Market news

-

23:30

Commodities. Daily history for Jan 04’2017:

(raw materials / closing price /% change)

Oil 53.35 +0.17%

Gold 1,164.20 -0.09%

-

23:29

Stocks. Daily history for Jan 04’2017:

(index / closing price / change items /% change)

Nikkei +479.79 19594.16 +2.51%

TOPIX +35.87 1554.48 +2.36%

Hang Seng -15.93 22134.47 -0.07%

CSI 300 +26.08 3368.31 +0.78%

Euro Stoxx 50 +2.50 3317.52 +0.08%

FTSE 100 +11.85 7189.74 +0.17%

DAX +0.07 11584.31 +0.00%

CAC 40 +0.07 4899.40 +0.00%

DJIA +60.40 19942.16 +0.30%

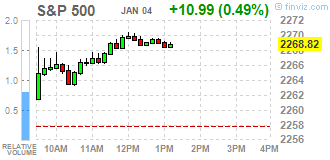

S&P 500 +12.92 2270.75 +0.57%

NASDAQ +47.92 5477.00 +0.88%

S&P/TSX +113.72 15516.75 +0.74%

-

23:28

Currencies. Daily history for Jan 04’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0488 +0,79%

GBP/USD $1,2322 +0,69%

USD/CHF Chf1,0206 -0,65%

USD/JPY Y117,24 -0,43%

EUR/JPY Y122,96 +0,37%

GBP/JPY Y144,45 +0,26%

AUD/USD $0,7281 +0,88%

NZD/USD $0,6966 +0,73%

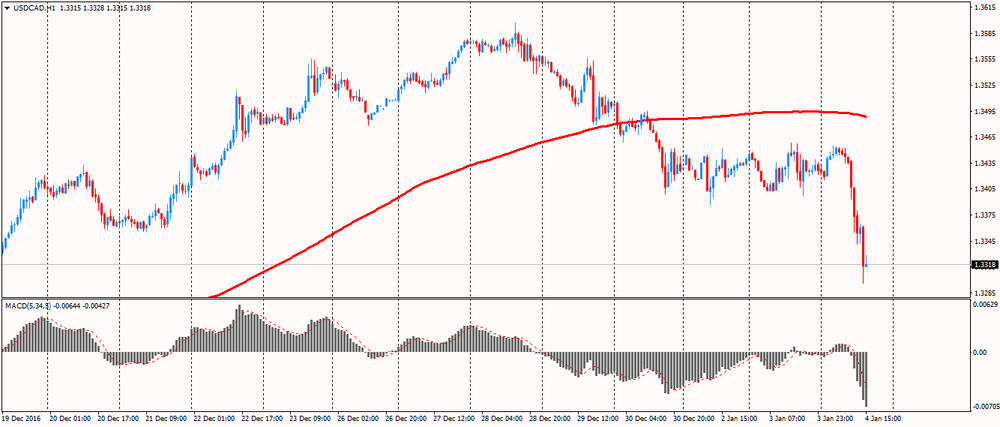

USD/CAD C$1,3299 -0,95%

-

23:00

Schedule for today,Thursday , Jan 05’2017 (GMT0)

01:45 China Markit/Caixin Services PMI December 53.1 53.3

08:15 Switzerland Consumer Price Index (MoM) December -0.2% -0.1%

08:15 Switzerland Consumer Price Index (YoY) December -0.3% 0.0%

09:30 United Kingdom Purchasing Manager Index Services December 55.2 54.7

10:00 Eurozone Producer Price Index, MoM November 0.8% 0.3%

10:00 Eurozone Producer Price Index (YoY) November -0.4% 0.1%

13:00 United Kingdom MPC Member Andy Haldane Speaks

13:15 U.S. ADP Employment Report December 216 170

13:30 Canada Industrial Product Price Index, m/m November 0.7%

13:30 Canada Industrial Product Price Index, y/y November 0.8%

13:30 U.S. Continuing Jobless Claims 2102 2051

13:30 U.S. Initial Jobless Claims 265 260

14:45 U.S. Services PMI (Finally) December 54.6

15:00 U.S. ISM Non-Manufacturing December 57.2 56.6

16:00 U.S. Crude Oil Inventories December 0.614 -2300

-

22:30

Australia: AIG Services Index, December 57.7

-

21:05

Major US stock indexes finished trading in the "green zone"

Major stock Wall Street indices showed an increase during the second trading day of the year, supported by stocks of consumer goods companies in the sector, as well as the expectations of the investors of the December Fed meeting minutes.

According to the minutes, Fed officials noted "considerable uncertainty" regarding Trump policy impact on the economy. Almost all the leaders of the Central Bank believe that fiscal stimulus could accelerate the growth of the national economy in the next few years. However, the Fed emphasized the uncertainty with regards to the timing, scale and composition of future policies. In addition, Fed officials agreed that it is too early to say what changes will happen and how they will affect the economic outlook. Many participants of the meeting also talked about his concern at the fact that the increased uncertainty "hampered the process of communication about the likely course of interest rates." Recall that in December, Fed officials voted unanimously to increase the key rate to a range of 0.50% -0.75%.

In addition, as it became known today, the index of business activity in New York significantly improved the results of December, exceeding the estimates of experts, and showing the second consecutive monthly expansion. This is evidenced by a report published by the Institute for Supply Management (ISM) in New York. According to the data, the index assesses the economic conditions in the sectors of production and services for the companies listed in New York, jumped in December to 63.8 points compared to 52.5 points in November. Economists had forecast that the index was 53.5 points.

Oil futures rose about 1.5 percent, which was due to expectations of reductions in US oil inventories and signs that oil producers will adhere to the agreed conditions to reduce oil production, which came into force this week. The American Petroleum Institute (API) will publish its data on oil reserves in the United States today, and tomorrow will come the official statistics from the US Department of Energy. Analysts expect the US Energy Department reported a decline in crude oil inventories of 2.3 million barrels. Recall the previous week crude oil inventories rose by 0.614 million barrels.

DOW index components closed mostly in positive territory (16 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 2.28%). Outsider were shares of Cisco Systems, Inc. (CSCO, -1.39%).

All business sectors S & P index ended the session in positive territory. The leader turned conglomerates sector (+ 2.4%).

At the close:

Dow + 0.30% 19,941.61 +59.85

Nasdaq + 0.88% 5,477.01 +47.93

S & P + 0.57% 2,270.72 +12.89

-

20:00

U.S.: Total Vehicle Sales, mln, December 18.29 (forecast 17.7)

-

20:00

DJIA +0.28% 19,936.66 +54.90 Nasdaq +0.86% 5,475.87 +46.79 S&P +0.53% 2,269.88 +12.05

-

18:20

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose in the second trading day of the new year, supported by consumer discretionary stocks, as investors awaited minutes of the Federal Reserve's December meeting where it raised interest rates. The central bank had cited strength in the labor market and a slight uptick in inflation among reasons for its move.

Most of Dow stocks in positive area (17 of 30). Top gainer - NIKE, Inc. (NKE, +1.77%). Top loser - Cisco Systems, Inc. (CSCO, -1.02%).

All S&P sectors also in positive area. Top gainer - Conglomerates (+2.7%).

At the moment:

Dow 19856.00 +58.00 +0.29%

S&P 500 2263.00 +10.50 +0.47%

Nasdaq 100 4930.75 +24.50 +0.50%

Oil 53.29 +0.96 +1.83%

Gold 1165.40 +3.40 +0.29%

U.S. 10yr 2.46 +0.01

Информационно-аналитический отдел TeleTrade

-

17:00

European stocks closed: FTSE 100 +11.85 7189.74 +0.17% DAX +0.07 11584.31 +0.00% CAC 40 +0.07 4899.40 +0.00%

-

16:47

WSE: Session Results

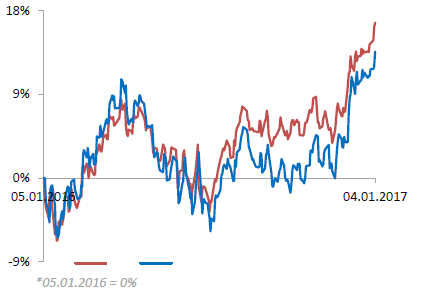

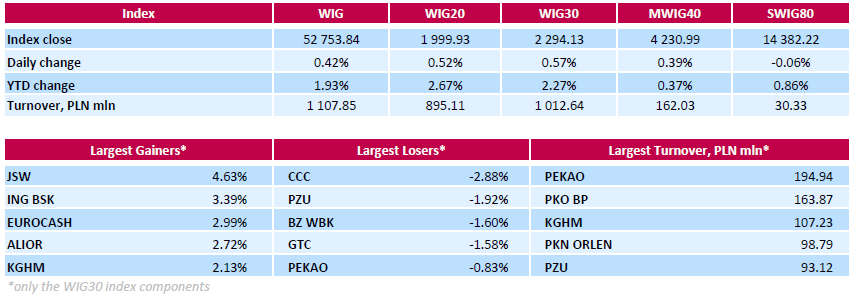

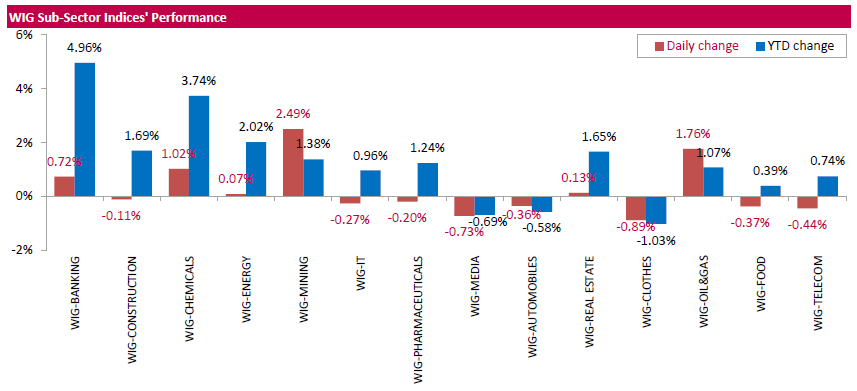

Polish equity market closed higher on Wednesday. The broad market benchmark, the WIG Index, surged by 0.42%. Sector performance within the WIG Index was mixed. Mining (+2.49%) outperformed, while clothes (-0.89%) lagged behind.

The large-cap stocks added 0.57%, as measured by the WIG30 Index. Within the index components, coking coal miner JSW (WSE: JSW) led the gainers pack with a 4.63% advance, recovering somewhat after two weeks of declines, which pushed the stock's quotation down nearly 20%. It was followed by FMCG-wholesaler EUROCASH (WSE: EUR) and two banking names ING BSK (WSE: ING) and ALIOR (WSE; ALR), climbing by 2.72%-3.39%. On the other side of the ledger, footwear retailer CCC (WSE: CCC) recorded the biggest drop of 2.88%, breaking a six-session streak of gains. Other major decliners were insurer PZU (WSE: PZU), bank BZ WBK (WSE: BZW) and property developer GTC (WSE: GTC), plunging by 1.92%, 1.6% and 1.58% respectively.

-

15:51

Goldman Sachs on oil price dynamics

Goldman Sachs expects oil prices to peak at $ 59 a barrel during summer amid growth in the US shale oil production. Oil Market Outlook in early 2017 will largely be determined by the oil-producing countries cuts, which in the summer will lead to a decrease in reserves of oil in storage until the normal levels.

However, the production of shale oil in the US is growing rapidly, and the number of drilling rigs operating in is at a 13-month high.

-

15:14

-

14:57

WSE: After start on Wall Street

The market in the US started wit rise, which increased slightly after the first transactions. In addition, there is a noticeable revival of copper, which price rises to surrounding of yesterday's highs, what gives us a good afternoon mood. The Warsaw WIG20 went on the green side and still has a chance to end the day above the level of 2,000 points.

An hour before the close of trading, the WIG20 index was at the level of 1,992 points (+ 0.16%).

-

14:42

The rather muted reaction in EUR/NOK to Tuesday's sharp fall in the oil price highlights how NOK sensitivity to the price of crude has been declining steadily over the past months, says Danske Bank

-

14:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.33%, S&P +0.33%

-

14:28

Before the bell: S&P futures +0.21%, NASDAQ futures +0.17%

U.S. stock-index futures advanced. Investors await the publication of the minutes of the December Federal Open Market Committee meeting.

Global Stocks:

Nikkei 19,594.16 +479.79 +2.51%

Hang Seng 22,134.47 -15.93 -0.07%

Shanghai 3,159.82 +23.90 +0.76%

FTSE 7,178.50 +0.61 +0.01%

CAC 4,901.16 +1.83 +0.04%

DAX 11,574.55 -9.69 -0.08%

Crude $52.67 (+0.65%)

Gold $1,165.60 (+0.31%)

-

14:21

Bank of America Merrill will be looking at 3 things at December FOMC minutes

"1- The minutes from the December 14th FOMC meeting are likely to reveal modest optimism about the improvement in the recent data but a "cloud of uncertainty" about how fiscal policy could change the trajectory. While it seems likely that there will be some form of fiscal stimulus, the details are not yet apparent which makes it difficult to gauge the risks to the forecast. We therefore think the minutes will show that there was a conversation about the possible scenarios without committing to the outcome. We also think that Fed officials likely discussed the health of the labor market with a particular emphasis on measuring slack in the labor market given the drop in the unemployment rate to 4.6%. The labor force participation rate has edged higher this year, but in a very choppy fashion making it hard to decipher the trend. Moreover, the improvement in wages has been uneven, further complicating whether we have returned to full employment.

2- Inflation will also be in focus. The statement noted that although market measures of inflation compensation have moved up considerably, they remain low. And meanwhile survey-based measures remained little changed. Seemingly the Fed is not concerned about a rise in inflation expectations that could bias inflation higher. We think there will likely be a bit of a debate over the risks to inflation.

3- We will also look out for any conversation about risk management. Interestingly, Fed Chair Yellen did not talk about the asymmetry when policy is close to the effective lower bound. When asked about allowing the "economy to run hot" she said that it was not the Fed's intention to be behind the curve with policy. This was perceived to be a hawkish signal by the markets. It will be interesting to see the discussion among Fed officials about the risks".

Copyright © 2017 BofAML, eFXnews™

-

13:59

Euro area annual inflation is expected to be 1.1% in December 2016

Euro area annual inflation is expected to be 1.1% in December 2016, up from 0.6% in November 2016, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in December (2.5%, compared with -1.1% in November), followed by services (1.2%, compared with 1.1% in November), food, alcohol & tobacco (1.2%, compared with 0.7% in November) and non-energy industrial goods (0.3%, stable compared with November).

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

28.79

-0.04(-0.1387%)

600

ALTRIA GROUP INC.

MO

68.15

0.52(0.7689%)

14249

Amazon.com Inc., NASDAQ

AMZN

755.97

2.30(0.3052%)

6156

American Express Co

AXP

75.35

0.32(0.4265%)

522

Apple Inc.

AAPL

116.04

-0.11(-0.0947%)

65999

AT&T Inc

T

43

-0.02(-0.0465%)

7577

Barrick Gold Corporation, NYSE

ABX

16.47

0.08(0.4881%)

69328

Caterpillar Inc

CAT

93.75

-0.24(-0.2553%)

160

Chevron Corp

CVX

118.5

0.65(0.5515%)

3838

Cisco Systems Inc

CSCO

30.35

0.07(0.2312%)

4669

Citigroup Inc., NYSE

C

60.71

0.12(0.1981%)

46640

Deere & Company, NYSE

DE

103.69

-0.36(-0.346%)

618

Facebook, Inc.

FB

117.2

0.34(0.2909%)

34022

Ford Motor Co.

F

12.7

0.11(0.8737%)

67815

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.95

0.17(1.2337%)

87013

General Electric Co

GE

31.63

-0.06(-0.1893%)

1121

General Motors Company, NYSE

GM

35.11

-0.04(-0.1138%)

1291

Goldman Sachs

GS

241.66

0.09(0.0373%)

980

Google Inc.

GOOG

788

1.86(0.2366%)

1561

Intel Corp

INTC

36.74

0.14(0.3825%)

6319

International Business Machines Co...

IBM

167.2

0.01(0.006%)

330

Johnson & Johnson

JNJ

116

0.16(0.1381%)

575

JPMorgan Chase and Co

JPM

87.16

0.41(0.4726%)

13038

McDonald's Corp

MCD

87.16

0.41(0.4726%)

13038

Microsoft Corp

MSFT

62.6

0.02(0.032%)

3271

Nike

NKE

52.26

0.28(0.5387%)

8535

Pfizer Inc

PFE

33.01

0.01(0.0303%)

2208

Starbucks Corporation, NASDAQ

SBUX

55.46

0.11(0.1987%)

260

Tesla Motors, Inc., NASDAQ

TSLA

214.16

-2.83(-1.3042%)

55230

The Coca-Cola Co

KO

41.9

0.10(0.2392%)

338

Twitter, Inc., NYSE

TWTR

16.51

0.07(0.4258%)

17111

Verizon Communications Inc

VZ

54.7

0.12(0.2199%)

1250

Visa

V

79.39

-0.11(-0.1384%)

4315

Walt Disney Co

DIS

106.01

-0.07(-0.066%)

6021

Yahoo! Inc., NASDAQ

YHOO

38.92

0.02(0.0514%)

1001

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

-

13:50

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Buy from Neutral at BofA/Merrill

Altria (MO) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Other:

UnitedHealth (UNH) initiated with an Overweight at Piper Jaffray

McDonald's (MCD) target lowered to $137 from $139 at Instinet

-

12:52

Orders

EUR/USD

Offers: 1.0450 1.0480-85 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0400 1.0380-85 1.0365 1.0345-50 1.0300

GBP/USD

Offers: 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids: 1.2250 1.2220 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8500 0.8525-30 0.8550 0.8575-80 0.8600

Bids: 0.8480 0.8450 0.8435 0.8400 0.8385 0.8350

EUR/JPY

Offers: 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.50 122.30 122.00 121.75 121.50 121.00

USD/JPY

Offers: 118.00 118.20-25 118.45-50 118.80 119.00

Bids: 117.50 117.20-25 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers: 0.7280 0.7300 0.73200.73500.7365 0.73800.7400

Bids: 0.7250 0.7225-30 0.7200 0.7175-80 0.7145-50 0.7100-10

-

12:01

WSE: Mid session comment

The morning phase of today's trading brought considerable higher activity on the Warsaw Stock Exchange which adds credibility to concluded transactions. The index of the largest companies is still located near the psychological level of 2,000 points, which was defeated in the first fifteen minutes of trading, but it was only a test, after which the graph of the WIG20 index returned even slightly below yesterday's close. European markets show similar behavior and even slightly better publications of PMI's for services did not change this state.

At the halfway point of quotations the WIG20 index was at the level of 1,984 points (-0,26%) and the turnover in the segment of blue chips was amounted to PLN 429 million.

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, December 0.9% (forecast 0.8%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, December 1.1% (forecast 1%)

-

09:32

United Kingdom: Net Lending to Individuals, bln, November 5.1 (forecast 4.9)

-

09:30

United Kingdom: Consumer credit, mln, November 1926

-

09:30

United Kingdom: Mortgage Approvals, November 67.5 (forecast 67.4)

-

09:30

United Kingdom: PMI Construction, December 54.2 (forecast 53)

-

09:12

Eurozone Composite PMI signalled a faster rate of expansion than the earlier flash estimate - Markit

At 54.4 in December, up from November's 53.9, the final Markit Eurozone PMI Composite Output Index signalled a faster rate of expansion than the earlier flash estimate. Manufacturing led the growth acceleration, with production increasing at the quickest pace since April 2014. Service sector activity also rose solidly, with the rate of increase staying close to November's 11-month high.

Chris Williamson, Chief Business Economist at IHS Markit said: "The final PMI data signal an even stronger end to 2016 than the preliminary flash numbers, though whether this provides a much-needed springboard for the euro area's recovery to gain further momentum in 2017 remains very uncertain. Much depends on political events over the course of the next year. "The survey data are signalling a 0.4% expansion of GDP in the fourth quarter, with growth accelerating in December as business activity rose at the fastest rate for over five-and-a-half years".

-

09:00

Eurozone: Services PMI, December 53.7 (forecast 53.1)

-

08:57

Germany’s service sector remained in good health at the end of 2016 - Markit

Germany's service sector remained in good health at the end of 2016, despite seeing growth of business activity ease slightly. New orders rose at a slower, yet still solid, pace amid reports of improving client demand. Outstanding business increased marginally for the second straight month, encouraging companies to raise their staffing levels further. Meanwhile, a combination of rising raw material costs (notably fuel) and greater wages led to a sharp increase in input prices. Charges rose more quickly as a result.

The final seasonally adjusted Markit Germany Services PMI Business Activity Index posted 54.3 in December, down slightly from November's 55.1 but still signalling robust growth. The latest reading marked the end of a strong final quarter, during which the sector has recovered growth momentum following a notable slowdown in September. The quarterly average (54.5) was the highest since Q1 2016. December's rise in activity was widely attributed to new business gains.

-

08:55

Germany: Services PMI, December 54.3 (forecast 53.8)

-

08:50

France: Services PMI, 52.9 (forecast 52.6)

-

08:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR3.43bln) 1.0700 (889m)

USD/JPY 115.00 (USD 434m) 115.50 (561m) 116.50 (330m) 118.00 (655m)

GBP/USD 1.2250 (GBP 547m)

EUR/GBP 0.8500 (EUR 1.04bln)

EUR/JPY 123.00 (EUR 406m)

Информационно-аналитический отдел TeleTrade

-

08:31

Major European stock markets trading in the green zone: FTSE 100 7,179.22 1.33 0.02%, DAX 11,613.94 29.70 0.26%, CAC 40 4,911.27 11.94 0.24%

-

08:16

WSE: After opening

WIG20 index opened at 1991.97 points (+0.12%)*

WIG 52670.78 0.26%

WIG30 2287.43 0.28%

mWIG40 4221.28 0.16%

*/ - change to previous close

The cash market opens with growth of 0.12% at a moderate turnover focused on JSW and Pekao. The German DAX gained 0.2%, which means a slight upward correction in relation to yesterday's weaker close. On the Warsaw Stock Exchange first bars are seen as clear growth and the level of 2,000 points was quickly tested.

After fifteen minutes of trading WIG20 index was at the level of 1,998 points (+0,44%).

-

08:09

Spanish unemployment has decreased in December by 86,849 people

The number of unemployed registered in the offices of the Public Employment Services has decreased in December by 86,849 people in relation to the previous month. In this way, the total number of registered unemployed is 3,702,974 people and continues in the lowest levels of the last 7 years. In seasonally adjusted terms, unemployment dropped in December in 49,243 people. With respect to December 2015, unemployment has decreased by 390,534 people, the largest decrease in a calendar year of the whole historical series.

-

07:43

Today’s events

-

At 08:00 GMT Spain's report on the change in the number of unemployed

-

At 19:00 GMT Fed meeting minutes

-

At 19:00 GMT the total sales of cars in the USA

-

-

07:18

Options levels on wednesday, January 4, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0707 (2025)

$1.0622 (707)

$1.0560 (250)

Price at time of writing this review: $1.0415

Support levels (open interest**, contracts):

$1.0339 (2219)

$1.0298 (2926)

$1.0246 (2214)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44738 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- Overall open interest on the PUT options with the expiration date March, 13 is 54777 contracts, with the maximum number of contracts with strike price $1,0000 (5067);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from January, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (563)

$1.2414 (251)

$1.2319 (124)

Price at time of writing this review: $1.2264

Support levels (open interest**, contracts):

$1.2181 (805)

$1.2085 (459)

$1.1988 (1333)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14375 contracts, with the maximum number of contracts with strike price $1,2800 (3009);

- Overall open interest on the PUT options with the expiration date March, 13 is 17183 contracts, with the maximum number of contracts with strike price $1,1500 (2970);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from January, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:06

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.3%, FTSE + 0.4%

-

07:04

Marine Le Pen wants a common currency, the euro, in parallel to the French franc - Forexlive

-

07:01

The Japanese manufacturing sector ended 2016 on a positive note - Markit

Overall operating conditions improved at the sharpest rate since December 2015, helped by stronger growth in both production and new orders. As a result, goods producers were more confident towards taking on additional workers, with the rate of job creation picking up to a 32-month high. Buying activity also rose at the quickest rate in nearly one year.

The headline PMI posted 52.4 in December, up from 51.3 in November, signalling a sharper improvement in manufacturing conditions in Japan. In fact, the latest reading was the highest since December last year and contributed to the strongest quarterly average since Q4 2015. The higher figure reflected increases in output, new orders and employment.

-

06:58

Japan PM, Shinzo Abe: the main priority in 2017 will be the economy

During his speech today, prime minister Shinzo Abe, said that for him and his cabinet the economy will be the top priority in 2017. Answering journalists' questions, the politician added that early elections are not planned and the government will continue to work with "abenomics".

Recall that to exit the crisis Shinzo Abe offers the program of "Three Arrows". The first of them - the achievement of the objectives for higher prices. Abe is also supporting stimulus measures from the budget. And finally, the third "Arrow" is aimed at developing measures to reform the public sector, which would help to attract investment, as well as the growth of consumption.

-

06:35

Global Stocks

European stock markets charged higher again on Tuesday, closing at a fresh one-year high after upbeat Chinese and U.S. manufacturing data fueled optimism over economic growth in the world's two largest economies.

U.S. stocks closed up Tuesday below their highs for the first trading session of 2017 as oil prices dropped. The Dow Jones Industrial Average DJIA, +0.60% rose 119.16 points, or 0.6%, to finish at 19,881.76, led higher by shares of Nike Inc. NKE, +2.26% and Verizon Communications Inc. VZ, +2.25% The S&P 500 index SPX, +0.85% closed up 19.00 points, or 0.9%, at 2,257.83, with the telecom and health care sectors the strongest performers.

Japanese equities kicked off the new year sharply higher on Wednesday, leading the region's gains amid a robust outlook for the U.S. economy, coupled with expectations of continued yen weakness.

-

00:30

Japan: Manufacturing PMI, December 52.4 (forecast 51.9)

-