.45(-0.6516%)

6000

Yahoo! Inc., NASDAQ

YHOO

40.1

0.04(0.0998%)

2430

Yandex N.V., NASDAQ

YNDX

20.57

0.13(0.636%)

22183

-

13:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Travelers (TRV) downgraded to Underweight from Equal-Weight at Morgan Stanley

Other:

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

-

13:31

U.S.: Continuing Jobless Claims, 2112 (forecast 2051)

-

13:30

Canada: Industrial Product Price Index, m/m, November 0.3% (forecast 0.2%)

-

13:30

U.S.: Initial Jobless Claims, 235 (forecast 260)

-

13:30

Canada: Industrial Product Price Index, y/y, November 1.4%

-

13:21

US private sector employment increased by 153,000 jobs from November to December, below estimates

Private sector employment increased by 153,000 jobs from November to December according to the December ADP National Employment Report.

"As we exit 2016, it's interesting to note that the private sector generated an average of 174,000 jobs per month, down from 209,000 in 2015," said Ahu Yildirmaz, vice president and head of the ADP Research Institute. "And while job gains in December were slightly below our monthly average, the U.S. labor market has experienced unprecedented seven years of growth that has brought us to near full employment. As we enter 2017, the tightening labor market will likely slow the growth."

-

13:15

U.S.: ADP Employment Report, December 153 (forecast 170)

-

13:09

Tesla Motors (TSLA) began production of lithium-ion battery cells on Gigafactory

The manufacturer of electric vehicles Tesla Motors Inc reported yesterday that it has partnered with the Japanese company Panasonic to start mass production of lithium-ion battery cells on Gigafactory plant in Nevada.

According to the report, cylindrical "cell in 2170", jointly developed by Tesla and Panasonic, will be used for energy storage products and Tesla Model 3.

TSLA shares fell in premarket trading to $ 225.99 (-0.44%).

-

12:46

Orders

EUR/USD

Offers: 1.0580-85 1.0600 1.0620 1.0650 1.0680 1.0700 1.0730 1.0750

Bids: 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400 1.0380-85 1.0365 1.0345-50

GBP/USD

Offers: 1.2330 1.2350-55 1.2380-85 1.2400 1.2460 1.2500

Bids: 1.2280 1.2265 1.2250 1.2220 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8580-85 0.8600 0.8620 0.8650 0.8685 0.8700

Bids: 0.8545-50 0.8525-30 0.8500 0.8485 0.8450

EUR/JPY

Offers: 122.50 122.80 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.00 121.75 121.50 121.00 120.80 120.50 120.00

USD/JPY

Offers: 116.30 116.50-60 116.80 117.00 117.20-30 117.50 117.80 118.00

Bids: 115.50-55 115.20 115.00 114.80 114.50 114.30 114.00

AUD/USD

Offers: 0.7330 0.7350 0.7375-80 0.7400

Bids: 0.7280 0.7250 0.7230 0.7200

-

12:33

Short EUR/HUF if below 307.65, Equilor says

-

12:01

WSE: Mid session comment

The first half of today's session brought another attempts to gain the level of 2,000 points for the WIG20 index. Quite helpful was the growth boost in Europe, which unfortunately ended quickly. The WIG20 at noon reported on the new session maximum, so the upward trend both in the today's session as well as in whole wave of growth initiated in mid-November is continued.

At the halfway point of the session the WIG20 index was at the level of 1,998 points (-0,06%); the turnover in the segment of large companies was amounted to PLN 320 million.

-

11:38

Major European stock indices trading flat

Markets in Europe traded with slight modifications after opening in the red zone.

The composite index Stoxx 600 rose 0.08 percent, with most sectors trading in negative territory. However, the UK FTSE index set a new intraday record, rising above 7,200.

UK service sector expanded at the fastest pace since July 2015, due to the high level of growth in new orders, data showed today. Purchasing Managers Index from Markit rose to 56.2 in December from 55.2 in November. The index remains above 50 for the fifth month in a row, indicating continuing recovery of growth after contracting in July related to the EU referendum. The index was is expected to drop to 54.7. The growth rate was also sharper than the 20-year long-term average.

The increase in new orders was the strongest since July 2015. Employment rose in a constant pace since November, at seven-month high, and the mood in relation to the 12-month outlook strengthened, despite ongoing uncertainty regarding Brexit and European elections. Price pressures remain elevated at the end of 2016. Purchasing prices rose the second fastest pace since April 2011. As a result, providers have raised their own costs at the fastest pace since April 2011.

Eurozone producer prices rose for the first time since mid-2013 in November, showed on Thursday Eurostat data. In November, producer prices unexpectedly rose 0.1 percent from a year earlier, after falling 0.4 percent in October. It was the first annual increase since June 2013, when prices rose by 0.2 percent. Economists had forecast a drop of 0.1 percent.

Shares of Persimmon increased by more than 5.5 percent. The company reported revenue of £ 3,14 billion ($ 3.86 billion), an increase of 8 percent for the full year.

Bellway, another UK developer, was also among the best performers, its market capitalization has increased by more than 3.5 percent.

Shares of insurance companies were among the outsiders after JP Morgan cut its estimates for several companies in the sector, including RSA Insurance Group, whose stock fell more than 2 percent.

Shares of Deutsche Bank rose 2 percent after the German lender agreed to pay $ 95 million to settle a lawsuit with the US government, accused the bank of tax evasion.

At the moment:

FTSE 7186.23 -3.51 -0.05%

DAX 11572.14 -12.17 -0.11%

CAC 4898.96 -0.44 -0.01%

-

10:54

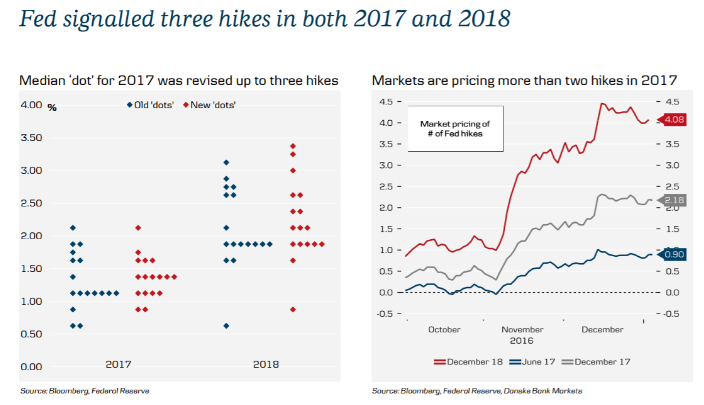

'Uncertain' mentioned 15 times in December FOMC minutes vs 5 times In Nov - Danske. Trumponomics in focus

"The FOMC members think the economic outlook is very 'uncertain' until we get more information about 'Trumponomics'. The word 'uncertain' is mentioned 15 times versus five times in the minutes from the November meeting.

The FOMC members think 'growth might turn out to be faster or slower than they currently anticipated' depending on the policy mix (tougher immigration rules and more protectionism slow growth while infrastructure spending and tax cuts increase growth). 'Almost all' FOMC members think there are upside risks to their growth forecasts due to the likely fiscal boost, which they have not fully taken into account.

Given the Fed's focus on 'Trumponomics', any comments or tweets from Donald Trump on economic policy will be followed closely.

We stick to our view that the Fed will hike twice this year (June and December) but believe the risk is skewed towards three hikes. One of the reasons is that the Fed has turned more dovish this year due to shifting voting rights, which mean that we (for now) weight dovish comments more relative to hawkish comments. This year we learned that it does not take much for the (dovish) FOMC members to postpone a hike.

That said, we believe the Fed is likely to increase its hiking pace in 2018 (late 2017 at the earliest), as we think Trump's fiscal policy is likely to have the biggest growth impact in 2018 due to policy lags (see also Five Macro Themes for 2017, 1 December 2016), although much can obviously still happen before 2018".

Copyright © 2017 Danske, eFXnews™

-

10:02

Industrial producer prices rose by 0.3% in euro area

In November 2016, compared with October 2016, industrial producer prices rose by 0.3% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In October 2016 prices increased by 0.8% in the euro area and by 1.0% in the EU28. In November 2016, compared with November 2015, industrial producer prices rose by 0.1% in the euro area and by 0.7% in the EU28.

-

10:01

Oil fell amind Libya production fears

This morning, the New York futures for Brent fell 0.34% to $ 56.27 and WTI crude oil futures were down -0.21% to $ 53.15. Thus, the black gold prices drop slightly, correcting after yesterday's rally. Today, there are fears that the growth of oil production in Libya is able to neutralize the OPEC agreement. According to some reports Libian National Oil Corp. currently produces about 700,000 barrels per day. According to statements by the Libyan authorities in the last month, the country plans in 2017 to increase production twice.

-

10:00

Eurozone: Producer Price Index, MoM , November 0.3% (forecast 0.1%)

-

10:00

Eurozone: Producer Price Index (YoY), November 0.1% (forecast -0.1%)

-

09:34

UK service sector expanded sharply in December - Markit

The final batch of UK PMI survey data for 2016 from IHS Markit and CIPS signalled that the dominant UK service sector expanded sharply in December, rounding off the strongest quarter of the year. The rate of expansion of activity accelerated for the third month running to the sharpest since July 2015, fuelled by stronger growth in new work. Employment rose at a pace unchanged from November's seven-month high, and sentiment towards the 12-month outlook strengthened despite ongoing uncertainty regarding Brexit and European elections. The survey data also signalled that inflationary pressures in the sector remained substantial, with prices charged rising at the strongest rate since April 2011.

The Index remained above 50.0 for the fifth consecutive month in December, indicating a continued recovery in growth following a contraction in July linked to the EU referendum. Moreover, the Index rose for the third consecutive month to 56.2, from 55.2, signalling the fastest expansion since July 2015. The rate of growth was also sharper than the 20-year long-run survey average.

-

09:30

United Kingdom: Purchasing Manager Index Services, December 56.2 (forecast 54.7)

-

09:14

Latest Eurozone Retail PMI survey data showed a lift in sales in the final month of 2016 - Markit

Latest Eurozone Retail PMI survey data showed a lift in sales in the final month of 2016, reflecting growth across both Germany and France. However, Italian retailers endured another month of falling sales, with the pace of decline slightly faster than in November. Adjusted for the impact of usual seasonal factors, the seasonally adjusted headline Markit Eurozone Retail PMI - which tracks month-on-month changes in likefor-like retail sales in the bloc's biggest three economies combined - registered 50.4 in December, up from November's 48.6. That signalled a rise in sales for the first time in four months, albeit marginal.

-

08:56

Major European stock markets trading lower: FTSE -0.1%, DAX -0.4%, CAC40 -0.4%, FTMIB -0.1%, IBEX -0.5%

-

08:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

Информационно-аналитический отдел TeleTrade

-

08:23

The Swiss Consumer Price Index fell by 0.1% in December 2016

The Swiss Consumer Price Index (CPI) fell by 0.1% in December 2016 compared with the previous month, reaching 100.0 points (December 2015=100). Inflation was 0.0% in comparison with the same month in the previous year. The average annualised inflation rate in 2016 was -0.4%. These are the findings from the Federal Statistical Office (FSO).

-

08:17

WSE: After opening

WIG20 index opened at 1994.72 points (-0.26%)*

WIG 52664.38 -0.17%

WIG30 2288.81 -0.23%

mWIG40 4229.91 -0.03%

*/ - change to previous close

The cash market began from a discount with the turnover focused on the shares of PGNiG (WSE: PGN) losing as a result of the reduction of gas prices in retail tariffs. The German DAX also opened so poorly. The level of 2,000 points still remains unassailable, although we are in the process of testing the main resistance on the WIG20.

After fifteen minutes of trading the WIG20 index was at the level of 1,993 points (-0,31%).

-

08:15

Switzerland: Consumer Price Index (YoY), December 0.0% (forecast 0.0%)

-

08:15

Switzerland: Consumer Price Index (MoM) , December -0.1% (forecast -0.1%)

-

08:03

Today’s events

-

At 09:30 GMT Spain will hold an auction to sell 10-year bonds

-

At 10:00 GMT France will hold an auction to sell 10-year bonds

-

At 13:00 GMT Member of the Commission of the Bank of England, Andy Haldane will make a speech

-

-

07:39

Standard & Poor's, Moritz Kraemer: the probability of a hard Brexit scenario increasing

-

07:30

Options levels on thursday, January 5, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0718 (2024)

$1.0663 (2295)

$1.0619 (341)

Price at time of writing this review: $1.0547

Support levels (open interest**, contracts):

$1.0460 (2056)

$1.0416 (1067)

$1.0381 (2232)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 48982 contracts, with the maximum number of contracts with strike price $1,1500 (3227);

- Overall open interest on the PUT options with the expiration date March, 13 is 57268 contracts, with the maximum number of contracts with strike price $1,0000 (5244);

- The ratio of PUT/CALL was 1.17 versus 1.23 from the previous trading day according to data from January, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.2609 (1168)

$1.2513 (567)

$1.2417 (252)

Price at time of writing this review: $1.2345

Support levels (open interest**, contracts):

$1.2281 (609)

$1.2185 (793)

$1.2088 (457)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14634 contracts, with the maximum number of contracts with strike price $1,2800 (3003);

- Overall open interest on the PUT options with the expiration date March, 13 is 17228 contracts, with the maximum number of contracts with strike price $1,1500 (2980);

- The ratio of PUT/CALL was 1.18 versus 1.20 from the previous trading day according to data from January, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

WSE: Before opening

Wednesday's session on the New York stock exchange ended with increases in the major indexes. The Dow Jones Industrial rose at the close of 0.30 percent, the S&P 500 was firmer by 0.57 percent and the Nasdaq Comp. went up by 0.88 percent.

The minutes published after the December meeting of the Federal Reserve indicates that its members can raise growth forecasts for the US economy because of the prospect of fiscal loosening. At the same time, however, some members indicated that further strengthening of the dollar could have a negative impact on inflation and this fact has been noticed by investors. As a result, weakens the dollar, more expensive are raw materials and rising Asian stock markets, outside Tokyo, where the Nikkei index lost due to the strengthening of the yen. Also helps good data from China, better PMI for the services sector and stronger yuan.

Therefore, it is particularly favorable environment for emerging markets and can help to defeat the level of 2,000 points by the WIG20 index.

In the case of the Polish market, today's session will be the last before a long weekend.

-

07:06

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.5%, CAC40 + 0.4%, FTSE + 0.2%

-

06:57

The New Zealand dollar was trading at its highest levels in around three weeks

-

06:55

Former UK representative Ivan Rogers dissatisfied with the Brexit approach

Recently Ivan Rogers, announced his resignation. The report of the representative of the British staff in Brussels showed weak preparation in conducting the important negotiations between UK and EU. In addition, Rogers noted the inexperience of the new cabinet and the lack of a clear plan for Brexit. "Once again, the authorities in London have received demands for a more detailed plan."

-

06:51

A number of risks" might call for "different path" than present course of gradual rate hikes - FOMC minutes

The pace of further interest rate hikes may speed up if the jobs market continues to improve, according to the minutes of the December meeting of the Federal Open Market Committee, cited by rttnews.

At the December 13-14 meeting, the FOMC raised interest rates for only the second time in a decade by a quarter-percentage point to 0.50%-0.75%, with policy makers also predicting two or three additional rate hikes in 2017

However, "A number of risks" might call for "different path" than present course of gradual rate hikes, the minutes revealed Wednesday.

The unemployment rate dropped to 4.6% in December. It is feared that a moved below 4.5% could spur inflation to rise faster than the Fed currently projects.

"Many" FOMC members noted the risk "sizable undershooting" of the jobless rate "had increased somewhat and that the Federal Open Market Committee might need to raise the federal funds rate more quickly than currently anticipated to limit the degree of undershooting and stem a potential buildup of inflationary pressures," according to the minutes.

-

06:37

Global Stocks

European stock markets charged higher again on Tuesday, closing at a fresh one-year high after upbeat Chinese and U.S. manufacturing data fueled optimism over economic growth in the world's two largest economies.

U.S. stocks closed just shy of record levels on Wednesday following the release of the Federal Reserve's policy minutes from its December meeting and a strong showing in auto sales.

Asian equities started Thursday's session largely higher, building on start-of-the-year strength as U.S. stocks continued to gain overnight, though Japan equities retreated slightly after their stout kickoff to 2017.

-

01:46

China: Markit/Caixin Services PMI, December 53.4 (forecast 53.3)

-