Market news

-

21:07

Major US stock indexes finished trading above zero

Major US stock indices are moderately higher after data showed that employment in December increased less than expected, but the rebound wages signaled steady growth in the labor market.

As it became known, job creation slowed in December and the unemployment rate rose slightly, but wage growth was the strongest since 2009, pointing to a tightening of the labor market for more than seven years after the beginning of the expansion. The number of people employed in non-agricultural sectors of the economy rose to a seasonally adjusted 156 000 in December from the previous month, the Labor Department said Friday. The unemployment rate rose slightly to 4.7% last month from 4.6% in November, reflecting more Americans entering the labor market. Economists had expected 178,000 new jobs, and the unemployment rate to 4.7%.

In addition, new orders for manufactured goods in the US fell by reducing the pressure in November in a volatile category of civilian aircraft, but the underlying trend suggests that production is gradually being strengthened. The US Commerce Department said today that production orders for goods decreased by 2.4%, after a revised increase of up to 2.8% in October. The November decline followed a growth for four consecutive months and was the biggest drop since December 2015. Economists predicted that factory orders decline by 2.2% in November after being shown previously reported increase of 2.7% in October.

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.78%). Outsider were shares of Verizon Communications Inc. (VZ, -2.56%).

Sector S & P index also ended the day mostly in positive territory. The leader turned out to be the technology sector (+ 0.3%). Most of the basic materials sector fell (-0.3%).

-

20:01

DJIA +0.41% 19,980.12 +80.83 Nasdaq +0.71% 5,526.95 +39.01 S&P +0.44% 2,278.99 +9.99

-

17:00

European stocks closed: FTSE 100 +14.74 7210.05 +0.20% DAX +14.07 11599.01 +0.12% CAC 40 +9.20 4909.84 +0.19%

-

16:27

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes slightly hgigh on Friday after data showed employment in December rose less than expected but a rebound in wages suggested sustained growth in the labor market. The public and private sectors together added 156000 jobs last month, a U.S. Labor Department report showed, compared with 204000 jobs added in November. Average hourly earnings increased 10 cents, or 0,4%, after slipping 0,1% in November. That pushed the year-on-year increase in average hourly earnings to 2,9%, the largest increase since June 2009.

Most of Dow stocks in negative area (17 of 30). Top gainer - The Walt Disney Company (DIS, +1.51%). Top loser - Verizon Communications Inc. (VZ, -2.26%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Basic Materials (-0.6%).

At the moment:

Dow 19852.00 +31.00 +0.16%

S&P 500 2267.00 +2.75 +0.12%

Nasdaq 100 4990.25 +28.25 +0.57%

Oil 53.47 -0.29 -0.54%

Gold 1174.70 -6.60 -0.56%

U.S. 10yr 2.41 +0.04

-

15:58

ING sees GBP/USD falling to $1.20, with the dollar gaining a tailwind from rising U.S. yields

-

15:35

Fed's Mester: Expectations for 3 Rate Increases in 2017 `Reasonable'

-

15:18

US factory orders decreased following four consecutive monthly increases

New orders for manufactured durable goods in November decreased $11.0 billion or 4.6 percent to $228.2 billion, the U.S. Census Bureau announced today. This decrease, down following four consecutive monthly increases, followed a 4.8 percent October increase. Excluding transportation, new orders increased

0.5 percent. Excluding defense, new orders decreased 6.6 percent.

Transportation equipment, also down following four consecutive monthly increases, drove the decrease, $11.7 billion or 13.2 percent to $76.6 billion.

-

15:00

U.S.: Factory Orders , November -2.4% (forecast -2.2%)

-

15:00

Canada: Ivey Purchasing Managers Index, December 60.8

-

14:47

Iran capitalizes on OPEC oil cut to sell millions of barrels - Reuters sources

-

14:34

U.S. Stocks open: Dow -0.06%, Nasdaq +0.05%, S&P -0.05%

-

14:28

Before the bell: S&P futures +0.02%, NASDAQ futures +0.07%

U.S. stock-index futures were flat as investors assessed mixed data on the U.S. labour market .

Global Stocks:

Nikkei 19,454.33 -66.36 -0.34%

Hang Seng 22,503.01 +46.32 +0.21%

Shanghai 3,154.29 -11.12 -0.35%

FTSE 7,199.81 +4.50 +0.06%

CAC 4,897.45 -3.19 -0.07%

DAX 11,586.13 +1.19 +0.01%

Crude $54.22 (+0.86%)

Gold $1,179.20 (-0.18%)

-

14:27

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

780.53

0.08(0.0103%)

18058

American Express Co

AXP

75

-0.32(-0.4249%)

5025

AMERICAN INTERNATIONAL GROUP

AIG

65.9

0.30(0.4573%)

500

Apple Inc.

AAPL

116.58

-0.03(-0.0257%)

89918

AT&T Inc

T

42.22

0.06(0.1423%)

31522

Barrick Gold Corporation, NYSE

ABX

17.16

-0.21(-1.209%)

109432

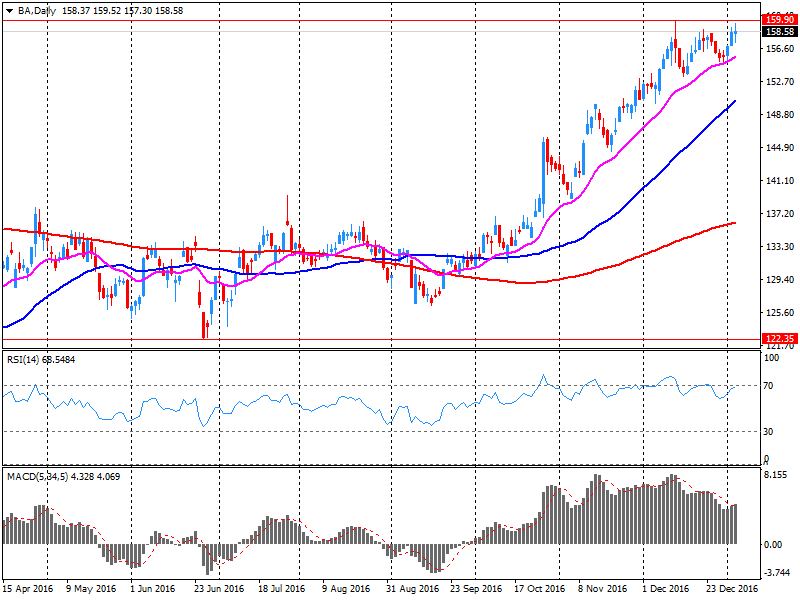

Boeing Co

BA

158.9

0.19(0.1197%)

241

Chevron Corp

CVX

117.5

0.19(0.162%)

342

Cisco Systems Inc

CSCO

30.24

0.07(0.232%)

4625

Exxon Mobil Corp

XOM

88.89

0.34(0.384%)

808

Facebook, Inc.

FB

120.83

0.16(0.1326%)

38037

Ford Motor Co.

F

12.81

0.04(0.3132%)

37564

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.7

0.08(0.5472%)

103689

General Electric Co

GE

31.53

0.01(0.0317%)

2557

General Motors Company, NYSE

GM

36.7

0.31(0.8519%)

1294

Goldman Sachs

GS

241.99

0.67(0.2776%)

4357

Google Inc.

GOOG

794.9

0.88(0.1108%)

1838

Intel Corp

INTC

36.4

0.05(0.1376%)

2481

International Business Machines Co...

IBM

168.2

-0.50(-0.2964%)

110

Johnson & Johnson

JNJ

117

0.14(0.1198%)

998

McDonald's Corp

MCD

118.73

-0.97(-0.8104%)

1960

Merck & Co Inc

MRK

60.54

0.43(0.7154%)

190

Microsoft Corp

MSFT

62.4

0.10(0.1605%)

2207

Nike

NKE

53.01

-0.05(-0.0942%)

2511

Pfizer Inc

PFE

33.7

0.09(0.2678%)

350

Starbucks Corporation, NASDAQ

SBUX

168.2

-0.50(-0.2964%)

110

Tesla Motors, Inc., NASDAQ

TSLA

226.25

-0.50(-0.2205%)

7929

Travelers Companies Inc

TRV

117.02

-1.31(-1.1071%)

1282

Twitter, Inc., NYSE

TWTR

17.19

0.10(0.5851%)

24932

United Technologies Corp

UTX

112

0.65(0.5837%)

175

Verizon Communications Inc

VZ

54.03

-0.0325(-0.0601%)

6388

Wal-Mart Stores Inc

WMT

158.9

0.19(0.1197%)

241

Walt Disney Co

DIS

108.02

0.64(0.596%)

9818

Yahoo! Inc., NASDAQ

YHOO

41.19

-0.15(-0.3628%)

6900

Yandex N.V., NASDAQ

YNDX

21.58

-0.30(-1.3711%)

15040

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Hold from Sell at Vertical Research

Walt Disney (DIS) upgraded to Outperform at RBC Capital Mkts; target raised to $130

Downgrades:

Travelers (TRV) downgraded to Underweight from Neutral at Atlantic Equities

McDonald's (MCD) downgraded to Neutral from Buy at UBS

Other:

-

13:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 2.42bln) 1.0600 (505m) 1.0700 (2.41bln) 1.0800 (281m) 1.0850 (690m)

USD/JPY 115.00 (USD 1.3bln) 116.00 (700m) 117.00 (420m) 117.25 (380m) 118.00 (839m)

USD/CAD 1.3245 (USD 300m) 1.3300 (1.26bln)

NZD/USD 0.7005 (NZD 173m)

-

13:40

US trade balance deficit up $2.9 billion in November

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $45.2 billion in November, up $2.9 billion from $42.4 billion in October, revised. November exports were $185.8 billion, $0.4 billion less than October exports. November imports were $231.1 billion, $2.4 billion more than October imports.

-

13:37

Important increase for Canadian employment, the result of gains in full-time work

Employment rose by 54,000 (+0.3%) in December, the result of gains in full-time work. The unemployment rate increased 0.1 percentage points to 6.9%, as more people participated in the labour market.

In the fourth quarter of 2016, employment increased by 108,000 (+0.6%), the largest increase since the second quarter of 2010. This followed a gain of 62,000 (+0.3%) in the third quarter.

In the 12 months to December, employment gains totalled 214,000 or 1.2%, compared with a growth rate of 0.9% observed over the same period one year earlier. A year-end review is presented in a separate section below.

-

13:35

US average hourly earnings increased more than expected in December. Dollar moves up

In December, average hourly earnings for all employees on private nonfarm payrolls increased by 10 cents to $26.00, after edging down by 2 cents in November. Over the year, average hourly earnings have risen by 2.9 percent. In December, average hourly earnings of private-sector production and nonsupervisory employees increased by 7 cents to $21.80

-

13:33

NFP moderately lower than forecasts, US unemployment rate stable

Total nonfarm payroll employment rose by 156,000 in December, and the unemployment rate was little changed at 4.7 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in health care and social assistance.

The unemployment rate, at 4.7 percent, and the number of unemployed persons, at 7.5 million, changed little in December. However, both measures edged down in the fourth quarter, after showing little net change earlier in the year.

-

13:30

U.S.: Unemployment Rate, December 4.7% (forecast 4.7%)

-

13:30

U.S.: Average hourly earnings , December 0.4% (forecast 0.3%)

-

13:30

U.S.: Nonfarm Payrolls, December 156 (forecast 178)

-

13:30

U.S.: International Trade, bln, November -45.2 (forecast -42.5)

-

13:30

Canada: Unemployment rate, December 6.9% (forecast 6.9%)

-

13:30

U.S.: Average workweek, December 34.3 (forecast 34.4)

-

13:30

Canada: Trade balance, billions, November 0.53 (forecast -1.6)

-

13:30

Canada: Employment , December 53.7 (forecast -5)

-

13:06

Orders

EUR/USD

Offers: 1.0600-05 1.0620 1.0650 1.0680 1.0700 1.0730 1.0750 1.0775-80 1.0800

Bids: 1.0550-60 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400 1.0380-85 1.0365 1.0350

GBP/USD

Offers: 1.2400 1.2430-35 1.2450 1.2480 1.2500 1.2520 1.2550

Bids: 1.2350-60 1.2320 1.2300 1.2280 1.2265 1.2250 1.2220 1.2200

EUR/GBP

Offers: 0.8565 0.8580-85 0.8600 0.8620 0.8650 0.8685 0.8700

Bids: 0.8540 0.8520-25 0.8500 0.8485 0.8450 0.8430 0.8400

EUR/JPY

Offers: 122.85 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.50 122.30 122.00 121.75 121.50 121.00

USD/JPY

Offers: 116.50 116.80 117.00 117.20-30 117.50 117.80 118.00

Bids: 116.00 115.75-80 115.50 115.20 115.00 114.80 114.50 114.30 114.00

AUD/USD

Offers: 0.7350-55 0.7375-80 0.7400 0.7420-25 0.7450 0.7475-80 0.7500

Bids: 0.7300 0.7280 0.7250 0.7230 0.7200

-

12:16

The dishonest media does not report that any money spent on building the Great Wall (for sake of speed), will be paid back by Mexico later! @realDonaldTrump

-

11:31

Goldman Sachs on US job report: We are in line with consensus across the board for payrolls on Friday, where we expect 180k on the headline and the unemployment rate to tick up to 4.7%

-

10:09

Danske estimate non-farm payrolls increased by 170,000

"We estimate non-farm payrolls increased by 170,000 in December in line with the recent trend and more or less in line with the consensus of 178,000. We estimate private services was the main contributor to job growth with 150,000 new jobs. After four months in decline, we estimate manufacturing employment was unchanged in December as manufacturing activity has recovered. Construction employment probably increased 8,000 in December. We estimate the unemployment rate rose to 4.7% and that average hourly earnings increased 0.2% m/m, implying a small increase in the wage growth rate of 2.6% y/y".

-

10:07

Euro area retail sales up 2.3% on year

In November 2016 compared with October 2016, the seasonally adjusted volume of retail trade fell by 0.4% in the euro area (EA19) and by 0.1% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In October the retail trade volume increased by 1.4% in the euro area and by 1.3% in the EU28. In November 2016 compared with November 2015 the calendar adjusted retail sales index increased by 2.3% in the euro area and by 3.4% in the EU28.

-

10:01

Eurozone: Industrial confidence, December 0.0 (forecast -1)

-

10:01

Eurozone: Consumer Confidence, December -5 (forecast -5)

-

10:01

Eurozone: Business climate indicator , December 0.8 (forecast 0.4)

-

10:01

Eurozone: Economic sentiment index , December 107.8 (forecast 106.8)

-

10:00

Eurozone: Retail Sales (MoM), November -0.4% (forecast -0.4%)

-

10:00

Eurozone: Retail Sales (YoY), November 2.3%

-

09:52

Oil rose slightly

This morning, the New York futures for Brent rose 0.14% to $ 56.97 and WTI rose 0.17% to $ 53.85. Thus, the black gold supported by yesterday's data on US inventories. Over the past week inventories declined by 7.1 million barrels. Most analysts forecast a decline in production by only 2 million barrels. Additional support for the black gold has provided information on the reduction of production by Saudi Arabia. Oil production in the country decreased by about 10 million barrels per day.

-

09:25

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 2.42bln) 1.0600 (505m) 1.0700 (2.41bln) 1.0800 (281m) 1.0850 (690m)

USD/JPY 115.00 (USD 1.3bln) 116.00 (700m) 117.00 (420m) 117.25 (380m) 118.00 (839m)

USD/CAD 1.3245 (USD 300m) 1.3300 (1.26bln)

NZD/USD 0.7005 (NZD 173m)

Информационно-аналитический отдел TeleTrade

-

08:39

Major European stock markets trading lower: FTSE -0.1%, DAX -0.2%, CAC40 -0.4%, IBEX flat

-

08:20

Today’s events

-

At 11:15 GMT the ECB member Yves Mersch will make a speech

-

At 17:15 GMT FOMC member Charles Evans will give a speech

-

At 18:00 GMT FOMC member Jeffrey Lacker will give a speech

-

Italy celebrates the Day of the Epiphany

-

-

08:18

Dollar sold again as Europe opens. NFP expected at 178K, same as last month

-

07:46

France: Trade Balance, bln, November -4.4 (forecast -4.9)

-

07:21

Options levels on friday, January 6, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0736 (2297)

$1.0719 (585)

$1.0679 (254)

Price at time of writing this review: $1.0578

Support levels (open interest**, contracts):

$1.0530 (1104)

$1.0492 (1087)

$1.0444 (2270)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 51290 contracts, with the maximum number of contracts with strike price $1,1500 (3372);

- Overall open interest on the PUT options with the expiration date March, 13 is 58004 contracts, with the maximum number of contracts with strike price $1,0000 (5263);

- The ratio of PUT/CALL was 1.13 versus 1.17 from the previous trading day according to data from January, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.2613 (1291)

$1.2517 (544)

$1.2422 (253)

Price at time of writing this review: $1.2380

Support levels (open interest**, contracts):

$1.2285 (679)

$1.2188 (889)

$1.2091 (469)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14983 contracts, with the maximum number of contracts with strike price $1,2800 (3003);

- Overall open interest on the PUT options with the expiration date March, 13 is 17563 contracts, with the maximum number of contracts with strike price $1,1500 (2982);

- The ratio of PUT/CALL was 1.17 versus 1.18 from the previous trading day according to data from January, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.2%

-

07:15

German retail sales expected to be between 1.8% and 2.1% larger than that in 2015

According to estimates of the Federal Statistical Office (Destatis), retail turnover 2016 in Germany is expected to be in real terms between 1.8% and 2.1% larger than that in 2015. In nominal terms turnover is expected to increase by between 2.4% and 2.6%.

This estimation is based on data for the first eleven months of 2016. In this period retail turnover was in real terms 1.9% and in nominal terms 2.2% larger than that in the corresponding period of the previous year.

-

07:08

German factory orders down 2.5% in November. Eur/Usd unchanged so far

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had decreased in November 2016 a seasonally and working-day adjusted 2.5% on October 2016. For October 2016, revision of the preliminary outcome resulted in an increase of 5.0% compared with September 2016 (primary +4.9%). Price-adjusted new orders without major orders in manufacturing had decreased in November 2016 a seasonally and working-day adjusted 0.6% on October 2016.

In November 2016, domestic orders decreased by 2.8% and foreign orders by 2.3% on the previous month. New orders from the euro area were down 2.7% on the previous month, new orders from other countries decreased by 2.0% compared to October 2016.

-

07:01

Japanese wages increased by 0.2% year on year

Wages increased by 0.2% year on year, which is slightly higher than the previous value of 0.1%, and coincided with the forecast of economists. This was reported today by the Ministry of Health, Labour and Welfare of Japan. Changes in salary levels - an indicator showing the average full-time employee's pre-tax income. This indicator takes into account compensation for overtime work and bonuses, but do not take into account the income received in the form of interest on financial assets or capital gains. Earnings contributes to consumption, and therefore the upward trend is considered to be an inflationary factor for the Japanese economy.

-

07:01

Germany: Retail sales, real adjusted , November -1.8% (forecast -0.6%)

-

07:01

Germany: Retail sales, real adjusted , November -1.8% (forecast -0.6%)

-

07:01

Germany: Retail sales, real unadjusted, y/y, November 3.2% (forecast 1.2%)

-

07:00

Germany: Factory Orders s.a. (MoM), November -2.5% (forecast -2.3%)

-

06:59

OPEC Secretary-General Mohammed Barkindo: negotiations will be held at the energy conference in Abu Dhabi

The Secretary General intends to hold informal talks with Oil Minister of Saudi Arabia and six other countries that accepted production cuts.

-

06:56

Australian trade balance showed surplus in November

In trend terms, the balance on goods and services was a deficit of $16m in November 2016, a decrease of $503m (97%) on the deficit in October 2016.

In seasonally adjusted terms, the balance on goods and services was a surplus of $1,243m in November 2016, a turnaround of $2,362m on the deficit in October 2016.

In seasonally adjusted terms, goods and services credits rose $2,322m (8%) to $30,083m. Non-rural goods rose $2,010m (12%) and rural goods rose $588m (17%). Non-monetary gold fell $305m (18%). Net exports of goods under merchanting remained steady at $5m. Services credits rose $29m.

-

06:54

Global Stocks

U.K. stocks pushed further into record territory in bouncy trade on Thursday, supported by a rally in shares of house builders on the back of upbeat news from Persimmon PLC. The index was hovering around the flatline for most of the session as traders digested minutes from the U.S. Federal Reserve's meeting in December, released after Wednesday's close in London.

The tech-heavy Nasdaq closed at a record Thursday, as the broader stock market finished lower, dragged down by a steep slide in the financial sector and major retailers. Mixed data on jobs also raised concerns a day before the closely watched December employment report due Friday.

Japanese shares dropped Friday on yen-strengthening as traders awaited U.S. jobs data for clues on Federal Reserve rate actions. The yen's gain against the dollar comes as investors grow cautious about the U.S. economic outlook, and as traders second-guessed their once unshakeable belief in a continuous greenback rally driven by Fed rate rises.

-

00:30

Australia: Trade Balance , November -1.24 (forecast -0.3)

-

00:00

Japan: Labor Cash Earnings, YoY, November 0.2% (forecast 0.2%)

-